|

|

市場調査レポート

商品コード

1301546

タイのアルコール飲料市場Alcoholic Drinks in Thailand |

||||||

| タイのアルコール飲料市場 |

|

出版日: 2023年06月22日

発行: Euromonitor International

ページ情報: 英文 72 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

タイのアルコール飲料総消費量は、あらゆるチャネル、特に外食産業を通じて、COVID-19危機の影響から回復し始めています。タイ政府は現在、SARS-CoV-2ウイルスの蔓延を抑えるために課していた閉鎖政策、ソーシャルディスタンス、ロックダウン、国際線搭乗禁止などの制限を終了しています。消費者はますます外で過ごすようになり、市場全体を活性化させています。

当レポートでは、タイのアルコール飲料市場について調査し、2018年~2022年の最新小売販売データ、主要企業、主要ブランド、法律・流通・価格問題などの市場に影響を与える主要な要因など、包括的な情報を提供しています。

目次

目次と表のリスト

エグゼクティブサマリー

- 2022年のアルコール飲料:全体像

- 2022年の主要動向

- 競合情勢

- 小売業の発展

- オントレードとオフトレードの分割

- アルコール飲料で次に来るのは?

市場の背景

- 法律

- 法定購入年齢と法定飲酒年齢

- 飲酒運転

- 広告

- 禁煙

- 営業時間

- 貿易施設

税金と関税

運営環境

- 密輸・並行輸入

- 免税

- 越境・個人輸入

主要な新製品の発売

- プレミアム化戦略

- 法定飲酒年齢に達した若い消費者をターゲットに設定

- 見通し

市場指標

市場データ

免責事項

ソース

タイのビール

タイのワイン

タイのスピリッツ

タイのシードル/ペリー

タイのRTD

The total consumption of alcoholic drinks in Thailand has started recovering from the impact of the COVID-19 crisis through all channels, especially in foodservice. The Thai Government has now ended the restrictions that it imposed to limit the spread of the SARS-CoV-2 virus, such as the closure policy, social distancing, national lockdown, and an international flight ban. Consumers are increasingly spending time outside, which has served to bolster the entire market. Moreover, the revival of in...

Euromonitor International's Alcoholic Drinks in Thailand report offers a comprehensive guide to the size and shape of the market at a national level. It provides the latest retail sales data (2018-2022), allowing you to identify the sectors driving growth. It identifies the leading companies, the leading brands and offers strategic analysis of key factors influencing the market - be they legislative, distribution or pricing issues. Forecasts to 2027 illustrate how the market is set to change.

Product coverage: Beer, Cider/Perry, RTDs, Spirits, Wine.

Data coverage: market sizes (historic and forecasts), company shares, brand shares and distribution data.

Why buy this report?

- Get a detailed picture of the Alcoholic Drinks market;

- Pinpoint growth sectors and identify factors driving change;

- Understand the competitive environment, the market's major players and leading brands;

- Use five-year forecasts to assess how the market is predicted to develop.

TABLE OF CONTENTS

List Of Contents And Tables

EXECUTIVE SUMMARY

- Alcoholic drinks in 2022: The big picture

- 2022 key trends

- Competitive landscape

- Retailing developments

- On-trade vs off-trade split

- What next for alcoholic drinks?

