|

|

市場調査レポート

商品コード

1644145

四輪駆動(4WD)車の世界市場Four Wheel Drive (4WD) Vehicles |

||||||

適宜更新あり

|

|||||||

| 四輪駆動(4WD)車の世界市場 |

|

出版日: 2025年01月27日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 136 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

四輪駆動(4WD)車の世界市場は2030年までに5,649億米ドルに達する見込み

2024年に4,727億米ドルと推定された四輪駆動(4WD)車の世界市場は、2024年から2030年にかけてCAGR 3.0%で成長し、2030年には5,649億米ドルに達すると予測されます。本レポートで分析したセグメントのひとつであるSUVとクロスオーバーは、CAGR 3.3%を記録し、分析期間終了時には2,884億米ドルに達すると予測されます。ピックアップトラックセグメントの成長率は、分析期間中CAGR 2.9%と推定されます。

米国市場は推定1,248億米ドル、中国はCAGR 2.9%で成長予測

米国の四輪駆動(4WD)車市場は、2024年に1,248億米ドルと推定されます。世界第2位の経済大国である中国は、2030年までに910億米ドルの市場規模に達すると予測され、分析期間2024-2030年のCAGRは2.9%です。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ2.9%と2.5%と予測されています。欧州では、ドイツがCAGR 2.7%で成長すると予測されています。

世界の四輪駆動(4WD)車市場- 主要動向と促進要因のまとめ

なぜ四輪駆動(4WD)車の人気が高まっているのか?

四輪駆動(4WD)車は、オフロード性能の向上と優れたトラクションにより、近年大きな人気を博しています。四輪駆動(4WD)車は、4つの車輪に同時にパワーを配分するため、悪天候や悪路での走行に適しています。伝統的にオフロード愛好家や地方に住む人々に支持されてきた4WD車だが、都市部の消費者がその多用途性と信頼性を認識するにつれ、主流市場に参入してきました。4WDモデルにおけるADAS(先進運転支援システム)や統合技術の登場が、需要をさらに促進しています。また、自動車メーカー各社は、環境意識の高い購買層にアピールするため、より燃費が良く、環境に優しい4WD車を投入し、商品ラインアップを拡大しています。雪や泥、岩だらけの景色を走破するユニークな能力を持つ4WD車は、冒険を求める人や予測不可能な気候の地域のドライバーにとって必需品となっています。

四輪駆動(4WD)市場を牽引しているのはどのセグメントか?

車種にはSUV、トラック、高級車があり、中でもSUVは家族連れや若い社会人の間で人気が高まっているため、市場を独占しています。ピックアップトラックも重要なセグメントであり、特に北米では仕事とレジャーの両方の目的で重宝されています。ドライブトレイン技術には、ドライバーが2輪と4輪のモードを切り替えられるパートタイム4WDと、全輪を連続的に駆動するフルタイム4WDがあります。パートタイム4WDシステムは燃費の良さで好まれ、フルタイム4WDシステムは安定性とコントロール性を高めています。用途は、オフロード・アドベンチャーからユーティリティ、緊急サービスまで多岐にわたる。アドベンチャー・ツーリズムの需要の高まりとレクリエーション活動の増加が、オフロード対応車の市場をさらに押し上げています。

4WD技術の新たな動向とは?

いくつかの技術的進歩と市場動向が、4WD車業界を再構築しています。4WDシステムにおけるハイブリッドおよび電気ドライブトレインの統合は、環境に優しい車への需要の高まりに対応する重要な動向です。自動車メーカーは、二酸化炭素排出量を削減しながら、従来の自動車と同じ頑丈な性能を提供する電動4WDモデルを開発しています。もうひとつの動向は、耐久性を損なうことなく車両の燃費を向上させるために、アルミニウムや高強度鋼などの軽量素材を使用することです。先進的なトラクションコントロールシステムやトルクベクタリング技術も、車両の安定性と安全性を高めるために統合されつつあります。予測メンテナンスや地形対応システムにおけるAIや機械学習の活用は、ドライバーと4WD車の関わり方を変え、オフロード走行をより安全で直感的なものにします。さらに、スマート・インフォテインメント・システムと接続機能の台頭により、4WD車は技術に精通した消費者にとってより魅力的なものとなっています。

四輪駆動(4WD)車市場の成長を促進する要因とは?

