|

|

市場調査レポート

商品コード

1745060

金型の世界市場Dies and Molds |

||||||

適宜更新あり

|

|||||||

| 金型の世界市場 |

|

出版日: 2025年06月06日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 288 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

金型の世界市場は2030年までに21億米ドルに達する見込み

2024年に14億米ドルと推定される金型の世界市場は、2024年から2030年にかけてCAGR 6.8%で成長し、2030年には21億米ドルに達すると予測されます。本レポートで分析したセグメントの1つである液体金型は、CAGR 7.3%を記録し、分析期間終了時には13億米ドルに達すると予測されています。固形金型セグメントの成長率は、分析期間でCAGR 5.4%と推定されます。

米国市場は3億9,420万米ドルと推定、中国はCAGR 10.7%で成長予測

米国の金型市場は、2024年に3億9,420万米ドルと推定されます。世界第2位の経済大国である中国は、2030年までに4億4,760万米ドルの市場規模に達すると予測され、分析期間2024-2030年のCAGRは10.7%です。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ3.3%と6.6%と予測されています。欧州では、ドイツがCAGR 4.5%で成長すると予測されています。

世界の金型市場- 主要動向と促進要因のまとめ

なぜ金型は世界の製造業と製品イノベーションの基盤なのか?

金型は、自動車、家電、航空宇宙、医療機器、パッケージングなどの幅広い産業において、大量生産に不可欠なツールとして機能し、現代の製造業の屋台骨を形成しています。これらの精密加工部品は、金属、プラスチック、セラミック、複合材などの材料を、高い寸法精度で複雑かつ再現可能な形状に成形、切断、型押し、成形するために使用されます。金型は通常、スタンピング、鍛造、押出などの工程で使用され、金型は射出成形、ブロー成形、ダイキャストなどの工程で重要な役割を果たします。ばらつきを最小限に抑えながら、高速で大量生産を可能にする金型は、規模と標準化を重視する産業にとって不可欠なものです。世界の製造業の高度化と、急速に変化する消費者の要求による製品サイクルの短縮に伴い、柔軟で高性能な金型システムに対するニーズは飛躍的に高まっています。さらに、軽量素材、小型化されたコンポーネント、複雑な部品形状の台頭により、工具メーカーは、極端な圧力、温度、摩耗に耐えることができる、より洗練された耐久性のある金型を開発する必要に迫られています。要するに、これらの工具は、製造の効率性と一貫性を実現するだけでなく、イノベーションの促進要因でもあり、新しい製品設計を経済的に実現し、市場に迅速に投入することを可能にしているのです。

技術革新は、金型設計、製造、ライフサイクルをどのように変化させているか?

技術の進歩は金型業界を大きく変革し、精度の向上、生産時間の短縮、金型システムの寿命延長を実現しています。CAD/CAMソフトウェアの統合は、設計プロセスに革命をもたらし、より少ない反復と手作業による介入で、高度に複雑で最適化された金型設計を可能にしました。コンピュータ支援エンジニアリング(CAE)ツールは現在、応力分布、熱流動、材料変形をリアルタイムでシミュレートし、エンジニアが製造開始前に潜在的な欠陥を予見するのに役立っています。アディティブ・マニュファクチャリング(AM)、つまり3Dプリンティングは、ラピッド・プロトタイピングや、従来の機械加工では困難だった金型内のコンフォーマル冷却チャンネルの製造において、ゲームチェンジャーとして台頭してきています。この技術革新は、冷却効率、サイクルタイム、部品の品質を劇的に改善します。さらに、粉末冶金鋼、タングステン合金、セラミック複合材などの先端材料は、耐熱性と摩耗特性を向上させるために使用されています。高速CNC機械加工と放電加工(EDM)は、精密射出成形のような用途で特に重要な、より厳しい公差と滑らかな仕上げを可能にします。センサーやIoT対応の監視システムも金型に組み込まれ、温度、圧力、疲労に関するリアルタイムのフィードバックを提供することで、予知保全を促進し、ダウンタイムを削減しています。これらの技術革新は、性能や耐久性を向上させるだけでなく、金型生産をインダストリー4.0の標準に合わせることで、データ駆動型、俊敏性、接続性を高めています。

金型の需要が業界や世界市場で拡大している理由とは?