MARKET BACKGROUND

- Legislation

- Legal purchasing age and legal drinking age

- Drink driving

- Advertising

- Smoking ban

- Opening hours

- On-trade establishments

- Table 1 Number of On-trade Establishments by Type 2016-2022

TAXATION AND DUTY LEVIES

- Summary 1 Taxation and Duty Levies on Alcoholic Drinks 2022

OPERATING ENVIRONMENT

- Contraband/parallel trade

- Duty free

- Cross-border/private imports

KEY NEW PRODUCT LAUNCHES

- Premiumisation strategies

- Targeting young consumers of legal drinking age

- Outlook

MARKET INDICATORS

- Table 2 Retail Consumer Expenditure on Alcoholic Drinks 2017-2022

MARKET DATA

- Table 3 Sales of Alcoholic Drinks by Category: Total Volume 2017-2022

- Table 4 Sales of Alcoholic Drinks by Category: Total Value 2017-2022

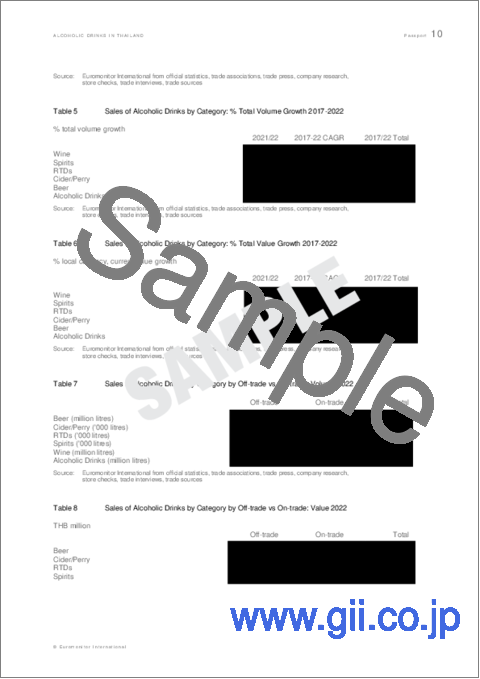

- Table 5 Sales of Alcoholic Drinks by Category: % Total Volume Growth 2017-2022

- Table 6 Sales of Alcoholic Drinks by Category: % Total Value Growth 2017-2022

- Table 7 Sales of Alcoholic Drinks by Category by Off-trade vs On-trade: Volume 2022

- Table 8 Sales of Alcoholic Drinks by Category by Off-trade vs On-trade: Value 2022

- Table 9 Sales of Alcoholic Drinks by Category by Off-trade vs On-trade: % Volume 2022

- Table 10 Sales of Alcoholic Drinks by Category by Off-trade vs On-trade: % Value 2022

- Table 11 GBO Company Shares of Alcoholic Drinks: % Total Volume 2018-2022

- Table 12 Distribution of Alcoholic Drinks by Format: % Off-trade Value 2017-2022

- Table 13 Distribution of Alcoholic Drinks by Format and by Category: % Off-trade Volume 2022

- Table 14 Forecast Sales of Alcoholic Drinks by Category: Total Volume 2022-2027

- Table 15 Forecast Sales of Alcoholic Drinks by Category: Total Value 2022-2027

- Table 16 Forecast Sales of Alcoholic Drinks by Category: % Total Volume Growth 2022-2027

- Table 17 Forecast Sales of Alcoholic Drinks by Category: % Total Value Growth 2022-2027

DISCLAIMER

SOURCES

- Summary 2 Research Sources

BEER IN THAILAND

KEY DATA FINDINGS

2022 DEVELOPMENTS

- Global inflation causes beer prices to surge

- New regulation supports development of microbreweries

- Beer's recovery driven by country reopens

PROSPECTS AND OPPORTUNITIES

- Domestic lager dominates the market

- Aggressive movement from market leaders

- Healthy premium choice becomes the key innovation focus amongst international players

CATEGORY BACKGROUND

- Lager price band methodology

- Summary 3 Lager by Price Band 2022

CATEGORY DATA

- Table 18 Sales of Beer by Category: Total Volume 2017-2022

- Table 19 Sales of Beer by Category: Total Value 2017-2022

- Table 20 Sales of Beer by Category: % Total Volume Growth 2017-2022

- Table 21 Sales of Beer by Category: % Total Value Growth 2017-2022

- Table 22 Sales of Beer by Off-trade vs On-trade: Volume 2017-2022

- Table 23 Sales of Beer by Off-trade vs On-trade: Value 2017-2022

- Table 24 Sales of Beer by Off-trade vs On-trade: % Volume Growth 2017-2022

- Table 25 Sales of Beer by Off-trade vs On-trade: % Value Growth 2017-2022

- Table 26 Sales of Beer by Craft vs Standard 2017-2022

- Table 27 GBO Company Shares of Beer: % Total Volume 2018-2022

- Table 28 NBO Company Shares of Beer: % Total Volume 2018-2022

- Table 29 LBN Brand Shares of Beer: % Total Volume 2019-2022

- Table 30 Forecast Sales of Beer by Category: Total Volume 2022-2027

- Table 31 Forecast Sales of Beer by Category: Total Value 2022-2027

- Table 32 Forecast Sales of Beer by Category: % Total Volume Growth 2022-2027

- Table 33 Forecast Sales of Beer by Category: % Total Value Growth 2022-2027

WINE IN THAILAND

KEY DATA FINDINGS

2022 DEVELOPMENTS

- Country's reopening drives the growth of on-trade

- Still red wine leads the wine market

- Siam Winery maintains its leading position with Mont Clair

PROSPECTS AND OPPORTUNITIES

- Penfolds adapts business plan to changing consumer lifestyles and tastes

- Imported wine sees greater opportunity

- Modern grocery retailers remains the largest channel thanks to its convenience, and price promotions

