|

|

市場調査レポート

商品コード

1754346

オキソアルコール市場レポート:タイプ別、地域別、2025~2033年Oxo-Alcohol Market Report by Type (2-Ethylhexanol, n-Butanol, iso-Butanol), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| オキソアルコール市場レポート:タイプ別、地域別、2025~2033年 |

|

出版日: 2025年06月02日

発行: IMARC

ページ情報: 英文 137 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のオキソアルコールの市場規模は2024年に155億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに337億米ドルに達し、2025~2033年にかけて8.55%の成長率(CAGR)を示すと予測しています。

オキソアルコールは、オレフィンをロジウム触媒の存在下、低圧で合成ガスと反応させることによって調製される化合物です。イソブタノール(IBA)、N-ブタノール(NBA)、2-エチルヘキサノール(2-EH)などがあり、接着剤、界面活性剤、塗料、コーティング剤、可塑剤、アセテート、印刷インキ、エーテルなどの製造に溶剤や化学中間体として広く使用されています。このほか、繊維、包装、自動車産業で広く利用されているアクリレートの製造にも広範な用途が見出されています。

オキソアルコール市場の動向

急速な工業化と製造工場の拡大が、世界中でオキソアルコールの需要を喚起している主な要因のひとつです。さらに、世界人口の増加により建設活動が活発化し、オキソアルコールを配合した可塑剤のニーズが高まっています。これとは別に、オキソアルコールはポリ塩化ビニル(PVC)製品の製造に広く使用されており、その汎用性、柔軟性、耐久性の高さから、さまざまな産業分野で採用されています。例えば、化粧品業界ではフレグランス、スキンケア、ヘアケア製品の調合に使用されています。さらに、自動車産業における高品質の潤滑システムに対する需要の高まりが、市場にプラスの影響を与えています。オキソアルコールは、機械や自動車用の潤滑剤を合成するための分散剤や合成中間体として使用されます。これに加えて、湿度の高い条件下での乾燥時の白化を防ぎ、流動性、光沢、耐性を向上させるために、塗料の合成にオキソアルコールが広く採用されていることが、市場の成長を強化しています。医薬品や農業分野でのオキソアルコールの使用増加が市場を牽引しています。さらに、2-エチルヘキサノールの柔軟性、低排出ガス、良好な接着性、燃料性能向上特性を理由に、原料としての用途が増加していることも、市場の成長を刺激しています。さらに、より効率的なオキソアルコールの変種を導入するための研究開発(R&D)活動に対する大手市場プレイヤーの資金増加も、市場成長を促進すると予測されています。

本レポートで扱う主な質問

- 世界のオキソアルコールの2024年の市場規模は?

- 世界のオキソアルコール市場の2025~2033年の展望は?

- 世界のオキソアルコール市場に対するCOVID-19の影響は?

- 世界のオキソアルコール市場の主な促進要因は?

- 世界のオキソアルコール市場の主な動向は?

- 世界のオキソアルコール市場におけるタイプ別区分は?

- 世界のオキソアルコール市場における主な地域市場は?

- 世界のオキソアルコール市場における主なプレイヤーは?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 物理的および化学的性質

