|

|

市場調査レポート

商品コード

1701632

MICEの市場規模、シェア、動向分析レポート:イベントタイプ別、予約モード別、地域別、セグメント予測、2025年~2030年MICE Market Size, Share & Trends Analysis Report By Event Type, By Booking Mode (Direct Booking, Online Travel Agents & Agencies, Destination Management Companies ), By Region, And Segment Forecasts, 2025 - 2030 |

||||||

カスタマイズ可能

|

|||||||

| MICEの市場規模、シェア、動向分析レポート:イベントタイプ別、予約モード別、地域別、セグメント予測、2025年~2030年 |

|

出版日: 2025年03月26日

発行: Grand View Research

ページ情報: 英文 100 Pages

納期: 2~10営業日

|

全表示

- 概要

- 図表

- 目次

MICE市場の成長と動向:

Grand View Research, Inc.の最新レポートによると、世界のMICE市場規模は2025年から2030年にかけて9.2%のCAGRを記録し、2030年には1兆4,669億4,000万米ドルに達すると推定されています。

企業はビジネスを促進するために会議・インセンティブ・カンファレンス・展示会(MICE)イベントやインセンティブ旅行を活用し、それによって現地の観光を促進しています。企業が主催するB2B/B2Cイベントの増加と先端技術の利用がイベント産業を牽引しています。多様な文化を持ついくつかの国は、MICEイベントを開催して収益を上げることで、自国の観光部門を活性化させることに注力しています。また、企業イベントや展示会、従業員のエンゲージメントを目的とした出張者の増加といった要因も、市場の成長を後押ししています。

すべての雇用主が考慮する重要な要素は、従業員のエンゲージメントです。柔軟な職場環境の出現により、レジャー旅行の需要が増加しており、これが市場の成長を後押ししています。展示会主催者によるジオクローニングの採用も成長を促進しています。主催者や出展者は、国内外の観客とつながる戦略としてジオクローニングを模索しています。ジオクローニングの背景にある考え方は、世界のさまざまな地域で有名な展示会やイベントブランドを複製することです。RELXの一部門であるリードエグジビションは、EuroBLECH、RAILTEX、PSE Europeなどのブランドでジオクローニングの実施に成功しており、業界の成長に貢献しています。

会議・インセンティブ・カンファレンス・展示会市場全体で持続可能な慣行が採用されているため、プレーヤーは消費者の支持を得る機会を得ています。国連気候変動会議(COP-26)やネット・ゼロ・カーボン・イベント(Net Zero Carbon Events)などのイニシアチブの影響により、多くの会場、ホテル、航空会社が自社のイベントから生じる二酸化炭素排出量を推定し、環境への影響を削減または相殺することに取り組んでいます。これとは別に、イベントプランナーもクライアントも、持続可能性やESGの方針に沿ったカーボンニュートラルやゼロカーボンイベントの開発・実施を目指しています。

市場関係者は、顧客ニーズの多様化に伴い、サービスの差別化というコンセプトに注目しています。ブリージャー旅行や報奨旅行への嗜好の高まりは、予測期間中に新規参入企業を惹きつける重要な要因のひとつになると予想されます。いくつかの企業は、従業員の士気を高め、モチベーションを高めるために、インセンティブ旅行を提供しています。例えば、カナダのラグジュアリー専門旅行会社であるトラベル・エッジのレジャー部門は、航空券、クルーズ、バケーション、VIP旅行を専門とする750人近いスペシャリストを擁しており、コーポレート&イベント部門は、100人のコーポレート・トラベル&イベント・プランナーを擁し、オーダーメイドでフルサービスの旅行管理ソリューションを提供しています。

MICE市場レポートのハイライト

- イベントの種類別では、2024年にはミーティング部門が38.9%と大半の収益シェアを占める。これは世界の企業イベントの増加に起因します。パンデミック(世界的大流行)時には、重要なイベントの中止や封鎖命令が出されたため、この分野にも変化が生じた。さらに、人口密度の低い地方都市の人気が高まっていることも、これらの地域での会議需要を促進しています。

