|

|

市場調査レポート

商品コード

1642850

カーボンブラックの市場規模、シェア、動向、予測:タイプ、グレード、用途、地域別、2025年~2033年Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| カーボンブラックの市場規模、シェア、動向、予測:タイプ、グレード、用途、地域別、2025年~2033年 |

|

出版日: 2025年01月18日

発行: IMARC

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

カーボンブラックの市場の世界市場規模は2024年に179億米ドルとなりました。今後、IMARC Groupは、2033年には254億米ドルに達し、2025~2033年のCAGRは3.57%になると予測しています。現在、アジア太平洋地域が市場を独占しており、2024年の市場シェアは51.1%を超えています。タイヤやプラスチック産業での製品使用の増加、世界の建設活動の活発化、スマート製造プロセスの出現、政府による厳しい環境規制が、市場の重要な成長促進要因として作用しています。

カーボンブラックは導電性の高い元素状炭素の一種で、炭化水素の制御された気相熱分解によって製造されます。カーボンブラックには、アセチレンブラック、ファーネスブラック、チャンネルブラック、サーマルブラックなど、さまざまな形態があり、それぞれに独自の特性があります。カーボンブラックは、タイヤ製造、プラスチック、コーティング、印刷インキ、塗料、電池、ゴムコンパウンド、導電性パッケージング、フィルム、繊維など、幅広い用途で使用されています。カーボンブラックは、優れた引張強度、加工安定性の向上、紫外線(UV)保護性能の強化、低い転がり抵抗を実現する、コスト効率が高く、汎用性が高く、耐久性の高い製品です。

世界各国の政府による厳しい環境規制の賦課は、排出レベルを削減し、環境に優しいソリューションとしてカーボンブラックの採用を促進するためであり、これが市場の成長を後押ししています。さらに、プラスチックの製造において顔料や紫外線(UV)安定剤として広く利用されていることも、市場の成長に寄与しています。これに加えて、インクやポリマーなど特定の産業に合わせた特殊グレードのカーボンブラックの開発が、市場成長にプラスの影響を与えています。さらに、リサイクルと持続可能性が重視されるようになったため、環境に優しい用途で製品が広く採用されるようになったことも、市場の成長を支えています。このほか、革新的な用途とカーボンブラックの品質向上をもたらす研究開発(R&D)への投資が増加していることも、市場の成長を後押ししています。

カーボンブラックの市場動向/促進要因:

タイヤ産業における製品利用の高まり

カーボンブラックはタイヤ製造において補強フィラーとして利用され、強度と弾力性を提供します。さらに、自動車産業が急成長してタイヤの必要性が高まり、カーボンブラックの消費量が直接的に増加していることも市場の成長を支えています。これに加えて、商用車と個人用を問わず自動車の需要が高まっていることも、タイヤ産業の成長に拍車をかけています。さらに、急速な都市化とインフラ開発の進展が、様々なタイプの自動車需要を促進しています。これとは別に、優れた操縦性、燃費効率、安全性を提供する高性能タイヤの人気の高まりが、カーボンブラックの必要性をさらに強調しています。

世界中で増加する建設活動

建設業界の著しい成長は、市場成長を促進する重要な要因の一つです。カーボンブラックは、コンクリートの着色や材料全体の強度向上など、さまざまな用途に広く使用されています。さらに、急速な都市化、工業化、インフラ開拓活動が、カーボンブラックを含む建設資材の需要を促進し、市場成長を後押ししています。さらに、膨大な量の建設資材を必要とする大規模なインフラプロジェクトに対する世界各地の政府による投資が増加していることも、成長を促進する要因となっています。加えて、美観を重視するアーキテクチャへの移行動向は、カーボンブラックを顔料として使用する着色コンクリートの使用増加につながり、市場成長に寄与しています。これとは別に、持続可能で弾力性のあるインフラの建設に対する注目の高まりが、カーボンブラックを利用したものを含む高品質の建設資材の需要をさらに促進しています。

