|

|

市場調査レポート

商品コード

1165580

希少神経筋疾患に対する新たな治療薬市場:パイプライン分析Emerging Therapeutics for Rare Neuromuscular Diseases: Pipeline Analysis |

||||||

| 希少神経筋疾患に対する新たな治療薬市場:パイプライン分析 |

|

出版日: 2022年11月09日

発行: Frost & Sullivan

ページ情報: 英文 63 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

当レポートでは、世界の希少神経筋疾患に対する新たな治療薬市場について調査し、市場の概要とともに、戦略的インペラティブ、成長の機会などを提供しています。

目次

戦略的インペラティブ

- 成長がますます困難になるのはなぜか

- 戦略的インペラティブ

- 希少神経筋疾患に対する上位3つの戦略的インペラティブの影響

- 成長の機会が成長パイプラインエンジンを加速させる

成長機会分析

- 分析範囲

- セグメンテーション

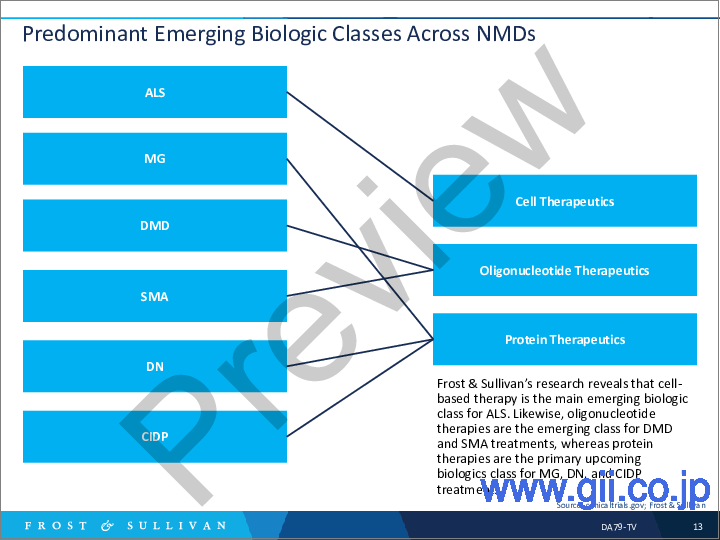

- NMD全体で優勢な新興生物学的クラス

- 成長促進要因

- 成長抑制要因

成長環境

- 希少神経筋疾患治療に対する投資家の関心が急激に高まる

- 生物製剤の進歩を可能にするベンチャー支援企業のスナップショット

- 神経筋疾患の生物学的特許

- 特許状況-神経筋疾患の生物製剤

- 主な市場参入企業

筋萎縮性側索硬化症(ASL):生物製剤パイプライン分析

- 筋萎縮性側索硬化症の生物学的療法

- 筋萎縮性側索硬化症細胞療法、2022年

- 筋萎縮性側索硬化症オリゴヌクレオチド療法、2022年

- 筋萎縮性側索硬化症タンパク質療法、2022年

- 筋萎縮性側索硬化症治療のための最近の生物学的研究のハイライト

- 筋萎縮性側索硬化症治療の新しい治療パラダイムの探索

重症筋無力症(MG):生物製剤パイプライン分析

- 重症筋無力症治療のための今後の生物製剤

- 重症筋無力症のタンパク質療法

- 重症筋無力症の生物製剤における臨床試験の進捗状況

- 重症筋無力症のための主要な生物製剤

デュシェンヌ型筋ジストロフィ(DMD):生物製剤パイプライン分析

- デュシェンヌ型筋ジストロフィの新たな生物製剤の情勢における遺伝子治療

- デュシェンヌ型筋ジストロフィのエクソンスキッピング療法

- デュシェンヌ型筋ジストロフィに対するミクロジストロフィン遺伝子治療

- デュシェンヌ型筋ジストロフィの管理をリードするオリゴヌクレオチド療法

脊髄性筋萎縮症(SMA):生物製剤パイプライン分析

- 脊髄性筋萎縮症の承認済みおよび新興生物製剤クラス

- 脊髄性筋萎縮症の臨床情勢を変える生物製剤

- 画期的な治療法による脊髄性筋萎縮症管理

- NovartisのZolgensma:脊髄性筋萎縮症の臨床的ブレークスルー

糖尿病性腎症(DN) &慢性炎症性脱髄性多発神経炎(CIDP):生物製剤パイプライン分析

- 糖尿病性腎症治療のための生物製剤

- 糖尿病性腎症における治療の個別化のための生物製剤

- 慢性炎症性脱髄性多発神経炎治療のための新たな生物製剤

- 慢性炎症性脱髄性多発神経炎治療のための免疫グロブリン

成長の機会領域

- 成長の機会1:RNA治療薬

- 成長の機会2:細胞・遺伝子治療

- 成長の機会3:タンパク質治療薬

次のステップ

Strategic partnering and new product development will enable better biologics for personalized and targeted treatment

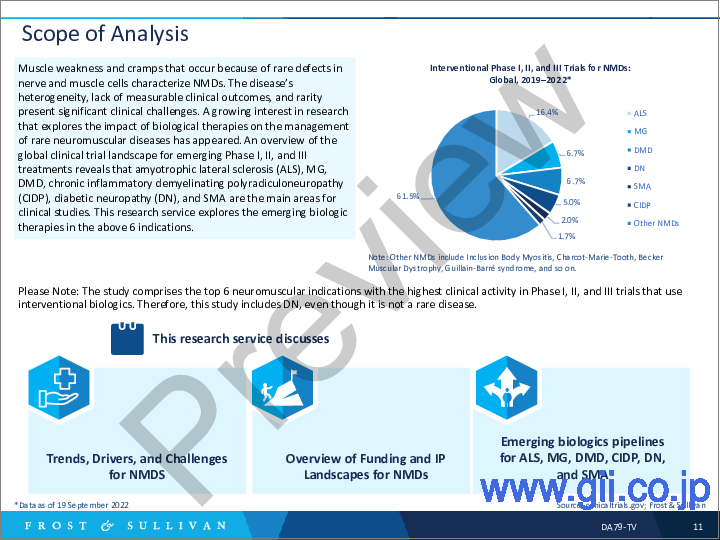

