|

市場調査レポート

商品コード

1822664

レンタカーの市場機会、成長促進要因、産業動向分析、2025~2034年予測Car Rental Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

カスタマイズ可能

|

|||||||

| レンタカーの市場機会、成長促進要因、産業動向分析、2025~2034年予測 |

|

出版日: 2025年08月25日

発行: Global Market Insights Inc.

ページ情報: 英文 230 Pages

納期: 2~3営業日

|

概要

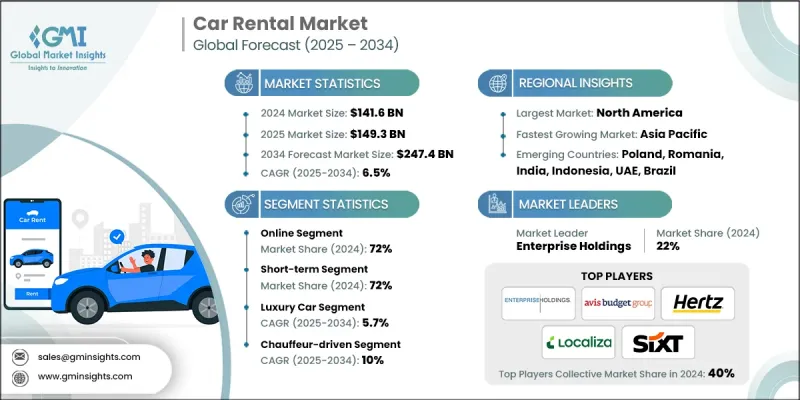

Global Market Insights Inc.が発行した最新レポートによると、世界のレンタカー市場は2024年に1,416億米ドルと推定され、CAGR 6.5%で2025年の1,493億米ドルから2034年には2,474億米ドルに成長すると予測されています。

国内旅行と国際旅行の着実な成長は、レンタカー市場の重要な促進要因です。レジャーやビジネスで新たな目的地を探索する人が増えるにつれ、柔軟で便利な交通手段へのニーズが高まっています。レンタカーは、公共交通機関の時刻表や高額なタクシーに頼ることなく、旅行者が自分のペースで自由に観光できる機会を提供します。

| 市場範囲 | |

|---|---|

| 開始年 | 2024 |

| 予測年 | 2025-2034 |

| 市場規模 | 1,416億米ドル |

| 予測金額 | 2,474億米ドル |

| CAGR | 6.5% |

オンライン・セグメントにおける需要の高まり

2024年には、ウェブサイトやモバイルアプリを通じて顧客にシームレスで便利な予約体験を提供するオンラインセグメントが顕著なシェアを占める。このセグメントは、インターネット普及率とスマートフォン利用率の上昇から恩恵を受け、ユーザーは価格の比較、車両の選択、予約の管理をリアルタイムで行うことができます。各社は、ユーザーインターフェースの強化、AIを活用したパーソナライゼーションの統合、即時カスタマーサポートの提供など、デジタルプラットフォームに多額の投資を行っています。

短期レンタルの普及拡大

短期レンタカーセグメントは、所有の負担なく柔軟で短期間の車両利用を求める旅行者や都市部の顧客に支えられ、2024年に大きな収益を上げました。このセグメントの成長は、観光と出張の増加に牽引され、利便性と手頃な価格に対する消費者の嗜好の高まりに支えられています。数時間から数日間のレンタルにより、利用者は当面の移動ニーズを効率的に満たすことができます。市場セグメンテーションでは、このセグメントを獲得するために、競争力のある価格設定、多様な車両オプション、迅速な車両アクセスの提供に注力しています。

高級車の採用増加

2024年には、可処分所得の増加と富裕層のプレミアム体験に対する需要の高まりに後押しされ、高級車レンタカーセグメントが大きなシェアを占めました。高級レンタカーは高度な機能、優れた快適性、ブランドの威信を提供し、ステータスや独占性を優先する顧客を惹きつけています。レンタル会社は、高級車メーカーと提携し、個人向けサービスを提供し、デジタルプラットフォームを活用して高級志向の顧客にターゲットを絞ったマーケティングを行うことで、市場での足場を固めています。