- アジア太平洋地域は、予測期間中に大きなCAGRを記録すると予想されます。この地域の市場拡大は、旅行・観光セクターの開発に大きな影響を受けています。例えば、世界観光機関(WTO)によると、アジア太平洋地域の2022年1~9月の国際線到着者数は3倍以上(230%増)に達しました。

- ミーティング・プランナーは、斬新な技術と安全プロトコルを導入しています。COVID-19では、マイクロソフト・チームズ、グーグルミート、スカイプといったバーチャル・ミーティングのための新しいテクノロジーの導入が加速しました。国際会議コンベンション協会(ICCA)によると、2019年に開催された会議は米国が934件で首位を維持し、ドイツ、フランスがこれに続いた。

目次

第1章 調査手法と範囲

第2章 エグゼクティブサマリー

第3章 MICE市場の変数、動向、範囲

- 市場系統の見通し

- 親市場の見通し

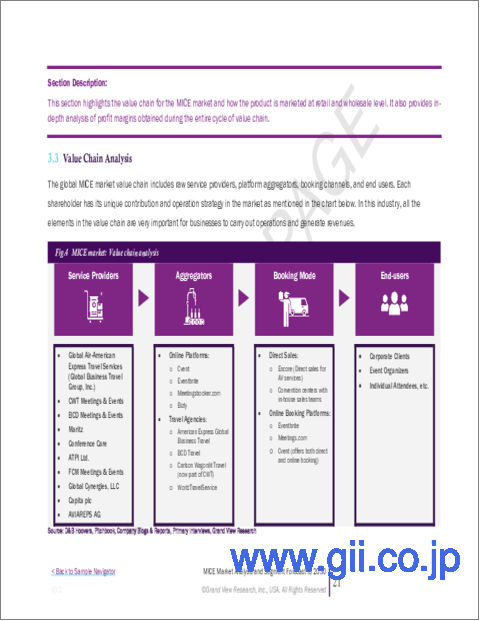

- 業界バリューチェーン分析

- 予約モードの分析と動向

- 市場力学

- 市場促進要因分析

- 市場抑制要因分析

- 市場機会

- 市場の課題

- 業界分析ツール

- ポーターのファイブフォース分析

- 市場参入戦略

第4章 消費者行動分析

- 人口統計分析

- 消費者の動向と嗜好

- 購入決定に影響を与える要因

- 消費者向けサービスの採用

- 観察と推奨事項

第5章 MICE市場:イベントタイプ別推定・動向分析

- MICE市場、イベントタイプ別:主なポイント

- イベントタイプ別変動分析と市場シェア、2024年と2030年

- イベントタイプ別、2018年~2030年

- 会議

- インセンティブ

- カンファレンス

- 展覧会

第6章 MICE市場:予約モード別推定・動向分析

- MICE市場、予約モード別:主なポイント

- 予約モード別変動分析と市場シェア、2024年と2030年

- 予約モード別、2018年~2030年

- 直接予約

- オンライン旅行代理店(OTA)

- デスティネーション・マネジメント・カンパニー(DCM)

- 旅行管理会社(TMC)

- その他

第7章 MICE市場:地域別推定・動向分析

- MICE市場:地域展望

- 地域別マーケットプレイス:重要なポイント

- 地域別、2018年~2030年

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第8章 MICE市場:競合分析

- 主要市場参入企業による最近の動向と影響分析

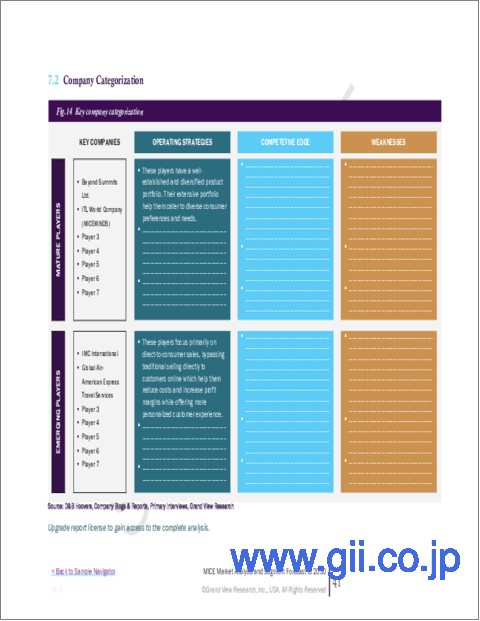

- 企業分類

- 参入企業の概要

- 財務実績

- サービスベンチマーク

- 企業市場シェア分析、2024年(%)

- 企業ヒートマップ分析

- 戦略マッピング

- 企業プロファイル

- Global Air-American Express Travel Services(Global Business Travel Group, Inc.)