金型に対する世界の需要は、製造活動の活発化、消費者市場の拡大、複数の業界にわたる技術革新に対応して急増しています。特に、電気自動車(EV)へのシフトに伴い、新しい部品形状や材料の組み合わせが要求される中、自動車産業は金属プレス用の金型やプラスチック部品用の金型に大きく依存しており、依然として主要なユーザーとなっています。スマートフォン、タブレット、ウェアラブル端末が、高度な金型やマイクロツールを使って製造される高精度で小型化された部品を必要とするため、家電や通信も需要を牽引しています。医療分野では、特に低侵襲手術器具、診断機器、単回使用ディスポーザブルなど、機器の技術革新が急速なペースで進んでいるため、厳格な公差と生体適合性のある材料を使用した部品を製造できる医療グレードの金型に対するニーズが高まっています。持続可能性の圧力に対応する包装業界では、生分解性材料やリサイクル可能な材料の採用が進んでおり、異なる流動特性や冷却特性に対応するための新しい金型設計が必要とされています。一方、アジア太平洋、ラテンアメリカ、アフリカの新興国では、現地製造インフラへの投資が進んでおり、輸入依存度の低減を目指す金型メーカーに新たなビジネスチャンスをもたらしています。さらに、北米と欧州では、サプライチェーンの混乱と地政学的な変化により、金型製造能力に対する国内需要が復活しつつあります。産業の多様化とデジタル化が進む中、最新の金型が提供する汎用性と精度は、従来の生産システムと次世代生産システムの両方において不可欠な地位を確保しています。

金型市場の成長と進化を促す主な要因は?

金型市場の成長は、世界の製造業の進化を反映する経済的、技術的、戦略的要因の融合によって推進されています。特に消費財や電子機器では、製品ライフサイクルの短縮が主要な推進力となっており、迅速な設計変更や柔軟な生産ラインをサポートするツーリングソリューションへの需要が高まっています。また、デジタル製造技術によって実現されるカスタマイズと少量生産の重要性の高まりも、モジュラー方式とクイックチェンジ方式の金型システムの応用範囲を拡大しています。生産ラインの自動化が進み、金型メーカーは、ロボットアーム、ビジョンシステム、リアルタイムの品質管理機構とシームレスに動作する、よりスマートで統合された金型を提供する必要に迫られています。環境規制と循環型経済の目標は、メーカーにリサイクル可能で軽量な材料の採用を促しています。さらに、サプライチェーン・レジリエンス戦略と各国の産業政策に後押しされた国内製造能力への戦略的投資により、先進経済諸国と新興経済諸国の両方で、地域に根ざした金型生産拠点が育成されています。航空宇宙、再生可能エネルギー、電動モビリティなどの最終用途産業の拡大は、高度な金型ソリューションに新たな技術課題と市場機会をもたらしています。全体として、金型市場は、数量が増加しているだけでなく、高度化も進んでおり、未来に対応した製造エコシステムの要としての地位を確立しています。

セグメント

タイプ(液体金型、固体金型、金型)、アプリケーション(医療、航空宇宙、自動車、ICT、消費財、その他のアプリケーション)

調査対象企業の例(注目の42社)

- ACE Mould

- Adval Tech Holding AG

- Arburg GmbH+Co KG

- DMG Mori Aktiengesellschaft

- Dongguan Sincere Tech

- Exco Technologies Limited

- Gentiger Machinery Industrial Co., Ltd.

- Husky Injection Molding Systems Ltd.

- Makino Milling Machine Co., Ltd.

- Meusburger Georg GmbH & Co KG

- Mold-Tech

- Pelco Tool and Mold

- PHB Inc.

