|

|

市場調査レポート

商品コード

1446454

溶接装置の市場規模、シェア、動向分析レポート:タイプ別、技術別、最終用途別、地域別、セグメント予測、2024年~2030年Welding Equipment Market Size, Share & Trends Analysis Report By Type (Automatic), By Technology (Arc Welding, Resistance Welding), By End-Use, By Region, And Segment Forecasts, 2024 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| 溶接装置の市場規模、シェア、動向分析レポート:タイプ別、技術別、最終用途別、地域別、セグメント予測、2024年~2030年 |

|

出版日: 2024年02月01日

発行: Grand View Research

ページ情報: 英文 125 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

溶接装置市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界の溶接装置市場は2030年までに277億7,000万米ドルに達すると予測され、2024年から2030年までのCAGRは5.1%で拡大すると予測されています。

溶接装置の需要は、手動のものに比べてロボット溶接装置やレーザー溶接技術などの自動化装置に対する消費者の嗜好の高まりが後押ししています。溶接装置の需要の大部分は、自動車、航空宇宙、輸送、建設などの最終用途産業と関連しており、これらの産業もマクロ経済的要因のために経営難に陥っています。

HIS Markitによると、2022年の世界の新車販売台数は8,240万台で、2021年に比べ3.7%増加しています。世界の自動車需要の継続的な増加は、自動車産業における工具やロボットの需要を増加させると予想されます。その結果、予測期間中に溶接装置の需要が増加すると予想されます。

重工業、建築・建設、運輸は、溶接装置の重要な最終用途産業の一つです。運輸部門では、様々な車体部品の製造に溶接装置が一般的に利用されています。国際自動車製造者機構(OICA)によると、2022年の世界の自動車生産台数は8,162万8,533台でした。自動車分野では、自動化、ロボット化、IIoTなど、顧客の需要増に対応するための技術革新や技術進歩により、溶接装置の需要が増加すると予想されます。また、電気自動車の販売台数の増加は、今後数年間、溶接装置産業の採用をさらに促進すると予想されます。

世界の建設活動の増加は、中国、インド、ブラジル、中東・アフリカのような発展途上国における急速な都市化と相まって、建設部門の拡大を推進する構えです。可処分所得の増加と個人消費能力の向上が、新築ビル建設への投資を促進すると予想されます。さらに、複数の国々で都市計画やインフラ整備を重視する政府の取り組みが、建設部門の成長にさらなる弾みをつけるとみられます。その結果、建設業界の前向きな軌道は市場の拡大に好影響を与えると予想されます。

溶接装置市場のレポートハイライト

- 2023年には、自動溶接装置が世界市場を独占し、総売上シェアの56.4%を占めました。この優位性は、生産性を高め、サイクル時間を短縮し、溶接プロセスの効率を改善する能力に起因します。自動溶接装置の世界規模での普及は近年急増しており、その原動力となっているのは、迅速な溶接サイクル時間の達成、高出力の実現、溶接コストの大幅な低減です。

- 2023年には、アーク溶接技術セグメントが世界収益の最大シェアを占めました。アーク溶接技術の普及が拡大しているのは、柔軟性や多様な条件への適応性など、固有の特性に起因しています。特に、ロボットアーク溶接の継続的な進歩は、溶接装置市場におけるアーク溶接セグメントの成長を推進する上で極めて重要な役割を果たしています。

- 航空宇宙最終用途セグメントは、発熱体、回路基板トレース、電子部品、アクチュエーター、ファインリボン溶接、インダクター、メッシュ溶接、ハイブリッドマイクロウェルドデバイスなど、航空宇宙製造における用途の増加により、2024年から2030年にかけて最も速いCAGRで成長すると予測されています。

- アジア太平洋地域は、堅調な自動車産業により世界市場を席巻しています。電気自動車やハイブリッド車の需要増加が溶接装置の需要にプラスに働くと期待されています。

- 2023年2月、Miller Electric Mfg.LLCは、miller Deltaweld 852、Deltaweld 402、Deltaweld 602、溶接機を東南アジアで発売しました。これらの溶接機は特に東南アジアに対応しています。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 溶接装置市場の変数、動向、範囲

