|

|

市場調査レポート

商品コード

1636014

EPA・DHA市場レポート:タイプ別、由来別、用途別、地域別、2025-2033年EPA & DHA Market Report by Type (Eicosapentaenoic Acid, Docosahexaenoic Acid ), Source, Application, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| EPA・DHA市場レポート:タイプ別、由来別、用途別、地域別、2025-2033年 |

|

出版日: 2025年01月10日

発行: IMARC

ページ情報: 英文 128 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

EPA・DHA市場の世界市場規模は、2024年に19億9,050万米ドルに達しました。今後、IMARC Groupは、市場は2033年までに33億6,960万米ドルに達し、2025年から2033年にかけて5.72%の成長率(CAGR)を示すと予測しています。オメガ3脂肪酸の健康効果に対する消費者の意識の高まり、機能性食品やサプリメントに対する需要の高まり、漁業における持続可能で環境に優しい調達方法の普及が、市場を牽引する主な要因のいくつかです。

EPA(エイコサペンタエン酸)・DHA(ドコサヘキサエン酸)は、類似した化学構造を持つ長鎖多価不飽和オメガ3脂肪酸を指し、人間の健康に不可欠です。通常、サケ、サバ、イワシ、藻類などの脂肪分の多い魚に含まれるEPA・DHAは、人間の体内では合成されないため、食事やサプリメントから摂取する必要があります。魚やサプリメントから摂取したEPA・DHAは生物学的利用能が高いため、人体に比較的容易に吸収され、細胞膜など必要な構造物に取り込まれます。EPA・DHAは認知機能の低下を防ぎ、抗炎症作用によって心臓病、コレステロール、関節炎などの慢性疾患のリスクを軽減するため、脳の機能と開発に重要です。さらに、EPA・DHAは免疫系を調整し、皮膚の健康に役立ち、加齢黄斑変性症のリスクを最小限に抑えるためにも重要です。

EPA・DHA市場動向:

世界市場は、EPA・DHAを含有するサプリメントや機能性食品への需要の高まりによって大きく牽引されています。これは、大衆、特に老年人口の間で、心臓病、糖尿病、がんなどの慢性疾患の罹患率が上昇していることに起因しています。これに伴い、健康やフィットネスに対する消費者の意識が高まっていることも、EPA・DHA強化食品の需要を後押ししています。さらに、乳児用調製粉乳やペットフードにおけるEPA・DHAの使用量の増加が、市場に有利な成長機会を生み出しています。このほか、製造業者が高純度・高濃度のEPA・DHAサプリメントや機能性食品を製造できるようにする加工技術の継続的な進歩も、市場に弾みをつけています。消費者層の間で植物ベースの菜食主義が広まりつつあることから、藻類ベースのサプリメントや食品など、植物ベースの由来のEPA・DHAの利用が増加しています。市場は、食品やサプリメントに関する規制や表示要件のパラダイムシフトによってさらに活性化され、その結果、企業は新しい規則に準拠するために処方やマーケティング戦略を調整しています。市場に寄与するその他の要因としては、急速な都市化、水産業界における持続可能で環境に優しい調達方法の普及、可処分所得水準の上昇、主要企業による広範な研究開発活動などが挙げられます。

本レポートで扱う主な質問

- 世界のEPA・DHA市場はこれまでどのように推移してきたか?

- 世界のEPA・DHA市場における促進要因、抑制要因、機会は何か?

- 各促進要因、抑制要因、機会が世界のEPA・DHA市場に与える影響は?

- 主要な地域市場とは?

- 最も魅力的なEPA・DHA市場はどの国か?

- タイプ別の市場内訳は?

- EPA・DHA市場で最も魅力的なタイプは?

- 由来別の市場内訳は?

- EPA・DHA市場で最も魅力的な由来は?

- 用途別の市場内訳は?

- EPA・DHA市場で最も魅力的な用途は?

- 世界のEPA・DHA市場の競合構造は?

- 世界のEPA・DHA市場における主要プレイヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のEPA・DHA市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:タイプ別

- エイコサペンタエン酸(EPA)

- 市場動向

- 市場予測

- ドコサヘキサエン酸(DHA)

- 市場動向

- 市場予測

第7章 市場内訳:由来別

- 魚油

- 市場動向

- 市場予測

- 藻類油

- 市場動向

- 市場予測

- オキアミ油

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第8章 市場内訳:用途別

- 乳児用調合乳

- 市場動向

- 市場予測

- 栄養補助食品

- 市場動向

- 市場予測

- 栄養強化飲食品

- 市場動向

- 市場予測

- 医薬品

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第10章 促進要因・抑制要因・機会

- 概要

- 促進要因

- 抑制要因

- 機会

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- AlgiSy BioSciences Inc.