4WD車市場の成長は、ドライブトレイン技術の進歩、SUVに対する消費者の嗜好の高まり、アドベンチャー・ツーリズムの拡大など、いくつかの要因によって牽引されています。主な要因のひとつは、市街地とオフロードの両方の環境で優れた性能を発揮する多用途車に対する需要の高まりです。また、4WD車は安定性と制御性が向上するため、安全機能に対する意識の高まりも市場成長に寄与しています。ハイブリッドや電動4WDモデルの開発などの技術革新により、4WD車は環境意識の高い購買層にとってより魅力的なものとなっています。冒険と探検を求める世界の動向に後押しされたアウトドア・レクリエーション活動の急増が、オフロード対応車の販売をさらに押し上げています。さらに、建設・農業部門は引き続き4WDトラックやユーティリティ・ビークルに大きく依存しており、これらの業界の需要を牽引しています。最後に、よりクリーンで効率的な自動車に対する政府の優遇措置が、自動車メーカーに先進4WD技術への投資を促しています。

セグメント

タイプ別(SUVおよびクロスオーバー,ピックアップトラック,プレミアムおよび高級セダン)

調査対象企業の例(全49件)

- BMW Group(Bayerische Motoren Werke AG)

- Force Motors Ltd.

- Ford Motor Co.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Jaguar Land Rover Automotive PLC

- Mahindra & Mahindra Ltd.

- Mitsubishi Motors Corporation

- Toyota Motor Corporation

- Volkswagen AG

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- その他欧州

- アジア太平洋

- その他の地域

第4章 競合

Global Four Wheel Drive (4WD) Vehicles Market to Reach US$564.9 Billion by 2030

The global market for Four Wheel Drive (4WD) Vehicles estimated at US$472.7 Billion in the year 2024, is expected to reach US$564.9 Billion by 2030, growing at a CAGR of 3.0% over the analysis period 2024-2030. SUVs & Crossovers, one of the segments analyzed in the report, is expected to record a 3.3% CAGR and reach US$288.4 Billion by the end of the analysis period. Growth in the Pickup Trucks segment is estimated at 2.9% CAGR over the analysis period.

The U.S. Market is Estimated at US$124.8 Billion While China is Forecast to Grow at 2.9% CAGR

The Four Wheel Drive (4WD) Vehicles market in the U.S. is estimated at US$124.8 Billion in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$91.0 Billion by the year 2030 trailing a CAGR of 2.9% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 2.9% and 2.5% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 2.7% CAGR.

Global Four Wheel Drive (4WD) Vehicles Market - Key Trends and Drivers Summarized

Why Are Four Wheel Drive (4WD) Vehicles Becoming More Popular?

Four Wheel Drive (4WD) vehicles have gained significant popularity in recent years, thanks to their enhanced off-road capabilities and superior traction. These vehicles distribute power to all four wheels simultaneously, making them ideal for challenging terrains and adverse weather conditions. While traditionally favored by off-road enthusiasts and those living in rural areas, 4WD vehicles have entered mainstream markets as urban consumers recognize their versatility and reliability. The advent of advanced driver-assistance systems (ADAS) and integrated technologies in 4WD models has further fueled demand. Automakers are also expanding their offerings, introducing more fuel-efficient and eco-friendly 4WD vehicles to appeal to environmentally conscious buyers. With their unique ability to navigate snow, mud, and rocky landscapes, 4WD vehicles have become a must-have for adventure seekers and drivers in unpredictable climates.

Which Segments Are Driving the Four Wheel Drive (4WD) Market?

Vehicle types include SUVs, trucks, and luxury vehicles, with SUVs dominating the market due to their rising popularity among families and young professionals. Pickup trucks are also a significant segment, especially in North America, where they are valued for both work and leisure purposes. Drivetrain technologies vary between part-time 4WD, which allows drivers to switch between two-wheel and four-wheel modes, and full-time 4WD, which continuously powers all wheels. Part-time 4WD systems are preferred for their fuel efficiency, while full-time 4WD systems offer enhanced stability and control. Applications range from off-road adventures to utility and emergency services. The growing demand for adventure tourism and the rise in recreational activities have further propelled the market for off-road-capable vehicles.

What Are the Emerging Trends in 4WD Technology?

