|

|

市場調査レポート

商品コード

1643513

倉庫管理における人工知能の世界市場Artificial Intelligence in Warehousing |

||||||

適宜更新あり

|

|||||||

| 倉庫管理における人工知能の世界市場 |

|

出版日: 2025年01月27日

発行: Market Glass, Inc. (Formerly Global Industry Analysts, Inc.)

ページ情報: 英文 218 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

倉庫管理における人工知能の世界市場は2030年までに429億米ドルに達する見込み

2024年に114億米ドルと推定される倉庫管理における人工知能の世界市場は、2030年には429億米ドルに達し、分析期間2024-2030年のCAGRは24.8%で成長すると予測されます。本レポートで分析したセグメントの1つである倉庫ハードウェアにおけるAIは、CAGR 21.3%を記録し、分析期間終了時には174億米ドルに達すると予測されます。ウェアハウジングソフトウェアにおけるAIセグメントの成長率は、分析期間でCAGR 26.9%と推定されます。

米国市場は30億米ドルと推定、中国はCAGR23.7%で成長予測

米国の倉庫管理における人工知能市場は、2024年に30億米ドルと推定されます。世界第2位の経済大国である中国は、分析期間2024年から2030年にかけてCAGR23.7%で推移し、2030年には市場規模が66億米ドルに達すると予測されています。その他の注目すべき地域別市場としては、日本とカナダがあり、分析期間中のCAGRはそれぞれ22.2%と21.7%と予測されています。欧州では、ドイツがCAGR約17.4%で成長すると予測されています。

世界の倉庫管理における人工知能市場- 主要動向と促進要因まとめ

AIは倉庫業務をどのように変革するか?

人工知能(AI)は、プロセスの自動化、在庫管理の最適化、業務効率の改善によって倉庫業務に革命をもたらしています。従来、倉庫は手作業に大きく依存しており、非効率、エラー、プロセスの遅れにつながっていました。AIは、機械学習(ML)、ロボット工学、高度なデータ分析を活用して倉庫業務を合理化することで、こうした課題に対処します。

自動搬送車(AGV)やドローンなど、AIを搭載したロボティクスは、製品回収、在庫確認、オーダーピッキングなどの作業にますます使用されるようになっています。これらのロボットは倉庫内を自律的に移動し、スピードと精度を向上させるとともに、危険な作業や反復的な作業における人手の必要性を削減します。AIはまた、在庫レベルを予測し、製品需要の動向を特定し、在庫状況をリアルタイムで把握することで、在庫管理を強化します。この機能により、倉庫が最適なキャパシティで稼働し、過剰在庫や在庫切れの可能性を減らすことができます。

自動化にとどまらず、AIは過去のデータや市場動向を分析することで、サプライチェーンの予測を最適化しています。これにより、倉庫は需要の急増、季節変動、サプライチェーンの混乱などを予測し、必要なときに確実に製品を供給できるようになります。AIはまた、倉庫レイアウトの非効率性を特定し、より良い整理整頓とスムーズなワークフローを可能にすることで、納期の短縮と運用コストの削減を実現します。

倉庫管理におけるAI導入の原動力とは?

業務効率化とコスト削減のニーズの高まりが、倉庫業におけるAI導入の大きな原動力となっています。世界サプライチェーンが複雑化し、顧客の期待が高まるにつれ、倉庫は効率を改善し、エラーを減らし、フルフィルメント時間を短縮する必要があります。予測分析、ロボット工学、リアルタイムデータ処理などのAI技術は、業務の合理化、ワークフローの最適化、生産性の向上に必要なツールを提供します。

eコマースの台頭と配送時間の短縮に対する需要も、倉庫管理におけるAIの導入に拍車をかけています。オンラインショッピングの増加と迅速な注文処理の必要性により、従来の倉庫管理のやり方では、顧客が求めるスピードと正確性を満たすにはもはや十分ではありません。AIソリューションは、倉庫が大量の注文をより効率的に管理し、迅速なピッキング、梱包、出荷を可能にします。AIはまた、商品のリアルタイム追跡を促進し、倉庫が顧客に分刻みの最新情報を提供し、サプライチェーンの可視性を向上させることを保証しています。

さらに、AIを活用した倉庫管理システムは、時間のかかる労働集約的な作業を自動化することで、人件費の削減にも貢献しています。特にロジスティクスやeコマースのような分野では、人件費の上昇や労働力不足が問題となっており、AIソリューションは、運用コストを大幅に増加させることなく効率性を維持したい企業にとって魅力的な選択肢となっています。

AIは倉庫管理の精度とスピードを改善できるか?

