|

|

市場調査レポート

商品コード

1560854

FPSO(浮体式海洋石油・ガス生産貯蔵積出設備)の世界市場:2024年~2031年Global Floating Production Storage and Offloading Market - 2024 - 2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| FPSO(浮体式海洋石油・ガス生産貯蔵積出設備)の世界市場:2024年~2031年 |

|

出版日: 2024年09月23日

発行: DataM Intelligence

ページ情報: 英文 209 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

レポート概要

FPSO(浮体式海洋石油・ガス生産貯蔵積出設備)の世界市場規模は、2023年に2,520万米ドルと評価され、2031年には3,899万米ドルに達する見込みで、予測期間(2024-2031年)にCAGRで5.61%の成長が予測されています。

オフショア油田・ガス田では、FPSO船を使用して海底油層から炭化水素を回収し、石油・ガス・水に変換します。この船は、シャトル・タンカーに積み込まれるまで、あるいは輸出パイプラインを経由して製油所に移送されるまで、処理された原油・天然ガスを保持します。

ポンプ、発電機、貯蔵タンク、制御室、宿泊施設などがあり、遠隔地での石油・ガスの採掘・精製を手頃なコストで支援します。FPSO船は、従来の海上石油・ガス施設よりも柔軟で多用途、安全で時間効率に優れ、大容量の貯蔵が可能です。現在の油田が枯渇した場合、FPSO船はコストのかかる海底パイプラインを必要とせず、新しい場所に移設することができます。

その結果、現地のパイプラインインフラが不足し、小規模な石油・ガス田が何年も涸渇しているようなフロンティア地域で支持を集めています。また、取り外し可能なタレットシステムを備えているため、緊急時に撤収し、再び取り付けて操業を継続することができ、悪天候にも適しています。

市場力学

海洋探査・生産活動や限界埋蔵量の開発に対する需要の高まりにより、市場の発展が期待されます。しかし、多額の設置コストが予測期間中の拡大を阻害する可能性があります。

海洋探査・生産活動への注目の高まり

海洋探査・生産活動への注目が高まり、深海や超深海での探査が増加しているため、FPSO市場は急成長すると予測されます。国際エネルギー機関(IEA)によると、オフショア石油・ガス生産への年間設備投資は劇的に増加すると予想されており、業界の成長を後押ししています。さらに、FPSOは陸上石油源の枯渇によって支えられています。

深海や超深海の海洋埋蔵物では、過酷な状況に対抗するためのコンパクトな統合システムに対する需要が高まっており、6年後のFPSO市場の成長を押し上げると予想されます。これは、コスト効率が高く、効率的な生産プロセスで高い収量が見込めるためです。

限界埋蔵量の開発活動の増加

FPSOが固定構造物の助けを借りずに作業できる能力とともに、遠隔地沖合における限界埋蔵油田の開発活動が増加し、市場開拓に好影響を与えると予想されます。例えば、2018年にはオーストラリアのノース・ウェスタン・シェルフで油田が発見されました。さらに、このようなユニットが悪天候にも耐えられることから、市場の開拓が予測されています。

浮体式生産貯蔵積出事業の成長を助けたその他の理由には、限界油田や困難な条件が含まれます。今後数年間は、オフショア・シェール油田における新たなE&P活動がFPSOの要件を押し上げる可能性が高いです。

高い設置コスト

運用コストは、施設の一般的な運用費を用いて計算され、未知の施設については、施設のタイプ、規模、生産量、築年数に基づくベンチマークを用いて外挿されました。概念的には単純だが、油田のライザーとフローラインは最も重要なコンポーネントのひとつであり、高度な技術力を必要とし、その結果、多額の資本コストがかかります。

市場セグメンテーション

FPSO市場は、製品タイプ別に改造型と新設型に区分されます。

改造型が圧倒的シェアを占める

改造型が市場で最も大きな割合を占めると予想されます。改造FPSOは、既存の輸送船(多くは原油シャトルタンカー)を改造して作られる浮体式生産・貯蔵・積出設備です。タンカーからFPSOへの改造には数ヶ月かかります。一方、新造FPSOは建造に数年かかります。その結果、改造FPSO市場は大きく発展すると予想されます。

地域別の市場分析

北米での投資増加

オフショア石油・天然ガス事業は、米国のエネルギー供給、経済成長、雇用創出に不可欠です。石油・天然ガス産業は、石油・天然ガス機械、航空・海上輸送、法律・保険サービスなど、さまざまな製造・サービス事業の雇用を支えています。

エネルギーインフラの成長を支える投資の増加と、メキシコのような国々におけるオフショア石油・ガス生産需要の増加は、FPSO市場を前進させると思われます。

市場の競合情勢

市場の主要プレーヤーには、Bumi Armada、SBM Offshore、Bluewater Energy Services、Teekay、Shell、ExxonMobil、Petrobras、Chevron、BW Offshore、MODECが含まれます。