- Plansee Group

- Plastikon Industries, Inc.

- SACMI Molds & Dies

- Schuler Group GmbH

- Sodick Co., Ltd.

- Stack Plastics, Inc.

- Xcentric Mold & Engineering

関税影響係数

Global Industry Analystsは、本社の国、製造拠点、輸出入(完成品とOEM)に基づく企業の競争力の変化を予測しています。この複雑で多面的な市場力学は、人為的な売上原価の増加、収益性の低下、サプライチェーンの再構築など、ミクロおよびマクロの市場力学の中でも特に競合他社に影響を与える見込みです。

Global Industry Analystsは、世界の主要なチーフ・エコノミスト(1万4,949人)、シンクタンク(62団体)、貿易・産業団体(171団体)の専門家の意見に熱心に従いながら、エコシステムへの影響を評価し、新たな市場の現実に対処しています。あらゆる主要国の専門家やエコノミストが、関税とそれが自国に与える影響についての意見を追跡調査しています。

Global Industry Analystsは、この混乱が今後2-3ヶ月で収束し、新しい世界秩序がより明確に確立されると予想しています。Global Industry Analystsは、これらの開発をリアルタイムで追跡しています。

2025年4月:交渉フェーズ

4月のリリースでは、世界市場全体に対する関税の影響を取り上げ、地域別の市場調整について紹介します。当社の予測は、過去のデータと進化する市場影響要因に基づいています。

2025年7月:最終関税リセット

お客様には、各国間で最終リセットが発表された後、7月に無料アップデート版をお届けします。最終アップデート版には、明確に定義された関税影響分析が組み込まれています。

相互および二国間貿易と関税の影響分析:

アメリカ <>中国<>メキシコ <>カナダ <>EU <>日本<>インド <>その他176カ国

業界をリードするエコノミスト:Global Industry Analystsの知識ベースは、国家、シンクタンク、貿易・業界団体、大企業、そして世界の計量経済状況におけるこの前例のないパラダイムシフトの影響を共有する領域の専門家など、最も影響力のあるチーフエコノミストを含む1万4,949人のエコノミストを追跡しています。当社の16,491を超えるレポートのほとんどは、マイルストーンに基づくこの2段階のリリーススケジュールを取り入れています。

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- スペイン

- ロシア

- その他欧州

- アジア太平洋

- オーストラリア

- インド

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- アルゼンチン

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東

- イラン

- イスラエル

- サウジアラビア

- アラブ首長国連邦

- その他中東

- アフリカ

第4章 競合

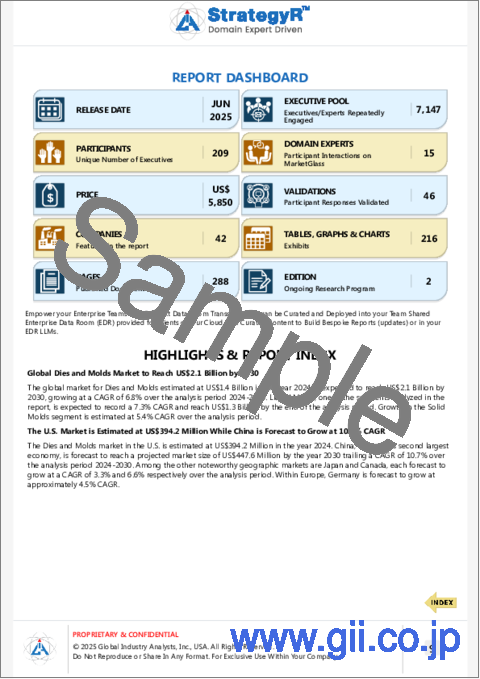

Global Dies and Molds Market to Reach US$2.1 Billion by 2030

The global market for Dies and Molds estimated at US$1.4 Billion in the year 2024, is expected to reach US$2.1 Billion by 2030, growing at a CAGR of 6.8% over the analysis period 2024-2030. Liquid Molds, one of the segments analyzed in the report, is expected to record a 7.3% CAGR and reach US$1.3 Billion by the end of the analysis period. Growth in the Solid Molds segment is estimated at 5.4% CAGR over the analysis period.

