|

|

市場調査レポート

商品コード

1701955

医療用フレキシブル包装市場:材料別、製品別、エンドユーザー別、地域別、2025-2033年Medical Flexible Packaging Market Report by Material, Product, End User, and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 医療用フレキシブル包装市場:材料別、製品別、エンドユーザー別、地域別、2025-2033年 |

|

出版日: 2025年04月01日

発行: IMARC

ページ情報: 英文 142 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

医療用フレキシブル包装市場の世界市場規模は2024年に299億米ドルに達しました。今後、IMARC Groupは、市場は2033年までに500億米ドルに達し、2025年から2033年にかけて5.72%の成長率(CAGR)を示すと予測しています。ユーザーフレンドリーな包装に対する需要の高まり、規制遵守の厳格化、材料科学と技術の絶え間ない進歩、持続可能性への関心の高まり、ヘルスケア分野の拡大、製品の安全性重視の高まり、消費者の嗜好の進化などが市場拡大に寄与しています。

医療用フレキシブル包装とは、医療・ヘルスケア製品を保管・保護するために設計された特殊な包装を指します。耐久性、バリア性、無菌性を維持できる柔軟な材料を使用して作られています。この種の包装は、医療用品、医薬品、医療機器のライフサイクル全体を通して、完全性と安全性を確保するために極めて重要です。医療用フレキシブル包装は、ヘルスケア業界において様々な役割を果たしています。汚染、湿気、光、その他の外的要因から製品を保護することで、保存期間を延ばし、製品の有効性を維持します。さらに、医療品の保管、輸送、調剤を便利にします。医療用フレキシブル包装の利点には、軽量であるため輸送コストが削減できること、さまざまな製品のサイズや形状に適応できることなどがあります。医療用フレキシブル包装には、パウチ、バッグ、ラップ、小袋などいくつかの種類があります。

世界の医療用フレキシブル包装の市場は、医療製品のための効率的で便利な包装ソリューションに対する需要の増加の影響を受けています。フレキシブル包装は、携帯性、使いやすさ、無駄の削減といった利点を提供し、医療従事者や患者の嗜好に合致しています。さらに、医療業界における厳しい規制や基準が、信頼性が高く安全な包装の採用を後押しし、市場の成長をさらに増大させています。医療用フレキシブル包装は、内容物の無菌性と完全性を維持することでこれらの規制への準拠を保証し、患者の安全性を高めます。これに伴い、材料科学と技術の進歩が市場の拡大に寄与しています。バリア材料、印刷技術、改ざん防止機能の革新は、医療用フレキシブル包装の機能性と視覚的魅力を高め、進化する市場ニーズに対応しています。さらに、持続可能性への注目が高まり、リサイクル可能な材料の使用や包装廃棄物の削減など、環境に配慮した実践への注目が高まっていることも、市場の成長を後押ししています。

医療用フレキシブル包装の市場傾向/促進要因:

効率的で利便性の高い包装ソリューションへの需要の高まり

効率的で便利な包装ソリューションへの需要の高まりは、世界の医療用フレキシブル包装の市場の極めて重要な促進要因です。ヘルスケア専門家も患者も同様に、使いやすさ、携帯性、無駄の削減を保証する包装を求めています。フレキシブル包装は、軽量で持ち運びが容易な選択肢を医療製品に提供することで、こうしたニーズに対応しています。包装資材の柔軟性によりカスタマイズが容易で、さまざまなタイプの医療機器、医薬品、消耗品を確実に包装することができます。この汎用性により、全体的なユーザーエクスペリエンスが向上し、医療施設内のプロセスが合理化されます。ヘルスケアの実践が進化し続けるにつれて、ユーザーフレンドリーな包装ソリューションが重視されるようになり、業界全体で医療用フレキシブル包装の採用がさらに促進されると予想されます。

