|

|

市場調査レポート

商品コード

1667036

医療レーザー市場の機会、成長促進要因、産業動向分析、2025~2034年の予測Medical Laser Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| 医療レーザー市場の機会、成長促進要因、産業動向分析、2025~2034年の予測 |

|

出版日: 2024年12月18日

発行: Global Market Insights Inc.

ページ情報: 英文 135 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界の医療レーザー市場は2024年に61億米ドルに達し、2025年から2034年までのCAGRは17%という堅調な成長率を予測しています。

この顕著な拡大は、特に高度な医療処置がより身近で手頃なものになりつつある新興国での、美容治療に対する需要の増加と医療ツーリズムの増加によってもたらされています。ヘルスケアサービスが普及するにつれて、世界中の個人が一流の医療施設を利用するようになり、医療レーザーの人気の高まりに寄与しています。市場の軌跡は、レーザー治療の有効性と安全性を高める技術の進歩にも影響されています。非侵襲的で低侵襲的な処置が支持され続けるにつれて、医療レーザーは、皮膚の若返りから脱毛まで、幅広い治療に不可欠なものとなっています。この変化は、美的改善と個人の幸福を優先する文化的傾向を反映しています。

この市場成長の重要な促進要因は、非侵襲的で低侵襲の美容処置に対する消費者の意識の高まりです。より多くの患者が、従来の手術に代わる効果的で低リスクの選択肢を選ぶようになっており、医療レーザーが様々な治療に好ましい選択肢となっています。レーザー脱毛、タトゥー除去、スキンリサーフェシング、ボディコントゥアリングは、最も求められている施術の一つであり、最小限のダウンタイムと不快感で希望する外観を得ることができます。このような美容治療への嗜好の高まりは、ソーシャルメディアや世界の美容動向に後押しされた美の基準への注目の高まりと密接に結びついています。ヘルスケアプロバイダーは、患者の期待に応えるために最新のレーザー技術を採用することで、この需要に応えています。

| 市場範囲 | |

|---|---|

| 開始年 | 2024 |

| 予測年 | 2025-2034 |

| 開始金額 | 61億米ドル |

| 予測金額 | 278億米ドル |

| CAGR | 17% |

医療レーザー市場は、固体レーザー、ガスレーザー、色素レーザー、ダイオードレーザーなどいくつかのセグメントに分けられます。これらの中でダイオードレーザは、2024年に市場をリードし、19億米ドルの印象的な収益を生み出しました。その人気は、コンパクト設計、エネルギー効率、治療と美容の両方のアプリケーションへの適応性に起因するところが大きいです。ダイオードレーザはコスト効率が高く、ヘルスケアプロバイダに脱毛や血管処置を含む様々な治療に使用できる予算に優しいソリューションを提供します。この手頃な価格により、ダイオードレーザーは、特に外来診療所や小規模な医療現場で広く利用できるようになり、医療や美容の幅広い用途で広く採用されるようになりました。

2024年、皮膚科が医療レーザー市場を独占し、最大のシェアは皮膚疾患の治療におけるレーザーの精度と有効性に起因します。医療レーザーは、瘢痕縮小、色素沈着補正、皮膚の若返りなどの処置に非常に効果的であり、副次的な組織損傷を最小限に抑えてターゲットを絞った治療を提供します。スキンケアや外見に対する意識が高まるにつれ、レーザーを用いた皮膚科治療に対する需要が急増しています。この動向は特に、美容処置に対する意識の高まりと、ソーシャルメディアが美の理想に与えた影響に影響されています。

米国の医療レーザー市場は、低侵襲の美容治療への強い嗜好によって、2024年に24億米ドルを生み出しました。同国の確立されたヘルスケアインフラは、皮膚科や眼科を含む様々な専門分野での高度なレーザー技術の普及を支えています。業界大手による絶え間ない技術革新は、医療レーザーの性能とアクセシビリティをさらに高め、米国を世界市場の主要貢献国として確固たるものにしています。継続的な進歩と患者の需要の増加により、米国は医療レーザー業界の最前線に位置しています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 業界洞察

