|

|

市場調査レポート

商品コード

1790105

折りたたみ・組み立て式コンテナの市場規模、シェア、動向分析レポート:素材別、製品タイプ別、最終用途別、地域別、セグメント別予測、2025年~2033年Foldable And Collapsible Container Market Size, Share & Trends Analysis Report By Material (Plastic, Metal, Wood), By Product (Bulk Bins, Pallets, Crates), Type, By End-use, By Region, And Segment Forecasts, 2025 - 2033 |

||||||

カスタマイズ可能

|

|||||||

| 折りたたみ・組み立て式コンテナの市場規模、シェア、動向分析レポート:素材別、製品タイプ別、最終用途別、地域別、セグメント別予測、2025年~2033年 |

|

出版日: 2025年07月04日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

折りたたみ・組み立て式コンテナ市場のサマリー

世界の折りたたみ・組み立て式コンテナ市場規模は、2024年に16億4,000万米ドルと推計され、2033年には23億2,000万米ドルに達すると予測され、2025年から2033年までのCAGRは4.0%で成長すると予測されます。市場を牽引しているのは、省スペースでコスト効率の高い保管・輸送ソリューションに対する需要の高まりです。

さらに、ロジスティクスと倉庫管理における持続可能性と再利用可能なパッケージングへの注目の高まりが、市場の成長を後押ししています。倉庫や物流における効率的なスペース利用に対する需要の高まりが、主に折りたたみ・折り畳み式コンテナ市場を牽引しています。eコマース、製造業、小売業が拡大するにつれて、スペースを最適化し、遊休倉庫を削減する倉庫施設に対する圧力が高まっています。折りたたみ式コンテナは、企業が使用時には同じ設置面積でより多くの商品を保管し、未使用時には返品物流や保管時の容積を大幅に削減することを可能にすることで、このニーズに対応します。例えば、イケアやアマゾンは、折りたたみ可能なコンテナ・システムを採用することで、リバース・ロジスティクスを合理化し、コスト削減と業務効率の向上を実現しています。

持続可能性と循環経済の原則が重視されるようになったことも、市場の成長に寄与しています。折りたたみ式コンテナは通常、再利用可能で、HDPEや金属合金のようなリサイクル可能な素材や長持ちする素材から作られており、使い捨て包装の必要性を減らしています。環境フットプリントに関する規制圧力や消費者の意識の高まりに伴い、産業界は使い捨て包装から、より耐久性があり環境に優しいソリューションへと移行しつつあります。例えば、自動車メーカーや電子機器メーカーは、プラスチック廃棄物を削減し、ESG(環境・社会・ガバナンス)目標に沿うため、折りたたみ式包装に移行しています。

市場はまた、材料科学と製品設計における技術的進歩からも利益を得ています。技術革新により、クイックロックシステム、RFID追跡機能、より安全な取り扱いのための人間工学に基づいたデザインなどの機能を備えた、軽量かつ強靭な容器の創造が可能になりました。これにより、医薬品、農業、化学品などの分野にわたって、折りたたみ可能な容器の使い勝手が向上しています。

さらに、輸送と労働のコスト削減が市場導入を加速させています。折りたたみ式コンテナは、空のコンテナ容積を減らすことで往復コストを大幅に削減し、燃料使用量の削減と輸送回数の減少につながります。これは、特に長距離輸送や国際貿易に関連します。さらに、これらのコンテナは、自動ハンドリング・システムと互換性のあるモジュール式で標準化された設計を特徴としていることが多く、人件費やマテリアルハンドリング中の損傷を軽減します。例えば、欧州やアジアの物流会社は、木製パレットや硬い箱を折りたたみ式プラスチック・コンテナに置き換えて、フリートの効率を高め、総所有コストを削減しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 世界の折りたたみ・組み立て式コンテナ市場の変数、動向、範囲

