|

|

市場調査レポート

商品コード

1633759

ゴルフグローブの世界市場:市場規模・シェア・動向分析 (購入者別・流通チャネル別・地域別)、セグメント別予測 (2025年~2030年)Golf Gloves Market Size, Share & Trends Analysis Report By Buyer (Individual Golf Gloves, Institutional Golf Gloves, Promotional Golf Gloves), By Distribution Channel (Offline, Online), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| ゴルフグローブの世界市場:市場規模・シェア・動向分析 (購入者別・流通チャネル別・地域別)、セグメント別予測 (2025年~2030年) |

|

出版日: 2024年12月10日

発行: Grand View Research

ページ情報: 英文 80 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

ゴルフグローブ市場の成長と動向

Grand View Research, Inc.の最新レポートによると、世界のゴルフグローブの市場規模は2025年から2030年にかけてCAGR 4.6%を記録し、2030年には4億5,170万米ドルに達すると推定されています。

マクロレベルでは、スポーツとしてのゴルフ人気の高まりが、世界のゴルフグローブの需要に大きく寄与しています。2018年には、約420万人のベビーブーマーがゴルフをプレーし、これは2017年の360万人から増加しています。また、2018年の新規参入者の約15.0%が50歳以上の高齢者であり、過去10年間で最も大きな割合を占めていることが確認されました。若年層の参加は同年610万人となっています。

製品別では、個人用ゴルフグローブが2024年の最大セグメントに浮上しました。このスポーツがますます個性への情熱を受け入れるようになり、個人用ゴルフグローブはファッショナブルなアクセサリーに進化しました。近い将来、多くの企業がこの成長動向を利用することが予想されます。個々のゴルフグローブは、主に革を使用して作られており、色やサイズの多種多様で利用可能です。

販促用ゴルフグローブセグメントは、プレミアム手袋の需要の高まりにより、予測期間中に最も速いCAGRで拡大する可能性があります。これらの手袋は販売促進を目的としているため、個人用や施設用よりも比較的高価です。カスタマイズされたロゴが特徴で、幅広いカラーオプションとアートワークが用意されています。かなりの割引を得るために、著名なブランドは、通常、バルクでこれらの手袋を購入します。近年では、プロモーションゴルフグローブのいくつかのメーカーは、世界中の様々な消費者をターゲットに、これらの製品をより手頃な価格にすることに焦点を当てています。

アジア太平洋は、予測可能な将来に最も有利な地域市場として浮上すると予想されます。アジア太平洋市場ではコロナウィルスの大流行によりサプライチェーンが大混乱に陥っていますが、同地域で急速に進化している防疫ライフスタイルにより、近い将来、より多くの参入企業がゴルフに参加するようになると思われます。COVID-19の大流行により、世界中のほとんどのゴルフ場が閉鎖されましたが、社会的距離を置く措置により、オーストラリアのゴルフ場は、クイーンズランド州のクラブを唯一の例外として、2020年第1四半期中も営業を続けることができました。

この業界は、製品のバリエーションと価格に関して非常に競争が激しいです。市場参入企業は、世界中の消費者の間で通気性素材の人気が高まっていることから、ゴルフグローブの製造に軽量素材を採用することに注力しています。

ゴルフグローブ市場:分析概要

- 市場参入企業の増加、市場で事業展開する主要企業が実施する効果的なオフライン流通戦略、顧客にとって使いやすいデザインと製品の入手可能性などが牽引し、個人購入者層が2024年に52.6%の最大収益シェアを占めました。

- 流通チャネル別では、オフライン流通セグメントが2024年に世界のゴルフグローブ産業で最大の収益シェアを占めました。

- アジア太平洋地域のゴルフグローブ市場は、予測期間中に最も速いCAGRを経験すると予測され、この地域におけるスポーツの人気の高まり、世界および国内メーカーが提供する多くの製品、ゲームへの参加の増加によって駆動されます。

