|

|

市場調査レポート

商品コード

1820244

航空宇宙用コーティングの市場規模、シェア、動向、予測:樹脂タイプ別、製品形態別、用途別、航空機タイプ別、エンドユーザー別、地域別、2025~2033年Aerospace Coatings Market Size, Share, Trends and Forecast by Resin Type, Product Form, Application, Aircraft Type, End User, and Region, 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 航空宇宙用コーティングの市場規模、シェア、動向、予測:樹脂タイプ別、製品形態別、用途別、航空機タイプ別、エンドユーザー別、地域別、2025~2033年 |

|

出版日: 2025年09月01日

発行: IMARC

ページ情報: 英文 146 Pages

納期: 2~3営業日

|

概要

世界の航空宇宙用コーティングの市場規模は2024年に14億8,000万米ドルとなりました。今後、IMARC Groupは、2033年には22億3,000万米ドルに達し、2025~2033年にかけて4.45%のCAGRを示すと予測しています。現在、北米が市場を独占しており、2024年には38.6%を超える大きな市場シェアを占めています。この市場を牽引しているのは、航空需要の増加、航空機の生産と整備の強化です。環境に優しい軽量コーティングの技術進歩は、燃費効率を高め、環境規制を満たします。さらに、軍事費の増加と先進的な防衛航空機の必要性が、航空宇宙用コーティング市場シェアをさらに押し上げています。

航空宇宙用コーティングの世界市場は、航空機需要の増加により、航空機の生産とメンテナンス活動の増加に牽引されています。環境に優しい軽量素材などのコーティング技術の進歩は、燃費効率を高め、環境への影響を低減し、厳しい規制基準に合致しています。これとともに、軍事費の増大と先進的な防衛航空機へのニーズも市場成長に寄与しています。政府報告書によると、アジアの防衛予算は増加しており、2024年には4.2%の増加が見込まれています。特に中国の国防予算は1兆6,650億人民元(2,360億米ドル)に上り、この地域の総支出5,340億米ドルの44%を占めています。ソウルの52億米ドルのミサイル防衛プログラムに見られるように、日本、韓国、オーストラリアなどは防衛態勢に多額の投資を行っています。特に研究開発費を含めると、軍事費総額は3,000億米ドルを超えます。この地域の国々が防衛能力を向上させるにつれて、現代の軍事プラットフォームの耐久性とステルス性を確保するための先進的な航空宇宙用コーティングに対する需要が増加すると予想されます。また、航空機の老朽化に伴う改修・改修の増加により、耐久性に優れた高性能コーティングの需要が高まっています。航空部門が拡大しているアジア太平洋と中東の新興市場が市場をさらに押し上げ、航空宇宙用コーティング市場の明るい展望を生み出しています。

米国は主要な地域市場として際立っており、主に民間、軍事、一般航空部門を含む同国の堅調な航空産業が市場を牽引しています。燃費効率の高い航空機に対する需要の高まりが、軽量化と性能向上を実現する先端コーティングの採用に拍車をかけています。さらに、厳しい環境規制が低VOCで持続可能なコーティングソリューションの開発を後押ししています。航空機の整備、修理、オーバーホール(MRO)サービス、特に老朽化した機体に対するニーズの高まりが、航空宇宙用コーティング市場の成長をさらに後押ししています。さらに、防衛予算の増加と次世代軍用機への投資が、過酷な条件下での耐久性と耐食性を提供する高性能コーティングの需要に寄与しています。2025年1月28日、米国空軍(USAF)は次世代適応推進(NGAP)プログラムを拡大し、GE AviationとPratt & Whitneyにそれぞれ35億米ドルの競争発注を行い、USAFの将来の空軍のためにさらなる先進的なターボジェットエンジンを開発しました。これらのエンジンは、適応サイクル技術を使用して、スペクトルの両端で性能を向上させます。このエンジンは、F-22に代わる次世代有人戦闘機や無人システムの動力源となり、F-35を改良するものと思われます。出力と熱需要の増加により、先進的な航空宇宙用コーティングが耐久性と耐熱性を提供し、エンジン全体の効率を維持します。

航空宇宙用コーティング市場の動向

軽量で燃費の良い航空機への需要の高まり

航空宇宙分野では、運航経費を削減し、環境への影響を最小限に抑えるため、軽量で燃料効率の高い航空機の開発にシフトしています。このため、性能と寿命を向上させるために特殊なコーティングを必要とする高度な複合材料が使用されるようになっています。航空宇宙用コーティングは、これらの材料を環境の影響から守り、空気力学を強化し、抵抗を下げるために不可欠です。例えば、Boeingは、2040年には世界の民間航空機保有数が49,000機を超えると予測しており、これは航空機の増産、ひいては航空宇宙用コーティング市場の需要増を強く反映しています。航空会社がより新しく燃費の良い航空機を保有するようになるにつれ、軽量化と燃費の向上を可能にする革新的なコーティング技術に対する需要はますます高まっています。このようなニーズは、航空宇宙用コーティング業界における継続的な研究開発の原動力となり、航空部門の変化するニーズを満たす製品の生産につながっています。