厳しい規制遵守と安全基準

ヘルスケア業界における厳しい規制と安全基準は、世界の医療用フレキシブル包装の市場に大きな影響を与えています。医療製品は、無菌状態を維持し、汚染を防ぎ、内容物の完全性を保証する包装を必要とします。規制機関は、患者の安全性と製品の有効性を保証するために、包装材料、滅菌プロセス、表示要件を規定するガイドラインを実施しています。医療用フレキシブル包装は、このような厳しい基準を満たすのに優れています。外部汚染物質に対するバリアを提供し、製品の安定性を維持し、改ざん防止機能を組み込むその能力は、医療分野の重要な安全ニーズに合致しています。規制要件を遵守する上で包装が果たす役割は、ヘルスケア提供者と患者の両方を保護する上でその重要性を強調しています。

材料科学の進歩と技術革新

材料科学と技術の進歩は、世界の医療用フレキシブル包装の市場を形成する極めて重要な原動力です。材料の革新は、湿気や酸素、その他の潜在的な脅威に対して卓越した保護を提供する高性能バリアフィルムの開発につながりました。これらの進歩は医療製品の保存期間を延ばし、その有効性と信頼性に貢献しています。さらに、印刷技術における技術革新は、医療品の正確な識別と使用を助ける、包装上の明確で有益なラベリングを可能にします。ホログラフィックシールやQRコードなどの改ざん防止機能は、製品の安全性とトレーサビリティを高めます。材料と技術の絶え間ない進化により、医療用フレキシブル包装はダイナミックで効果的なソリューションであり続け、ヘルスケア業界の変化し続ける需要に応えています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の医療用フレキシブル包装市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:材料別

- プラスチック

- 主要セグメント

- ポリ塩化ビニル

- ポリプロピレン

- ポリエチレンテレフタレート

- ポリエチレン

- その他

- 主要セグメント

- 紙

- アルミニウム

- バイオプラスチック

第7章 市場内訳:製品別

- パウチ・バッグ

- シール

- 高バリアフィルム

- ラップ

- 蓋・ラベル

- その他

第8章 市場内訳:エンドユーザー別

- 医薬品製造

- 医療機器製造

- インプラント製造

- 受託包装

- その他

第9章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 市場内訳:国別

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Amcor plc

- Becton Dickinson and Company

- Berry Global Inc.

- Catalent Inc.

- CCL Industries Inc.

- Coveris

- Huhtamaki Oyj

- Mondi plc

- Sealed Air Corporation

- Sonoco Products Company

- WestRock Company

- Winpak Ltd.

List of Figures

- Figure 1: Global: Medical Flexible Packaging Market: Major Drivers and Challenges

- Figure 2: Global: Medical Flexible Packaging Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Medical Flexible Packaging Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 4: Global: Medical Flexible Packaging Market: Breakup by Material (in %), 2024

- Figure 5: Global: Medical Flexible Packaging Market: Breakup by Product (in %), 2024

- Figure 6: Global: Medical Flexible Packaging Market: Breakup by End User (in %), 2024

- Figure 7: Global: Medical Flexible Packaging Market: Breakup by Region (in %), 2024