- 市場系統の見通し

- 浸透と成長の見込みマッピング

- 業界バリューチェーン分析

- 原材料の動向

- 製造/技術動向

- 規制の枠組み

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会分析

- 市場課題分析

- ビジネス環境分析

- ポーターのファイブフォース分析

- PESTEL分析

第4章 世界の折りたたみ・組み立て式コンテナ市場:素材推定・動向分析

- 重要なポイント

- 素材変動分析と市場シェア、2024年と2033年

- プラスチック

- 金属

- 木材

- その他

第5章 世界の折りたたみ・組み立て式コンテナ市場:製品タイプの推定・動向分析

- 重要なポイント

- 製品タイプの変動分析と市場シェア、2024年と2033年

- バルクビン

- パレット

- 木箱

- ボックス

- カートン

- その他

第6章 世界の折りたたみ・組み立て式コンテナ市場:最終用途の推定・動向分析

- 重要なポイント

- 最終用途変動分析と市場シェア、2024年と2033年

- 産業・自動車

- 食品・飲料

- 医薬品・化学

- 建設・建築

- その他

第7章 世界の折りたたみ・組み立て式コンテナ市場:地域推定・動向分析

- 重要なポイント

- 地域変動分析と市場シェア、2024年と2033年

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- ラテンアメリカ

- ブラジル

- アルゼンチン

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第8章 競合情勢

- 世界の主要企業と最近の動向、そして業界への影響

- 企業分類

- 企業の市況分析

- 企業ヒートマップ分析

- 企業ダッシュボード分析

- 戦略マッピング

- 拡張

- 合併と買収

- コラボレーション

- 新製品タイプの発売

- その他

第9章 企業一覧(概要、財務実績、製品タイプ概要)

- ショラー・アリベール

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- ウェストロック社

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- ABシーコンテナプライベートリミテッド

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- ヴィンサム・アクセル

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- スペクテイナー

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- サハイラック

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- フレキシブル包装ソリューション

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- ロジマルクト

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- チェップ

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- フレックスコンテナ

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- RPPコンテナ

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- コープレックス

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

- 山東連勝プレハブ建設株式会社

- 会社概要

- 財務実績

- 製品タイプのベンチマーク

List of Tables

- 1. Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 2. Foldable and Collapsible Container market estimates and forecasts, by Plastics, 2021 - 2033 (USD Million)

- 3. Foldable and Collapsible Container market estimates and forecasts, by Metal, 2021 - 2033 (USD Million)

- 4. Foldable and Collapsible Container market estimates and forecasts, by Wood, 2021 - 2033 (USD Million)

- 5. Foldable and Collapsible Container market estimates and forecasts, by Others, 2021 - 2033 (USD Million)

- 6. Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 7. Foldable and Collapsible Container market estimates and forecasts, by Bulk Bins, 2021 - 2033 (USD Million)

- 8. Foldable and Collapsible Container market estimates and forecasts, by Pallets, 2021 - 2033 (USD Million)

- 9. Foldable and Collapsible Container market estimates and forecasts, by Crates, 2021 - 2033 (USD Million)

- 10. Foldable and Collapsible Container market estimates and forecasts, by Boxes, 2021 - 2033 (USD Million)

- 11. Foldable and Collapsible Container market estimates and forecasts, by Cartons, 2021 - 2033 (USD Million)

- 12. Foldable and Collapsible Container market estimates and forecasts, by Others, 2021 - 2033 (USD Million)

- 13. Foldable and Collapsible Container market estimates and forecasts, by End Use, 2021 - 2033 (USD Million)

- 14. Foldable and Collapsible Container market estimates and forecasts, in Industrial & Automotive, 2021 - 2033 (USD Million)

- 15. Foldable and Collapsible Container market estimates and forecasts, in Food & Beverage, 2021 - 2033 (USD Million)

