|

|

市場調査レポート

商品コード

1516374

カーリースの市場規模:車両タイプ別、リースタイプ別、推進別、最終用途別、 2024~2032年の予測Car Leasing Market Size - By Vehicle Type (Hatchback, Sedan, SUV, Crossover), By Lease Type (Open-ended, Close-ended), By Propulsion (ICE, Electric), By End Use (Commercial, Individual) & Forecast, 2024 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| カーリースの市場規模:車両タイプ別、リースタイプ別、推進別、最終用途別、 2024~2032年の予測 |

|

出版日: 2024年04月08日

発行: Global Market Insights Inc.

ページ情報: 英文 320 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

カーリースの世界市場規模は2024年から2032年にかけてCAGR 5%を記録し、柔軟な交通手段を求める消費者の嗜好とリースが提供する利便性と柔軟性に後押しされます。

ライフスタイルや嗜好の変化に伴い、所有にこだわることなく手間をかけずに自動車を利用したいと考える個人や企業が増えています。リースは、定期的に新しいモデルにアップグレードする自由を提供し、メンテナンスや再販の心配をなくすため、進化するモビリティ事情においてますます魅力的な選択肢となっています。

例えば、起亜インディアは2024年5月、オリックス・オートと提携し、ブランドへのアクセス向上を目的とした車両リース・プログラム「起亜リース」を発表しました。これは、保険、メンテナンス、転売に関する懸念事項をカバーし、手間のかからない経験を顧客に提供するものです。この開発は、手間がかからず便利な交通手段を求める動向の高まりを反映しており、世界的にカーリースの普及が進む可能性があります。これは、カーリース業界を拡大し、進化する消費者ニーズに対応するためのパートナーシップと革新的なサービスの重要性を強調するものです。

カーリース市場は、タイプ、リースタイプ、推進力、最終用途、地域によって区分されます。

商用セグメントは、企業によるフリート車両の需要増に起因して、2032年までに顕著な利益を獲得します。リースは企業に、所有の負担なしに費用対効果が高く柔軟な輸送ソリューションを提供します。小規模企業から大企業まで、企業は車両を効率的に管理するためにリースを選択しています。初期費用の削減と業務の柔軟性の最大化に重点を置く商用車セグメントは、企業が拡張性のある輸送ソリューションを求める中、自動車リース業界における優位性を維持すると思われます。

ハッチバック・セグメントは、その多用途性、手頃な価格、都市部の通勤者や小家族に広く訴求する魅力により、2032年までにかなりの足場を築くと思われます。コンパクトでありながら広々としたデザインのハッチバックは、日常使いに実用的であるため、長期リースの選択肢として人気があります。さらに、燃費効率と維持費の低さがリース市場での優位性を高め、信頼できる交通手段を求める予算意識の高い消費者にアピールしています。

アジア太平洋地域の自動車リース市場シェアは、急速な都市化、可処分所得の増加、手間のかからない移動手段への嗜好の高まりに後押しされ、2024年から2032年にかけて顕著なCAGRを記録するであろう。ライドシェアリングサービスや企業リースの台頭により、同地域ではリース車に対する旺盛な需要が示されています。さらに、拡大する自動車産業と支援的な政府政策が、世界のカーリース業界におけるアジア太平洋地域の突出した存在感を高め、その成長と発展の極めて重要な一因となっています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 業界洞察

- エコシステム分析

- サプライヤーの状況

- 自動車メーカー

- 金融機関

- オンライン・リース・プラットフォーム

- 保険会社

- エンドユーザー

- 利益率分析

- テクノロジーとイノベーションの展望

- 特許分析

- 主要ニュースと取り組み

- 規制状況

- 影響要因

- 促進要因

- 車両選択とアップグレードの柔軟性

- メーカーとリース会社間の協業の増加

- 手間のかからないモビリティ・ソリューションへの嗜好の高まり

- 環境意識の高まりによる環境に優しいリースへの需要の高まり

- 業界の潜在的リスク&課題

- 追加料金や隠れたコストが発生する可能性

- 車両所有に比べ、カスタマイズオプションが限定的

- 促進要因

- 成長可能性分析

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業シェア分析

- 競合のポジショニング・マトリックス

- 戦略展望マトリックス

第5章 市場推計・予測:車両タイプ別、2021年~2032年

- 主要動向

- ハッチバック

- ICE

- 電気自動車

- セダン

- ICE

- 電動

- SUV

- ICE

- 電気自動車

- クロスオーバー

- ICE

- 電気自動車

第6章 市場推計・予測:リースタイプ別、2021年~2032年

- 主要動向

- オープンエンド

- クローズエンド

第7章 市場推計・予測:推進別、2021年~2032年

- 主要動向

- ICE

- 電気

第8章 市場推計・予測:最終用途別、2021-2032年

- 主要動向

- 業務

- 個人

第9章 市場推計・予測:地域別、2021-2032年

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- ニュージーランド

- 東南アジア

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- その他ラテンアメリカ

- 中東・アフリカ

- UAE

- 南アフリカ

- サウジアラビア

- その他中東・アフリカ

第10章 企業プロファイル

- ALD Automotive

- Ally Financial

- Avis Budget Group

- BNP Paribas SA

- Caldwell Leasing

- Chase Auto Finance

- Deutsche Leasing AG

- Donlen

- Element Fleet Management Corp.

- Enterprise Holdings, Inc.

- Flexdrive

- Ford Motor Credit

- GM Financial

- Hertz

- Hitachi Capital

- Mercedes-Benz Financial Services

- Toyota Financial Services

- United Leasing, Inc.

- Volkswagen Financial Services

- Wilmar Inc.