目次

第1章 分析方法・範囲

第2章 エグゼクティブサマリー

第3章 ゴルフグローブ市場:変動要因・傾向・範囲

- 市場連関の見通し

- 親市場の見通し

- 関連/付随市場の見通し

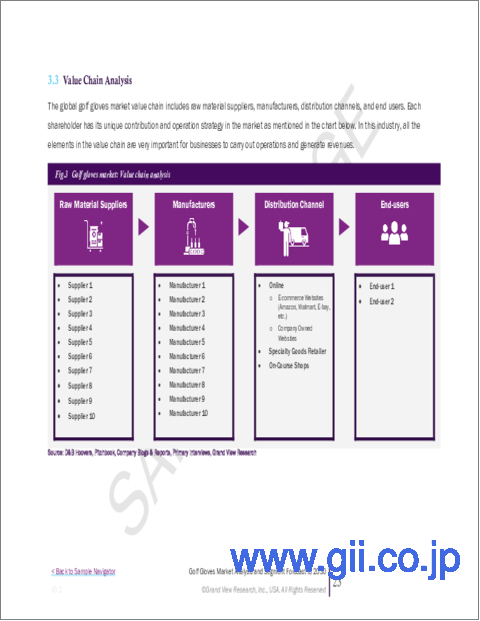

- 業界バリューチェーン分析

- 利益率分析 (業界レベル)

- 市場力学

- 市場促進要因の分析

- 市場抑制要因の分析

- 市場機会

- 市場の課題

- 業界分析ツール

- ポーターのファイブフォース分析

- 市場参入戦略

第4章 消費者行動の分析

- 人口統計分析

- 消費者の動向と嗜好

- 購入決定に影響を与える要因

- 消費者の原料採用状況

- 観察と推奨事項

第5章 ゴルフグローブ市場:購入者別の展望・推定・予測

- ゴルフグローブ市場:主なポイント、購入者

- 変動分析と市場シェア:購入者 (2024年・2030年)

- 購入者 (2018~2030年)

- 個人用ゴルフグローブ

- 団体用ゴルフグローブ

- 販促用ゴルフグローブ

第6章 ゴルフグローブ市場:流通チャネル別の展望・推定・予測

- ゴルフグローブ市場:主なポイント、流通チャネル別

- 変動分析と市場シェア:流通チャネル別 (2024年・2030年)

- 流通チャネル別 (2018~2030年)

- オンライン

- オフライン

第7章 ゴルフグローブ市場:地域推定・動向分析

- ゴルフグローブ市場:地域別の展望

- 地域別市場:重要なポイント

- 地域別 (2018~2030年)

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東

第8章 ゴルフグローブ市場:競合分析

- 最新動向と影響分析:主な市場参入企業別

- 企業分類

- 参入企業の概要

- 財務実績

- 原料のベンチマーク

- 企業ヒートマップ分析

- 戦略マッピング

- 企業プロファイル

- Callaway Golf Company (Topgolf Callaway Brands)

- SRIXON (Sumitomo Rubber Industries, Ltd.)

- Acushnet Holdings Corp.

- Under Armour Inc.

- Zero Friction

- TaylorMade Golf Co.

- G/FORE

- Mizuno

- North Coast Golf Co.

- RED ROOSTER GOLF

List of Tables

- Table 1. Golf gloves market: Key market driver analysis

- Table 2. Golf gloves market: Key market restraint analysis

- Table 3. Global golf gloves market estimates & forecast, by region (USD Million)

- Table 4. Global golf gloves market estimates & forecast, by buyer (USD Million)

- Table 5. Global golf gloves market estimates & forecast, by distribution channel (USD Million)

- Table 6. North America golf gloves market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 7. North America golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 8. North America golf gloves market estimates & forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 9. U.S. macro-economic outlay

- Table 10. U.S golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 11. U.S. golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 12. Canada macro-economic outlay

- Table 13. Canada golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 14. Canada golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 15. Mexico macro-economic outlay

- Table 16. Mexico golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 17. Mexico golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 18. Europe golf gloves market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 19. Europe golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 20. Europe golf gloves market estimates & forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 21. U.K. macro-economic outlay

- Table 22. U.K. golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 23. U.K. golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 24. Germany macro-economic outlay

- Table 25. Germany golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 26. Germany golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 27. France macro-economic outlay

- Table 28. France golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 29. France golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 30. Italy macro-economic outlay

- Table 31. Italy golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 32. Italy golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 33. Spain macro-economic outlay

