|

|

市場調査レポート

商品コード

1628020

建設機械レンタルの市場機会、成長促進要因、産業動向分析、2025年~2034年予測Construction Equipment Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| 建設機械レンタルの市場機会、成長促進要因、産業動向分析、2025年~2034年予測 |

|

出版日: 2024年11月15日

発行: Global Market Insights Inc.

ページ情報: 英文 175 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の建設機械レンタル市場は、2024年に1,474億米ドルと評価され、2025年から2034年にかけてCAGR 6.2%で成長すると予測されています。

建設機械の購入コストが高いことから、建設業者はより経済的で実用的なソリューションとしてレンタルやレンタルサービスを選ぶようになっています。土木機械、道路建設機械、マテリアルハンドリング機械などの設備には多額の値札が付いており、レンタルが魅力的な選択肢となっています。このシフトは、多くのレンタル業者がサービスの一環として提供している、職場の安全性向上を目的としたオペレータートレーニングプログラムによってさらに後押しされています。

米国やドイツなどの地域では、人件費の高騰と労働力不足が、機械所有の経済的負担に拍車をかけています。メーカー各社は収益性を維持するために機械の価格を引き上げており、民間建設会社にとっては購入が難しくなっています。自動ハンドリング、テレマティクス、運転支援など、機械の技術革新はさらにコストを上昇させ、企業は購入よりもレンタルを優先するようになっています。

先進的な建設機械のレンタルに対する世界の需要は、性能の向上と作業の迅速化という利点から増加傾向にあります。レンタル会社は、リアルタイムでの機械追跡を可能にする通信と情報工学を組み合わせたテレマティクスのような最先端技術の統合をますます進めています。GPSの統合やクラウドベースの接続といった機能により、作業効率と安全性が向上するため、これらのオプションは建設業者にとって非常に魅力的なものとなっています。

| 市場範囲 | |

|---|---|

| 開始年 | 2024 |

| 予測年 | 2025-2034 |

| 開始金額 | 1,474億米ドル |

| 予測金額 | 2,645億米ドル |

| CAGR | 6.2% |

2024年、バックホー分野のシェアは50%を占め、2034年までに763億米ドルを生み出すと予測されています。この成長の原動力は、道路建設や公共インフラプロジェクトの急速な開発です。より高い品質を実現するためのインフラ開発の機械化が、土木・道路建設機械のレンタル需要を促進しています。同様に、掘削機も住宅建設活動の増加により力強い成長を遂げており、レンタル市場において大きな機会を提供しています。

マテリアルハンドリングおよびクレーンのカテゴリーには、保管およびハンドリング機器、エンジニアリングシステム、産業用トラック、バルクマテリアルハンドリング機器が含まれます。2024年に45%のシェアを占めたバルクマテリアルハンドリング機器は、大規模なインフラプロジェクトを迅速化する役割を担っているため、需要が増加しています。大型商業ビルや超高層ビルの建設動向は、マテリアルハンドリングレンタルの採用を後押ししています。

2024年の世界市場は北米が35%のシェアでリード。米国は、建設活動の急増と大手レンタル業者の存在により、地域の成長を牽引しています。また、カナダでは観光関連のインフラ整備が進んでおり、市場拡大をさらに後押ししています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 業界洞察

- エコシステム分析

- 原材料サプライヤー

- 部品サプライヤー

- メーカー

- 技術プロバイダー

- 流通業者

- エンドユーザー

- サプライヤーの状況

- 利益率分析

- 技術とイノベーションの展望

- 特許分析

- 規制状況

- 価格分析

- バイヤーの行動と嗜好

- 影響要因

- 促進要因

- 新規建設機械の高コスト

- 北米で急成長する建設機械レンタル業界

- 技術的に高度な建設機械への高い需要

- 業界の潜在的リスク&課題

- アプリケーション産業の不安定性

- 熟練した資格のある設備オペレーターの不足

- 促進要因

- 成長可能性分析

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業シェア分析

- 競合のポジショニング・マトリックス

- 戦略展望マトリックス

第5章 市場推計・予測:製品別、2021年~2034年

- 主要動向

- 土木建設機械

- マテリアルハンドリング&クレーン

- コンクリート機器

第6章 市場推計・予測:土木・道路建設機械別、2021年~2034年

- 主要動向

- バックホー

- 掘削機

- ローダー

- 締固め装置

- その他

第7章 市場推計・予測:マテリアルハンドリング・クレーン別、2021年~2034年

- 主要動向

- 保管・ハンドリング機器

- 設計システム

- 産業用トラック

- バルクマテリアルハンドリング機器

第8章 市場推計・予測:コンクリート機器別、2021年~2034年

- 主要動向

- コンクリートポンプ

- 破砕機

- トランジットミキサー

- アスファルトペーバー

- バッチプラント

第9章 市場推計・予測:地域別、2021年~2034年

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ロシア

- 北欧

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 東南アジア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- サウジアラビア

第10章 企業プロファイル

- Aktio

- Al Faris Equipment Rental

- Ashtead

- Boels Rental

- Briggs Equipment

- Byrne Equipment Rental

- Caterpillar

- Cramo

- H&E Equipment Services

- Herc Holdings(Herc Rentals)

- Hinkel Equipment Rental

- Kanamoto

- Kiloutou SAS

- Liebherr-International

- Loxam

- Maxim Crane Works

- Mtandt Rentals

- Pekkaniska

- Sunstate Equipment(Sumitomo)

- United Rentals

The Global Construction Equipment Rental Market was valued at USD 147.4 billion in 2024 and is projected to grow at a CAGR of 6.2% from 2025 to 2034. The high cost of purchasing construction machinery is driving contractors to opt for rental and hiring services as a more economical and practical solution. Equipment such as earth-moving, road-building, and material-handling machines come with significant price tags, making rentals an attractive alternative. This shift is further supported by operator training programs aimed at improving workplace safety, which many rental providers offer as part of their services.

