|

|

市場調査レポート

商品コード

1303478

バイオプラスチック市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2023年~2030年)- 製品別、エンドユーザー別、地域別(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ)Bioplastics Market - Global Industry Analysis, Size, Share, Growth, Trends, and Forecast 2023-2030 - By Product, Technology, Grade, Application, End-user, Region: (North America, Europe, Asia Pacific, Latin America and Middle East and Africa) |

||||||

|

|||||||

| バイオプラスチック市場 - 世界の業界分析、規模、シェア、成長、動向、予測(2023年~2030年)- 製品別、エンドユーザー別、地域別(北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ) |

|

出版日: 2023年07月03日

発行: Fairfield Market Research

ページ情報: 英文 220 Pages

納期: 2~5営業日

|

- 全表示

- 概要

- 目次

プラスチックが環境に与える影響が深刻化し、持続可能な廃棄物管理が世界中で求められている中、バイオプラスチックは有力な代替品として台頭し続けています。世界では年間2億トン以上のプラスチック廃棄物が発生しており、そのうちリサイクルされているのは10%未満であることから、従来のプラスチックに代わる効果的で持続可能な代替品に対する需要は非常に高まっています。

当レポートでは、世界のバイオプラスチック市場について調査し、市場の概要とともに、製品別、エンドユーザー別、地域別動向、および市場に参入する企業の競合動向などを提供しています。

目次

第1章 エグゼクティブサマリー

第2章 市場概要

- 市場の定義とセグメンテーション

- 市場力学

- バリューチェーン分析

- ポーターのファイブフォース分析

- COVID-19の影響分析

- 政府の規制

- 技術情勢

- 親市場におけるrPETのシェア

- 原材料分析

- 経済分析

第3章 生産高と貿易統計、2019年~2022年

第4章 価格動向分析と将来のプロジェクト、2019年~2030年

第5章 世界のバイオプラスチック市場の見通し、2019年~2030年

- 世界のバイオプラスチック市場の見通し、製品別、2019年~2030年

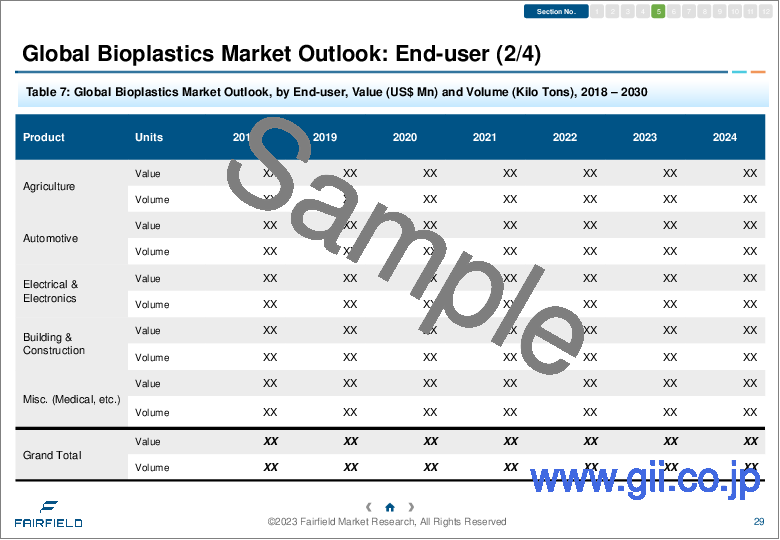

- 世界のバイオプラスチック市場の見通し、エンドユーザー別、2019年~2030年

- 世界のバイオプラスチック市場の見通し、地域別、2019年~2030年

第6章 北米のバイオプラスチック市場の見通し、2019年~2030年

第7章 欧州のバイオプラスチック市場の見通し、2019年~2030年

第8章 アジア太平洋のバイオプラスチック市場の見通し、2019年~2030年

第9章 ラテンアメリカのバイオプラスチック市場の見通し、2019年~2030年

第10章 中東・アフリカのバイオプラスチック市場の見通し、2019年~2030年

第11章 競合情勢

- 企業の市場シェア分析、2021年

- 競争力ダッシュボード

- 製品と用途のヒートマップ

- 企業の製造フットプリント分析

- 企業プロファイル

- BASF SE

- TotalEnergies Corbion

- Mitsubishi Chemical

- Eastman

- NatureWorks LLC

- Covation Biomaterials

- Avantium

- Kaneka Corporation

- Futamura

- Jinhui Zhaolong High Tech.

- Zhejiang Hisun Biomaterials

- Bio Valore World SpA

- ANKOR Bioplastics

- Celanese Corporation

第12章 付録

Addressing the escalating environmental impact of plastics and the need for sustainable waste management worldwide, bioplastics continue to emerge as a viable alternative. With the world generating over 200 million tons of plastic waste annually, of which less than 10% is recycled, there is a critical demand for effective sustainable alternatives to conventional plastics. Fairfield Market Research's upcoming study aims to provide valuable insights into the global bioplastics market from 2021 to 2025.

Introduction of New Biopolymer Varieties to Drive Bioplastic Sales:

Although bioplastics currently account for just over 1% of global plastics production, the market is experiencing progressive growth. Production volumes have doubled over the past decade, and demand is rising due to the increasing sophistication of bioplastics and the introduction of new variants in biopolymer categories. Biopolymer varieties such as bio-based polypropylene (PP), polylactic acid (PLA), and polyhydroxyalkanoates (PHAs) are experiencing high demand. With the introduction of new products and exploration of new application areas, the bioplastics market is poised for further growth in the near future.

Automotive and Packaging Industries Drive Bioplastics Consumption:

The automotive industry, driven by the rise of e-mobility, is undergoing material innovation. Bioplastics are increasingly preferred for various automotive components, driven by the demand for lightweight and energy-efficient automobiles. In addition to interior applications, automakers are utilizing bioplastics for under-the-hood and exterior applications to reduce reliance on volatile energy markets.

The packaging industry is a major consumer of bioplastics, particularly as it transitions from a linear to a circular economy. New bioplastic variants, such as polyethylene furanoate (PEF), are expected to enter the market with superior thermal and barrier attributes. Furthermore, the expanding application base in areas such as wound management, drug delivery, tissue engineering, and orthopedic devices is driving demand for bioplastics in the global market. The medical industry is increasingly considering bioplastics as an ideal material for numerous applications.

Asia Pacific Leads Global Bioplastics Production:

Europe is expected to be at the forefront of bioplastics consumption, as the region pioneers the path to a sustainable and circular bio-economy. North America will also be a significant market for bioplastics manufacturers. In Asia Pacific, the expansion of the flexible packaging sector particularly benefits bioplastics companies. Production-wise, Asia Pacific contributes nearly 50% to the global bioplastics market.

Competition Landscape in the Global Bioplastics Market:

Leading players driving competition in the global bioplastics market include: Eastman Chemical Company, Dow Inc., Novamont S.p.A., BASF SE, Plantic, Corbion N.V., Natureworks, Mitsubishi Chemical Holdings, Biome Technologies plc, and Danimer Scientific. Eastman Chemical Company recently introduced Treva™, a cellulose-based bioplastic variant that has the potential to replace conventional engineering polymers. The surge in sales of single-use/disposable plastics during the COVID-19 pandemic poses a setback for bioplastics and biodegradable plastics manufacturers, as well as ongoing waste management initiatives.

Table of Contents

1. Executive Summary

- 1.1. Global Bioplastics Market Snapshot

- 1.2. Key Market Trends

- 1.3. Future Projections

- 1.4. Analyst Recommendations

2. Market Overview

- 2.1. Market Definitions and Segmentations

- 2.2. Market Dynamics

- 2.2.1. Drivers

- 2.2.1.1. Driver A

- 2.2.1.2. Driver B

- 2.2.1.3. Driver C

- 2.2.2. Restraints

- 2.2.2.1. Restraint 1

- 2.2.2.2. Restraint 2

- 2.2.3. Market Opportunities Matrix

- 2.2.1. Drivers

- 2.3. Value Chain Analysis

- 2.4. Porter's Five Forces Analysis

- 2.5. Covid-19 Impact Analysis

- 2.5.1. Pre-covid and Post-covid Scenario

- 2.5.2. Supply Impact

- 2.5.3. Demand Impact

- 2.6. Government Regulations

- 2.7. Technology Landscape

- 2.8. Share of rPET in Parent Market

- 2.9. Raw Material Analysis

- 2.10. Economic Analysis

3. Production Output and Trade Statistics, 2019 - 2022

- 3.1. Bioplastics Supply-Demand Analysis

- 3.2. Regional Production Statistics

- 3.2.1. North America

- 3.2.2. Europe

- 3.2.3. Asia Pacific

- 3.2.4. Latin America

- 3.2.5. Middle East & Africa

4. Price Trends Analysis and Future Projects, 2019 - 2030

- 4.1. Key Highlights

- 4.2. Prominent Factors Affecting Prices

- 4.3. By Product and By End-users

- 4.4. By Region

5. Global Bioplastics Market Outlook, 2019 - 2030

- 5.1. Global Bioplastics Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 5.1.1. Key Highlights

- 5.1.1.1. Non-biodegradable

- 5.1.1.1.1. PE

- 5.1.1.1.2. PET

- 5.1.1.1.3. PA

- 5.1.1.1.4. PTT

- 5.1.1.1.5. Misc. (PP, etc.)

- 5.1.1.2. Biodegradable

- 5.1.1.2.1. PBAT

- 5.1.1.2.2. PLA

- 5.1.1.2.3. PBS

- 5.1.1.2.4. Starch Blends

- 5.1.1.2.5. PHA

- 5.1.1.2.6. Misc. (Cellulose Films, etc.)

- 5.1.1.1. Non-biodegradable

- 5.1.1. Key Highlights

- 5.2. Global Bioplastics Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 5.2.1. Key Highlights

- 5.2.1.1. Packaging

- 5.2.1.1.1. Rigid

- 5.2.1.1.2. Flexible

- 5.2.1.2. Consumer Goods

- 5.2.1.3. Textiles

- 5.2.1.4. Agriculture

- 5.2.1.5. Automotive

- 5.2.1.6. Automotive

- 5.2.1.7. Electrical & Electronics

- 5.2.1.8. Building & Construction

- 5.2.1.9. Misc. (Medical, etc.)

- 5.2.1.1. Packaging

- 5.2.1. Key Highlights

- 5.3. Global Bioplastics Market Outlook, by Region, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 5.3.1. Key Highlights

- 5.3.1.1. North America

- 5.3.1.2. Europe

- 5.3.1.3. Asia Pacific

- 5.3.1.4. Latin America

- 5.3.1.5. Middle East & Africa

- 5.3.2. BPS Analysis/Market Attractiveness Analysis

- 5.3.1. Key Highlights

6. North America Bioplastics Market Outlook, 2019 - 2030

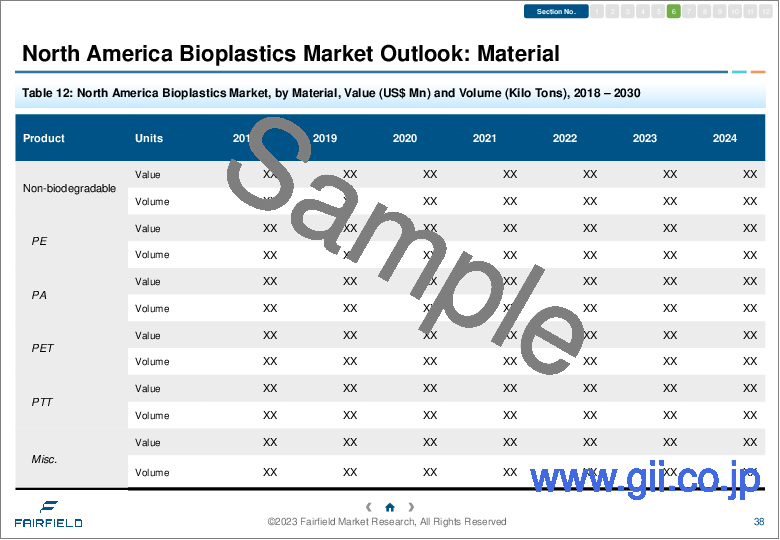

- 6.1. North America Bioplastics Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 6.1.1. Key Highlights

- 6.1.1.1. Non-biodegradable

- 6.1.1.1.1. PE

- 6.1.1.1.2. PET

- 6.1.1.1.3. PA

- 6.1.1.1.4. PTT

- 6.1.1.1.5. Misc. (PP, etc.)

- 6.1.1.2. Biodegradable

- 6.1.1.2.1. PBAT

- 6.1.1.2.2. PLA

- 6.1.1.2.3. PBS

- 6.1.1.2.4. Starch Blends

- 6.1.1.2.5. PHA

- 6.1.1.2.6. Misc. (Cellulose Films, etc.)

- 6.1.1.1. Non-biodegradable

- 6.1.1. Key Highlights

- 6.2. North America Bioplastics Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 6.2.1. Key Highlights

- 6.2.1.1. Packaging

- 6.2.1.1.1. Rigid

- 6.2.1.1.2. Flexible

- 6.2.1.2. Consumer Goods

- 6.2.1.3. Textiles

- 6.2.1.4. Agriculture

- 6.2.1.5. Automotive

- 6.2.1.6. Automotive

- 6.2.1.7. Electrical & Electronics

- 6.2.1.8. Building & Construction

- 6.2.1.9. Misc. (Medical, etc.)

- 6.2.1.1. Packaging

- 6.2.1. Key Highlights

- 6.3. North America Bioplastics Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 6.3.1. Key Highlights

- 6.3.1.1. U.S.

- 6.3.1.2. Canada

- 6.3.2. BPS Analysis/Market Attractiveness Analysis

- 6.3.1. Key Highlights

7. Europe Bioplastics Market Outlook, 2019 - 2030

- 7.1. Europe Bioplastics Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 7.1.1. Key Highlights

- 7.1.1.1. Non-biodegradable

- 7.1.1.1.1. PE

- 7.1.1.1.2. PET

- 7.1.1.1.3. PA

- 7.1.1.1.4. PTT

- 7.1.1.1.5. Misc. (PP, etc.)

- 7.1.1.2. Biodegradable

- 7.1.1.2.1. PBAT

- 7.1.1.2.2. PLA

- 7.1.1.2.3. PBS

- 7.1.1.2.4. Starch Blends

- 7.1.1.2.5. PHA

- 7.1.1.2.6. Misc. (Cellulose Films, etc.)

- 7.1.1.1. Non-biodegradable

- 7.1.1. Key Highlights

- 7.2. Europe Bioplastics Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 7.2.1. Key Highlights

- 7.2.1.1. Packaging

- 7.2.1.1.1. Rigid

- 7.2.1.1.2. Flexible

- 7.2.1.2. Consumer Goods

- 7.2.1.3. Textiles

- 7.2.1.4. Agriculture

- 7.2.1.5. Automotive

- 7.2.1.6. Automotive

- 7.2.1.7. Electrical & Electronics

- 7.2.1.8. Building & Construction

- 7.2.1.9. Misc. (Medical, etc.)

- 7.2.1.1. Packaging

- 7.2.1. Key Highlights

- 7.3. Europe Bioplastics Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 7.3.1. Key Highlights

- 7.3.1.1. Germany

- 7.3.1.2. France

- 7.3.1.3. U.K.

- 7.3.1.4. Italy

- 7.3.1.5. Spain

- 7.3.1.6. Turkey

- 7.3.1.7. Russia

- 7.3.1.8. Rest of Europe

- 7.3.2. BPS Analysis/Market Attractiveness Analysis

- 7.3.1. Key Highlights

8. Asia Pacific Bioplastics Market Outlook, 2019 - 2030

- 8.1. Asia Pacific Bioplastics Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 8.1.1. Key Highlights

- 8.1.1.1. Non-biodegradable

- 8.1.1.1.1. PE

- 8.1.1.1.2. PET

- 8.1.1.1.3. PA

- 8.1.1.1.4. PTT

- 8.1.1.1.5. Misc. (PP, etc.)

- 8.1.1.2. Biodegradable

- 8.1.1.2.1. PBAT

- 8.1.1.2.2. PLA

- 8.1.1.2.3. PBS

- 8.1.1.2.4. Starch Blends

- 8.1.1.2.5. PHA

- 8.1.1.2.6. Misc. (Cellulose Films, etc.)

- 8.1.1.1. Non-biodegradable

- 8.1.1. Key Highlights

- 8.2. Asia Pacific Bioplastics Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 8.2.1. Key Highlights

- 8.2.1.1. Packaging

- 8.2.1.1.1. Rigid

- 8.2.1.1.2. Flexible

- 8.2.1.2. Consumer Goods

- 8.2.1.3. Textiles

- 8.2.1.4. Agriculture

- 8.2.1.5. Automotive

- 8.2.1.6. Automotive

- 8.2.1.7. Electrical & Electronics

- 8.2.1.8. Building & Construction

- 8.2.1.9. Misc. (Medical, etc.)

- 8.2.1.1. Packaging

- 8.2.1. Key Highlights

- 8.3. Asia Pacific Bioplastics Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 8.3.1. Key Highlights

- 8.3.1.1. China

- 8.3.1.2. Japan

- 8.3.1.3. South Korea

- 8.3.1.4. India

- 8.3.1.5. Southeast Asia

- 8.3.1.6. Rest of Asia Pacific

- 8.3.2. BPS Analysis/Market Attractiveness Analysis

- 8.3.1. Key Highlights

9. Latin America Bioplastics Market Outlook, 2019 - 2030

- 9.1. Latin America Bioplastics Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 9.1.1. Key Highlights

- 9.1.1.1. Non-biodegradable

- 9.1.1.1.1. PE

- 9.1.1.1.2. PET

- 9.1.1.1.3. PA

- 9.1.1.1.4. PTT

- 9.1.1.1.5. Misc. (PP, etc.)

- 9.1.1.2. Biodegradable

- 9.1.1.2.1. PBAT

- 9.1.1.2.2. PLA

- 9.1.1.2.3. PBS

- 9.1.1.2.4. Starch Blends

- 9.1.1.2.5. PHA

- 9.1.1.2.6. Misc. (Cellulose Films, etc.)

- 9.1.1.1. Non-biodegradable

- 9.1.1. Key Highlights

- 9.2. Latin America Bioplastics Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 9.2.1. Key Highlights

- 9.2.1.1. Packaging

- 9.2.1.1.1. Rigid

- 9.2.1.1.2. Flexible

- 9.2.1.2. Consumer Goods

- 9.2.1.3. Textiles

- 9.2.1.4. Agriculture

- 9.2.1.5. Automotive

- 9.2.1.6. Automotive

- 9.2.1.7. Electrical & Electronics

- 9.2.1.8. Building & Construction

- 9.2.1.9. Misc. (Medical, etc.)

- 9.2.1.1. Packaging

- 9.2.1. Key Highlights

- 9.3. Latin America Bioplastics Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 9.3.1. Key Highlights

- 9.3.1.1. Brazil

- 9.3.1.2. Mexico

- 9.3.1.3. Rest of Latin America

- 9.3.2. BPS Analysis/Market Attractiveness Analysis

- 9.3.1. Key Highlights

10. Middle East & Africa Bioplastics Market Outlook, 2019 - 2030

- 10.1. Middle East & Africa Bioplastics Market Outlook, by Product, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 10.1.1. Key Highlights

- 10.1.1.1. Non-biodegradable

- 10.1.1.1.1. PE

- 10.1.1.1.2. PET

- 10.1.1.1.3. PA

- 10.1.1.1.4. PTT

- 10.1.1.1.5. Misc. (PP, etc.)

- 10.1.1.2. Biodegradable

- 10.1.1.2.1. PBAT

- 10.1.1.2.2. PLA

- 10.1.1.2.3. PBS

- 10.1.1.2.4. Starch Blends

- 10.1.1.2.5. PHA

- 10.1.1.2.6. Misc. (Cellulose Films, etc.)

- 10.1.1.1. Non-biodegradable

- 10.1.1. Key Highlights

- 10.2. Middle East & Africa Bioplastics Market Outlook, by End-users, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 10.2.1. Key Highlights

- 10.2.1.1. Packaging

- 10.2.1.1.1. Rigid

- 10.2.1.1.2. Flexible

- 10.2.1.2. Consumer Goods

- 10.2.1.3. Textiles

- 10.2.1.4. Agriculture

- 10.2.1.5. Automotive

- 10.2.1.6. Automotive

- 10.2.1.7. Electrical & Electronics

- 10.2.1.8. Building & Construction

- 10.2.1.9. Misc. (Medical, etc.)

- 10.2.1.1. Packaging

- 10.2.2. BPS Analysis/Market Attractiveness Analysis

- 10.2.1. Key Highlights

- 10.3. Middle East & Africa Bioplastics Market Outlook, by Country, Volume (Kilo Tons) and Value (US$ Mn), 2019 - 2030

- 10.3.1. Key Highlights

- 10.3.1.1. GCC

- 10.3.1.2. South Africa

- 10.3.1.3. Rest of Middle East & Africa

- 10.3.2. BPS Analysis/Market Attractiveness Analysis

- 10.3.1. Key Highlights

11. Competitive Landscape

- 11.1. Company Market Share Analysis, 2021

- 11.2. Competitive Dashboard

- 11.3. Product vs Application Heatmap

- 11.4. Company Manufacturing Footprint Analysis

- 11.5. Company Profiles

- 11.5.1. BASF SE

- 11.5.1.1. Company Overview

- 11.5.1.2. Product Portfolio

- 11.5.1.3. Financial Overview

- 11.5.1.4. Business Strategies and Development

- 11.5.2. TotalEnergies Corbion

- 11.5.3. Mitsubishi Chemical

- 11.5.4. Eastman

- 11.5.5. NatureWorks LLC

- 11.5.6. Covation Biomaterials

- 11.5.7. Avantium

- 11.5.8. Kaneka Corporation

- 11.5.9. Futamura

- 11.5.10. Jinhui Zhaolong High Tech.

- 11.5.11. Zhejiang Hisun Biomaterials

- 11.5.12. Bio Valore World SpA

- 11.5.13. ANKOR Bioplastics

- 11.5.14. Celanese Corporation

- 11.5.1. BASF SE

12. Appendix

- 12.1. Research Methodology

- 12.2. Report Assumptions

- 12.3. Acronyms and Abbreviations