- Table 34. Spain golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 35. Spain golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 36. Asia Pacific golf gloves market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 37. Asia Pacific golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 38. Asia Pacific golf gloves market estimates & forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 39. China macro-economic outlay

- Table 40. China golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 41. China golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 42. Japan macro-economic outlay

- Table 43. Japan golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 44. Japan golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 45. Australia macro-economic outlay

- Table 46. Australia golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 47. Australia golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 48. India macro-economic outlay

- Table 49. India golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 50. India golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 51. South Korea macro-economic outlay

- Table 52. South Korea golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 53. South Korea golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 54. Latin America golf gloves market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 55. Latin America golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 56. Latin America golf gloves market estimates & forecast, by distribution channel, (USD Million)

- Table 57. Brazil macro-economic outlay

- Table 58. Brazil golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 59. Brazil golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 60. Middle East & Africa golf gloves market estimates and forecast, by country, 2018 - 2030 (USD Million)

- Table 61. Middle East & Africa golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 62. Middle East golf gloves market estimates & forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 63. Saudi Arabia macro-economic outlay

- Table 64. Saudi Arabia golf gloves market estimates and forecast, by buyer, 2018 - 2030 (USD Million)

- Table 65. Saudi Arabia golf gloves market estimates and forecast, by distribution channel, 2018 - 2030 (USD Million)

- Table 66. Recent developments & impact analysis, by key market participants

- Table 67. Company heat map analysis, 2024

- Table 68. Companies implementing key strategies

List of Figures

- Fig. 1 Golf gloves market segmentation

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Primary research approaches

- Fig. 5 Primary research process

- Fig. 6 Market snapshot

- Fig. 7 Segment snapshot

- Fig. 8 Regional snapshot

- Fig. 9 Competitive landscape snapshot

- Fig. 10 Global parent industry and golf gloves market size (USD Million)

- Fig. 11 Global golf gloves market size, 2018 to 2030 (USD Million)

- Fig. 12 Global golf gloves market: Penetration & growth prospect mapping

- Fig. 13 Global golf gloves market: Value chain analysis

- Fig. 14 Global golf gloves market: Dynamics

- Fig. 15 Global golf gloves market: Porter's five forces analysis

- Fig. 16 Global golf gloves market estimates & forecast, by buyer (USD Million)

- Fig. 17 Individual golf gloves market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 18 Institutional golf gloves market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 19 Promotional golf gloves market estimates & forecasts, 2018 - 2030 (USD Million)

- Fig. 20 Global golf gloves market estimates & forecast, by distribution channel (USD Million)

- Fig. 21 Golf gloves market estimates & forecasts for online distribution, 2018 - 2030 (USD Million)

- Fig. 22 Golf gloves market estimates & forecasts for offline distribution, 2018 - 2030 (USD Million)

- Fig. 23 Golf gloves market: Regional outlook, 2024 & 2030, (USD Million)

- Fig. 24 Regional marketplace: Key takeaways

- Fig. 25 North America golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 26 US golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 27 Canada golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 28 Mexico golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 29 Europe golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 30 UK golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 31 Germany golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 32 France golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 33 Italy golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 34 Spain golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 35 Asia Pacific golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 36 China golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 37 Japan golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 38 Australia golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 39 India golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 40 South Korea Arabia golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 41 Latin America golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 42 Brazil golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 43 Middle East golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 44 Saudi Arabia golf gloves market estimates & forecast, 2018 - 2030 (USD Million)

- Fig. 45 Key company categorization

- Fig. 46 Strategic framework of golf gloves

Golf Gloves Market Growth & Trends:

The global golf gloves market size is estimated to reach USD 451.7 million by 2030, registering a CAGR of 4.6% from 2025 to 2030, according to a new report by Grand View Research, Inc. At a macro level, the rising popularity of golf as a sport is contributing significantly to the demand for golf gloves worldwide. In 2018, approximately 4.2 million baby boomers played golf, which is an increase from 3.6 million in 2017. It was also observed that about 15.0% of newcomers in 2018 were older than 50, which was the most significant percentage in the last ten years. The participation of young adults stood at 6.1 million that year.