- 主要業界動向

第5章 世界のオキソアルコール産業

- 市場概要

- 市場実績

- 数量動向

- 金額動向

- COVID-19の影響

- 価格分析

- 主要価格指標

- 価格構造

- 価格動向

- 市場内訳:タイプ別

- 市場内訳:地域別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 原材料調達

- 製造

- 流通

- 輸出

- 最終用途

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 主要成功要因とリスク要因

- 貿易データ

- 輸入:主要国別

- 輸出:主要国別

第6章 市場内訳:地域別

- アジア

- 北米

- 西洋欧州

- その他

第7章 市場内訳:タイプ別

- 2-エチルヘキサノール

- 市場実績

- 市場内訳:用途別

- 市場内訳:地域別

- 価格動向

- 主要メーカーと生産能力

- N-ブタノール

- 市場実績

- 市場内訳:用途別

- 市場内訳:地域別

- 価格動向

- 主要メーカーと生産能力

- イソブタノール

- 市場実績

- 市場内訳:用途別

- 市場内訳:地域別

- 価格動向

- 主要メーカーと生産能力

第8章 オキソアルコール製造プロセス

- 製品概要

- 製造プロセス

- 関与する化学反応

- 原材料の要件

- マスバランスと原料転換率

第9章 オキソアルコール原料分析

- 原料市場の動向

- プロピレン

- 天然ガス

- 市場内訳:地域別

- プロピレン

- 天然ガス

- 価格動向

- プロピレン

- 天然ガス

- 主要な原料サプライヤー

- プロピレン

- 天然ガス

第10章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- China Petrochemical Corporation

- OQ Chemicals GmbH(OQ SAOC)

- LG Chem

- BASF SE

- Eastman Chemical Company

- Formosa Plastics Corporation

- Sasol Limited

List of Figures

- Figure 1: Global: Oxo-Alcohol Market: Major Drivers and Challenges

- Figure 2: Global: Oxo-Alcohol Market: Sales Volume (in Million Tons), 2019-2024

- Figure 3: Global: Oxo-Alcohol Market: Volume Breakup by Segment (in %), 2024

- Figure 4: Global: 2-Ethylhexanol Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 5: Global: n-Butanol Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 6: Global: Iso-Butanol Market: Sales Volume (in Million Tons), 2019 & 2024

- Figure 7: Global: Oxo-Alcohol Market: Sales Value (in Billion USD), 2019-2024

- Figure 8: Global: Oxo-alcohol Market: Average Price Trends (in USD/Ton), 2019-2024

- Figure 9: Oxo-alcohol Market: Price Structure

- Figure 10: Global: Oxo-alcohol Market Forecast: Average Price Trends (in USD/Ton), 2025-2033

- Figure 11: Global: Oxo-Alcohol Market: Value Breakup by Type (in %), 2024

- Figure 12: Global: Oxo-Alcohol Market: Value Breakup by Region (in %), 2024

- Figure 13: Global: Oxo-Alcohol Industry: SWOT Analysis

- Figure 14: Global: Oxo-Alcohol Industry: Porters Five Forces Analysis

- Figure 15: Global: Oxo-Alcohol Industry: Value Chain Analysis

- Figure 16: Global: 2-Ethylhexanol: Import Value Breakup by Country (in %)

- Figure 17: China: 2-Ethylhexanol: Import Value Trend (in '000 USD)

- Figure 18: Global: n-Butanol: Import Value Breakup by Country (in %)

- Figure 19: China: n-Butanol: Import Value Trend (in '000 USD)

- Figure 20: Global: 2-Ethylhexanol: Export Value Breakup by Country (in %)

- Figure 21: Germany: 2-Ethylhexanol Export Value Trend (in '000 USD)

- Figure 22: Global: n-Butanol: Export Value Breakup by Country (in %)

- Figure 23: US: n-Butanol: Export Value Trend (in '000 USD)

- Figure 24: Asia: Oxo-Alcohol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Asia: Oxo-Alcohol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: North America: Oxo-Alcohol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: North America: Oxo-Alcohol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Western Europe: Oxo-Alcohol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Western Europe: Oxo-Alcohol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Others: Oxo-Alcohol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Others: Oxo-Alcohol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: 2-Ethylhexanol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: n-Butanol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Iso-Butanol Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: 2-Ethylhexanol Market: Production Capacity Breakup by Region (in %), 2024

- Figure 36: Global: 2-Ethylhexanol Market: Consumption Volume Breakup by Region (in %), 2024

- Figure 37: Global: n-Butanol Market: Production Capacity Breakup by Region (in %), 2024

- Figure 38: Global: n-Butanol Market: Consumption Volume Breakup by Region (in %), 2024

