|

|

市場調査レポート

商品コード

1316258

EPAとDHAの世界市場-2023年~2030年Global EPA & DHA Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| EPAとDHAの世界市場-2023年~2030年 |

|

出版日: 2023年07月27日

発行: DataM Intelligence

ページ情報: 英文 190 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

市場概要

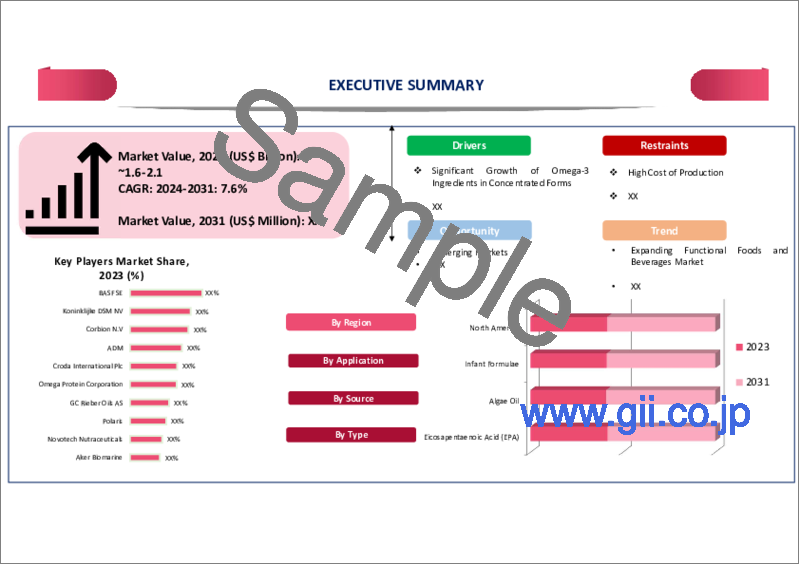

世界のEPAとDHA市場は、2022年に18億米ドルに達し、2030年には29億米ドルに達すると予測され、予測期間2023-2030年のCAGRは6.5%で成長すると予測されています。EPAとDHA市場は、製品の多様化と技術革新の傾向が高まっています。例えば、企業は持続可能で植物由来のオメガ3供給源に対する需要の高まりに対応するため、藻類ベースのEPAとDHAサプリメントを導入しています。

EPAとDHA市場は、オメガ3脂肪酸の健康効果に対する意識の高まりにより、大幅な成長を遂げています。EPA(エイコサペンタエン酸)とDHA(ドコサヘキサエン酸)は、心臓血管と脳の健康をサポートするために不可欠な成分です。同市場では、魚油、藻類油、オメガ3系サプリメントなど、さまざまな製品オプションが提供されており、消費者がこれらの栄養素を食生活に取り入れるのに便利になっています。

オメガ3を強化した機能性食品の採用が増加していることが、EPAとDHA市場を牽引しています。食品メーカーは、健康志向の消費者に対応するため、EPAとDHAを幅広い強化食品や飲食品に組み込んでいます。例えば、オメガ3を強化した牛乳、ヨーグルト、シリアルなどが増加しています。さらに、ペットの健康と栄養に対する関心の高まりから、ペットフード製品にEPAとDHAが配合されるようになり、ペット栄養分野での市場拡大を牽引しています。

市場力学

オメガ3の効能とヘルスケア推奨への世界の注目がEPAとDHA市場の成長を促進

世界の保健機関や規制機関は、公衆衛生の促進におけるオメガ3脂肪酸の重要性を強調しています。各国政府は、食事ガイドラインや公衆衛生キャンペーンを通じて、EPAとDHAの摂取を奨励する政策を実施しています。さらに、EPAやDHA製品の品質と安全性を確保するための規制も整備され、消費者は標準化された信頼性の高いサプリメントを安心して利用できるようになっています。

こうした支援策が消費者の信頼を高め、EPAとDHA市場の動向を後押ししています。さらに、ヘルスケアの推奨や治療プロトコルにオメガ3サプリメントの摂取が含まれるようになったことも、市場の成長を後押ししています。ヘルスケア専門家は、心血管疾患、炎症性疾患、その他の健康上の懸念を抱える患者にEPAとDHAのサプリメントを推奨する傾向が強まっており、必須脂肪酸の需要をさらに押し上げています。

植物由来源に対する需要の高まりがEPAとDHA市場の成長を促進

持続可能性と環境問題に対する意識の高まりに伴い、藻類油のような植物由来のEPAとDHA源に対する需要が高まっています。藻類由来のオメガ3サプリメントは、魚油に代わるものを求める菜食主義者やベジタリアンの消費者の間で人気を博しています。藻類油は、持続可能で環境に優しい選択肢を提供し、海洋資源への圧力を軽減し、漁業による環境への影響を緩和します。

植物ベースの動きが勢いを増すにつれて、藻類を原料とするEPAとDHAのサプリメントに対する需要が高まり、EPAとDHA市場の成長を促進すると予想されます。藻類由来のEPAとDHA製品の市場シェアは、消費者の嗜好の変化や倫理的配慮に対応して拡大すると予測されます。

