|

|

市場調査レポート

商品コード

1575153

半導体ファブレスの市場規模、シェア、動向分析レポート:タイプ別、最終用途別、地域別、セグメント予測、2024年~2030年Semiconductor Fabless Market Size, Share & Trends Analysis Report By Type, By End-use (Application Specific Integrated Circuits (ASIC), Graphic Processing Units (GPUs)), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 半導体ファブレスの市場規模、シェア、動向分析レポート:タイプ別、最終用途別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年09月20日

発行: Grand View Research

ページ情報: 英文 130 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

半導体ファブレスの市場規模と動向:

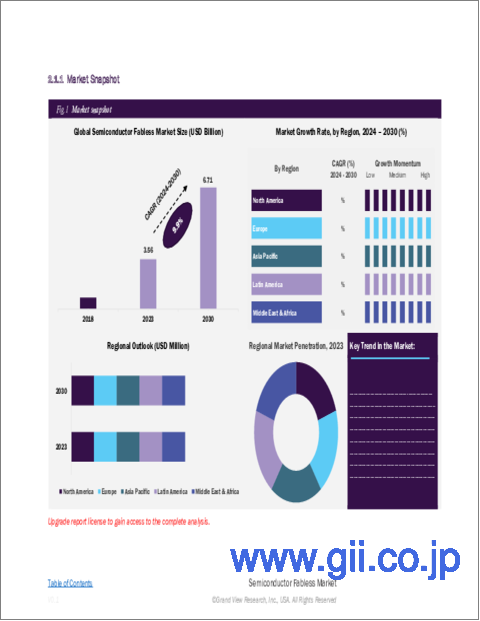

世界の半導体ファブレス市場規模は2023年に35億6,000万米ドルと推定され、2024年から2030年にかけてCAGR 9.9%で成長すると予測されています。

市場の成長は、特にコンシューマーエレクトロニクス、ヘルスケア、車載エレクトロニクスなどの分野における先端半導体デバイスの需要増に起因しています。半導体製造プロセスの技術的進歩も、市場の成長に極めて重要な役割を果たしています。加えて、様々な産業におけるデジタルトランスフォーメーションの台頭は、半導体部品への需要を加速させ、市場の成長を促進しています。

人工知能(AI)と機械学習(ML)技術の急速な進歩が市場の成長を促進しています。AIやMLのアプリケーションが自動車、ヘルスケア、家電などの産業でますます普及するにつれ、複雑な計算や大規模なデータセットを処理できる特殊な半導体ソリューションへの需要が高まっています。半導体ファブレス企業は、製造設備を必要としない革新的なチップの設計に注力しています。半導体ファブレス企業は、AIやMLのワークロードに合わせた先進的なプロセッサーやアクセラレーターを開発することで、この動向に注力しています。高性能でエネルギー効率に優れたチップに注力することで、AI主導のアプリケーションのエコシステムの拡大をサポートし、市場競争力を高めることができます。

5Gネットワークの拡大も半導体ファブレス市場の重要な成長要因です。5G技術が世界的に展開され続ける中、高速データトランスミッション、低遅延、強化されたコネクティビティをサポートできる半導体部品への需要が高まっています。複数の半導体企業が、5Gインフラの展開成功に不可欠な高度な無線周波数(RF)コンポーネント、広帯域トランシーバ、ネットワークプロセッサを設計しています。このように、世界中で5Gネットワークの成長をサポートするための特殊なコンポーネントに対する需要が増加していることが、市場の成長をさらに促進しています。

モノのインターネット(IoT)デバイスの普及は、半導体部品の需要を促進すると予想されます。IoTアプリケーションは、スマートホームデバイス、産業オートメーション、ウェアラブル技術にまたがっており、いずれも多様な半導体部品を必要とします。様々なIoTアプリケーション向けの高集積・高効率チップへの需要の高まりが、市場の成長を後押ししています。これらの中には、シームレスな接続とデータ交換を可能にする低消費電力マイクロコントローラ、センサー、通信モジュールなどが含まれます。IoTエコシステムが拡大し続ける中、半導体ファブレスコンポーネントの需要は2024年から2030年にかけて増加すると予想されます。