Muscle weakness, cramps, and impaired musculoskeletal functions that occur due to rare defects in nerve and muscle cells characterize neuromuscular disorders (NMDs). The disorders are largely classified as motor neuron diseases, hereditary ataxias, peripheral nerve disorders, neuromuscular junction transmission disorders, and myopathies. NMDs present significant clinical challenges because of disease heterogeneity and rarity of occurrence. The lack of measurable early disease markers and clinical outcomes further complicates the management of such disorders.

Biologics presents a personalized and targeted method to treat NMDs and is a promising treatment class. An overview of the global clinical trial landscape for emerging Phase 1, 2, and 3 treatments revealed that Amyotrophic Lateral Sclerosis (ALS), Myasthenia Gravis (MG), Duchenne Muscular Dystrophy (DMD), Chronic Inflammatory Demyelinating Polyradiculoneuropathy (CIDP), Diabetic Neuropathy (DN), and Spinal Muscular Atrophy (SMA) are the key hotspots for clinical studies. These indications are likely to witness new drug developments. Frost & Sullivan's research, "Emerging Therapeutics for Rare Neuromuscular Diseases: A Pipeline Analysis" explores emerging biologics across these six NMDs.

Key biologics emerging for these rare NMDs include: stem cell therapies, other cell-based treatments, gene therapies, RNA therapeutics, immunotherapies, and other protein/peptide-based treatments. There were 3 recent US FDA approvals for NMD RNA therapies: Nusinersen for SMA and Eteplirsen for DMD in 2016, and Golodirsen for DMD in 2019. Furthermore, Sarepta's Casimersen for DMD and argenx's efgartigimod for MG were approved as recently as 2021. Biologics have opened doors for ground-breaking disease-modifying treatments and will transform the quality of life for patients across the world.