製造プロセスにおける最近の進歩

製造プロセスの進歩は、より高い効率、廃棄物の削減、特定の粒子径でのカーボンブラックの製造を可能にし、市場成長の触媒となっています。さらに、プロセス制御と自動化の革新が品質管理の改善につながり、特殊グレードのカーボンブラックの生産を可能にしていることも、市場の成長を支えています。さらに、カーボンブラック生産分野における研究開発(R&D)は、性能特性を高める新しい方法を導入しており、市場の成長を促進しています。これとは別に、生産コストの最適化と市場の需要に応じて製造規模を拡大する能力が、市場の成長をさらに後押ししています。これに加えて、カーボンブラック生産における技術革新と技術進化を促進する研究機関と業界関係者の協力関係の増加が、市場成長の触媒となっています。

目次

第1章 序文

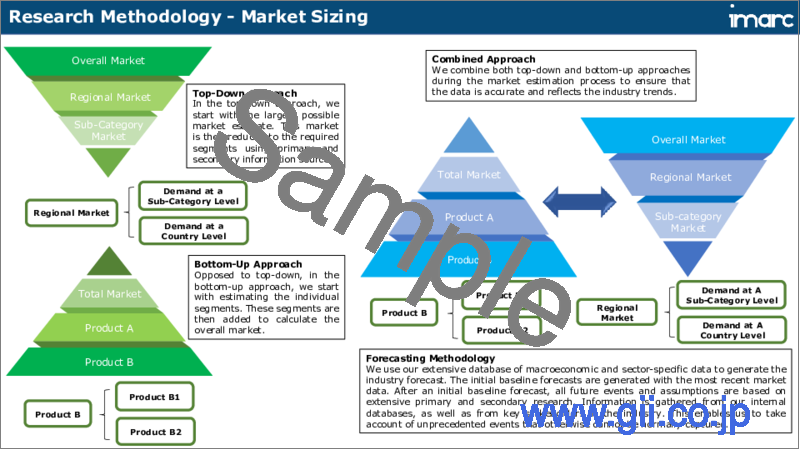

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

- 概要

- 主要業界動向

第5章 世界のカーボンブラック市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場内訳:タイプ別

- 市場内訳:グレード別

- 市場内訳:用途別

- 市場内訳:地域別

- 市場予測

第6章 市場内訳:タイプ別

- ファーネスブラック

- 市場動向

- 市場予測

- チャンネルブラック

- 市場動向

- 市場予測

- サーマルブラック

- 市場動向

- 市場予測

- アセチレンブラック

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第7章 市場内訳:グレード別

- 標準グレード

- 市場動向

- 市場予測

- スペシャルグレード

- 市場動向

- 市場予測

第8章 市場内訳:用途別

- タイヤ

- 市場動向

- 市場予測

- タイヤ以外のゴム

- 市場動向

- 市場予測

- プラスチック

- 市場動向

- 市場予測

- インクとコーティング

- 市場動向

- 市場予測

- その他

- 市場動向

- 市場予測

第9章 市場内訳:地域別

- アジア太平洋地域

- 市場動向

- 市場予測

- 欧州

- 市場動向

- 市場予測

- 北米

- 市場動向

- 市場予測

- 中東・アフリカ

- 市場動向

- 市場予測

- ラテンアメリカ

- 市場動向

- 市場予測

第10章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第11章 バリューチェーン分析

第12章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第13章 価格分析

第14章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Cabot Corporation

- Thai Carbon Black Public Company Limited(Birla Carbon)

- Orion Engineered Carbons S.A.

- Phillips Carbon Black Limited

- Tokai Carbon Co., Ltd.

- Omsk Carbon Group OOO

- Jiangxi Black Cat Carbon Black Inc., Ltd.

- OCI Company Ltd.

