|

|

市場調査レポート

商品コード

1661119

植物油市場レポート:油の種類別、用途別、地域別、2025年~2033年Vegetable Oil Market Report by Oil Type (Palm Oil, Soybean Oil, Sunflower Oil, Canola Oil, Coconut Oil, Palm Kernel Oil), Application (Food Industry, Biofuels, and Others), and Region 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 植物油市場レポート:油の種類別、用途別、地域別、2025年~2033年 |

|

出版日: 2025年02月10日

発行: IMARC

ページ情報: 英文 140 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

植物油市場の世界市場規模は2024年に2,805億米ドルに達しました。IMARC Groupは、2025年から2033年にかけての成長率(CAGR)は4.81%で、2033年には4,084億米ドルに達すると予測しています。より健康的な食習慣へのシフトの高まり、植物油の工業用途の増加、農業慣行の進歩、可処分所得の増加、特定の食用油の健康上の利点に関する意識の高まりは、市場を推進している主な要因の一部です。

植物油は様々な植物、主に種子や果実から抽出される液体脂肪です。一般的な供給源としては、大豆、トウモロコシ、ヒマワリ、キャノーラなどがあります。熱伝導媒体、風味増強剤、食品に水分を加える成分として、調理やベーキングに広く使用されています。植物油はまた、石鹸、スキンケア製品、バイオ燃料の製造にも利用されています。植物油には必須脂肪酸が豊富に含まれているが、その栄養価は原料によって異なります。植物油の中には不飽和脂肪酸を多く含むものもあり、適度に摂取すれば一般的に心臓に良いとされています。

不飽和脂肪酸を多く含む健康的な油に対する消費者の嗜好の変化は、全世界の市場成長を促進する主要な要因の一つです。また、消費者の健康志向の高まりも、オリーブ油やキャノーラ油の需要に影響を与えています。化粧品、石鹸、バイオ燃料における植物油の工業的用途が市場成長に寄与しています。世界人口の増加と新興経済国の所得増加が食用油の必要性を煽っています。農法の進歩は収量の向上につながり、植物油の生産をより効率的でコスト効率の高いものにしています。政府の政策と貿易規制は、生産コストと価格設定に影響を与え、市場の形成に重要な役割を果たしています。オンライン・プラットフォームを含む流通チャネルは、様々な油への消費者のアクセスを容易にしています。持続可能性への懸念や倫理的な農法は、消費者の選択において影響力を持つ要素になりつつあり、これは全世界の市場に明るい見通しをもたらしています。

植物油市場傾向/促進要因:

消費者の健康志向の変化

健康志向の現代社会では、飽和脂肪酸が少なく不飽和脂肪酸が多い植物油への需要が高まっています。パーム油やココナッツ油のような飽和脂肪酸を多く含む従来の油よりも、一価不飽和脂肪酸や多価不飽和脂肪酸を多く含むオリーブ油、キャノーラ油、アボカド油などが好まれるようになっています。さらに、オメガ3脂肪酸を豊富に含む油は、その健康効果が証明され、支持されるようになってきています。一般消費者の意識向上キャンペーン、科学的調査、表示への取り組みが、この傾向をさらに強めています。多くの消費者は、油の健康的な属性に基づいて、より多くの情報に基づいた選択を行っており、これは、より健康的であるとして販売されている特定のタイプの植物油の市場需要を大幅に促進しています。

産業用途の増加

食用にとどまらず、植物油には数多くの産業用途があり、消費者の間でその需要が大幅に拡大しています。これらの油は、石鹸、洗剤、化粧品、さらにはバイオ燃料の製造における主要成分であり、これが市場をさらに牽引しています。植物油の多機能性は、様々な産業プロセスにおいて不可欠なものとなっています。産業が拡大し多様化するにつれ、植物油の需要も拡大しています。例えば、バイオ燃料分野、特にバイオディーゼルの台頭も植物油産業の成長を促進しています。また、企業は植物油の新しい産業用途を発見するために研究に投資しており、これがさらに需要を促進しています。