半導体設計の複雑さとコストの増加は、市場の成長を妨げる可能性のある大きな要因の1つです。加えて、主要企業は製造においてサードパーティのファウンドリーに大きく依存しているため、ファウンドリーの生産能力が制約を受けたり、地政学的な問題が世界貿易に影響したりすると、サプライチェーンの脆弱性や潜在的な混乱につながる可能性があります。さらに、技術進歩のペースが速いため、継続的な技術革新が必要となり、最新の動向や規格への対応に苦慮している企業にとってはリスクとなります。これらの要因は、半導体ファブレス企業にとって厳しい環境を生み出し、成長を鈍化させ、新たな機会を生かす能力に影響を与える可能性があります。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 市場の変数、動向、範囲

- 市場系統の見通し

- 業界バリューチェーン分析

- 市場力学

- 市場促進要因の影響分析

- 市場抑制要因の影響分析

- 市場機会の影響分析

- 業界分析ツール

- ポーターの分析

- PESTEL分析

第4章 半導体ファブレス市場:タイプの推定・動向分析

- タイプ変動分析と市場シェア、2023年と2030年

- タイプ別市場推計・予測

第5章 半導体ファブレス市場:最終用途の推定・動向分析

- 最終用途変動分析と市場シェア、2023年と2030年

- 最終用途別市場推計・予測

第6章 半導体ファブレス市場:地域の推定・動向分析

- 半導体ファブレス市場:地域別展望

- 北米

- 北米の半導体ファブレス市場の推定と予測、2018年-2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州半導体ファブレス市場の推定と予測、2018年-2030年

- ドイツ

- 英国

- フランス

- アジア太平洋

- アジア太平洋地域の半導体ファブレス市場の推定と予測、2018年-2030年

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- ラテンアメリカ

- ラテンアメリカの半導体ファブレス市場の推定と予測、2018年-2030年

- ブラジル

- 中東・アフリカ

- 中東・アフリカ半導体ファブレス市場の推定と予測、2018-2030年

- アラブ首長国連邦

- サウジアラビア王国(KSA)

- 南アフリカ

第7章 競合情勢

- 企業分類

- 企業市場シェア分析、2023年

- 企業ヒートマップ分析

- 戦略マッピング

- 拡大

- コラボレーション

- 合併と買収

- 新たな最終用途の発売

- パートナーシップ

- その他

- 企業プロファイル

- Broadcom Inc.

- Qualcomm Inc.

- Nvidia Corporation

- Advanced Micro Devices Inc.(AMD)

- MediaTek Inc.

- Novatek Microelectronics Corp.

- UNISOC(Shanghai)Technologies Co., Ltd.

- XMOS

- LSI Corporation

- SMIC

List of Tables

- Table 1 Semiconductor fabless market, 2018 - 2030 (USD Million)

- Table 2 Global market estimates and forecasts, by region, 2018 - 2030 (USD Million)

- Table 3 Global market estimates and forecasts, by type, 2018 - 2030 (USD Million)

- Table 4 Global market estimates and forecasts, by end use, 2018 - 2030 (USD Million)

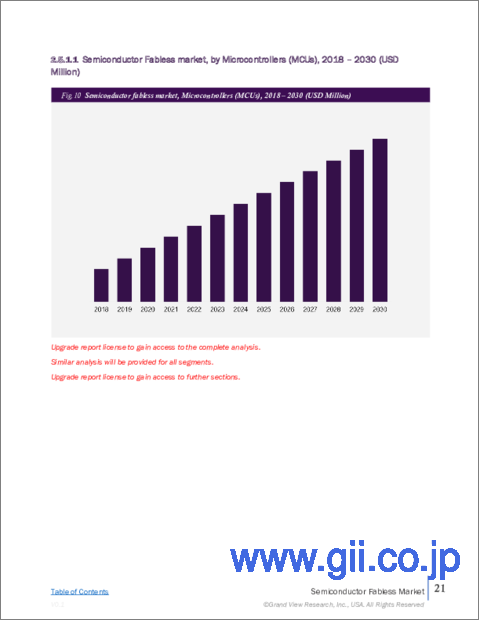

- Table 5 Microcontrollers (MCUs) semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 6 Digital Signal Processors (DSP) semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 7 Graphic Processing Units (GPUs) semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 8 Specific Integrated Circuits (ASIC) semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 9 Power Management ICs (PMICs) semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 10 Others semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 11 Consumer Electronics semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 12 Automotive semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 13 Industrial semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 14 Telecommunication semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 15 Healthcare semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 16 Others semiconductor fabless market, by region, 2018 - 2030 (USD Million)

