|

|

市場調査レポート

商品コード

1530016

洗濯洗剤の市場規模、シェア、動向分析レポート:製品別、用途別、地域別、セグメント予測、2024年~2030年Laundry Detergent Market Size, Share & Trends Analysis Report By Product, By Application (Household, Industrial OR institutional), By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 洗濯洗剤の市場規模、シェア、動向分析レポート:製品別、用途別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年07月30日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 目次

洗濯洗剤市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の洗濯洗剤市場規模は2030年までに2億6,952万米ドルに達し、2024~2030年のCAGRは5.5%で成長すると予測されています。

新興経済諸国における洗濯機の普及率の上昇が、同セグメントの成長を促進すると期待されています。

洗濯洗剤市場のトップブランドは、Tide、Purex、Surfです。この3ブランドで洗濯洗剤市場のシェアの半分近くを占めています。洗濯洗剤業界を支配しているベンダーは、Proctor & Gamble、Unilever、Church & Dwight Co., Inc.、Henkelの4社です。Unilever、Proctor & Gamble、Henkelの3社が製造するブランドは、中・高級消費者層に集中しているのに対し、Church & Dwightは低価格消費者層を対象にしています。新興経済諸国における可処分所得の増加は、消費者がその品質と会社の評判に基づいてブランドを購入する傾向にある、業界に新しい動向を形成しています。しかし、この動向は北米や欧州の成熟市場にのみ見られるものです。アフリカやアジア太平洋の消費者は、価格面で製品を好みます。

主要参入企業には、Unilever、Henkel AG &Co.KGaA、Church & Dwight Co., Inc.、Proctor & Gambleなどです。業界の主要参入企業の合併は、予測されるタイムラインで業界を統合する可能性があります。例えば、2016年の洗濯洗剤業界の主要合併は、ドイツの消費財会社Henkel AG &Co.KGaAによる買収です。

洗濯洗剤市場レポートのハイライト

- 洗濯洗剤市場の世界需要は2023年に1,852億8,000万米ドルであり、2024~2030年にかけて約5.5%のCAGRで成長し、2030年には総売上高2,695億2,000万米ドルを超えると予測されます。

- 粉末洗剤は、2023年の総収入の32.0%以上を占める市場最大の製品セグメントです。

- 家庭用セグメントは予測期間中に大きく成長する見込みです。

- アジア太平洋が洗濯洗剤市場を独占し、2023年の市場シェアは35.7%でした。

- この業界は、Unilever、Henkel AG &Co.KGaA、Church & Dwight Co., Inc.、Proctor & Gambleなどです。各社は、国際的なプレゼンスを高め、大きなシェアを獲得するために、戦略的な合併や買収に動いています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 洗濯洗剤市場の変数、動向、範囲

- 市場イントロダクション/系統展望

- 市場規模と成長展望

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 洗濯洗剤市場分析ツール

- ポーターの分析

- PESTEL分析

第4章 洗濯洗剤市場:製品推定・動向分析

- セグメントダッシュボード

- 洗濯洗剤市場:製品変動分析、2023年と2030年

- 粉末洗剤

- 液体洗剤

- 軟化剤

- 洗剤タブレット

- その他

第5章 洗濯洗剤市場:用途推定・動向分析

- セグメントダッシュボード

- 洗濯洗剤市場:用途変動分析、2023年と2030年

- 家庭

- 産業または公共機関

第6章 洗濯洗剤市場:地域別、推定・動向分析

- 洗濯洗剤市場シェア、地域別、2023年と2030年、100万米ドル

- 北米

- 北米の洗濯洗剤市場推定・予測、2018~2030年

- 米国

- カナダ

- 欧州

- 欧州の洗濯洗剤市場推定・予測、2018~2030年

- 英国

- ドイツ

- ロシア

- アジア太平洋

- アジア太平洋の洗濯洗剤市場推定・予測、2018~2030年

- 中国

- 日本

- インド

- 韓国

- ラテンアメリカ

- ラテンアメリカの洗濯洗剤市場推定・予測、2018~2030年

- ブラジル

- 中東・アフリカ

- サウジアラビア

第7章 競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業分類

- 企業ヒートマップ分析

- 企業プロファイル

- Unilever

- Henkel AG &Co. KGaA

- Church &Dwight Co., Inc.

- Procter &Gamble

- Lion Corporation

- Kao Corporation

- Method Products, PBC

- Reckit Benckiser Group plc.

