|

|

市場調査レポート

商品コード

1395017

鉛製錬・精製市場- 炉別、製法別、用途別・予測、2023年~2032年Lead Smelting and Refining Market - By Furnace, By Method, By Application & Forecast, 2023 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 鉛製錬・精製市場- 炉別、製法別、用途別・予測、2023年~2032年 |

|

出版日: 2023年10月06日

発行: Global Market Insights Inc.

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の鉛製錬・精製市場は、特に自動車分野での鉛蓄電池需要の増加により、2023年から2032年にかけてCAGR 4%で成長します。

自動車産業が持続可能性を重視するようになるにつれて、効率的で環境に配慮した鉛製錬・精製プロセスの必要性が高まっています。鉛蓄電池の採用拡大と持続可能な慣行へのコミットメントを原動力とするこの二重のダイナミズムは、鉛製錬・精製産業の実質的な規模と関連性を形成するために収束すると思われます。

技術の進歩を採用し、持続可能な慣行を取り入れる自動車メーカーは、鉛製錬・精製市場の見通しを強化することに大きく寄与し、業界の革新に沿った環境に配慮した鉛の生産方法に対する需要を促進します。例えば、2023年にグリーヴス・リテールは、Eリキシャ専用に設計された鉛蓄電池「Power Raja by Greaves」を発売しました。これらのバッテリーは、e-リキシャ・セグメントの明確な要件に対応し、この市場内の多様なニーズに対応するために様々な容量で利用可能です。

鉛製錬・精製産業は、方法、用途、地域によって分けられます。

様々な供給源から鉛を分離・精製するイオン交換法の有効性に起因して、方法タイプによるイオン交換セグメントは2032年まで大きな利益を獲得します。産業界が持続可能で効率的な精製プロセスを重視する中、イオン交換はその汎用性と環境への配慮から、好まれる方法として台頭してくると思われます。責任ある鉛処理への注目が高まる中、イオン交換セグメントは市場力学の中心的貢献者として際立つ存在となると思われます。

放射線防護セグメントによる鉛製錬・精製市場規模は、電離放射線を遮蔽する鉛の重要な役割に牽引され、2032年までに鉛製錬・精製市場の注目すべきシェアを獲得するであろう。産業界、特にヘルスケアと原子力部門が厳格な安全対策に注力するにつれて、放射線防護用の高品質鉛への需要が高まっています。この用途における鉛の汎用性は、作業員の安全や環境規制に対する関心の高まりと相まって、放射線防護分野を市場の主要な牽引役として位置づけると思われます。

アジア太平洋地域は2023年から2032年にかけて顕著なCAGRを記録すると予想されるが、これは同地域の旺盛な産業活動、特に新興経済国が自動車および産業セクターの鉛蓄電池需要を牽引しているためです。製造業の拡大とインフラ・プロジェクトの増加が、鉛精錬の必要性をさらに加速させています。アジア太平洋は、世界の業界情勢において極めて重要な役割を担っており、特に鉛製錬・精製産業への貢献が期待されます。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 鉛製錬・精製産業洞察

- エコシステム分析

- 業界への影響要因

- 促進要因

- 業界の潜在的リスク&課題

- 成長の可能性分析

- COVID-19影響分析

- 規制状況

- 米国

- 欧州

- 価格分析、2022年

- 技術展望

- ポーター分析

- PESTEL分析

- ロシア・ウクライナ戦争の影響

第4章 競合情勢

- イントロダクション

- 企業マトリックス分析

- 世界企業シェア分析

- 競合のポジショニングマトリックス

- 戦略ダッシュボード

第5章 鉛製錬・精製市場規模・予測:炉別、2018年~2032年

- 回転式

- 反射炉

- 高炉

第6章 鉛製錬・精製市場規模・予測:製法別、2018年~2032年

- 乾式製錬

- 溶媒抽出

- イオン交換法

第7章 鉛製錬・精製市場規模・予測:用途別、2018年~2032年

- 金属・非金属抽出

- 卑金属

- 貴金属

- レアアース

- 非金属鉱物

- 弾薬

- 電池

- 建設

- 放射線防護

第8章 鉛製錬・精製市場規模・予測:地域別、2018年~2032年

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- インドネシア

- マレーシア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

第9章 企業プロファイル

- Gravita India Pvt. Ltd.