- Figure 8: Global: Medical Flexible Packaging (Plastics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 9: Global: Medical Flexible Packaging (Plastics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 10: Global: Medical Flexible Packaging (Paper) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 11: Global: Medical Flexible Packaging (Paper) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 12: Global: Medical Flexible Packaging (Aluminum) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 13: Global: Medical Flexible Packaging (Aluminum) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 14: Global: Medical Flexible Packaging (Bioplastics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 15: Global: Medical Flexible Packaging (Bioplastics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 16: Global: Medical Flexible Packaging (Pouches and Bags) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 17: Global: Medical Flexible Packaging (Pouches and Bags) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 18: Global: Medical Flexible Packaging (Seals) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 19: Global: Medical Flexible Packaging (Seals) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 20: Global: Medical Flexible Packaging (High Barrier Films) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 21: Global: Medical Flexible Packaging (High Barrier Films) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 22: Global: Medical Flexible Packaging (Wraps) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 23: Global: Medical Flexible Packaging (Wraps) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 24: Global: Medical Flexible Packaging (Lids and Labels) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 25: Global: Medical Flexible Packaging (Lids and Labels) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 26: Global: Medical Flexible Packaging (Other Products) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 27: Global: Medical Flexible Packaging (Other Products) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 28: Global: Medical Flexible Packaging (Pharmaceutical Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 29: Global: Medical Flexible Packaging (Pharmaceutical Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 30: Global: Medical Flexible Packaging (Medical Device Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 31: Global: Medical Flexible Packaging (Medical Device Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 32: Global: Medical Flexible Packaging (Implant Manufacturing) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 33: Global: Medical Flexible Packaging (Implant Manufacturing) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 34: Global: Medical Flexible Packaging (Contract Packaging) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 35: Global: Medical Flexible Packaging (Contract Packaging) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 36: Global: Medical Flexible Packaging (Other End Users) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 37: Global: Medical Flexible Packaging (Other End Users) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 38: North America: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 39: North America: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 40: United States: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 41: United States: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 42: Canada: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 43: Canada: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 44: Asia-Pacific: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 45: Asia-Pacific: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 46: China: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 47: China: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 48: Japan: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 49: Japan: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 50: India: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 51: India: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 52: South Korea: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 53: South Korea: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 54: Australia: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 55: Australia: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 56: Indonesia: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 57: Indonesia: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 58: Others: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 59: Others: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 60: Europe: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 61: Europe: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 62: Germany: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 63: Germany: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 64: France: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 65: France: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 66: United Kingdom: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 67: United Kingdom: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 68: Italy: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 69: Italy: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 70: Spain: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 71: Spain: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 72: Russia: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 73: Russia: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 74: Others: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 75: Others: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 76: Latin America: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 77: Latin America: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 78: Brazil: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 79: Brazil: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 80: Mexico: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 81: Mexico: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 82: Others: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 83: Others: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 84: Middle East and Africa: Medical Flexible Packaging Market: Sales Value (in Million USD), 2019 & 2024

- Figure 85: Middle East and Africa: Medical Flexible Packaging Market: Breakup by Country (in %), 2024

- Figure 86: Middle East and Africa: Medical Flexible Packaging Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 87: Global: Medical Flexible Packaging Industry: SWOT Analysis

- Figure 88: Global: Medical Flexible Packaging Industry: Value Chain Analysis

- Figure 89: Global: Medical Flexible Packaging Industry: Porter's Five Forces Analysis

List of Tables

- Table 1: Global: Medical Flexible Packaging Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Medical Flexible Packaging Market Forecast: Breakup by Material (in Million USD), 2025-2033

- Table 3: Global: Medical Flexible Packaging Market Forecast: Breakup by Product (in Million USD), 2025-2033

- Table 4: Global: Medical Flexible Packaging Market Forecast: Breakup by End User (in Million USD), 2025-2033

- Table 5: Global: Medical Flexible Packaging Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Medical Flexible Packaging Market: Competitive Structure

- Table 7: Global: Medical Flexible Packaging Market: Key Players

The global medical flexible packaging market size reached USD 29.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.0 Billion by 2033, exhibiting a growth rate (CAGR) of 5.72% during 2025-2033. Rising demand for user-friendly packaging, stringent regulatory adherence, continuous advancements in material science and technology, growing sustainability concerns, expanding healthcare sectors, increased emphasis on product safety, and evolving consumer preferences contribute to the market's expansion.

