|

|

市場調査レポート

商品コード

1547172

遠隔操作の世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- コンポーネント別、企業規模別、用途別、地域別Teleoperations Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

|

|||||||

| 遠隔操作の世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- コンポーネント別、企業規模別、用途別、地域別 |

|

出版日: 2024年08月26日

発行: Fairfield Market Research

ページ情報: 英文 290 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

世界の遠隔操作の市場規模は、2024年に5億657万米ドルになるとみられ、2031年には35億1,600万米ドルに上昇するという予測もあり、大きな成長を遂げようとしています。この急増は、31.90%という堅調なCAGRによってもたらされます。市場予測は大幅な成長を示唆しており、今後数年間で市場規模の大幅な拡大が予想されます。この上昇軌道は、ロボティックプロセスオートメーションの進歩や、各業界における遠隔操作ソリューションの導入拡大が大きな要因となっています。

遠隔操作、またはテレロボティクスは、人間のオペレーターによるロボットシステムの遠隔操作を指します。典型的な遠隔操作のセットアップでは、ロボットに信号が送信され、ロボットが割り当てられたタスクを実行し、確認信号がオペレーターに返信されます。テレメトリーとして知られるこのプロセスは、オペレーターに拡張現実(AR)の一形態を提供し、遠くからでもロボットの行動を見たり制御したりすることを可能にします。

インダストリー4.0とデジタルトランスフォーメーションの重要性の高まりが、遠隔操作市場の拡大を大きく後押ししています。世界中の政府がインダストリー4.0への投資を強化し、産業内の自動化を促進するためのインセンティブやリベートを提供しています。この動向は、スマート技術の採用拡大によってさらに強化され、遠隔操作ソリューションの需要増につながっています。

北米は世界の遠隔操作市場の主要地域として台頭しており、最大の市場シェアを占めています。同地域は、様々な産業で遠隔操作ソリューションの迅速な導入が進んでいることから、予測期間中も主導権を維持すると見られています。欧州市場も、市場全体への貢献度の高さで注目されます。

当レポートでは、世界の遠隔操作市場について調査し、市場の概要とともに、コンポーネント別、企業規模別、用途別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナ・ロシア紛争の影響

- 経済概要

- PESTLE分析

第3章 世界の遠隔操作市場の見通し、2019年~2031年

- 世界の遠隔操作市場の見通し、コンポーネント別、金額(100万米ドル)、2019年~2031年

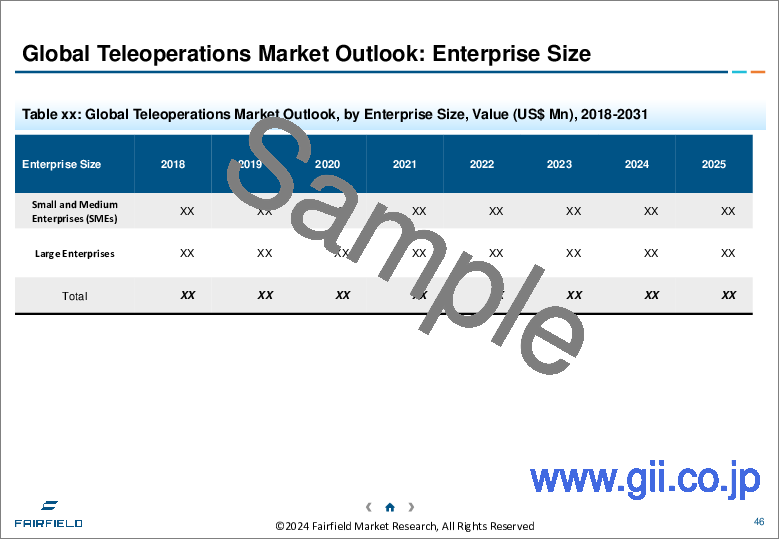

- 世界の遠隔操作市場の見通し、企業規模別、金額(100万米ドル)、2019年~2031年

- 世界の遠隔操作市場の見通し、用途別、価値(100万米ドル)、2019年~2031年

- 世界の遠隔操作市場の見通し、地域別、金額(100万米ドル)、2019年~2031年

第4章 北米の遠隔操作市場の見通し、2019年~2031年

第5章 欧州の遠隔操作市場の見通し、2019年~2031年

第6章 アジア太平洋の遠隔操作市場の見通し、2019年~2031年

第7章 ラテンアメリカの遠隔操作市場の見通し、2019年~2031年

第8章 中東・アフリカの遠隔操作市場の見通し、2019年~2031年

第9章 競合情勢

- コンポーネント別と用途別のヒートマップ

- 企業市場シェア分析、2023年

- 競争ダッシュボード

- 企業プロファイル

- Ottopia

- Cognicept

- Voysys

- Formant

- Taurob GmbH

- Shadow Robot Company

- Scooterson

- Quantum Signal LLC

- Neya Systems

- Phantom Autos

第10章 付録

The global teleoperations market, valued at $506.57 million in 2024, is poised for significant growth, with projections indicating a rise to $3.516 billion by 2031. This surge is driven by a robust CAGR of 31.90%. Market projections suggest substantial growth, with significant expansions in market size anticipated in the coming years. This upward trajectory is largely fueled by advancements in robotic process automation and the growing deployment of teleoperation solutions across industries.

Teleoperations: Transforming Remote Control in Smart Manufacturing

Teleoperations, or telerobotics, refer to the remote control of robotic systems by human operators. In a typical telerobotic setup, signals are transmitted to a robot, which then carries out the assigned tasks, with confirmation signals relayed back to the operator. This process, known as telemetry, provides operators with a form of augmented reality (AR), enabling them to view and control the robot's actions from afar.

The increasing importance of Industry 4.0 and digital transformation is significantly driving the expansion of the teleoperations market. Governments around the globe are ramping up investments in Industry 4.0 initiatives, offering incentives and rebates to promote automation within industries. This trend is further bolstered by the growing adoption of smart technologies, leading to an increased demand for teleoperation solutions.

North America Dominates the Teleoperations Market

North America is emerging as a key player in the global teleoperations market, commanding the largest market share. The region is expected to maintain its leadership throughout the forecast period, driven by the swift adoption of teleoperation solutions across various industries. The European market is also notable for its strong contribution to the overall market value.

United States: A Hotbed of Teleoperations Innovation

The United States is a significant market for teleoperations, thanks to the presence of leading companies specializing in teleoperation solutions. The rising popularity of autonomous vehicles and the integration of smart technology across sectors have positioned the U.S. as a major contributor to the global teleoperations market. The adoption of driverless vehicles in logistics and delivery is already underway, giving the U.S. a competitive advantage in the market.

Asia: A Market with Tremendous Potential

Asia, particularly India, is poised to exhibit impressive growth rates in the teleoperations market. The growing importance of teleoperations across various industries and the government's emphasis on enhancing robotic process automation are key drivers of the market's expansion in the region. The adoption of smart factory solutions further accelerates the market's growth in Asia.

Germany: A Key Player in the European Teleoperations Market

Germany, with its strong robotics sector and rising demand for smart vehicles, is set to be a major player in the European teleoperations market. The country's focus on cost reduction and the adoption of smart manufacturing solutions are driving the growth of teleoperations in Germany. Increased government investments in robotic process automation further boost the market's prospects.

Hardware Segment Leads the Teleoperations Market

Within the teleoperations market, the hardware segment is expected to hold the largest market share. The demand for teleoperated devices at operational sites is driving the growth of the hardware segment, which includes telemanipulators, head-mounted displays (HMDs), and other related devices. The need for advanced and cost-effective teleoperation hardware is propelling the market's expansion.

Large Enterprises Drive Teleoperations Demand

Large enterprises are anticipated to be the primary drivers of demand in the teleoperations market. Teleoperation solutions offer these enterprises efficient task management capabilities, enabling them to manage remote operations and warehouses effectively. The ability to perform tasks with minimal human intervention allows large enterprises to optimize time management and focus on more critical activities.

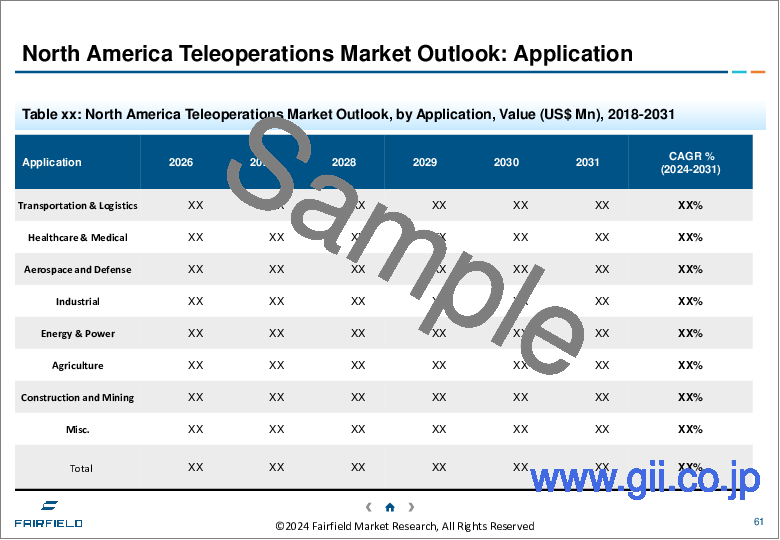

Transportation and Logistics: The Foremost Application of Teleoperations

The transportation and logistics sector is the largest application area for teleoperations. The ability to remotely control robotic devices and manage extensive warehouses with numerous items is becoming increasingly crucial for businesses worldwide. As a result, teleoperations are playing a pivotal role in enhancing the efficiency of logistics and transportation operations.

Strategic Partnerships and Innovation Fuel Market Competition

The competitive Analysis of the global teleoperations market is marked by strategic partnerships, mergers and acquisitions, and geographic expansion. Companies in the teleoperations market are focusing on innovation and collaboration to expand their product portfolios and meet the growing demand from customers. The introduction of new products and strategic alliances are key drivers of the market's growth.

In a recent development, DriveU.auto secured substantial funding to accelerate the adoption of autonomous vehicles through enhanced connectivity. Similarly, Ottopia's teleoperation software has been integrated into the NVIDIA DRIVE AGX platform, a comprehensive solution for developing safe autonomous vehicles in the transportation sector.

Competitive Analysis

- Ottopia

- Cognicept

- Voysys

- Formant

- Taurob GmbH

- Shadow Robot Company

- Scooterson

- Quantum Signal LLC

- Neya Systems

- Phantom Auto

Key Segments of Teleoperations Market Research

By Component:

- Hardware

- HMD Devices

- Telemanipulator Devices

- Others

- Teleoperation Platform/Software

- Services

- Design & Development Services

- Consulting Services

- Integration Services

- Support & Maintenance

By Enterprise Size:

- Teleoperations for SMEs

- Teleoperations for Large Enterprises

By Application:

- Teleoperations for Transportation & Logistics

- Teleoperations for Healthcare & Medical

- Teleoperations for Military & Public Safety

- Teleoperations for Smart Factory/Industry 4.0

- Teleoperations for Energy & Power

- Teleoperations for Agriculture

- Teleoperations for Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East and Africa (MEA)

Table of Contents

1. Executive Summary

- 1.1. Global Teleoperations Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value, 2023

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Global Teleoperations Market Outlook, 2019 - 2031

- 3.1. Global Teleoperations Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

- 3.1.1. Key Highlights

- 3.1.1.1. Hardware

- 3.1.1.1.1. HMD Devices

- 3.1.1.1.2. Telemanipulator Devices

- 3.1.1.1.3. Others

- 3.1.1.2. Teleoperation Platform/Software

- 3.1.1.3. Services

- 3.1.1.3.1. Design & Development Services

- 3.1.1.3.2. Consulting Services

- 3.1.1.3.3. Integration Services

- 3.1.1.3.4. Support & Maintenance

- 3.1.1.1. Hardware

- 3.1.1. Key Highlights

- 3.2. Global Teleoperations Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 3.2.1. Key Highlights

- 3.2.1.1. Teleoperations for SMEs

- 3.2.1.2. Teleoperations for Large Enterprises

- 3.2.1. Key Highlights

- 3.3. Global Teleoperations Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

- 3.3.1. Key Highlights

- 3.3.1.1. Teleoperations for Transportation & Logistics

- 3.3.1.2. Teleoperations for Healthcare & Medical

- 3.3.1.3. Teleoperations for Military & Public Safety

- 3.3.1.4. Teleoperations for Smart Factory/Industry 4.0

- 3.3.1.5. Teleoperations for Energy & Power

- 3.3.1.6. Teleoperations for Agriculture

- 3.3.1.7. Teleoperations for Others

- 3.3.1. Key Highlights

- 3.4. Global Teleoperations Market Outlook, by Region, Value (US$ Mn), 2019 - 2031

- 3.4.1. Key Highlights

- 3.4.1.1. North America

- 3.4.1.2. Europe

- 3.4.1.3. Asia Pacific

- 3.4.1.4. Latin America

- 3.4.1.5. Middle East & Africa

- 3.4.1. Key Highlights

4. North America Teleoperations Market Outlook, 2019 - 2031

- 4.1. North America Teleoperations Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

- 4.1.1. Key Highlights

- 4.1.1.1. Hardware

- 4.1.1.1.1. HMD Devices

- 4.1.1.1.2. Telemanipulator Devices

- 4.1.1.1.3. Others

- 4.1.1.2. Teleoperation Platform/Software

- 4.1.1.3. Services

- 4.1.1.3.1. Design & Development Services

- 4.1.1.3.2. Consulting Services

- 4.1.1.3.3. Integration Services

- 4.1.1.3.4. Support & Maintenance

- 4.1.1.1. Hardware

- 4.1.1. Key Highlights

- 4.2. North America Teleoperations Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 4.2.1. Key Highlights

- 4.2.1.1. Teleoperations for SMEs

- 4.2.1.2. Teleoperations for Large Enterprises

- 4.2.1. Key Highlights

- 4.3. North America Teleoperations Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

- 4.3.1. Key Highlights

- 4.3.1.1. Teleoperations for Transportation & Logistics

- 4.3.1.2. Teleoperations for Healthcare & Medical

- 4.3.1.3. Teleoperations for Military & Public Safety

- 4.3.1.4. Teleoperations for Smart Factory/Industry 4.0

- 4.3.1.5. Teleoperations for Energy & Power

- 4.3.1.6. Teleoperations for Agriculture

- 4.3.1.7. Teleoperations for Others

- 4.3.2. BPS Analysis/Market Attractiveness Analysis

- 4.3.1. Key Highlights

- 4.4. North America Teleoperations Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

- 4.4.1. Key Highlights

- 4.4.1.1. U.S. Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 4.4.1.2. U.S. Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 4.4.1.3. U.S. Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 4.4.1.4. Canada Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 4.4.1.5. Canada Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 4.4.1.6. Canada Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 4.4.2. BPS Analysis/Market Attractiveness Analysis

- 4.4.1. Key Highlights

5. Europe Teleoperations Market Outlook, 2019 - 2031

- 5.1. Europe Teleoperations Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1. Hardware

- 5.1.1.1.1. HMD Devices

- 5.1.1.1.2. Telemanipulator Devices

- 5.1.1.1.3. Others

- 5.1.1.2. Teleoperation Platform/Software

- 5.1.1.3. Services

- 5.1.1.3.1. Design & Development Services

- 5.1.1.3.2. Consulting Services

- 5.1.1.3.3. Integration Services

- 5.1.1.3.4. Support & Maintenance

- 5.1.1.1. Hardware

- 5.1.1. Key Highlights

- 5.2. Europe Teleoperations Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Teleoperations for SMEs

- 5.2.1.2. Teleoperations for Large Enterprises

- 5.2.1. Key Highlights

- 5.3. Europe Teleoperations Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. Teleoperations for Transportation & Logistics

- 5.3.1.2. Teleoperations for Healthcare & Medical

- 5.3.1.3. Teleoperations for Military & Public Safety

- 5.3.1.4. Teleoperations for Smart Factory/Industry 4.0

- 5.3.1.5. Teleoperations for Energy & Power

- 5.3.1.6. Teleoperations for Agriculture

- 5.3.1.7. Teleoperations for Others

- 5.3.2. BPS Analysis/Market Attractiveness Analysis

- 5.3.1. Key Highlights

- 5.4. Europe Teleoperations Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

- 5.4.1. Key Highlights

- 5.4.1.1. Germany Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.2. Germany Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.3. Germany Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.1.4. U.K. Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.5. U.K. Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.6. U.K. Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.1.7. France Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.8. France Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.9. France Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.1.10. Italy Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.11. Italy Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.12. Italy Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.1.13. Turkey Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.14. Turkey Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.15. Turkey Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.1.16. Russia Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.17. Russia Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.18. Russia Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.1.19. Rest of Europe Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 5.4.1.20. Rest of Europe Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 5.4.1.21. Rest of Europe Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 5.4.2. BPS Analysis/Market Attractiveness Analysis

- 5.4.1. Key Highlights

6. Asia Pacific Teleoperations Market Outlook, 2019 - 2031

- 6.1. Asia Pacific Teleoperations Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1. Hardware

- 6.1.1.1.1. HMD Devices

- 6.1.1.1.2. Telemanipulator Devices

- 6.1.1.1.3. Others

- 6.1.1.2. Teleoperation Platform/Software

- 6.1.1.3. Services

- 6.1.1.3.1. Design & Development Services

- 6.1.1.3.2. Consulting Services

- 6.1.1.3.3. Integration Services

- 6.1.1.3.4. Support & Maintenance

- 6.1.1.1. Hardware

- 6.1.1. Key Highlights

- 6.2. Asia Pacific Teleoperations Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Teleoperations for SMEs

- 6.2.1.2. Teleoperations for Large Enterprises

- 6.2.1. Key Highlights

- 6.3. Asia Pacific Teleoperations Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. Teleoperations for Transportation & Logistics

- 6.3.1.2. Teleoperations for Healthcare & Medical

- 6.3.1.3. Teleoperations for Military & Public Safety

- 6.3.1.4. Teleoperations for Smart Factory/Industry 4.0

- 6.3.1.5. Teleoperations for Energy & Power

- 6.3.1.6. Teleoperations for Agriculture

- 6.3.1.7. Teleoperations for Others

- 6.3.2. BPS Analysis/Market Attractiveness Analysis

- 6.3.1. Key Highlights

- 6.4. Asia Pacific Teleoperations Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

- 6.4.1. Key Highlights

- 6.4.1.1. China Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 6.4.1.2. China Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.4.1.3. China Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 6.4.1.4. Japan Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 6.4.1.5. Japan Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.4.1.6. Japan Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 6.4.1.7. South Korea Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 6.4.1.8. South Korea Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.4.1.9. South Korea Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 6.4.1.10. India Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 6.4.1.11. India Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.4.1.12. India Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 6.4.1.13. Southeast Asia Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 6.4.1.14. Southeast Asia Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.4.1.15. Southeast Asia Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 6.4.1.16. Rest of Asia Pacific Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 6.4.1.17. Rest of Asia Pacific Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 6.4.1.18. Rest of Asia Pacific Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 6.4.2. BPS Analysis/Market Attractiveness Analysis