AIは倉庫管理の精度とスピードを飛躍的に向上させ、現代のサプライチェーン・マネジメントの要となっています。最も大きな進歩のひとつは、オーダーピッキングにおけるAIの活用です。AIを搭載したロボットは、リアルタイムの在庫データに基づいて迅速に商品を探し出し、取り出すことができるため、人的ミスを減らし、注文処理プロセスをスピードアップすることができます。これらのロボットは、高度なビジョンシステム、機械学習アルゴリズム、センサーを使用して倉庫をナビゲートし、広いスペースや無秩序なスペースでも高い精度で商品を特定します。

AIはまた、ルーティングやタスクのスケジューリングを最適化することで、スピードアップにも貢献します。機械学習モデルを通じて、AIシステムは過去のデータから継続的に学習し、変化する状況に適応することで、ピッキングや梱包作業中に最も効率的な経路を確保することができます。これは時間の節約になるだけでなく、倉庫設備の消耗を減らし、最終的にはメンテナンス・コストの削減にもつながります。

さらに、AIは在庫管理の精度を向上させる。予測分析を使用することで、AIは需要とサプライチェーンのニーズを予測し、在庫レベルが最適に維持されるようにすることができます。これにより、倉庫は在庫切れや過剰在庫を回避することができ、売上損失や無駄な在庫の発生を防ぐことができます。また、AIを活用したシステムは在庫をリアルタイムで追跡できるため、可視性が向上し、在庫監査や補充時にエラーが発生する可能性が低くなります。

何が倉庫管理AI市場の成長を牽引しているのか?

倉庫管理における人工知能市場の成長は、ロジスティクスおよびサプライチェーン業界の進化するニーズを反映するいくつかの重要な要因によって牽引されています。eコマースの成長により、迅速かつ正確な注文処理に対する需要が高まっていることが、AI導入の大きな原動力となっています。顧客がより迅速な配送を期待する中、倉庫はオペレーションを最適化し、注文の迅速な処理を保証する技術を導入しなければならないです。AIは、労働集約的な作業を自動化し、倉庫のワークフローを改善することで、完璧なソリューションを提供します。

ロボット工学、機械学習、ビッグデータ分析における技術の進歩は、倉庫管理におけるAIの成長をさらに促進しています。これらの技術革新は、既存の倉庫インフラへのAI技術のシームレスな統合を可能にし、企業がAIソリューションを採用し、拡張することを容易にします。リアルタイムのデータ分析、予測分析、自律型ロボットにより、倉庫はこれまでにない効率性と精度で機能します。

倉庫管理・物流におけるコスト削減のニーズも、AIを活用したソリューションの成長を促す重要な要因のひとつです。企業が人件費の上昇や業務の最適化というプレッシャーに直面する中、AIは定型業務を自動化し意思決定を改善することで、費用対効果の高い代替手段を提供します。こうした利点は、シームレスなサプライチェーン管理に対する需要の高まりと相まって、倉庫におけるAIの急速な導入を後押ししています。

最後に、持続可能性を重視し、サプライチェーンが環境に与える影響を低減する傾向が強まっていることも、市場の成長に寄与しています。AIは、エネルギー使用を最適化し、廃棄物を削減し、倉庫内の資源配分を改善することができ、より広範な持続可能性目標や企業の社会的責任イニシアティブに合致します。これらの要因は、より良いパフォーマンス指標と顧客満足度向上のニーズと相まって、倉庫管理におけるAI市場の拡大を促進しています。

セグメント

コンポーネント(ハードウェアコンポーネント、ソフトウェアコンポーネント、サービスコンポーネント)、デプロイメント(クラウド導入モード、オンプレミス導入モード)、アプリケーション(オーダーピッキング&仕分けアプリケーション、在庫管理アプリケーション、予知保全アプリケーション、倉庫最適化アプリケーション、その他アプリケーション)、最終用途(小売&eコマース最終用途、物流&運輸最終用途、製造最終用途、飲食品最終用途、その他最終用途)

調査対象企業の例(全48件)

- ABB Ltd.