世界人口の増加

世界人口の増加は、当然のことながら食料需要を増加させ、ひいては食用油の需要も増加させる。人口の増加に伴い、特に所得が増加している新興国では、より多くの人々がより多くの種類の油を購入できるようになり、それが市場の成長に寄与しています。また、食品生産用の植物油の需要も人口と連動して伸びています。さらに、世界の料理がより身近になり、人気が高まるにつれて、それらの料理に欠かせない油の需要も増加しています。

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界の植物油産業

- 市場概要

- 市場実績

- 数量動向

- 金額動向

- COVID-19の影響

- 市場内訳:地域別

- 市場内訳:油の種類別

- 市場内訳:用途別

- 市場予測

- SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

- バリューチェーン分析

- 入力サプライヤー

- 農民

- コレクター

- メーカー

- 販売代理店

- 小売業者

- 最終消費者

- ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

- 価格分析

- 主要価格指標

- 価格構造

- 価格動向

- 市場促進要因と成功要因

第6章 主要地域の実績

- 中国

- 市場動向

- 市場予測

- 米国

- 市場動向

- 市場予測

- インド

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- インドネシア

- 市場動向

- 市場予測

- マレーシア

- 市場動向

- 市場予測

- ブラジル

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場:油の種類別

- パーム油

- 市場動向

- 市場予測

- 大豆油

- 市場動向

- 市場予測

- ひまわり油

- 市場動向

- 市場予測

- キャノーラ油

- 市場動向

- 市場予測

- ココナッツオイル

- 市場動向

- 市場予測

- パーム核油

- 市場動向

- 市場予測

第8章 市場:用途別

- 食品産業

- 市場動向

- 市場予測

- バイオ燃料

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 競合情勢

- 市場構造

- 主要企業

第10章 植物油製造

- 製品概要

- パーム油

- キャノーラ油

- ココナッツオイル

- 大豆油

- 詳細なプロセスフロー

- パーム油

- キャノーラ油

- ココナッツオイル

- 大豆油

- 様々な種類の単位操作

- パーム油

- キャノーラ油

- ココナッツオイル

- 大豆油

- マスバランスと原材料要件

- パーム油

- キャノーラ油

- ココナッツオイル

- 大豆油

第11章 プロジェクトの詳細・必要条件・費用

- 土地要件と費用

- 建設要件と費用

- 工場レイアウト

- 工場の機械

- 機械写真

- 原材料の要件と支出

- 原材料と最終製品の写真

- 包装の要件と支出

- 輸送の要件と支出

- ユーティリティの要件と支出

- 人員要件と支出

- その他の設備投資

第12章 融資と資金援助

第13章 プロジェクトの経済性

- プロジェクトの資本コスト

- 技術経済的パラメーター

- サプライチェーンの各段階における製品価格とマージン

- 課税と減価償却

- 収入予測

- 支出予測

- 財務分析

- 利益分析

第14章 主要企業のプロファイル

- Archer-Daniels-Midland Company

- Bunge Limited

- Cargill, Incorporated

- Louis Dreyfus Company BV

- Wilmar International Ltd.

List of Figures

- Figure 1: Global: Vegetable Oil Market: Major Drivers and Challenges

- Figure 2: Global: Vegetable Oil Production: Volume Trends (in Million Tons), 2019-2024

- Figure 3: Global: Vegetable Oil Consumption: Volume Trends (in Million Tons), 2019-2024

- Figure 4: Global: Vegetable Oil Consumption: Value Trends (in Billion USD), 2019-2024

- Figure 5: Global: Vegetable Oil Market: Breakup by Region (in %), 2024

- Figure 6: Global: Vegetable Oil Market: Breakup by Oil Type (in %), 2024

- Figure 7: Global: Vegetable Oil Market: Breakup by Application (in %), 2024

- Figure 8: Global: Vegetable Oil Production Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 9: Global: Vegetable Oil Consumption Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 10: Global: Vegetable Oil Consumption Forecast: Value Trends (in Billion USD), 2025-2033