COVID-19影響分析

パンデミックは世界のサプライチェーンに大きな混乱をもたらし、FPSOの設置やメンテナンスに必要な重要な機器や資材の納入を遅らせました。進行中のプロジェクトの延期や、新規FPSOの試運転の遅れの原因となった。輸送の制限と社会的分離の要件は、現地で訓練を受けた労働力と技術専門家の利用を妨げ、プロジェクトの期限をさらに遅らせました。

オフショア要員の多くが検疫制限を受け、操業やメンテナンスのスケジュールに影響を与えました。疫病によって生じた経済的不確実性と財政的ひずみのため、一部の企業は、計画されていたFPSOプロジェクトを中止または延期しました。特に、開発の初期段階であったり、かなりの財務的リスクを抱えていた構想で顕著でした。

ロシア・ウクライナ紛争の影響

ロシア・ウクライナ紛争は、主にサプライチェーンの混乱とエネルギー市場の変動により、FPSO(FPSO)業界に大きな影響を与えました。紛争はエネルギー安全保障の再評価を促し、いくつかの国が代替エネルギー源を模索し、ロシアの石油・ガスへの依存を減らすよう促しました。

生産量の減少を補い、エネルギー需要を満たすために、オペレーターが新たなオフショア領域を開拓しようと努力する中、業界の変革はFPSOユニットに対するニーズの増加につながった。加えて、現在の地政学的状況と制裁措置の実施は、FPSOの建設とメンテナンスに必要な資材や部品の調達に影響を及ぼしています。

企業は、サプライチェーンの混乱や地域リスクの増大による遅延や費用の増大に直面しています。このような課題から、FPSO業界では、紛争が続く中、リスクを最小限に抑え、操業の安定性を確保することに重点を置いた、より慎重な投資アプローチがとられています。

目次

第1章 FPSOの世界市場の調査手法と調査範囲

- 調査手法

- 調査目的と調査範囲

第2章 FPSOの世界市場:市場定義と概要

第3章 FPSOの世界市場:エグゼクティブサマリー

- 推進別の市場内訳

- 船型別の市場内訳

- 用途別の市場内訳

- タイプ別の市場内訳

- 地域別の市場内訳

第4章 FPSOの世界市場:市場力学

- 市場への影響要因

- 促進要因

- 海洋探査・生産活動への注目の高まり

- 限界埋蔵量の開発活動の増加

- 抑制要因

- 高い設置コスト

- 機会

- 影響分析

- 促進要因

第5章 FPSOの世界市場:産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 FPSOの世界市場:COVID-19分析

- COVID-19の市場分析

- COVID-19の価格ダイナミクス

- 需給スペクトラム

- パンデミック時の市場に関連する政府の取り組み

- メーカーの戦略的取り組み

- 結論

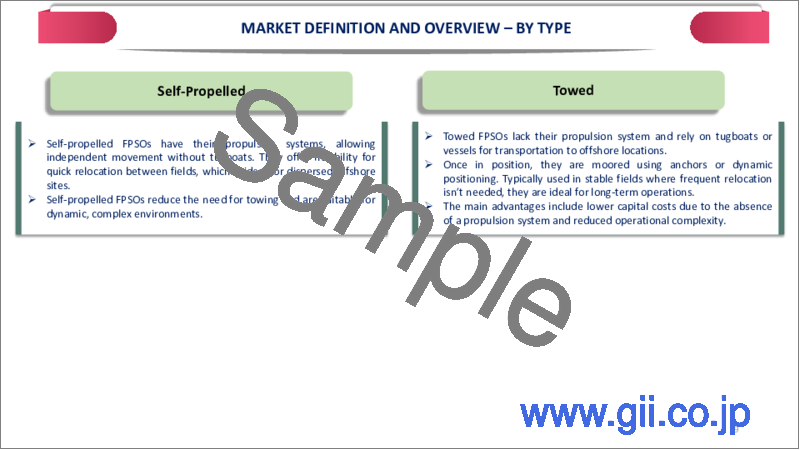

第7章 FPSOの世界市場:推進別

- 自走式

- 曳航式

第8章 FPSOの世界市場:製品タイプ別

- シングルハル

- ダブルハル

第9章 FPSOの世界市場:タイプ別

- 新造船

- 改造船

第10章 FPSOの世界市場:用途別

- 浅海

- 深海

- 超深海

第11章 FPSOの世界市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 FPSOの世界市場:競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 FPSOの世界市場:企業プロファイル

- Bumi Armada

- 企業概要

- 製品ポートフォリオと説明

- 主なハイライト

- 財務概要

- SBM Offshore

- Bluewater Energy Services

- Teekay

- Shell

- ExxonMobil

- Petrobras

- Chevron

- BW Offshore

- MODEC

第14章 FPSOの世界市場:重要考察

第15章 FPSOの世界市場:DataM

Report Overview

The Global Floating Production Storage and Offloading Market size was worth US$ 25.20 million in 2023 and is estimated to reach US$ 38.99 million by 2031, growing at a CAGR of 5.61% during the forecast period (2024-2031).

Offshore oil and gas fields use floating production storage and offloading (FPSO) vessels to collect hydrocarbons from subsea oil reservoirs and transform them into oil, gas and water. The ships hold processed crude oil or natural gas until offloaded onto a shuttle tanker or transferred to refineries via an export pipeline.

Pumps, generators, storage tanks, control rooms and lodging facilities are available to assist in extracting and refining oil and gas in remote places at affordable costs. FPSO boats are more flexible, versatile, safe and time-efficient to offer a large storage capacity than conventional offshore oil & gas facilities. When a current oilfield is depleted, FPSO vessels can be transferred to a new place without the need for costly underwater oil pipelines.

As a result, it is gaining traction in frontier areas where local pipeline infrastructure is lacking and smaller oil and gas fields have become dry for years. They are also appropriate for adverse weather situations since they have detachable turret systems that can be withdrawn during an emergency and reattached to continue operations.

Market Dynamics

The market is expected to develop due to rising demand for offshore exploration and production activities and the exploitation of marginal oil reserves. However, hefty installation costs may stifle expansion during the forecast period.

The rising focus on offshore exploration and production activities

Because of the increased focus on offshore exploration and production activities and increased exploration in deep and ultra-deepwater, the FPSO market is predicted to grow rapidly. As per the International Energy Agency (IEA), annual capital investment in offshore oil and gas production is expected to increase dramatically, boosting industry growth. Furthermore, FPSOs are supported by the exhaustion of onshore oil sources.

The growing demand for integrated compact integrated systems in deep and ultra-deepwater offshore reserves to combat harsh circumstances will boost FPSO market growth in six years. Due to cost-effective and efficient production processes with high yield potential.

The rise in exploitation activities of marginal oil reserves

Increased exploitation of marginal oil deposits in remote offshore areas, along with the ability of FPSOs to work without the help of a fixed structure, are expected to have a favorable impact on market development. For example, an oil field was discovered in Australia's North Western Shelf in 2018. Furthermore, the market is predicted to develop due to the capacity of such units to survive adverse weather conditions.

Other reasons that have aided the growth of the floating production storage and offloading business include marginal fields and difficult conditions. Over the next few years, new E&P activities in offshore shale fields are likely to boost FPSO requirements.

High installation costs

Operational costs were calculated using general operating expenses for facilities and extrapolated for unknown facilities using benchmarks based on facility type, size, production and age. While conceptually simple, an oilfield's risers and flowlines are some of the most crucial components, requiring a high level of technical sophistication and, as a result, a significant capital cost.

Market Segment Analysis

By type, the floating production storage & offloading market is segmented into converted and new-build.

The converted segment holds the lion's share

The converted category is expected to take the largest proportion of the market. Converted FPSOs are floating production, storage and offloading vessels created by altering an existing transportation vessel, often a crude oil shuttle tanker. Converting a tanker to an FPSO takes a few months. A new-build FPSO, on the other hand, takes several years to construct. As a result, the market for converted floating production storage and offloading is expected to develop significantly.

Market Geographical Analysis

Rising investments in North America

The offshore oil and natural gas business are critical to U.S. energy supply, economic growth and employment creation. The oil & natural gas industry supports jobs in various manufacturing & service businesses, including oil & natural gas machinery, air & sea transportation and legal & insurance services.

Increasing investments to support energy infrastructure growth and increased demand for offshore oil and gas production in countries like Mexico will propel the floating production storage and offloading market forward.

Market Competitive Landscape

Major players in the market include Bumi Armada, SBM Offshore, Bluewater Energy Services, Teekay, Shell, ExxonMobil, Petrobras, Chevron, BW Offshore and MODEC.

COVID-19 Impact Analysis

The pandemic produced significant disruptions in global supply chains, delaying the delivery of critical equipment and materials required for FPSO installation and maintenance. It caused the postponement of ongoing projects and the delay in the commissioning of new FPSOs. Restrictions on transportation and the requirement for social separation hindered the availability of trained labor and technical professionals on-site, further delayed project deadlines.

Many offshore personnel were subjected to quarantine restrictions, affecting operations and maintenance schedules. Due to economic uncertainties and financial strains created by the epidemic, some corporations canceled or postponed planned FPSO projects. It was especially noticeable in initiatives that were in the early stages of development or had considerable financial risks.

