|

|

市場調査レポート

商品コード

1854889

ヒューマノイドロボットの世界市場(2026年~2036年)The Global Humanoid Robots Market 2026-2036 |

||||||

|

|||||||

| ヒューマノイドロボットの世界市場(2026年~2036年) |

|

出版日: 2025年10月30日

発行: Future Markets, Inc.

ページ情報: 英文 481 Pages, 142 Tables, 50 Figures

納期: 即納可能

|

概要

2025年、ヒューマノイドロボット市場はかつてない勢いを見せており、その活動は当初の予測をはるかに超えて加速しています。投資、生産規模の拡大、商業展開は収束しつつあり、この産業が研究プロトタイプから商業的現実へと決定的に移行したことを示しています。中国のロボット産業では資金調達活動が目覚ましく、2025年1~9月期には610件、総額500億元(70億米ドル)の投資取引が発生し、前年同期比で250%増加しました。第3四半期だけで243件の取引があり、前年比102%増となっています。主な取引には、北京を拠点とするNoetix Roboticsが3億元(4,200万米ドル)のPre-B資金調達を完了したこと、業界のリーダーであるUBTECHがプレースメント、転換社債、現金引出権を含む10億米ドルの巨額の戦略的資金調達枠を確保したことなどがあります。このような資本流入は、商業化のスケジュールが予測より早まっているという投資家の自信の高まりを反映しています。

生産能力はすべての主要地域で劇的に拡大しています。Teslaは2025年にOptimusを5,000台にすることを目標に掲げ、2026年までに10万台に拡大する計画です。中国メーカーのBYDは、2025年に1,500台のヒューマノイドを目標に掲げ、2026年までに2万台に拡大する計画です。上海を拠点とするAgibotも同様に、2025年に5,000台を目標としています。Agility Roboticsは、年間1万台のDigitロボットを生産できる専用工場を建設しました。こうした生産へのコミットメントは、パイロットスケールの製造から産業スケールの経営への根本的な転換を意味します。

おそらくもっとも重要なことは、コストの壁が予測を上回るスピードで崩壊していることです。中国メーカーのUnitreeは2025年7月、同社のヒューマノイド、R1をわずか5,900ドルで発表し、市場に衝撃を与えました。これは、同社のG1モデルの1万6,000ドル、H1の9万ドルに続くもので、市場のTierが複数あることを示しています。Goldman Sachsは、製造コストが前年比で40%減少したことを報告しており、現在のコストは構成によって3万米ドル~15万米ドルです。

パイロットプログラムは商業運転に移行しつつあります。Figure AIはBMWのスパータンバーグプラントで自動車組立のテストを続けています。Agility RoboticsのDigitはAmazonとGXOのロジスティクス施設で稼働しています。UBTECHは、BYD、Geely、FAW-Volkswagen、BAIC、Foxconnなどの主要自動車メーカーとパートナーシップを結んでいます。もっとも注目すべきは、Unitreeのヒューマノイド2台がJD.comを通じて消費者に販売されたことで、この部門で初めて消費者販売が記録されました。10億米ドル規模の資金調達、10万台規模の生産目標、1万米ドルを下回る価格設定、拡大する商業展開の収束は、ヒューマノイドロボット市場が重要な変曲点に達したことを示唆しており、主流への採用は当初予測された2030年代ではなく、2026年~2028年の時間枠に向かって加速しています。

当レポートでは、世界のヒューマノイドロボット市場について調査し、市場の詳細な予測、競合の分析、技術の評価、地域の市場力学(保守的なシナリオと楽観的なシナリオを含む)などを提供しています。

目次

第1章 エグゼクティブサマリー

- 商業的実現可能性

- 地域のエコシステムの力学

- 現在の用途と展開のタイムライン

- 投資の勢いと市場予測

- 市場の促進要因と課題

- リーダーシップへの戦略的影響

- 技術準備度と将来の見通し

第2章 イントロダクション

- ヒューマノイドロボット:定義と特徴

- 略歴と進化

- ヒューマノイドロボットの現状(2025年)

- ヒューマノイドロボットの重要性

- 市場と用途(TRL)

- 3つの波の枠組み

- 商業開発のモデルと段階

- 投資と資金調達

- コスト

- 市場促進要因

- 課題

- 世界の規制

- 日本市場

- 米国の市場

- 中国市場

第3章 技術とコンポーネントの分析

- ヒューマノイドロボット設計の進歩

- 重要なコンポーネント

- インテリジェント制御システムと最適化

- 先進のロボティクスと自動化

- 製造

- ブレインコンピューターインターフェース

- ロボティクスとインテリジェントヘルス

- マイクロナノロボット

- 医療・リハビリテーションロボット

- メカトロニクスとロボティクス

- 画像処理、ロボティクス、インテリジェントビジョン

- AIと機械学習

- センサーと認識技術

- 電力・エネルギー管理

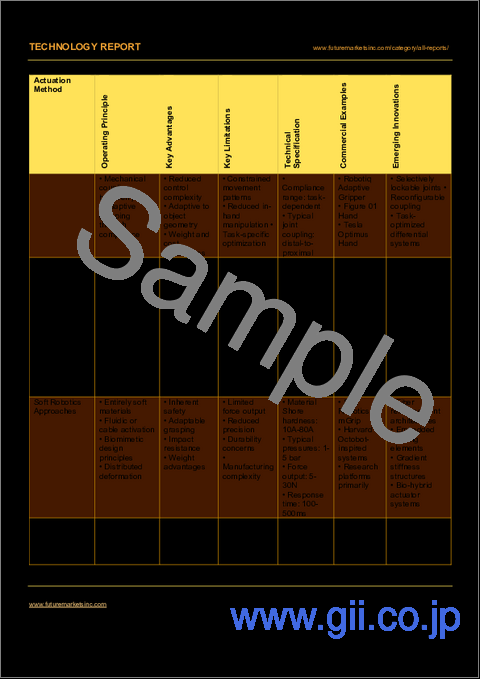

- アクチュエーター

- モーター

- 減速機

- ネジ

- ベアリング

- アームエフェクター

- ヒューマノイドロボット向けSoC

- クラウドロボティクスとロボットのインターネット(IoRT)

- ヒューマンロボットインタラクション(HRI)とソーシャルロボティクス

- バイオミメティックデザインとバイオインスパイアードデザイン

- ヒューマノイドロボット向け材料

- 皮膚組織の結合

第4章 最終用途市場

- 市場サプライチェーン

- 商業化のレベル

- 医療・支援

- 教育・研究

- カスタマーサービス・ホスピタリティ

- エンターテインメン・とレジャー

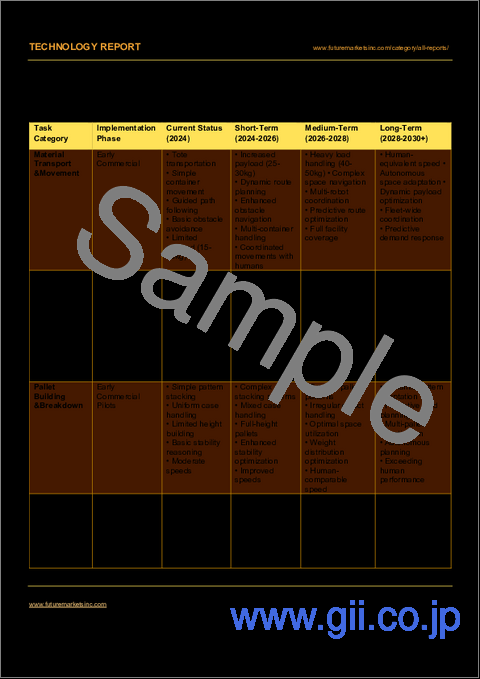

- 製造・産業

- 軍事・防衛

- 個人使用・家庭環境

第5章 世界の市場規模(数量と収益)(2024年~2036年)

- 市場の促進要因と労働力の力学

- 総出荷台数の予測:3つの波の採用モデル

- 交換サイクルの力学

- 成長軌道分析

- 地域の分布予測

- 市場集中の進化

- 前回予測との比較

- 危険因子と感応度

- 収益(合計)

- 平均販売価格の軌跡と促進要因

- 地理的収益分布

- 交換サイクル収益の力学

- 市場構造と集中

- バッテリー容量(GWh)の予測

- ハードウェアコンポーネント