- Amazon Web Services, Inc.

- Google LLC

- Honeywell International, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Siemens AG

- Zebra Technologies Corporation

目次

第1章 調査手法

第2章 エグゼクティブサマリー

- 市場概要

- 主要企業

- 市場動向と促進要因

- 世界市場の見通し

第3章 市場分析

- 米国

- カナダ

- 日本

- 中国

- 欧州

- フランス

- ドイツ

- イタリア

- 英国

- その他欧州

- アジア太平洋

- その他の地域

第4章 競合

Global Artificial Intelligence in Warehousing Market to Reach US$42.9 Billion by 2030

The global market for Artificial Intelligence in Warehousing estimated at US$11.4 Billion in the year 2024, is expected to reach US$42.9 Billion by 2030, growing at a CAGR of 24.8% over the analysis period 2024-2030. AI in Warehousing Hardware, one of the segments analyzed in the report, is expected to record a 21.3% CAGR and reach US$17.4 Billion by the end of the analysis period. Growth in the AI in Warehousing Software segment is estimated at 26.9% CAGR over the analysis period.

The U.S. Market is Estimated at US$3.0 Billion While China is Forecast to Grow at 23.7% CAGR

The Artificial Intelligence in Warehousing market in the U.S. is estimated at US$3.0 Billion in the year 2024. China, the world's second largest economy, is forecast to reach a projected market size of US$6.6 Billion by the year 2030 trailing a CAGR of 23.7% over the analysis period 2024-2030. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at a CAGR of 22.2% and 21.7% respectively over the analysis period. Within Europe, Germany is forecast to grow at approximately 17.4% CAGR.

Global Artificial Intelligence in Warehousing Market - Key Trends & Drivers Summarized

How Is AI Transforming Warehousing Operations?

Artificial Intelligence (AI) is revolutionizing warehousing by automating processes, optimizing inventory management, and improving operational efficiency. Traditionally, warehouses relied heavily on manual labor, leading to inefficiencies, errors, and slow processes. AI addresses these challenges by utilizing machine learning (ML), robotics, and advanced data analytics to streamline warehouse operations.

AI-powered robotics, such as automated guided vehicles (AGVs) and drones, are increasingly used for tasks like product retrieval, inventory checking, and order picking. These robots can navigate warehouses autonomously, improving speed and accuracy while reducing the need for human labor in hazardous or repetitive tasks. AI also enhances inventory management by predicting stock levels, identifying trends in product demand, and providing real-time insights into inventory status. This capability ensures that warehouses operate at optimal capacity, reducing the chances of overstocking or stockouts.

Beyond automation, AI is optimizing supply chain forecasting by analyzing historical data and market trends. This allows warehouses to predict demand surges, seasonal fluctuations, and supply chain disruptions, ensuring that products are available when needed. AI can also identify inefficiencies in warehouse layouts, enabling better organization and smoother workflows, which results in faster turnaround times and reduced operational costs.

What Drives the Adoption of AI in Warehousing?

The growing need for operational efficiency and cost reduction is a major driver of AI adoption in warehousing. As global supply chains become more complex and customer expectations rise, warehouses must improve efficiency, reduce errors, and speed up fulfillment times. AI technologies, including predictive analytics, robotics, and real-time data processing, provide the tools needed to streamline operations, optimize workflows, and enhance productivity.

The rise of e-commerce and the demand for faster delivery times is also fueling the adoption of AI in warehousing. With the increase in online shopping and the need for rapid order fulfillment, traditional warehousing practices are no longer sufficient to meet the speed and accuracy required by customers. AI solutions help warehouses manage large volumes of orders more efficiently, allowing for quicker picking, packing, and shipping. AI is also facilitating real-time tracking of goods, which ensures that warehouses can provide up-to-the-minute updates to customers and improve supply chain visibility.

Moreover, AI-driven warehousing systems help reduce labor costs by automating time-consuming and labor-intensive tasks. With rising labor costs and labor shortages, particularly in sectors like logistics and e-commerce, AI solutions are an attractive alternative for businesses looking to maintain efficiency without significantly increasing operational expenses.

Can AI Improve Accuracy and Speed in Warehousing?

