|

|

市場調査レポート

商品コード

1720939

父子関係・親族関係検査サービス市場:用途別、製品別市場予測 - エグゼクティブコンサルタントガイド付き(2025年~2029年)Paternity & Relationship Testing Services. Global Market Forecasts by Application and by Product with Executive and Consultant Guides 2025 to 2029 |

||||||

|

|||||||

| 父子関係・親族関係検査サービス市場:用途別、製品別市場予測 - エグゼクティブコンサルタントガイド付き(2025年~2029年) |

|

出版日: 2025年05月05日

発行: Howe Sound Research

ページ情報: 英文 168 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

もう親子鑑定だけではありません。妊娠検査、祖父母検査、兄弟姉妹の検査などがあります。この新たな成長産業では、そのすべてを手に入れることができます。消費者向け遺伝子検査が、法的に認知された人間関係検査のニーズを後押ししています。サプライヤーは、主流ではない需要からも利益を得ることができます。DNA検査は境界を超えて日常生活に浸透しつつあります。

他のサービスと同様、重要なのは、顧客が必要としている時に、そのニーズに応えることです。この開発産業におけるチャンスと落とし穴のすべてを知ることができます。

これは複雑な分野ですが、この読みやすいレポートによって、経営陣全員が技術と機会の両方について迅速に理解することができます。技術の進歩は速いです。遺伝子工学が主流の商業分野へと移行するにつれ、技術は研究室からデスクトップへと移行しつつあります。

当レポートは、世界の父子関係・親族関係検査サービス市場について調査し、市場の概要とともに、用途別、製品別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 市場ガイド

第2章 イントロダクションと市場の定義

- 父子関係・親族関係検査とは何か

- ゲノミクス革命

- 市場定義

- 調査手法

- 視点:ヘルスケアとIVD業界

- 染色体、遺伝子、エピジェネティクス

第3章 市場概要

- 市場参入組織

- 学術研究機関

- 診断試験開発者

- 計測機器サプライヤー

- 薬品・試薬メーカー

- 病理サプライヤー

- 独立系臨床検査室

- 公共の国立/地域研究所

- 病院検査室

- 臨床検査室

- 監査機関

- 認証機関

- 親族関係検査

- 概要

- 法的使用- 特例

- 権利と責任- 複雑な図

- 法医学的使用

- 臨床用途

- 家族による使用と自由裁量による使用

- 消費者向け遺伝子検査サービスの役割

- 移民の使用

第4章 市場動向

- 計測、自動化、診断の動向

- 成長促進要因

- 成長抑制要因

第5章 関係性テストの最近の動向

第6章 主要企業のプロファイル

- Alphabiolabs

- Bureau Veritas

- Canadian DNA Services

- Easy DNA

- Eurofins Scientific

- Gene by Gene, Ltd.

- Genex Diagnostics

- Intelligenetics

- Invitae Corporation(Natera)