The U.S. Market is Estimated at US$394.2 Million While China is Forecast to Grow at 10.7% CAGR

The Dies and Molds market in the U.S. is estimated at US$394.2 Million in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$447.6 Million by the year 2030 trailing a CAGR of 10.7% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 3.3% and 6.6% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 4.5% CAGR.

Global Dies and Molds Market - Key Trends & Drivers Summarized

Why Are Dies and Molds Fundamental to Global Manufacturing and Product Innovation?

Dies and molds form the backbone of modern manufacturing, serving as essential tools in mass production across a wide range of industries such as automotive, consumer electronics, aerospace, medical devices, and packaging. These precision-engineered components are used to shape, cut, stamp, or form materials-whether metals, plastics, ceramics, or composites-into complex, repeatable geometries with high dimensional accuracy. Dies are typically used for processes such as stamping, forging, and extrusion, while molds are critical in injection molding, blow molding, and die casting operations. Their ability to facilitate high-speed, high-volume production with minimal variation makes them indispensable in industries that rely on scale and standardization. As global manufacturing becomes more advanced and product cycles shorten due to rapidly changing consumer demands, the need for flexible, high-performance die and mold systems has increased exponentially. Additionally, the rise of lightweight materials, miniaturized components, and complex part geometries has pushed toolmakers to develop more sophisticated and durable dies and molds capable of withstanding extreme pressures, temperatures, and abrasive wear. In essence, these tools are not only enablers of efficiency and consistency in manufacturing but also drivers of innovation, allowing new product designs to be economically realized and brought to market at speed.

How Are Technological Innovations Reshaping Die and Mold Design, Fabrication, and Lifecycle?

Technological advancements are profoundly transforming the die and mold industry, enhancing precision, reducing production time, and extending the lifespan of tooling systems. The integration of CAD/CAM software has revolutionized the design process, enabling highly intricate and optimized die and mold designs with fewer iterations and less manual intervention. Computer-aided engineering (CAE) tools now simulate stress distribution, thermal flow, and material deformation in real time, helping engineers foresee potential defects before manufacturing begins. Additive manufacturing (AM), or 3D printing, is emerging as a game-changer in rapid prototyping and even in producing conformal cooling channels within molds that are difficult to achieve through traditional machining. This innovation drastically improves cooling efficiency, cycle time, and part quality. Additionally, advanced materials such as powder metallurgy steels, tungsten alloys, and ceramic composites are being used to improve heat resistance and wear characteristics. High-speed CNC machining and electric discharge machining (EDM) allow for tighter tolerances and smoother finishes, particularly important in applications like precision injection molding. Sensors and IoT-enabled monitoring systems are also being embedded into tooling to provide real-time feedback on temperature, pressure, and fatigue, promoting predictive maintenance and reducing downtime. These innovations are not just enhancing performance and durability, but are also aligning die and mold production with Industry 4.0 standards, making it more data-driven, agile, and connected.

Why Is Demand for Dies and Molds Expanding Across Industries and Global Markets?

The global demand for dies and molds is surging in response to rising manufacturing activities, expanding consumer markets, and technological innovation across multiple verticals. The automotive industry remains a dominant user, relying heavily on dies for metal stamping and molds for plastic components, especially as the shift toward electric vehicles (EVs) demands new part geometries and material combinations. Consumer electronics and telecommunications are also driving demand, as smartphones, tablets, and wearables require highly precise, miniaturized components produced using advanced molds and micro-tools. In the medical sector, the rapid pace of device innovation-particularly in minimally invasive surgical tools, diagnostic equipment, and single-use disposables-is creating a robust need for medical-grade molds capable of producing parts with exacting tolerances and biocompatible materials. The packaging industry, responding to sustainability pressures, is adopting biodegradable and recyclable materials that require new mold designs to accommodate differing flow and cooling characteristics. Meanwhile, emerging economies in Asia-Pacific, Latin America, and Africa are investing in local manufacturing infrastructure, creating new opportunities for die and mold manufacturers as these regions seek to reduce import dependency. Additionally, reshoring initiatives in North America and Europe, prompted by supply chain disruptions and geopolitical shifts, are reviving domestic demand for toolmaking capabilities. As industries continue to diversify and digitize, the versatility and precision offered by modern dies and molds ensure their essential status in both traditional and next-gen production systems.

