|

|

市場調査レポート

商品コード

1399643

ロータベータ市場規模:ブレードタイプ別、動力源別、作物タイプ別、重量別、2023~2032年予測Rotavators Market Size - By Blade Type (L Type, C Type), By Power Source (Engine, Tractor-mounted), By Crop Type (Vegetable, Fruit, Row Crop, Others), By Weight (Light, Standard, Heavy-Duty), & Forecast 2023 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| ロータベータ市場規模:ブレードタイプ別、動力源別、作物タイプ別、重量別、2023~2032年予測 |

|

出版日: 2023年11月24日

発行: Global Market Insights Inc.

ページ情報: 英文 200 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

ロータベータ市場規模は2023年から2032年にかけてCAGR 5.9%を記録する見込みです。

最近、いくつかのロータベータメーカーは、環境問題に対処するために、より静かで排出ガスのない代替案を提供するために、電気とハイブリッドモデルを模索しています。遠隔監視と診断を可能にするためにロータベータにデジタル機能と接続機能を搭載する動きが活発化しており、メンテナンスと作業効率を高めるためにテレマティクスを統合する動きが市場の成長を後押しします。

ブレードタイプ別では、Lタイプセグメントの市場価値が2032年まで拡大します。この成長は、農地における雑草駆除のために雑草を効果的に切断し、根こそぎ除去するLタイプブレードの需要が高まっていることに起因しています。Lタイプブレードは、硬い土壌にも軟らかい土壌にも適し、異なる地形や耕作要件にも適応できるため、様々な土壌条件下で汎用性を発揮します。作物残渣、堅い植生、より深い土壌耕起を支援するための圧縮土壌を切断する能力は、セグメントの拡大を後押しします。

作物タイプに関しては、野菜分野のロータベータ産業は2032年まで大幅に拡大する見込みです。ロータベータは、植え付けを容易にし、種子と土壌の接触を良くし、発芽率を向上させるために、均一で水平な表面を確保するため、野菜の種子に理想的な苗床を提供します。また、圧縮された土壌を砕き、空気を含ませる一方で、有機物と栄養分を混合して細かい苗床を作り、野菜作物の根の浸透性と吸水性を向上させるため、植え付け前の土壌を整える効率的なツールとしても機能します。

地域別では、精密農業とスマート農業技術の高い普及率に牽引され、欧州のロータベータ市場規模は2032年まで堅調な成長が見込まれます。食糧生産の強化が急務となっていることから、農業の近代化に向けた政府の支援が増加しています。持続可能な農業への強いコミットメントにより、欧州の農家は環境に優しく効率的な土作りを優先する傾向が強まっており、これが業界の成長概要となります。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 ロータベータ市場の産業洞察

- COVID-19の影響

- ロシア・ウクライナ戦争の影響

- エコシステム分析

- ベンダーマトリックス

- 利益率分析

- 技術とイノベーションの展望

- 特許分析

- 主要ニュースと取り組み

- 規制状況

- 影響要因

- 促進要因

- 農業の機械化の進展

- 精密農業への需要の高まり

- 世界人口と食糧需要の拡大

- 小規模農業の機械化ニーズの高まり

- 業界の潜在的リスク・課題

- 複雑なメンテナンス要件

- 促進要因

- 成長可能性分析

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 各社の市場シェア

- 主要市場参入企業の競合分析

- AGCO Corporation

- CNH Industrial(New Holland)

- Deere & Company(John Deere)

- Kubota Corporation

- Mahindra & Mahindra

- Preet Agro Industries

- Tirth Agro Technology Pvt. Ltd.

- 競合のポジショニングマトリックス

- 戦略展望マトリックス

第5章 ロータベータ市場推定・予測:ブレードタイプ別

- 主要動向:ブレードタイプ別

- Lタイプ

- Cタイプ

第6章 ロータベータ市場推定・予測:動力源別

- 主要動向:動力源別

- エンジン

- トラクター搭載

第7章 ロータベータ市場推定・予測:作物タイプ別

- 主要動向:作物タイプ別

- 野菜

- 果実

- 畝作物

- その他

第8章 ロータベータ市場推定・予測:重量別

- 主要動向:重量別

- 軽量

- 標準

- 重量

第9章 ロータベータ市場推定・予測、地域別

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- オランダ

- 北欧

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- 東南アジア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- サウジアラビア