環境に優しいコーティングの採用増加

環境に関する法律により、航空宇宙産業は環境に優しいコーティングソリューションへの移行を余儀なくされています。従来の溶剤系コーティングは揮発性有機化合物(VOC)を放出し、大気汚染の原因となり健康に有害です。これに対処するため、米国環境保護庁(EPA)などの規制機関は、航空宇宙産業の製造およびリワーク作業に対する有害大気汚染物質排出基準(NESHAP)を公布しました。これらの規制は、クロムやカドミウムなどの危険な排出量を全国で約12万3,700トン削減しようとするものです。メーカー各社は、性能を犠牲にすることなくこの厳しい規制を満たす水性コーティングやクロムフリーコーティングを開発することで対応しています。環境に優しいコーティングへのシフトは、規制遵守を支援するだけでなく、環境責任を重視する世界の航空業界を支えるものでもあります。この変化は航空宇宙用コーティング業界の技術革新を促進し、効率的で環境に優しい製品を生み出しています。

MRO活動の成長と機体の拡大

国際航空セクターでは航空機保有台数が大幅に増加しており、整備・修理・オーバーホール(MRO)サービスに対するニーズが高まっています。従って、これは重要な航空宇宙用コーティング市場動向の一つとして作用しています。Jyotiraditya M. Scindia民間航空大臣によると、インドの航空機保有数は2014年の400機から2023年には644機に増加し、急成長する航空産業を反映しています。このような航空機の増加は、航空会社が拡大する航空機を効率的かつ安全に維持しようとするため、MRO活動の活況に拍車をかけています。より多くの航空機が就航するにつれて、Safranのようなプレーヤーは、国際的なMROネットワークを拡大するために多額の投資を行っています。例えば、Safran Aircraft Enginesは、モロッコの新工場やブリュッセル工場の拡張など、世界中に整備工場を作るために10億ユーロ以上を費やし、就航するLEAPエンジンの増加に対応しています。このような投資と航空機の大型化は、成長する世界の航空機を支えるMROサービスが果たす重要な役割を浮き彫りにしています。

目次

第1章 序文

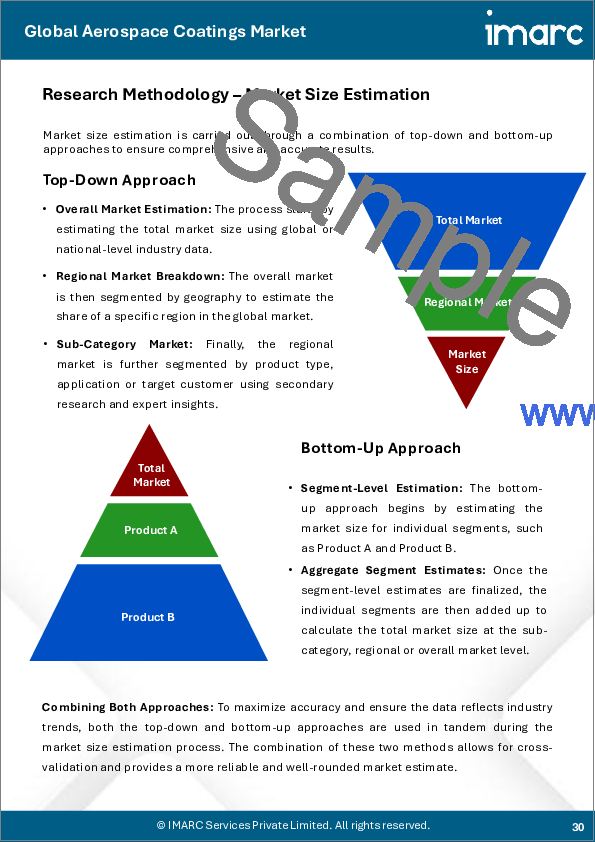

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 一次情報

- 二次情報

- 市場推定

- ボトムアップアプローチ

- トップダウンアプローチ

- 調査手法

第3章 エグゼクティブサマリー

第4章 イントロダクション

第5章 世界の航空宇宙用コーティング市場

- 市場概要

- 市場実績

- COVID-19の影響

- 市場予測

第6章 市場内訳:樹脂タイプ別

- エポキシ

- アクリル

- ポリウレタン

- その他

第7章 市場内訳:製品形態別

- 液体

- 粉末

- その他

第8章 市場内訳:用途別

- 外装

- 内装

第9章 市場内訳:航空機タイプ別

- 商用

- 軍事用

- その他

第10章 市場内訳:エンドユーザー別

- オリジナル機器製造会社(OEM)

- 整備、修理、オーバーホール会社(MRO会社)

第11章 市場内訳:地域別

- 北米

- 米国

- カナダ

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- その他

- ラテンアメリカ

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

第12章 SWOT分析

第13章 バリューチェーン分析

第14章 ポーターのファイブフォース分析

第15章 価格分析

第16章 競合情勢

- 市場構造

- 主要企業

- 主要企業のプロファイル

- Aalberts Surface Treatment GmbH

- Akzo Nobel N.V.

- Axalta Coating Systems Ltd.

- Henkel AG & Co. KGaA

- Hentzen Coatings Inc.

- IHI Ionbond AG

- Mankiewicz Gebr. & Co.(GmbH & Co. KG)

- PPG Industries Inc.

- Saint-Gobain S.A.

- The Sherwin-Williams Company

- Zircotec Ltd.