- 6.4.1. Key Highlights

7. Latin America Teleoperations Market Outlook, 2019 - 2031

- 7.1. Latin America Teleoperations Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1. Hardware

- 7.1.1.1.1. HMD Devices

- 7.1.1.1.2. Telemanipulator Devices

- 7.1.1.1.3. Others

- 7.1.1.2. Teleoperation Platform/Software

- 7.1.1.3. Services

- 7.1.1.3.1. Design & Development Services

- 7.1.1.3.2. Consulting Services

- 7.1.1.3.3. Integration Services

- 7.1.1.3.4. Support & Maintenance

- 7.1.1.1. Hardware

- 7.1.1. Key Highlights

- 7.2. Latin America Teleoperations Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 7.2.1. Key Highlights

- 7.2.1.1. Teleoperations for SMEs

- 7.2.1.2. Teleoperations for Large Enterprises

- 7.2.1. Key Highlights

- 7.3. Latin America Teleoperations Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. Teleoperations for Transportation & Logistics

- 7.3.1.2. Teleoperations for Healthcare & Medical

- 7.3.1.3. Teleoperations for Military & Public Safety

- 7.3.1.4. Teleoperations for Smart Factory/Industry 4.0

- 7.3.1.5. Teleoperations for Energy & Power

- 7.3.1.6. Teleoperations for Agriculture

- 7.3.1.7. Teleoperations for Others

- 7.3.2. BPS Analysis/Market Attractiveness Analysis

- 7.3.1. Key Highlights

- 7.4. Latin America Teleoperations Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

- 7.4.1. Key Highlights

- 7.4.1.1. Brazil Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 7.4.1.2. Brazil Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 7.4.1.3. Brazil Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 7.4.1.4. Mexico Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 7.4.1.5. Mexico Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 7.4.1.6. Mexico Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 7.4.1.7. Argentina Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 7.4.1.8. Argentina Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 7.4.1.9. Argentina Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 7.4.1.10. Rest of Latin America Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 7.4.1.11. Rest of Latin America Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 7.4.1.12. Rest of Latin America Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 7.4.2. BPS Analysis/Market Attractiveness Analysis

- 7.4.1. Key Highlights

8. Middle East & Africa Teleoperations Market Outlook, 2019 - 2031

- 8.1. Middle East & Africa Teleoperations Market Outlook, by Component, Value (US$ Mn), 2019 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1. Hardware

- 8.1.1.1.1. HMD Devices

- 8.1.1.1.2. Telemanipulator Devices

- 8.1.1.1.3. Others

- 8.1.1.2. Teleoperation Platform/Software

- 8.1.1.3. Services

- 8.1.1.3.1. Design & Development Services

- 8.1.1.3.2. Consulting Services

- 8.1.1.3.3. Integration Services

- 8.1.1.3.4. Support & Maintenance

- 8.1.1.1. Hardware

- 8.1.1. Key Highlights

- 8.2. Middle East & Africa Teleoperations Market Outlook, by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 8.2.1. Key Highlights

- 8.2.1.1. Teleoperations for SMEs

- 8.2.1.2. Teleoperations for Large Enterprises

- 8.2.1. Key Highlights

- 8.3. Middle East & Africa Teleoperations Market Outlook, by Application, Value (US$ Mn), 2019 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. Teleoperations for Transportation & Logistics