- CWT Meetings &Events

- BCD Meetings &Events

- Maritz

- Conference Care

- ATPI Ltd.

- FCM Meetings &Events

- Global Cynergies, LLC

- Capita plc

- AVIAREPS AG

- ITL World Company(MICEMINDS)Company Overview

- Questex

- Beyond Summits

- American Express Global Business Travel(GBT)

- Meetings and Incentives Worldwide, Inc.

- One10, LLC

- Creative Group, Inc.

- Cambria DMC

- Carlson Wagonlit Travel

- Ci Events

List of Tables

- Table 1 MICE market: Key market driver analysis

- Table 2 MICE market: Key market restraint analysis

- Table 3 MICE market estimates & forecast, 2018 - 2030, by event type, 2018 - 2030 (USD Billion)

- Table 4 Meetings market estimates & forecast, 2018 - 2030 (USD Billion)

- Table 5 Incentives market estimates & forecast, 2018 - 2030 (USD Billion)

- Table 6 Conferences market estimates & forecast, 2018 - 2030 (USD Billion)

- Table 7 Exhibitions market estimates & forecast, 2018 - 2030 (USD Billion)

- Table 8 MICE market estimates & forecast, 2018 - 2030, by booking mode, 2018 - 2030 (USD Billion)

- Table 9 MICE market estimates & forecast, through direct booking, 2018 - 2030 (USD Billion)

- Table 10 MICE market estimates & forecast, through online travel agents and agencies (OTAs), 2018 - 2030 (USD Billion)

- Table 11 MICE market estimates & forecast, through destination management companies (DMCs), 2018 - 2030 (USD Billion)

- Table 12 MICE market estimates & forecast, through travel management companies (TMCs), 2018 - 2030 (USD Billion)

- Table 13 MICE market estimates & forecast, through other booking modes, 2018 - 2030 (USD Billion)

- Table 14 MICE market estimates & forecast, 2018 - 2030, by region, 2018 - 2030 (USD Billion)

- Table 15 North America MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 16 North America MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 17 North America MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 18 U.S. macro-economic outlay

- Table 19 U.S. MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 20 U.S. MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 21 U.S. MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 22 Canada macro-economic outlay

- Table 23 Canada MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 24 Canada MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 25 Canada MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 26 Mexico macro-economic outlay

- Table 27 Mexico MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 28 Mexico MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 29 Mexico MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 30 Europe MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 31 Europe MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 32 Europe MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 33 U.K. macro-economic outlay

- Table 34 U.K. MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 35 U.K. MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 36 U.K. MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 37 Germany macro-economic outlay

- Table 38 Germany MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 39 Germany MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 40 Germany MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 41 France macro-economic outlay

- Table 42 France MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 43 France MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 44 France MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 45 Italy macro-economic outlay

- Table 46 Italy MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 47 Italy MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 48 Italy MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 49 Spain macro-economic outlay

- Table 50 Spain MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 51 Spain MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 52 Spain MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 53 Austria macro-economic outlay

- Table 54 Austria MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 55 Austria MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 56 Austria MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 57 Netherlands macro-economic outlay

- Table 58 Netherlands MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 59 Netherlands MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 60 Netherlands MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 61 Asia Pacific MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 62 Asia Pacific MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 63 Asia Pacific MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 64 China macro-economic outlay

- Table 65 China MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 66 China MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 67 China MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 68 India macro-economic outlay

- Table 69 India MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 70 India MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 71 India MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 72 Japan macro-economic outlay

- Table 73 Japan MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 74 Japan MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 75 Japan MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 76 ASEAN macro-economic outlay

- Table 77 ASEAN MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 78 ASEAN MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 79 ASEAN MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 80 Australia macro-economic outlay

- Table 81 Australia MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 82 Australia MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 83 Australia MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 84 Latin America MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 85 Latin America MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 86 Latin America MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 87 Brazil macro-economic outlay