- 市場系統の見通し

- 集中と成長の見通しマッピン

- 業界のバリューチェーン分析

- 原材料の見通し

- 製造業の展望

- エンドユーザーの見通し

- 規制の枠組み

- テクノロジーフレームワーク

- 自由貿易協定の影響

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 業界の課題

- 業界の機会

- 業界分析ツール

- ポーターのファイブフォース分析

- マクロ環境分析

- 経済メガトレンド分析

第4章 溶接装置市場:技術推定・動向分析

- テクノロジー変動分析と市場シェア、2023年と2030年

- テクノロジー別、2018年から2030年まで

- アーク溶接

- 抵抗溶接

- レーザービーム溶接

- 酸素燃料溶接

- その他

第5章 溶接装置市場:タイプ推定・動向分析

- タイプの変動分析と市場シェア、2023年と2030年

- タイプ別、2018年から2030年まで

- 自動

- 半自動

- スプレー技術

- マニュアル

第6章 溶接装置市場:最終用途の推定・動向分析

- タイプの変動分析と市場シェア、2023年と2030年

- 最終用途別、2018年から2030年まで

- 航空宇宙

- 自動車

- 建築と建設

- エネルギー

- 石油ガス

- マリン

- その他

第7章 溶接装置市場:地域推定・動向分析

- 地域変動分析と市場シェア、2023年と2030年

- 北米

- 北米溶接装置市場の推定・予測、2018年から2030年

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州溶接装置市場の推定・予測、2018年から2030年

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- アジア太平洋地域

- アジア太平洋地域の溶接装置市場の推定・予測と2018年から2030年

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- 中南米

- 中南米の溶接装置市場推定・予測と2018年~2030年

- ブラジル

- アルゼンチン

- 中東とアフリカ

- 中東およびアフリカの溶接装置市場の推定・予測、2018年から2030年

- 南アフリカ

- サウジアラビア

第8章 溶接装置市場-競合情勢

- 主要市場参入企業による最近の動向と影響分析

- 企業の分類

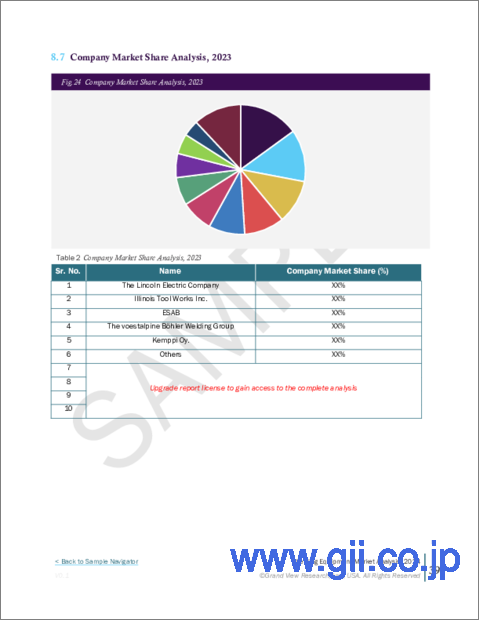

- 企業の市場シェア分析

- 企業の市場での位置づけ

- 企業ヒートマップ分析

- 戦略マッピング

- 拡大

- 合併と買収

- パートナーシップとコラボレーション

- 新製品の発売

- 研究開発

- 企業プロファイル

- The Lincoln Electric Company

- ACRO Automation Systems, Inc

- Miller Electric Mfg. LLC

- Ador Welding Limited

- Mitco Weld Products Pvt. Ltd.

- voestalpine Bohler Welding Group GmbH

- Carl Cloos Schweisstechnik GmbH

- OTC DAIHEN Inc.

- Illinois Tool Works Inc.

- Panasonic Industry Co., Ltd.

- Coherent, Inc.

- ESAB

- Polysoude SAS

- Kemppi Oy.

- Cruxweld Industrial Equipments Pvt. Ltd.

