|

|

市場調査レポート

商品コード

1466617

シートモールディングコンパウンドの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- 製品別、技術別、グレード別、用途別、エンドユーザー別、地域別Sheet Molding Compound Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2031 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

|

|||||||

| シートモールディングコンパウンドの世界市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2031年)- 製品別、技術別、グレード別、用途別、エンドユーザー別、地域別 |

|

出版日: 2024年04月17日

発行: Fairfield Market Research

ページ情報: 英文 243 Pages

納期: 2~5営業日

|

全表示

- 概要

- 目次

近年、シートモールディングコンパウンド(SMC)の市場規模は著しい成長を遂げており、2031年には35億米ドルを超えると予測されています。この需要の急増は、様々な産業、特に自動車や消費財においてSMCが極めて重要な役割を果たしていることを裏付けています。

自動車業界は、燃費と性能を向上させるために軽量材料を追求しており、これがSMCの需要を促進する主な要因となっています。自動車メーカーは、従来のスチール製コンポーネントに代わる有力な選択肢として、SMCにますます注目しています。これらのコンパウンドは固有の軽量特性を備えているため、ピックアップトラックの箱、ボンネット、バンパー、フェンダー、デッキリッドなどの重要な自動車部品の製造に魅力的な材料となっています。この変化は、重金属への依存を減らし、先端複合材料を採用する業界全体の動向を反映しています。

メーカー各社は、SMCの機械的特性を強化するための研究開発に積極的に投資し、進化するエンドユーザーのニーズに応えています。特に、低密度SMCの開発に炭素繊維を使用する動きが活発化しています。炭素繊維による補強は、SMCの強度と耐久性を高めると同時に軽量性にも貢献し、重量が重視される自動車用途に理想的な材料となっています。ハイブリッド技術の進歩は、新たな用途を開拓し、メーカーの収益性を高めることで、SMC市場に革命を起こそうとしています。

当レポートでは、世界のシートモールディングコンパウンド市場について調査し、市場の概要とともに、製品タイプ別、最終用途別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- ウクライナ・ロシア紛争の影響

- 経済概要

- PESTLE分析

第3章 世界のシートモールディングコンパウンド市場の見通し、2018年~2031年

- 世界のシートモールディングコンパウンド市場の見通し、製品タイプ別、金額(10億米ドル)、数量(トン)、2018年~2031年

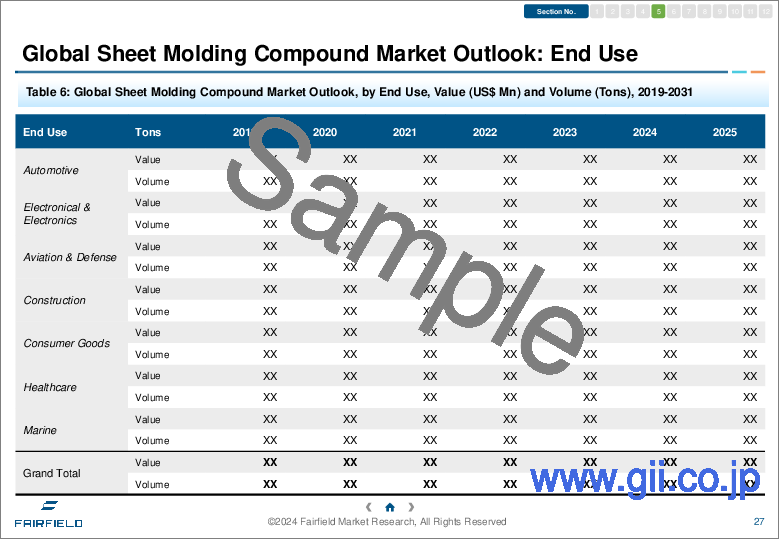

- 世界のシートモールディングコンパウンド市場の見通し、最終用途別、金額(10億米ドル)、数量(トン)、2018年~2031年

- 世界のシートモールディングコンパウンド市場の見通し、地域別、金額(10億米ドル)、数量(トン)、2018年~2031年

第4章 北米のシートモールディングコンパウンド市場の見通し、2018年~2031年

第5章 欧州のシートモールディングコンパウンド市場の見通し、2018年~2031年

第6章 アジア太平洋のシートモールディングコンパウンド市場の見通し、2018年~2031年

第7章 ラテンアメリカのシートモールディングコンパウンド市場の見通し、2018年~2031年

第8章 中東・アフリカのシートモールディングコンパウンド市場の見通し、2018年~2031年

第9章 競合情勢

- 最終用途別vs最終用途別ヒートマップ

- メーカー別と最終用途別のヒートマップ

- 企業市場シェア分析、2023年

- 競合ダッシュボード

- 企業プロファイル

- IDI Composites International

- Menzolit

- Polny

- Continental Structural Plastics Inc.