北米が有利な地域となる

北米のレンタカー市場は、国内旅行の増加、ビジネス分野の拡大、技術革新が相まって、2034年まで力強い成長を遂げると思われます。企業はデータ分析とモバイル技術を活用して、顧客体験の向上、車両管理の最適化、非接触型レンタルの導入を進めています。ライドシェアプラットフォームとの戦略的提携や、レンタル車両への電気自動車の導入により、市場での地位はさらに強化されています。

レンタカー市場の主要プレーヤーは、Movida、Advantage Rent-a-car、Uber、Sixt、Europcar、CAR Inc.、Hertz、Localiza、Avis Budget Group、Enterprise Holdingsです。

レンタカー市場で事業を展開する企業は、市場での地位を強化し、進化する顧客の期待に応えるため、さまざまな戦略的取り組みを実施しています。主な焦点はデジタルトランスフォーメーションで、モバイルアプリ、オンライン予約プラットフォーム、AIを活用したカスタマーサービスツールへの投資により、利便性を高め、レンタル体験を合理化しています。多くの企業が車両を拡大し、エコノミーから高級車、電気自動車まで幅広い選択肢を提供することで、さまざまな顧客層に対応しています。

目次

第1章 調査手法

- 調査デザイン

- 調査アプローチ

- データ収集方法

- GMI独自のAIシステム

- AIを活用した調査の強化

- ソース一貫性プロトコル

- 基本推定と計算

- 基準年計算

- 予測モデル

- 市場予測の主な動向

- 定量化された市場影響分析

- 成長パラメータの予測に対する数学的影響

- シナリオ分析フレームワーク

- 1次調査と検証

- 一次情報

- データマイニングソース

- 有料情報源

- 地域別の情報源

- 有料情報源

- 調査の軌跡と信頼度スコア

- 調査トレイルの構成要素

- スコアリングコンポーネント

- 調査の透明性に関する補足

- ソースアトリビューションフレームワーク

- 品質保証指標

- 信頼へのコミットメント

第2章 エグゼクティブサマリー

第3章 業界考察

- エコシステム分析

- サプライヤーの情勢

- 利益率

- コスト構造

- 各段階での付加価値

- バリューチェーンに影響を与える要因

- ディスラプション

- 業界への影響要因

- 促進要因

- 観光とビジネス旅行の増加

- 所有権からアクセスへの移行

- デジタルプラットフォームと非接触レンタル

- 持続可能性の推進

- 業界の潜在的リスク&課題

- 高額な車両メンテナンスおよび減価償却費

- 規制と競争の圧力

- 市場機会

- サブスクリプションとMaaSの統合

- 新興市場の成長

- 企業パートナーシップ

- 技術の差別化

- 促進要因

- 成長可能性分析

- 規制情勢

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- ポーター分析

- PESTEL分析

- テクノロジーとイノベーションの情勢

- 現在の技術動向

- 新興技術

- 価格動向

- 地域別

- 製品別

- 特許分析

- 持続可能性と環境側面

- 持続可能な慣行

- 廃棄物削減戦略

- 生産におけるエネルギー効率

- 環境に優しい取り組み

- カーボンフットプリントの考慮

- ユースケース

- 最良のシナリオ

- 収益最適化と付帯サービス

- 車両あたりの収益(RPV)分析とベンチマーク

- RPV:車両カテゴリ、場所の種類、季節

- 地理的RPV変動と市場力学

- 法人セグメントとレジャーセグメントのRPV比較

- 過去のRPVの動向と将来の予測

- 補助的な収益源とアップセル戦略

- GPSおよびナビゲーションシステムの収益貢献

- 保険および保護商品の販売

- 燃料サービスおよび手数料

- アクセサリーおよび機器のレンタル収入

- アップグレードとプレミアムサービスの収益

- 動的価格設定と収益管理

- AIを活用した価格最適化とパフォーマンス

- 需要予測の精度と収益への影響

- 競争力のある価格情報と対応戦略

- 季節やイベントに基づいた価格戦略

- クロスセルと顧客価値の向上

- ロイヤルティプログラムの収益と顧客維持

- 法人アカウントの拡大とサービス統合

- デジタルプラットフォームの収益化と手数料収入

- ホテルと旅行サービスの提携

- 車両あたりの収益(RPV)分析とベンチマーク

- 顧客獲得と生涯価値分析

- チャネルおよびセグメント別の顧客獲得コスト(CAC)