AI is dramatically improving both accuracy and speed in warehousing, making it a cornerstone of modern supply chain management. One of the most significant advancements is the use of AI in order picking. AI-powered robots can swiftly locate and retrieve items based on real-time inventory data, reducing human error and speeding up the order fulfillment process. These robots use advanced vision systems, machine learning algorithms, and sensors to navigate warehouses and identify products with high precision, even in large or disorganized spaces.

AI also contributes to speed by optimizing routing and task scheduling. Through machine learning models, AI systems can continuously learn from historical data and adapt to changing conditions, ensuring that the most efficient paths are taken during picking and packing operations. This not only saves time but also reduces wear and tear on warehouse equipment, ultimately lowering maintenance costs.

Furthermore, AI improves the accuracy of stock management. By using predictive analytics, AI can forecast demand and supply chain needs, ensuring that stock levels are maintained optimally. This helps warehouses avoid stockouts or overstocking, which could lead to lost sales or wasted inventory. AI-driven systems can also track inventory in real time, improving visibility and reducing the likelihood of errors during stock audits and replenishments.

What’s Driving the Growth of the AI in Warehousing Market?

The growth in the Artificial Intelligence in Warehousing market is driven by several key factors that reflect the evolving needs of the logistics and supply chain industries. The increasing demand for fast and accurate order fulfillment, driven by e-commerce growth, is a significant driver of AI adoption. As customers expect faster delivery times, warehouses must implement technologies that optimize operations and ensure swift processing of orders. AI offers the perfect solution by automating labor-intensive tasks and improving warehouse workflows.

Technological advancements in robotics, machine learning, and big data analytics are further fueling the growth of AI in warehousing. These innovations enable the seamless integration of AI technologies into existing warehouse infrastructure, making it easier for businesses to adopt and scale AI solutions. Real-time data analysis, predictive analytics, and autonomous robots allow warehouses to function with unprecedented efficiency and precision.

The need for cost reduction in warehousing and logistics is another key factor driving the growth of AI-powered solutions. As businesses face rising labor costs and the pressure to optimize operations, AI provides a cost-effective alternative by automating routine tasks and improving decision-making. These benefits, coupled with the growing demand for seamless supply chain management, are propelling the rapid adoption of AI in warehouses.

Finally, the increasing emphasis on sustainability and reducing the environmental impact of supply chains is contributing to the market’s growth. AI can optimize energy usage, reduce waste, and improve resource allocation within warehouses, aligning with broader sustainability goals and corporate social responsibility initiatives. These factors, combined with the need for better performance metrics and enhanced customer satisfaction, are driving the expansion of the AI in Warehousing market.

SCOPE OF STUDY:

The report analyzes the Artificial Intelligence in Warehousing market in terms of units by the following Segments, and Geographic Regions/Countries:

Segments:

Component (Hardware Component, Software Component, Services Component); Deployment (Cloud Deployment Mode, On-Premise Deployment Mode); Application (Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application, Warehouse Optimization Application, Other Applications); End-Use (Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use, Other End-Uses)

Geographic Regions/Countries:

World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Select Competitors (Total 48 Featured) -

- ABB Ltd.

- Amazon Web Services, Inc.

- Google LLC

- Honeywell International, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- SAP SE

- Siemens AG

- Zebra Technologies Corporation

TABLE OF CONTENTS

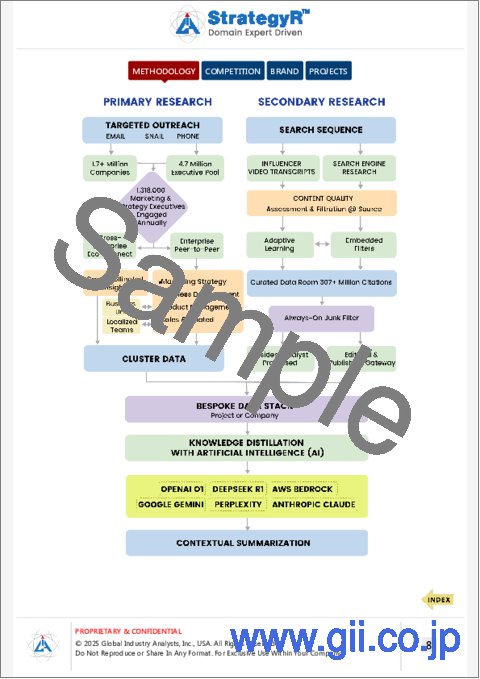

I. METHODOLOGY

II. EXECUTIVE SUMMARY

- 1. MARKET OVERVIEW

- Influencer Market Insights

- World Market Trajectories

- Economic Frontiers: Trends, Trials & Transformations

- Artificial Intelligence in Warehousing - Global Key Competitors Percentage Market Share in 2024 (E)