- China Synthetic Rubber Corporation

List of Figures

- Figure 1: Global: Carbon Black Market: Major Drivers and Challenges

- Figure 2: Global: Carbon Black Market: Sales Value (in Billion USD), 2019-2024

- Figure 3: Global: Carbon Black Market: Breakup by Type (in %), 2024

- Figure 4: Global: Carbon Black Market: Breakup by Grade (in %), 2024

- Figure 5: Global: Carbon Black Market: Breakup by Application (in %), 2024

- Figure 6: Global: Carbon Black Market: Breakup by Region (in %), 2024

- Figure 7: Global: Carbon Black Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 8: Global: Carbon Black Industry: SWOT Analysis

- Figure 9: Global: Carbon Black Industry: Value Chain Analysis

- Figure 10: Global: Carbon Black Industry: Porter's Five Forces Analysis

- Figure 11: Global: Carbon Black (Furnace Black) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 12: Global: Carbon Black (Furnace Black) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 13: Global: Carbon Black (Channel Black) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 14: Global: Carbon Black (Channel Black) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 15: Global: Carbon Black (Thermal Black) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 16: Global: Carbon Black (Thermal Black) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 17: Global: Carbon Black (Acetylene Black) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 18: Global: Carbon Black (Acetylene Black) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 19: Global: Carbon Black (Other Types) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 20: Global: Carbon Black (Other Types) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 21: Global: Carbon Black (Standard Grade) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 22: Global: Carbon Black (Standard Grade) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 23: Global: Carbon Black (Specialty Grade) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 24: Global: Carbon Black (Specialty Grade) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 25: Global: Carbon Black (Tire) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 26: Global: Carbon Black (Tire) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 27: Global: Carbon Black (Non-Tire Rubber) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 28: Global: Carbon Black (Non-Tire Rubber) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 29: Global: Carbon Black (Plastics) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 30: Global: Carbon Black (Plastics) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 31: Global: Carbon Black (Inks and Coatings) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 32: Global: Carbon Black (Inks and Coatings) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 33: Global: Carbon Black (Other Applications) Market: Sales Value (in Million USD), 2019 & 2024

- Figure 34: Global: Carbon Black (Other Applications) Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 35: Asia Pacific: Carbon Black Market: Sales Value (in Million USD), 2019 & 2024

- Figure 36: Asia Pacific: Carbon Black Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 37: Europe: Carbon Black Market: Sales Value (in Million USD), 2019 & 2024

- Figure 38: Europe: Carbon Black Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 39: North America: Carbon Black Market: Sales Value (in Million USD), 2019 & 2024

- Figure 40: North America: Carbon Black Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 41: Middle East and Africa: Carbon Black Market: Sales Value (in Million USD), 2019 & 2024

- Figure 42: Middle East and Africa: Carbon Black Market Forecast: Sales Value (in Million USD), 2025-2033

- Figure 43: Latin America: Carbon Black Market: Sales Value (in Million USD), 2019 & 2024

- Figure 44: Latin America: Carbon Black Market Forecast: Sales Value (in Million USD), 2025-2033

List of Tables

- Table 1: Global: Carbon Black Market: Key Industry Highlights, 2024 and 2033

- Table 2: Global: Carbon Black Market Forecast: Breakup by Type (in Million USD), 2025-2033

- Table 3: Global: Carbon Black Market Forecast: Breakup by Grade (in Million USD), 2025-2033

- Table 4: Global: Carbon Black Market Forecast: Breakup by Application (in Million USD), 2025-2033

- Table 5: Global: Carbon Black Market Forecast: Breakup by Region (in Million USD), 2025-2033

- Table 6: Global: Carbon Black Market Structure

- Table 7: Global: Carbon Black Market: Key Players

The global carbon black market size was valued at USD 17.9 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 25.4 Billion by 2033, exhibiting a CAGR of 3.57% from 2025-2033. Asia Pacific currently dominates the market, holding a market share of over 51.1% in 2024. The increasing product usage in the tire and plastics industries, rising construction activities across the globe, the advent of smart manufacturing processes, and strict environmental regulations imposed by governments are acting as crucial growth-inducing factors for the market.