Medical flexible packaging refers to a specialized type of packaging designed to store and protect medical and healthcare products. It is crafted using flexible materials that offer durability, barrier properties, and sterility maintenance. This type of packaging is crucial for ensuring the integrity and safety of medical supplies, pharmaceuticals, and devices throughout their lifecycle. Medical flexible packaging serves various purposes within the healthcare industry. It safeguards products from contamination, moisture, light, and other external factors, thereby extending shelf life and maintaining product efficacy. Moreover, it facilitates convenient storage, transport, and dispensing of medical items. The advantages of medical flexible packaging include its lightweight nature, which reduces shipping costs, and its adaptability to different product sizes and shapes. There are several types of medical flexible packaging, including pouches, bags, wraps, and sachets.

The global medical flexible packaging market is influenced by the increasing demand for efficient and convenient packaging solutions for medical products. Flexible packaging offers advantages like portability, ease of use, and reduced wastage, which align with the preferences of medical professionals and patients alike. Moreover, stringent regulations and standards in the healthcare industry propel the adoption of reliable and safe packaging, further augmenting market growth. Medical flexible packaging ensures compliance with these regulations by maintaining the sterility and integrity of the contents, thus enhancing patient safety. In line with this, advancements in material science and technology contribute to the market's expansion. Innovations in barrier materials, printing techniques, and tamper-evident features enhance the functionality and visual appeal of medical flexible packaging, addressing evolving market needs. Additionally, the rising focus on sustainability and surging focus on environmentally conscious practices, including the use of recyclable materials and reduced packaging waste, are fueling market growth.

Medical Flexible Packaging Market Trends/Drivers:

Increasing demand for efficient and convenient packaging solutions

The escalating demand for efficient and convenient packaging solutions is a pivotal driving factor in the global medical flexible packaging market. Healthcare professionals and patients alike seek packaging that ensures ease of use, portability, and reduced wastage. Flexible packaging addresses these needs by offering lightweight and easily transportable options for medical products. The flexibility of packaging materials allows for easy customization, ensuring that different types of medical devices, pharmaceuticals, and consumables can be securely packaged. This versatility enhances the overall user experience and streamlines processes within medical facilities. As healthcare practices continue to evolve, the emphasis on user-friendly packaging solutions is expected to further fuel the adoption of medical flexible packaging across the industry.

Stringent regulatory compliance and safety standards

The stringent regulations and safety standards within the healthcare industry have a significant impact on the global medical flexible packaging market. Medical products require packaging that maintains sterility, prevents contamination, and ensures the integrity of the contents. Regulatory bodies enforce guidelines that dictate packaging materials, sterilization processes, and labeling requirements to guarantee patient safety and product efficacy. Medical flexible packaging excels in meeting these stringent criteria. Its ability to provide a barrier against external contaminants, maintain product stability, and incorporate tamper-evident features aligns with the critical safety needs of the medical field. The packaging's role in adhering to regulatory requirements underscores its importance in safeguarding both healthcare providers and patients.

Advancements in material science and technological innovations

Advancements in material science and technology are pivotal driving forces in shaping the global medical flexible packaging market. Material innovations have led to the development of high-performance barrier films that offer exceptional protection against moisture, oxygen, and other potential threats. These advancements extend the shelf life of medical products, contributing to their efficacy and reliability. Additionally, technological innovations in printing techniques enable clear and informative labeling on packaging, aiding in accurate identification and usage of medical items. Tamper-evident features, such as holographic seals and QR codes, enhance product security and traceability. The continuous evolution of materials and technology ensures that medical flexible packaging remains a dynamic and effective solution, meeting the ever-changing demands of the healthcare industry.

Medical Flexible Packaging Industry Segmentation:

Breakup by Material:

- Plastics

- Polyvinyl Chloride

- Polypropylene

- Polyethylene Terephthalate

- Polyethylene

- Others

- Paper

- Aluminum

- Bioplastics

Plastics dominates the market

The plastics segment of the global medical flexible packaging market is driven by the inherent versatility and adaptability of plastics, which allows for the creation of customized packaging solutions tailored to the unique requirements of medical products. Plastics offer an array of properties such as barrier protection, flexibility, and durability, ensuring the safe containment of sensitive medical items. Moreover, advancements in plastic material technologies have led to the development of high-performance polymers with enhanced barrier properties, reducing the risk of contamination and extending product shelf life. In line with this, the cost-effectiveness of plastic packaging solutions makes them an attractive option for manufacturers seeking efficient and economical ways to package medical devices and pharmaceuticals. Furthermore, the increasing emphasis on sustainable practices has prompted the plastics industry to innovate with eco-friendly materials and recyclable options, aligning with the broader trend toward environmental responsibility.