Several technological advancements and market trends are reshaping the 4WD vehicle industry. The integration of hybrid and electric drivetrains in 4WD systems is a significant trend, addressing the growing demand for eco-friendly vehicles. Automakers are developing electric 4WD models that offer the same rugged performance as traditional vehicles while reducing carbon emissions. Another trend is the use of lightweight materials, such as aluminum and high-strength steel, to improve vehicle fuel efficiency without compromising durability. Advanced traction control systems and torque vectoring technologies are also being integrated to enhance vehicle stability and safety. The use of AI and machine learning in predictive maintenance and terrain response systems is transforming how drivers interact with 4WD vehicles, making off-roading safer and more intuitive. Furthermore, the rise of smart infotainment systems and connectivity features has made 4WD vehicles more appealing to tech-savvy consumers.

What Factors Are Driving the Growth in the Four Wheel Drive (4WD) Vehicles Market?

The growth in the 4WD vehicle market is driven by several factors, including advancements in drivetrain technology, increasing consumer preference for SUVs, and the expansion of adventure tourism. One of the main drivers is the growing demand for versatile vehicles that can perform well in both urban and off-road environments. The rising awareness of safety features has also contributed to market growth, as 4WD vehicles offer enhanced stability and control. Technological innovations, such as the development of hybrid and electric 4WD models, have made these vehicles more attractive to eco-conscious buyers. The surge in outdoor recreational activities, fueled by a global trend toward adventure and exploration, has further boosted sales of off-road-capable vehicles. Additionally, the construction and agriculture sectors continue to rely heavily on 4WD trucks and utility vehicles, driving demand in these industries. Lastly, government incentives for cleaner and more efficient vehicles have encouraged automakers to invest in advanced 4WD technologies.

SCOPE OF STUDY:

The report analyzes the Four Wheel Drive (4WD) Vehicles market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Type (SUVs & Crossovers, Pickup Trucks, Premium & Luxury Sedans)

Geographic Regions/Countries:

World; USA; Canada; Japan; China; Europe; France; Germany; Italy; UK; Rest of Europe; Asia-Pacific; Rest of World.

Select Competitors (Total 49 Featured) -

- BMW Group (Bayerische Motoren Werke AG)

- Force Motors Ltd.

- Ford Motor Co.

- Hyundai Motor Company

- Isuzu Motors Ltd.

- Jaguar Land Rover Automotive PLC

- Mahindra & Mahindra Ltd.

- Mitsubishi Motors Corporation

- Toyota Motor Corporation

- Volkswagen AG

TABLE OF CONTENTS

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- Economic Frontiers: Trends, Trials & Transformations

- Four Wheel Drive (4WD) Vehicles - Global Key Competitors Percentage Market Share in 2024 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2024 (E)

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- Rising Demand for Off-Road Adventures Propels Market Growth

- Growing Popularity of SUVs and Crossover Vehicles Expands Addressable Market

- Focus on Improved Traction and Vehicle Stability Drives Adoption of 4WD Technology

- Advancements in 4WD Systems Strengthen Business Case for Automotive Innovation

- Impact of Electrification on 4WD Systems Spurs Innovation in Hybrid and Electric Models

- Increasing Urbanization and Demand for Versatile Vehicles Accelerates Adoption

- Integration of Advanced Driver Assistance Systems (ADAS) Sustains Market Momentum

- Focus on Fuel Efficiency and Reduced Emissions Shapes Market Dynamics

- Increasing Usage of 4WD Vehicles in Commercial and Agricultural Sectors Spurs Demand

- Impact of Harsh Weather Conditions in Certain Regions Boosts Adoption

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Four Wheel Drive (4WD) Vehicles Market Analysis of Annual Sales in US$ Million for Years 2015 through 2030

- TABLE 2: World Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 3: World Historic Review for Four Wheel Drive (4WD) Vehicles by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