- 16. Foldable and Collapsible Container market estimates and forecasts, in Pharmaceutical & Chemical, 2021 - 2033 (USD Million)

- 17. Foldable and Collapsible Container market estimates and forecasts, in Construction & Building, 2021 - 2033 (USD Million)

- 18. Foldable and Collapsible Container market estimates and forecasts, in Others, 2021 - 2033 (USD Million)

- 19. Foldable and Collapsible Container market estimates and forecasts, by Region, 2021 - 2033 (USD Million)

- 20. North America Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 21. North America Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 22. North America Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 23. North America Foldable and Collapsible Container market estimates and forecasts, by End use, 2021 - 2033 (USD Million)

- 24. U.S. Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 25. U.S. Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (Units) (USD Million)

- 26. U.S. Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (Units) (USD Million)

- 27. U.S. Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (Units) (USD Million)

- 28. Canada Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 29. Canada Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 30. Canada Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 31. Canada Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 32. Mexico Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 33. Mexico Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 34. Mexico Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 35. Mexico Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 36. Europe Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 37. Europe Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 38. Europe Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 39. Europe Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 40. Germany Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 41. Germany Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 42. Germany Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 43. Germany Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 44. UK Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 45. UK Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 46. UK Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 47. UK Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 48. France Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 49. France Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 50. France Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 51. France Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 52. Italy Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 53. Italy Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 54. Italy Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 55. Italy Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 56. Spain Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 57. Spain Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 58. Spain Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 59. Spain Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 60. Asia Pacific Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 61. Asia Pacific Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 62. Asia Pacific Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 63. Asia Pacific Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 64. China Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 65. China Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 66. China Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 67. China Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 68. Japan Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 69. Japan Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 70. Japan Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 71. Japan Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 72. India Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 73. India Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 74. India Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 75. India Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 76. Australia Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 77. Australia Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 78. Australia Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 79. Australia Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 80. South Korea Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 81. South Korea Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 82. South Korea Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 83. South Korea Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 84. Latin America Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 85. Latin America Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 86. Latin America Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 87. Latin America Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 88. Brazil Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 89. Brazil Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 90. Brazil Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 91. Brazil Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 92. Argentina Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 93. Argentina Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 94. Argentina Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 95. Argentina Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 96. Middle East & Africa Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 97. Middle East & Africa Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 98. Middle East & Africa Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 99. Middle East & Africa Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 100. Saudi Arabia Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 101. Saudi Arabia Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 102. Saudi Arabia Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 103. Saudi Arabia Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 104. UAE Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 105. UAE Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 106. UAE Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 107. UAE Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

- 108. South Africa Foldable and Collapsible Container market estimates and forecasts, 2021 - 2033 (USD Million)

- 109. South Africa Foldable and Collapsible Container market estimates and forecasts, by Material, 2021 - 2033 (USD Million)

- 110. South Africa Foldable and Collapsible Container market estimates and forecasts, by Product Type, 2021 - 2033 (USD Million)

- 111. South Africa Foldable and Collapsible Container market estimates and forecasts, by end use, 2021 - 2033 (USD Million)

List of Figures

- 1. Information Procurement

- 2. Primary Research Pattern

- 3. Primary Research Process

- 4. Market Research Approaches - Bottom-Up Approach

- 5. Market Research Approaches - Top-Down Approach

- 6. Market Research Approaches - Combined Approach

- 7. Foldable and Collapsible Container Market- Market Snapshot

- 8. Foldable and Collapsible Container Market- Segment Snapshot (1/2)

- 9. Foldable and Collapsible Container Market- Segment Snapshot (2/2)

- 10. Foldable and Collapsible Container Market- Competitive Landscape Snapshot

- 11. Foldable and Collapsible Container Market: Penetration & Growth Prospect Mapping

- 12. Foldable and Collapsible Container Market: Value Chain Analysis

- 13. Foldable and Collapsible Container Market: Porter's Five Force Analysis

- 14. Foldable and Collapsible Container Market: PESTEL Analysis

- 15. Foldable and Collapsible Container Market: Material Movement Analysis, 2024 & 2033

