|

|

市場調査レポート

商品コード

1642554

粘着テープの市場レポート:材料別、樹脂別、技術別、用途別、地域別、2025年~2033年Adhesive Tapes Market Report by Material, Resin, Technology, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 粘着テープの市場レポート:材料別、樹脂別、技術別、用途別、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 138 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界の粘着テープの市場規模は、2024年に729億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに1,085億米ドルに達し、2025年から2033年にかけて4.06%の成長率(CAGR)を示すと予測しています。アジア太平洋が明確な優位性を示し、2024年には35%を超える大きな市場シェアを占めました。これは、エレクトロニクスや自動車産業からの製品需要が高まっているためです。

粘着テープは、片面または両面に粘着物質を塗布した柔軟なバッキング材からなる多用途材料です。要求される粘着レベルや使用目的に応じて、永久粘着性、剥離可能粘着性、再貼付可能粘着性などがあります。マスキングテープ、ダクトテープ、両面テープ、電気用テープ、包装用テープ、医療用テープなどがあり、ヘルスケア分野では創傷処置、包帯、医療器具の固定などに使われています。紙、ポリ塩化ビニル(PVC)、ポリエステル、布、発泡体など、さまざまな材料で作られた裏地があります。

現在、航空宇宙産業では、航空機キャビンのシール、配線の絶縁、複合材料の接着などの用途で粘着テープの需要が増加しており、市場の成長を後押ししています。このほか、使い勝手の良さと幅広い材料を接着できる能力から、美術品や工芸品における粘着テープの採用が増加していることも、市場の成長に寄与しています。さらに、断熱材、水蒸気バリア、床材などの材料を接着したり、塗装時に表面をマスキングしたりするために、建築用途で粘着テープの利用が増加していることも、良好な市場見通しをもたらしています。これとは別に、大気汚染の影響を最小限に抑えるため、軽量で低燃費の自動車への需要が高まっていることも、市場の成長を強めています。さらに、eコマース分野でさまざまな荷物を固定するために粘着テープの採用が増加していることも、市場の成長を支えています。

粘着テープの市場動向/促進要因:

包装業界の業務改善の高まり

包装業界の業務改善に対する需要の高まりは、現在粘着テープの市場の成長にプラスの影響を与えています。粘着テープの継続的な需要は、パッケージに安全で信頼性の高いシーリングを提供し、輸送中や保管中の商品の保護を保証する能力に起因しています。さらに、粘着テープは包装廃棄物の最小化に重要な役割を果たしており、業界の持続可能な取り組みに貢献しています。さらに、粘着テープの市場では研究開発(R&D)が急ピッチで進められており、パッケージング分野の特殊な要件に対応する革新的な製品が提供されています。このような継続的な技術革新は、包装業界における絶えず進化する課題と機会に対応するために不可欠です。

電子・電気用途の需要増加

現在、電子・電気用途での粘着テープ需要の高まりが、市場の成長にプラスの影響を与えています。これに加えて、様々な産業で電子機器や電気機器の普及が進んでいることが、信頼性が高く効率的な接着ソリューションの需要を促進しています。粘着テープは、その汎用性と適応性により、部品の固定、回路の絶縁、製品全体の性能向上に重要な役割を果たしています。企業の電子・電気製品の革新と拡大に伴い、粘着テープの需要は着実に増加しています。さらに、フレキシブル・エレクトロニクスやウェアラブル・デバイスなどの新技術の出現により、粘着テープの用途に新たな道が生まれつつあります。これらの最先端技術革新は、柔軟で信頼性の高い接着ニーズにおいて粘着テープに大きく依存しています。これらの技術が進歩し続けるにつれて、粘着テープ市場は、それらのユニークな要件に対応するためにさらに拡大する態勢を整えています。

特殊テープ製造における技術進歩の増加

特殊テープの製造における技術進歩の増加は、粘着テープの市場の成長を促進しています。これに加えて、粘着テープ製造における継続的な研究開発(R&D)活動は、革新的な材料と製造技術を生み出しています。これらの進歩により、粘着強度の向上、耐久性の改善、さまざまな環境要因に対する優れた耐性など、特性が強化された特殊テープが生み出されています。さらに、製造工程や機械の継続的な改良により、生産効率が合理化され、コストが削減され、粘着テープ全体の品質が向上しています。自動化された生産システムの採用とスマートテクノロジーの統合は、メーカーが精密で一貫性のある特殊テープの需要増に対応するのに役立っています。この効率改善は、多様な産業ニーズに応える高品質の粘着テープの安定供給を確保することで、市場の成長を促進しています。