Data Tables

- TABLE 1 Rotavators market 360 degree synopsis, 2018-2032

- TABLE 2 Rotavators market, 2018 - 2022, (USD Million & Units)

- TABLE 3 Rotavators market, 2023 - 2032, (USD Million & Units)

- TABLE 4 Rotavators market, by region, 2018 - 2022 (USD Million & Units)

- TABLE 5 Rotavators market, by region, 2023 - 2032 (USD Million & Units)

- TABLE 6 Rotavators market, by blade type, 2018 - 2022, (USD Million & Units)

- TABLE 7 Rotavators market, by blade type, 2023 - 2032, (USD Million & Units)

- TABLE 8 Rotavators market, by power source, 2018 - 2022, (USD Million & Units)

- TABLE 9 Rotavators market, by power source, 2023 - 2032, (USD Million & Units)

- TABLE 10 Rotavators market, by crop type, 2018 - 2022, (USD Million & Units)

- TABLE 11 Rotavators market, by crop type, 2023 - 2032, (USD Million & Units)

- TABLE 12 Rotavators market, by weight, 2018 - 2022, (USD Million & Units)

- TABLE 13 Rotavators market, by weight, 2023 - 2032, (USD Million & Units)

- TABLE 14 Covid-19 impact on North America rotavators market.

- TABLE 15 Covid-19 impact on Europe rotavators market.

- TABLE 16 Covid-19 impact on Asia Pacific rotavators market.

- TABLE 17 Covid-19 impact on Latin America rotavators market.

- TABLE 18 Covid-19 impact on MEA rotavators market.

- TABLE 19 Vendor matrix

- TABLE 20 Patent analysis

- TABLE 21 Industry impact forces

- TABLE 22 Company market share, 2022

- TABLE 23 Competitive analysis of major market players, 2022

- TABLE 24 L type market, 2018 - 2022 (USD Million & Units)

- TABLE 25 L type market, 2023 - 2032 (USD Million & Units)

- TABLE 26 C type market, 2018 - 2022 (USD Million & Units)

- TABLE 27 C type market, 2023 - 2032 (USD Million & Units)

- TABLE 28 Engine market, 2018 - 2022 (USD Million & Units)

- TABLE 29 Engine market, 2023 - 2032 (USD Million & Units)

- TABLE 30 Tractor-mounted market, 2018 - 2022 (USD Million & Units)

- TABLE 31 Tractor-mounted market, 2023 - 2032 (USD Million & Units)

- TABLE 32 Vegetable market, 2018 - 2022 (USD Million & Units)

- TABLE 33 Vegetable market, 2023 - 2032 (USD Million & Units)

- TABLE 34 Fruit market, 2018 - 2022 (USD Million & Units)

- TABLE 35 Fruit market, 2023 - 2032 (USD Million & Units)

- TABLE 36 Row crop market, 2018 - 2022 (USD Million & Units)

- TABLE 37 Row crop market, 2023 - 2032 (USD Million & Units)

- TABLE 38 Others market, 2018 - 2022 (USD Million & Units)

- TABLE 39 Others market, 2023 - 2032 (USD Million & Units)

- TABLE 40 Light market, 2018 - 2022 (USD Million & Units)

- TABLE 41 Light market, 2023 - 2032 (USD Million & Units)

- TABLE 42 Standard market, 2018 - 2022 (USD Million & Units)

- TABLE 43 Standard market, 2023 - 2032 (USD Million & Units)

- TABLE 44 Heavy-duty market, 2018 - 2022 (USD Million & Units)

- TABLE 45 Heavy-duty market, 2023 - 2032 (USD Million & Units)