What Are the Key Drivers Powering the Growth and Evolution of the Dies and Molds Market?

The growth in the dies and molds market is propelled by a convergence of economic, technological, and strategic factors that reflect the evolving nature of global manufacturing. A key driver is the shortening of product lifecycles, especially in consumer goods and electronics, which increases the demand for tooling solutions that support rapid design changes and flexible production lines. The growing importance of customization and low-volume production-enabled by digital manufacturing techniques-is also expanding the application scope for modular and quick-change die and mold systems. Rising automation in production lines is pushing toolmakers to deliver smarter, more integrated tooling that can operate seamlessly with robotic arms, vision systems, and real-time quality control mechanisms. Environmental regulations and circular economy goals are prompting manufacturers to adopt recyclable and lightweight materials, which in turn require reengineering of tooling systems to handle new material behaviors. Furthermore, strategic investments in domestic manufacturing capabilities-driven by supply chain resilience strategies and national industrial policies-are fostering localized die and mold production hubs in both developed and emerging economies. The expansion of end-use industries such as aerospace, renewable energy, and electric mobility is introducing fresh technical challenges and market opportunities for advanced tooling solutions. Overall, the dies and molds market is not only growing in volume but also evolving in sophistication, establishing itself as a cornerstone of future-ready manufacturing ecosystems.

SCOPE OF STUDY:

The report analyzes the Dies and Molds market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Type (Liquid Molds, Solid Molds, Dies); Application (Medical, Aerospace, Automotive, ICT, Consumer Goods, Other Applications)

Geographic Regions/Countries:

World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Select Competitors (Total 42 Featured) -

- ACE Mould

- Adval Tech Holding AG

- Arburg GmbH + Co KG

- DMG Mori Aktiengesellschaft

- Dongguan Sincere Tech

- Exco Technologies Limited

- Gentiger Machinery Industrial Co., Ltd.

- Husky Injection Molding Systems Ltd.

- Makino Milling Machine Co., Ltd.

- Meusburger Georg GmbH & Co KG

- Mold-Tech

- Pelco Tool and Mold

- PHB Inc.

- Plansee Group

- Plastikon Industries, Inc.

- SACMI Molds & Dies

- Schuler Group GmbH

- Sodick Co., Ltd.

- Stack Plastics, Inc.

- Xcentric Mold & Engineering

TARIFF IMPACT FACTOR

Our new release incorporates impact of tariffs on geographical markets as we predict a shift in competitiveness of companies based on HQ country, manufacturing base, exports and imports (finished goods and OEM). This intricate and multifaceted market reality will impact competitors by artificially increasing the COGS, reducing profitability, reconfiguring supply chains, amongst other micro and macro market dynamics.

We are diligently following expert opinions of leading Chief Economists (14,949), Think Tanks (62), Trade & Industry bodies (171) worldwide, as they assess impact and address new market realities for their ecosystems. Experts and economists from every major country are tracked for their opinions on tariffs and how they will impact their countries.

We expect this chaos to play out over the next 2-3 months and a new world order is established with more clarity. We are tracking these developments on a real time basis.

As we release this report, U.S. Trade Representatives are pushing their counterparts in 183 countries for an early closure to bilateral tariff negotiations. Most of the major trading partners also have initiated trade agreements with other key trading nations, outside of those in the works with the United States. We are tracking such secondary fallouts as supply chains shift.

To our valued clients, we say, we have your back. We will present a simplified market reassessment by incorporating these changes!