目次

第1章 序文

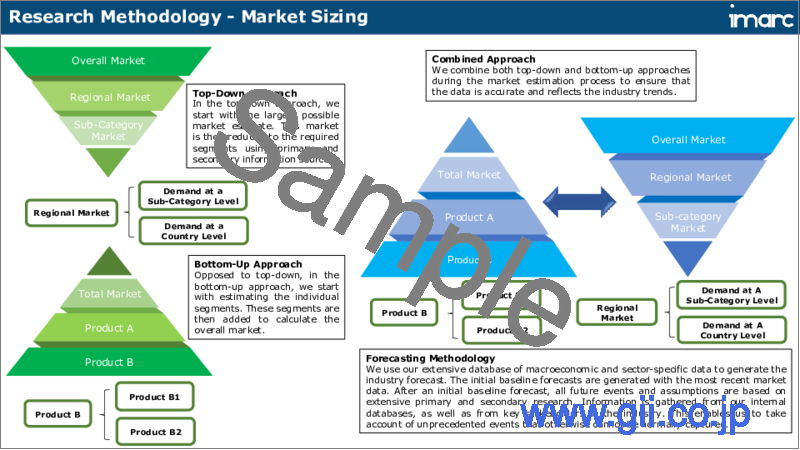

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 予測調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の粘着テープ市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:材料別

- 市場内訳:樹脂別

- 市場内訳:技術別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:材料別

- ポリプロピレン

- 市場動向

- 市場予測

- 紙

- 市場動向

- 市場予測

- ポリ塩化ビニル

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:樹脂別

- アクリル

- 市場動向

- 市場予測

- ゴム

- 市場動向

- 市場予測

- シリコーン

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:技術別

- 水性粘着テープ

- 市場動向

- 市場予測

- 溶剤系粘着テープ

- 市場動向

- 市場予測

- ホットメルト系粘着テープ

- 市場動向

- 市場予測

第9章 市場内訳:用途別

- 包装用テープ

- 市場動向

- 市場予測

- マスキングテープ

- 市場動向

- 市場予測

- 特殊テープ

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第10章 市場内訳:地域別

- 北米

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- アジア太平洋

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第11章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第12章 バリューチェーン分析

第13章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第14章 価格分析

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- 3M Company

- Nitto Denko Corporation

- Tesa SE

- Lintec Corporation

- Avery Dennison Corporation

- Intertape Polymer Group Inc.

- Shurtape Technologies LLC.

- Scapa Group PLC

- Lohmann GmbH & Co. Kg

- Nichiban Co. Ltd.

- Sekisui Chemical Co. Ltd.

List of Figures

- Figure 1: Global: Adhesive Tapes Market: Major Drivers and Challenges

- Figure 2: Global: Adhesive Tapes Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Adhesive Tapes Market: Breakup by Material (in %), 2024

- Figure 4: Global: Adhesive Tapes Market: Breakup by Resin (in %), 2024

- Figure 5: Global: Adhesive Tapes Market: Breakup by Technology (in %), 2024

- Figure 6: Global: Adhesive Tapes Market: Breakup by Application (in %), 2024

- Figure 7: Global: Adhesive Tapes Market: Breakup by Region (in %), 2024

- Figure 8: Global: Adhesive Tapes Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 9: Global: Adhesive Tapes Industry: SWOT Analysis