- Table 17 North America semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 18 North America semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 19 U.S. semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 20 U.S. semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 21 Canada semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 22 Canada semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 23 Mexico semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 24 Mexico semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 25 Europe semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 26 Europe semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 27 Germany semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 28 Germany semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 29 UK semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 30 UK semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 31 France semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 32 France semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 33 Asia Pacific semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 34 Asia Pacific semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 35 China semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 36 China semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 37 India semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 38 India semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 39 Japan semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 40 Japan semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 41 Australia semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 42 Australia semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 43 South Korea semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 44 South Korea semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 45 Latin America semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 46 Latin America semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 47 Brazil semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 48 Brazil semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 49 Middle East & Africa semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 50 Middle East & Africa semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 51 UAE semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 52 UAE semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 53 Kingdom of Saudi Arabia (KSA) semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 54 Kingdom of Saudi Arabia (KSA) semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 55 South Africa semiconductor fabless market, by type, 2018 - 2030 (USD Million)

- Table 56 South Africa semiconductor fabless market, by end use, 2018 - 2030 (USD Million)

- Table 57 Company Market Share, 2023

- Table 58 Company Heat Map Analysis

- Table 59 Key companies undergoing expansion

- Table 60 Key companies undergoing collaborations

- Table 61 Key companies undergoing new product launch

- Table 62 Key companies undergoing mergers & acquisitions

- Table 63 Key companies undergoing other strategies

List of Figures

- Fig. 1 Semiconductor Fabless Market Segmentation

- Fig. 2 Information Procurement

- Fig. 3 Information Analysis

- Fig. 4 Market Formulation & Data Visualization

- Fig. 5 Data Validation & Publishing

- Fig. 6 Semiconductor Fabless Market Snapshot

- Fig. 7 Segment Snapshot

- Fig. 8 Competitive Landscape Snapshot

- Fig. 9 Semiconductor Fabless Market Value, 2023 & 2030 (USD Million)

- Fig. 10 Semiconductor Fabless - Industry Value Chain Analysis

- Fig. 11 Semiconductor Fabless Market - Market Dynamics

- Fig. 12 Semiconductor Fabless Market: PORTER's Analysis

- Fig. 13 Semiconductor Fabless Market: PESTEL Analysis

- Fig. 14 Semiconductor Fabless Market, by Type: Key Takeaways

- Fig. 15 Semiconductor Fabless Market, by Type: Market Share, 2023 & 2030

- Fig. 16 Semiconductor Fabless Market, by End Use: Key Takeaways

- Fig. 17 Semiconductor Fabless Market, by End Use: Market Share, 2023 & 2030

- Fig. 18 Semiconductor Fabless Market, by Region, 2023 & 2030 (USD Million)

- Fig. 19 Regional Marketplace: Key Takeaways

- Fig. 20 North America Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 21 U.S. Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 22 Canada Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 23 Mexico Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 24 Europe Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 25 Germany Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 26 UK Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 27 France Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 28 Asia Pacific Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 29 China Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 30 India Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 31 Japan Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 32 Australia Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 33 South Korea Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 34 Latin America Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 35 Brazil Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 36 MEA Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 37 U.A.E. Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 38 Kingdom of Saudi Arabia Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 39 South Africa Semiconductor Fabless Market Estimates & Forecast, 2018 - 2030 (USD Million)

- Fig. 40 Company Market Share Analysis, 2023

- Fig. 41 Strategic Framework

Semiconductor Fabless Market Size & Trends:

The global semiconductor fabless market size was estimated at USD 3.56 billion in 2023 and is expected to grow at a CAGR of 9.9% from 2024 to 2030. The market's growth can be attributed to the increasing demand for advanced semiconductor devices, particularly in sectors such as consumer electronics, healthcare, and automotive electronics. Technological advancements in semiconductor fabrication processes also play a pivotal role in the market's growth. In addition, the rise of digital transformation across various industries is accelerating the demand for semiconductor components, thereby driving the market's growth.

The rapid advancement of artificial intelligence (AI) and machine learning (ML) technologies is driving the growth of the market. As AI and ML applications become increasingly prevalent across industries such as automotive, healthcare, and consumer electronics, the demand for specialized semiconductor solutions that can handle complex computations and large data sets is growing. Semiconductor fabless companies focus on designing innovative chips without the need for manufacturing facilities. They are focusing on this trend by developing advanced processors and accelerators tailored for AI and ML workloads. This focus on high-performance and energy-efficient chips supports the growing ecosystem of AI-driven applications and helps market companies gain a competitive edge in the market.

The expansion of 5G networks is another significant growth factor for the semiconductor fabless market. As 5G technology continues to roll out globally, there is an increasing demand for semiconductor components that can support high-speed data transmission, low latency, and enhanced connectivity. Several semiconductor companies are designing advanced radio frequency (RF) components, high-bandwidth transceivers, and network processors that are critical for the successful deployment of 5G infrastructure. Thus, increasing demand for specialized components to support the growth of 5G networks across the globe is further driving the growth of the market.

The proliferation of Internet of Things (IoT) devices is expected to drive the demand for semiconductor components. IoT applications span across smart home devices, industrial automation, and wearable technology, all of which require a diverse range of semiconductor components. Increasing demand for highly integrated and efficient chips for various IoT applications is boosting the market's growth. Some of these include low-power microcontrollers, sensors, and communication modules that enable seamless connectivity and data exchange. As the IoT ecosystem continues to expand, the demand for semiconductor fabless components is expected to increase from 2024 to 2030.

The increasing complexity and cost of semiconductor design is one of the major factors that could hamper the growth of the market. In addition, market companies depend heavily on third-party foundries for manufacturing, which can lead to supply chain vulnerabilities and potential disruptions if foundry capacity is constrained or if there are geopolitical issues affecting global trade. Furthermore, the rapid pace of technological advancement necessitates continuous innovation, posing a risk for companies that struggle to keep up with the latest trends and standards. These factors create a challenging environment for semiconductor fabless companies, potentially slowing their growth and affecting their ability to capitalize on emerging opportunities.

Global Semiconductor Fabless Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global semiconductor fabless market report based on type, end use, and region:

- Type Outlook (Revenue, USD Million, 2018 - 2030)

- Microcontrollers (MCUs)

- Digital Signal Processors (DSP)

- Graphic Processing Units (GPUs)

- Application Specific Integrated Circuits (ASIC)

- Power Management ICs (PMICs)

- Others

- End Use Outlook (Revenue, USD Million, 2018 - 2030)

- Consumer Electronics

- Automotive

- Industrial

- Telecommunication

- Healthcare

- Others

- Regional Outlook (Revenue, USD Million, 2018 - 2030)

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Latin America

- Brazil

- Middle East & Africa

- UAE

- Kingdom of Saudi Arabia

- South Africa

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definitions

- 1.3. Information Procurement

- 1.4. Information Analysis

- 1.4.1. Market Formulation & Data Visualization

- 1.4.2. Data Validation & Publishing

- 1.5. Research Scope and Assumptions

- 1.6. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segmental Outlook

- 2.3. Competitive Landscape Snapshot

Chapter 3. Market Variables, Trends, and Scope

- 3.1. Market Lineage Outlook

- 3.2. Industry Value Chain Analysis

- 3.3. Market Dynamics

- 3.3.1. Market Driver Impact Analysis

- 3.3.2. Market Restraint Impact Analysis

- 3.3.3. Market Opportunity Impact Analysis

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Analysis

- 3.4.2. PESTEL Analysis

Chapter 4. Semiconductor Fabless Market: Type Estimates & Trend Analysis

- 4.1. Type Movement Analysis & Market Share, 2023 & 2030

- 4.2. Semiconductor Fabless Market Estimates & Forecast, By Type

- 4.2.1. Microcontrollers (MCUs)

- 4.2.2. Digital Signal Processors (DSP)

- 4.2.3. Graphic Processing Units (GPUs)

- 4.2.4. Application Specific Integrated Circuits (ASIC)

- 4.2.5. Power Management ICs (PMICs)

- 4.2.6. Others

Chapter 5. Semiconductor Fabless Market: End Use Estimates & Trend Analysis

- 5.1. End Use Movement Analysis & Market Share, 2023 & 2030

- 5.2. Semiconductor Fabless Market Estimates & Forecast, By End Use

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. Industrial

- 5.2.4. Telecommunication

- 5.2.5. Healthcare

- 5.2.6. Others

Chapter 6. Semiconductor Fabless Market: Regional Estimates & Trend Analysis

- 6.1. Semiconductor Fabless Market: Regional Outlook

- 6.2. North America

- 6.2.1. North America Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.2.2. U.S.

- 6.2.2.1. U.S. Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.2.3. Canada

- 6.2.3.1. Canada Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.2.4. Mexico

- 6.2.4.1. Mexico Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3. Europe

- 6.3.1. Europe Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3.2. Germany

- 6.3.2.1. Germany Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3.3. UK

- 6.3.3.1. UK Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.3.4. France

- 6.3.4.1. France Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Asia Pacific Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.2. China

- 6.4.2.1. China Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.3. India

- 6.4.3.1. India Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.4. Japan

- 6.4.4.1. Japan Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.5. Australia

- 6.4.5.1. Australia Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.4.6. South Korea

- 6.4.6.1. South Korea Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.5. Latin America

- 6.5.1. Latin America Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.5.2. Brazil

- 6.5.2.1. Brazil Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6. MEA

- 6.6.1. MEA Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6.2. UAE

- 6.6.2.1. UAE Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6.3. Kingdom of Saudi Arabia (KSA)

- 6.6.3.1. Kingdom of Saudi Arabia (KSA) Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

- 6.6.4. South Africa

- 6.6.4.1. South Africa Semiconductor Fabless market estimates & forecasts, 2018 - 2030 (USD Million)

Chapter 7. Competitive Landscape

- 7.1. Company Categorization

- 7.2. Company Market Share Analysis, 2023

- 7.3. Company Heat Map Analysis

- 7.4. Strategy Mapping

- 7.4.1. Expansion

- 7.4.2. Collaborations

- 7.4.3. Mergers & Acquisitions

- 7.4.4. New End Use Launches

- 7.4.5. Partnerships

- 7.4.6. Others

- 7.5. Company Profiles

- 7.5.1. Broadcom Inc.

- 7.5.1.1. Company Overview

- 7.5.1.2. Financial Performance

- 7.5.1.3. Product Benchmarking

- 7.5.1.4. Strategic Initiatives

- 7.5.2. Qualcomm Inc.

- 7.5.2.1. Company Overview

- 7.5.2.2. Financial Performance

- 7.5.2.3. Product Benchmarking

- 7.5.2.4. Strategic Initiatives

- 7.5.3. Nvidia Corporation

- 7.5.3.1. Company Overview

- 7.5.3.2. Financial Performance

- 7.5.3.3. Product Benchmarking

- 7.5.3.4. Strategic Initiatives

- 7.5.4. Advanced Micro Devices Inc. (AMD)

- 7.5.4.1. Company Overview

- 7.5.4.2. Financial Performance

- 7.5.4.3. Product Benchmarking

- 7.5.4.4. Strategic Initiatives

- 7.5.5. MediaTek Inc.

- 7.5.5.1. Company Overview

- 7.5.5.2. Financial Performance

- 7.5.5.3. Product Benchmarking

- 7.5.5.4. Strategic Initiatives

- 7.5.6. Novatek Microelectronics Corp.

- 7.5.6.1. Company Overview

- 7.5.6.2. Financial Performance

- 7.5.6.3. Product Benchmarking

- 7.5.6.4. Strategic Initiatives

- 7.5.7. UNISOC(Shanghai)Technologies Co., Ltd.

- 7.5.7.1. Company Overview

- 7.5.7.2. Financial Performance

- 7.5.7.3. Product Benchmarking

- 7.5.7.4. Strategic Initiatives

- 7.5.8. XMOS

- 7.5.8.1. Company Overview

- 7.5.8.2. Financial Performance

- 7.5.8.3. Product Benchmarking

- 7.5.8.4. Strategic Initiatives

- 7.5.9. LSI Corporation

- 7.5.9.1. Company Overview

- 7.5.9.2. Financial Performance

- 7.5.9.3. Product Benchmarking

- 7.5.9.4. Strategic Initiatives

- 7.5.10. SMIC

- 7.5.10.1. Company Overview

- 7.5.10.2. Financial Performance

- 7.5.10.3. Product Benchmarking

- 7.5.10.4. Strategic Initiatives

- 7.5.1. Broadcom Inc.