- 8.3.1.2. Teleoperations for Healthcare & Medical

- 8.3.1.3. Teleoperations for Military & Public Safety

- 8.3.1.4. Teleoperations for Smart Factory/Industry 4.0

- 8.3.1.5. Teleoperations for Energy & Power

- 8.3.1.6. Teleoperations for Agriculture

- 8.3.1.7. Teleoperations for Others

- 8.3.2. BPS Analysis/Market Attractiveness Analysis

- 8.3.1. Key Highlights

- 8.4. Middle East & Africa Teleoperations Market Outlook, by Country, Value (US$ Mn), 2019 - 2031

- 8.4.1. Key Highlights

- 8.4.1.1. GCC Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 8.4.1.2. GCC Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 8.4.1.3. GCC Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 8.4.1.4. South Africa Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 8.4.1.5. South Africa Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 8.4.1.6. South Africa Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 8.4.1.7. Egypt Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 8.4.1.8. Egypt Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 8.4.1.9. Egypt Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 8.4.1.10. Nigeria Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 8.4.1.11. Nigeria Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 8.4.1.12. Nigeria Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 8.4.1.13. Rest of Middle East & Africa Teleoperations Market by Component, Value (US$ Mn), 2019 - 2031

- 8.4.1.14. Rest of Middle East & Africa Teleoperations Market by Enterprise Size, Value (US$ Mn), 2019 - 2031

- 8.4.1.15. Rest of Middle East & Africa Teleoperations Market by Application, Value (US$ Mn), 2019 - 2031

- 8.4.2. BPS Analysis/Market Attractiveness Analysis

- 8.4.1. Key Highlights

9. Competitive Landscape

- 9.1. By Component vs by Application Heat map

- 9.2. Company Market Share Analysis, 2023

- 9.3. Competitive Dashboard

- 9.4. Company Profiles

- 9.4.1. Ottopia

- 9.4.1.1. Company Overview

- 9.4.1.2. Product Portfolio

- 9.4.1.3. Financial Overview

- 9.4.1.4. Business Strategies and Development

- 9.4.2. Cognicept

- 9.4.2.1. Company Overview

- 9.4.2.2. Product Portfolio

- 9.4.2.3. Financial Overview

- 9.4.2.4. Business Strategies and Development

- 9.4.3. Voysys

- 9.4.3.1. Company Overview

- 9.4.3.2. Product Portfolio

- 9.4.3.3. Financial Overview

- 9.4.3.4. Business Strategies and Development

- 9.4.4. Formant

- 9.4.4.1. Company Overview

- 9.4.4.2. Product Portfolio

- 9.4.4.3. Financial Overview

- 9.4.4.4. Business Strategies and Development

- 9.4.5. Taurob GmbH

- 9.4.5.1. Company Overview

- 9.4.5.2. Product Portfolio

- 9.4.5.3. Financial Overview

- 9.4.5.4. Business Strategies and Development

- 9.4.6. Shadow Robot Company

- 9.4.6.1. Company Overview

- 9.4.6.2. Product Portfolio

- 9.4.6.3. Financial Overview

- 9.4.6.4. Business Strategies and Development

- 9.4.7. Scooterson

- 9.4.7.1. Company Overview

- 9.4.7.2. Product Portfolio

- 9.4.7.3. Financial Overview

- 9.4.7.4. Business Strategies and Development

- 9.4.8. Quantum Signal LLC

- 9.4.8.1. Company Overview

- 9.4.8.2. Product Portfolio

- 9.4.8.3. Financial Overview

- 9.4.8.4. Business Strategies and Development

- 9.4.9. Neya Systems

- 9.4.9.1. Company Overview

- 9.4.9.2. Product Portfolio

- 9.4.9.3. Financial Overview

- 9.4.9.4. Business Strategies and Development

- 9.4.10. Phantom Autos

- 9.4.10.1. Company Overview

- 9.4.10.2. Product Portfolio

- 9.4.10.3. Financial Overview

- 9.4.10.4. Business Strategies and Development

- 9.4.1. Ottopia

10. Appendix

- 10.1. Research Methodology

- 10.2. Report Assumptions

- 10.3. Acronyms and Abbreviations