- Colgate-Palmolive Company

Laundry Detergent Market Growth & Trends:

The global laundry detergent market size is expected to reach USD 269.52 million by 2030, registering to grow at a CAGR of 5.5% from 2024 to 2030 according to a new report by Grand View Research, Inc. Rising penetration of washing machines in the developing economies is expected to propel the sector growth.

The top brands of the laundry detergent market include Tide, Purex, and Surf. These three brands are responsible for nearly half of the market share of the laundry detergent market. The four vendors which control the laundry detergent industry are Proctor & Gamble, Unilever, Church & Dwight, and Henkel. The brands produced by the Unilever, Proctor & Gamble and Henkel concentrate on the middle and high-class segment of consumer whereas Church & Dwight targets the low end of the consumer segment. The rising disposable income in the developing economies is forging new trends in the industry where consumers are inclined to buy brands based on their quality and the company's reputation. However, this trend is only common for the mature market of North America and Europe. The consumers from Africa and Asia Pacific region prefer the product based on its pricing.

Key players include Unilever, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Proctor & Gamble. Mergers of major players in the industry are likely to consolidate the industry in the predicted timeline. For instance, the key merger of the laundry detergent industry in 2016 is the acquisition of the Sun Products by the German consumer goods company Henkel AG & Co. KGaA.

Laundry Detergent Market Report Highlights:

- The global demand for laundry detergent market was USD 185.28 billion in 2023 and is expected to grow at a CAGR of around 5.5% from 2024 to 2030 to exceed a total revenue of USD 269.52 billion by 2030.

- Powder detergents was the biggest product segment in the market accounting for over 32.0% of the total revenue in 2023

- The household segment is expected to grow significantly over the forecast period.

- Asia Pacific dominated the laundry detergent market, with a market share of 35.7% in 2023.

- The industry is dominated by global players such as Unilever, Henkel AG & Co. KGaA, Church & Dwight Co., Inc., Proctor & Gamble. Companies are moving towards strategic mergers and acquisitions to increase their international presence and gain significant share.

Table of Contents

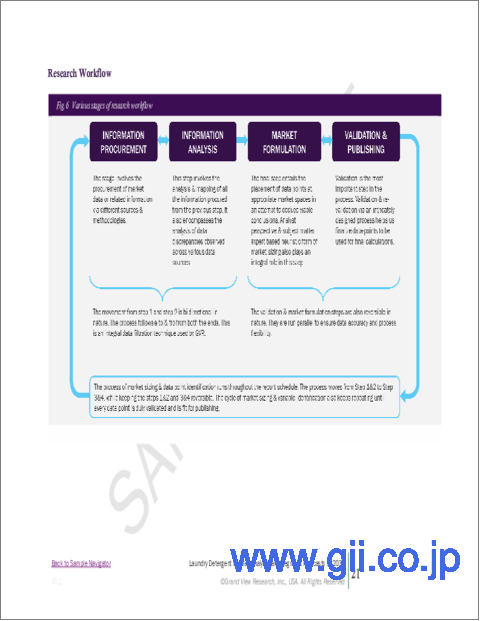

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation and Scope

- 1.2. Market Definitions

- 1.3. Research Methodology

- 1.3.1. Information Procurement

- 1.3.2. Information or Data Analysis

- 1.3.3. Market Formulation & Data Visualization

- 1.3.4. Data Validation & Publishing

- 1.4. Research Scope and Assumptions

- 1.4.1. List of Data Sources

Chapter 2. Executive Summary

- 2.1. Market Outlook

- 2.2. Segment Outlook

- 2.3. Competitive Insights

Chapter 3. Laundry detergent Market Variables, Trends, & Scope

- 3.1. Market Introduction/Lineage Outlook

- 3.2. Market Size and Growth Prospects (USD Million)

- 3.3. Market Dynamics

- 3.3.1. Market Drivers Analysis

- 3.3.2. Market Restraints Analysis

- 3.4. Laundry detergent Market Analysis Tools

- 3.4.1. Porter's Analysis

- 3.4.1.1. Bargaining power of the suppliers

- 3.4.1.2. Bargaining power of the buyers

- 3.4.1.3. Threats of substitution

- 3.4.1.4. Threats from new entrants

- 3.4.1.5. Competitive rivalry

- 3.4.2. PESTEL Analysis

- 3.4.2.1. Political landscape

- 3.4.2.2. Economic and Social landscape

- 3.4.2.3. Technological landscape

- 3.4.2.4. Environmental landscape

- 3.4.2.5. Legal landscape

- 3.4.1. Porter's Analysis

Chapter 4. Laundry Detergent Market: Product Estimates & Trend Analysis

- 4.1. Segment Dashboard

- 4.2. Laundry detergent Market: Product Movement Analysis, 2023 & 2030 (USD Million)

- 4.3. Powder Detergent

- 4.3.1. Powder Detergent Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.4. Liquid Detergent

- 4.4.1. Liquid Detergent Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.5. Fabric Softener

- 4.5.1. Fabric Softener Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.6. Detergent Tablets

- 4.6.1. Detergent Tablets Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 4.7. Other Detergents

- 4.7.1. Other Detergents Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 5. Laundry Detergent Market: Application Estimates & Trend Analysis

- 5.1. Segment Dashboard

- 5.2. Laundry detergent Market: Application Movement Analysis, 2023 & 2030 (USD Million)

- 5.3. Household

- 5.3.1. Household Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

- 5.4. Industrial or Institutional

- 5.4.1. Industrial or Institutional Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Million)

Chapter 6. Laundry detergent Market: Regional Estimates & Trend Analysis

- 6.1. Laundry detergent Market Share, By Region, 2023 & 2030, USD Million

- 6.2. North America

- 6.2.1. North America Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.2.2. U.S.

- 6.2.2.1. U.S. Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.2.3. Canada

- 6.2.3.1. Canada Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3. Europe

- 6.3.1. Europe Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3.2. U.K.

- 6.3.2.1. U.K. Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3.3. Germany

- 6.3.3.1. Germany Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.3.4. Russia

- 6.3.4.1. Russia Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Asia Pacific Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.2. China

- 6.4.2.1. China Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.3. Japan

- 6.4.3.1. Japan Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.4. India

- 6.4.4.1. India Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.4.5. South Korea

- 6.4.5.1. South Korea Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5. Latin America

- 6.5.1. Latin America Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.5.2. Brazil

- 6.5.2.1. Brazil Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6. Middle East and Africa

- 6.6.1. Saudi Arabia

- 6.6.1.1. Saudi Arabia Laundry detergent Market Estimates and Forecasts, 2018 - 2030 (USD Million)

- 6.6.1. Saudi Arabia

Chapter 7. Competitive Landscape

- 7.1. Recent Developments & Impact Analysis by Key Market Participants

- 7.2. Company Categorization

- 7.3. Company Heat Map Analysis

- 7.4. Company Profiles

- 7.4.1. Unilever

- 7.4.1.1. Participant's Overview

- 7.4.1.2. Financial Performance

- 7.4.1.3. Product Benchmarking

- 7.4.1.4. Recent Developments/ Strategic Initiatives

- 7.4.2. Henkel AG & Co. KGaA

- 7.4.2.1. Participant's Overview

- 7.4.2.2. Financial Performance

- 7.4.2.3. Product Benchmarking

- 7.4.2.4. Recent Developments/ Strategic Initiatives

- 7.4.3. Church & Dwight Co., Inc.

- 7.4.3.1. Participant's Overview

- 7.4.3.2. Financial Performance

- 7.4.3.3. Product Benchmarking

- 7.4.3.4. Recent Developments/ Strategic Initiatives

- 7.4.4. Procter & Gamble

- 7.4.4.1. Participant's Overview

- 7.4.4.2. Financial Performance

- 7.4.4.3. Product Benchmarking

- 7.4.4.4. Recent Developments/ Strategic Initiatives

- 7.4.5. Lion Corporation

- 7.4.5.1. Participant's Overview

- 7.4.5.2. Financial Performance

- 7.4.5.3. Product Benchmarking

- 7.4.5.4. Recent Developments/ Strategic Initiatives

- 7.4.6. Kao Corporation

- 7.4.6.1. Participant's Overview

- 7.4.6.2. Financial Performance

- 7.4.6.3. Product Benchmarking

- 7.4.6.4. Recent Developments/ Strategic Initiatives

- 7.4.7. Method Products, PBC

- 7.4.7.1. Participant's Overview

- 7.4.7.2. Financial Performance

- 7.4.7.3. Product Benchmarking

- 7.4.7.4. Recent Developments/ Strategic Initiatives

- 7.4.8. Reckit Benckiser Group plc.

- 7.4.8.1. Participant's Overview

- 7.4.8.2. Financial Performance

- 7.4.8.3. Product Benchmarking

- 7.4.8.4. Recent Developments/ Strategic Initiatives

- 7.4.9. Colgate-Palmolive Company

- 7.4.9.1. Participant's Overview

- 7.4.9.2. Financial Performance

- 7.4.9.3. Product Benchmarking

- 7.4.1. Unilever