- TABLE 46 North America rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 47 North America rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 48 North America rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 49 North America rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 50 North America rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 51 North America rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 52 North America rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 53 North America rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 54 U.S. rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 55 U.S. rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 56 U.S. rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 57 U.S. rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 58 U.S. rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 59 U.S. rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 60 U.S. rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 61 U.S. rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 62 Canada rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 63 Canada rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 64 Canada rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 65 Canada rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 66 Canada rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 67 Canada rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 68 Canada rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 69 Canada rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 70 Europe rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 71 Europe rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 72 Europe rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 73 Europe rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 74 Europe rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 75 Europe rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 76 Europe rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 77 Europe rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 78 UK rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 79 UK rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 80 UK rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 81 UK rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 82 UK rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 83 UK rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 84 UK rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 85 UK rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 86 Germany rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 87 Germany rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 88 Germany rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 89 Germany rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 90 Germany rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 91 Germany rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 92 Germany rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 93 Germany rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 94 France rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 95 France rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 96 France rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 97 France rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 98 France rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 99 France rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 100 France rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 101 France rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 102 Italy rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 103 Italy rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 104 Italy rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 105 Italy rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 106 Italy rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 107 Italy rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 108 Italy rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 109 Italy rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 110 Spain rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 111 Spain rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 112 Spain rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 113 Spain rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 114 Spain rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 115 Spain rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 116 Spain rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 117 Spain rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 118 Netherlands rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 119 Netherlands rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 120 Netherlands rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 121 Netherlands rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 122 Netherlands rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 123 Netherlands rotavators market, by crop type, 2023 - 2032 (USD Million & Units

- TABLE 124 Netherlands rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 125 Netherlands rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 126 Nordics rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 127 Nordics rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 128 Nordics rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 129 Nordics rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 130 Nordics rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 131 Nordics rotavators market, by crop type, 2023 - 2032 (USD Million & Units

- TABLE 132 Nordics rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 133 Nordics rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 134 Asia Pacific rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 135 Asia Pacific rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 136 Asia Pacific rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 137 Asia Pacific rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 138 Asia Pacific rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 139 Asia Pacific rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 140 Asia Pacific rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 141 Asia Pacific rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 142 China rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 143 China rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 144 China rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 145 China rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 146 China rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 147 China rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 148 China rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 149 China rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 150 India rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 151 India rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 152 India rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 153 India rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 154 India rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 155 India rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 156 India rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 157 India rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 158 Japan rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 159 Japan rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 160 Japan rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 161 Japan rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 162 Japan rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 163 Japan rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 164 Japan rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 165 Japan rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 166 South Korea rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 167 South Korea rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 168 South Korea rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 169 South Korea rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 170 South Korea rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 171 South Korea rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 172 South Korea rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 173 South Korea rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 174 Australia rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 175 Australia rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 176 Australia rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 177 Australia rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 178 Australia rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 179 Australia rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 180 Australia rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 181 Australia rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 182 Southeast Asia rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 183 Southeast Asia rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 184 Southeast Asia rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 185 Southeast Asia rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 186 Southeast Asia rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 187 Southeast Asia rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 188 Southeast Asia rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 189 Southeast Asia rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 190 Latin America rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 191 Latin America rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 192 Latin America rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 193 Latin America rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 194 Latin America rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 195 Latin America rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 196 Latin America rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 197 Latin America rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 198 Brazil rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 199 Brazil rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 200 Brazil rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 201 Brazil rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 202 Brazil rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 203 Brazil rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 204 Brazil rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 205 Brazil rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 206 Mexico rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 207 Mexico rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 208 Mexico rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 209 Mexico rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 210 Mexico rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 211 Mexico rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 212 Mexico rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 213 Mexico rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 214 Argentina rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 215 Argentina rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 216 Argentina rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 217 Argentina rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 218 Argentina rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 219 Argentina rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 220 Argentina rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 221 Argentina rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 222 MEA rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 223 MEA rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 224 MEA rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 225 MEA rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 226 MEA rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 227 MEA rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 228 MEA rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 229 MEA rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 230 UAE rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 231 UAE rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 232 UAE rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 233 UAE rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 234 UAE rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 235 UAE rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 236 UAE rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 237 UAE rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 238 South Africa rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 239 South Africa rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 240 South Africa rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 241 South Africa rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 242 South Africa rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 243 South Africa rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 244 South Africa rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 245 South Africa rotavators market, by weight, 2023 - 2032 (USD Million & Units)

- TABLE 246 Saudi Arabia rotavators market, by blade type, 2018 - 2022 (USD Million & Units)

- TABLE 247 Saudi Arabia rotavators market, by blade type, 2023 - 2032 (USD Million & Units)

- TABLE 248 Saudi Arabia rotavators market, by power source, 2018 - 2022 (USD Million & Units)

- TABLE 249 Saudi Arabia rotavators market, by power source, 2023 - 2032 (USD Million & Units)