While biologics may appear to cost more than small molecule treatments, they provide a personalized and, in some cases, the only treatment option. They can also be less expensive than lifetime treatment costs for certain rare NMDs. For example, Zolgensma's $2.1 million price tag (approximate) is still lower than the standard medical costs incurred for SMA patients in a lifetime. Furthermore, the evolving payer landscape is likely to get more standardized in the coming years to offer greater access to biologicals. Therefore, biologics are suitably poised to transform the rare NMD landscape with personalized and targeted treatment strategies and will provide life-saving treatment options for fatal neuromuscular conditions.

Key Points Discussed:

- What are the key emerging biologics for NMDs with high clinical activity?

- What are the key drivers or challenges for biologics development across NMDs?

- How do venture funding and patent landscapes look for NMD biologics?

- Who are the key industry participants developing biologics for NMDs?

- What are the clinical trends emerging across each biologic category for NMDs?

- Which biologic categories provide promising growth opportunities for NMD management?

Table of Contents

Strategic Imperatives

- Why Is It Increasingly Difficult to Grow?The Strategic Imperative 8™: Factors Creating Pressure on Growth

- The Strategic Imperative 8™

- The Impact of the Top 3 Strategic Imperatives on Rare Neuromuscular Disease Management

- Growth Opportunities Fuel the Growth Pipeline Engine™

- Research Methodology

Growth Opportunity Analysis

- Scope of Analysis

- Segmentation

- Predominant Emerging Biologic Classes Across NMDs

- Growth Drivers

- Growth Restraints

Growth Environment

- Sharp Growth in Investor Interest for Rare NMD Treatments

- Snapshot of Venture-backed Companies that Enable Biologics Progress

- Biologic Patents for NMDs

- Patent Landscape-Biologics for NMDs

- Top Participants

ALS: Biologics Pipeline Analysis

- Biological Therapies for ALS

- ALS Cell Therapies, 2022

- ALS Oligonucleotide Therapies, 2022

- ALS Protein Therapies, 2022

- Highlights of Recent Biologics Studies for ALS Treatment

- Exploring New Therapy Paradigms for ALS Treatment

MG: Biologics Pipeline Analysis

- Upcoming Biologics for MG Treatment

- Protein Therapies for MG

- Clinical Trial Progress in Biologics* for MG

- Dominant MG Biologics

DMD: Biologics Pipeline Analysis

- Gene Therapies in the Emerging DMD Biologics Landscape

- Exon-Skipping Therapies for DMD

- Microdystrophin Gene Therapies for DMD

- Oligonucleotide Therapies to Lead DMD Management

SMA: Biologics Pipeline Analysis

- Approved and Emerging Biologics* Classes for SMA

- Biologics Transforming the Clinical Landscape for SMA

- SMA Management Through Groundbreaking Therapies

- Novartis' Zolgensma: A Clinical Breakthrough for SMA

- Novartis' Zolgensma: A Clinical Breakthrough for SMA (continued)

- Novartis' Zolgensma: A Clinical Breakthrough for SMA (continued)

DN & CIDP: Biologics Pipeline Analysis

- Biologics for DN Treatment

- Biologics for Treatment Personalization in DN

- Emerging Biologics for CIDP Treatment

- Immunoglobulins for CIDP Treatments

Growth Opportunity Universe

- Growth Opportunity 1: RNA Therapeutics

- Growth Opportunity 1: RNA Therapeutics (continued)

- Growth Opportunity 2: Cell and Gene Therapeutics

- Growth Opportunity 2: Cell and Gene Therapeutics (continued)

- Growth Opportunity 3: Protein Therapeutics

- Growth Opportunity 3: Protein Therapeutics (continued)

Next Steps

- Your Next Steps

- Why Frost, Why Now?

- Legal Disclaimer