Global Car Leasing Market size will record a 5% CAGR between 2024 and 2032, propelled by consumer preferences for flexible transportation solutions and the convenience and flexibility offered by leasing. With changing lifestyles and preferences, more individuals and businesses are opting for hassle-free access to vehicles without the commitment of ownership. Leasing provides the freedom to upgrade to newer models regularly and eliminates concerns about maintenance and resale, making it an increasingly attractive option in the evolving mobility landscape.

For instance, in May 2024, Kia India collaborated with Orix Auto to unveil 'Kia Lease', a vehicle leasing program aimed at improving brand accessibility. It provides customers with a hassle-free experience, covering insurance, maintenance, and resale concerns. This development reflects a growing trend towards hassle-free and convenient transportation solutions, potentially driving increased adoption of car leasing worldwide. It underscores the importance of partnerships and innovative offerings in expanding the car leasing industry and meeting evolving consumer needs.

The car leasing market is segmented based on type, lease type, propulsion, end use, and region.

The commercial segment will amass notable gains by 2032, attributed to the increasing demand for fleet vehicles by businesses. Leasing offers businesses cost-effective and flexible transportation solutions without the burden of ownership. From small enterprises to large corporations, companies opt for leasing to manage their vehicle fleets efficiently. With a focus on reducing upfront costs and maximizing operational flexibility, the commercial segment will maintain its dominance in the car leasing industry as businesses seek scalable transportation solutions.

The hatchback segment will establish a considerable foothold by 2032, driven by its versatility, affordability, and widespread appeal among urban commuters and small families. With compact yet spacious designs, hatchbacks offer practicality for everyday use, making them popular choices for long-term leasing arrangements. Additionally, their fuel efficiency and lower maintenance costs further contribute to their dominance in the leasing market, appealing to budget-conscious consumers seeking reliable transportation solutions.

Asia Pacific car leasing market share will register a remarkable CAGR from 2024 to 2032, fueled by rapid urbanization, increasing disposable income, and a growing preference for hassle-free mobility solutions. With the rise of ride-sharing services and corporate leasing, the region witnesses robust demand for leased vehicles. Moreover, the expanding automotive industry and supportive government policies contribute to Asia Pacific's prominence in the global car leasing industry as a pivotal contributor to its growth and development.

Table of Contents

Chapter 1 Methodology & Scope

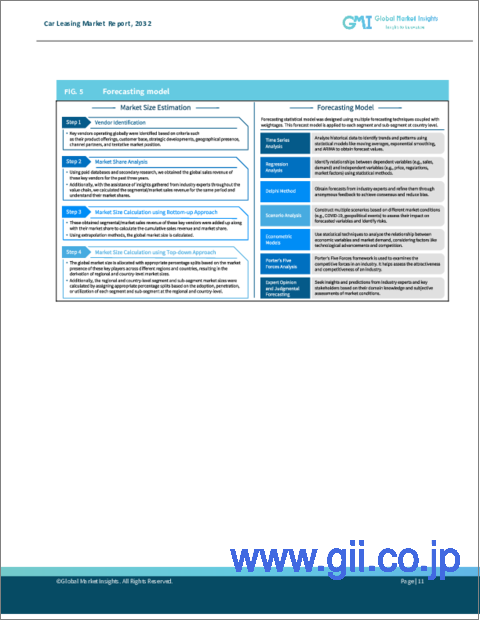

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360 degree synopsis, 2018 - 2032

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Automobile manufacturers

- 3.2.2 Financial institutions

- 3.2.3 Online leasing platforms

- 3.2.4 Insurance companies

- 3.2.5 End-user

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Flexibility in vehicle selection and upgrades

- 3.8.1.2 Rise in collaboration between manufacturers and leasing companies

- 3.8.1.3 Growing preference for hassle-free mobility solutions

- 3.8.1.4 Environmental consciousness driving demand for eco-friendly leases

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Potential for additional fees and hidden costs

- 3.8.2.2 Limited customization options compared to vehicle ownership

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2023

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle type, 2021-2032 ($Bn)

- 5.1 Key trends

- 5.2 Hatchback

- 5.2.1 ICE

- 5.2.2 Electric

- 5.3 Sedan

- 5.3.1 ICE

- 5.3.2 Electric

- 5.4 SUV

- 5.4.1 ICE

- 5.4.2 Electric

- 5.5 Crossover

- 5.5.1 ICE

- 5.5.2 Electric

Chapter 6 Market Estimates & Forecast, By Lease Type, 2021-2032 ($Bn)

- 6.1 Key trends

- 6.2 Open-ended

- 6.3 Close-ended

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021-2032 ($Bn)

- 7.1 Key trends

- 7.2 ICE

- 7.3 Electric

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2032 ($Bn)

- 8.1 Key trends

- 8.2 Commercial

- 8.3 Individual

Chapter 9 Market Estimates & Forecast, By Region, 2021-2032 ($Bn)

- 9.1 Key trends, by region

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.3.7 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.4.7 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 ALD Automotive

- 10.2 Ally Financial

- 10.3 Avis Budget Group

- 10.4 BNP Paribas SA

- 10.5 Caldwell Leasing

- 10.6 Chase Auto Finance

- 10.7 Deutsche Leasing AG

- 10.8 Donlen

- 10.9 Element Fleet Management Corp.

- 10.10 Enterprise Holdings, Inc.

- 10.11 Flexdrive

- 10.12 Ford Motor Credit

- 10.13 GM Financial

- 10.14 Hertz

- 10.15 Hitachi Capital

- 10.16 Mercedes-Benz Financial Services

- 10.17 Toyota Financial Services

- 10.18 United Leasing, Inc.

- 10.19 Volkswagen Financial Services

- 10.20 Wilmar Inc.