List of Tables

- Table 1 Welding Equipment Market 2018 - 2030 (USD Billion)

- Table 2 Global market estimates and forecasts by region, 2018 - 2030 (USD Billion)

- Table 3 Global market estimates and forecasts by technology, 2018 - 2030 (USD Billion)

- Table 4 Global market estimates and forecasts by type, 2018 - 2030 (USD Billion)

- Table 5 Global market estimates and forecasts by end-use, 2018 - 2030 (USD Billion)

- Table 6 North America welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 7 North America welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 8 North America welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 9 U.S. welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 10 U.S. welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 11 U.S. welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 12 Canada welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 13 Canada welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 14 Canada welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 15 Mexico welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 16 Mexico welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 17 Mexico welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 18 Europe welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 19 Europe welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 20 Europe welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 21 Germany welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 22 Germany welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 23 Germany welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 24 France welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 25 France welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 26 France welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 27 UK welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 28 UK welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 29 UK welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 30 Spain welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 31 Spain welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 32 Spain welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 33 Italy welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 34 Italy welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 35 Italy welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 36 Asia Pacific welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 37 Asia Pacific welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 38 Asia Pacific welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 39 China welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 40 China welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 41 China welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 42 Japan welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 43 Japan welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 44 Japan welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 45 South Korea welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 46 South Korea welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 47 South Korea welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 48 India welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 49 India welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 50 India welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 51 Australia welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 52 Australia welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 53 Australia welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 54 Central & South America welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 55 Central & South America welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 56 Central & South America welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 57 Brazil welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 58 Brazil welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 59 Brazil welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 60 Argentina welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 61 Argentina welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 62 Argentina welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 63 Middle East & Africa welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 64 Middle East & Africa welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 65 Middle East & Africa welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 66 South Africa welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 67 South Africa welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 68 South Africa welding equipment market by end-use, 2018 - 2030 (USD Billion)

- Table 69 Saudi Arabia welding equipment market by technology, 2018 - 2030 (USD Billion)

- Table 70 Saudi Arabia welding equipment market by type, 2018 - 2030 (USD Billion)

- Table 71 Saudi Arabia welding equipment market by end-use, 2018 - 2030 (USD Billion)

List of Figures

- Fig. 1 Market research process

- Fig. 2 Data triangulation techniques

- Fig. 3 Primary research pattern

- Fig. 4 Market research approaches

- Fig. 5 QFD modeling for market share assessment

- Fig. 6 Information Procurement

- Fig. 7 Market Formulation and Validation

- Fig. 8 Data Validating & Publishing

- Fig. 9 Market Segmentation & Scope

- Fig. 10 Welding Equipment Market Snapshot

- Fig. 11 Type Segment Snapshot

- Fig. 12 Type Segment Snapshot

- Fig. 13 End-use Segment Snapshot

- Fig. 14 Competitive Landscape Snapshot

- Fig. 15 Parent market outlook

- Fig. 16 Welding Equipment Market Value, 2023 (USD Billion)

- Fig. 17 Welding Equipment Market - Value Chain Analysis

- Fig. 18 Welding Equipment Market - Market Dynamics

- Fig. 19 Welding Equipment Market - PORTER's Analysis

- Fig. 20 Welding Equipment Market - PESTEL Analysis

- Fig. 21 Welding Equipment Market Estimates & Forecasts, By Technology: Key Takeaways

- Fig. 22 Welding Equipment Market Share, By Technology, 2023 & 2030

- Fig. 23 Arc Welding Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 24 Resistance Welding Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 25 Laser Beam Welding Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 26 Oxy-Fuel Welding Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 27 Others Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 28 Welding Equipment Market Estimates & Forecasts, By Type: Key Takeaways

- Fig. 29 Welding Equipment Market Share, By Type, 2023 & 2030

- Fig. 30 Automatic Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 31 Semi-Automatic Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 32 Manual Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 33 Welding Equipment Market Estimates & Forecasts, By End-uses: Key Takeaways

- Fig. 34 Welding Equipment Market Share, By End-uses, 2023 & 2030

- Fig. 35 Aerospace Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 36 Automotive Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 37 Building & Construction Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 38 Energy Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 39 Oil & Gas Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 40 Marine Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 41 Others Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 42 Welding Equipment Market Revenue, By Region, 2023 & 2030 (USD Billion)

- Fig. 43 North America Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 44 U.S. Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 45 Canada Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 46 Mexico Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 47 Europe Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 48 Germany Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 49 France Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 50 UK Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 51 Spain Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 52 Italy Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 53 Asia Pacific Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 54 China Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 55 Japan Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 56 South Korea Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 57 India Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 58 Australia Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 59 Central & South America Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 60 Brazil Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 61 Argentina Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 62 Middle East & Africa Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 63 South Africa Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 64 Saudi Arabia Welding Equipment Market Estimates & Forecasts, 2018 - 2030 (USD Billion)