APRIL 2025: NEGOTIATION PHASE

Our April release addresses the impact of tariffs on the overall global market and presents market adjustments by geography. Our trajectories are based on historic data and evolving market impacting factors.

JULY 2025 FINAL TARIFF RESET

Complimentary Update: Our clients will also receive a complimentary update in July after a final reset is announced between nations. The final updated version incorporates clearly defined Tariff Impact Analyses.

Reciprocal and Bilateral Trade & Tariff Impact Analyses:

USA <> CHINA <> MEXICO <> CANADA <> EU <> JAPAN <> INDIA <> 176 OTHER COUNTRIES.

Leading Economists - Our knowledge base tracks 14,949 economists including a select group of most influential Chief Economists of nations, think tanks, trade and industry bodies, big enterprises, and domain experts who are sharing views on the fallout of this unprecedented paradigm shift in the global econometric landscape. Most of our 16,491+ reports have incorporated this two-stage release schedule based on milestones.

COMPLIMENTARY PREVIEW

Contact your sales agent to request an online 300+ page complimentary preview of this research project. Our preview will present full stack sources, and validated domain expert data transcripts. Deep dive into our interactive data-driven online platform.

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- Tariff Impact on Global Supply Chain Patterns

- Dies and Molds - Global Key Competitors Percentage Market Share in 2025 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2025 (E)

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Growth in Automotive and Industrial Manufacturing Throws the Spotlight on Precision Die and Mold Solutions

- Push Toward Lightweight and Complex Components Fuels Demand for High-Performance Tooling Materials

- Growth of Injection Molding in Consumer Electronics Supports Market for Micro-Tolerance Mold Designs

- Expansion of EV Battery and Housing Components Propels Use of Custom Stamping and Forming Dies

- Rising Need for Shorter Product Development Cycles Accelerates Adoption of Digital Mold Flow Simulation

- Technological Advances in CNC and EDM Machining Enhance Accuracy and Reproducibility in Die Making

- Integration with AM and Hybrid Manufacturing Enables Custom Inserts and Tooling for Small Batch Runs

- Shift Toward Modular Mold Bases and Interchangeable Cavities Drives Efficiency in High-Mix Production

- Increased Use of Hot Runners and Conformal Cooling Technologies Enhances Cycle Times and Product Quality

- Regional Expansion of Mold Makers in Asia-Pacific Strengthens Global Supply Chain Accessibility

- Automotive Safety and Lightweighting Regulations Accelerate Demand for Precision Tooling in Metal Forming

- Rising Complexity in Packaging and Medical Devices Supports Demand for Micro-Mold and High-Gloss Finishes

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Dies and Molds Market Analysis of Annual Sales in US$ Thousand for Years 2015 through 2030

- TABLE 2: World Recent Past, Current & Future Analysis for Dies and Molds by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 3: World Historic Review for Dies and Molds by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 4: World 15-Year Perspective for Dies and Molds by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets for Years 2015, 2025 & 2030

- TABLE 5: World Recent Past, Current & Future Analysis for Liquid Molds by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 6: World Historic Review for Liquid Molds by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 7: World 15-Year Perspective for Liquid Molds by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 8: World Recent Past, Current & Future Analysis for Solid Molds by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 9: World Historic Review for Solid Molds by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 10: World 15-Year Perspective for Solid Molds by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 11: World Recent Past, Current & Future Analysis for Dies by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 12: World Historic Review for Dies by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 13: World 15-Year Perspective for Dies by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 14: World Recent Past, Current & Future Analysis for Medical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 15: World Historic Review for Medical by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 16: World 15-Year Perspective for Medical by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 17: World Recent Past, Current & Future Analysis for Aerospace by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 18: World Historic Review for Aerospace by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 19: World 15-Year Perspective for Aerospace by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 20: World Recent Past, Current & Future Analysis for Automotive by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 21: World Historic Review for Automotive by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 22: World 15-Year Perspective for Automotive by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 23: World Recent Past, Current & Future Analysis for ICT by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 24: World Historic Review for ICT by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 25: World 15-Year Perspective for ICT by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 26: World Recent Past, Current & Future Analysis for Consumer Goods by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 27: World Historic Review for Consumer Goods by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 28: World 15-Year Perspective for Consumer Goods by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