- 16. Foldable and Collapsible Container Market: Product Type Movement Analysis, 2024 & 2033

- 17. Foldable and Collapsible Container Market: End Use Movement Analysis, 2024 & 2033

- 18. Foldable and Collapsible Container Market: Regional Movement Analysis, 2024 & 2033

- 19. Foldable and Collapsible Container Market: Company Positioning Analysis

- 20. Foldable and Collapsible Container Market: Strategy Mapping

Foldable And Collapsible Container Market Summary

The global foldable and collapsible container market size was estimated at USD 1.64 billion in 2024 and is projected to reach USD 2.32 billion by 2033, growing at a CAGR of 4.0% from 2025 to 2033. The market is driven by rising demand for space-saving and cost-efficient storage and transportation solutions.

Additionally, growing focus on sustainability and reusable packaging in logistics and warehousing fuels market growth. The rising demand for efficient space utilization in warehousing and logistics primarily drives the foldable and collapsible container market. As e-commerce, manufacturing, and retail industries expand, the pressure on warehousing facilities to optimize space and reduce idle storage grows. Foldable containers address this need by allowing businesses to store more goods in the same footprint when in use and significantly reduce volume during return logistics or storage when not in use. For example, IKEA and Amazon have adopted collapsible container systems to streamline reverse logistics, cutting costs and improving operational efficiency.

The growing emphasis on sustainability and circular economy principles is also contributing to market growth. Collapsible containers are typically reusable and made from recyclable or long-lasting materials such as HDPE or metal alloys, reducing the need for single-use packaging. With increasing regulatory pressure and consumer awareness regarding environmental footprints, industries are shifting from disposable packaging to more durable and environmentally friendly solutions. For instance, automotive and electronics manufacturers are transitioning to foldable packaging to reduce plastic waste and align with ESG (Environmental, Social, and Governance) targets.

The market also benefits from technological advancements in material science and product design. Innovations have enabled the creation of lightweight yet strong containers with features such as quick-lock systems, integrated RFID tracking, and ergonomic designs for safer handling. This enhances the usability of collapsible containers across sectors like pharmaceuticals, agriculture, and chemicals.

Moreover, cost reduction in transportation and labor is accelerating market adoption. Foldable containers drastically reduce return trip costs by decreasing the volume of empty containers, translating into lower fuel use and fewer trips. This is especially relevant in long-haul transportation and global trade. Additionally, these containers often feature modular and standardized designs that are compatible with automated handling systems, reducing labor costs and damage during material handling. For instance, logistics companies in Europe and Asia are replacing wooden pallets and rigid boxes with collapsible plastic containers to increase fleet efficiency and reduce total cost of ownership.

Global Foldable And Collapsible Container Market Report Segmentation

This report forecasts revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global foldable and collapsible container market report based on material, product type, end use, and region:

- Material Outlook (Revenue, USD Million, 2021 - 2033)

- Plastic

- Metal

- Wood

- Others

- Product Type Outlook (Revenue, USD Million, 2021 - 2033)

- Bulk Bins

- Pallets

- Crates

- Boxes

- Cartons

- Others

- End Use Outlook (Revenue, USD Million, 2021 - 2033)

- Industrial & Automotive

- Food & Beverage

- Pharmaceutical & Chemical

- Construction & Building

- Others

- Regional Outlook (Revenue, USD Million, 2021 - 2033)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Table of Contents