- Laboratory Corporation of America

- Myriad Genetics

- Quest Diagnostics

- Verogen

第7章 世界の人間関係テスト市場規模

- 国別世界市場

- 用途別世界市場

- 製品別世界市場

第8章 世界の父子関係・親族関係検査サービス市場規模、用途別

- 法務

- 移民検査

- 臨床

- 消費者裁量

第9章 世界の父子関係・親族関係検査サービス市場規模、製品別

- 装置

- 試薬・キット

- ソフトウェア

- サービス

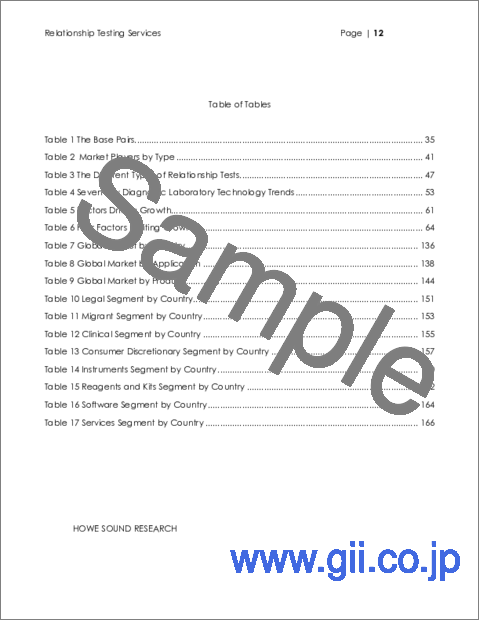

Table of Tables

- Table 1: The Base Pairs

- Table 2: Market Players by Type

- Table 3: The Different Types of Relationship Tests

- Table 4: Seven Key Diagnostic Laboratory Technology Trends

- Table 5: Factors Driving Growth

- Table 6: Four Factors Limiting Growth

- Table 7: Global Market by Country

- Table 8: Global Market by Application

- Table 9: Global Market by Product

- Table 10: Legal Segment by Country

- Table 11: Migrant Segment by Country

- Table 12: Clinical Segment by Country

- Table 13: Consumer Discretionary Segment by Country

- Table 14: Instruments Segment by Country

- Table 15: Reagents and Kits Segment by Country

- Table 16: Software Segment by Country

- Table 17: Services Segment by Country

Table of Figures

- Figure 1: Global Healthcare Spending

- Figure 2: The Lab Test Pie

- Figure 3: DNA Strands and Chromosomes

- Figure 4: Karyogram of Human Chromosomes

- Figure 5: Size of Various Genomes

- Figure 6: The Road to Diagnostics

- Figure 7: Centralized vs. Decentralized Laboratory Service

- Figure 8: A Highly Multiplexed Syndromic Testing Unit

- Figure 9: The Real Cost to Sequence the Human Genome

- Figure 10: The Codevelopment Process

- Figure 11: Country Market Shares

- Figure 12: Application Share by Year

- Figure 13: Application Segment Growth Rates

- Figure 14: Segment Share Shifts

- Figure 15: Application Segment Share Base Year

- Figure 16: Application Segment Share Final Year

- Figure 17: Product Share by Year

- Figure 18: Product Segment Growth Rates

- Figure 19: Product Segment Share Shifts

- Figure 20: Product Segment Share Base Year

- Figure 21: Product Segment Share Final Year

- Figure 22: Legal vs. Total Market Growth

- Figure 23: Migrant vs. Total Market Growth

- Figure 24: Clinical vs. Total Market Growth

- Figure 25: Consumer Discretionary vs. Total Market Growth

- Figure 26: Instrument vs. Total Market Growth

- Figure 27: Reagents and Kits vs. Total Market Growth

- Figure 28: Software vs. Total Market Growth

- Figure 29: Services vs. Total Market Growth

OVERVIEW:

Its not just paternity testing anymore! Maternity testing, Grandparent testing. Sibling testing. Infidelity testing? Who knew? It's all up for grabs in this new growth industry. Direct to Consumer genetic testing is driving the need for legally recognized relationship testing. Suppliers can benefit from non mainstream demand as well. DNA testing is crossing the chasm and moving into everyday life.

Like any service the key is reaching the customer when they are in need. Find out all about the opportunities and pitfalls in this developing industry.

This is a complex area, but this readable report will bring the entire management team up to speed, on both the technology and the opportunity. The technology is moving fast. It is coming out of the lab and onto the desktop as genetics crosses the chasm into mainstream commerce.

Table of Contents

1. Market Guides

- 1.1. Relationship Testing - Strategic Situation Analysis

- 1.2. Guide for Executives, Marketing, Sales and Business Development Staff

- 1.3. Guide for Management Consultants and Investment Advisors

2. Introduction and Market Definition

- 2.1. What is Paternity & Relationship Testing?

- 2.2. The Genomics Revolution

- 2.3. Market Definition

- 2.3.1. Revenue Market Size.

- 2.3.2. Legal

- 2.3.3. Migrant

- 2.3.4. Clinical

- 2.3.5. Discretionary

- 2.3.6. Instruments

- 2.3.7. Reagents

- 2.3.8. Software and Services

- 2.4. Methodology

- 2.4.1. Methodology

- 2.4.2. Sources

- 2.4.3. Authors

- 2.5. Perspective: Healthcare and the IVD Industry

- 2.5.1. Global Healthcare Spending

- 2.5.2. Spending on Diagnostics

- 2.5.3. Important Role of Insurance for Diagnostics

- 2.6. Chromosomes, Genes and Epigenetics

- 2.6.1. Chromosomes

- 2.6.2. Genes

- 2.6.3. Epigenetics

3. Market Overview

- 3.1. Players in a Dynamic Market

- 3.1.1. Academic Research Lab

- 3.1.2. Diagnostic Test Developer

- 3.1.3. Instrumentation Supplier

- 3.1.4. Chemical/Reagent Supplier

- 3.1.5. Pathology Supplier

- 3.1.6. Independent Clinical Laboratory

- 3.1.7. Public National/regional Laboratory

- 3.1.8. Hospital Laboratory

- 3.1.9. Physicians Office Lab (POLS)