- TABLE 29: World Recent Past, Current & Future Analysis for Other Applications by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 30: World Historic Review for Other Applications by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 31: World 15-Year Perspective for Other Applications by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific, Latin America, Middle East and Africa for Years 2015, 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 32: USA Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 33: USA Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 34: USA 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 35: USA Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 36: USA Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 37: USA 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- CANADA

- TABLE 38: Canada Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 39: Canada Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 40: Canada 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 41: Canada Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 42: Canada Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 43: Canada 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- JAPAN

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 44: Japan Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 45: Japan Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 46: Japan 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 47: Japan Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 48: Japan Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 49: Japan 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- CHINA

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 50: China Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 51: China Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 52: China 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 53: China Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 54: China Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 55: China 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- EUROPE

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 56: Europe Recent Past, Current & Future Analysis for Dies and Molds by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 57: Europe Historic Review for Dies and Molds by Geographic Region - France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 58: Europe 15-Year Perspective for Dies and Molds by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK, Spain, Russia and Rest of Europe Markets for Years 2015, 2025 & 2030

- TABLE 59: Europe Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 60: Europe Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 61: Europe 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 62: Europe Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 63: Europe Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 64: Europe 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- FRANCE

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 65: France Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 66: France Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 67: France 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 68: France Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 69: France Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 70: France 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- GERMANY

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 71: Germany Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 72: Germany Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 73: Germany 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 74: Germany Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 75: Germany Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 76: Germany 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- ITALY

- TABLE 77: Italy Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 78: Italy Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 79: Italy 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 80: Italy Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 81: Italy Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 82: Italy 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- UNITED KINGDOM

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 83: UK Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 84: UK Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 85: UK 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 86: UK Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 87: UK Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 88: UK 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- SPAIN

- TABLE 89: Spain Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 90: Spain Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 91: Spain 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 92: Spain Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 93: Spain Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 94: Spain 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- RUSSIA

- TABLE 95: Russia Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 96: Russia Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 97: Russia 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 98: Russia Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 99: Russia Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 100: Russia 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- REST OF EUROPE

- TABLE 101: Rest of Europe Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 102: Rest of Europe Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 103: Rest of Europe 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 104: Rest of Europe Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 105: Rest of Europe Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 106: Rest of Europe 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- ASIA-PACIFIC

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 107: Asia-Pacific Recent Past, Current & Future Analysis for Dies and Molds by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 108: Asia-Pacific Historic Review for Dies and Molds by Geographic Region - Australia, India, South Korea and Rest of Asia-Pacific Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 109: Asia-Pacific 15-Year Perspective for Dies and Molds by Geographic Region - Percentage Breakdown of Value Sales for Australia, India, South Korea and Rest of Asia-Pacific Markets for Years 2015, 2025 & 2030

- TABLE 110: Asia-Pacific Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 111: Asia-Pacific Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 112: Asia-Pacific 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 113: Asia-Pacific Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 114: Asia-Pacific Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 115: Asia-Pacific 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- AUSTRALIA

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Australia for 2025 (E)

- TABLE 116: Australia Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 117: Australia Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 118: Australia 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 119: Australia Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 120: Australia Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 121: Australia 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- INDIA

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in India for 2025 (E)

- TABLE 122: India Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 123: India Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 124: India 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 125: India Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 126: India Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 127: India 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- SOUTH KOREA

- TABLE 128: South Korea Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 129: South Korea Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 130: South Korea 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 131: South Korea Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 132: South Korea Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 133: South Korea 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- REST OF ASIA-PACIFIC

- TABLE 134: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 135: Rest of Asia-Pacific Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 136: Rest of Asia-Pacific 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 137: Rest of Asia-Pacific Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 138: Rest of Asia-Pacific Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 139: Rest of Asia-Pacific 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- LATIN AMERICA

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Latin America for 2025 (E)

- TABLE 140: Latin America Recent Past, Current & Future Analysis for Dies and Molds by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 141: Latin America Historic Review for Dies and Molds by Geographic Region - Argentina, Brazil, Mexico and Rest of Latin America Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 142: Latin America 15-Year Perspective for Dies and Molds by Geographic Region - Percentage Breakdown of Value Sales for Argentina, Brazil, Mexico and Rest of Latin America Markets for Years 2015, 2025 & 2030

- TABLE 143: Latin America Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 144: Latin America Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 145: Latin America 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 146: Latin America Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 147: Latin America Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 148: Latin America 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- ARGENTINA

- TABLE 149: Argentina Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 150: Argentina Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 151: Argentina 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 152: Argentina Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 153: Argentina Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 154: Argentina 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- BRAZIL

- TABLE 155: Brazil Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 156: Brazil Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 157: Brazil 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 158: Brazil Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 159: Brazil Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 160: Brazil 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- MEXICO

- TABLE 161: Mexico Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 162: Mexico Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 163: Mexico 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 164: Mexico Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 165: Mexico Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 166: Mexico 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- REST OF LATIN AMERICA

- TABLE 167: Rest of Latin America Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 168: Rest of Latin America Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 169: Rest of Latin America 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 170: Rest of Latin America Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 171: Rest of Latin America Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 172: Rest of Latin America 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- MIDDLE EAST

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Middle East for 2025 (E)

- TABLE 173: Middle East Recent Past, Current & Future Analysis for Dies and Molds by Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2024 through 2030 and % CAGR

- TABLE 174: Middle East Historic Review for Dies and Molds by Geographic Region - Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 175: Middle East 15-Year Perspective for Dies and Molds by Geographic Region - Percentage Breakdown of Value Sales for Iran, Israel, Saudi Arabia, UAE and Rest of Middle East Markets for Years 2015, 2025 & 2030

- TABLE 176: Middle East Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 177: Middle East Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 178: Middle East 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 179: Middle East Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 180: Middle East Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 181: Middle East 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- IRAN

- TABLE 182: Iran Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 183: Iran Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 184: Iran 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 185: Iran Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 186: Iran Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 187: Iran 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- ISRAEL

- TABLE 188: Israel Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 189: Israel Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 190: Israel 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 191: Israel Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 192: Israel Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 193: Israel 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- SAUDI ARABIA

- TABLE 194: Saudi Arabia Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 195: Saudi Arabia Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 196: Saudi Arabia 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 197: Saudi Arabia Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 198: Saudi Arabia Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 199: Saudi Arabia 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- UNITED ARAB EMIRATES

- TABLE 200: UAE Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 201: UAE Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 202: UAE 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 203: UAE Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 204: UAE Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 205: UAE 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- REST OF MIDDLE EAST

- TABLE 206: Rest of Middle East Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 207: Rest of Middle East Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 208: Rest of Middle East 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 209: Rest of Middle East Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 210: Rest of Middle East Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 211: Rest of Middle East 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030

- AFRICA

- Dies and Molds Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Africa for 2025 (E)

- TABLE 212: Africa Recent Past, Current & Future Analysis for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 213: Africa Historic Review for Dies and Molds by Type - Liquid Molds, Solid Molds and Dies Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 214: Africa 15-Year Perspective for Dies and Molds by Type - Percentage Breakdown of Value Sales for Liquid Molds, Solid Molds and Dies for the Years 2015, 2025 & 2030

- TABLE 215: Africa Recent Past, Current & Future Analysis for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications - Independent Analysis of Annual Sales in US$ Thousand for the Years 2024 through 2030 and % CAGR

- TABLE 216: Africa Historic Review for Dies and Molds by Application - Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications Markets - Independent Analysis of Annual Sales in US$ Thousand for Years 2015 through 2023 and % CAGR

- TABLE 217: Africa 15-Year Perspective for Dies and Molds by Application - Percentage Breakdown of Value Sales for Medical, Aerospace, Automotive, ICT, Consumer Goods and Other Applications for the Years 2015, 2025 & 2030