CATEGORY DATA

- Table 34 Sales of Wine by Category: Total Volume 2017-2022

- Table 35 Sales of Wine by Category: Total Value 2017-2022

- Table 36 Sales of Wine by Category: % Total Volume Growth 2017-2022

- Table 37 Sales of Wine by Category: % Total Value Growth 2017-2022

- Table 38 Sales of Wine by Off-trade vs On-trade: Volume 2017-2022

- Table 39 Sales of Wine by Off-trade vs On-trade: Value 2017-2022

- Table 40 Sales of Wine by Off-trade vs On-trade: % Volume Growth 2017-2022

- Table 41 Sales of Wine by Off-trade vs On-trade: % Value Growth 2017-2022

- Table 42 Sales of Still Red Wine by Price Segment: % Off-trade Volume 2017-2022

- Table 43 Sales of Still Rose Wine by Price Segment: % Off-trade Volume 2017-2022

- Table 44 Sales of Still White Wine by Price Segment: % Off-trade Volume 2017-2022

- Table 45 Sales of Other Sparkling Wine by Price Segment: % Off-trade Volume 2017-2022

- Table 46 GBO Company Shares of Still Light Grape Wine: % Total Volume 2018-2022

- Table 47 NBO Company Shares of Still Light Grape Wine: % Total Volume 2018-2022

- Table 48 LBN Brand Shares of Still Light Grape Wine: % Total Volume 2019-2022

- Table 49 GBO Company Shares of Champagne: % Total Volume 2018-2022

- Table 50 NBO Company Shares of Champagne: % Total Volume 2018-2022

- Table 51 LBN Brand Shares of Champagne: % Total Volume 2019-2022

- Table 52 GBO Company Shares of Other Sparkling Wine: % Total Volume 2018-2022

- Table 53 NBO Company Shares of Other Sparkling Wine: % Total Volume 2018-2022

- Table 54 LBN Brand Shares of Other Sparkling Wine: % Total Volume 2019-2022

- Table 55 GBO Company Shares of Fortified Wine and Vermouth: % Total Volume 2018-2022

- Table 56 NBO Company Shares of Fortified Wine and Vermouth: % Total Volume 2018-2022

- Table 57 LBN Brand Shares of Fortified Wine and Vermouth: % Total Volume 2019-2022

- Table 58 Forecast Sales of Wine by Category: Total Volume 2022-2027

- Table 59 Forecast Sales of Wine by Category: Total Value 2022-2027

- Table 60 Forecast Sales of Wine by Category: % Total Volume Growth 2022-2027

- Table 61 Forecast Sales of Wine by Category: % Total Value Growth 2022-2027

SPIRITS IN THAILAND

KEY DATA FINDINGS

2022 DEVELOPMENTS

- Rise in global oil price shocks the market

- Spirits sales increase through on-trade channels thanks to the recovery of tourism

- Domestic manufacturers dominate

PROSPECTS AND OPPORTUNITIES

- Premiumisation becomes the key marketing strategy for leading player

- Change in consumers' behaviour after pandemic impacts spirits

- Giant companies tapping into shochu/soju

CATEGORY BACKGROUND

- Vodka, gin, other blended Scotch whisky, dark rum and white rum price band methodology

- Summary 4 Benchmark Brands 2022

CATEGORY DATA

- Table 62 Sales of Spirits by Category: Total Volume 2017-2022

- Table 63 Sales of Spirits by Category: Total Value 2017-2022

- Table 64 Sales of Spirits by Category: % Total Volume Growth 2017-2022

- Table 65 Sales of Spirits by Category: % Total Value Growth 2017-2022

- Table 66 Sales of Spirits by Off-trade vs On-trade: Volume 2017-2022

- Table 67 Sales of Spirits by Off-trade vs On-trade: Value 2017-2022

- Table 68 Sales of Spirits by Off-trade vs On-trade: % Volume Growth 2017-2022

- Table 69 Sales of Spirits by Off-trade vs On-trade: % Value Growth 2017-2022

- Table 70 Sales of Dark Rum by Price Platform: % Total Volume 2017-2022

- Table 71 Sales of White Rum by Price Platform: % Total Volume 2017-2022

- Table 72 Sales of Other Blended Scotch Whisky by Price Platform: % Total Volume 2017-2022