- Figure 11: Global: Vegetable Oil Industry: SWOT Analysis

- Figure 12: Global: Vegetable Oil Industry: Value Chain Analysis

- Figure 13: Global: Vegetable Oil Industry: Porter's Five Forces Analysis

- Figure 14: Global: Vegetable Oil Market: Average Prices (in USD/Ton), 2019-2024

- Figure 15: Vegetable Oil Market: Price Structure

- Figure 16: Global: Vegetable Oil Market Forecast: Average Prices (in USD/Tons), 2025-2033

- Figure 17: China: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 18: China: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 19: United States: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 20: United States: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 21: India: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 22: India: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 23: Europe: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 24: Europe: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 25: Indonesia: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 26: Indonesia: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 27: Malaysia: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 28: Malaysia: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 29: Brazil: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 30: Brazil: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 31: Others: Vegetable Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 32: Others: Vegetable Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 33: Global: Palm Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 34: Global: Palm Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 35: Global: Soybean Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 36: Global: Soybean Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 37: Global: Canola Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 38: Global: Canola Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 39: Global: Sunflower Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 40: Global: Sunflower Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 41: Global: Coconut Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 42: Global: Coconut Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 43: Global: Palm Kernel Oil Market: Volume Trends (in Million Tons), 2019 & 2024

- Figure 44: Global: Palm Kernel Oil Market Forecast: Volume Trends (in Million Tons), 2025-2033

- Figure 45: Global: Vegetable Oil Market: Food Industry (in Million Tons), 2019 & 2024

- Figure 46: Global: Vegetable Oil Market Forecast: Food Industry (in Million Tons), 2025-2033

- Figure 47: Global: Vegetable Oil Market: Biofuels (in Million Tons), 2019 & 2024

- Figure 48: Global: Vegetable Oil Market Forecast: Biofuels (in Million Tons), 2025-2033

- Figure 49: Global: Vegetable Oil Market: Other Uses (in Million Tons), 2019 & 2024

- Figure 50: Global: Vegetable Oil Market Forecast: Other Uses (in Million Tons), 2025-2033

- Figure 51: Palm Oil Manufacturing: Detailed Process Flow

- Figure 52: Soybean Oil Manufacturing: Detailed Process Flow

- Figure 53: Canola Oil Manufacturing: Detailed Process Flow

- Figure 54: Sunflower Oil Manufacturing: Detailed Process Flow

- Figure 55: Palm Oil Manufacturing: Conversion Rate of Feedstocks

- Figure 56: Soybean Oil Manufacturing: Conversion Rate of Feedstocks

- Figure 57: Canola Oil Manufacturing: Conversion Rate of Feedstocks

- Figure 58: Sunflower Oil Manufacturing: Conversion Rate of Feedstocks

- Figure 59: Vegetable Oil Manufacturing: Proposed Plant Layout

- Figure 60: Vegetable Oil Manufacturing: Breakup of Capital Costs (in %)

- Figure 61: Vegetable Oil Industry: Profit Margins at Various Levels of the Supply Chain

- Figure 62: Vegetable Oil Processing: Manufacturing Cost Breakup (in %)

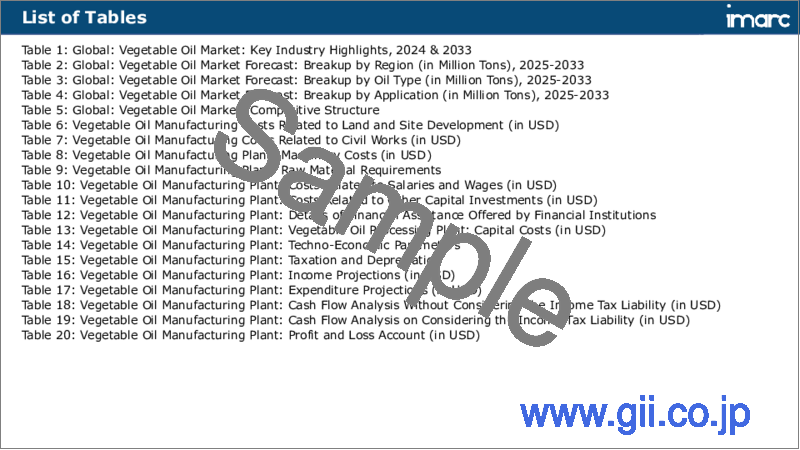

List of Tables

- Table 1: Global: Vegetable Oil Market: Key Industry Highlights, 2024 & 2033

- Table 2: Global: Vegetable Oil Market Forecast: Breakup by Region (in Million Tons), 2025-2033