Breakup by Product:

- Pouches and Bags

- Seals

- High Barrier Films

- Wraps

- Lids and Labels

- Others

Pouches and bags dominate the market

The pouches and bags segment is being propelled by several crucial factors, which includes the convenience-driven consumer lifestyle. In line with this, the segment benefits from the rising demand for sustainable packaging solutions, with eco-friendly materials and designs gaining prominence. Moreover, technological advancements in manufacturing processes enable the creation of innovative pouches and bags with enhanced functionalities, such as resealable features and barrier protection. Furthermore, the versatility of pouches and bags in accommodating various product types, from food to personal care items, drives their adoption across industries. The segment's responsiveness to evolving market preferences, coupled with its cost-effectiveness and customizable nature, further contributes to its growth.

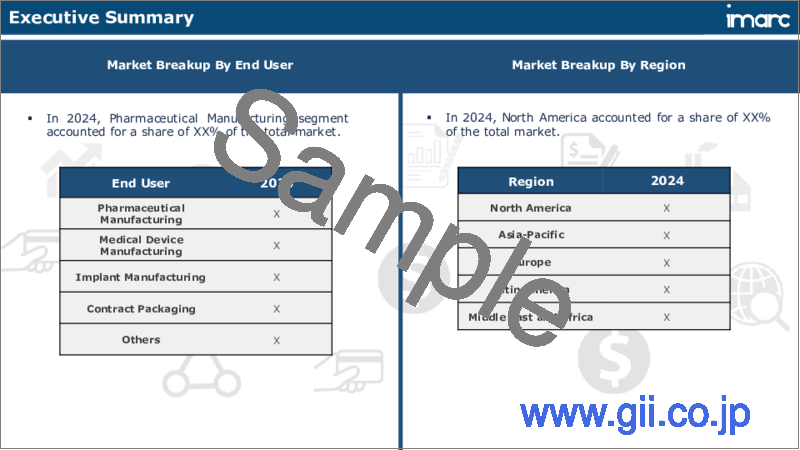

Breakup by End User:

- Pharmaceutical Manufacturing

- Medical Device Manufacturing

- Implant Manufacturing

- Contract Packaging

- Others

In the pharmaceutical manufacturing segment, precision and sterility in packaging are of paramount importance to safeguard product integrity. Adhering to strict regulations, packaging solutions ensure pharmaceutical efficacy, prevent contamination, and provide clear labeling for enhanced patient safety and regulatory compliance. In medical device manufacturing, specialized packaging maintains device functionality and sterility, meeting industry regulations while accommodating diverse sizes and materials. Implant manufacturing relies on packaging that preserves implant integrity, biocompatibility, and physical protection. Customized packaging aligns with implant specifications. Contract packaging prioritizes flexibility, efficiency, and customization, meeting diverse product needs. The others segment encompasses industries with unique packaging requirements, united by convenience, sustainability, regulatory adherence, and content protection.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific exhibits a clear dominance, accounting for the largest medical flexible packaging market share

The market research report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific accounted for the largest market share.

In the Asia Pacific, the medical flexible packaging market is propelled by the escalating demand for healthcare services, driven by population growth and increased healthcare awareness. Moreover, stringent regulatory requirements and safety standards underscore the significance of packaging integrity and sterility, driving the adoption of medical flexible packaging that aligns with these regulations. Furthermore, rapid technological advancements in material science and packaging technology contribute to the market's growth by offering innovative solutions that enhance product protection and user experience. Additionally, the region's shifting consumer preferences towards convenience and sustainability further amplify the demand for flexible packaging solutions. As healthcare infrastructure expands and market players focus on addressing evolving needs, these factors collectively shape the Asia Pacific medical flexible packaging market, making it a dynamic and influential sector within the healthcare packaging domain.