Carbon black refers to a form of elemental carbon that is highly conductive and is manufactured through the controlled vapor-phase pyrolysis of hydrocarbons. It exists in different forms, such as acetylene black, furnace black, channel black, and thermal black, each having unique properties. Carbon black finds extensive applications in tire manufacturing, plastics, coatings, printing inks, paints, batteries, rubber compounds, conductive packaging, film, and fibers. It is a cost-effective, versatile, and highly durable product that offers excellent tensile strength, improved processing stability, enhanced ultraviolet (UV) protection, and low rolling resistance.

The imposition of strict environmental regulations by governments across the globe to reduce emission levels and promote the adoption of carbon black as an eco-friendly solution is propelling the market growth. Additionally, the widespread product utilization as a pigment and ultraviolet (UV) stabilizer in the manufacturing of plastics is contributing to the market growth. Besides this, the development of specialized grades of carbon black, which are tailored for specific industries, such as inks and polymers, is positively influencing the market growth. Moreover, the widespread product adoption in eco-friendly applications owing to the increasing emphasis on recycling and sustainability is supporting the market growth. Besides this, the escalating investments in research and development (R&D) resulting in innovative applications and improved quality of carbon black are favoring the market growth.

Carbon Black Market Trends/Drivers:

The rising product utilization in the tire industry

Carbon black is utilized in tire manufacturing as a reinforcing filler, providing strength and resilience. Furthermore, the surge in the automotive industry, which has intensified the need for tires, leading to a direct increase in carbon black consumption, is supporting the market growth. Besides this, the escalating demand for vehicles, both commercial and personal, has catalyzed the growth of the tire industry. Moreover, rapid urbanization, coupled with increasing infrastructural developments, is facilitating the demand for various types of vehicles. Apart from this, the rising popularity of high-performance tires that offer better handling, fuel efficiency, and safety is further emphasizing the need for carbon black.

The increasing construction activities across the globe

The significant growth in the construction industry is one of the key factors propelling the market growth. Carbon black is widely used for various applications, including concrete coloring and enhancing the material's overall strength. Furthermore, the rapid urbanization, industrialization, and infrastructure development activities, which are facilitating the demand for construction materials, including those containing carbon black, are favoring the market growth. Moreover, the increasing investment by several governments across the globe in several large-scale infrastructure projects requiring vast quantities of construction materials is acting as another growth-inducing factor. Additionally, the shifting trend towards aesthetically pleasing architecture, which has led to the increased use of colored concrete where carbon black is used as a pigment, is contributing to the market growth. Apart from this, the rising focus on building sustainable and resilient infrastructure is further fueling the demand for high-quality construction materials, including those utilizing carbon black.

The recent advancements in manufacturing process

The advancements in manufacturing processes, which have enabled the production of carbon black with higher efficiency, reduced waste, and specific particle size, are catalyzing the market growth. Furthermore, the innovations in process control and automation, which have led to improved quality control, allowing for the production of specialized grades of carbon black, are supporting the market growth. Moreover, the research and development (R&D) in the field of carbon black production, which has introduced new methods that enhance performance characteristics, is propelling the market growth. Apart from this, the optimization of production costs and the ability to scale manufacturing according to market demands is further bolstering the market growth. Besides this, the increasing collaborations between research institutions and industry players fostering innovation and technological evolution in carbon black production are catalyzing the market growth.

Carbon Black Industry Segmentation:

Breakup by Type:

Furnace Black

Channel Black

Thermal Black

Acetylene Black

Others

Furnace black dominates the market

Furnace black is dominating the market as it is widely utilized in various applications across multiple industries, including tire manufacturing, plastics, coatings, and rubber products. Additionally, the production process of furnace black is highly efficient and scalable, as it involves the incomplete combustion of heavy petroleum products, making it suitable for large-scale manufacturing. Besides this, the method used in its production allows for accurate control over particle size and structure, which leads to specific grades and quality levels, catering to unique industry needs. Moreover, the introduction of modern production techniques, which aid in minimizing the environmental impact and aligning with the global trend towards sustainability, is positively influencing the market growth. Along with this, furnace black is known for its excellent reinforcing properties, which makes it the preferred choice in industries that require materials with enhanced strength and durability.