In terms of product, individual golf gloves emerged as the largest segment in 2024. With the sport increasingly embracing a passion for individuality, individual golf gloves have evolved to become a fashionable accessory. In the near term, numerous companies are expected to capitalize on this growing trend. Individual golf gloves are principally made using leather and are available in a wide variety of colors and sizes.

The promotional golf gloves segment is likely to expand at the fastest CAGR over the forecast period owing to the rising demand for premium gloves. As these gloves are intended for promotional purposes, they are relatively more expensive than the individual and institutional variants. They feature customized logos and are available in a wide range of color options and artwork. To get a sizable discount, prominent brands typically purchase these gloves in bulk. In recent years, several manufacturers of promotional golf gloves have been focusing on making these products more affordable to target a variety of consumers worldwide.

Asia Pacific is anticipated to emerge as the most lucrative regional market in the foreseeable future. Though the coronavirus outbreak has been creating massive supply chain disruptions in the Asia Pacific markets, rapidly evolving quarantine lifestyles within the region are likely to encourage more individuals to participate in golf in the near term. While the COVID-19 pandemic led to the closure of most golf courses worldwide, social distancing measures helped keep golf courses in Australia to remain open during the first quarter of 2020, with the only exception of clubs in Queensland.

The industry is highly competitive when it comes to product variation and pricing. Prominent market participants are focusing on employing lighter materials to manufacture golf gloves, given the rising popularity of breathable materials among consumers worldwide.

Golf Gloves Market Report Highlights:

- The individual buyers segment held the largest revenue share of 52.6% in 2024, driven by the growing number of participants in the game, effective offline distribution strategies implemented by the key companies operating in the market, and the availability of customer-friendly designs and products.

- By distribution channel, the offline distribution segment held the largest revenue share of the global golf gloves industry in 2024.

- The Asia Pacific golf gloves market is projected to experience the fastest CAGR during the forecast period, driven by the growing popularity of sports in the region, the many products delivered by global and domestic manufacturers, and increasing participation in the game.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Golf Gloves Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.1.2. Related Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Profit Margin Analysis (Industry-level)

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Market Opportunities

- 3.3.4. Market Challenges

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Five Forces Analysis

- 3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographic Analysis

- 4.2. Consumer Trends and Preferences

- 4.3. Factors Affecting Buying Decision

- 4.4. Consumer Ingredient Adoption

- 4.5. Observations & Recommendations

Chapter 5. Golf Gloves Market: Buyer Estimates & Trend Analysis

- 5.1. Golf Gloves Market, By Buyer: Key Takeaways

- 5.2. Buyer Movement Analysis & Market Share, 2024 & 2030

- 5.3. Market Estimates & Forecasts, By Buyer, 2018 - 2030 (USD Million)

- 5.3.1. Individual golf gloves

- 5.3.1.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 5.3.2. Institutional golf gloves

- 5.3.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 5.3.3. Promotional golf gloves

- 5.3.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 5.3.1. Individual golf gloves

Chapter 6. Golf Gloves Market: Distribution Channel Estimates & Trend Analysis

- 6.1. Golf gloves Market, By Distribution Channel: Key Takeaways

- 6.2. Distribution Channel Movement Analysis & Market Share, 2024 & 2030

- 6.3. Market Estimates & Forecasts, by Distribution Channel, 2018 - 2030 (USD Million)

- 6.3.1. Online

- 6.3.1.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 6.3.2. Offline

- 6.3.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 6.3.1. Online

Chapter 7. Golf Gloves Market: Regional Estimates & Trend Analysis

- 7.1. Golf Gloves Market: Regional Outlook

- 7.2. Regional Marketplaces: Key Takeaways

- 7.3. Market Estimates & Forecasts, by Region, 2018 - 2030 (USD Million)

- 7.3.1. North America

- 7.3.1.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.1.2. U.S.

- 7.3.1.2.1. Key Country Dynamics

- 7.3.1.2.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.1.3. Canada

- 7.3.1.3.1. Key Country Dynamics

- 7.3.1.3.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.1.4. Mexico

- 7.3.1.4.1. Key Country Dynamics

- 7.3.1.4.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.2. Europe

- 7.3.2.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.2.2. U.K.