- TABLE 250 Saudi Arabia rotavators market, by crop type, 2018 - 2022 (USD Million & Units)

- TABLE 251 Saudi Arabia rotavators market, by crop type, 2023 - 2032 (USD Million & Units)

- TABLE 252 Saudi Arabia rotavators market, by weight 2018 - 2022 (USD Million & Units)

- TABLE 253 Saudi Arabia rotavators market, by weight, 2023 - 2032 (USD Million & Units)

Charts & Figures

- FIG 1 GMI's report coverage in the global rotavators market

- FIG 2 Industry segmentation

- FIG 3 Forecast calculation

- FIG 4 Profile break-up of primary respondents

- FIG 5 Rotavators market 360 degree synopsis, 2018 - 2032

- FIG 6 Rotavators market ecosystem analysis

- FIG 7 Profit margin analysis

- FIG 8 Growth potential analysis

- FIG 9 Porter's analysis

- FIG 10 PESTEL analysis

- FIG 11 Competitive analysis of major market players, 2022

- FIG 12 Competitive positioning matrix

- FIG 13 Strategic outlook matrix

- FIG 14 SWOT Analysis, AGCO Corporation

- FIG 15 SWOT Analysis, Alpego S.p.A

- FIG 16 SWOT Analysis, CNH Industrial (New Holland)

- FIG 17 SWOT Analysis, Deere & Company (John Deere)

- FIG 18 SWOT Analysis, Howard Australia Pty Ltd.

- FIG 19 SWOT Analysis, Kubota Corporation

- FIG 20 SWOT Analysis, Kuhn Group

- FIG 21 SWOT Analysis, Lemken

- FIG 22 SWOT Analysis, Mahindra & Mahindra

- FIG 23 SWOT Analysis, Maschio Gaspardo Group

- FIG 24 SWOT Analysis, Preet Agro Industries

- FIG 25 SWOT Analysis, SDF Group (SAME Deutz-Fahr)

- FIG 26 SWOT Analysis, Shaktiman Agro

- FIG 27 SWOT Analysis, Tirth Agro Technology Pvt. Ltd.

- FIG 28 SWOT Analysis, Yanmar Co., Ltd.

Rotavators Market size is poised to record 5.9% CAGR from 2023-2032, on account of the higher interest in electric and alternative power sources for several agricultural equipment.

Of late, several rotavator manufacturers are exploring electric and hybrid models to offer quieter, emission-free alternatives for addressing the environmental concerns. The increasing incorporation of digital and connectivity features into rotavators to enable remote monitoring and diagnostics along with the integration of telematics to enhance maintenance and operational efficiency will drive the market growth.

The overall rotavators industry is segmented based on blade type, power source, crop type, weight, and region.

In terms of blade type, the market value from the L type segment will witness expansion through 2032. The growth can be attributed to the rising demand for L-type blades in effectively cutting and uprooting weeds for weed control in agricultural fields. L-type blades offer versatility in various soil conditions as they are suitable for both hard and soft soils while being adaptable to different terrains and farming requirements. The ability to cut through crop residue, tough vegetation, and compacted soil for aiding deeper soil tillage will also boost the segment expansion.

With respect to crop type, the rotavators industry from the vegetable segment is expected to significantly expand up to 2032. Rotavators offer an ideal seedbed for vegetable seeds as they ensure a uniform and level surface for ensuring easier planting, better seed-to-soil contact, and improved germination rates. They also act as efficient tools for preparing the soil prior to planting given their ability to break up the compacted soil and aerate it whilst creating a fine seedbed by mixing organic matter and nutrients to render better root penetration and water absorption for the vegetable crops.

