|

|

市場調査レポート

商品コード

1555075

リチウムイオンバッテリーリサイクルの世界市場(2025年~2040年)The Global Li-ion Battery Recycling Market 2025-2040 |

||||||

|

|||||||

| リチウムイオンバッテリーリサイクルの世界市場(2025年~2040年) |

|

出版日: 2024年09月16日

発行: Future Markets, Inc.

ページ情報: 英文 177 Pages, 29 Tables, 30 Figures, 98 Companies profiled

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

リチウムイオンバッテリーリサイクル市場は、電気自動車と再生可能エネルギー貯蔵システムの採用の増加によって牽引されています。リチウムイオンバッテリーの需要が急増し続ける中、持続可能なEOLソリューションが不可欠となっています。電化へのシフトは、モビリティ部門の脱炭素化にとって重大な部分です。この移行と成長を支えるためには、電気自動車バッテリーの原材料の安定供給と、持続可能な使用済みバッテリーの回収・リサイクルシステムの確立が不可欠です。

リサイクル市場は今後10年間で大幅な拡大が見込まれ、数量・収益ともに大幅な増加が予測されています。この成長の主な促進要因は、厳しい環境規制、原材料コストの上昇、循環型経済指針の重視の高まりなどです。世界各国の政府はバッテリーのリサイクルを奨励する政策を実施する一方、メーカーは使用済みバッテリーから貴重な材料を回収することによる経済的・環境的利益を認識するようになっています。

市場情勢は、既存企業と革新的なスタートアップが混在していることを特徴としており、それぞれがリサイクル効率の向上とコスト削減に向け独自の技術を開発しています。湿式冶金、乾式冶金、直接リサイクルの手法は、増大する需要を満たすために改良され、規模が拡大されています。さらに、機械化学的前処理や電気化学的手法などの新技術も登場しており、より高い回収率と環境に対する影響の低減が期待されています。

当レポートでは、世界のリチウムイオンバッテリーリサイクル市場について調査分析し、今後10年間の市場の動向、技術の進歩、成長機会などに関する知見を提供しています。

目次

第1章 イントロダクション

- リチウムイオンバッテリー

- リチウムイオンバッテリーとは

- リチウムイオン正極

- リチウムイオン負極

- バッテリー故障

- EOL

- 持続可能性

- 電気自動車(EV)市場

- 交換用バッテリーパックの新興市場

- EVバッテリーのクローズドループバリューチェーン

- リチウムイオンバッテリーリサイクルのバリューチェーン

- 循環型ライフサイクル

- 世界の規制と政策

- 中国

- 欧州連合

- 米国

- インド

- 韓国

- 日本

- オーストラリア

- 輸送

- 持続可能性と環境的利益

第2章 リサイクルの手法と技術

- 黒色粉末

- 異なる正極化学のリサイクル

- 準備

- 前処理

- 放電

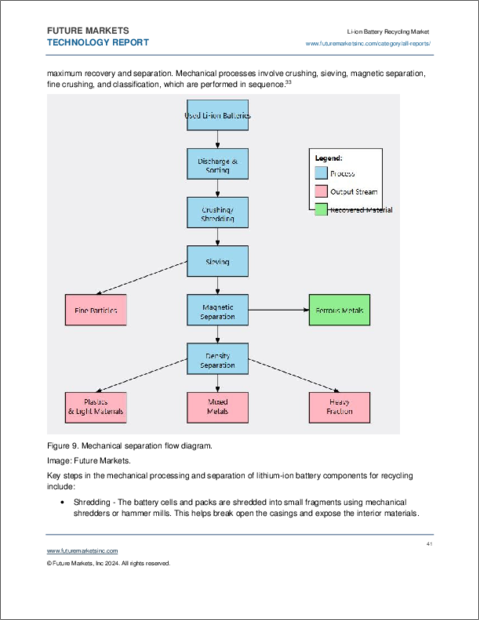

- 機械的前処理

- 熱処理前処理

- リサイクル技術の比較

- 湿式冶金

- 手法の概要

- SWOT分析

- 乾式冶金

- 手法の概要

- SWOT分析

- 直接リサイクル

- 手法の概要

- SWOT分析

- その他の手法

- 機械化学的前処理

- 電気化学的手法

- イオン液体

- 特定コンポーネントのリサイクル

- 負極(グラファイト)

- 正極

- 電解質

- リチウムイオンバッテリー以外のリサイクル

- 従来のプロセスと新しいプロセス

- リチウム金属電池

- リチウム硫黄電池(Li-S)