- Table 88 Brazil MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 89 Brazil MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 90 Brazil MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 91 Middle East & Africa MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 92 Middle East & Africa MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 93 Middle East & Africa MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 94 South Africa macro-economic outlay

- Table 95 South Africa MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 96 South Africa MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 97 South Africa MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 98 UAE macro-economic outlay

- Table 99 UAE MICE market estimates and forecast, 2018 - 2030 (USD Billion)

- Table 100 UAE MICE market revenue estimates and forecast, by event type, 2018 - 2030 (USD Billion)

- Table 101 UAE MICE market revenue estimates and forecast, by booking mode, 2018 - 2030 (USD Billion)

- Table 102 Recent developments & impact analysis, by key market participants

- Table 103 Company market share, 2024 (%)

- Table 104 Company heat map analysis, 2024

- Table 105 Companies implementing key strategies

List of Figures

- Fig. 1 MICE market segmentation

- Fig. 2 Information procurement

- Fig. 3 Primary research pattern

- Fig. 4 Primary research approaches

- Fig. 5 Primary research process

- Fig. 6 Market snapshot

- Fig. 7 Segment snapshot

- Fig. 8 Regional snapshot

- Fig. 9 Competitive landscape snapshot

- Fig. 10 Parent industry and MICE services market size, 2024 (USD Billion)

- Fig. 11 MICE market: Value chain analysis

- Fig. 12 MICE market: Dynamics

- Fig. 13 MICE market: Porter's five forces analysis

- Fig. 14 MICE market, by event type: Key takeaways

- Fig. 15 MICE market: Event Type movement analysis, 2024 & 2030 (%)

- Fig. 16 Meetings market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 17 Incentives market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 18 Conferences market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 19 Exhibitions market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 20 MICE market, by booking mode: Key takeaways

- Fig. 21 MICE market: Booking Mode movement analysis, 2024 & 2030 (%)

- Fig. 22 MICE market estimates & forecast, through direct booking, 2018 - 2030 (USD Billion)

- Fig. 23 MICE market estimates & forecast, through online travel agents and agencies (OTAs), 2018 - 2030 (USD Billion)

- Fig. 24 MICE market estimates & forecast, through destination management companies (DMCs), 2018 - 2030 (USD Billion)

- Fig. 25 MICE market estimates & forecast, through travel management companies (TMCs), 2018 - 2030 (USD Billion)

- Fig. 26 MICE market estimates & forecast, through other booking modes, 2018 - 2030 (USD Billion)

- Fig. 27 MICE market: Regional outlook, 2024 & 2030 (USD Billion)

- Fig. 28 Regional marketplace: Key takeaways

- Fig. 29 North America MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 30 U.S. MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 31 Canada MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 32 Mexico MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 33 Europe MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 34 Germany MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 35 UK MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 36 France MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 37 Italy MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 38 Spain MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 39 Austria MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 40 Netherlands MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 41 Asia Pacific MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 42 China MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 43 India MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 44 Japan MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 45 ASEAN MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 46 Australia MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 47 Latin America MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 48 Brazil MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 49 Middle East & Africa MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 50 South Africa MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 51 UAE MICE market estimates & forecast, 2018 - 2030 (USD Billion)

- Fig. 52 Key company categorization

- Fig. 53 Company market share analysis, 2024

- Fig. 54 Strategic Framework of the MICE Market

MICE Market Growth & Trends:

The global MICE market size is estimated to reach USD 1,466.94 billion by 2030, registering a CAGR of 9.2% from 2025 to 2030, according to a new report by Grand View Research, Inc. Companies are utilizing meetings, incentives, conferences, and exhibitions (MICE) events and incentive travel to promote their business, thereby driving local tourism. A rise in the number of B2B/B2C events sponsored by enterprises and the use of advanced technology is driving the events industry. Several countries with diverse cultures are focused on boosting their tourism sector by organizing MICE events to generate revenue. Factors, such as the increasing number of business travelers for corporate events, exhibitions, and employee engagement are also driving the market growth.

