|

|

市場調査レポート

商品コード

1134499

ウェルスマネジメントにおけるESG(環境、社会、ガバナンス):テーマ別調査ESG (Environmental, Social and Governance) in Wealth Management - Thematic Research |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| ウェルスマネジメントにおけるESG(環境、社会、ガバナンス):テーマ別調査 |

|

出版日: 2022年09月07日

発行: GlobalData

ページ情報: 英文 35 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ウェルスマネージャーの82%が、今後12ヶ月間にESG(環境、社会、ガバナンス)投資に割り当てられる金融顧客資産の割合が増加すると予想しています。

当レポートでは、ウェルスマネジメントにおけるESG(環境、社会、ガバナンス)について調査し、ウェルスマネジメント分野におけるESG(環境、社会、ガバナンス)導入の現状、今後この分野を形成すると予想される主要な動向などの情報を提供しています。

目次

目次

- 市場規模と需要パターン

- 意識と製品選好

- グリーンウォッシングとコンプライアンス

- 競争力学

付録

Drawing on GlobalData's 2021 Global Wealth Managers Survey, this report explores the current state of ESG adoption in the wealth management space and analyzes the key trends that are expected to shape the sector going forward.

Environmental, social, and governance (ESG) is no longer just a buzzword. The theme is having a major impact on the broader financial services industry - particularly the wealth management sector. Globally, HNW investors allocate an average of 26% of their financial assets to ESG investment products. However, there are strong differences between wealth managers' ESG commitments. According to GlobalData's 2021 Global Wealth Managers Survey, 51% of wealth managers in the HNW space have an ESG proposition; this proportion jumps as high as 87% in the UK but falls to as little as 23% in New Zealand.

Scope

- 82% of wealth managers expect the proportion of financial client assets allocated to ESG investments to increase over the next 12 months.

- HNW investors opt for ESG investments for a multitude of reasons. However, return on investment considerations are the number one driver.

- Younger generations are more open to ESG investments. Using the UK as an example, 75% of consumers in their 20s regard sustainable investing as "very important" or "somewhat important."

- HNW investors expect a sophisticated ESG proposition. Globally, 73% of wealth managers agree that HNW investors expect ESG products that apply positive as opposed to negative screening strategies.

Reasons to Buy

- Learn about the size of the ESG market and understand HNW demand patterns across countries.

- Understand how HNW investors' and retail investors' attitudes towards ESG differ.

- Learn about product preferences in the ESG space.

- Learn about current compliance issues and the growing relevance of greenwashing, as well as the impact these factors will have on wealth managers.

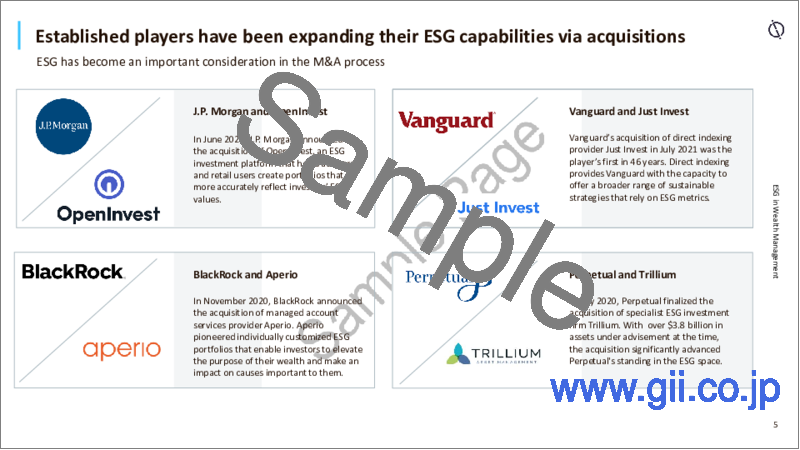

- Understand what your competitors are doing in the ESG space via different case studies.

Table of Contents

Table of Contents

- Market Size and Demand Patterns

- Attitudes and Product Preferences

- Greenwashing and Compliance

- Competitive Dynamics