- 全固体電池(ASSB)

第3章 市場の分析

- 市場促進要因

- 市場の課題

- 現在の市場

- 近年の市場のニュース、資金調達、発展

- リチウムイオンバッテリーリサイクルの経済的利益

- 金属の価格

- 二次エネルギー貯蔵

- LFPバッテリー

- その他のコンポーネントと材料

- コスト削減

- 競合情勢

- サプライチェーン

- 世界の処理能力、現行と計画中

- 将来の見通し

- 世界市場(2018年~2040年)

- 化学

- キロトン

- 収益

- 地域

第4章 企業プロファイル(企業98社のプロファイル)

第5章 用語と定義

第6章 調査手法

第7章 参考文献

List of Tables

- Table 1. Lithium-ion (Li-ion) battery supply chain

- Table 2. Commercial Li-ion battery cell composition

- Table 3. Key technology trends shaping lithium-ion battery cathode development

- Table 4. Cathode Materials Used in Commercial LIBs and Recycling Methods

- Table 5. Fate of end-of-life Li-ion batteries

- Table 6. Closed-loop value chain for electric vehicle (EV) batteries

- Table 7. Li-ion battery recycling value chain

- Table 8. Potential circular life cycle for lithium-ion batteries

- Table 9. Regulations pertaining to the recycling and treatment of EOL batteries in the EU, USA, and China

- Table 10. China regulations and policies related to batteries

- Table 11. Sustainability and environmental benefits of Li-ion recycling

- Table 12. Typical lithium-ion battery recycling process flow

- Table 13. Main feedstock streams that can be recycled for lithium-ion batteries

- Table 14. Comparison of LIB recycling methods

- Table 15. Comparison of conventional and emerging processes for recycling beyond lithium-ion batteries

- Table 16. Market drivers for lithium-ion battery recycling

- Table 17. Market challenges in lithium-ion battery recycling

- Table 18. Recent market news, funding and developments in Li-ion battery recycling

- Table 19. Economic assessment of battery recycling options

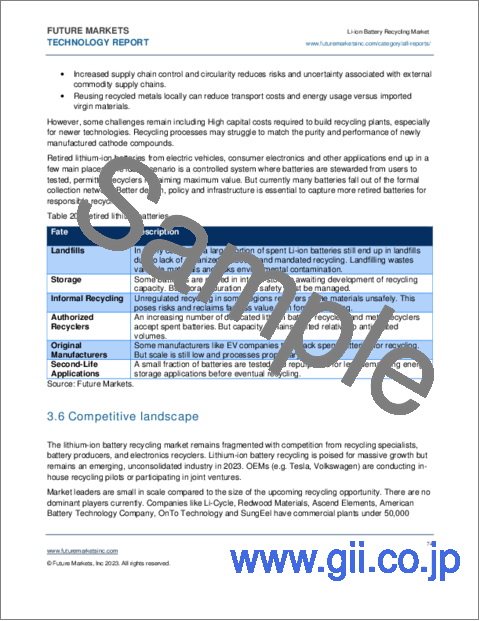

- Table 20. Retired lithium-batteries

- Table 21. Global capacities, current and planned (tonnes/year)

- Table 22. Global lithium-ion battery recycling market in tonnes segmented by cathode chemistry, 2018-2040

- Table 23. Global Li-ion battery recycling market, 2018-2040 (ktonnes)

- Table 24. Global Li-ion battery recycling market, 2018-2040 (billions USD)

- Table 25. Li-ion battery recycling market, by region, 2018-2040 (ktonnes)

- Table 26. Li-ion battery recycling market, in Europe, 2018-2040 (ktonnes)

- Table 27. Li-ion battery recycling market, in China, 2018-2040 (ktonnes)

- Table 28. Li-ion battery recycling market, in Rest of Asia-Pacific, 2018-2040 (ktonnes)

- Table 29. Li-ion battery recycling market, in North America, 2018-2040 (ktonnes)

List of Figures

- Figure 1. Li-ion battery cell pack

- Figure 2. Lithium Cell Design

- Figure 3. Functioning of a lithium-ion battery

- Figure 4. LIB cathode recycling routes

- Figure 5. Lithium-ion recycling process

- Figure 6. Process for recycling lithium-ion batteries from EVs

- Figure 7. Circular life cycle of lithium ion-batteries

- Figure 8. Typical direct, pyrometallurgical, and hydrometallurgical recycling methods for recovery of Li-ion battery active materials