An important factor that every employer considers is employee engagement. The demand for leisure travel has increased due to the emergence of flexible work environments, which, in turn, drives the growth of the market. The adoption of geo-cloning by exhibition organizers is also driving the growth. Organizers and exhibitors are exploring geo-cloning as a strategy to connect with audiences locally and internationally. The idea behind geo-cloning is to replicate well-known exhibition and event brands in different parts of the world. Reed Exhibitions, a division of RELX, successfully implements geo-cloning for brands, such as EuroBLECH, RAILTEX, and PSE Europe, contributing to the industry growth.

The adoption of sustainable practices across the meetings, incentives, conferences, and exhibitions market is offering players an opportunity to gain traction among consumers. Due to the influence of initiatives such as the United Nations Climate Change Conference (COP-26) and Net Zero Carbon Events, a number of venues, hotels, and airlines are working toward estimating the carbon footprint resulting from their own events and decreasing or offsetting their impact on the environment. Apart from this, event planners and clients are both aiming to develop and carry out carbon-neutral or zero-carbon events in line with their sustainability and ESG policies

Market players have been focusing on the concept of service differentiation owing to the varying client needs. The increasing preference for bleisure trips and incentive travel is expected to be one of the key factors attracting new players over the forecast period. Several companies have been providing incentive travel offers to their employees to boost their morale and motivate them. For example, the leisure division at Travel Edge, a Canadian luxury-focused travel agency, has close to 750 specialists specializing in air, cruise, vacation, and VIP travel and its corporate & events division offers 100 corporate travel and event planners specializing in tailored and full-service travel management solutions.

MICE Market Report Highlights:

- Based on event type, the meetings segment accounted for a majority revenue share of 38.9% in 2024. This can be attributed to the increase in corporate events worldwide. During the pandemic, this section underwent a change as a result of the cancellation of significant events and lockdown orders. Additionally, the rise in popularity of regional destinations coupled with less densely populated tier cities is also driving the demand for meetings in these regions.

- Asia Pacific is expected to witness a significant CAGR over the forecast period. The market expansion in this region is significantly influenced by the development of the travel and tourism sector. For instance, according to World Tourism Organization, Asia Pacific saw more than triple (+230%) international arrivals in the first nine months of 2022.

- Meeting planners are implementing novel technologies and safety protocols. COVID-19 accelerated the adoption of newer technologies such as Microsoft Teams, Google Meet, and Skype for virtual meetings. According to the International Congress and Convention Association (ICCA), the U.S. remained at the top with 934 meetings held in the year 2019, followed by Germany and France.

Table of Contents

Chapter 1. Methodology and Scope

- 1.1. Market Segmentation & Scope

- 1.2. Market Definition

- 1.3. Information Procurement

- 1.3.1. Purchased Database

- 1.3.2. GVR's Internal Database

- 1.3.3. Secondary Sources & Third-Party Perspectives

- 1.3.4. Primary Research

- 1.4. Information Analysis

- 1.4.1. Data Analysis Models

- 1.5. Market Formulation & Data Visualization

- 1.6. Data Validation & Publishing

Chapter 2. Executive Summary

- 2.1. Market Snapshot

- 2.2. Segment Snapshot

- 2.3. Competitive Landscape Snapshot

Chapter 3. MICE Market Variables, Trends & Scope

- 3.1. Market Lineage Outlook

- 3.1.1. Parent Market Outlook

- 3.2. Industry Value Chain Analysis

- 3.2.1. Booking Mode Analysis and Trends

- 3.3. Market Dynamics

- 3.3.1. Market Driver Analysis

- 3.3.2. Market Restraint Analysis

- 3.3.3. Market Opportunities

- 3.3.4. Market Challenges

- 3.4. Industry Analysis Tools

- 3.4.1. Porter's Five Forces Analysis

- 3.5. Market Entry Strategies

Chapter 4. Consumer Behavior Analysis

- 4.1. Demographic Analysis

- 4.2. Consumer Trends and Preferences

- 4.3. Factors Affecting Buying Decision

- 4.4. Consumer Service Adoption

- 4.5. Observations & Recommendations

Chapter 5. MICE Market: Event Type Estimates & Trend Analysis

- 5.1. MICE Market, By Event Type: Key Takeaways

- 5.2. Event Type Movement Analysis & Market Share, 2024 & 2030

- 5.3. Market Estimates & Forecasts, By Event Type, 2018 - 2030 (USD Billion)