- Table 3: Global: Vegetable Oil Market Forecast: Breakup by Oil Type (in Million Tons), 2025-2033

- Table 4: Global: Vegetable Oil Market Forecast: Breakup by Application (in Million Tons), 2025-2033

- Table 5: Global: Vegetable Oil Market: Competitive Structure

- Table 6: Vegetable Oil Manufacturing Costs Related to Land and Site Development (in USD)

- Table 7: Vegetable Oil Manufacturing Costs Related to Civil Works (in USD)

- Table 8: Vegetable Oil Manufacturing Plant: Machinery Costs (in USD)

- Table 9: Vegetable Oil Manufacturing Plant: Raw Material Requirements

- Table 10: Vegetable Oil Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

- Table 11: Vegetable Oil Manufacturing Plant: Costs Related to Other Capital Investments (in USD)

- Table 12: Vegetable Oil Manufacturing Plant: Details of Financial Assistance Offered by Financial Institutions

- Table 13: Vegetable Oil Manufacturing Plant: Vegetable Oil Processing Plant: Capital Costs (in USD)

- Table 14: Vegetable Oil Manufacturing Plant: Techno-Economic Parameters

- Table 15: Vegetable Oil Manufacturing Plant: Taxation and Depreciation

- Table 16: Vegetable Oil Manufacturing Plant: Income Projections (in USD)

- Table 17: Vegetable Oil Manufacturing Plant: Expenditure Projections (in USD)

- Table 18: Vegetable Oil Manufacturing Plant: Cash Flow Analysis Without Considering the Income Tax Liability (in USD)

- Table 19: Vegetable Oil Manufacturing Plant: Cash Flow Analysis on Considering the Income Tax Liability (in USD)

- Table 20: Vegetable Oil Manufacturing Plant: Profit and Loss Account (in USD)

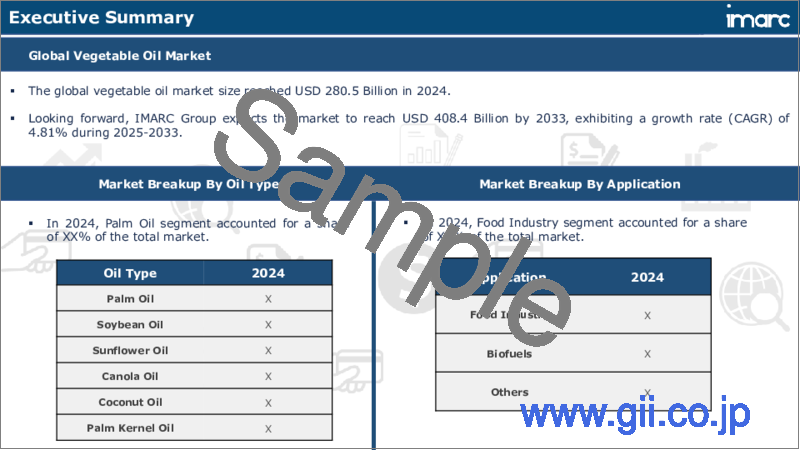

The global vegetable oil market size reached USD 280.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 408.4 Billion by 2033, exhibiting a growth rate (CAGR) of 4.81% during 2025-2033. The rising shift towards healthier eating habits, increasing industrial uses of vegetable oils, advances in agricultural practices, rising disposable income, and increased awareness about the health benefits of certain cooking oils are some of the major factors propelling the market.

