|

|

市場調査レポート

商品コード

1660728

自動車用NVH材料市場レポート:製品、車両タイプ、用途、地域別、2025年~2033年Automotive NVH Materials Market Report by Product (Polyurethane, Mixed Textiles Fibers, Fiber Glass, Polyester Fiber, NBR, Polypropylene, PVC, Textile Materials, Textile Materials ), Vehicle Type, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用NVH材料市場レポート:製品、車両タイプ、用途、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 141 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

自動車用NVH材料の世界市場規模は2024年に136億米ドルに達しました。今後、IMARC Groupは、2033年までに市場は199億米ドルに達し、2025年から2033年にかけて4.4%の成長率(CAGR)を示すと予測しています。市場は、騒音低減と車両快適性の向上に対する需要の高まりによって大きく成長しています。メーカーは現在、騒音・振動・ハーシュネス(NVH)制御のための先進軽量材料を重視しており、これは主に、より効率的で静かな自動車を求める顧客の要求と規制政策に後押しされています。

自動車用NVH材料は、騒音・振動・ハーシュネス材料としても知られ、自動車の不要な騒音、振動(自動車のメカニズムによる振動)、ハーシュネス(不快さのレベル)を低減するために使用されます。NVH材料は、ゴム成形品、金属・フィルム積層品、発泡成形品、エンジニアリング樹脂などで構成され、空気伝搬音や構造伝搬音、車室内部品から発生する騒音を抑制するために使用されています。近年、騒音を吸収し車内への侵入を防ぐことで不快感を防ぎ、乗り心地を向上させるNVH材料の需要が高まっています。

市場動向:

ここ数年、インドや中国など新興地域の自動車販売台数は着実に増加しています。自動車の騒音レベルを下げるための厳しい政府規制が、これらの地域におけるNVH材料の需要を高めています。さらに、複数のメーカーが燃費を向上させた軽量車両を開発しており、これが車両の騒音・振動品質の向上に役立っています。また、NVHソリューションのポートフォリオを強化するため、M&Aにも注力しています。現在、市場成長を牽引しているその他の要因としては、NVHと市場開拓レベルが購買決定に与える影響、革新的技術を用いた先進的なNVH製品、ライフスタイルの変化、先進国・新興経済諸国ともに所得が上昇していることなどが挙げられます。

本レポートで扱う主な質問

- 自動車用NVH材料の市場の市場規模は?

- 自動車用NVH材料の市場の成長率は?

- 自動車用NVH材料の市場の世界市場を牽引する主な要因は何か?

- 自動車用NVH材料の市場の世界市場におけるCOVID-19の影響は?

- 世界の自動車用NVH材料の市場の製品別内訳は?

- 世界の自動車用NVH材料の市場の車種別内訳は?

- 世界の自動車用NVH材料の市場の用途別内訳は?

- 世界の自動車用NVH材料の市場の主要地域は?

- 主要プレーヤーは?

- 自動車用NVH材料の市場の最大セグメントは?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の自動車用NVH材料市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:製品別

- 市場内訳:車両タイプ別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:製品別

- ポリウレタン

- 市場動向

- 市場予測

- 混合繊維

- 市場動向

- 市場予測

- ファイバーグラス

- 市場動向

- 市場予測

- ポリエステル繊維

- 市場動向

- 市場予測

- ノンブル

- 市場動向

- 市場予測

- ポリプロピレン

- 市場動向

- 市場予測

- PVC

- 市場動向

- 市場予測

- 繊維材料(合成繊維)

- 市場動向

- 市場予測

- 繊維材料(綿)

- 市場動向

- 市場予測

第7章 市場内訳:車両タイプ別

- 乗用車

- 市場動向

- 市場予測

- 小型商用車

- 市場動向

- 市場予測

- HCV

- 市場動向

- 市場予測

第8章 市場内訳:用途別

- トランクモジュール

- 市場動向

- 市場予測

- フロアモジュール

- 市場動向

- 市場予測

- ホイールアーチ

- 市場動向

- 市場予測

- コックピットモジュール

- 市場動向

- 市場予測

- ルーフモジュール

- 市場動向

- 市場予測

- エンジンケース

- 市場動向

- 市場予測

- ボンネットライナー

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- アジア太平洋地域

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- 北米

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第10章 世界の自動車用NVH材料産業:SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 世界の自動車用NVH材料産業:バリューチェーン分析

- 概要

- 原材料サプライヤー

- ポリマー製造業者

- 自動車部品メーカー

- 自動車OEM

第12章 世界の自動車用NVH材料産業:ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 世界の自動車用NVH材料産業:価格分析

- 価格指標

- 価格構造

- マージン分析

第14章 自動車のNVH材料製造プロセス

- 製品概要

- 原材料要件

- 製造工程

- 主要成功要因とリスク要因

第15章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- BASF SE

- The DOW Chemical Company

- ExxonMobil

- 3M Company

- Mitsui Chemicals, Inc.

- Sumitomo Riko Company Limited

- Covestro AG

- Celanese Corporation

- Huntsman Corporation

- Lanxess AG

- Borgers AG

List of Figures

- Figure 1: Global: Automotive NVH Materials Market: Major Drivers and Challenges

- Figure 2: Global: Automotive NVH Materials Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Automotive NVH Materials Market: Breakup by Product (in %), 2024

- Figure 4: Global: Automotive NVH Materials Market: Breakup by Vehicle Type (in %), 2024

- Figure 5: Global: Automotive NVH Materials Market: Breakup by Application (in %), 2024

- Figure 6: Global: Automotive NVH Materials Market: Breakup by Region (in %), 2024

- Figure 7: Global: Automotive NVH Materials Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Automotive NVH Materials Industry: SWOT Analysis

- Figure 9: Global: Automotive NVH Materials Industry: Value Chain Analysis

- Figure 10: Global: Automotive NVH Materials Industry: Porter's Five Forces Analysis

- Figure 11: Global: Automotive NVH Materials (Polyurethane) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Automotive NVH Materials (Polyurethane) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Automotive NVH Materials (Mixed Textiles Fibers) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Automotive NVH Materials (Mixed Textiles Fibers) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Automotive NVH Materials (Fiber Glass) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Automotive NVH Materials (Fiber Glass) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Automotive NVH Materials (Polyester Fiber) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Automotive NVH Materials (Polyester Fiber) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Automotive NVH Materials (NBR) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Automotive NVH Materials (NBR) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Automotive NVH Materials (Polypropylene) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Automotive NVH Materials (Polypropylene) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Automotive NVH Materials (PVC) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Automotive NVH Materials (PVC) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Automotive NVH Materials (Textile Synthetic Materials) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Automotive NVH Materials (Textile Synthetic Materials) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Automotive NVH Materials (Textile Cotton Materials) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Automotive NVH Materials (Textile Cotton Materials) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Automotive NVH Materials (Passenger Vehicles) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Automotive NVH Materials (Passenger Vehicles) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Automotive NVH Materials (LCV) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Automotive NVH Materials (LCV) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Automotive NVH Materials (HCV) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Automotive NVH Materials (HCV) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Global: Automotive NVH Materials (Trunk Module) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Global: Automotive NVH Materials (Trunk Module) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Global: Automotive NVH Materials (Floor Module) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Global: Automotive NVH Materials (Floor Module) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: Global: Automotive NVH Materials (Wheel Arches) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: Global: Automotive NVH Materials (Wheel Arches) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Global: Automotive NVH Materials (Cockpit Module) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Global: Automotive NVH Materials (Cockpit Module) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Global: Automotive NVH Materials (Roof Module) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Global: Automotive NVH Materials (Roof Module) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 45: Global: Automotive NVH Materials (Engine Casing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 46: Global: Automotive NVH Materials (Engine Casing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 47: Global: Automotive NVH Materials (Bonnet Liners) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 48: Global: Automotive NVH Materials (Bonnet Liners) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Asia Pacific: Automotive NVH Materials Market: Sales Value (in Million USD), 2019 & 2024

- Figure 50: Asia Pacific: Automotive NVH Materials Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 51: Europe: Automotive NVH Materials Market: Sales Value (in Million USD), 2019 & 2024

- Figure 52: Europe: Automotive NVH Materials Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 53: North America: Automotive NVH Materials Market: Sales Value (in Million USD), 2019 & 2024

- Figure 54: North America: Automotive NVH Materials Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 55: Latin America: Automotive NVH Materials Market: Sales Value (in Million USD), 2019 & 2024

- Figure 56: Latin America: Automotive NVH Materials Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 57: Middle East and Africa: Automotive NVH Materials Market: Sales Value (in Million USD), 2019 & 2024

- Figure 58: Middle East and Africa: Automotive NVH Materials Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 59: Automotive NVH Materials Manufacturing: Process Flow

List of Tables

- Table 1: Global: Automotive NVH Materials Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Automotive NVH Materials Market Forecast: Breakup by Product (in Million USD), 2025-2033

- Table 3: Global: Automotive NVH Materials Market Forecast: Breakup by Vehicle Type (in Million USD), 2025-2033

- Table 4: Global: Automotive NVH Materials Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Automotive NVH Materials Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Automotive NVH Materials: Raw Material Requirements

- Table 7: Global: Automotive NVH Materials Market Structure

- Table 8: Global: Automotive NVH Materials Market: Key Players

The global automotive NVH materials market size reached USD 13.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.4% during 2025-2033. The market is growing significantly due to the amplifying demand for improved noise reduction and vehicle comfort. Manufacturers are currently emphasizing on advanced, lightweight materials for noise, vibration, and harshness (NVH) control, principally driven by customer requirements and regulatory policies for more efficient and quieter vehicles.

Automotive NVH materials, also known as noise, vibration, and harshness materials, are used to reduce unwanted noise, vibrations (oscillations due to automobile mechanics), and harshness (the level of discomfort) in automobiles. NVH materials, including molded rubbers, metal and film laminates, molded foams and engineering resins, are used to control air and structure-borne noises as well as noise generated from the interior components of the vehicles. In recent years, there has been a heightened demand for NVH materials as they absorb noise and prevent it from entering the vehicle, thereby preventing discomfort and improving the ride quality.

Market Trends:

Over the past few years, the sales of automobiles in emerging regions like India and China have been rising steadily. The strict government regulations for reducing vehicle noise levels are increasing the demand for NVH materials in these regions. Moreover, several manufacturers are developing lightweight vehicles with enhanced fuel efficiency which helps in improving the noise and vibration quality of the vehicles. They are also focusing on mergers and acquisitions (M&A) to enhance their portfolio for NVH solutions. Some of the other factors that are currently driving the market growth are the influence of NVH and Vehicle Refinement Levels on buying decisions, advanced NVH products with innovative technologies, changing lifestyles and rising incomes in both developed and developing economies.

Key Market Segmentation:

Breakup by Product:

- Polyurethane

- Mixed Textiles Fibers

- Fiber Glass

- Polyester Fiber

- NBR

- Polypropylene

- PVC

- Textile Materials (Synthetic)

- Textile Materials (Cotton)

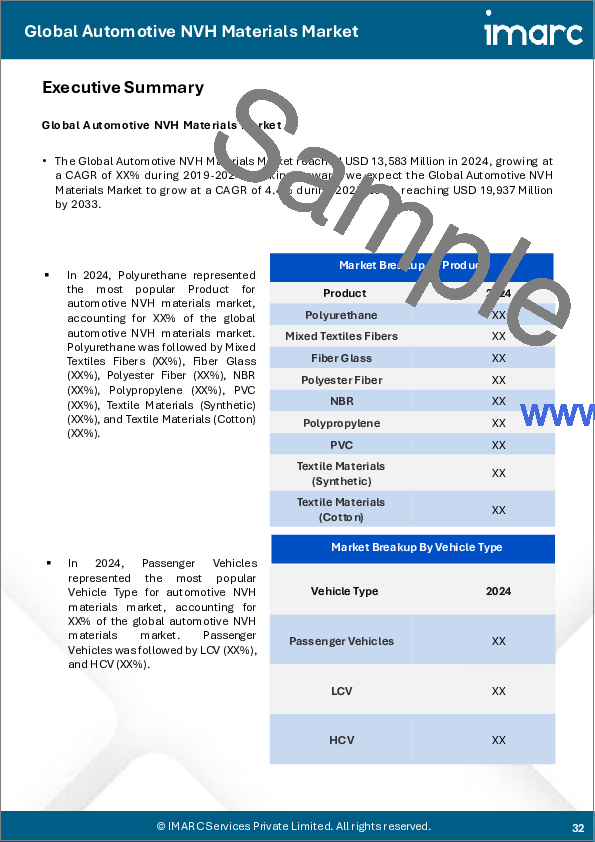

Based on product, the market has been segmented into polyurethane, mixed textiles fibers, fiber glass, polyester fiber, NBR, polypropylene, PVC, textile materials (synthetic) and textile materials (cotton). Currently, polyurethane is the most popular product type in the global automotive NVH materials market.

Breakup by Vehicle Type:

- Passenger Vehicles

- LCV

- HCV

On the basis of vehicle type, the market has been segmented into passenger vehicles, LCV and HCV, wherein, passenger vehicles dominate the market, holding the largest share.

Breakup by Application:

- Trunk Module

- Floor Module

- Wheel Arches

- Cockpit Module

- Roof Module

- Engine Casing

- Bonnet Liners

The market has also been segregated on the basis of application into trunk module, floor module, wheel arches, cockpit module, roof module, engine casing and bonnet liners.

Breakup by Region:

- Asia Pacific

- Europe

- North America

- Middle East and Africa

- Latin America

Region-wise, Asia Pacific exhibits a clear dominance in the global automotive NVH materials market. Other major regions include Europe, North America, Middle East and Africa, and Latin America.

Competitive Landscape:

The competitive landscape of the market has also been examined with some of the key players being BASF SE, The DOW Chemical Company, ExxonMobil, 3M Company, Mitsui Chemicals, Inc., Sumitomo Riko Company Limited, Covestro AG, Celanese Corporation, Huntsman Corporation, Lanxess AG and Borgers AG.

Key Questions Answered in This Report

- 1.What is the market size of the automotive NVH materials market?

- 2.What is the growth rate of the automotive NVH materials market?

- 3.What are the key factors driving the global automotive NVH materials market?

- 4.What has been the impact of COVID-19 on the global automotive NVH materials market?

- 5.What is the breakup of the global automotive NVH materials market based on the product?

- 6.What is the breakup of the global automotive NVH materials market based on the vehicle type?

- 7.What is the breakup of the global automotive NVH materials market based on the application?

- 8.What are the key regions in the global automotive NVH materials market?

- 9.Who are the key players?

- 10.What is the largest segment of the automotive NVH materials market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Automotive NVH Materials Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Product

- 5.5 Market Breakup by Vehicle Type

- 5.6 Market Breakup by Application

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

6 Market Breakup by Product

- 6.1 Polyurethane

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Mixed Textiles Fibers

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Fiber Glass

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Polyester Fiber

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 NBR

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Polypropylene

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

- 6.7 PVC

- 6.7.1 Market Trends

- 6.7.2 Market Forecast

- 6.8 Textile Materials (Synthetic)

- 6.8.1 Market Trends

- 6.8.2 Market Forecast

- 6.9 Textile Materials (Cotton)

- 6.9.1 Market Trends

- 6.9.2 Market Forecast

7 Market Breakup by Vehicle Type

- 7.1 Passenger Vehicles

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 LCV

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 HCV

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

8 Market Breakup by Application

- 8.1 Trunk Module

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Floor Module

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Wheel Arches

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Cockpit Module

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Roof Module

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

- 8.6 Engine Casing

- 8.6.1 Market Trends

- 8.6.2 Market Forecast

- 8.7 Bonnet Liners

- 8.7.1 Market Trends

- 8.7.2 Market Forecast

9 Market Breakup by Region

- 9.1 Asia Pacific

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 North America

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 Global Automotive NVH Materials Industry: SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Global Automotive NVH Materials Industry: Value Chain Analysis

- 11.1 Overview

- 11.2 Suppliers of Raw Materials

- 11.3 Manufacturers of Polymers

- 11.4 Automotive Component Manufacturers

- 11.5 Automobile OEMs

12 Global Automotive NVH Materials Industry: Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Global Automotive NVH Materials Industry: Price Analysis

- 13.1 Price Indicators

- 13.2 Price Structure

- 13.3 Margin Analysis

14 Automotive NVH Materials Manufacturing Process

- 14.1 Product Overview

- 14.2 Raw Material Requirements

- 14.3 Manufacturing Process

- 14.4 Key Success and Risk Factors

15 Competitive Landscape

- 15.1 Market Structure

- 15.2 Key Players

- 15.3 Profiles of Key Players

- 15.3.1 BASF SE

- 15.3.2 The DOW Chemical Company

- 15.3.3 ExxonMobil

- 15.3.4 3M Company

- 15.3.5 Mitsui Chemicals, Inc.

- 15.3.6 Sumitomo Riko Company Limited

- 15.3.7 Covestro AG

- 15.3.8 Celanese Corporation

- 15.3.9 Huntsman Corporation

- 15.3.10 Lanxess AG

- 15.3.11 Borgers AG