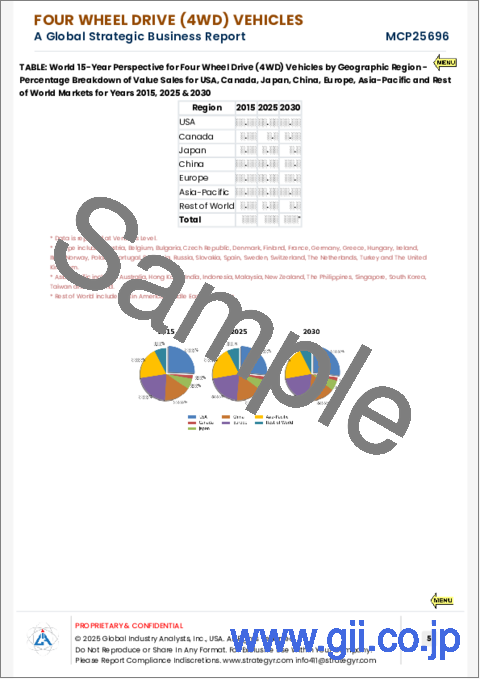

- TABLE 4: World 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets for Years 2015, 2025 & 2030

- TABLE 5: World Recent Past, Current & Future Analysis for SUVs & Crossovers by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 6: World Historic Review for SUVs & Crossovers by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 7: World 15-Year Perspective for SUVs & Crossovers by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2015, 2025 & 2030

- TABLE 8: World Recent Past, Current & Future Analysis for Pickup Trucks by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 9: World Historic Review for Pickup Trucks by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 10: World 15-Year Perspective for Pickup Trucks by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2015, 2025 & 2030

- TABLE 11: World Recent Past, Current & Future Analysis for Premium & Luxury Sedans by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 12: World Historic Review for Premium & Luxury Sedans by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 13: World 15-Year Perspective for Premium & Luxury Sedans by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2015, 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 14: USA Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 15: USA Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 16: USA 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- CANADA

- TABLE 17: Canada Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 18: Canada Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 19: Canada 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- JAPAN

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 20: Japan Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 21: Japan Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 22: Japan 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- CHINA

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 23: China Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 24: China Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 25: China 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- EUROPE

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 26: Europe Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

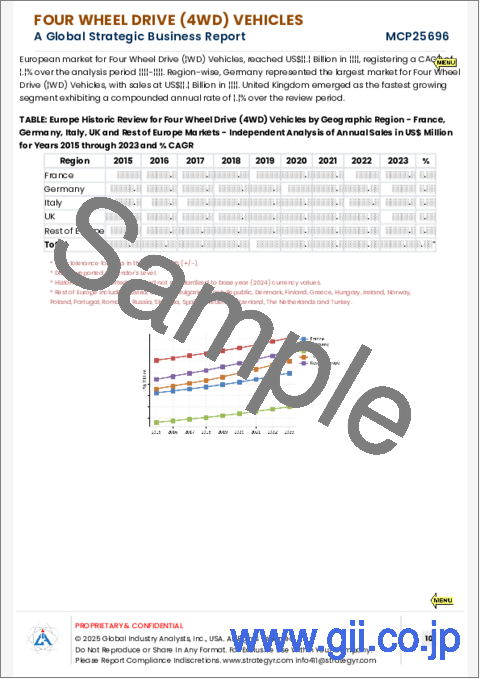

- TABLE 27: Europe Historic Review for Four Wheel Drive (4WD) Vehicles by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 28: Europe 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK and Rest of Europe Markets for Years 2015, 2025 & 2030

- TABLE 29: Europe Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 30: Europe Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 31: Europe 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- FRANCE

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 32: France Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 33: France Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 34: France 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- GERMANY

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 35: Germany Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 36: Germany Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 37: Germany 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- ITALY

- TABLE 38: Italy Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 39: Italy Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 40: Italy 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- UNITED KINGDOM

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 41: UK Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 42: UK Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 43: UK 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- REST OF EUROPE

- TABLE 44: Rest of Europe Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 45: Rest of Europe Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 46: Rest of Europe 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- ASIA-PACIFIC

- Four Wheel Drive (4WD) Vehicles Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 47: Asia-Pacific Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 48: Asia-Pacific Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 49: Asia-Pacific 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030

- REST OF WORLD

- TABLE 50: Rest of World Recent Past, Current & Future Analysis for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 51: Rest of World Historic Review for Four Wheel Drive (4WD) Vehicles by Type - SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans Markets - Independent Analysis of Annual Sales in US$ Million for Years 2015 through 2023 and % CAGR

- TABLE 52: Rest of World 15-Year Perspective for Four Wheel Drive (4WD) Vehicles by Type - Percentage Breakdown of Value Sales for SUVs & Crossovers, Pickup Trucks and Premium & Luxury Sedans for the Years 2015, 2025 & 2030