- Figure 10: Global: Adhesive Tapes Industry: Value Chain Analysis

- Figure 11: Global: Adhesive Tapes Industry: Porter's Five Forces Analysis

- Figure 12: Global: Adhesive Tapes (Polypropylene) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Adhesive Tapes (Polypropylene) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Adhesive Tapes (Paper) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Adhesive Tapes (Paper) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Adhesive Tapes (Polyvinyl Chloride) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Adhesive Tapes (Polyvinyl Chloride) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Adhesive Tapes (Other Materials) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Adhesive Tapes (Other Materials) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Adhesive Tapes (Acrylic) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Adhesive Tapes (Acrylic) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Adhesive Tapes (Rubber) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Adhesive Tapes (Rubber) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Adhesive Tapes (Silicone) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Adhesive Tapes (Silicone) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Adhesive Tapes (Other Resins ) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Adhesive Tapes (Other Resins) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Adhesive Tapes (Water-Based) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Adhesive Tapes (Water-Based) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Adhesive Tapes (Solvent-Based) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Adhesive Tapes (Solvent-Based) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Adhesive Tapes (Hot-Melt-Based) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Adhesive Tapes (Hot-Melt-Based) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Adhesive Tapes (Packaging) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Adhesive Tapes (Packaging) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Global: Adhesive Tapes (Masking) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Global: Adhesive Tapes (Masking) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: Global: Adhesive Tapes (Specialized) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: Global: Adhesive Tapes (Specialized) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Global: Adhesive Tapes (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Global: Adhesive Tapes (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: North America: Adhesive Tapes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: North America: Adhesive Tapes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Europe: Adhesive Tapes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Europe: Adhesive Tapes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Asia Pacific: Adhesive Tapes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Asia Pacific: Adhesive Tapes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Middle East and Africa: Adhesive Tapes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Middle East and Africa: Adhesive Tapes Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Latin America: Adhesive Tapes Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Latin America: Adhesive Tapes Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

- Table 1: Global: Adhesive Tapes Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Adhesive Tapes Market Forecast: Breakup by Material (in Million USD), 2025-2033

- Table 3: Global: Adhesive Tapes Market Forecast: Breakup by Resin (in Million USD), 2025-2033

- Table 4: Global: Adhesive Tapes Market Forecast: Breakup by Technology (in Million USD), 2025-2033

- Table 5: Global: Adhesive Tapes Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 6: Global: Adhesive Tapes Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 7: Global: Adhesive Tapes Market Structure

- Table 8: Global: Adhesive Tapes Market: Key Players

The global adhesive tapes market size reached USD 72.9 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 108.5 billion by 2033, exhibiting a growth rate (CAGR) of 4.06% during 2025-2033. Asia Pacific exhibits a clear dominance, holding a significant market share of over 35% in 2024. This is attributed to the escalating product demand from electronics and automotive industries.

Adhesive tapes are versatile materials consisting of a flexible backing material coated with an adhesive substance on one or both sides. They comprise adhesive materials, which can be permanent, removable, or repositionable, depending on the required level of adhesion and the intended use. They are available as masking, duct, double-sided, electrical, packaging, and medical tape, which is used in the healthcare sector for wound care, bandaging, and securing medical equipment. They have backings made of various materials, including paper, polyvinyl chloride (PVC), polyester, cloth, and foam.

At present, the increasing demand for adhesive tapes in the aerospace industry for applications, such as sealing aircraft cabins, insulating wiring, and bonding composite materials is impelling the growth of the market. Besides this, the rising employment of adhesive tapes in arts and crafts due to their ease of use and ability to bond a wide range of materials is contributing to the growth of the market. In addition, the growing utilization of adhesive tapes in construction purposes to bond materials like insulation, vapor barriers, and flooring and in masking surfaces during painting is offering a favorable market outlook. Apart from this, the increasing demand for lightweight and fuel-efficient vehicles to minimize the impact of air pollution is strengthening the growth of the market. Additionally, the rising adoption of adhesive tapes in the e-commerce sector for securing various packages is supporting the growth of the market.

Adhesive Tapes Market Trends/Drivers:

Growing improvements in the operations of the packaging industry

The growing demand for improvements in the operations of the packaging industry is currently exerting a positive influence on the growth of the adhesive tapes market. The ongoing demand for adhesive tapes stems from their ability to provide secure and reliable sealing for packages, ensuring the protection of goods during transit and storage. Moreover, adhesive tapes are playing a vital role in minimizing packaging waste, contributing to sustainability efforts in the industry. Furthermore, the adhesive tapes market is witnessing a surge in research and development (R&D) operations, leading to innovative product offerings that cater to the specific requirements of the packaging sector. This continuous innovation is essential to meet the ever-evolving challenges and opportunities within the packaging industry.

