|

|

市場調査レポート

商品コード

1355825

藻類色素の市場規模:タイプ別、形態別、由来別、用途別、世界予測、2023年~2032年Algal Pigments Market Size - By Type (Beta-carotene, Fucoxanthin, Lutein, Chlorophyll, Phycocyanin, Astaxanthin, Phycoerythrin), By Form (Powder, Liquid), By Source (Microalgae, Macroalgae/Seaweed), Application & Global Forecast, 2023 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 藻類色素の市場規模:タイプ別、形態別、由来別、用途別、世界予測、2023年~2032年 |

|

出版日: 2023年08月01日

発行: Global Market Insights Inc.

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界の藻類色素の市場規模は、製薬業界および栄養補助食品業界全体での藻類色素の適用範囲の拡大により、2023年から2032年の間に7.4%のCAGRで拡大すると予想されます。

藻類色素は、その抗酸化作用と健康増進特性により、製薬産業や栄養補助食品産業で応用されています。例えば、微細藻類由来のカロテノイド色素であるアスタキサンチンは、その潜在的な健康上の利点から栄養補助食品として使用され、この分野の市場成長を推進しています。

さらに、倫理的に調達された天然成分へのシフトが加速し、同じ方向への研究開発努力が増加していることも、製品需要を刺激すると思われます。一例として、2023年2月にFrontiers in Energy Researchで発表された研究では、光バイオリアクター内で微細藻類のバイオフィルムを成長させる方法が発表され、廃水を資源として商業的に重要な化学物質の生産が可能になっています。

藻類色素市場全体は、タイプ、形態、由来、用途、地域によって分類されます。

β-カロテンセグメントは、2023年から2032年にかけて健全な成長率を記録すると思われます。β-カロテン色素の需要は、主に視力と免疫機能に不可欠なビタミンAの前駆体としての役割を含む、その健康上の利点に対する意識の高まりによって牽引されています。さらに、化粧品業界と食品業界は、クリーンラベル製品を求める消費者の嗜好に応え、天然の着色料および抗酸化剤としてβ-カロテンを利用しています。天然成分や植物由来成分への関心の高まりに加え、こうした要因が、様々な用途におけるβ-カロテン色素の需要を引き続き押し上げています。

2032年まで、用途別では医薬品セグメントが藻類色素の市場シェアを独占する可能性があります。藻類色素は、その豊富な栄養素含有量と抗酸化特性により、医薬品分野で人気を集めています。アスタキサンチンやフィコシアニンなどのこれらの色素は、抗炎症作用や抗酸化作用を含む潜在的な健康上の利点を提供するため、医薬品やサプリメントの処方において価値があります。さらに、その天然由来は、クリーンラベルや植物由来成分への需要の高まりと合致しており、医薬品用途での魅力を高めています。

欧州の藻類色素産業は、いくつかの要因によって大きな成長を遂げています。欧州の消費者は、環境に優しく健康志向の動向に合わせて、天然で持続可能な原料を求める傾向が強まっています。合成添加物や着色料に対する厳しい規制が、食品や化粧品における藻類色素のような天然代替物への需要を促進しています。さらに、持続可能なバイオテクノロジーに対する政府の取り組みや研究投資は、欧州市場における藻類色素の開発と採用をさらに促進し、その成長を促進しています。

目次

第1章 調査手法と調査範囲

第2章 エグゼクティブサマリー

第3章 藻類色素産業の洞察

- エコシステム分析

- 業界への影響要因

- 促進要因

- 技術の進歩

- 持続可能性と環境への懸念

- 栄養補助食品と化粧品業界の形態

- 業界の潜在的リスク&課題

- 高い生産コスト

- 合成着色料との競合

- 賞味期限と官能特性

- 促進要因

- 成長の可能性分析

- COVID-19の影響分析

- ロシア・ウクライナ戦争の影響

- 規制状況

- 米国

- 欧州

- 価格分析、2022年

- 技術展望

- 今後の市場動向

- ポーター分析

- PESTEL分析

第4章 競合情勢

- イントロダクション

- 企業マトリックス分析

- 世界企業の市場シェア分析

- 競合ポジショニングマトリックス

- 戦略ダッシュボード

第5章 藻類色素市場:タイプ別、2018~2032年

- 主要動向:タイプ別

- β-カロテン

- フコキサンチン

- ルテイン

- クロロフィル

- フィコシアニン

- アスタキサンチン

- フィコエリトリン

第6章 藻類色素市場:形態別、2018~2032年

- 主要動向:形態別

- 粉末

- 液体

第7章 藻類色素市場:由来別、2018~2032年

- 主要動向:由来別

- 微細藻類

- 微細藻類/海藻

第8章 藻類色素市場:用途別、2018~2032年

- 主要動向:用途別

- 食品・飲料

- 医薬品

- 化粧品

- 水産養殖

- 栄養補助食品

- その他

第9章 藻類色素市場:地域別、2018~2032年

- 主要動向:地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- インドネシア

- マレーシア

- ラテンアメリカ

- ブラジル

- メキシコ

- アルゼンチン

- MEA

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- エジプト

第10章 企業プロファイル

- Algatech

- Cyanotech Corporation

- Naturex(part of Givaudan)

- BASF SE

- DIC Corporation

- Sensient Technologies Corporation

- Chr. Hansen Holding A/S

- Doehler Group

- FMC Corporation

- Kemin Industries, Inc.

- Valensa International

- Parry Nutraceuticals(EID Parry India Ltd.)

- Algamo s.r.o.

- Algix, LLC

- Givaudan S.A.

Data Tables

- TABLE 1 Market revenue, by type (2022)

- TABLE 2 Market revenue, by source (2022)

- TABLE 3 Market revenue, by form (2022)

- TABLE 4 Market revenue, by application (2022)

- TABLE 5 Market revenue, by region (2022)

- TABLE 6 Global algal pigments market size, 2018 - 2032, (USD Billion)

- TABLE 7 Global algal pigments market size, 2018 - 2032, (Kilo Tons)

- TABLE 8 Global algal pigments market size, by region, 2018 - 2032 (USD Billion)

- TABLE 9 Global algal pigments market size, by region, 2018 - 2032 (Kilo Tons)

- TABLE 10 Global algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 11 Global algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 12 Global algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 13 Global algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 14 Global algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 15 Global algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 16 Global algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 17 Global algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 18 Industry impact forces

- TABLE 19 North America algal pigments market size, by country, 2018 - 2032 (USD Billion)

- TABLE 20 North America algal pigments market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 21 North America algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 22 North America algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 23 North America algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 24 North America algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 25 North America algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 26 North America algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 27 North America algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 28 North America algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 29 U.S. algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 30 U.S. algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 31 U.S. algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 32 U.S. algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 33 U.S. algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 34 U.S. algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 35 U.S. algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 36 U.S. algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 37 Canada algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 38 Canada algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 39 Canada algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 40 Canada algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 41 Canada algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 42 Canada algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 43 Canada algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 44 Canada algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 45 Europe algal pigments market size, by country, 2018 - 2032 (USD Billion)

- TABLE 46 Europe algal pigments market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 47 Europe algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 48 Europe algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 49 Europe algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 50 Europe algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 51 Europe algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 52 Europe algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 53 Europe algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 54 Europe algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 55 Germany algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 56 Germany algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 57 Germany algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 58 Germany algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 59 Germany algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 60 Germany algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 61 Germany algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 62 Germany algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 63 UK algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 64 UK algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 65 UK algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 66 UK algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 67 UK algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 68 UK algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 69 UK algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 70 UK algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 71 France algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 72 France algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 73 France algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 74 France algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 75 France algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 76 France algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 77 France algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 78 France algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 79 Spain algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 80 Spain algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 81 Spain algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 82 Spain algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 83 Spain algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 84 Spain algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 85 Spain algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 86 Spain algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 87 Italy algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 88 Italy algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 89 Italy algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 90 Italy algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 91 Italy algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 92 Italy algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 93 Italy algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 94 Italy algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 95 Asia Pacific algal pigments market size, by country, 2018 - 2032 (USD Billion)

- TABLE 96 Asia Pacific algal pigments market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 97 Asia Pacific algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 98 Asia Pacific algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 99 Asia Pacific algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 100 Asia Pacific algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 101 Asia Pacific algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 102 Asia Pacific algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 103 Asia Pacific algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 104 Asia Pacific algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 105 China algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 106 China algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 107 China algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 108 China algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 109 China algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 110 China algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 111 China algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 112 China algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 113 Japan algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 114 Japan algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 115 Japan algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 116 Japan algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 117 Japan algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 118 Japan algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 119 Japan algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 120 Japan algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 121 India algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 122 India algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 123 India algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 124 India algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 125 India algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 126 India algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 127 India algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 128 India algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 129 Australia algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 130 Australia algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 131 Australia algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 132 Australia algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 133 Australia algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 134 Australia algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 135 Australia algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 136 Australia algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 137 South Korea algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 138 South Korea algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 139 South Korea algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 140 South Korea algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 141 South Korea algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 142 South Korea algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 143 South Korea algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 144 South Korea algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 145 Indonesia algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 146 Indonesia algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 147 Indonesia algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 148 Indonesia algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 149 Indonesia algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 150 Indonesia algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 151 Indonesia algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 152 Indonesia algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 153 Malaysia algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 154 Malaysia algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 155 Malaysia algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 156 Malaysia algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 157 Malaysia algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 158 Malaysia algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 159 Malaysia algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 160 Malaysia algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 161 Latin America algal pigments market size, by country, 2018 - 2032 (USD Billion)

- TABLE 162 Latin America algal pigments market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 163 Latin America algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 164 Latin America algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 165 Latin America algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 166 Latin America algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 167 Latin America algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 168 Latin America algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 169 Latin America algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 170 Latin America algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 171 Brazil algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 172 Brazil algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 173 Brazil algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 174 Brazil algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 175 Brazil algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 176 Brazil algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 177 Brazil algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 178 Brazil algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 179 Mexico algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 180 Mexico algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 181 Mexico algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 182 Mexico algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 183 Mexico algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 184 Mexico algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 185 Mexico algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 186 Mexico algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 187 Argentina algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 188 Argentina algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 189 Argentina algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 190 Argentina algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 191 Argentina algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 192 Argentina algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 193 Argentina algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 194 Argentina algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 195 MEA algal pigments market size, by country, 2018 - 2032 (USD Billion)

- TABLE 196 MEA algal pigments market size, by country, 2018 - 2032 (Kilo Tons)

- TABLE 197 MEA algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 198 MEA algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 199 MEA algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 200 MEA algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 201 MEA algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 202 MEA algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 203 MEA algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 204 MEA algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 205 South Africa algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 206 South Africa algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 207 South Africa algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 208 South Africa algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 209 South Africa algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 210 South Africa algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 211 South Africa algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 212 South Africa algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 213 Saudi Arabia algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 214 Saudi Arabia algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 215 Saudi Arabia algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 216 Saudi Arabia algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 217 Saudi Arabia algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 218 Saudi Arabia algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 219 Saudi Arabia algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 220 Saudi Arabia algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 221 UAE algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 222 UAE algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 223 UAE algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 224 UAE algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 225 UAE algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 226 UAE algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 227 UAE algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 228 UAE algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

- TABLE 229 Egypt algal pigments market size, by type, 2018 - 2032 (USD Billion)

- TABLE 230 Egypt algal pigments market size, by type, 2018 - 2032 (Kilo Tons)

- TABLE 231 Egypt algal pigments market size, by form, 2018 - 2032 (USD Billion)

- TABLE 232 Egypt algal pigments market size, by form, 2018 - 2032 (Kilo Tons)

- TABLE 233 Egypt algal pigments market size, by source, 2018 - 2032 (USD Billion)

- TABLE 234 Egypt algal pigments market size, by source, 2018 - 2032 (Kilo Tons)

- TABLE 235 Egypt algal pigments market size, by application, 2018 - 2032 (USD Billion)

- TABLE 236 Egypt algal pigments market size, by application, 2018 - 2032 (Kilo Tons)

Charts & Figures

- FIG. 1 Industry segmentation

- FIG. 2 Market estimation and forecast methodology

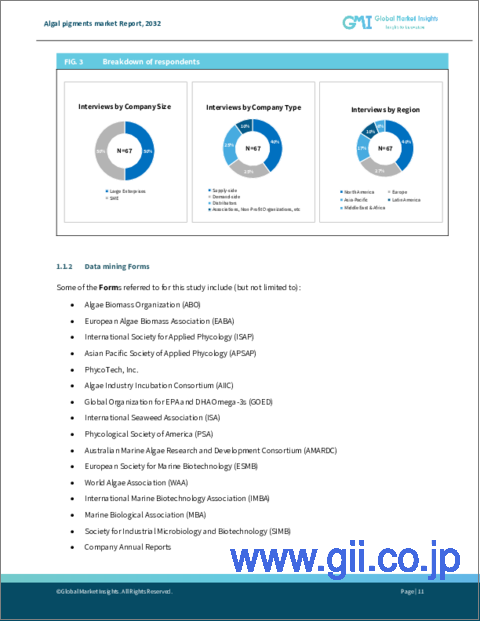

- FIG. 3 Breakdown of primary participants

- FIG. 4 Algal pigments industry, 360o synopsis, 2018 - 2032

- FIG. 5 Growth potential analysis

- FIG. 6 Porter's analysis

- FIG. 7 PESTEL analysis

- FIG. 8 Company matrix analysis, 2022

- FIG. 9 Strategy dashboard, 2022

Global Algal Pigments Market size will expand at 7.4% CAGR between 2023 and 2032, driven by the expanding application scope of algal pigments across the pharmaceutical and nutraceutical industries. Algal pigments have found applications in the pharmaceutical and nutraceutical industries due to their antioxidant and health-promoting properties. For instance, astaxanthin, a carotenoid pigment derived from microalgae, is used as a dietary supplement for its potential health benefits, driving market growth in this sector.

Additionally, the accelerating shift toward ethically sourced natural ingredients and increasing R&D efforts in the same direction will stimulate product demand. Quoting an instance, in February 2023, published research in Frontiers in Energy Research unveiled a method for growing microalgae biofilms within photobioreactors, enabling the production of commercially significant chemicals using wastewater as a resource.

The overall algal pigments market is categorized based on type, form, application, and region.

The beta-carotene segment will record a healthy growth rate from 2023 to 2032. The demand for beta-carotene pigments is primarily driven by the growing awareness of their health benefits, including their role as precursors to vitamin A, which is essential for vision and immune function. Additionally, the cosmetic and food industries utilize beta-carotene as a natural colorant and antioxidant, responding to consumer preferences for clean-label products. These factors, alongside the rising interest in natural and plant-based ingredients, continue to fuel the demand for beta-carotene pigments in various applications.

The pharmaceutical segment could dominate the algal pigments market share in terms of application through 2032. Algal pigments are gaining popularity in the pharmaceutical sector due to their rich nutrient content and antioxidant properties. These pigments, such as astaxanthin and phycocyanin, offer potential health benefits, including anti-inflammatory and antioxidant effects, making them valuable in the formulation of pharmaceutical products and supplements. Furthermore, their natural origin aligns with the increasing demand for clean-label and plant-based ingredients, enhancing their appeal in pharmaceutical applications.

Europe algal pigments industry is experiencing significant growth due to several factors. European consumers are increasingly seeking natural and sustainable ingredients, aligning with eco-friendly and health-conscious trends. Stringent regulations on synthetic additives and colors drive the demand for natural alternatives like algal pigments in food and cosmetics. Moreover, government initiatives and research investments in sustainable biotechnology further promote the development and adoption of algal pigments in the European market, fostering its growth.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Industry coverage

- 1.2 Market scope & definition

- 1.3 Base estimates & calculations

- 1.3.1 Data collection

- 1.4 Forecast parameters

- 1.5 COVID-19 impact analysis at the global level

- 1.6 Data validation

- 1.7 Data forms

- 1.7.1 Primary

- 1.7.2 Secondary

- 1.7.2.1 Paid forms

- 1.7.2.2 Unpaid forms

Chapter 2 Executive Summary

- 2.1 Algal pigments industry 360 degree synopsis, 2018 - 2032

- 2.2 Business trends

- 2.3 Type trends

- 2.4 Source type trends

- 2.5 Form trends

- 2.6 Application trends

- 2.7 Regional trends

Chapter 3 Algal pigments Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological Advancements

- 3.2.1.2 Sustainability and Environmental Concerns

- 3.2.1.3 Nutraceutical and Cosmetics Industry Forms

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High Production Costs

- 3.2.2.2 Competition from Synthetic Colorants

- 3.2.2.3 Shelf Life and Sensory Properties

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.3.1 type

- 3.3.2 Source

- 3.3.3 Form

- 3.3.4 Application

- 3.4 COVID-19 impact analysis

- 3.5 Impact of Russia Ukraine war

- 3.6 Regulatory landscape

- 3.6.1 U.S.

- 3.6.2 Europe

- 3.7 Pricing analysis, 2022

- 3.8 Technology landscape

- 3.8.1 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2022

- 4.1 Introduction

- 4.2 Company matrix analysis, 2022

- 4.3 Global company market share analysis, 2022

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Algal pigments Market, By Type 2018 - 2032

- 5.1 Key trends, by type

- 5.2 Beta-carotene

- 5.3 Fucoxanthin

- 5.4 Lutein

- 5.5 Chlorophyll

- 5.6 Phycocyanin

- 5.7 Astaxanthin

- 5.8 Phycoerythrin

Chapter 6 Algal pigments Market, By Form 2018 - 2032

- 6.1 Key trends, by form

- 6.2 Powder

- 6.3 Liquid

Chapter 7 Algal pigments Market, By source 2018 - 2032

- 7.1 Key trends, by form

- 7.2 Microalgae

- 7.3 Macroalgae/Seaweed

Chapter 8 Algal pigments Market, By Application 2018 - 2032

- 8.1 Key trends, by application

- 8.2 Food & Beverages

- 8.3 Pharmaceuticals

- 8.4 Cosmetics

- 8.5 Aquaculture

- 8.6 Nutraceuticals

- 8.7 Others

Chapter 9 Algal pigments Market, By Region 2018 - 2032

- 9.1 Key trends, by region

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Indonesia

- 9.4.7 Malaysia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Egypt

Chapter 10 Company Profiles

- 10.1 Algatech

- 10.2 Cyanotech Corporation

- 10.3 Naturex (part of Givaudan)

- 10.4 BASF SE

- 10.5 DIC Corporation

- 10.6 Sensient Technologies Corporation

- 10.7 Chr. Hansen Holding A/S

- 10.8 Doehler Group

- 10.9 FMC Corporation

- 10.10 Kemin Industries, Inc.

- 10.11 Valensa International

- 10.12 Parry Nutraceuticals (EID Parry India Ltd.)

- 10.13 Algamo s.r.o.

- 10.14 Algix, LLC

- 10.15 Givaudan S.A.