- エコシステム分析

- 業界への影響要因

- 促進要因

- 低侵襲手術に対する需要の高まり

- 医療レーザーシステムの技術進歩

- 美容治療に対する需要の増加

- 新興諸国における医療ツーリズムの開発

- 業界の潜在的リスク&課題

- 高い設置コスト

- 厳しい安全規制

- 促進要因

- 成長可能性分析

- 規制状況

- 米国

- 欧州

- 技術情勢

- 今後の市場動向

- 現在の業界動向

- 新興企業のシナリオ

- ポーターの分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業シェア分析

- 企業マトリックス分析

- 主要市場プレーヤーの競合分析

- 競合のポジショニング・マトリックス

- 戦略展望マトリックス

第5章 市場推計・予測:製品別、2021年~2034年

- 主要動向

- 固体レーザーシステム

- ガスレーザーシステム

- ダイレーザーシステム

- ダイオードレーザシステム

第6章 市場推計・予測:用途別、2021年~2034年

- 主要動向

- 眼科

- 皮膚科

- 婦人科

- 歯科

- 泌尿器科

- 循環器科

- 消化器内科

- その他

第7章 市場推計・予測:最終用途別、2021年~2034年

- 主要動向

- 病院

- 専門クリニック

- 外来手術センター

- その他の最終用途

第8章 市場推計・予測:地域別、2021年~2034年

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第9章 企業プロファイル

- Alcon Laboratories

- Alma Lasers

- American Medical Systems

- Bausch &Lomb

- BIOLASE

- CANDELA CORPORATION

- Cynosure

- Dentsply Sirona

- Fotona

- IRIDEX Corporation

- Koninklijke Philips

- Lumenis

- Ra Medical Systems

- Topcon Corporation

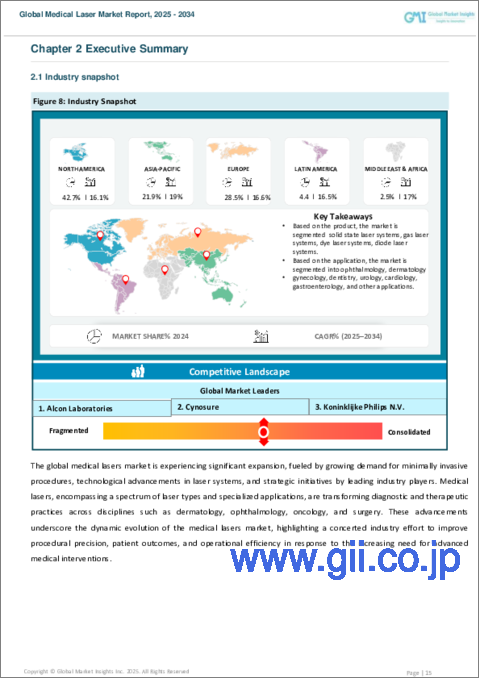

The Global Medical Laser Market reached USD 6.1 billion in 2024, with projections indicating a robust growth rate of 17% CAGR from 2025 to 2034. This remarkable expansion is driven by the increasing demand for aesthetic treatments and the rise in medical tourism, particularly in emerging economies where advanced medical procedures are becoming more accessible and affordable. As healthcare services become more widespread, individuals from around the world are taking advantage of top-tier medical facilities, contributing to the growing popularity of medical lasers. The market's trajectory is also influenced by technological advancements that enhance the effectiveness and safety of laser treatments. As non-invasive and minimally invasive procedures continue to gain favor, medical lasers have become integral in a wide range of treatments, from skin rejuvenation to hair removal. This shift reflects a broader cultural trend toward prioritizing aesthetic improvement and personal well-being.

A significant driver behind this market growth is the rising consumer awareness of non-invasive and minimally invasive cosmetic procedures. More patients are opting for effective, low-risk alternatives to traditional surgery, making medical lasers the preferred option for various treatments. Laser hair removal, tattoo removal, skin resurfacing, and body contouring are among the most sought-after procedures, allowing individuals to achieve their desired appearance with minimal downtime and discomfort. This growing preference for aesthetic treatments is closely tied to the increasing focus on beauty standards fueled by social media and global beauty trends. Healthcare providers are responding to this demand by adopting the latest laser technologies to meet patient expectations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.1 Billion |

| Forecast Value | $27.8 Billion |

| CAGR | 17% |

The medical laser market is divided into several segments, including solid-state lasers, gas lasers, dye lasers, and diode lasers. Among these, diode lasers led the market in 2024, generating an impressive USD 1.9 billion in revenue. Their popularity is largely attributed to their compact design, energy efficiency, and adaptability for both therapeutic and aesthetic applications. Diode lasers are cost-effective, offering healthcare providers a budget-friendly solution that can be used for various treatments, including hair removal and vascular procedures. This affordability has made diode lasers widely accessible, especially in outpatient clinics and smaller medical practices, ensuring widespread adoption across a range of medical and cosmetic applications.

In 2024, dermatology dominated the medical laser market, with the largest share attributed to the precision and effectiveness of lasers in treating skin conditions. Medical lasers are highly effective in procedures such as scar reduction, pigmentation correction, and skin rejuvenation, providing targeted treatments with minimal collateral tissue damage. As individuals become more conscious of skin care and appearance, demand for laser-based dermatological treatments has surged. This trend is particularly influenced by the growing awareness of aesthetic procedures, combined with the impact of social media on beauty ideals.

The U.S. medical laser market generated USD 2.4 billion in 2024, driven by a strong preference for minimally invasive aesthetic treatments. The country's established healthcare infrastructure supports the widespread adoption of advanced laser technologies across various specialties, including dermatology and ophthalmology. Continuous innovation by leading industry players further enhances the performance and accessibility of medical lasers, solidifying the U.S. as a major contributor to the global market. With ongoing advancements and increasing patient demand, the U.S. remains at the forefront of the medical laser industry.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for minimally invasive surgical procedures

- 3.2.1.2 Technological advancements in medical laser systems

- 3.2.1.3 Increasing demand for aesthetic treatments

- 3.2.1.4 Growing medical tourism in developing countries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High installation costs

- 3.2.2.2 Stringent safety regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technological Landscape

- 3.6 Future market trends

- 3.7 Current trends in the industry

- 3.8 Start-up scenario

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Solid state laser systems

- 5.3 Gas laser systems

- 5.4 Dye laser systems

- 5.5 Diode laser systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Ophthalmology

- 6.3 Dermatology

- 6.4 Gynecology

- 6.5 Dentistry

- 6.6 Urology

- 6.7 Cardiology

- 6.8 Gastroenterology

- 6.9 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Specialty clinics

- 7.4 Ambulatory surgical centers

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alcon Laboratories

- 9.2 Alma Lasers

- 9.3 American Medical Systems

- 9.4 Bausch & Lomb

- 9.5 BIOLASE

- 9.6 CANDELA CORPORATION

- 9.7 Cynosure

- 9.8 Dentsply Sirona

- 9.9 Fotona

- 9.10 IRIDEX Corporation

- 9.11 Koninklijke Philips

- 9.12 Lumenis

- 9.13 Ra Medical Systems

- 9.14 Topcon Corporation