- 7.3.2.2.1. Key Country Dynamics

- 7.3.2.2.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.2.3. Germany

- 7.3.2.3.1. Key Country Dynamics

- 7.3.2.3.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.2.4. France

- 7.3.2.4.1. Key Country Dynamics

- 7.3.2.4.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.2.5. Italy

- 7.3.2.5.1. Key Country Dynamics

- 7.3.2.5.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.2.6. Spain

- 7.3.2.6.1. Key Country Dynamics

- 7.3.2.6.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.3. Asia Pacific

- 7.3.3.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.3.2. China

- 7.3.3.2.1. Key Country Dynamics

- 7.3.3.2.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.3.3. Japan

- 7.3.3.3.1. Key Country Dynamics

- 7.3.3.3.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.3.4. Australia

- 7.3.3.4.1. Key Country Dynamics

- 7.3.3.4.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.3.5. India

- 7.3.3.5.1. Key Country Dynamics

- 7.3.3.5.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.3.6. South Korea

- 7.3.3.6.1. Key Country Dynamics

- 7.3.3.6.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.4. Latin America

- 7.3.4.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.4.2. Brazil

- 7.3.4.2.1. Key Country Dynamics

- 7.3.4.2.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.5. Middle East

- 7.3.5.1. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.5.2. Saudi Arabia

- 7.3.5.2.1. Key Country Dynamics

- 7.3.5.2.2. Market Estimates and Forecast, 2018 - 2030 (USD Million)

- 7.3.1. North America

Chapter 8. Golf gloves Market: Competitive Analysis

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company Categorization

- 8.3. Participant's Overview

- 8.4. Financial Performance

- 8.5. Ingredient Benchmarking

- 8.6. Company Heat Map Analysis

- 8.7. Strategy Mapping

- 8.8. Company Profiles

- 8.8.1. Callaway Golf Company (Topgolf Callaway Brands)

- 8.8.1.1. Company Overview

- 8.8.1.2. Financial Performance

- 8.8.1.3. Ingredient Portfolios

- 8.8.1.4. Strategic Initiatives

- 8.8.2. SRIXON (Sumitomo Rubber Industries, Ltd.)

- 8.8.2.1. Company Overview

- 8.8.2.2. Financial Performance

- 8.8.2.3. Ingredient Portfolios

- 8.8.2.4. Strategic Initiatives

- 8.8.3. Acushnet Holdings Corp.

- 8.8.3.1. Company Overview

- 8.8.3.2. Financial Performance

- 8.8.3.3. Ingredient Portfolios

- 8.8.3.4. Strategic Initiatives

- 8.8.4. Under Armour Inc.

- 8.8.4.1. Company Overview

- 8.8.4.2. Financial Performance

- 8.8.4.3. Ingredient Portfolios

- 8.8.4.4. Strategic Initiatives

- 8.8.5. Zero Friction

- 8.8.5.1. Company Overview

- 8.8.5.2. Financial Performance

- 8.8.5.3. Ingredient Portfolios

- 8.8.5.4. Strategic Initiatives

- 8.8.6. TaylorMade Golf Co.

- 8.8.6.1. Company Overview

- 8.8.6.2. Financial Performance

- 8.8.6.3. Ingredient Portfolios

- 8.8.6.4. Strategic Initiatives

- 8.8.7. G/FORE

- 8.8.7.1. Company Overview

- 8.8.7.2. Financial Performance

- 8.8.7.3. Ingredient Portfolios

- 8.8.7.4. Strategic Initiatives

- 8.8.8. Mizuno

- 8.8.8.1. Company Overview

- 8.8.8.2. Financial Performance

- 8.8.8.3. Ingredient Portfolios

- 8.8.8.4. Strategic Initiatives

- 8.8.9. North Coast Golf Co.

- 8.8.9.1. Company Overview

- 8.8.9.2. Financial Performance

- 8.8.9.3. Ingredient Portfolios

- 8.8.9.4. Strategic Initiatives

- 8.8.10. RED ROOSTER GOLF

- 8.8.10.1. Company Overview

- 8.8.10.2. Financial Performance

- 8.8.10.3. Ingredient Portfolios

- 8.8.10.4. Strategic Initiatives

- 8.8.1. Callaway Golf Company (Topgolf Callaway Brands)