- Arctic Nutrition AG

- BASF SE

- Biosearch Sau

- Corbion NV

- Croda International PLC

- KD Pharma Group

- Koninklijke DSM NV

- Nordic Naturals Inc

- Novasep Holding SAS

- Novotech Nutraceuticals Inc

- Omega Protein Corporation

- Polaris

List of Figures

- Figure 1: Global: EPA & DHA Market: Major Drivers and Challenges

- Figure 2: Global: EPA & DHA Market: Sales Value (in Million USD), 2019-2024

- Figure 3: Global: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 4: Global: EPA & DHA Market: Breakup by Type (in %), 2024

- Figure 5: Global: EPA & DHA Market: Breakup by Source (in %), 2024

- Figure 6: Global: EPA & DHA Market: Breakup by Application (in %), 2024

- Figure 7: Global: EPA & DHA Market: Breakup by Region (in %), 2024

- Figure 8: Global: EPA & DHA (Eicosapentaenoic Acid (EPA)) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: EPA & DHA (Eicosapentaenoic Acid (EPA)) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: EPA & DHA (Docosahexaenoic Acid (DHA)) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: EPA & DHA (Docosahexaenoic Acid (DHA)) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: EPA & DHA (Fish Oil) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: EPA & DHA (Fish Oil) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: EPA & DHA (Algae Oil) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: EPA & DHA (Algae Oil) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: EPA & DHA (Krill Oil) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: EPA & DHA (Krill Oil) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: EPA & DHA (Other Sources) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: EPA & DHA (Other Sources) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: EPA & DHA (Infant Formulae) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: EPA & DHA (Infant Formulae) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: EPA & DHA (Dietary Supplements) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: EPA & DHA (Dietary Supplements) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: EPA & DHA (Fortified Food and Beverages) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: EPA & DHA (Fortified Food and Beverages) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: EPA & DHA (Pharmaceuticals) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: EPA & DHA (Pharmaceuticals) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: EPA & DHA (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: EPA & DHA (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: North America: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: North America: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: United States: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: United States: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Canada: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Canada: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Asia-Pacific: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Asia-Pacific: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: China: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: China: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: Japan: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: Japan: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: India: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: India: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: South Korea: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: South Korea: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: Australia: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: Australia: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Indonesia: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Indonesia: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: Others: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: Others: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: Europe: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: Europe: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Germany: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Germany: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: France: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: France: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: United Kingdom: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: United Kingdom: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Italy: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Italy: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Spain: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Spain: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: Russia: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: Russia: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: Others: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: Others: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Latin America: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Latin America: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Brazil: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Brazil: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Mexico: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Mexico: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Others: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Others: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Middle East and Africa: EPA & DHA Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Middle East and Africa: EPA & DHA Market: Breakup by Country (in %), 2024

- Figure 78: Middle East and Africa: EPA & DHA Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 79: Global: EPA & DHA Industry: Drivers, Restraints, and Opportunities

- Figure 80: Global: EPA & DHA Industry: Value Chain Analysis

- Figure 81: Global: EPA & DHA Industry: Porter's Five Forces Analysis

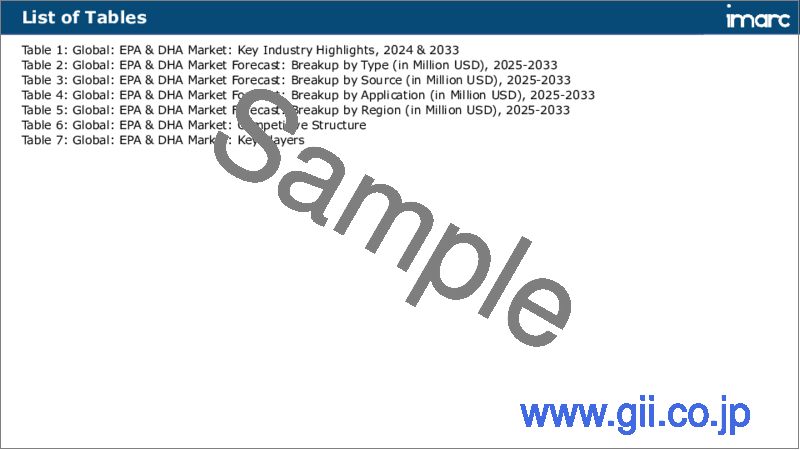

List of Tables

- Table 1: Global: EPA & DHA Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: EPA & DHA Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: EPA & DHA Market Forecast: Breakup by Source (in Million USD), 2025-2033

- Table 4: Global: EPA & DHA Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: EPA & DHA Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: EPA & DHA Market: Competitive Structure

- Table 7: Global: EPA & DHA Market: Key Players

The global EPA & DHA market size reached USD 1,990.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,369.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033. The increasing consumer awareness about the health benefits of omega-3 fatty acids, rising demand for functional foods and supplements, and the growing prevalence of sustainable and eco-friendly sourcing practices in the fishing industry represent some of the key factors driving the market.

EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid) refer to long-chain polyunsaturated omega-3 fatty acids with similar chemical structures that are essential for human health. Usually found in fatty fish, such as salmon, mackerel, sardines and algae, EPA and DHA are not synthesized by the human body and must be obtained through diet or supplementation. EPA and DHA from fish and supplements are highly bioavailable, therefore they are absorbed by the human body relatively easily and can be incorporated into cell membranes and other structures where they are needed. EPA and DHA are important for brain function and development as they protect against cognitive decline and their anti-inflammatory properties help to reduce the risk of chronic diseases, such as heart disease, cholesterol, and arthritis. In addition to this, EPA and DHA are important for regulating the immune system, benefitting skin health and minimizing the risks of age-related macular degeneration.

EPA & DHA Market Trends:

The global market is majorly driven by the augmenting demand for supplements and functional foods containing EPA and DHA. This can be attributed to the rising incidences of chronic diseases, such as heart disease, diabetes, and cancer among the masses, particularly the geriatric population. In line with this, the increasing awareness among consumers regarding health and fitness is also propelling the demand for EPA and DHA fortified foods. Moreover, the increasing usage of EPA and DHA in infant formula and pet food is creating lucrative growth opportunities in the market. Besides this, continual technological advancements in the processing techniques enabling manufacturers to produce high-purity and high-concentration EPA and DHA supplements and functional foods are providing an impetus to the market. The growing adoption of plant-based vegan diets among the consumer base is resulting in a higher uptake of plant-based sources of EPA and DHA, such as algae-based supplements and foods. The market is further fueled by the paradigm shift in regulations and labeling requirements for food and supplements, resulting in companies adjusting their formulations and marketing strategies to comply with new rules. Some of the other factors contributing to the market include rapid urbanization, growing prevalence of sustainable and eco-friendly sourcing practices in the fishing industry, inflating disposable income levels, and extensive research and development (R&D) activities conducted by the key players.

Key Market Segmentation:

Type Insights:

- Eicosapentaenoic Acid (EPA)

- Docosahexaenoic Acid (DHA)

Source Insights:

- Fish Oil

- Algae Oil

- Krill Oil

- Others

Application Insights:

- Infant Formulae

- Dietary Supplements

- Fortified Food and Beverages

- Pharmaceuticals

- Others

- A detailed breakup and analysis of the EPA & DHA market based on the application has also been provided in the report. This includes infant formulae, dietary supplements, fortified food and beverages, pharmaceuticals, and others. According to the report, dietary supplements accounted for the largest market share.

Regional Insights:

- North America

- United States

- Canada

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

- The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific was the largest market for EPA & DHA. Some of the factors driving the Asia Pacific EPA & DHA market included the growing geriatric population, continual technological advancements in sustainable fishing practices, increasing awareness regarding health and fitness, etc.

Competitive Landscape:

- The report has also provided a comprehensive analysis of the competitive landscape in the global EPA & DHA market. Competitive analysis such as market structure, market share by key players, player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the companies covered include AlgiSy BioSciences Inc., Arctic Nutrition AG, BASF SE, Biosearch Sau, Corbion NV, Croda International PLC, KD Pharma Group, Koninklijke DSM NV, Nordic Naturals Inc, Novasep Holding SAS, Novotech Nutraceuticals Inc, Omega Protein Corporation, Polaris, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Key Questions Answered in This Report:

- How has the global EPA & DHA market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global EPA & DHA market?

- What is the impact of each driver, restraint, and opportunity on the global EPA & DHA market?

- What are the key regional markets?

- Which countries represent the most attractive EPA & DHA market?

- What is the breakup of the market based on the type?

- Which is the most attractive type in the EPA & DHA market?

- What is the breakup of the market based on the source?

- Which is the most attractive source in the EPA & DHA market?

- What is the breakup of the market based on application?

- Which is the most attractive application in the EPA & DHA market?

- What is the competitive structure of the global EPA & DHA market?

- Who are the key players/companies in the global EPA & DHA market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global EPA & DHA Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Type

- 6.1 Eicosapentaenoic Acid (EPA)

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Docosahexaenoic Acid (DHA)

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

7 Market Breakup by Source

- 7.1 Fish Oil

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Algae Oil

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Krill Oil

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Others

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

8 Market Breakup by Application

- 8.1 Infant Formulae

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Dietary Supplements

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Fortified Food and Beverages

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Pharmaceuticals

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 Drivers, Restraints, and Opportunities

- 10.1 Overview

- 10.2 Drivers

- 10.3 Restraints

- 10.4 Opportunities

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 AlgiSy BioSciences Inc.

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.2 Arctic Nutrition AG

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.3 BASF SE

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Biosearch Sau

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.5 Corbion NV

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.6 Croda International PLC

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.6.3 Financials

- 14.3.6.4 SWOT Analysis

- 14.3.7 KD Pharma Group

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.8 Koninklijke DSM NV

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.8.4 SWOT Analysis

- 14.3.9 Nordic Naturals Inc

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.10 Novasep Holding SAS

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.11 Novotech Nutraceuticals Inc

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 SWOT Analysis

- 14.3.12 Omega Protein Corporation

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.13 Polaris

- 14.3.13.1 Company Overview

- 14.3.13.2 Product Portfolio

- 14.3.1 AlgiSy BioSciences Inc.

Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.