- Competitive Market Presence - Strong/Active/Niche/Trivial for Players Worldwide in 2024 (E)

- 2. FOCUS ON SELECT PLAYERS

- 3. MARKET TRENDS & DRIVERS

- AI-Powered Automation Spurs Growth in Smart Warehousing Solutions

- Integration of Robotics and AI Strengthens Business Case for Fully Automated Warehouses

- AI in Warehouse Energy Management Expands Opportunities for Sustainable Operations

- Demand for AI in Order Fulfillment Accelerates Adoption of Advanced Picking Systems

- AI in Warehouse Management Systems Strengthens Use Cases in Omnichannel Retail

- Emerging AI Tools for Supply Chain Analytics Set the Stage for Smarter Warehousing

- Growing E-Commerce Demand Spurs Innovations in AI-Driven Last-Mile Delivery

- AI in Cold Storage Logistics Strengthens Business Case for Precision Temperature Control

- Demand for Enhanced Order Accuracy Drives Adoption of AI in Warehousing

- Integration of AI in Reverse Logistics Expands Market for Returns Management

- AI in Warehouse Security Systems Bodes Well for Theft and Loss Prevention

- 4. GLOBAL MARKET PERSPECTIVE

- TABLE 1: World Artificial Intelligence in Warehousing Market Analysis of Annual Sales in US$ Million for Years 2015 through 2030

- TABLE 2: World Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 3: World 6-Year Perspective for Artificial Intelligence in Warehousing by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets for Years 2025 & 2030

- TABLE 4: World Recent Past, Current & Future Analysis for Hardware Component by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 5: World 6-Year Perspective for Hardware Component by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 6: World Recent Past, Current & Future Analysis for Software Component by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 7: World 6-Year Perspective for Software Component by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 8: World Recent Past, Current & Future Analysis for Services Component by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 9: World 6-Year Perspective for Services Component by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 10: World Recent Past, Current & Future Analysis for Other Applications by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 11: World 6-Year Perspective for Other Applications by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 12: World Recent Past, Current & Future Analysis for Order picking & Sorting Application by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 13: World 6-Year Perspective for Order picking & Sorting Application by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 14: World Recent Past, Current & Future Analysis for Inventory Management Application by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 15: World 6-Year Perspective for Inventory Management Application by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 16: World Recent Past, Current & Future Analysis for Predictive Maintenance Application by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 17: World 6-Year Perspective for Predictive Maintenance Application by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 18: World Recent Past, Current & Future Analysis for Warehouse Optimization Application by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 19: World 6-Year Perspective for Warehouse Optimization Application by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 20: World Recent Past, Current & Future Analysis for Retail & E-Commerce End-Use by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 21: World 6-Year Perspective for Retail & E-Commerce End-Use by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 22: World Recent Past, Current & Future Analysis for Logistics & Transportation End-Use by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 23: World 6-Year Perspective for Logistics & Transportation End-Use by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 24: World Recent Past, Current & Future Analysis for Manufacturing End-Use by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 25: World 6-Year Perspective for Manufacturing End-Use by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 26: World Recent Past, Current & Future Analysis for Food & Beverage End-Use by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 27: World 6-Year Perspective for Food & Beverage End-Use by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 28: World Recent Past, Current & Future Analysis for Other End-Uses by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 29: World 6-Year Perspective for Other End-Uses by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 30: World Recent Past, Current & Future Analysis for Cloud Deployment Mode by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 31: World 6-Year Perspective for Cloud Deployment Mode by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

- TABLE 32: World Recent Past, Current & Future Analysis for On-Premise Deployment Mode by Geographic Region - USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 33: World 6-Year Perspective for On-Premise Deployment Mode by Geographic Region - Percentage Breakdown of Value Sales for USA, Canada, Japan, China, Europe, Asia-Pacific and Rest of World for Years 2025 & 2030

III. MARKET ANALYSIS

- UNITED STATES

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United States for 2025 (E)