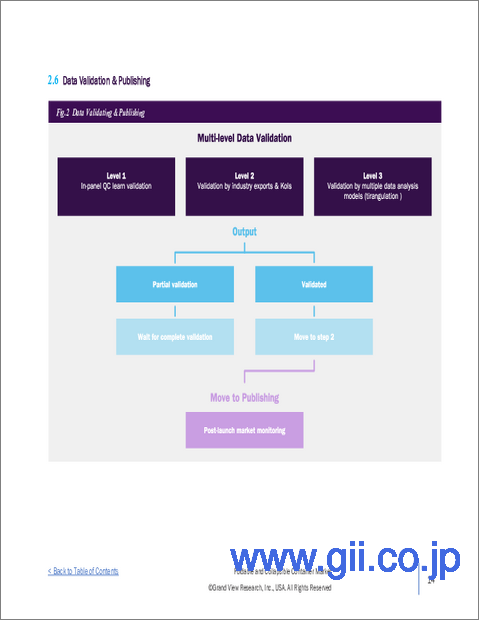

Chapter 1. Methodology and Scope

- 1.1. Research Methodology

- 1.1.1. Market Segmentation

- 1.1.2. Market Definition

- 1.2. Research Scope & Assumptions

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

- 1.7. List of Abbreviations

Chapter 2. Executive Summary

- 2.1. Market Snapshot, 2024 (USD Million)

- 2.2. Segmental Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Global Foldable and Collapsible Container Market Variables, Trends, and Scope

- 3.1. Market Lineage Outlook

- 3.2. Penetration & Growth Prospect Mapping

- 3.3. Industry Value Chain Analysis

- 3.3.1. Raw Material Trends

- 3.3.2. Manufacturing/Technology Trends

- 3.4. Regulatory Framework

- 3.5. Market Dynamics

- 3.5.1. Market Driver Analysis

- 3.5.2. Market Restraint Analysis

- 3.5.3. Market Opportunity Analysis

- 3.5.4. Market Challenge Analysis

- 3.6. Business Environment Analysis

- 3.6.1. Porter's Five Forces Analysis

- 3.6.2. PESTEL Analysis

Chapter 4. Global Foldable and Collapsible Container Market: Material Estimates & Trend Analysis

- 4.1. Key Takeaways

- 4.2. Material Movement Analysis & Market Share, 2024 & 2033

- 4.2.1. Plastic

- 4.2.1.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 4.2.2. Metal

- 4.2.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 4.2.3. Wood

- 4.2.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 4.2.4. Others

- 4.2.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 4.2.1. Plastic

Chapter 5. Global Foldable and Collapsible Container Market: Product Type Estimates & Trend Analysis

- 5.1. Key Takeaways

- 5.2. Product Type Movement Analysis & Market Share, 2024 & 2033

- 5.2.1. Bulk Bins

- 5.2.1.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 5.2.2. Pallets

- 5.2.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 5.2.3. Crates

- 5.2.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 5.2.4. Boxes

- 5.2.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 5.2.5. Cartons

- 5.2.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 5.2.6. Others

- 5.2.6.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 5.2.1. Bulk Bins

Chapter 6. Global Foldable and Collapsible Container Market: End Use Estimates & Trend Analysis

- 6.1. Key Takeaways

- 6.2. End Use Movement Analysis & Market Share, 2024 & 2033

- 6.2.1. Industrial & Automotive

- 6.2.1.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 6.2.2. Food & Beverage

- 6.2.2.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 6.2.3. Pharmaceutical & Chemical

- 6.2.3.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 6.2.4. Construction & Building

- 6.2.4.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 6.2.5. Others

- 6.2.5.1. Market estimates and forecasts, 2021 - 2033 (USD Million)

- 6.2.1. Industrial & Automotive

Chapter 7. Global Foldable and Collapsible Container Market: Region Estimates & Trend Analysis

- 7.1. Key Takeaways

- 7.2. Regional Movement Analysis & Market Share, 2024 & 2033

- 7.3. North America

- 7.3.1. North America Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.3.2. U.S.