Vegetable oil is a liquid fat extracted from various plants, primarily from seeds or fruits. Common sources include soybean, corn, sunflower, and canola. It is widely used in cooking and baking as a heat transfer medium, flavor enhancer, and ingredient that adds moisture to food. Vegetable oils are also utilized in the production of soaps, skincare products, and biofuels. They are rich in essential fatty acids, though the nutritional value can vary depending on the source. Some vegetable oils are high in unsaturated fats, which are generally considered heart-healthy when consumed in moderation.

Changing consumer preference for healthier oils that are rich in unsaturated fats represents one of the key factors driving the growth of the market across the globe. The market is also driven by the rising health consciousness among consumers which is further influencing the demand for oils like olive and canola. Industrial applications of vegetable oils in cosmetics, soaps, and biofuels are contributing to the market growth. The growing global population and rising incomes in emerging economies are fueling the need for edible oils. Advances in agricultural practices are leading to improved yields, thus making vegetable oil production more efficient and cost-effective. Government policies and trade regulations play a crucial role in shaping the market, affecting production costs and pricing. Distribution channels, including online platforms, facilitate easier consumer access to a variety of oils. Sustainability concerns and ethical farming practices are becoming influential factors in consumer choice which is creating a positive outlook for the market across the globe.

Vegetable Oil Market Trends/Drivers:

Changing consumer preferences for healthier options

In the contemporary health-conscious society, there is a growing demand for vegetable oils that are low in saturated fats and high in unsaturated fats. Oils, such as olive, canola, and avocado oils, rich in monounsaturated and polyunsaturated fats, are increasingly preferred over traditional oils high in saturated fats like palm or coconut oil. Additionally, oils rich in omega-3 fatty acids are finding favor for their proven health benefits. Public awareness campaigns, scientific research, and labeling initiatives are amplifying this trend. Many consumers are making more informed choices based on the health attributes of oils, which is significantly driving market demand for specific types of vegetable oils that are marketed as being healthier.

Rising industrial applications

Beyond the culinary realm, vegetable oils have numerous industrial uses that are considerably widening their demand among consumers. These oils are key ingredients in the production of soaps, detergents, cosmetics, and even biofuels which is further driving the market. The multi-functionality of vegetable oils makes them indispensable in a variety of industrial processes. As industries expand and diversify, so does the demand for vegetable oils. For instance, the rising biofuels sector, particularly biodiesel, is also facilitating the growth of the vegetable oil industry. Companies are also investing in research to discover new industrial applications for vegetable oils, which is further driving its demand.

Rising worldwide population

The world's growing population naturally increases the demand for food and, by extension, cooking oils which is acting as a major growth-inducing factor in the market. As the population rises, especially in emerging economies where incomes are also increasing, more people can afford a wider variety of oils which is contributing to the market growth. The demand for vegetable oils for food production also grows in tandem with the population. Moreover, as global cuisines become more accessible and popular, the oils integral to those cuisines see a rise in demand.

Vegetable Oil Industry Segmentation:

Breakup by Oil Type:

- Palm Oil

- Soybean Oil

- Sunflower Oil

- Canola Oil

- Coconut Oil

- Palm Kernel Oil

Palm oil accounts for the largest market share

The demand for palm oil in the vegetable oil market is driven by a variety of factors. Primarily, its cost-effectiveness makes it an attractive option for both consumers and industries. Palm oil is one of the most yield-efficient oil crops, which is leading to lower production costs and, consequently, more affordable retail prices. In addition to this, the versatility of palm oil makes it highly desirable across multiple sectors. In the food industry, it is used extensively for frying, baking, and as an ingredient in processed foods like snacks and confectionery items. It also serves as a key ingredient in non-food items, such as cosmetics, detergents, and biofuels, broadening its demand in the market. In line with this, the ease of storage and long shelf life of palm oil adds to its appeal. Unlike some other vegetable oils, palm oil is stable at room temperature, which reduces the need for refrigeration and makes it suitable for tropical climates.