Rising demand for electronics and electrical applications

At present, the rising demand for adhesive tapes in electronics and electrical applications is positively influencing the growth of the market. Besides this, the ongoing proliferation of electronic devices and electrical equipment across various industries is driving the demand for reliable and efficient bonding solutions. Adhesive tapes, with their versatility and adaptability, are playing an instrumental role in securing components, insulating circuits, and enhancing overall product performance. As businesses innovate and expand their electronic and electrical offerings, the demand for adhesive tapes is steadily increasing. Furthermore, the advent of emerging technologies, such as flexible electronics and wearable devices, is creating new avenues for adhesive tape applications. These cutting-edge innovations rely heavily on adhesive tapes for their flexible and reliable bonding needs. As these technologies continue to advance, the adhesive tape market is poised to increase further to cater to their unique requirements.

Increasing technological advancements in the production of specialty tapes

The increasing technological advancement in the manufacturing of specialty tapes are propelling the growth of the adhesive tapes market. Besides this, ongoing research and development (R&D) activities in adhesive tape manufacturing are yielding innovative materials and production techniques. These advancements are enabling the creation of specialty tapes with enhanced properties, such as greater adhesion strength, improved durability, and superior resistance to various environmental factors. Furthermore, the continuous refinement of manufacturing processes and machinery is streamlining production efficiency, reducing costs, and enhancing the overall quality of adhesive tapes. The adoption of automated production systems and the integration of smart technologies are helping manufacturers meet the rising demand for specialty tapes with precision and consistency. This efficiency improvement is fostering market growth by ensuring a stable supply of high-quality adhesive tapes to meet diverse industrial needs.

Adhesive Tapes Industry Segmentation:

Breakup by Material:

Polypropylene

Paper

Polyvinyl Chloride

Others

Polypropylene dominates the market

Polypropylene is a versatile polymer known for its excellent combination of properties, making it well-suited for various tape applications. It has good tensile strength, which means it can resist stretching and tearing. This property is essential for tapes used in packaging and sealing applications, as they need to withstand stress and pressure. Polypropylene is relatively resistant to many chemicals, making it suitable for tapes used in environments where exposure to chemicals is a concern. It has inherent water-resistant properties, making it a suitable choice for tapes used in applications where exposure to moisture or humidity is likely. It is relatively inexpensive compared to some other materials, making it a cost-effective choice for manufacturing adhesive tapes.

Breakup by Resin:

Acrylic

Rubber

Silicone

Others

Acrylic holds the largest share in the market

Acrylic resin is commonly used in adhesive tapes as an adhesive material for providing strong initial tack and adhesion to various types of surfaces, including plastics, metals, glass, and paper. It offers good resistance to ultraviolet (UV) radiation, weathering, and aging, making it suitable for outdoor applications. It can withstand extreme ranges of temperature, including both cold and hot conditions, without losing its adhesive properties. It is often resistant to chemicals, which makes them suitable for applications where exposure to chemicals is a concern. It is generally transparent, so it does not obstruct visibility when used in clear tapes. It typically has a fast bonding time, allowing for quick assembly or bonding of materials.

Breakup by Technology:

Water-Based Adhesive Tapes

Solvent-Based Adhesive Tapes

Hot-Melt-Based Adhesive Tapes

Water-based adhesive tapes are a type of adhesive tape that uses a water-based adhesive as the bonding agent. These tapes are widely used for various applications due to their versatility, ease of use, and environmentally friendly properties. They are created to be easily removable without leaving behind residue or damaging the substrate.

Solvent-based adhesive tapes are a type of adhesive tape that uses a solvent-based adhesive as the bonding agent. They are known for their strong and durable bonding capabilities. They can adhere to various types of substrates, including plastics, metals, and glass, making them suitable for various industrial applications. They are often resistant to environmental factors, such as moisture, heat, and chemicals. This makes them suitable for outdoor applications and in harsh conditions.

Hot melt-based adhesive tapes use a thermoplastic adhesive that becomes liquid when heated and solidifies upon cooling. They offer rapid bonding as the adhesive becomes liquid when heated, allowing for fast adhesion upon application. This makes them suitable for high-speed production processes. They can be used for various applications, including sealing, packaging, bonding, and assembly.