汚染物質への懸念がEPAとDHA市場成長の課題に

EPAとDHA市場の主な抑制要因の1つは、魚油や海洋由来の製品に含まれる汚染物質の潜在的リスクです。これらのオメガ3脂肪酸は一般的に魚やその他の海洋生物から摂取されるため、環境汚染物質や重金属、毒素が体内に蓄積される可能性があります。水銀、PCB、ダイオキシンなどの汚染物質が特定の魚種や海洋油に含まれている可能性があり、製品の安全性や潜在的な健康リスクに対する消費者の懸念が高まっています。

この抑制要因に対処するため、EPAとDHA市場のメーカーやサプライヤーは、製品が安全基準や規制要件を満たしていることを確認するため、第三者機関による試験や認証など、厳格な品質管理対策を実施する必要があります。精製された高品質のEPAとDHAサプリメントを提供することで、消費者の信頼を築き、市場におけるこの抑制要因を克服することができます。

COVID-19影響分析

COVID-19分析には、COVID前シナリオ、COVIDシナリオ、COVID後シナリオに加え、価格力学(COVID前シナリオと比較したパンデミック中およびパンデミック後の価格変動を含む)、需給スペクトラム(取引制限、封鎖、およびその後の問題による需給の変化)、政府の取り組み(政府機関による市場、セクター、産業を活性化するための取り組み)、メーカーの戦略的取り組み(COVID問題を緩和するためにメーカーが行ったことをここで取り上げる)が含まれます。

目次

第1章 調査手法と調査範囲

第2章 市場の定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場への影響要因

- 促進要因

- 抑制要因

- 機会

- 影響分析

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 タイプ別

- エイコサペンタエン酸(EPA)

- ドコサヘキサエン酸(DHA)

第8章 供給源別

- 藻類油

- クリルオイル

- 魚油

- その他

第9章 用途別

- 乳児用調製粉乳

- 栄養補助食品

- 強化飲食品

- 医薬品

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- BASF SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Koninklijke DSM NV

- Corbion N.V.

- The Archer Daniels Midland Company

- Croda International Plc

- KD Pharma Group

- Lonza Group Ltd.

- Omega Protein Corporation

- GC Rieber Oils AS

- Polaris

第13章 付録

Market Overview

The Global EPA & DHA Market reached US$ 1.8 billion in 2022 and is expected to reach US$ 2.9 billion by 2030 and is expected to grow with a CAGR of 6.5% during the forecast period 2023-2030. The EPA and DHA market is witnessing a rising trend in product diversification and innovation. For instance, companies are introducing algae-based EPA and DHA supplements to cater to the growing demand for sustainable and plant-based sources of omega-3s.

The EPA and DHA market is witnessing substantial growth due to the increasing awareness of the health benefits of omega-3 fatty acids. EPA (Eicosapentaenoic Acid) and DHA (Docosahexaenoic Acid) are essential components for supporting cardiovascular and brain health. The market offers various product options, including fish oil, algal oil, and omega-3 supplements, making it convenient for consumers to incorporate these nutrients into their diets.

The rising adoption of omega-3-enriched functional foods is driving the EPA and DHA markets. Food manufacturers are incorporating EPA and DHA into a wide range of fortified food and beverages to cater to health-conscious consumers. For example, there has been an increase in the availability of omega-3-enriched milk, yogurt, and cereals. Moreover, the growing focus on pet health and nutrition has led to the inclusion of EPA and DHA in pet food products, driving the market's expansion in the pet nutrition segment.

Market Dynamics

Global Emphasis on Omega-3 Benefits and Healthcare Recommendations Propel EPA & DHA Market Growth

Health organizations and regulatory bodies worldwide have been emphasizing the importance of omega-3 fatty acids in promoting public health. Governments are implementing policies to encourage the consumption of EPA and DHA through dietary guidelines and public health campaigns. Additionally, regulations are in place to ensure the quality and safety of EPA and DHA products, providing consumers with the assurance of standardized and reliable supplements.

These supportive measures have contributed to increased consumer confidence, thereby boosting the EPA and DHA market trends. Furthermore, the inclusion of omega-3 supplementation in healthcare recommendations and treatment protocols has bolstered market growth. Healthcare professionals are increasingly recommending EPA and DHA supplements to patients with cardiovascular issues, inflammatory conditions, and other health concerns, further driving the demand for these essential fatty acids.

Rising Demand for Plant-Based Sources Propels EPA & DHA Market Growth

With the increasing awareness of sustainability and environmental concerns, there is a growing demand for plant-based sources of EPA and DHA, such as algal oil. Algae-derived omega-3 supplements have gained popularity among vegan and vegetarian consumers who seek an alternative to fish oil. Algal oil offers a sustainable and eco-friendly option, reducing the pressure on marine resources and mitigating the environmental impact of fishing.

As the plant-based movement gains momentum, the demand for EPA and DHA supplements sourced from algae is expected to rise, propelling the growth of the EPA and DHA markets. The market share of algal-based EPA and DHA products is projected to increase in response to changing consumer preferences and ethical considerations.