- 7.3.2.1. U.S. Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.3.3. Canada

- 7.3.3.1. Canada Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.3.4. Mexico

- 7.3.4.1. Mexico Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.4. Europe

- 7.4.1. Europe Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.4.2. Germany

- 7.4.2.1. Germany Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.4.3. UK

- 7.4.3.1. UK Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.4.4. France

- 7.4.4.1. France Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.4.5. Italy

- 7.4.5.1. Italy Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.4.6. Spain

- 7.4.6.1. Spain Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.5. Asia Pacific

- 7.5.1. Asia Pacific Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.5.2. China

- 7.5.2.1. China Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.5.3. India

- 7.5.3.1. India Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.5.4. Japan

- 7.5.4.1. Japan Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.5.5. South Korea

- 7.5.5.1. South Korea Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.5.6. Australia

- 7.5.6.1. Australia Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.6. Latin America

- 7.6.1. Latin America Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.6.2. Brazil

- 7.6.2.1. Brazil Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.6.3. Argentina

- 7.6.3.1. Argentina Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.7. Middle East & Africa

- 7.7.1. Middle East & Africa Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.7.2. Saudi Arabia

- 7.7.2.1. Saudi Arabia Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.7.3. UAE

- 7.7.3.1. UAE Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

- 7.7.4. South Africa

- 7.7.4.1. South Africa Foldable and Collapsible Container Market Estimates & Forecasts, 2021 - 2033 (USD Million)

Chapter 8. Competitive Landscape

- 8.1. Key Global Players & Recent Developments & Their Impact on the Industry

- 8.2. Company Categorization

- 8.3. Company Market Position Analysis

- 8.4. Company Heat Map Analysis

- 8.5. Company Dashboard Analysis

- 8.6. Strategy Mapping

- 8.6.1. Expansions

- 8.6.2. Mergers & Acquisitions

- 8.6.3. Collaborations

- 8.6.4. New Product Type Launches

- 8.6.5. Others

Chapter 9. Company Listing (Overview, Financial Performance, Product Types Overview)

- 9.1. Schoeller Allibert

- 9.1.1. Company Overview

- 9.1.2. Financial Performance

- 9.1.3. Product Type Benchmarking

- 9.2. WestRock Company

- 9.2.1. Company Overview

- 9.2.2. Financial Performance

- 9.2.3. Product Type Benchmarking

- 9.3. A B Sea Container Private Limited

- 9.3.1. Company Overview

- 9.3.2. Financial Performance

- 9.3.3. Product Type Benchmarking

- 9.4. Vinsum Axpress

- 9.4.1. Company Overview

- 9.4.2. Financial Performance

- 9.4.3. Product Type Benchmarking

- 9.5. Spectainer

- 9.5.1. Company Overview

- 9.5.2. Financial Performance

- 9.5.3. Product Type Benchmarking

- 9.6. SAHAY RACKS

- 9.6.1. Company Overview

- 9.6.2. Financial Performance

- 9.6.3. Product Type Benchmarking

- 9.7. Flexible Packaging Solutions

- 9.7.1. Company Overview

- 9.7.2. Financial Performance

- 9.7.3. Product Type Benchmarking

- 9.8. Logimarkt

- 9.8.1. Company Overview

- 9.8.2. Financial Performance

- 9.8.3. Product Type Benchmarking

- 9.9. CHEP

- 9.9.1. Company Overview

- 9.9.2. Financial Performance

- 9.9.3. Product Type Benchmarking

- 9.10. Flex Container

- 9.10.1. Company Overview

- 9.10.2. Financial Performance

- 9.10.3. Product Type Benchmarking

- 9.11. RPP Containers

- 9.11.1. Company Overview

- 9.11.2. Financial Performance

- 9.11.3. Product Type Benchmarking

- 9.12. Corplex

- 9.12.1. Company Overview

- 9.12.2. Financial Performance

- 9.12.3. Product Type Benchmarking

- 9.13. Shandong Liansheng Prefabricated Construction Co., Ltd.

- 9.13.1. Company Overview

- 9.13.2. Financial Performance

- 9.13.3. Product Type Benchmarking