- Fig. 65 Key Company Categorization

- Fig. 66 Company Market Positioning

- Fig. 67 Key Company Market Share Analysis, 2023

- Fig. 68 Strategy Mapping

Welding Equipment Market Growth & Trends:

The global welding equipment market is anticipated to reach USD 27.77 billion by 2030 and is anticipated to expand at a CAGR of 5.1% from 2024 to 2030, according to a new report by Grand View Research, Inc. The demand for welding equipment is fueled by growing consumer preference for automated devices such as robotic welding equipment and laser welding techniques in comparison to manual ones. The majority of the demand for welding equipment is associated with end-use industries such as automotive, aerospace, transportation, and construction, which are also experiencing operational difficulties owing to macro-economic factors.

According to HIS Markit, new vehicle sales accounted for 82.4 million globally in 2022, which is up by 3.7% in 2021. The continually increasing demand for automobiles worldwide is anticipated to increase the demand for tools and robots in the automotive industry. This, in turn, is expected to boost the demand for welding equipment over the projected period.

Heavy industries, building & construction, and transportation are among the important end-use industries of welding equipment. In the transportation sector, welding equipment is commonly utilized to fabricate various vehicle body components. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), in 2022, the worldwide output of vehicles was 81,628,533 units. Innovations and technical advancements, such as automation, robotics, IIoT, and others, in the automotive sector to meet rising customer demand are anticipated to increase the demand for welding equipment. In addition, the increasing sales of electric vehicles are expected to further propel the adoption of the welding equipment industry in the coming years.

The rise in construction activities globally, coupled with swift urbanization in developing nations like China, India, Brazil, and those in the Middle East and Africa, is poised to propel the expansion of the construction sector. Increased disposable incomes and enhanced consumer spending capabilities are expected to drive investment in new building construction. Furthermore, government initiatives emphasizing urban planning and infrastructure development in multiple countries are likely to provide additional momentum to the growth of the construction sector. Consequently, the positive trajectory of the construction industry is anticipated to have a favorable impact on the expansion of the market.

Welding Equipment Market Report Highlights:

- In 2023, automatic welding equipment dominated the global market, accounting for 56.4% of the total revenue share. This dominance is attributed to its capacity to enhance productivity, reduce cycle duration, and improve efficiency in welding processes. The widespread adoption of automatic welding equipment on a global scale has surged in recent years, driven by its ability to achieve rapid weld cycle times, deliver high output, and substantially lower welding costs

- In 2023, the arc welding technology segment held the largest share of the global revenue in 2023. The growing prevalence of arc welding technology can be attributed to its inherent characteristics, including flexibility and adaptability to diverse conditions. Notably, continuous advancements in robotic arc welding play a pivotal role in propelling the growth of the arc welding segment within the welding equipment market

- The aerospace end-use segment is projected to witness growth at the fastest CAGR from 2024 to 2030 owing to the growing applications in aerospace manufacturing, including heating elements, circuit board traces, electronic components, actuators, fine ribbon welding, inductors, mesh welding, and hybrid micro-weld devices

- Asia Pacific dominated the global market on account of the robust automotive industry. Increasing demand for electric and hybrid cars is expected to benefit the demand for welding equipment

- In February 2023, Miller Electric Mfg. LLC launched the miller Deltaweld 852, Deltaweld 402, Deltaweld 602, welding machines in Southeast Asia. These machines specifically cater

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. Welding Equipment Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.2. Concentration & Growth Prospect Mappin

- 3.3. Industry Value Chain Analysis

- 3.3.1. Raw Material Outlook

- 3.3.2. Manufacturing Outlook

- 3.3.3. End-user Outlook

- 3.4. Regulatory Framework

- 3.5. Technology Framework

- 3.6. Impact of Free Trade Agreements

- 3.7. Market Dynamics

- 3.7.1. Market Driver Analysis

- 3.7.2. Market Restraint Analysis

- 3.7.3. Industry Challenges

- 3.7.4. Industry Opportunities

- 3.8. Industry Analysis Tools

- 3.8.1. Porter's Five Forces Analysis

- 3.8.2. Macro-environmental Analysis

- 3.9. Economic Mega Trend Analysis

Chapter 4. Welding Equipment Market: Technology Estimates & Trend Analysis

- 4.1. Technology Movement Analysis & Market Share, 2023 & 2030

- 4.2. Welding Equipment Market Estimates & Forecast, By Technology, 2018 to 2030 (USD Billion)