Breakup by Grade:

Standard Grade

Specialty Grade

Standard grade dominates the market

Standard grade carbon black is dominating the market as it is suitable for a wide array of applications, including the automotive, construction, plastics, and rubber industries. Furthermore, it is more cost-effective to produce, making it attractive to various industries looking to minimize expenses. Additionally, the standard grade carbon black is readily available across different markets, which ensures that it meets the demands of various industries without supply chain disruptions. Moreover, it exhibits compatibility with different polymers and materials, enhancing its appeal to manufacturers across diverse sectors. Apart from this, standard grade carbon black offers ease of integration into various products and processes. It also aligns well with major industries, such as tire manufacturing, where it is used as a reinforcing agent, and the plastics industry, where it serves as a black pigment.

Breakup by Application:

Tire

Non-Tire Rubber

Plastics

Inks and Coatings

Others

Tire dominates the market

Tire manufacturing is dominating the market as carbon black is widely used as a reinforcing agent, enhancing the strength, durability, and resilience of the tires. Furthermore, it provides the necessary wear resistance and tensile strength, making it indispensable in tire production. Additionally, the global surge in the automotive industry, especially in emerging markets, which has led to an increased demand for tires, is acting as another growth-inducing factor. Apart from this, the shifting trend towards high-performance and energy-efficient tires that offer better fuel economy and safety is facilitating the demand for carbon black, as it plays a significant role in achieving these properties. Moreover, the continuous innovation in tire manufacturing technology, which allows for more specialized applications of carbon black, is contributing to the market growth.

Breakup by Region:

Asia Pacific

Europe

North America

Middle East and Africa

Latin America

Asia Pacific exhibits a clear dominance in the market, accounting for the largest carbon black market share

The report has also provided a comprehensive analysis of all the major regional markets, which include Asia Pacific, Europe, North America, Middle East and Africa, and Latin America. According to the report, Asia Pacific represented the largest market segment.

The Asia Pacific hosts some of the largest automotive markets in the world, which directly translates into high demand for tires and, consequently, carbon black. Additionally, the region's rapid industrial growth across sectors, such as construction, manufacturing, and electronics is facilitating the demand for carbon black in various applications, including pigments and reinforcing materials. Besides this, the rising disposable income across emerging economies in the region, which has led to increased consumption of goods that use carbon black, including electronics, personal care products, and automobiles, is positively influencing the market growth. Moreover, the presence of several key carbon black manufacturers, which supports local demand and also serves as an export base, is boosting the market growth. Along with this, the implementation of several policies by the regional governments encouraging manufacturing and industrial activities is favoring the market growth.

Competitive Landscape:

Major players are creating new grades of carbon black and enhancing existing products to meet specific industry needs and adhere to evolving regulations and standards. Furthermore, the leading companies are acquiring or merging with other companies to broaden their product portfolio, expand into new markets, and leverage synergies in technology and distribution. They are focusing on developing greener manufacturing processes and products that align with global sustainability goals. Additionally, several key players are ensuring consistent product availability, reducing costs, and improving efficiency to meet global demand and navigate complex international trade landscapes. Moreover, they are segmenting their offerings to cater to specific industries, provide more targeted solutions, and differentiate themselves from competitors. Besides this, top companies are forming strategic partnerships with other industry players, research institutions, and governmental bodies to combine resources, share knowledge, and drive innovation.

The report has provided a comprehensive analysis of the competitive landscape in the global carbon black market. Detailed profiles of all major companies have also been provided. Some of the key players in the market include:

Cabot Corporation

Thai Carbon Black Public Company Limited (Birla Carbon)

Orion Engineered Carbons S.A.

Phillips Carbon Black Limited

Tokai Carbon Co., Ltd.

Omsk Carbon Group OOO

Jiangxi Black Cat Carbon Black Inc., Ltd.

OCI Company Ltd.