- Table 73 Sales of English Gin by Price Platform: % Total Volume 2017-2022

- Table 74 Sales of Vodka by Price Platform: % Total Volume 2017-2022

- Table 75 Sales of Vodka by Flavoured vs Non-flavoured: % Total Volume 2017-2022

- Table 76 GBO Company Shares of Spirits: % Total Volume 2018-2022

- Table 77 NBO Company Shares of Spirits: % Total Volume 2018-2022

- Table 78 LBN Brand Shares of Spirits: % Total Volume 2019-2022

- Table 79 Forecast Sales of Spirits by Category: Total Volume 2022-2027

- Table 80 Forecast Sales of Spirits by Category: Total Value 2022-2027

- Table 81 Forecast Sales of Spirits by Category: % Total Volume Growth 2022-2027

- Table 82 Forecast Sales of Spirits by Category: % Total Value Growth 2022-2027

CIDER/PERRY IN THAILAND

KEY DATA FINDINGS

2022 DEVELOPMENTS

- Consumption after COVID-19 accelerates cider/perry market in 2022

- Local preferences weaken demand for cider/perry

- International brands extending their reach

PROSPECTS AND OPPORTUNITIES

- Local brand building platform for further development

- Premium image weakens cider/perry's opportunity

- On-trade growth

CATEGORY DATA

- Table 83 Sales of Cider/Perry: Total Volume 2017-2022

- Table 84 Sales of Cider/Perry: Total Value 2017-2022

- Table 85 Sales of Cider/Perry: % Total Volume Growth 2017-2022

- Table 86 Sales of Cider/Perry: % Total Value Growth 2017-2022

- Table 87 Sales of Cider/Perry by Off-trade vs On-trade: Volume 2017-2022

- Table 88 Sales of Cider/Perry by Off-trade vs On-trade: Value 2017-2022

- Table 89 Sales of Cider/Perry by Off-trade vs On-trade: % Volume Growth 2017-2022

- Table 90 Sales of Cider/Perry by Off-trade vs On-trade: % Value Growth 2017-2022

- Table 91 GBO Company Shares of Cider/Perry: % Total Volume 2018-2022

- Table 92 NBO Company Shares of Cider/Perry: % Total Volume 2018-2022

- Table 93 LBN Brand Shares of Cider/Perry: % Total Volume 2019-2022

- Table 94 Forecast Sales of Cider/Perry: Total Volume 2022-2027

- Table 95 Forecast Sales of Cider/Perry: Total Value 2022-2027

- Table 96 Forecast Sales of Cider/Perry: % Total Volume Growth 2022-2027

- Table 97 Forecast Sales of Cider/Perry: % Total Value Growth 2022-2027

RTDS IN THAILAND

KEY DATA FINDINGS

2022 DEVELOPMENTS

- RTDs market recovers, thanks to on-the-go consumption potential

- Price-sensitive attitude impedes consumer choices

- Siam Winery and its Spy brand maintains outright lead in 2022

PROSPECTS AND OPPORTUNITIES

- RTDs players seek further opportunity to grasp shochu/soju demand

- Smirnoff Midnight highlights the market's growth

- Potential for the development of products with a healthier positioning

CATEGORY DATA

- Table 98 Sales of RTDs by Category: Total Volume 2017-2022

- Table 99 Sales of RTDs by Category: Total Value 2017-2022

- Table 100 Sales of RTDs by Category: % Total Volume Growth 2017-2022

- Table 101 Sales of RTDs by Category: % Total Value Growth 2017-2022

- Table 102 Sales of RTDs by Off-trade vs On-trade: Volume 2017-2022

- Table 103 Sales of RTDs by Off-trade vs On-trade: Value 2017-2022

- Table 104 Sales of RTDs by Off-trade vs On-trade: % Volume Growth 2017-2022

- Table 105 Sales of RTDs by Off-trade vs On-trade: % Value Growth 2017-2022

- Table 106 GBO Company Shares of RTDs: % Total Volume 2018-2022

- Table 107 NBO Company Shares of RTDs: % Total Volume 2018-2022

- Table 108 LBN Brand Shares of RTDs: % Total Volume 2019-2022

- Table 109 Forecast Sales of RTDs by Category: Total Volume 2022-2027

- Table 110 Forecast Sales of RTDs by Category: Total Value 2022-2027

- Table 111 Forecast Sales of RTDs by Category: % Total Volume Growth 2022-2027

- Table 112 Forecast Sales of RTDs by Category: % Total Value Growth 2022-2027