|

|

市場調査レポート

商品コード

1279522

富裕層の資産配分の動向、戦略、促進要因、予測(2023年版)HNW Asset Allocation Trends, Strategies, Drivers and Forecast, 2023 Update |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 富裕層の資産配分の動向、戦略、促進要因、予測(2023年版) |

|

出版日: 2023年05月05日

発行: GlobalData

ページ情報: 英文 36 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

当レポートでは、世界の主要市場における富裕層の資産配分戦略を分析し、投資の動向や、現在と今後12か月における投資選択の促進要因などの情報を提供しています。

目次

- 富裕層の投資の動向

- 富裕層の投資の促進要因と予測

付録

Abstract

Drawing on results from GlobalData's annual Global Wealth Managers Survey, this report analyzes HNW asset allocation strategies across key global markets. In particular, it examines the drivers behind investment choices both now and over the next 12 months.

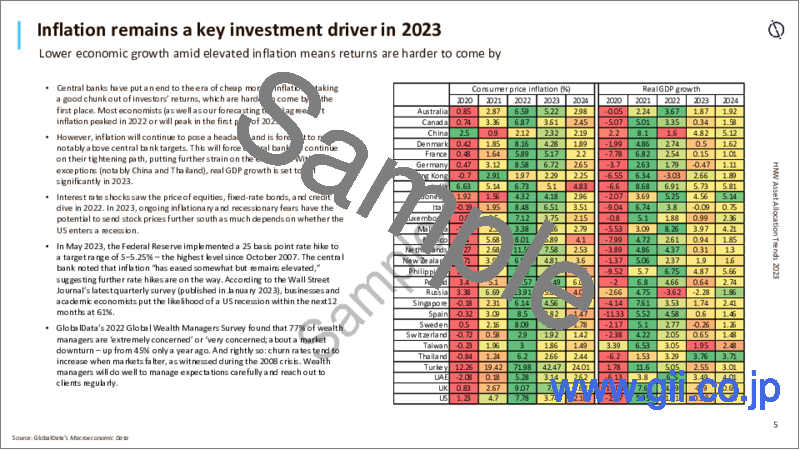

Reduced risk appetite is a key investment theme in 2023 as we enter a new economic cycle. Monetary tightening to curb inflationary pressures amid slower economic growth and mounting geopolitical concerns have caused significant market volatility, predominately on the downside. Investors can no longer rely on the availability of cheap money to support asset price growth; they are thus eager to explore new parts of financial markets to chase returns that are increasingly hard to come by. Over the coming year, wealth managers will have to work hard to alleviate investor concerns about the economy to put the abnormally high cash and near-cash balances to work.

Scope

- 55% of wealth managers expect HNW demand for cash and near-cash to increase over the next 12 months as investors shun risk.

- Demand in the equity space is shifting back towards capital appreciation after a punishing year for stocks and shares.

- HNW investors will remain net buyers of commodities in 2023, with expectations of further capital appreciation.

Reasons to Buy

- Learn how inflationary fears and resulting market upheaval have affected investment behavior in the HNW space.

- Identify investment trends and adjust your service proposition based on a detailed understanding of HNW investors' preferences.

- Discover how to best promote investment products by learning what is driving investment choices.

- Understand the effect increased volatility can have on investor behavior and how to minimize the risk of customers changing providers.

- Give your marketing strategies the edge required and capture new clients using insights from our data on HNW investment drivers.

Table of Contents

Table of Contents

- HNW Investment Trends

- HNW Investment Drivers and Forecast