Rising labor costs and workforce shortages in regions like the U.S. and Germany are adding to the financial burden of machinery ownership. Manufacturers have been increasing equipment prices to sustain profitability, making outright purchases less feasible for private construction firms. Innovations in machinery, including automated handling, telematics, and driving assistance, further escalate costs, leading firms to prioritize renting over buying.

Global demand for advanced construction equipment rentals is on the rise due to the benefits of improved performance and faster operations. Rental companies are increasingly integrating cutting-edge technologies like telematics, which combines telecommunications and informatics to enable real-time machine tracking. Features such as GPS integration and cloud-based connectivity enhance operational efficiency and safety, making these options highly appealing to contractors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $147.4 Billion |

| Forecast Value | $264.5 Billion |

| CAGR | 6.2% |

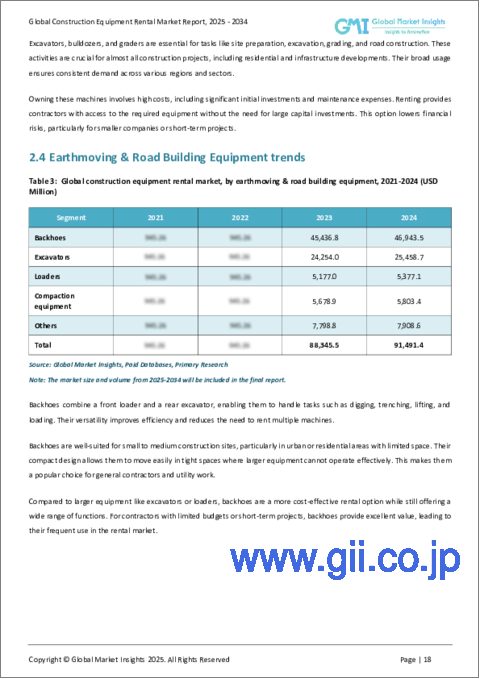

In 2024, the backhoes segment accounted for 50% share and is projected to generate USD 76.3 billion by 2034. This growth is fueled by rapid developments in road construction and public infrastructure projects. The mechanization of infrastructure development to achieve higher quality is driving demand for earth-moving and road-building equipment rentals. Similarly, excavators are witnessing strong growth due to rising residential construction activities, offering significant opportunities within the rental market.

The material handling and cranes category includes storage and handling equipment, engineered systems, industrial trucks, and bulk material handling equipment. Bulk material handling equipment, which held a 45% share in 2024, is seeing increasing demand due to its role in expediting large-scale infrastructure projects. The trend toward constructing large commercial buildings and skyscrapers boosts the adoption of material handling rentals.

North America led the global market in 2024, with 35% of the share. The U.S. drives regional growth due to a surge in construction activities and the presence of major rental providers. Additionally, growing tourism-related infrastructure development in Canada further supports market expansion.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Raw material suppliers

- 3.1.2 Component suppliers

- 3.1.3 Manufacturers

- 3.1.4 Technology providers

- 3.1.5 Distributors

- 3.1.6 End users

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Regulatory landscape

- 3.7 Pricing analysis

- 3.8 Buyer behavior and preferences

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 High cost of new construction equipment

- 3.9.1.2 Rapidly growing equipment rental industry in North America

- 3.9.1.3 High demand for technologically advanced construction equipment

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Instability of application industries

- 3.9.2.2 Lack of skilled and qualified equipment operators

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Earthmoving & road building equipment

- 5.3 Material handling & cranes

- 5.4 Concrete equipment

Chapter 6 Market Estimates & Forecast, By Earthmoving & Road Building Equipment, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Backhoes

- 6.3 Excavators

- 6.4 Loaders

- 6.5 Compaction equipment

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Material Handling and Cranes, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Storage & handling equipment

- 7.3 Engineered systems

- 7.4 Industrial trucks

- 7.5 Bulk material handling equipment

Chapter 8 Market Estimates & Forecast, By Concrete Equipment, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Concrete pumps

- 8.3 Crushers

- 8.4 Transit mixers

- 8.5 Asphalt pavers

- 8.6 Batching plants

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aktio

- 10.2 Al Faris Equipment Rental

- 10.3 Ashtead

- 10.4 Boels Rental

- 10.5 Briggs Equipment

- 10.6 Byrne Equipment Rental

- 10.7 Caterpillar

- 10.8 Cramo

- 10.9 H&E Equipment Services

- 10.10 Herc Holdings (Herc Rentals)

- 10.11 Hinkel Equipment Rental

- 10.12 Kanamoto

- 10.13 Kiloutou SAS

- 10.14 Liebherr-International

- 10.15 Loxam

- 10.16 Maxim Crane Works

- 10.17 Mtandt Rentals

- 10.18 Pekkaniska

- 10.19 Sunstate Equipment (Sumitomo)

- 10.20 United Rentals