- Figure 9. Mechanical separation flow diagram

- Figure 10. Recupyl mechanical separation flow diagram

- Figure 11. Flow chart of recycling processes of lithium-ion batteries (LIBs)

- Figure 12. Hydrometallurgical recycling flow sheet

- Figure 13. SWOT analysis for Hydrometallurgy Li-ion Battery Recycling

- Figure 14. Umicore recycling flow diagram

- Figure 15. SWOT analysis for Pyrometallurgy Li-ion Battery Recycling

- Figure 16. Schematic of direct recyling process

- Figure 17. SWOT analysis for Direct Li-ion Battery Recycling

- Figure 18. Schematic diagram of a Li-metal battery

- Figure 19. Schematic diagram of Lithium-sulfur battery

- Figure 20. Schematic illustration of all-solid-state lithium battery

- Figure 21. Li-ion Battery Recycling Market Supply Chain

- Figure 22. Global scrapped EV (BEV+PHEV) forecast to 2040

- Figure 23. Global Li-ion battery recycling market, 2018-2040 (chemistry)

- Figure 24. Global Li-ion battery recycling market, 2018-2040 (ktonnes)

- Figure 25. Global Li-ion battery recycling market, 2018-2040 (Billion USD)

- Figure 26. Global Li-ion battery recycling market, by region, 2018-2040 (ktonnes)

- Figure 27. Li-ion battery recycling market, in Europe, 2018-2040 (ktonnes)

- Figure 28. Li-ion battery recycling market, in China, 2018-2040 (ktonnes)

- Figure 29. Li-ion battery recycling market, in Rest of Asia-Pacific, 2018-2040 (ktonnes)

- Figure 30. Li-ion battery recycling market, in North America, 2018-2040 (ktonnes)

The market for lithium-ion battery recycling is driven by the increasing adoption of electric vehicles and renewable energy storage systems. As the demand for lithium-ion batteries continues to surge, the need for sustainable end-of-life solutions has become critical. The shift towards electrification is a crucial part of decarbonizing the mobility sector. To support this transition and growth, it is imperative to establish a stable supply of raw materials for electric vehicle batteries and a sustainable end-of-life battery collection and recycling system.

The recycling market is expected to expand significantly over the next decade, with projections indicating a substantial increase in both volume and revenue. Key factors fueling this growth include stringent environmental regulations, the rising cost of raw materials, and a growing emphasis on circular economy principles. Governments worldwide are implementing policies to encourage battery recycling, while manufacturers are increasingly recognizing the economic and environmental benefits of recovering valuable materials from spent batteries.

The market landscape is characterized by a mix of established players and innovative start-ups, each developing unique technologies to improve recycling efficiency and reduce costs. Hydrometallurgical, pyrometallurgical, and direct recycling methods are being refined and scaled up to meet the growing demand. Additionally, new techniques such as mechanochemical pre-treatment and electrochemical methods are emerging, promising higher recovery rates and lower environmental impact.

"The Global Li-ion Battery Recycling Market 2025-2035" is a comprehensive market research report that provides an in-depth analysis of the rapidly growing lithium-ion battery recycling industry. This report offers valuable insights into market trends, technological advancements, and growth opportunities in the global Li-ion battery recycling market over the next decade.

Key highlights of the report include:

- Market Overview and Forecasts: The report provides detailed market size estimates and projections from 2025 to 2035, segmented by recycling technology, battery chemistry, and geographical region. It offers a comprehensive analysis of market drivers, restraints, opportunities, and challenges shaping the industry's future.

- Technology Analysis: An in-depth examination of current and emerging Li-ion battery recycling technologies, including their strengths, weaknesses, opportunities, and threats (SWOT analysis).

- Application Insights: The study explores various applications of recycled materials across multiple sectors, including electric vehicles, consumer electronics, and energy storage systems.