- Zoltek Corporation

- DIC Corporation

- Changzhou Tianma Group Co., Ltd.

- Core Molding Technologies

- Zhejiang Sida New Materials Co., Ltd.

- Molymer SSP Co., Ltd.

- Showa Denko K.K.

- Devi Polymers Private Limited

第10章 付録

In recent years, the sheet molding compounds (SMC) market has witnessed remarkable growth, with projections indicating a valuation exceeding US$ 3.5 billion by 2031. This surge in demand underscores the pivotal role of SMCs across various industries, especially automotive and consumer goods. This comprehensive analysis delves into the key drivers, challenges, and opportunities shaping the global SMC market landscape.

Driving Forces Behind SMC Adoption:

The automotive industry's pursuit of lightweight materials to enhance fuel efficiency and performance stands as a primary driver fueling the demand for SMCs. Car manufacturers are increasingly turning to SMCs as a viable alternative to traditional steel components. These compounds offer inherent lightweight properties, making them attractive for manufacturing crucial automotive parts such as pickup truck boxes, hoods, bumpers, fenders, and deck lids. This shift reflects an industry-wide trend towards reducing reliance on heavy metals and embracing advanced composite materials.

Innovations Propelling Market Growth:

Manufacturers are actively investing in research and development to enhance the mechanical properties of SMCs, meeting evolving end-user needs. Notably, the use of carbon fiber for developing low-density SMCs has gained traction. Carbon fiber reinforcement enhances the strength and durability of SMCs while contributing to their lightweight nature, making them ideal for weight-sensitive automotive applications. Advancements in hybrid technology are poised to revolutionize the SMC market by unlocking new applications and driving greater profitability for manufacturers.

Regional Dynamics:

The geographical landscape of the SMC market is undergoing significant shifts, with East Asia emerging as a dominant player. While Europe has traditionally been a key market for automotive manufacturing, the rapid growth of the automotive industry in East Asia, particularly in China and Japan, is reshaping competitive dynamics. China's ambitious push towards electrifying the automotive sector, coupled with its thriving consumer goods industry, positions it as a key market player. Similarly, Japan's strong presence in automotive manufacturing and focus on technological innovation make it a lucrative market for SMC manufacturers.

Challenges and Opportunities:

Despite promising growth prospects, the SMC market faces challenges that could impact its trajectory. The emergence of alternative materials, such as long fiber injection (LFI), presents a competitive threat to traditional SMCs. The economic efficiency and comparable performance of LFI pose challenges to SMC manufacturers, necessitating strategic responses to maintain market dominance. Additionally, the rising prices of carbon fiber, a key component in SMC production, could hinder market growth by making SMCs less cost-competitive compared to alternative materials.

Competitive Landscape:

Key companies driving the SMC market include LyondellBasell Industries Ltd., TORAY INDUSTRIES, INC, Polynt S.p.A., Ashland Inc, Premix Inc., Mitsubishi Chemical Holdings Corporation, TEIJIN LIMITED, Wacker Chemie AG, ASTAR S.A., and Core Molding Techn.

Market Segmentation:

To provide comprehensive insights, the SMC market is segmented based on fiber type, end-use applications, and geographic regions.

Fiber Type:

Glass Fiber

Carbon Fiber

End-Use Applications:

Automotive

Electrical & Electronic

Aviation & Defense

Construction

Consumer Goods

Healthcare

Marine

Geographic Regions:

North America

Latin America

Europe

South Asia

East Asia

Oceania

Middle East and Africa

Table of Contents

1. Executive Summary

- 1.1. Global Sheet Molding Compound Market Snapshot

- 1.2. Future Projections

- 1.3. Key Market Trends

- 1.4. Regional Snapshot, by Value, 2024

- 1.5. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.2. Restraints

- 2.2.3. Market Opportunities

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. COVID-19 Impact Analysis

- 2.5.1. Supply

- 2.5.2. Demand

- 2.6. Impact of Ukraine-Russia Conflict

- 2.7. Economic Overview

- 2.7.1. World Economic Projections

- 2.8. PESTLE Analysis

3. Global Sheet Molding Compound Market Outlook, 2018 - 2031

- 3.1. Global Sheet Molding Compound Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 3.1.1. Key Highlights

- 3.1.1.1. Carbon Fiber

- 3.1.1.2. Glass Fiber

- 3.1.1. Key Highlights

- 3.2. Global Sheet Molding Compound Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 3.2.1. Key Highlights

- 3.2.1.1. Automotive

- 3.2.1.2. Electrical & Electronic

- 3.2.1.3. Aviation & Defense

- 3.2.1.4. Construction

- 3.2.1.5. Consumer Goods

- 3.2.1.6. Healthcare

- 3.2.1.7. Marine

- 3.2.1. Key Highlights

- 3.3. Global Sheet Molding Compound Market Outlook, by Region, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 3.3.1. Key Highlights

- 3.3.1.1. North America

- 3.3.1.2. Europe

- 3.3.1.3. Asia Pacific

- 3.3.1.4. Latin America

- 3.3.1.5. Middle East & Africa

- 3.3.1. Key Highlights

4. North America Sheet Molding Compound Market Outlook, 2018 - 2031

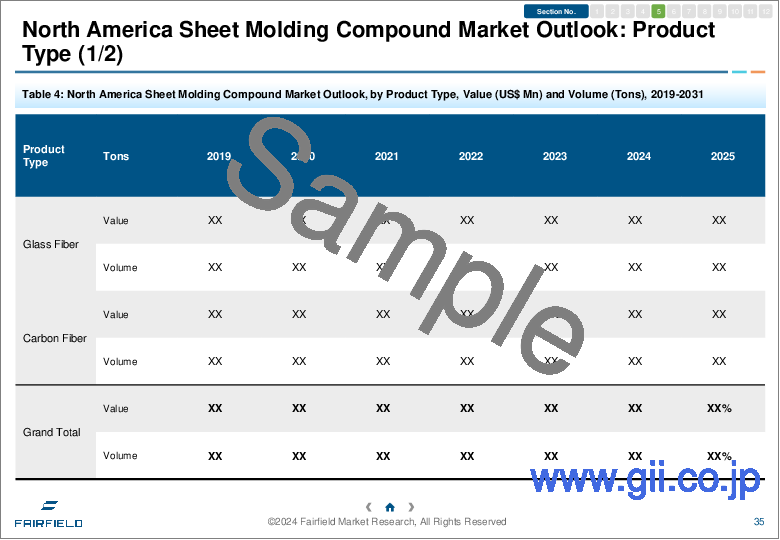

- 4.1. North America Sheet Molding Compound Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.1.1. Key Highlights

- 4.1.1.1. Carbon Fiber

- 4.1.1.2. Glass Fiber

- 4.1.1. Key Highlights

- 4.2. North America Sheet Molding Compound Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.2.1. Key Highlights

- 4.2.1.1. Automotive

- 4.2.1.2. Electrical & Electronic

- 4.2.1.3. Aviation & Defense

- 4.2.1.4. Construction

- 4.2.1.5. Consumer Goods

- 4.2.1.6. Healthcare

- 4.2.1.7. Marine

- 4.2.1. Key Highlights

- 4.3. North America Sheet Molding Compound Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.3.1. Key Highlights

- 4.3.1.1. U.S. Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.3.1.2. U.S. Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.3.1.3. Canada Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.3.1.4. Canada Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 4.3.2. BPS Analysis/Market Attractiveness Analysis

- 4.3.1. Key Highlights

5. Europe Sheet Molding Compound Market Outlook, 2018 - 2031

- 5.1. Europe Sheet Molding Compound Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.1.1. Key Highlights

- 5.1.1.1. Carbon Fiber

- 5.1.1.2. Glass Fiber

- 5.1.1. Key Highlights

- 5.2. Europe Sheet Molding Compound Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.2.1. Key Highlights

- 5.2.1.1. Automotive

- 5.2.1.2. Electrical & Electronic

- 5.2.1.3. Aviation & Defense

- 5.2.1.4. Construction

- 5.2.1.5. Consumer Goods

- 5.2.1.6. Healthcare

- 5.2.1.7. Marine

- 5.2.1. Key Highlights

- 5.3. Europe Sheet Molding Compound Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1. Key Highlights

- 5.3.1.1. Germany Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.2. Germany Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.3. U.K. Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.4. U.K. Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.5. France Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.6. France Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.7. Italy Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.8. Italy Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.9. Turkey Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.10. Turkey Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.11. Russia Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.12. Russia Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.13. Rest of Europe Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.1.14. Rest of Europe Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 5.3.2. BPS Analysis/Market Attractiveness Analysis

- 5.3.1. Key Highlights

6. Asia Pacific Sheet Molding Compound Market Outlook, 2018 - 2031

- 6.1. Asia Pacific Sheet Molding Compound Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.1.1. Key Highlights

- 6.1.1.1. Carbon Fiber

- 6.1.1.2. Glass Fiber

- 6.1.1. Key Highlights

- 6.2. Asia Pacific Sheet Molding Compound Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.2.1. Key Highlights

- 6.2.1.1. Automotive

- 6.2.1.2. Electrical & Electronic

- 6.2.1.3. Aviation & Defense

- 6.2.1.4. Construction

- 6.2.1.5. Consumer Goods

- 6.2.1.6. Healthcare

- 6.2.1.7. Marine

- 6.2.1. Key Highlights

- 6.3. Asia Pacific Sheet Molding Compound Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1. Key Highlights

- 6.3.1.1. China Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.2. China Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.3. Japan Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.4. Japan Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.5. South Korea Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.6. South Korea Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.7. India Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.8. India Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.9. Southeast Asia Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.10. Southeast Asia Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.11. Rest of Asia Pacific Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.1.12. Rest of Asia Pacific Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 6.3.2. BPS Analysis/Market Attractiveness Analysis

- 6.3.1. Key Highlights

7. Latin America Sheet Molding Compound Market Outlook, 2018 - 2031

- 7.1. Latin America Sheet Molding Compound Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.1.1. Key Highlights

- 7.1.1.1. Carbon Fiber

- 7.1.1.2. Glass Fiber

- 7.1.1. Key Highlights

- 7.2. Latin America Sheet Molding Compound Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.2.1.1. Automotive

- 7.2.1.2. Electrical & Electronic

- 7.2.1.3. Aviation & Defense

- 7.2.1.4. Construction

- 7.2.1.5. Consumer Goods

- 7.2.1.6. Healthcare

- 7.2.1.7. Marine

- 7.3. Latin America Sheet Molding Compound Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1. Key Highlights

- 7.3.1.1. Brazil Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.2. Brazil Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.3. Mexico Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.4. Mexico Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.5. Argentina Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.6. Argentina Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.7. Rest of Latin America Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.1.8. Rest of Latin America Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 7.3.2. BPS Analysis/Market Attractiveness Analysis

- 7.3.1. Key Highlights

8. Middle East & Africa Sheet Molding Compound Market Outlook, 2018 - 2031

- 8.1. Middle East & Africa Sheet Molding Compound Market Outlook, by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.1.1. Key Highlights

- 8.1.1.1. Carbon Fiber

- 8.1.1.2. Glass Fiber

- 8.1.1. Key Highlights

- 8.2. Middle East & Africa Sheet Molding Compound Market Outlook, by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.2.1. Key Highlights

- 8.2.1.1. Automotive

- 8.2.1.2. Electrical & Electronic

- 8.2.1.3. Aviation & Defense

- 8.2.1.4. Construction

- 8.2.1.5. Consumer Goods

- 8.2.1.6. Healthcare

- 8.2.1.7. Marine

- 8.2.1. Key Highlights

- 8.3. Middle East & Africa Sheet Molding Compound Market Outlook, by Country, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1. Key Highlights

- 8.3.1.1. GCC Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.2. GCC Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.3. South Africa Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.4. South Africa Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.5. Egypt Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.6. Egypt Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.7. Rest of Middle East & Africa Sheet Molding Compound Market by Product Type, Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.1.8. Rest of Middle East & Africa Sheet Molding Compound Market by End Use , Value (US$ Bn) and Volume (Tons), 2018 - 2031

- 8.3.2. BPS Analysis/Market Attractiveness Analysis

- 8.3.1. Key Highlights

9. Competitive Landscape

- 9.1. By End Use vs by End Use Heat map

- 9.2. Manufacturer vs by End Use Heatmap

- 9.3. Company Market Share Analysis, 2023

- 9.4. Competitive Dashboard

- 9.5. Company Profiles

- 9.5.1. IDI Composites International

- 9.5.1.1. Company Overview

- 9.5.1.2. Product Portfolio

- 9.5.1.3. Financial Overview

- 9.5.1.4. Business Strategies and Development

- 9.5.2. Menzolit

- 9.5.3. Polny

- 9.5.4. Continental Structural Plastics Inc.

- 9.5.5. Zoltek Corporation

- 9.5.6. DIC Corporation

- 9.5.7. Changzhou Tianma Group Co., Ltd.

- 9.5.8. Core Molding Technologies

- 9.5.9. Zhejiang Sida New Materials Co., Ltd.

- 9.5.10. Molymer SSP Co., Ltd.

- 9.5.11. Showa Denko K.K.

- 9.5.12. Devi Polymers Private Limited

- 9.5.1. IDI Composites International

10. Appendix

- 10.1.Research Methodology

- 10.2.Report Assumptions

- 10.3.Acronyms and Abbreviations