China Synthetic Rubber Corporation

Key Questions Answered in This Report

- 1. What is carbon black?

- 2. How big is the global carbon black market?

- 3. What is the expected growth rate of the global carbon black market during 2025-2033?

- 4. What are the key factors driving the global carbon black market?

- 5. What is the leading segment of the global carbon black market based on the type?

- 6. What is the leading segment of the global carbon black market based on grade?

- 7. What is the leading segment of the global carbon black market based on application?

- 8. What are the key regions in the global carbon black market?

- 9. Who are the key players/companies in the global carbon black market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Introduction

- 4.1 Overview

- 4.2 Key Industry Trends

5 Global Carbon Black Market

- 5.1 Market Overview

- 5.2 Market Performance

- 5.3 Impact of COVID-19

- 5.4 Market Breakup by Type

- 5.5 Market Breakup by Grade

- 5.6 Market Breakup by Application

- 5.7 Market Breakup by Region

- 5.8 Market Forecast

6 Market Breakup by Type

- 6.1 Furnace Black

- 6.1.1 Market Trends

- 6.1.2 Market Forecast

- 6.2 Channel Black

- 6.2.1 Market Trends

- 6.2.2 Market Forecast

- 6.3 Thermal Black

- 6.3.1 Market Trends

- 6.3.2 Market Forecast

- 6.4 Acetylene Black

- 6.4.1 Market Trends

- 6.4.2 Market Forecast

- 6.5 Others

- 6.5.1 Market Trends

- 6.5.2 Market Forecast

7 Market Breakup by Grade

- 7.1 Standard Grade

- 7.1.1 Market Trends

- 7.1.2 Market Forecast

- 7.2 Specialty Grade

- 7.2.1 Market Trends

- 7.2.2 Market Forecast

8 Market Breakup by Application

- 8.1 Tire

- 8.1.1 Market Trends

- 8.1.2 Market Forecast

- 8.2 Non-Tire Rubber

- 8.2.1 Market Trends

- 8.2.2 Market Forecast

- 8.3 Plastics

- 8.3.1 Market Trends

- 8.3.2 Market Forecast

- 8.4 Inks and Coatings

- 8.4.1 Market Trends

- 8.4.2 Market Forecast

- 8.5 Others

- 8.5.1 Market Trends

- 8.5.2 Market Forecast

9 Market Breakup by Region

- 9.1 Asia Pacific

- 9.1.1 Market Trends

- 9.1.2 Market Forecast

- 9.2 Europe

- 9.2.1 Market Trends

- 9.2.2 Market Forecast

- 9.3 North America

- 9.3.1 Market Trends

- 9.3.2 Market Forecast

- 9.4 Middle East and Africa

- 9.4.1 Market Trends

- 9.4.2 Market Forecast

- 9.5 Latin America

- 9.5.1 Market Trends

- 9.5.2 Market Forecast

10 SWOT Analysis

- 10.1 Overview

- 10.2 Strengths

- 10.3 Weaknesses

- 10.4 Opportunities

- 10.5 Threats

11 Value Chain Analysis

12 Porters Five Forces Analysis

- 12.1 Overview

- 12.2 Bargaining Power of Buyers

- 12.3 Bargaining Power of Suppliers

- 12.4 Degree of Competition

- 12.5 Threat of New Entrants

- 12.6 Threat of Substitutes

13 Price Analysis

14 Competitive Landscape

- 14.1 Market Structure

- 14.2 Key Players

- 14.3 Profiles of Key Players

- 14.3.1 Cabot Corporation

- 14.3.2 Thai Carbon Black Public Company Limited (Birla Carbon)

- 14.3.3 Orion Engineered Carbons S.A.

- 14.3.4 Phillips Carbon Black Limited

- 14.3.5 Tokai Carbon Co., Ltd.

- 14.3.6 Omsk Carbon Group OOO

- 14.3.7 Jiangxi Black Cat Carbon Black Inc., Ltd.

- 14.3.8 OCI Company Ltd.

- 14.3.9 China Synthetic Rubber Corporation