- TABLE 34: USA Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 35: USA 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 36: USA Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 37: USA 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 38: USA Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 39: USA 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 40: USA Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 41: USA 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- CANADA

- TABLE 42: Canada Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 43: Canada 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 44: Canada Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 45: Canada 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 46: Canada Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 47: Canada 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 48: Canada Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 49: Canada 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- JAPAN

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Japan for 2025 (E)

- TABLE 50: Japan Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 51: Japan 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 52: Japan Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 53: Japan 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 54: Japan Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 55: Japan 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 56: Japan Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 57: Japan 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- CHINA

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in China for 2025 (E)

- TABLE 58: China Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 59: China 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 60: China Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 61: China 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 62: China Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 63: China 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 64: China Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 65: China 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- EUROPE

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Europe for 2025 (E)

- TABLE 66: Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Geographic Region - France, Germany, Italy, UK and Rest of Europe Markets - Independent Analysis of Annual Sales in US$ Million for Years 2024 through 2030 and % CAGR

- TABLE 67: Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Geographic Region - Percentage Breakdown of Value Sales for France, Germany, Italy, UK and Rest of Europe Markets for Years 2025 & 2030

- TABLE 68: Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 69: Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 70: Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 71: Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 72: Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 73: Europe 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 74: Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 75: Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- FRANCE

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in France for 2025 (E)

- TABLE 76: France Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 77: France 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 78: France Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 79: France 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 80: France Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 81: France 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 82: France Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 83: France 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- GERMANY

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Germany for 2025 (E)

- TABLE 84: Germany Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 85: Germany 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 86: Germany Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 87: Germany 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 88: Germany Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 89: Germany 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 90: Germany Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 91: Germany 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- ITALY

- TABLE 92: Italy Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 93: Italy 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 94: Italy Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 95: Italy 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 96: Italy Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 97: Italy 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 98: Italy Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 99: Italy 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- UNITED KINGDOM

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in the United Kingdom for 2025 (E)

- TABLE 100: UK Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 101: UK 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 102: UK Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 103: UK 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 104: UK Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 105: UK 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 106: UK Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 107: UK 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- REST OF EUROPE

- TABLE 108: Rest of Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 109: Rest of Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 110: Rest of Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 111: Rest of Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 112: Rest of Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 113: Rest of Europe 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 114: Rest of Europe Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 115: Rest of Europe 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- ASIA-PACIFIC

- Artificial Intelligence in Warehousing Market Presence - Strong/Active/Niche/Trivial - Key Competitors in Asia-Pacific for 2025 (E)

- TABLE 116: Asia-Pacific Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 117: Asia-Pacific 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 118: Asia-Pacific Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 119: Asia-Pacific 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 120: Asia-Pacific Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 121: Asia-Pacific 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 122: Asia-Pacific Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 123: Asia-Pacific 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030

- REST OF WORLD

- TABLE 124: Rest of World Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Component - Hardware Component, Software Component and Services Component - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 125: Rest of World 6-Year Perspective for Artificial Intelligence in Warehousing by Component - Percentage Breakdown of Value Sales for Hardware Component, Software Component and Services Component for the Years 2025 & 2030

- TABLE 126: Rest of World Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Application - Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 127: Rest of World 6-Year Perspective for Artificial Intelligence in Warehousing by Application - Percentage Breakdown of Value Sales for Other Applications, Order picking & Sorting Application, Inventory Management Application, Predictive Maintenance Application and Warehouse Optimization Application for the Years 2025 & 2030

- TABLE 128: Rest of World Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by End-Use - Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 129: Rest of World 6-Year Perspective for Artificial Intelligence in Warehousing by End-Use - Percentage Breakdown of Value Sales for Retail & E-Commerce End-Use, Logistics & Transportation End-Use, Manufacturing End-Use, Food & Beverage End-Use and Other End-Uses for the Years 2025 & 2030

- TABLE 130: Rest of World Recent Past, Current & Future Analysis for Artificial Intelligence in Warehousing by Deployment - Cloud Deployment Mode and On-Premise Deployment Mode - Independent Analysis of Annual Sales in US$ Million for the Years 2024 through 2030 and % CAGR

- TABLE 131: Rest of World 6-Year Perspective for Artificial Intelligence in Warehousing by Deployment - Percentage Breakdown of Value Sales for Cloud Deployment Mode and On-Premise Deployment Mode for the Years 2025 & 2030