- Figure 39: Global: 2-Ethylhexanol Market: Breakup by Application (in %), 2024

- Figure 40: Global: n-Butanol Market: Breakup by Application (in %), 2024

- Figure 41: Global: Iso-Butanol Market: Breakup by Application (in %), 2024

- Figure 42: Global: Oxo-Alcohol Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 43: Global: 2-Ethylhexanol Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 44: Global: n-Butanol Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 45: Global: Iso-Butanol Market Forecast: Sales Volume (in Million Tons), 2025-2033

- Figure 46: Global: Oxo-Alcohol Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 47: Global: 2-Ethylhexanol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Global: n-Butanol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 49: Global: Iso-Butanol Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Global: 2-Ethylhexanol Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 51: Global: n-Butanol Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 52: Global: Iso-Butanol Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 53: Oxo-Alcohol Manufacturing: Detailed Process Flow

- Figure 54: Oxo-Alcohol (2-Ethyl Hexanol) Manufacturing: Conversion Rate of Feedstocks

- Figure 55: Oxo-Alcohol (n-Butanol and Iso-Butanol) Manufacturing: Conversion Rate of Feedstocks

- Figure 56: Global: Propylene Market: Production Volumes (in Million Tons), 2019-2024

- Figure 57: Global: Natural Gas Market: Production Volume (in Million Tons of Oil Equivalent), 2019-2024

- Figure 58: Global: Propylene Market: Production Breakup by Region (in %), 2024

- Figure 59: Global: Natural Gas Market: Production Breakup by Region (in %), 2024

- Figure 60: Global: Propylene Market: Average Price Trends (in USD/Ton), 2019-2033

- Figure 61: Global: Natural Gas Market: Average Price Trends (in USD/ Million Btu), 2019-2033

- Figure 62: Global: Propylene Market: Breakup by Manufacturer (in %)

- Figure 63: Global: Natural Gas Reserves: Breakup by Supplier (in %)

List of Tables

- Table 1: Physical and Chemical Properties of Oxo-Alcohol

- Table 2: Global: 2-Ethylhexanol: Import Data of Major Countries

- Table 3: Global: n-Butanol: Import Data of Major Countries

- Table 4: Global: 2-Ethylhexanol: Export Data of Major Countries

- Table 5: Global: n-Butanol: Export Data of Major Countries

- Table 6: Global: Oxo-Alcohol Market Forecast: Breakup by Region (in Million Tons), 2025-2033

- Table 7: Global: Oxo-Alcohol Market Forecast: Breakup by Type (in Million Tons), 2025-2033

- Table 8: Global: Oxo-Alcohol Market: Competitive Structure

- Table 9: Global: 2-Ethylhexanol Market: Capacity of Major Players (in Tons),

- Table 10: Global: n-Butanol Market: Capacity of Major Players (in Tons),

- Table 11: Global: Iso-Butanol Market: List of Major Players

- Table 12: Oxo-Alcohol Manufacturing Process: Raw Material Requirements

- Table 13: Global: Oxo-Alcohol Market: List of Major Players

- Table 14: Global: Propylene Market: List of Major Players

The global oxo-alcohol market size reached USD 15.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 33.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.55% during 2025-2033.

Oxo-alcohol is a chemical compound prepared by reacting olefins with syngas at low pressure in the presence of a rhodium catalyst. It includes Isobutanol (IBA), N-Butanol (NBA), and 2-Ethylhexanol (2-EH), which are widely used as solvents and chemical intermediates in manufacturing adhesives, surfactants, paints, coatings, plasticizers, acetates, printing inks, and ethers. Besides this, it finds extensive applications in manufacturing acrylates, which are extensively utilized in the textile, packaging, and automotive industries.