Breakup by Application:

Packaging Tapes

Masking Tapes

Specialized Tapes

Others

Packaging tapes hold the biggest share in the market

Packaging tapes are essential tools for logistics and shipping purposes and ensure products and parcels are securely bundled and safeguarded during transit. They possess the ability to withstand the rigors of transportation, including jostling, stacking, and exposure to varying temperatures, making them indispensable in the packaging industry. They are used to wrap and secure items, such as gifts, packages, and bundles. They provide a neat and secure packaging solution. Packaging tape can be used for temporary repairs of torn paper, cardboard, or plastic items. When packing fragile items, packaging tape is often used to secure bubble wrap or other protective materials around the items to prevent breakage.

Breakup by Region:

Polypropylene

Paper

Polyvinyl Chloride

Others

Polypropylene dominates the market

Polypropylene is a versatile polymer known for its excellent combination of properties, making it well-suited for various tape applications. It has good tensile strength, which means it can resist stretching and tearing. This property is essential for tapes used in packaging and sealing applications, as they need to withstand stress and pressure. Polypropylene is relatively resistant to many chemicals, making it suitable for tapes used in environments where exposure to chemicals is a concern. It has inherent water-resistant properties, making it a suitable choice for tapes used in applications where exposure to moisture or humidity is likely. It is relatively inexpensive compared to some other materials, making it a cost-effective choice for manufacturing adhesive tapes.

Breakup by Resin:

Acrylic

Rubber

Silicone

Others

Acrylic holds the largest share in the market

Acrylic resin is commonly used in adhesive tapes as an adhesive material for providing strong initial tack and adhesion to various types of surfaces, including plastics, metals, glass, and paper. It offers good resistance to ultraviolet (UV) radiation, weathering, and aging, making it suitable for outdoor applications. It can withstand extreme ranges of temperature, including both cold and hot conditions, without losing its adhesive properties. It is often resistant to chemicals, which makes them suitable for applications where exposure to chemicals is a concern. It is generally transparent, so it does not obstruct visibility when used in clear tapes. It typically has a fast bonding time, allowing for quick assembly or bonding of materials.

Breakup by Technology:

Water-Based Adhesive Tapes

Solvent-Based Adhesive Tapes

Hot-Melt-Based Adhesive Tapes

Water-based adhesive tapes are a type of adhesive tape that uses a water-based adhesive as the bonding agent. These tapes are widely used for various applications due to their versatility, ease of use, and environmentally friendly properties. They are created to be easily removable without leaving behind residue or damaging the substrate.

Solvent-based adhesive tapes are a type of adhesive tape that uses a solvent-based adhesive as the bonding agent. They are known for their strong and durable bonding capabilities. They can adhere to various types of substrates, including plastics, metals, and glass, making them suitable for various industrial applications. They are often resistant to environmental factors, such as moisture, heat, and chemicals. This makes them suitable for outdoor applications and in harsh conditions.

Hot melt-based adhesive tapes use a thermoplastic adhesive that becomes liquid when heated and solidifies upon cooling. They offer rapid bonding as the adhesive becomes liquid when heated, allowing for fast adhesion upon application. This makes them suitable for high-speed production processes. They can be used for various applications, including sealing, packaging, bonding, and assembly.

Breakup by Application:

Packaging Tapes

Masking Tapes

Specialized Tapes

Others

Packaging tapes hold the biggest share in the market

Packaging tapes are essential tools for logistics and shipping purposes and ensure products and parcels are securely bundled and safeguarded during transit. They possess the ability to withstand the rigors of transportation, including jostling, stacking, and exposure to varying temperatures, making them indispensable in the packaging industry. They are used to wrap and secure items, such as gifts, packages, and bundles. They provide a neat and secure packaging solution. Packaging tape can be used for temporary repairs of torn paper, cardboard, or plastic items. When packing fragile items, packaging tape is often used to secure bubble wrap or other protective materials around the items to prevent breakage.

North America

Europe

Asia Pacific

Middle East and Africa

Latin America

Asia Pacific exhibits a clear dominance, accounting for the largest adhesive tapes market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America. According to the report, Asia Pacific accounted for the largest market share.

Asia Pacific held the biggest market share due to the rising purchase of various passenger cars to commute comfortably without availing of public transportation. Besides this, the increasing investment in infrastructure development, including roads, bridges, airports, and buildings, is propelling the growth of the market. Apart from this, increasing online shopping activities among the masses to purchase various products and services online are supporting the growth of the market. Additionally, the rising demand for cost-effective alternatives to traditional fastening and bonding methods, such as welding or mechanical fasteners, is strengthening the growth of the market.