- Glencore plc

- Umicore

- Hindustan Zinc Limited(HZL)

- Yuguang Gold Lead Co. Ltd

- Ecobat Technologies

- Recylex S.A

- Dansuk Industrial Co., Ltd.

- Asia Recycling Resources Pte Ltd

- Doe Run Resources Corporation

- Boliden Group

- Tasnee

- Teck

- Nyrstar

- Cerro de Pasco Resources(CDPR)

Data Tables

- TABLE 1 Market revenue, by furnace (2022)

- TABLE 2 Market revenue, by method (2022)

- TABLE 3 Market revenue, by application (2022)

- TABLE 4 Market revenue, by region (2022)

- TABLE 5 Global Lead Smelting & Refining market size, 2018 - 2032, (USD Million)

- TABLE 6 Global Lead Smelting & Refining market size, 2018 - 2032, (Kilo Tons)

- TABLE 7 Global Lead Smelting & Refining market size, by region, 2018 - 2032 (USD Million)

- TABLE 8 Global Lead Smelting & Refining market size, by region, 2018 - 2032 (Kilo Tons)

- TABLE 9 Global Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 10 Global Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 11 Global Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 12 Global Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 13 Global Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 14 Global Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 15 Industry impact forces

- TABLE 16 North America Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 17 North America Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 18 North America Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 19 North America Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 20 North America Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 21 North America Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 22 North America Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 23 U.S. Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 24 U.S. Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 25 U.S. Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 26 U.S. Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 27 U.S. Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 28 U.S. Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 29 U.S. Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 30 Canada Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 31 Canada Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 32 Canada Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 33 Canada Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 34 Canada Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 35 Canada Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 36 Canada Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 37 Europe Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 38 Europe Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 39 Europe Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 40 Europe Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 41 Europe Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 42 Europe Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 43 Europe Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 44 Germany Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 45 Germany Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 46 Germany Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 47 Germany Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 48 Germany Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 49 Germany Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 50 Germany Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 51 UK Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 52 UK Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 53 UK Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 54 UK Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 55 UK Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 56 UK Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 57 UK Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 58 France Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 59 France Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 60 France Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 61 France Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 62 France Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 63 France Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 64 France Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 65 Spain Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 66 Spain Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 67 Spain Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 68 Spain Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 69 Spain Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 70 Spain Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 71 Spain Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 72 Italy Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 73 Italy Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 74 Italy Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 75 Italy Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 76 Italy Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 77 Italy Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 78 Italy Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 79 Asia Pacific Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 80 Asia Pacific Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 81 Asia Pacific Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 82 Asia Pacific Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 83 Asia Pacific Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 84 Asia Pacific Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 85 Asia Pacific Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 86 China Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 87 China Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 88 China Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 89 China Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 90 China Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 91 China Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 92 China Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 93 Japan Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 94 Japan Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 95 Japan Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 96 Japan Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 97 Japan Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 98 Japan Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 99 Japan Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 100 India Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 101 India Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 102 India Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 103 India Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 104 India Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 105 India Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 106 India Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 107 Australia Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 108 Australia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 109 Australia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 110 Australia Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 111 Australia Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 112 Australia Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 113 Australia Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 114 South Korea Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 115 South Korea Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 116 South Korea Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 117 South Korea Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 118 South Korea Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 119 South Korea Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 120 South Korea Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 121 Indonesia Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 122 Indonesia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 123 Indonesia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 124 Indonesia Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 125 Indonesia Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 126 Indonesia Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 127 Indonesia Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 128 Malaysia Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 129 Malaysia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 130 Malaysia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 131 Malaysia Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 132 Malaysia Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 133 Malaysia Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 134 Malaysia Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 135 Latin America Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 136 Latin America Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 137 Latin America Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 138 Latin America Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 139 Latin America Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 140 Latin America Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 141 Latin America Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 142 Brazil Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 143 Brazil Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 144 Brazil Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 145 Brazil Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 146 Brazil Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 147 Brazil Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 148 Brazil Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 149 Mexico Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 150 Mexico Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 151 Mexico Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 152 Mexico Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 153 Mexico Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 154 Mexico Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 155 Mexico Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 156 Argentina Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 157 Argentina Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 158 Argentina Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 159 Argentina Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 160 Argentina Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 161 Argentina Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 162 Argentina Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 163 Middle East & Africa Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 164 Middle East & Africa Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 165 Middle East & Africa Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 166 Middle East & Africa Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 167 Middle East & Africa Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 168 Middle East & Africa Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 169 Middle East & Africa Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 170 South Africa Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 171 South Africa Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 172 South Africa Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 173 South Africa Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 174 South Africa Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 175 South Africa Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 176 South Africa Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 177 Saudi Arabia Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 178 Saudi Arabia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 179 Saudi Arabia Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 180 Saudi Arabia Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 181 Saudi Arabia Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 182 Saudi Arabia Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 183 Saudi Arabia Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 184 UAE Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 185 UAE Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 186 UAE Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 187 UAE Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 188 UAE Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 189 UAE Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 190 UAE Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 191 Egypt Lead Smelting & Refining market size, 2018 - 2032 (Kilo Tons) (USD Million)