- 5.3.1. Meetings

- 5.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 5.3.2. Incentives

- 5.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 5.3.3. Conferences

- 5.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 5.3.4. Exhibitions

- 5.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 5.3.1. Meetings

Chapter 6. MICE Market: Booking Mode Estimates & Trend Analysis

- 6.1. MICE Market, By Booking Mode: Key Takeaways

- 6.2. Booking Mode Movement Analysis & Market Share, 2024 & 2030

- 6.3. Market Estimates & Forecasts, By Booking Mode, 2018 - 2030 (USD Billion)

- 6.3.1. Direct Booking

- 6.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 6.3.2. Online Travel Agents and Agencies (OTAs)

- 6.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 6.3.3. Destination Management Companies (DCMs)

- 6.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 6.3.4. Travel Management Companies (TMCs)

- 6.3.4.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 6.3.5. Others

- 6.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 6.3.1. Direct Booking

Chapter 7. MICE Market: Regional Estimates & Trend Analysis

- 7.1. MICE Market: Regional Outlook

- 7.2. Regional Marketplaces: Key Takeaways

- 7.3. Market Estimates & Forecasts, by Region, 2018 - 2030 (USD Billion)

- 7.3.1. North America

- 7.3.1.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.1.2. U.S.

- 7.3.1.2.1. Key country dynamics

- 7.3.1.2.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.1.3. Canada

- 7.3.1.3.1. Key country dynamics

- 7.3.1.3.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.1.4. Mexico

- 7.3.1.4.1. Key country dynamics

- 7.3.1.4.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2. Europe

- 7.3.2.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.2. UK

- 7.3.2.2.1. Key country dynamics

- 7.3.2.2.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.3. Germany

- 7.3.2.3.1. Key country dynamics

- 7.3.2.3.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.4. France

- 7.3.2.4.1. Key country dynamics

- 7.3.2.4.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.5. Italy

- 7.3.2.5.1. Key country dynamics

- 7.3.2.5.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.6. Spain

- 7.3.2.6.1. Key country dynamics

- 7.3.2.6.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.7. Austria

- 7.3.2.7.1. Key country dynamics

- 7.3.2.7.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.2.8. Netherlands

- 7.3.2.8.1. Key country dynamics

- 7.3.2.8.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.3. Asia Pacific

- 7.3.3.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.3.2. China

- 7.3.3.2.1. Key country dynamics

- 7.3.3.2.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.3.3. India

- 7.3.3.3.1. Key country dynamics

- 7.3.3.3.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.3.4. Japan

- 7.3.3.4.1. Key country dynamics

- 7.3.3.4.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.3.5. Australia

- 7.3.3.5.1. Key country dynamics

- 7.3.3.5.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.4. Latin America

- 7.3.4.1. Brazil

- 7.3.4.1.1. Key country dynamics

- 7.3.4.1.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.4.1. Brazil

- 7.3.5. Middle East & Africa

- 7.3.5.1. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.5.2. South Africa

- 7.3.5.2.1. Key country dynamics

- 7.3.5.2.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.5.3. UAE

- 7.3.5.3.1. Key country dynamics

- 7.3.5.3.2. Market estimates and forecast, 2018 - 2030 (USD Billion)

- 7.3.1. North America

Chapter 8. MICE Market: Competitive Analysis

- 8.1. Recent Developments & Impact Analysis, by Key Market Participants

- 8.2. Company Categorization

- 8.3. Participant's Overview

- 8.4. Financial Performance

- 8.5. Service Benchmarking

- 8.6. Company Market Share Analysis, 2024 (%)

- 8.7. Company Heat Map Analysis

- 8.8. Strategy Mapping

- 8.9. Company Profiles

- 8.9.1. Global Air-American Express Travel Services (Global Business Travel Group, Inc.)