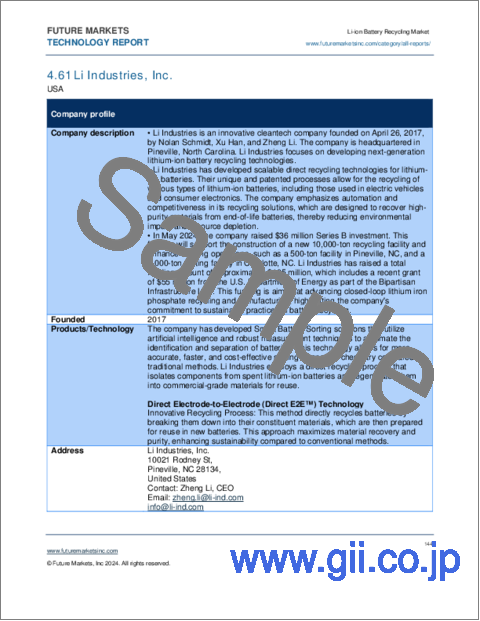

- Competitive Landscape: A comprehensive analysis of key players in the Li-ion battery recycling market, including their recycling technologies, market strategies, and recent developments. The report profiles leading companies and emerging startups shaping the industry's future. Companies profiled include 24M, 4R Energy Corporation, ACE Green Recycling, Inc., Accurec Recycling GmbH, AE Elemental, Akkuser Oy, Allye Energy, Altilium, American Battery Technology Company (ABTC), Anhua Taisen, Aqua Metals, Inc., Ascend Elements, Attero Recycling, BASF, Battery Pollution Technologies, Batrec Industrie AG, Battri, Batx Energies Private Limited, BMW, Botree Cycling, CATL, Cirba Solutions, Circu Li-ion, Circunomics, Cylib, Dowa Eco-System Co., EcoBat, Econili Battery, EcoPro, Electra Battery Materials Corporation (Electra), Emulsion Flow Technologies, Energy Source, Enim, Eramet, ExPost Technology, Farasis Energy, Fortum Battery Recycling, Ganfeng Lithium, Ganzhou Cyclewell Technology Co. Ltd, GEM Co., Ltd., GLC RECYCLE PTE. LTD., Glencore, Gotion, Green Li-ion, Green Mineral, GS Group, Guangdong Guanghua Sci-Tech, Huayou Cobalt, HydroVolt, InoBat, Inmetco, J-Cycle, Inc., Jiecheng New Energy, JX Nippon Metal Mining, Keyking Recycling, Korea Zinc, Kyoei Seiko, LG Chem Ltd., Li Industries, Li-Cycle, Lithion Technologies, Lohum, Mecaware, Metastable Materials, Mitsubishi Materials, NEU Battery Materials, Nickelhutte Aue, Nth Cycle, OnTo Technology LLC, Orano, Posco HY Clean Metal, Princeton NuEnergy (PNE), ProtectLiB, RecycLiCo Battery Materials, RecycleKaro, Redivium Australia, Redwood Materials, Renewable Metals, RT Advanced Materials, Ruicycle Environmental Protection Technology, Ruilong Technology, Saidemei Resources Recycling Research Institute, Sebitchem, Shunhua Lithium, SiTration, SK Innovation Co. Ltd., Smartville Inc., Solvay, Sumitomo, Summit Nanotech, SungEel HITech, Technology Minerals plc/ Recyclus, Tozero GmbH, Umicore, Volkswagen, Voltfang, Young Poong Corp., and Zero Carbon Technologies (ZERO).

- Future Outlook and Emerging Trends: Insights into technological advancements, potential disruptive technologies, and long-term market predictions extending to 2035 and beyond. The report identifies key growth areas and innovation hotspots in the Li-ion battery recycling industry.

- Regional Analysis: A detailed examination of Li-ion battery recycling market dynamics across North America, Europe, Asia-Pacific, and other regions, highlighting regional adoption trends and growth opportunities.

- Value Chain Analysis: An overview of the Li-ion battery recycling industry value chain, from battery collection to material recovery and reuse, providing a holistic view of the market ecosystem.

- Regulatory Landscape: An examination of relevant regulations and standards affecting the development and adoption of Li-ion battery recycling technologies across different regions.

This report is an essential resource for:

- Li-ion battery manufacturers and recyclers

- Electric vehicle manufacturers

- Consumer electronics companies

- Energy storage system providers

- Raw material suppliers and traders

- Waste management companies

- Investment firms and financial analysts

- Government agencies and policymakers

- Environmental organizations and researchers

Key features of the report include:

- Over 100 tables and figures providing clear, data-driven insights

- Detailed company profiles of more than 90 key players in the Li-ion battery recycling industry

- Comprehensive market size and forecast data segmented by technology, battery chemistry, and region

- In-depth analysis of emerging technologies and their potential impact on the market

- Expert commentary on market trends, challenges, and opportunities

The global Li-ion battery recycling market is poised for significant growth, with increasing demand for sustainable battery lifecycle management across various industries. This report provides a thorough understanding of the current market landscape, emerging technologies, and future growth prospects, making it an invaluable tool for decision-makers looking to capitalize on opportunities in the Li-ion battery recycling sector. By leveraging extensive primary and secondary research, including interviews with industry experts and analysis of proprietary data, "The Global Li-ion Battery Recycling Market 2025-2035" offers unparalleled insights into this dynamic and rapidly evolving industry. Whether you're a technology provider, battery manufacturer, recycler, investor, or researcher, this report will equip you with the knowledge and understanding needed to navigate the exciting future of Li-ion battery recycling technologies.