- TABLE 192 Egypt Lead Smelting & Refining market size, by furnace, 2018 - 2032 (USD Million)

- TABLE 193 Egypt Lead Smelting & Refining market size, by furnace, 2018 - 2032 (Kilo Tons)

- TABLE 194 Egypt Lead Smelting & Refining market size, by method, 2018 - 2032 (USD Million)

- TABLE 195 Egypt Lead Smelting & Refining market size, by method, 2018 - 2032 (Kilo Tons)

- TABLE 196 Egypt Lead Smelting & Refining market size, by application, 2018 - 2032 (USD Million)

- TABLE 197 Egypt Lead Smelting & Refining market size, by application, 2018 - 2032 (Kilo Tons)

Charts & Figures

- FIG. 1 Industry segmentation

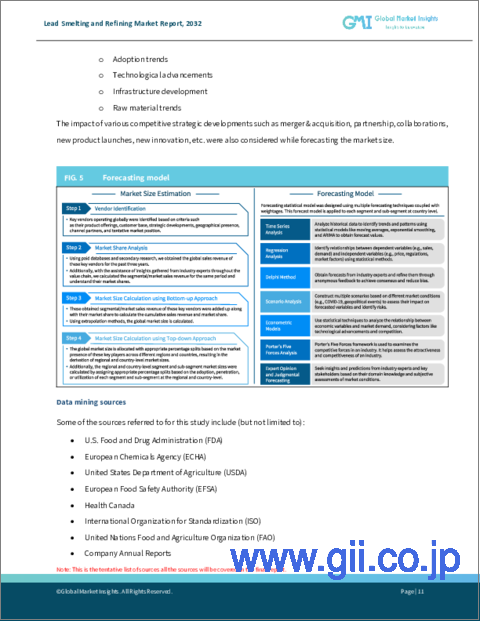

- FIG. 2 Market estimation and forecast methodology

- FIG. 3 Breakdown of primary participants

- FIG. 4 Lead Smelting & Refining industry, 360o synopsis, 2018 - 2032

- FIG. 5 Industry landscape, 2018-2032 (USD Million)

- FIG. 6 Growth potential analysis

- FIG. 7 Porter's analysis

- FIG. 8 PESTEL analysis

- FIG. 9 Company matrix analysis, 2022

- FIG. 10 Strategy dashboard, 2022

Global Lead Smelting and Refining Market will grow at a 4% CAGR from 2023 to 2032 due to the increasing demand for lead-acid batteries, particularly in the automotive sector. As the automobile industry places greater emphasis on sustainability, the need for efficient and environmentally conscious lead smelting and refining processes intensifies. This dual dynamic, fueled by the expanding adoption of lead-acid batteries and a commitment to sustainable practices, will converge to shape the substantial size and relevance of the lead smelting and refining industry.

Automobile manufacturers adopting technological advancements and integrating sustainable practices contribute significantly to strengthening the lead smelting and refining market outlook, fostering demand for environmentally conscious lead production methods in line with industry innovations. For instance, in 2023, Greaves Retail introduced 'Power Raja by Greaves,' a line of lead-acid batteries designed specifically for e-rickshaws. These batteries cater to the distinct requirements of the e-rickshaw segment and are available in various capacities to accommodate diverse needs within this market.

The lead smelting and refining industry is divided based on method, application, and region.

The ion exchange segment from method type will garner significant gains through 2032, owing to the effectiveness of ion exchange methods in separating and purifying lead from various sources. As industries emphasize sustainable and efficient refining processes, ion exchange will emerge as a favored method due to its versatility and environmental considerations. With a growing focus on responsible lead processing, the ion exchange segment will stand out as a central contributor to market dynamics.

The lead smelting and refining market size from the radiation protection segment will capture a notable lead smelting and refining market share by 2032, driven by the critical role of lead in shielding against ionizing radiation. As industries, particularly healthcare and nuclear sectors, focus on stringent safety measures, the demand for high-quality lead for radiation protection intensifies. The versatility of lead in this application, coupled with growing concerns for worker safety and environmental regulations, will position the radiation protection segment as a primary driver in the market.

Asia-Pacific will register a remarkable CAGR from 2023 to 2032, attributed to the region's robust industrial activities, especially in emerging economies, driving the demand for lead-acid batteries in the automotive and industrial sectors. The expanding manufacturing sector, coupled with increasing infrastructure projects, further accelerates the need for lead refining. Asia-Pacific's pivotal role in the global industrial landscape will position it as a key contributor, notably contributing to the lead smelting and refining industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Industry coverage

- 1.2 Market scope & definition

- 1.3 Base estimates & calculations

- 1.3.1 Data collection

- 1.4 Forecast parameters

- 1.5 COVID-19 impact analysis at global level

- 1.6 Data validation

- 1.7 Data Sources

- 1.7.1 Primary

- 1.7.2 Secondary

- 1.7.2.1 Paid sources

- 1.7.2.2 Unpaid sources

Chapter 2 Executive Summary

- 2.1 Lead Smelting & Refining industry 360 degree synopsis, 2018 - 2032

- 2.2 Business trends

- 2.3 Furnace trends

- 2.4 Method trends

- 2.5 Application trends

- 2.6 Regional trends

Chapter 3 Lead Smelting & Refining Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.3 Growth potential analysis

- 3.4 COVID- 19 impact analysis

- 3.5 Regulatory landscape

- 3.5.1 U.S.

- 3.5.2 Europe

- 3.6 Pricing analysis, 2022

- 3.7 Technology landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Impact of Russia Ukraine war

Chapter 4 Competitive Landscape, 2022

- 4.1 Introduction

- 4.2 Company matrix analysis, 2022

- 4.3 Global company market share analysis, 2022

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Lead Smelting & Refining Market Size and Forecast, By Furnace 2018 - 2032

- 5.1 Rotary

- 5.2 Reverberatory

- 5.3 Blast

Chapter 6 Lead Smelting & Refining Market Size and Forecast, By Method 2018 - 2032

- 6.1 Pyrometallurgical

- 6.2 Solvent Extraction

- 6.3 Ion Exchange

Chapter 7 Lead Smelting & Refining Market Size and Forecast, By Application 2018 - 2032

- 7.1 Metals & Non-metal Extraction

- 7.1.1 Base Metals

- 7.1.2 Precious Metals

- 7.1.3 Rare Earth Metals

- 7.1.4 Non-Metallic Minerals

- 7.2 Ammunition

- 7.3 Batteries

- 7.4 Construction

- 7.5 Radiation Protection

Chapter 8 Lead Smelting & Refining Market Size and Forecast, By Region 2018 - 2032

- 8.1 Key trends, by region

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Indonesia

- 8.4.7 Malaysia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Egypt

Chapter 9 Company Profiles

- 9.1 Gravita India Pvt. Ltd.

- 9.2 Glencore plc

- 9.3 Umicore

- 9.4 Hindustan Zinc Limited (HZL)

- 9.5 Yuguang Gold Lead Co. Ltd

- 9.6 Ecobat Technologies

- 9.7 Recylex S.A

- 9.8 Dansuk Industrial Co., Ltd.

- 9.9 Asia Recycling Resources Pte Ltd

- 9.10 Doe Run Resources Corporation

- 9.11 Boliden Group

- 9.12 Tasnee

- 9.13 Teck

- 9.14 Nyrstar

- 9.15 Cerro de Pasco Resources (CDPR)