Oxo-Alcohol Market Trends:

Rapid industrialization and the expansion of manufacturing plants are among the key factors catalyzing the demand for oxo-alcohols across the globe. In addition, the growing global population is resulting in rising construction activities, which, in turn, is increasing the need for plasticizers formulated with oxo-alcohols. Apart from this, oxo-alcohols are extensively used in preparing polyvinyl chloride (PVC) products, which are further employed in different industry verticals on account of their enhanced versatility, flexibility, and durability. For instance, it is employed in the cosmetics industry to formulate fragrances, skincare, and hair care products. Additionally, the growing demand for high-quality lubrication systems in the automotive industry is positively influencing the market. Oxo-alcohols are used as dispersants and synthesis intermediates to synthesize lubricants for machinery and automobiles. Besides this, the widespread adoption of oxo-alcohols in synthesizing coatings to prevent blushing when drying in humid conditions and improve flow, gloss, and resistance is strengthening the market growth. The rising use of these chemicals in the pharmaceutical and agricultural sectors is driving the market. Furthermore, the increasing applications of 2-Ethylhexanol as feedstock on account of its flexibility, lower emissions, good adhesion, and fuel performance enhancement properties are stimulating the market growth. Moreover, rising funds by leading market players in research and development (R&D) activities to introduce more efficient variants of oxo-alcohols, are anticipated to propel the market growth.

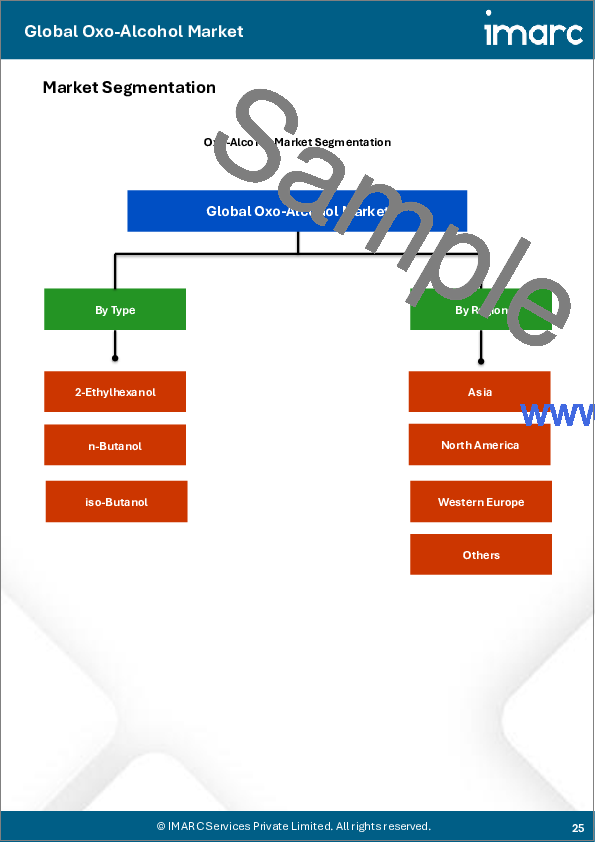

Key Market Segmentation:

Breakup by Type:

- 2-Ethylhexanol

- n-Butanol

- iso-Butanol

N-butanol currently represents the largest type as it is extensively used in various applications, such as acrylate, acetate, glycol ethers, and solvents.

Regional Insights:

- Asia

- North America

- Western Europe

- Others

- The report has also provided a comprehensive analysis of all the major regional Oxo-alcohol markets, which include Asia, North America, Western Europe and Others. Asia enjoys the leading position in the global market due to rapid industrialization and the growing population, which is resulting in the rising need for automotive and construction activities in the region.

Competitive Landscape:

- The competitive landscape of the industry has also been examined along with the profiles of the key players being China Petrochemical Corporation, OQ Chemicals GmbH (OQ SAOC), LG Chem, BASF SE, Eastman Chemical Company, Formosa Plastics Corporation and Sasol Limited.

Key Questions Answered in This Report

- 1.What was the global oxo-alcohol market size in 2024?

- 2.What will be the global oxo-alcohol market outlook during the forecast period 2025-2033?

- 3.What is the impact of COVID-19 on the global oxo-alcohol market?

- 4.What are the major global oxo-alcohol market drivers?

- 5.What are the major global oxo-alcohol market trends?

- 6.What is the global oxo-alcohol market breakup by type?

- 7.What are the major regional markets in the global oxo-alcohol industry?

- 8.Who are the leading players in the global oxo-alcohol industry?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Physical and Chemical Properties

- 4.3 Key Industry Trends

5 Global Oxo-Alcohol Industry

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Volume Trends

- 5.2.2 Value Trends

- 5.3 Impact of COVID-19

- 5.4 Price Analysis

- 5.4.1 Key Price Indicators

- 5.4.2 Price Structure

- 5.4.3 Price Trends

- 5.5 Market Breakup by Type

- 5.6 Market Breakup by Region

- 5.7 Market Forecast

- 5.8 SWOT Analysis

- 5.8.1 Overview

- 5.8.2 Strengths

- 5.8.3 Weaknesses

- 5.8.4 Opportunities

- 5.8.5 Threats

- 5.9 Value Chain Analysis

- 5.9.1 Raw Material Procurement

- 5.9.2 Manufacturing

- 5.9.3 Distribution

- 5.9.4 Exports

- 5.9.5 End Use

- 5.10 Porter's Five Forces Analysis

- 5.10.1 Overview

- 5.10.2 Bargaining Power of Buyers

- 5.10.3 Bargaining Power of Suppliers

- 5.10.4 Degree of Competition

- 5.10.5 Threat of New Entrants

- 5.10.6 Threat of Substitutes

- 5.11 Key Success and Risk Factors

- 5.12 Trade Data

- 5.12.1 Imports by Major Countries

- 5.12.2 Exports by Major Countries

6 Market Breakup by Region

- 6.1 Asia

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 North America

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Western Europe

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Others

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Type

- 7.1 2-Ethylhexanol

- 7.1.1 Market Performance

- 7.1.2 Market Breakup by Application

- 7.1.3 Market Breakup by Region

- 7.1.4 Price Trends

- 7.1.5 Key Manufacturers and Capacities

- 7.1.6 Market Forecast

- 7.2 n-Butanol

- 7.2.1 Market Performance

- 7.2.2 Market Breakup by Application

- 7.2.3 Market Breakup by Region

- 7.2.4 Price Trends

- 7.2.5 Key Manufacturers and Capacities

- 7.2.6 Market Forecast

- 7.3 iso-Butanol

- 7.3.1 Market Performance

- 7.3.2 Market Breakup by Application

- 7.3.3 Market Breakup by Region

- 7.3.4 Price Trends

- 7.3.5 Key Manufacturers and Capacities

- 7.3.6 Market Forecast

8 Oxo-Alcohol Manufacturing Process

- 8.1 Product Overview

- 8.2 Manufacturing Process

- 8.3 Chemical Reactions Involved

- 8.4 Raw Material Requirements

- 8.5 Mass Balance and Feedstock Conversion Rates

9 Oxo-Alcohol Feedstock Analysis

- 9.1 Feedstock Market Trends

- 9.1.1 Propylene

- 9.1.2 Natural Gas

- 9.2 Market Breakup by Region

- 9.2.1 Propylene

- 9.2.2 Natural Gas

- 9.3 Price Trends

- 9.3.1 Propylene

- 9.3.2 Natural Gas

- 9.4 Key Feedstock Suppliers

- 9.4.1 Propylene

- 9.4.2 Natural Gas

10 Competitive Landscape

- 10.1 Market Structure

- 10.2 Key Players

- 10.3 Key Player Profiles

- 10.3.1 China Petrochemical Corporation

- 10.3.2 OQ Chemicals GmbH (OQ SAOC)

- 10.3.3 LG Chem

- 10.3.4 BASF SE

- 10.3.5 Eastman Chemical Company

- 10.3.6 Formosa Plastics Corporation

- 10.3.7 Sasol Limited