- デジタルマーケティングのCACとコンバージョン率

- 従来の広告とパートナーシップチャネルのコスト

- 法人顧客獲得投資とROI

- 紹介プログラムの有効性とコスト分析

- 顧客生涯価値(LTV)モデリングとセグメンテーション

- 顧客タイプとレンタル頻度別のLTV

- 法人顧客とレジャー顧客の価値比較

- 地理的LTVの変動と市場特性

- ロイヤルティプログラムがLTV向上に与える影響

- 顧客維持と解約分析

- 顧客セグメントとサービスレベル別の維持率

- 解約予測と防止戦略

- サービス回復および顧客回復プログラム

- ネットプロモータースコア(NPS)が維持と成長に与える影響

- チャネルおよびセグメント別の顧客獲得コスト(CAC)

- 保険とリスク管理分析

- 保険コスト構造と経営戦略

- 車両の損傷と紛失防止

- 詐欺防止とセキュリティ対策

- 責任管理と法令遵守

- 車両ライフサイクルと資産管理

- 車両調達・取得戦略

- OEMパートナーシップとボリューム交渉戦略

- 購入とリースの意思意思決定の枠組みと財務への影響

- フリートミックスの最適化と需要の調整

- 新車と中古車の統合とコスト分析

- 艦隊の活用とパフォーマンスの最適化

- 地理的な艦隊配分と需要のバランス

- 季節ごとの車両管理とキャパシティ計画

- 車両のローテーションと位置転送の最適化

- 車両メンテナンスとライフサイクル管理

- 予防保守プログラムの最適化

- 保守コスト分析とベンダー管理

- 車両のダウンタイムの最小化とサービス効率

- 予知保全のための技術統合

- 残存価値管理と処分戦略

- 再販価値の最適化と市場タイミング

- 卸売vs.小売の廃棄チャネルのパフォーマンス

- 車両の状態と改修投資

- 廃棄コスト管理と収益最大化

- 車両調達・取得戦略

第4章 競合情勢

- イントロダクション

- 企業の市場シェア分析

- 北米

- 欧州

- アジア太平洋地域

- ラテンアメリカ

- 中東・アフリカ

- 主要市場企業の競合分析

- 競合ポジショニングマトリックス

- 戦略的展望マトリックス

- 主な発展

- 合併と買収

- パートナーシップとコラボレーション

- 新製品の発売

- 拡張計画と資金調達

- サービス品質と顧客満足度のベンチマーク

- 立地戦略と市場カバレッジ分析

- ブランドポジショニングとマーケティング効果の比較

第5章 市場推計・予測:予約制, 2021-2034

- 主要動向

- オンライン

- オフライン

第6章 市場推計・予測:レンタル期間別、2021-2034

- 主要動向

- 短期

- 長期的

第7章 市場推計・予測:車両別、2021-2034

- 主要動向

- 高級車

- エグゼクティブカー

- エコノミーカー

- SUV

- 多目的車両

第8章 市場推計・予測:用途別、2021-2034

- 主要動向

- レジャー/観光

- 仕事

第9章 市場推計・予測:最終用途別、2021-2034

- 主要動向

- ボランタリー

- 促進要因付き

第10章 市場推計・予測:地域別、2021-2034

- 主要動向

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- 北欧諸国

- ロシア

- アジア太平洋地域

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- 東南アジア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第11章 企業プロファイル

- Global companies

- Alamo Rent-a-Car

- Avis Budget Group

- eHi Car Services

- Enterprise Holdings

- Europcar

- Hertz Global Holdings

- Localiza

- Sixt

- Uber Technologies

- Zipcar

- Regional companies

- Advantage Rent A Car

- CAR Inc.

- Fox Rent A Car

- Green Motion

- Movida

- Payless Car Rental

- Rent-A-Wreck

- Thrifty Car Rental

- U-Save Car &Truck Rental

- 新興プレーヤー

- Book2wheel

- Drivezy

- Fluid Truck

- Getaround

- Gett

- HyreCar

- Maven

- Ola Cabs

- Rent Centric

- SHARE NOW

- Turo

- Zoomcar