Contaminant Concerns Pose Challenges to EPA and DHA Market Growth

One of the key restraints of the EPA and DHA market is the potential risk of contaminants in fish oil and marine-based products. As these omega-3 fatty acids are commonly sourced from fish and other marine organisms, there is a possibility of environmental pollutants, heavy metals, and toxins accumulating in their bodies. Contaminants like mercury, PCBs, and dioxins can be present in certain fish species and marine oils, raising concerns among consumers about product safety and potential health risks.

To address this restraint, manufacturers and suppliers in the EPA and DHA market need to implement rigorous quality control measures, such as third-party testing and certifications, to ensure that their products meet safety standards and regulatory requirements. Offering purified and high-quality EPA and DHA supplements can help build consumer trust and overcome this restraint in the market.

COVID-19 Impact Analysis

The COVID-19 Analysis includes Pre-COVID Scenario, COVID Scenario, and Post-COVID Scenario along with Pricing Dynamics (Including pricing change during and post-pandemic comparing it to pre-COVID scenarios), Demand-Supply Spectrum (Shift in demand and supply owing to trading restrictions, lockdown, and subsequent issues), Government Initiatives (Initiatives to revive market, sector or Industry by Government Bodies) and Manufacturers Strategic Initiatives (What manufacturers did to mitigate the COVID issues will be covered here).

Segment Analysis

The global EPA & DHA market has been segmented by type, source, application, and region.

Dietary Supplements Dominate the EPA and DHA Market, Catering to Health-Conscious Consumers

The dietary supplements segment is holding the largest market share, around 45% of the EPA and DHA market. Dietary supplements containing EPA and DHA are widely consumed by individuals seeking to boost their omega-3 intake and improve overall health. These supplements offer a convenient and precise way to obtain the recommended daily dosage of these essential fatty acids.

Additionally, the rising awareness of the health benefits associated with EPA and DHA consumption has contributed to the growth of the dietary supplements segment. Moreover, EPA (Eicosapentaenoic Acid) and DHA (Docosahexaenoic Acid) are prominent types of omega-3 fatty acids found in marine oils, making them the key components of these dietary supplements. Marine oils, sourced from fish and algae, are rich in EPA and DHA, making them ideal for formulating high-quality supplements.

Geographical Analysis

Asia Pacific Emerges as a Growing Force in the EPA & DHA Market, Paving the Way for Expanding Market Share and Size

By region, the global EPA & DHA market is segmented into North America, South America, Europe, Asia-Pacific, Middle-east, and Africa.

The Asia-Pacific region's EPA and DHA market size is experiencing significant growth due to increasing consumer awareness of the health benefits associated with omega-3 fatty acids. Fish oil, algal oil, and omega-3 supplements have gained popularity as they are known to support cardiovascular health and brain function. The rising prevalence of chronic diseases has driven the demand for EPA and DHA products in this region.

As a result, companies are expanding their product offerings to cater to the diverse health needs of consumers. The EPA and DHA market share in the Asia-Pacific region is projected to witness substantial growth as more people embrace preventive healthcare measures. Additionally, the market size is expected to expand as consumers seek personalized and targeted solutions to address their specific health concerns.

Competitive Landscape

The major global players in the market include: Koninklijke DSM NV, Corbion N.V., BASF SE, The Archer Daniels Midland Company, Croda International Plc, KD Pharma Group, Lonza Group Ltd., Omega Protein Corporation, GC Rieber Oils AS, and Polaris.

Why Purchase the Report?

- To visualize the global EPA & DHA market segmentation based on type, source, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities in the market by analyzing trends and co-development.

- Excel data sheet with numerous data points of EPA & DHA market-level with all segments.

- The PDF report consists of a cogently put-together market analysis after exhaustive qualitative interviews and an in-depth market study.

- Product mapping is available as Excel consists of key products of all the major market players.

The global EPA & DHA market report would provide approximately 61 tables, 62 figures, and 190 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Market Definition and Overview

3. Executive Summary

- 3.1. Market Snippet, by Type

- 3.2. Market Snippet, by Source

- 3.3. Market Snippet, by Application

- 3.4. Market Snippet, by Region

4. Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.2. Restraints

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Scenario Before COVID-19

- 6.1.2. Scenario During COVID-19

- 6.1.3. Scenario Post COVID-19

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During the Pandemic

- 6.5. Manufacturer's Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Eicosapentaenoic Acid (EPA)*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Docosahexaenoic Acid (DHA)

8. By Source

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2. Market Attractiveness Index, By Source

- 8.2. Algae Oil*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Krill oil

- 8.4. Fish Oil

- 8.5. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Infant Formulae*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Dietary Supplements

- 9.4. Fortified Food and Beverages

- 9.5. Pharmaceuticals

- 9.6. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America*

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. The U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. The U.K.

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. BASF SE

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Koninklijke DSM NV

- 12.3. Corbion N.V.

- 12.4. The Archer Daniels Midland Company

- 12.5. Croda International Plc

- 12.6. KD Pharma Group

- 12.7. Lonza Group Ltd.

- 12.8. Omega Protein Corporation

- 12.9. GC Rieber Oils AS

- 12.10. Polaris

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us