Competitive Landscape:

The competitive landscape within the medical flexible packaging market is marked by a dynamic interplay of industry forces. Companies vie for prominence by innovating packaging solutions that align with evolving market demands. Differentiation hinges on factors such as packaging material advancements, technology integration, and adherence to stringent regulations. Market players continuously refine packaging designs to enhance user experience, ensure product safety, and optimize supply chain efficiency. Customization remains a focal point, enabling tailored packaging solutions for diverse medical products. Sustainability initiatives play a pivotal role, with a growing emphasis on eco-friendly materials and reduced environmental impact. Additionally, the ability to swiftly respond to client requirements, scale operations, and offer cost-effective solutions forms a critical competitive edge. As the industry evolves, the competitive landscape is characterized by a pursuit of excellence in delivering packaging solutions that uphold the integrity, safety, and effectiveness of medical products across various sectors.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Amcor plc

- Becton Dickinson and Company

- Berry Global Inc.

- Catalent Inc.

- CCL Industries Inc.

- Coveris

- Huhtamaki Oyj

- Mondi plc

- Sealed Air Corporation

- Sonoco Products Company

- WestRock Company

- Winpak Ltd.

Key Questions Answered in This Report

- 1.What was the size of the global medical flexible packaging market in 2024?

- 2.What is the expected growth rate of the global medical flexible packaging market during 2025-2033?

- 3.What has been the impact of COVID-19 on the global medical flexible packaging market?

- 4.What are the key factors driving the global medical flexible packaging market?

- 5.What is the breakup of the global medical flexible packaging market based on the material?

- 6.What is the breakup of the global medical flexible packaging market based on the product?

- 7.What are the key regions in the global medical flexible packaging market?

- 8.Who are the key players/companies in the global medical flexible packaging market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Medical Flexible Packaging Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Forecast

6 Market Breakup by Material

- 6.1 Plastics

- 6.1.1 Market Trends

- 6.1.2 Key Segments

- 6.1.2.1 Polyvinyl Chloride

- 6.1.2.2 Polypropylene

- 6.1.2.3 Polyethylene Terephthalate

- 6.1.2.4 Polyethylene

- 6.1.2.5 Others

- 6.1.3 Market Forecast

- 6.2 Paper

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Aluminum

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Bioplastics

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

7 Market Breakup by Product

- 7.1 Pouches and Bags

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Seals

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 High Barrier Films

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Wraps

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Lids and Labels

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Others

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market Breakup by End User

- 8.1 Pharmaceutical Manufacturing

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Medical Device Manufacturing