TABLE OF CONTENTS

1. INTRODUCTION

- 1.1. Lithium-ion batteries

- 1.1.1. What is a Li-ion battery?

- 1.1.2. Li-ion cathode

- 1.1.3. Li-ion anode

- 1.1.4. Battery failure

- 1.1.5. End-of-life

- 1.1.6. Sustainability

- 1.2. The Electric Vehicle (EV) market

- 1.2.1. Emerging market for replacement battery packs

- 1.2.2. Closed-loop value chain for EV batteries

- 1.3. Lithium-Ion Battery recycling value chain

- 1.4. Circular life cycle

- 1.5. Global regulations and policies

- 1.5.1. China

- 1.5.2. EU

- 1.5.3. US

- 1.5.4. India

- 1.5.5. South Korea

- 1.5.6. Japan

- 1.5.7. Australia

- 1.5.8. Transportation

- 1.6. Sustainability and environmental benefits

2. RECYCLING METHODS AND TECHNOLOGIES

- 2.1. Black mass powder

- 2.2. Recycling different cathode chemistries

- 2.3. Preparation

- 2.4. Pre-Treatment

- 2.4.1. Discharging

- 2.4.2. Mechanical Pre-Treatment

- 2.4.3. Thermal Pre-Treatment

- 2.5. Comparison of recycling techniques

- 2.6. Hydrometallurgy

- 2.6.1. Method overview

- 2.6.1.1. Solvent extraction

- 2.6.2. SWOT analysis

- 2.6.1. Method overview

- 2.7. Pyrometallurgy

- 2.7.1. Method overview

- 2.7.2. SWOT analysis

- 2.8. Direct recycling

- 2.8.1. Method overview

- 2.8.1.1. Electrolyte separation

- 2.8.1.2. Separating cathode and anode materials

- 2.8.1.3. Binder removal

- 2.8.1.4. Relithiation

- 2.8.1.5. Cathode recovery and rejuvenation

- 2.8.1.6. Hydrometallurgical-direct hybrid recycling

- 2.8.2. SWOT analysis

- 2.8.1. Method overview

- 2.9. Other methods

- 2.9.1. Mechanochemical Pretreatment

- 2.9.2. Electrochemical Method

- 2.9.3. Ionic Liquids

- 2.10. Recycling of Specific Components

- 2.10.1. Anode (Graphite)

- 2.10.2. Cathode

- 2.10.3. Electrolyte

- 2.11. Recycling of Beyond Li-ion Batteries

- 2.11.1. Conventional vs Emerging Processes

- 2.11.2. Li-Metal batteries

- 2.11.3. Lithium sulfur batteries (Li-S)

- 2.11.4. All-solid-state batteries (ASSBs)

3. MARKET ANALYSIS

- 3.1. Market drivers

- 3.2. Market challenges

- 3.3. The current market

- 3.4. Recent market news, funding and developments

- 3.5. Economic case for Li-ion battery recycling

- 3.5.1. Metal prices

- 3.5.2. Second-life energy storage

- 3.5.3. LFP batteries

- 3.5.4. Other components and materials

- 3.5.5. Reducing costs

- 3.6. Competitive landscape

- 3.7. Supply chain

- 3.8. Global capacities, current and planned

- 3.9. Future outlook

- 3.10. Global market 2018-2040

- 3.10.1. Chemistry

- 3.10.2. Ktonnes

- 3.10.3. Revenues

- 3.10.4. Regional

- 3.10.4.1. Europe

- 3.10.4.1.1. Regional overview

- 3.10.4.2. China

- 3.10.4.2.1. Regional overview

- 3.10.4.3. Rest of Asia-Pacific

- 3.10.4.3.1. Regional overview

- 3.10.4.4. North America

- 3.10.4.4.1. Regional overview

- 3.10.4.1. Europe