Breakup by Application:

- Food Industry

- Biofuels

- Others

Food industry dominates the market

In the food industry, vegetable oils serve multiple functions that extend beyond mere cooking. They are widely used as frying mediums due to their high smoke points, thus making them ideal for deep-frying items like fries, doughnuts, and various fast foods. Their heat-stable nature makes them a suitable choice for sauteing and pan-frying as well. Vegetable oils are also employed as an ingredient in baked goods, such as bread, cakes, and cookies to add moisture, improve texture, and extend shelf life. Moreover, they act as emulsifiers and stabilizers in processed foods, aiding in the blending of ingredients and preventing separation in products like mayonnaise, dressings, and spreads. Certain types of vegetable oils, like olive oil, are often used as a flavor enhancer in culinary applications, bringing their distinct taste to dishes. In addition, they serve as a base in the production of margarine and vegetable shortening, offering a plant-based alternative to animal fats.

Breakup by Region:

- China

- United States

- India

- Europe

- Indonesia

- Malaysia

- Brazil

- Others

China holds the largest market share

The report has also provided a comprehensive analysis of all the major regional markets, which include China, the United States, India, Europe, Indonesia, Malaysia, Brazil, and others. According to the report, China accounted for the largest market share.

In China, the vegetable oil market is experiencing substantial growth due to several driving factors. Primarily, rapid urbanization and increasing household incomes are leading to a rise in demand for better-quality and diverse food products, including vegetable oils. As lifestyles become more hectic, the reliance on easy-to-cook food, which often requires cooking oils, is also rising. Health consciousness among consumers in the country is growing, which is pushing the demand for healthier vegetable oil options, such as olive and canola oils that are rich in unsaturated fats. The Chinese government's health initiatives and guidelines advocating lower consumption of saturated fats further endorse this trend. Industrial use of vegetable oils in China is burgeoning. With a booming manufacturing sector, the demand for vegetable oils in industrial applications, including biofuels, cosmetics, and even in the pharmaceutical industry, is increasing.

Competitive Landscape:

In the vegetable oil market, key players are engaging in a range of strategic activities to maintain a competitive edge. One of the primary focuses is on product diversification. Companies are introducing a variety of oils derived from different plants to cater to the health-conscious consumer, including options like avocado, grapeseed, and flaxseed oils. Research and development (R&D) are another area of significant investment. Companies are researching new refining techniques, long-lasting shelf-life solutions, and alternative industrial applications for vegetable oils. This not only expands market demand but also allows for innovation within the sector. Sustainability is increasingly becoming a cornerstone of business strategies. Many companies are adopting sustainable farming practices, reducing carbon footprints, and committing to fair trade practices to appeal to environmentally conscious consumers. Market penetration and geographical expansion are also on the agenda. Companies are entering new markets, particularly in developing nations, and enhancing their distribution networks both offline and online to reach a wider audience.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

- Archer-Daniels-Midland Company

- Bunge Limited

- Cargill, Incorporated

- Louis Dreyfus Company BV

- Wilmar International Ltd

Key Questions Answered in This Report

- 1.What is the impact of COVID-19 on the global vegetable oil market?

- 2.What will be the global vegetable oil market outlook during the forecast period 2025-2033?

- 3.What was the global vegetable oil market size in 2024?

- 4.What are the major global vegetable oil market drivers?

- 5.What are the major global vegetable oil market trends?

- 6.What is the global vegetable oil market breakup by oil type?

- 7.What is the global vegetable oil market breakup by application?

- 8.What are the major regional markets in the global vegetable oil industry?