- 3.1.10. Audit Body

- 3.1.11. Certification Body

- 3.2. Relationship Testing

- 3.2.1. Overview

- 3.2.2. Legal Use - a special case

- 3.2.2.1. Legal

- 3.2.2.2. Private

- 3.2.3. Rights and Responsibilities - a complex picture

- 3.2.4. Forensic Usage

- 3.2.5. Clinical Uses

- 3.2.6. Familial and Discretionary Use

- 3.2.7. Role of Direct to Consumer Genetic Testing Services

- 3.2.8. Immigration Use

4. Market Trends

- 4.1. Instrumentation, Automation & Diagnostic Trends

- 4.1.1. Traditional Automation and Centralization

- 4.1.2. The New Automation, Decentralization and Point Of Care

- 4.1.3. Instruments Key to Market Share

- 4.1.4. Bioinformatics Plays a Role

- 4.1.5. PCR Takes Command

- 4.1.6. Next Generation Sequencing Fuels a Revolution

- 4.1.7. NGS Impact on Pricing

- 4.1.8. Whole Genome Sequencing, A Brave New World

- 4.1.9. Companion Diagnostics Blurs Diagnosis and Treatment

- 4.2. Factors Driving Growth

- 4.2.1. Genetics Takes Center Stage

- 4.2.2. Cultural Shifts - Changing Meaning of Family

- 4.2.3. Media & Celebrity

- 4.2.4. Ancestry - Changing Attitudes

- 4.3. Factors Limiting Growth

- 4.3.1. Increased Competition Lowers Price

- 4.3.2. Lower Costs

- 4.3.3. Values Shifting

- 4.3.4. DTC Competition

5. Relationship Testing Recent Developments

- 5.1.1. Importance of This Section

- 5.1.2. How to Use This Section

- 5.2. DNA testing firm 23andMe files for bankruptcy

- 5.3. NextStep Genetics Launches

- 5.4. PAF Testings Expands DNA Testing Services

- 5.5. Innocence Project to use $1.5M grant

- 5.6. Data Standards To Protect Newborn DNA Privacy

- 5.7. DNA testing company Nebula accused

- 5.8. CariGenetics Launches Home Paternity Kits

- 5.9. Genetic Technologies Global Strategy

- 5.10. Canadian DNA lab Sells Fraudulent Tests

- 5.11. At-Home Paternity Tests

- 5.12. Natera Acquires Reproductive Health Assets from Invitae

- 5.13. AlphaBiolabs launches most powerful DNA test available

- 5.14. Fact Check: No law requires DNA testing to establish paternity in United States

- 5.15. Maury Povich Launches At-Home Paternity Test

- 5.16. Paternity Test Unveils IVF Mistake

- 5.17. Anti-Trafficking Agency Conducts Paternity Tests

- 5.18. Supreme Court limits DNA paternity testing

- 5.19. New law proposes DNA testing to weed-out false declarations of paternity

- 5.20. AffinityDNA Acquisition expands direct-to-consumer business

- 5.21. EasyDNA expands markets

- 5.22. AlphaBiolabs accredited as demand for prenatal paternity testing soars

- 5.23. Genetic Technologies to Acquire DTC Genetic Test Provider EasyDNA

- 5.24. DNA Diagnostics Center to Join Eurofins via Acquisition

- 5.25. Bode and Gene By Gene Receive Approval

- 5.26. Pioneers, myDNA and FamilyTreeDNA Merge

- 5.27. Researchers Urged to Adopt New Genomic Technologies for Relationship Testing

- 5.28. 'Not the Father': Baltimore Man Filing suit

- 5.29. Thermo Fisher Scientific Applied Biosystems SeqStudio Genetic Analyzer for Human Identification

6. Profiles of Key Companies

- 6.1. Alphabiolabs

- 6.2. Bureau Veritas

- 6.3. Canadian DNA Services

- 6.4. Easy DNA

- 6.5. Eurofins Scientific

- 6.6. Gene by Gene, Ltd.

- 6.7. Genex Diagnostics

- 6.8. Intelligenetics

- 6.9. Invitae Corporation (Natera)

- 6.10. Laboratory Corporation of America

- 6.11. Myriad Genetics

- 6.12. Quest Diagnostics

- 6.13. Verogen

7. Global Relationship Testing Market Size

- 7.1. Global Market by Country

- 7.1.1. Table - Global Market by Country

- 7.1.2. Chart - Country Market Shares

- 7.2. Global Market by Application

- 7.2.1. Table - Global Market by Application

- 7.2.2. Chart - Application Share by Year

- 7.2.3. Chart - Application Segment Growth Rates

- 7.2.4. Chart - Application Segment Share Shifts

- 7.2.5. Chart - Application Segment Share Base Year

- 7.2.6. Chart - Application Segment Share Final Year

- 7.3. Global Market by Product

- 7.3.1. Table - Global Market by Product

- 7.3.2. Chart - Product Share by Year

- 7.3.3. Chart - Product Segment Growth Rates

- 7.3.4. Chart - Product Segment Share Shifts

- 7.3.5. Chart - Product Segment Share Base Year

- 7.3.6. Chart - Product Segment Share Final Year

8. Global Relationship Market Sizes by Application

- 8.1. Legal Market

- 8.1.1. Table Legal - by Country

- 8.1.2. Chart - Legal Growth

- 8.2. Migrant Testing Market

- 8.2.1. Table Migrant - by Country

- 8.2.2. Chart - Migrant Growth

- 8.3. Clinical Market

- 8.3.1. Table Clinical - by Country

- 8.3.2. Chart - Clinical Growth

- 8.4. Consumer Discretionary Market

- 8.4.1. Table Consumer Discretionary - by Country

- 8.4.2. Chart - Consumer Discretionary Growth

9. Global Relationship Testing Market by Product

- 9.1. Instruments Market

- 9.1.1. Table Instruments - by Country

- 9.1.2. Chart - Instrument Growth

- 9.2. Reagents and Kits Market

- 9.2.1. Table Reagents and Kits - by Country

- 9.2.2. Chart - Reagents and Kits Growth

- 9.3. Software Market

- 9.3.1. Table Software - by Country

- 9.3.2. Software Growth

- 9.4. Services Market

- 9.4.1. Table Services - by Country

- 9.4.2. Chart - Services Growth