- 4.3. Arc Welding

- 4.3.1. Arc Welding Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.3.1.1. Arc Welding Market Revenue Estimates and Forecasts, By Type, 2018 - 2030 (USD Billion)

- 4.3.1. Arc Welding Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.4. Resistance Welding

- 4.4.1. Resistance Welding Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.5. Laser Beam Welding

- 4.5.1. Laser Beam Welding Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.6. Oxy-Fuel Welding

- 4.6.1. Oxy-Fuel Welding Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 4.7. Others

- 4.7.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Welding Equipment Market: Type Estimates & Trend Analysis

- 5.1. Type Movement Analysis & Market Share, 2023 & 2030

- 5.2. Welding Equipment Market Estimates & Forecast, By Type, 2018 to 2030 (USD Billion)

- 5.3. Automatic

- 5.3.1. Automatic Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.4. Semi-automatic

- 5.4.1. Semi-automatic Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.5. Spray technologies

- 5.5.1. Spray technologies Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 5.6. Manual

- 5.6.1. Manual Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Welding Equipment Market: End-use Estimates & Trend Analysis

- 6.1. Type Movement Analysis & Market Share, 2023 & 2030

- 6.2. Welding Equipment Market Estimates & Forecast, By End-use, 2018 to 2030 (USD Billion)

- 6.3. Aerospace

- 6.3.1. Aerospace Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.4. Automotive

- 6.4.1. Automotive Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.5. Building & Construction

- 6.5.1. Building & Construction Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.6. Energy

- 6.6.1. Energy Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.7. Oil & Gas

- 6.7.1. Oil & Gas Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.8. Marine

- 6.8.1. Marine Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

- 6.9. Others

- 6.9.1. Others Market Revenue Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Welding Equipment Market: Regional Estimates & Trend Analysis

- 7.1. Regional Movement Analysis & Market Share, 2023 & 2030

- 7.2. North America

- 7.2.1. North America Welding Equipment Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 7.2.2. U.S.

- 7.2.2.1. Key country dynamics

- 7.2.2.2. U.S. welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.2.3. Canada

- 7.2.3.1. Key country dynamics

- 7.2.3.2. Canada welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.2.4. Mexico

- 7.2.4.1. Key country dynamics

- 7.2.4.2. Mexico welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.3. Europe

- 7.3.1. Europe Welding Equipment Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 7.3.2. Germany

- 7.3.2.1. Key country dynamics

- 7.3.2.2. Germany welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.3.3. France

- 7.3.3.1. Key country dynamics

- 7.3.3.2. France welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.3.4. UK

- 7.3.4.1. Key country dynamics

- 7.3.4.2. UK welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.3.5. Spain

- 7.3.5.1. Key country dynamics

- 7.3.5.2. Spain welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.3.6. Italy

- 7.3.6.1. Key country dynamics

- 7.3.6.2. Italy welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific Welding Equipment Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 7.4.2. China

- 7.4.2.1. Key country dynamics

- 7.4.2.2. China welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.4.3. Japan

- 7.4.3.1. Key country dynamics

- 7.4.3.2. Japan welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.4.4. South Korea

- 7.4.4.1. Key country dynamics

- 7.4.4.2. South Korea welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.4.5. India

- 7.4.5.1. Key country dynamics

- 7.4.5.2. India welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.4.6. Australia

- 7.4.6.1. Key country dynamics

- 7.4.6.2. Australia welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.5. Central & South America

- 7.5.1. Central & South America Welding Equipment Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 7.5.2. Brazil

- 7.5.2.1. Key country dynamics

- 7.5.2.2. Brazil welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.5.3. Argentina

- 7.5.3.1. Key country dynamics

- 7.5.3.2. Argentina welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.6. Middle East & Africa

- 7.6.1. Middles East & Africa Welding Equipment Market Estimates & Forecast, 2018 - 2030 (USD Billion)

- 7.6.2. South Africa

- 7.6.2.1. Key country dynamics

- 7.6.2.2. South Africa welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

- 7.6.3. Saudi Arabia

- 7.6.3.1. Key country dynamics

- 7.6.3.2. South Africa welding equipment market estimates & forecast, 2018 - 2030 (USD Billion)

Chapter 8. Welding Equipment Market - Competitive Landscape

- 8.1. Recent Developments & Impact Analysis, By Key Market Participants

- 8.2. Company Categorization

- 8.3. Company Market Share Analysis

- 8.4. Company Market Positioning

- 8.5. Company Heat Map Analysis

- 8.6. Strategy Mapping

- 8.6.1. Expansion

- 8.6.2. Mergers & Acquisition

- 8.6.3. Partnerships & Collaborations

- 8.6.4. New Product Launches

- 8.6.5. Research And Development

- 8.7. Company Profiles

- 8.7.1. The Lincoln Electric Company

- 8.7.1.1. Participant's overview

- 8.7.1.2. Financial performance

- 8.7.1.3. Product benchmarking

- 8.7.1.4. Recent developments

- 8.7.2. ACRO Automation Systems, Inc

- 8.7.2.1. Participant's overview

- 8.7.2.2. Financial performance

- 8.7.2.3. Product benchmarking

- 8.7.2.4. Recent developments

- 8.7.3. Miller Electric Mfg. LLC

- 8.7.3.1. Participant's overview

- 8.7.3.2. Financial performance

- 8.7.3.3. Product benchmarking

- 8.7.3.4. Recent developments

- 8.7.4. Ador Welding Limited

- 8.7.4.1. Participant's overview

- 8.7.4.2. Financial performance

- 8.7.4.3. Product benchmarking

- 8.7.4.4. Recent developments

- 8.7.5. Mitco Weld Products Pvt. Ltd.

- 8.7.5.1. Participant's overview

- 8.7.5.2. Financial performance

- 8.7.5.3. Product benchmarking

- 8.7.5.4. Recent developments

- 8.7.6. voestalpine Bohler Welding Group GmbH

- 8.7.6.1. Participant's overview

- 8.7.6.2. Financial performance

- 8.7.6.3. Product benchmarking

- 8.7.6.4. Recent developments

- 8.7.7. Carl Cloos Schweisstechnik GmbH

- 8.7.7.1. Participant's overview

- 8.7.7.2. Financial performance

- 8.7.7.3. Product benchmarking

- 8.7.7.4. Recent developments

- 8.7.8. OTC DAIHEN Inc.

- 8.7.8.1. Participant's overview

- 8.7.8.2. Financial performance

- 8.7.8.3. Product benchmarking

- 8.7.8.4. Recent developments

- 8.7.9. Illinois Tool Works Inc.

- 8.7.9.1. Participant's overview

- 8.7.9.2. Financial performance

- 8.7.9.3. Product benchmarking

- 8.7.9.4. Recent developments

- 8.7.10. Panasonic Industry Co., Ltd.

- 8.7.10.1. Participant's overview

- 8.7.10.2. Financial performance

- 8.7.10.3. Product benchmarking

- 8.7.10.4. Recent developments

- 8.7.11. Coherent, Inc.

- 8.7.11.1. Participant's overview

- 8.7.11.2. Financial performance

- 8.7.11.3. Product benchmarking

- 8.7.11.4. Recent developments

- 8.7.12. ESAB

- 8.7.12.1. Participant's overview

- 8.7.12.2. Financial performance

- 8.7.12.3. Product benchmarking

- 8.7.12.4. Recent developments

- 8.7.13. Polysoude S.A.S.

- 8.7.13.1. Participant's overview

- 8.7.13.2. Financial performance

- 8.7.13.3. Product benchmarking

- 8.7.13.4. Recent developments

- 8.7.14. Kemppi Oy.

- 8.7.14.1. Participant's overview

- 8.7.14.2. Financial performance

- 8.7.14.3. Product benchmarking

- 8.7.14.4. Recent developments

- 8.7.15. Cruxweld Industrial Equipments Pvt. Ltd.

- 8.7.15.1. Participant's overview

- 8.7.15.2. Financial performance

- 8.7.15.3. Product benchmarking

- 8.7.15.4. Recent developments

- 8.7.1. The Lincoln Electric Company