- 8.9.1.1. Company Overview

- 8.9.1.2. Financial Performance

- 8.9.1.3. Service Portfolios

- 8.9.1.4. Strategic Initiatives

- 8.9.2. CWT Meetings & Events

- 8.9.2.1. Company Overview

- 8.9.2.2. Financial Performance

- 8.9.2.3. Service Portfolios

- 8.9.2.4. Strategic Initiatives

- 8.9.3. BCD Meetings & Events

- 8.9.3.1. Company Overview

- 8.9.3.2. Financial Performance

- 8.9.3.3. Service Portfolios

- 8.9.3.4. Strategic Initiatives

- 8.9.4. Maritz

- 8.9.4.1. Company Overview

- 8.9.4.2. Financial Performance

- 8.9.4.3. Service Portfolios

- 8.9.4.4. Strategic Initiatives

- 8.9.5. Conference Care

- 8.9.5.1. Company Overview

- 8.9.5.2. Financial Performance

- 8.9.5.3. Service Portfolios

- 8.9.5.4. Strategic Initiatives

- 8.9.6. ATPI Ltd.

- 8.9.6.1. Company Overview

- 8.9.6.2. Financial Performance

- 8.9.6.3. Service Portfolios

- 8.9.6.4. Strategic Initiatives

- 8.9.7. FCM Meetings & Events

- 8.9.7.1. Company Overview

- 8.9.7.2. Financial Performance

- 8.9.7.3. Service Portfolios

- 8.9.7.4. Strategic Initiatives

- 8.9.8. Global Cynergies, LLC

- 8.9.8.1. Company Overview

- 8.9.8.2. Financial Performance

- 8.9.8.3. Service Portfolios

- 8.9.8.4. Strategic Initiatives

- 8.9.9. Capita plc

- 8.9.9.1. Company Overview

- 8.9.9.2. Financial Performance

- 8.9.9.3. Service Portfolios

- 8.9.9.4. Strategic Initiatives

- 8.9.10. AVIAREPS AG

- 8.9.10.1. Company Overview

- 8.9.10.2. Financial Performance

- 8.9.10.3. Service Portfolios

- 8.9.10.4. Strategic Initiatives

- 8.9.11. ITL World Company (MICEMINDS)Company Overview

- 8.9.11.1. Financial Performance

- 8.9.11.2. Service Portfolios

- 8.9.11.3. Strategic Initiatives

- 8.9.12. Questex

- 8.9.12.1. Company Overview

- 8.9.12.2. Financial Performance

- 8.9.12.3. Service Portfolios

- 8.9.12.4. Strategic Initiatives

- 8.9.13. Beyond Summits

- 8.9.13.1. Company Overview

- 8.9.13.2. Financial Performance

- 8.9.13.3. Service Portfolios

- 8.9.13.4. Strategic Initiatives

- 8.9.14. American Express Global Business Travel (GBT)

- 8.9.14.1. Company Overview

- 8.9.14.2. Financial Performance

- 8.9.14.3. Service Portfolios

- 8.9.14.4. Strategic Initiatives

- 8.9.15. Meetings and Incentives Worldwide, Inc.

- 8.9.15.1. Company Overview

- 8.9.15.2. Financial Performance

- 8.9.15.3. Service Portfolios

- 8.9.15.4. Strategic Initiatives

- 8.9.16. One10, LLC

- 8.9.16.1. Company Overview

- 8.9.16.2. Financial Performance

- 8.9.16.3. Service Portfolios

- 8.9.16.4. Strategic Initiatives

- 8.9.17. Creative Group, Inc.

- 8.9.17.1. Company Overview

- 8.9.17.2. Financial Performance

- 8.9.17.3. Service Portfolios

- 8.9.17.4. Strategic Initiatives

- 8.9.18. Cambria DMC

- 8.9.18.1. Company Overview

- 8.9.18.2. Financial Performance

- 8.9.18.3. Service Portfolios

- 8.9.18.4. Strategic Initiatives

- 8.9.19. Carlson Wagonlit Travel

- 8.9.19.1. Company Overview

- 8.9.19.2. Financial Performance

- 8.9.19.3. Service Portfolios

- 8.9.19.4. Strategic Initiatives

- 8.9.20. Ci Events

- 8.9.20.1. Company Overview

- 8.9.20.2. Financial Performance

- 8.9.20.3. Service Portfolios

- 8.9.20.4. Strategic Initiatives

- 8.9.1. Global Air-American Express Travel Services (Global Business Travel Group, Inc.)