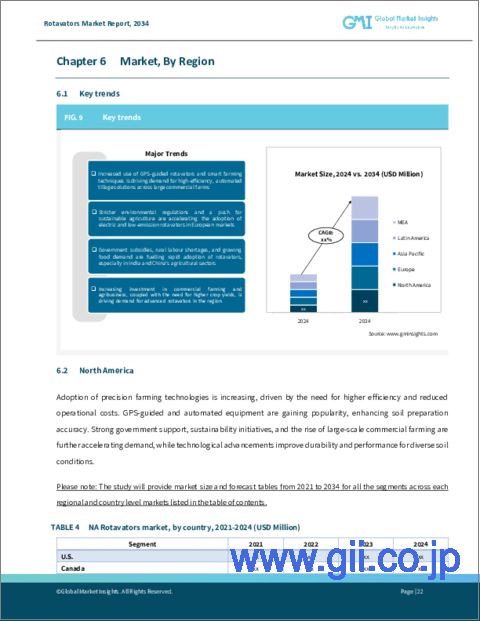

Regionally, Europe rotavators market size is expected to observe robust growth through 2032 led by the higher popularity of precision farming and smart agricultural technologies. The growing imperative for enhancing food production is making way for increased government support towards agricultural modernization. The rising emphasis of European farmers on prioritizing environmentally friendly and efficient soil preparation driven by the strong commitment to sustainable agriculture practices will outline the industry growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

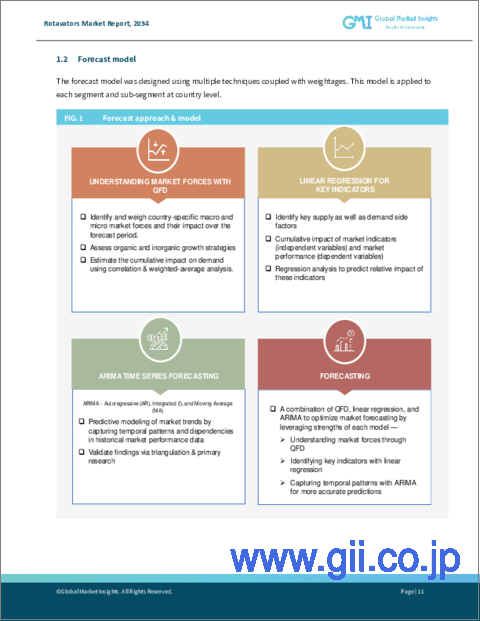

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Rotavators market 360 degree synopsis, 2018 - 2032

- 2.2 Regional trends

- 2.3 Blade type trends

- 2.4 Design trends

- 2.5 Crop type trends

Chapter 3 Rotavators Market Industry Insights

- 3.1 Impact of COVID-19

- 3.2 Impact of Russia-Ukraine war

- 3.3 Industry ecosystem analysis

- 3.4 Vendor matrix

- 3.5 Profit margin analysis

- 3.6 Technology & innovation landscape

- 3.7 Patent analysis

- 3.8 Key news and initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing mechanization in agriculture

- 3.10.1.2 Rising demand for precision farming

- 3.10.1.3 Expanding global population and food requirements

- 3.10.1.4 Growing need for small-scale farm mechanization

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Complex maintenance requirements

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2022

- 4.1 Introduction

- 4.2 Company market share, 2022

- 4.3 Competitive analysis of major market players, 2022

- 4.3.1 AGCO Corporation

- 4.3.2 CNH Industrial (New Holland)

- 4.3.3 Deere & Company (John Deere)

- 4.3.4 Kubota Corporation

- 4.3.5 Mahindra & Mahindra

- 4.3.6 Preet Agro Industries

- 4.3.7 Tirth Agro Technology Pvt. Ltd.

- 4.4 Competitive positioning matrix, 2022

- 4.5 Strategic outlook matrix, 2022

Chapter 5 Rotavators Market Estimates & Forecast, By Blade Type (Revenue & Shipment)

- 5.1 Key trends, by blade type

- 5.2 L type

- 5.3 C type

Chapter 6 Rotavators Market Estimates & Forecast, By Power Source (Revenue & Shipment)

- 6.1 Key trends, by power source

- 6.2 Engine

- 6.3 Tractor-mounted

Chapter 7 Rotavators Market Estimates & Forecast, By Crop Type (Revenue & Shipment)

- 7.1 Key trends, by crop type

- 7.2 Vegetable

- 7.3 Fruit

- 7.4 Row crop

- 7.5 Others

Chapter 8 Rotavators Market Estimates & Forecast, By Weight (Revenue & Shipment)

- 8.1 Key trends, by weight

- 8.2 Light

- 8.3 Standard

- 8.4 Heavy-duty

Chapter 9 Rotavators Market Estimates & Forecast, By Region (Revenue & Shipment)

- 9.1 Key trends, by region

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia