|

|

市場調査レポート

商品コード

1493387

自動車用ワイヤーハーネスの市場規模、シェア、動向分析レポート:車種別、部品別、用途別、電気自動車別、地域別、セグメント予測、2024年~2030年Automotive Wiring Harness Market Size, Share & Trends Analysis Report By Vehicle, By Component (Electric Wires, Connectors, Terminals), By Application, By Electric Vehicle, By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用ワイヤーハーネスの市場規模、シェア、動向分析レポート:車種別、部品別、用途別、電気自動車別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年05月31日

発行: Grand View Research

ページ情報: 英文 120 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

自動車用ワイヤーハーネス市場の成長と動向

Grand View Research, Inc.の調査レポートによると、自動車用ワイヤーハーネスの世界市場規模は2030年までに630億米ドルに達し、2024年から2030年までのCAGRは3.4%で成長すると予測されています。

技術的に高度な自動車に対する消費者の嗜好の変化は、ADAS、ナビゲーションシステム、エンターテインメントシステムなどの高度な機能性を自動車に統合するよう自動車メーカーに促しています。これらのシステムは電子部品に大きく依存しており、シームレスに機能させるにはワイヤーハーネスを使って相互接続する必要があります。

EVやハイブリッド車への嗜好は高まっているが、EVやハイブリッド車に使用される自動車用ワイヤーハーネスは、電気モーターへの電力供給、バッテリーパックの管理、ADASやインフォテインメント技術の統合のために高度な配線システムを必要とするため、より複雑になる傾向があります。そのため、自動車メーカーと自動車用ワイヤーハーネスメーカーは、これらの自動車に関連する複雑さに対処できる、より効率的で軽量かつ耐久性のある配線ソリューションを開発するために、研究開発に多額の投資を行っています。

自動車用ワイヤーハーネスは、電気信号を効率的に伝送するという基本的な目的だけでなく、さらなる安全機能を統合し、衝突検知・防止システムなどのさまざまな安全機能に貢献するものへと消費者の嗜好が大きく変化していることも、新たな購買動向のひとつと考えられます。安全機能が統合されたハーネスが好まれるのは、むしろ交通安全や事故防止に対するより広範な社会的アプローチを示しています。消費者は、事故のリスクを軽減し、 促進要因と同乗者の両方を保護する先進安全技術を搭載した自動車をますます優先するようになっています。さまざまな規制機関が策定している安全規制は、ハーネスを含む自動車部品への先進安全機能の統合をさらに後押ししています。サプライヤーは、安全機能強化に対する消費者の期待に応えつつ、進化する規制状況に合わせて製品を修正・アップグレードするための技術革新を余儀なくされています。

交通事故削減努力の一環として世界各国政府が策定している厳しい自動車安全規制と、交通安全に対する消費者の意識の高まりが、自動車メーカーにエアバッグ、アンチロックブレーキシステム(ABS)、トラクションコントロールシステム(TCS)、ADASといった最新の自動車安全システムを自動車に組み込むよう促しています。これらのシステムはすべて、タイムリーな作動と適切な機能を確保するための電力と信号の伝送に自動車用ワイヤーハーネスを使用しています。自動車メーカーが車両の安全性と規制遵守を重視する中、高度なワイヤーハーネス・ソリューションに対する需要は拡大すると予想されます。

自動車用ワイヤーハーネス市場のレポートハイライト

- 部品別では、端子分野が2024年から2030年にかけて大きなCAGRを記録すると予測されています。この成長は、安全機能やADAS(先進運転支援システム)など、自動車技術の進歩が拡大していることに起因しています。

- 用途別では、センサーハーネス分野が2024年から2030年にかけて最も速いCAGRで成長すると予測されています。自律走行用のLiDARやRADARといったセンサー技術の進歩が、複雑なセンサーネットワークをサポートできる高度なワイヤーハーネスの需要を促進しています。

- 電気自動車別では、化石燃料のコスト上昇、排ガス規制の実施、世界の充電インフラの成長が予想されることから、バッテリー電気自動車(BEV)セグメントが2023年に65.78%の最大収益シェアで市場をリードし、ひいては電気自動車を視野に入れた自動車用ハーネスの需要を促進すると予想されます。

- 車種別では、軽自動車セグメントが2023年に95.81%の最大売上シェアで市場をリードしました。SUV、ユーティリティバン、トラックなどの軽自動車の普及が、自動車用ハーネスソリューションの需要を促進しています。

- アジア太平洋地域は、2023年に45.8%の最大収益シェアで市場を独占し、予測期間中一貫したCAGRで成長すると予測されています。この地域は、人口が集中し、可処分所得が高く、低コストの労働力を容易に入手できることから、主要な自動車市場と考えられています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 自動車用ワイヤーハーネス市場:業界展望

- 市場の系譜

- バリューチェーン分析

- 市場力学

- 業界分析ツール

第4章 自動車用ワイヤーハーネス市場:部品別の推定・動向分析

- 部品別の変動分析と市場シェア(2023年・2030年)

- 部品別

第5章 自動車用ワイヤーハーネス市場:用途別の推定・動向分析

- 用途別の変動分析と市場シェア(2023年・2030年)

- 用途別

第6章 自動車用ワイヤーハーネス市場:電気自動車別の推定・動向分析

- 電気自動車別の変動分析と市場シェア(2023年・2030年)

- 電気自動車別

第7章 自動車用ワイヤーハーネス市場:車種別の推定・動向分析

- 車種別の変動分析と市場シェア(2023年・2030年)

- 車種別

第8章 自動車用ワイヤーハーネス市場:地域別の推定・動向分析

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

第9章 自動車用ワイヤーハーネス市場 - 競合情勢

- 企業分類

- 参入企業の概要

- 財務実績

- 製品ベンチマーク

- 企業シェア分析(2023年)

- 企業ヒートマップ分析

- 戦略マッピング

- 企業一覧

- Furukawa Electric Co., Ltd.

- LEONI AG

- Sumitomo Electric Industries, Ltd.

- Lear Corporation

- Spark Minda

- YAZAKI Corporation

- Aptiv PLC

- PKC Group (Motherson Group)

- Tianhai Auto Electronics Group Co., Ltd.

- Kromberg & Schubert GmbH Cable & Wire (Kromberg & Schubert Group)

List of Tables

- Table 1 Industry Snapshot

- Table 2 Automotive wiring harness market - Industry snapshot & key buying criteria, 2018 - 2030

- Table 3 Automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 4 Automotive wiring harness market, by region, 2018 - 2030 (USD Million)

- Table 5 Automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 6 Automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 7 Automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 8 Automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 9 Electric wires market, 2018 - 2030 (USD Million)

- Table 10 Electric wires market, by region, 2018 - 2030 (USD Million)

- Table 11 Connectors market, 2018 - 2030 (USD Million)

- Table 12 Connectors market, by region, 2018 - 2030 (USD Million)

- Table 13 Terminals market, 2018 - 2030 (USD Million)

- Table 14 Terminals market, by region, 2018 - 2030 (USD Million)

- Table 15 Others market, 2018 - 2030 (USD Million)

- Table 16 Others market, by region, 2018 - 2030 (USD Million)

- Table 17 Body wiring harness market, 2018 - 2030 (USD Million)

- Table 18 Body wiring harness market, by region, 2018 - 2030 (USD Million)

- Table 19 Chassis wiring harness market, 2018 - 2030 (USD Million)

- Table 20 Chassis wiring harness market, by region, 2018 - 2030 (USD Million)

- Table 21 Engine wiring harness market, 2018 - 2030 (USD Million)

- Table 22 Engine wiring harness market, by region, 2018 - 2030 (USD Million)

- Table 23 HVAC wiring harness market, 2018 - 2030 (USD Million)

- Table 24 HVAC wiring harness market, by region, 2018 - 2030 (USD Million)

- Table 25 Sensors wiring harness market, 2018 - 2030 (USD Million)

- Table 26 Sensors wiring harness market, by region, 2018 - 2030 (USD Million)

- Table 27 BEV market, 2018 - 2030 (USD Million)

- Table 28 BEV market, by region, 2018 - 2030 (USD Million)

- Table 29 PHEV market, 2018 - 2030 (USD Million)

- Table 30 PHEV market, by region, 2018 - 2030 (USD Million)

- Table 31 Light vehicles market, 2018 - 2030 (USD Million)

- Table 32 Light vehicles market, by region, 2018 - 2030 (USD Million)

- Table 33 Heavy vehicles market, 2018 - 2030 (USD Million)

- Table 34 Heavy vehicles market, by region, 2018 - 2030 (USD Million)

- Table 35 North America automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 36 North America automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 37 North America automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 38 North America automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 39 North America automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 40 U.S automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 41 U.S automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 42 U.S automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 43 U.S automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 44 U.S automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 45 Canada automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 46 Canada automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 47 Canada automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 48 Canada automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 49 Canada automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 50 Mexico automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 51 Mexico automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 52 Mexico automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 53 Mexico automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 54 Mexico automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 55 Europe automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 56 Europe automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 57 Europe automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 58 Europe automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 59 Europe automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 60 UK automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 61 UK automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 62 UK automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 63 UK automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 64 UK automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 65 Germany automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 66 Germany automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 67 Germany automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 68 Germany automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 69 Germany automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 70 France automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 71 France automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 72 France automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 73 France automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 74 France automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 75 Asia Pacific automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 76 Asia Pacific automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 77 Asia Pacific automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 78 Asia Pacific automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 79 Asia Pacific automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 80 China automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 81 China automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 82 China automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 83 China automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 84 China automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 85 India automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 86 India automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 87 India automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 88 India automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 89 India automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 90 Japan automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 91 Japan automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 92 Japan automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 93 Japan automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 94 Japan automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 95 Australia automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 96 Australia automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 97 Australia automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 98 Australia automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 99 Australia automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 100 South Korea automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 101 South Korea automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 102 South Korea automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 103 South Korea automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 104 South Korea automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 105 Latin America automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 106 Latin America automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 107 Latin America automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 108 Latin America automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 109 Latin America automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 110 Brazil automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 111 Brazil automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 112 Brazil automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 113 Brazil automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 114 Brazil automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 115 MEA automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 116 MEA automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 117 MEA automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 118 MEA automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 119 MEA automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 120 UAE automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 121 UAE automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 122 UAE automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 123 UAE automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 124 UAE automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 125 Saudi Arabia automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 126 Saudi Arabia automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 127 Saudi Arabia automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 128 Saudi Arabia automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 129 Saudi Arabia automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

- Table 130 South Africa automotive wiring harness market, 2018 - 2030 (USD Million)

- Table 131 South Africa automotive wiring harness market, by component, 2018 - 2030 (USD Million)

- Table 132 South Africa automotive wiring harness market, by application, 2018 - 2030 (USD Million)

- Table 133 South Africa automotive wiring harness market, by electric vehicle, 2018 - 2030 (USD Million)

- Table 134 South Africa automotive wiring harness market, by vehicle, 2018 - 2030 (USD Million)

List of Figures

- Fig. 1 Automotive wiring harness market segmentation

- Fig. 2 Value chain analysis

- Fig. 3 Automotive wiring harness market driver impact

- Fig. 4 Automotive wiring harness market driver impact

- Fig. 5 Automotive wiring harness market challenge impact

- Fig. 6 Automotive wiring harness - Porter's five forces

- Fig. 7 Automotive wiring harness market - Company market share analysis, 2023

- Fig. 8 Automotive wiring harness market - PESTEL analysis

- Fig. 9 Automotive wiring harness market, by component, 2023 & 2030 (USD Million)

- Fig. 10 Automotive wiring harness market, by application, 2023 & 2030 (USD Million)

- Fig. 11 Automotive wiring harness market, by electric vehicle, 2023 & 2030 (USD Million)

- Fig. 12 Automotive wiring harness market, by Vehicle, 2023 & 2030 (USD Million)

- Fig. 13 Automotive wiring harness market, By Region, 2023 & 2030

- Fig. 14 North America automotive wiring harness market - key takeaways

- Fig. 15 Europe automotive wiring harness market - key takeaways

- Fig. 16 Asia Pacific automotive wiring harness market - key takeaways

- Fig. 17 Latin America automotive wiring harness market - key takeaways

- Fig. 18 MEA automotive wiring harness market - key takeaways

Automotive Wiring Harness Market Growth & Trends:

The global automotive wiring harness market size is anticipated to reach USD 63.00 billion by 2030 and is anticipated to grow at a CAGR of 3.4% 2024 to 2030, according to a report published by Grand View Research, Inc. Shifting consumer preference toward technologically advanced automobiles is encouraging automobile manufacturers to integrate automobiles with advanced functionalities, such as ADAS, navigation systems, and entertainment systems. These systems rely heavily on electronic components, which need to be interconnected using wiring harnesses if they are to function seamlessly.

Although the preference for EVs and hybrid vehicles is rising, the automotive wiring harnesses used in EVs and hybrids tend to be more complex as these vehicles require sophisticated wiring systems to power their electric motors, manage battery packs, and integrate ADAS and infotainment technologies. Consequently, automakers and automotive wiring harness manufacturers are investing heavily in research and development to create more efficient, lightweight, and durable wiring solutions capable of addressing the complexities associated with these vehicles.

A significant shift in consumer preferences toward automotive wiring harnesses that not only serve the fundamental purpose of efficiently transmitting electrical signals but also integrate additional safety functionalities and contribute toward various safety features, including collision detection and prevention systems, can be considered one of the emerging buyer trends. The preference for harnesses with integrated safety functionalities is rather indicative of a broader societal approach to road safety and accident prevention. Consumers are increasingly prioritizing vehicles equipped with advanced safety technologies that mitigate the risk of accidents and protect both drivers and passengers. The safety regulations being drafted by various regulatory bodies are further incentivizing the integration of advanced safety functionalities into automotive components, including harnesses. Suppliers are compelled to innovate to modify and upgrade their products in line with the evolving regulatory landscape while meeting consumer expectations for enhanced safety features.

Stringent vehicular safety regulations being drafted by various governments worldwide as part of the efforts to reduce road accidents and the increasing consumer awareness about road safety are prompting automakers to integrate automobiles with modern vehicle safety systems, such as airbags, Anti-lock Braking Systems (ABS), Traction Control Systems (TCS), and ADAS. All these systems rely on automotive wiring harnesses for transmitting electrical power and signals to ensure timely activation and proper functioning. As automakers emphasize vehicle safety and regulatory compliance, the demand for sophisticated wiring harness solutions is expected to grow.

Automotive Wiring Harness Market Report Highlights:

- Based on component, the terminals segment is anticipated to register at the significant CAGR from 2024 to 2030. This growth can be attributed to the growing advancements in automotive technology, such as safety features and driver assistance systems

- Based on application, the sensors harness segment is expected to grow at the fastest CAGR from 2024 to 2030. Advancements in sensor technologies, such as LiDAR and RADAR for autonomous driving, are driving the demand for sophisticated wiring harnesses capable of supporting complex sensor networks

- Based on electric vehicle, the battery electric vehicles (BEVs) segment led the market with the largest revenue share of 65.78% in 2023, owing to the rising cost of fossil fuels, the implementation of emission regulations, and the anticipated growth of the charging infrastructure around the world, which in turn is expected to propel the demand for an automotive harness with the electric vehicle landscape

- Based on vehicle, the light vehicle segment led the market with the largest revenue share of 95.81% in 2023. The growing adoption of light vehicles such as SUVs, utility vans, or trucks is driving the demand for automotive vehicle harness solutions

- Asia Pacific dominated the market with the largest revenue share of 45.8% in 2023, and is expected to grow at a consistent CAGR over the forecast period. The region is considered a major automobile market due to high population concentration, high disposable income, and easy availability of low-cost labor

Table of Contents

Chapter 1. Methodology and Scope

- 1.1 Market Segmentation & Scope

- 1.2 Market Definitions

- 1.3 Information Procurement

- 1.3.1 Information analysis

- 1.3.2 Market formulation & data visualization

- 1.3.3 Data validation & publishing

- 1.4 Research Scope and Assumptions

- 1.4.1 List of data sources

Chapter 2. Executive Summary

- 2.1 Automotive Wiring Harness Market Snapshot

- 2.2 Automotive Wiring Harness Market - Segment Snapshot

- 2.3 Automotive Wiring Harness Market - Competitive Landscape Snapshot

Chapter 3. Automotive Wiring Harness Market: Industry Outlook

- 3.1 Market Lineage

- 3.2 Value Chain Analysis

- 3.3 Market Dynamics

- 3.3.1 Market drivers analysis

- 3.3.1.1 Growing need for enhanced electronics in modern automobiles

- 3.3.1.2 Increasing automobile production

- 3.3.1.3 Growing focus on vehicle safety systems

- 3.3.1.4 Need for high-voltage wiring designs in electric vehicles

- 3.3.2 Market challenge analysis

- 3.3.2.1 Challenges associated with manufacturing automotive wiring harness

- 3.3.2.2 Rising prices of automotive wiring harnesses

- 3.3.1 Market drivers analysis

- 3.4 Industry Analysis Tools

- 3.4.1 Porter's analysis

- 3.4.2 PESTLE analysis

Chapter 4. Automotive Wiring Harness Market: Component Estimates & Trend Analysis

- 4.1 Component Movement Analysis & Market Share, 2023 & 2030

- 4.2 Automotive Wiring Harness Market Estimates & Forecasts, By Component

- 4.2.1 Electric wires

- 4.2.2 Connectors

- 4.2.3 Terminals

- 4.2.4 Others

Chapter 5. Automotive Wiring Harness Market: Application Estimates & Trend Analysis

- 5.1 Application Movement Analysis & Market Share, 2023 & 2030

- 5.2 Automotive Wiring Harness Market Estimates & Forecasts, By Application

- 5.2.1 Body harness

- 5.2.2 Chassis harness

- 5.2.3 Engine harness

- 5.2.4 HVAC harness

- 5.2.5 Sensors harness

Chapter 6. Automotive Wiring Harness Market: Electric Vehicle Estimates & Trend Analysis

- 6.1 Electric Vehicle Movement Analysis & Market Share, 2023 & 2030

- 6.2 Automotive Wiring Harness Market Estimates & Forecasts, By Electric Vehicle

- 6.2.1 Battery Electric Vehicle (BEV)

- 6.2.2 Plug-in Hybrid Electric Vehicle (PHEV)

Chapter 7. Automotive Wiring Harness Market: Vehicle Type Estimates & Trend Analysis

- 7.1 Vehicle Type Movement Analysis & Market Share, 2023 & 2030

- 7.2 Automotive Wiring Harness Market Estimates & Forecasts, By Vehicle Type

- 7.2.1 Light Vehicles

- 7.2.2 Heavy Vehicles

Chapter 8. Automotive Wiring Harness Market: Regional Estimates and Trend Analysis

- 8.1 North America

- 8.1.1 North America automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.1.2 U.S.

- 8.1.2.1 U.S. automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.1.3 Canada

- 8.1.3.1 Canada automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.1.4 Mexico

- 8.1.4.1 Mexico automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.2 Europe

- 8.2.1 Europe automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.2.2 UK

- 8.2.2.1 UK automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.2.3 Germany

- 8.2.3.1 Germany automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.2.4 France

- 8.2.4.1 France automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.3 Asia Pacific

- 8.3.1 Asia Pacific automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.3.2 China

- 8.3.2.1 China automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.3.3 India

- 8.3.3.1 India automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.3.4 Japan

- 8.3.4.1 Japan automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.3.5 Australia

- 8.3.5.1 Australia automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.3.6 South Korea

- 8.3.6.1 South Korea automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.4 Latin America

- 8.4.1 Latin America automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.4.2 Brazil

- 8.4.2.1 Brazil automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.5 Middle East & Africa

- 8.5.1 Middle East & Africa automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.5.2 UAE

- 8.5.2.1 UAE automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.5.3 Saudi Arabia

- 8.5.3.1 Saudi Arabia automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

- 8.5.4 South Africa

- 8.5.4.1 Brazil automotive wiring harness market estimates and forecasts, 2018 - 2030 (USD Million)

Chapter 9. Automotive Wiring Harness Market - Competitive Landscape

- 9.1 Company Categorization

- 9.2 Participant's Overview

- 9.3 Financial Performance

- 9.4 Product Benchmarking

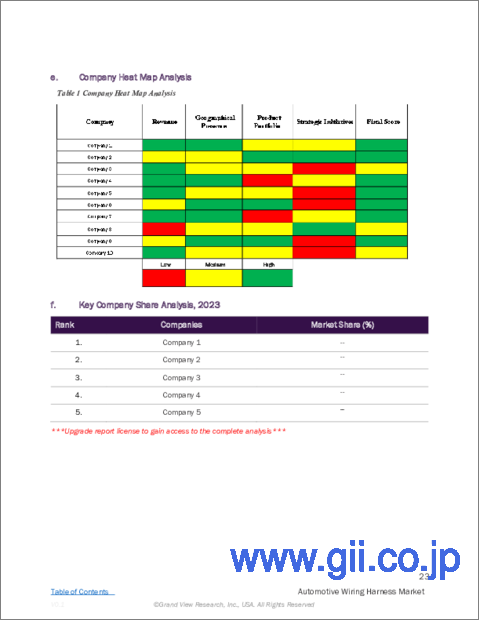

- 9.5 Company Share Analysis, 2023

- 9.6 Company Heat Map Analysis

- 9.7 Strategy Mapping

- 9.8 Company List

- 9.8.1 Furukawa Electric Co., Ltd.

- 9.8.2 LEONI AG

- 9.8.3 Sumitomo Electric Industries, Ltd.

- 9.8.4 Lear Corporation

- 9.8.5 Spark Minda

- 9.8.6 YAZAKI Corporation

- 9.8.7 Aptiv PLC

- 9.8.8 PKC Group (Motherson Group)

- 9.8.9 Tianhai Auto Electronics Group Co., Ltd.

- 9.8.10 Kromberg & Schubert GmbH Cable & Wire (Kromberg & Schubert Group)