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Implant Manufacturing

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Contract Packaging

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 North America

- 9.1.1 United States

- 9.1.1.1 Market Trends

- 9.1.1.2 Market Forecast

- 9.1.2 Canada

- 9.1.2.1 Market Trends

- 9.1.2.2 Market Forecast

- 9.1.1 United States

- 9.2 Asia-Pacific

- 9.2.1 China

- 9.2.1.1 Market Trends

- 9.2.1.2 Market Forecast

- 9.2.2 Japan

- 9.2.2.1 Market Trends

- 9.2.2.2 Market Forecast

- 9.2.3 India

- 9.2.3.1 Market Trends

- 9.2.3.2 Market Forecast

- 9.2.4 South Korea

- 9.2.4.1 Market Trends

- 9.2.4.2 Market Forecast

- 9.2.5 Australia

- 9.2.5.1 Market Trends

- 9.2.5.2 Market Forecast

- 9.2.6 Indonesia

- 9.2.6.1 Market Trends

- 9.2.6.2 Market Forecast

- 9.2.7 Others

- 9.2.7.1 Market Trends

- 9.2.7.2 Market Forecast

- 9.2.1 China

- 9.3 Europe

- 9.3.1 Germany

- 9.3.1.1 Market Trends

- 9.3.1.2 Market Forecast

- 9.3.2 France

- 9.3.2.1 Market Trends

- 9.3.2.2 Market Forecast

- 9.3.3 United Kingdom

- 9.3.3.1 Market Trends

- 9.3.3.2 Market Forecast

- 9.3.4 Italy

- 9.3.4.1 Market Trends

- 9.3.4.2 Market Forecast

- 9.3.5 Spain

- 9.3.5.1 Market Trends

- 9.3.5.2 Market Forecast

- 9.3.6 Russia

- 9.3.6.1 Market Trends

- 9.3.6.2 Market Forecast

- 9.3.7 Others

- 9.3.7.1 Market Trends

- 9.3.7.2 Market Forecast

- 9.3.1 Germany

- 9.4 Latin America

- 9.4.1 Brazil

- 9.4.1.1 Market Trends

- 9.4.1.2 Market Forecast

- 9.4.2 Mexico

- 9.4.2.1 Market Trends

- 9.4.2.2 Market Forecast

- 9.4.3 Others

- 9.4.3.1 Market Trends

- 9.4.3.2 Market Forecast

- 9.4.1 Brazil

- 9.5 Middle East and Africa

- 9.5.1 Market Trends

- 9.5.2 Market Breakup by Country

- 9.5.3 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Amcor plc

- 14.3.1.1 Company Overview

- 14.3.1.2 Product Portfolio

- 14.3.1.3 Financials

- 14.3.1.4 SWOT Analysis

- 14.3.2 Becton Dickinson and Company

- 14.3.2.1 Company Overview

- 14.3.2.2 Product Portfolio

- 14.3.2.3 Financials

- 14.3.2.4 SWOT Analysis

- 14.3.3 Berry Global Inc.

- 14.3.3.1 Company Overview

- 14.3.3.2 Product Portfolio

- 14.3.3.3 Financials

- 14.3.3.4 SWOT Analysis

- 14.3.4 Catalent Inc.

- 14.3.4.1 Company Overview

- 14.3.4.2 Product Portfolio

- 14.3.4.3 Financials

- 14.3.4.4 SWOT Analysis

- 14.3.5 CCL Industries Inc.

- 14.3.5.1 Company Overview

- 14.3.5.2 Product Portfolio

- 14.3.5.3 Financials

- 14.3.6 Coveris

- 14.3.6.1 Company Overview

- 14.3.6.2 Product Portfolio

- 14.3.7 Huhtamaki Oyj

- 14.3.7.1 Company Overview

- 14.3.7.2 Product Portfolio

- 14.3.7.3 Financials

- 14.3.8 Mondi plc

- 14.3.8.1 Company Overview

- 14.3.8.2 Product Portfolio

- 14.3.8.3 Financials

- 14.3.8.4 SWOT Analysis

- 14.3.9 Sealed Air Corporation

- 14.3.9.1 Company Overview

- 14.3.9.2 Product Portfolio

- 14.3.9.3 Financials

- 14.3.9.4 SWOT Analysis

- 14.3.10 Sonoco Products Company

- 14.3.10.1 Company Overview

- 14.3.10.2 Product Portfolio

- 14.3.10.3 Financials

- 14.3.10.4 SWOT Analysis

- 14.3.11 WestRock Company

- 14.3.11.1 Company Overview

- 14.3.11.2 Product Portfolio

- 14.3.11.3 Financials

- 14.3.11.4 SWOT Analysis

- 14.3.12 Winpak Ltd.

- 14.3.12.1 Company Overview

- 14.3.12.2 Product Portfolio

- 14.3.12.3 Financials

- 14.3.1 Amcor plc