- 9.Who are the leading global vegetable oil industry players?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Vegetable Oil Industry

- 5.1 Market Overview

- 5.2 Market Performance

- 5.2.1 Volume Trends

- 5.2.2 Value Trends

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Region

- 5.5 Market Breakup by Oil Type

- 5.6 Market Breakup by Application

- 5.7 Market Forecast

- 5.8 SWOT Analysis

- 5.8.1 Overview

- 5.8.2 Strengths

- 5.8.3 Weaknesses

- 5.8.4 Opportunities

- 5.8.5 Threats

- 5.9 Value Chain Analysis

- 5.9.1 Input Suppliers

- 5.9.2 Farmers

- 5.9.3 Collectors

- 5.9.4 Manufacturers

- 5.9.5 Distributors

- 5.9.6 Retailers

- 5.9.7 End-Consumers

- 5.10 Porter's Five Forces Analysis

- 5.10.1 Overview

- 5.10.2 Bargaining Power of Buyers

- 5.10.3 Bargaining Power of Suppliers

- 5.10.4 Degree of Competition

- 5.10.5 Threat of New Entrants

- 5.10.6 Threat of Substitutes

- 5.11 Price Analysis

- 5.11.1 Key Price Indicators

- 5.11.2 Price Structure

- 5.11.3 Price Trends

- 5.12 Key Market Drivers and Success Factors

6 Performance of Key Regions

- 6.1 China

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 United States

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 India

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Europe

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Indonesia

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

- 6.6 Malaysia

- 6.6.1 Market Trends

- 6.6.2 Market Forecast

- 6.7 Brazil

- 6.7.1 Market Trends

- 6.7.2 Market Forecast

- 6.8 Others

- 6.8.1 Market Trends

- 6.8.2 Market Forecast

7 Market by Oil Type

- 7.1 Palm Oil

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Soybean Oil

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

- 7.3 Sunflower Oil

- 7.3.1 Market Trends

- 7.3.2 Market Forecast

- 7.4 Canola Oil

- 7.4.1 Market Trends

- 7.4.2 Market Forecast

- 7.5 Coconut Oil

- 7.5.1 Market Trends

- 7.5.2 Market Forecast

- 7.6 Palm Kernel Oil

- 7.6.1 Market Trends

- 7.6.2 Market Forecast

8 Market by Application

- 8.1 Food Industry

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Biofuels

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Others

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

9 Competitive Landscape

- 9.1 Market Structure

- 9.2 Key Players

10 Vegetable Oil Manufacturing

- 10.1 Product Overview

- 10.1.1 Palm Oil

- 10.1.2 Canola Oil

- 10.1.3 Coconut Oil

- 10.1.4 Soybean Oil

- 10.2 Detailed Process Flow

- 10.2.1 Palm Oil

- 10.2.2 Canola Oil

- 10.2.3 Coconut Oil

- 10.2.4 Soybean Oil

- 10.3 Various Types of Unit Operations Involved

- 10.3.1 Palm Oil

- 10.3.2 Canola Oil

- 10.3.3 Coconut Oil

- 10.3.4 Soybean Oil

- 10.4 Mass Balance and Raw Material Requirements

- 10.4.1 Palm Oil

- 10.4.2 Canola Oil

- 10.4.3 Coconut Oil

- 10.4.4 Soybean Oil

11 Project Details, Requirements and Costs Involved

- 11.1 Land Requirements and Expenditures

- 11.2 Construction Requirements and Expenditures

- 11.3 Plant Layout

- 11.4 Plant Machinery

- 11.5 Machinery Pictures

- 11.6 Raw Material Requirements and Expenditures

- 11.7 Raw Material and Final Product Pictures

- 11.8 Packaging Requirements and Expenditures

- 11.9 Transportation Requirements and Expenditures

- 11.10 Utility Requirements and Expenditures

- 11.11 Manpower Requirements and Expenditures

- 11.12 Other Capital Investments

12 Loans and Financial Assistance

13 Project Economics

- 13.1 Capital Cost of the Project

- 13.2 Techno-Economic Parameters

- 13.3 Product Pricing and Margins Across Various Levels of the Supply Chain

- 13.4 Taxation and Depreciation

- 13.5 Income Projections

- 13.6 Expenditure Projections

- 13.7 Financial Analysis

- 13.8 Profit Analysis

14 Key Player Profiles

- 14.1 Archer-Daniels-Midland Company

- 14.2 Bunge Limited

- 14.3 Cargill, Incorporated

- 14.4 Louis Dreyfus Company BV

- 14.5 Wilmar International Ltd.