North America is estimated to expand further in this domain due to the increasing production of sustainable and eco-friendly adhesive tape solutions. Moreover, the rising demand for medical-grade adhesive tapes in the healthcare sector is contributing to the growth of the market.

Competitive Landscape:

Key market players are investing in research and development (R&D) activities to create innovative products with improved performance characteristics, which include tapes with enhanced adhesive properties, durability, and eco-friendly options to meet market demands. They are also focusing on sustainability by developing eco-friendly adhesive tapes made from recyclable materials or using adhesive technologies that reduce environmental impact. Top companies are expanding their market presence both geographically and in terms of offerings. They are also focusing on strategic acquisitions, partnerships, or opening new production facilities in emerging markets. Leading companies are tailoring their products to meet the specific needs of different industries. They are also implementing advanced manufacturing technologies and automation to improve production efficiency and reduce costs.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

3M Company

Nitto Denko Corporation

Tesa SE

Lintec Corporation

Avery Dennison Corporation

Intertape Polymer Group Inc.

Shurtape Technologies LLC.

Scapa Group PLC

Lohmann GmbH & Co. Kg

Nichiban Co. Ltd.

Sekisui Chemical Co. Ltd.

Key Questions Answered in This Report

- 1. What is the size of the global adhesive tapes market in 2024?

- 2. What is the expected growth rate of the global adhesive tapes market in 2025-2033?

- 3. What are the key factors driving the global adhesive tapes market?

- 4. What has been the impact of COVID-19 on the global adhesive tapes market?

- 5. What is the leading segment of the global adhesive tapes market based on material?

- 6. What is the leading segment of the global adhesive tapes market based on application?

- 7. What are the key regions in the global adhesive tapes market?

- 8. Who are the key companies/players in the global adhesive tapes market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Adhesive Tapes Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Material

- 5.5 Market Breakup by Resin

- 5.6 Market Breakup by Technology

- 5.7 Market Breakup by Application

- 5.8 Market Breakup by Region

- 5.9 Market Forecast

6 Market Breakup by Material

- 6.1 Polypropylene

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Paper

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Polyvinyl Chloride

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Others

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Resin

- 7.1 Acrylic

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Rubber

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Silicone

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Technology

- 8.1 Water-Based Adhesive Tapes

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Solvent-Based Adhesive Tapes

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Hot-Melt-Based Adhesive Tapes

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Market Breakup by Application

- 9.1 Packaging Tapes

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Masking Tapes

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 Specialized Tapes

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Others

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

10 Market Breakup by Region

- 10.1 North America

- 10.1.1 Market Trends

- 10.1.2 Market Forecast

- 10.2 Europe

- 10.2.1 Market Trends

- 10.2.2 Market Forecast

- 10.3 Asia Pacific

- 10.3.1 Market Trends

- 10.3.2 Market Forecast

- 10.4 Middle East and Africa

- 10.4.1 Market Trends

- 10.4.2 Market Forecast

- 10.5 Latin America

- 10.5.1 Market Trends

- 10.5.2 Market Forecast

11 SWOT Analysis

- 11.1 Overview

- 11.2 Strengths

- 11.3 Weaknesses

- 11.4 Opportunities

- 11.5 Threats

12 Value Chain Analysis

13 Porters Five Forces Analysis

- 13.1 Overview

- 13.2 Bargaining Power of Buyers

- 13.3 Bargaining Power of Suppliers

- 13.4 Degree of Competition

- 13.5 Threat of New Entrants

- 13.6 Threat of Substitutes

14 Price Analysis

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 3M Company

- 15.3.2 Nitto Denko Corporation

- 15.3.3 Tesa SE

- 15.3.4 Lintec Corporation

- 15.3.5 Avery Dennison Corporation

- 15.3.6 Intertape Polymer Group Inc.

- 15.3.7 Shurtape Technologies LLC.

- 15.3.8 Scapa Group PLC

- 15.3.9 Lohmann GmbH & Co. Kg

- 15.3.10 Nichiban Co. Ltd.

- 15.3.11 Sekisui Chemical Co. Ltd.