Russia-Ukraine War Impact

The conflict between Russia and Ukraine has significantly affected the Floating Production Storage and Offloading (FPSO) industry, primarily due to disruptions in the supply chain and shifts in energy markets. The conflict has prompted a reevaluation of energy security, prompting several nations to explore alternative energy sources and reduce the reliance on Russian oil & gas.

The industry's transformation has led to an increased need for FPSO units as operators strive to tap into fresh offshore territories to compensate for reduced production and meet energy demands. In addition, the current geopolitical situation and the implementation of sanctions have affected the procurement of necessary materials and components for the construction and maintenance of FPSOs.

Companies are facing delays and expense escalations due to supply chain disruptions and increased regional risk. The challenges mentioned have led to a more cautious investment approach in the FPSO industry, with a focus on minimizing risks and ensuring operational stability amidst ongoing conflicts.

By Propulsion

Self-Propelled

Towed

By Hull Type

Single Hull

Double Hull

By Type

New Built

Converted

By Usage

Shallow Water

Deep Water

Ultra-deep Water

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

UK

France

Italy

Spain

Rest of Europe

South America

Brazil

Argentina

Rest of South America

Asia-Pacific

China

India

Japan

Australia

Rest of Asia-Pacific

Middle East and Africa

Key Developments

In January 2024, Offshore Frontier Solution Pte Ltd in Singapore, a joint venture between MODEC and Toyo Engineering Corporation, selected ABB to supply a comprehensive electrical system and digital solutions for an ExxonMobil floating production storage and offloading (FPSO) vessel that will be deployed in the South American Uaru oil field. Errea Wittu, the offshore FPSO, will be stationed around 200 kilometers off the coast of Guyana.

MODEC, Inc. has revealed plans to open a new office in Kuala Lumpur, Malaysia in May 2024. This expansion, led by Offshore Frontier Solutions Pte. Ltd., is dedicated to supporting Engineering, Procurement, Construction and Installation (EPCI) projects for floating offshore solutions. The initiative aims to generate more than 200 new job opportunities in engineering and other corporate support functions, intending to fill them by early 2025.

Why Purchase the Report?

Visualize the composition of the floating production storage & offloading market segmentation by propulsion, hull type, usage, type and region, highlighting the critical commercial assets and players.

Identify commercial opportunities in the floating production storage & offloading market by analyzing trends and co-development deals.

Excel data sheet with thousands of floating production storage & offloading market-level 4/5 segmentation points.

Pdf report with the most relevant analysis cogently put together after exhaustive qualitative interviews and in-depth market study.

Product mapping in excel for the key product of all major market players

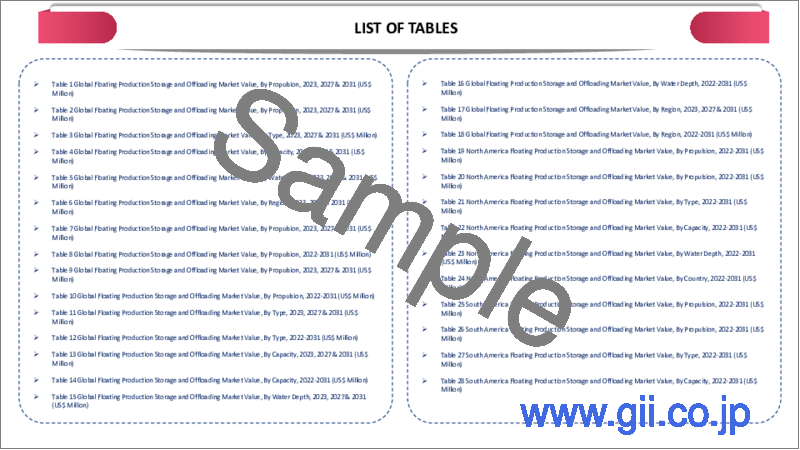

The global floating production storage & offloading market report would provide access to an approx. 69 market data tables, 59 figures and 209 pages.

Target Audience 2024

Floating Production Storage & Offloading Service Providers/ Buyers

Industry Investors/Investment Bankers

Education & Research Institutes

Emerging Companies

Floating Production Storage & Offloading Manufacturers

Table of Contents

1. Global Floating Production Storage & Offloading Market Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Global Floating Production Storage & Offloading Market - Market Definition and Overview

3. Global Floating Production Storage & Offloading Market - Executive Summary

- 3.1. Market Snippet by Propulsion

- 3.2. Market Snippet by Hull Type

- 3.3. Market Snippet by Usage

- 3.4. Market Snippet by Type

- 3.5. Market Snippet by Region

4. Global Floating Production Storage & Offloading Market-Market Dynamics

- 4.1. Market Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. The rising focus on offshore exploration and production activities

- 4.1.1.2. The rise in exploitation activities of marginal oil reserves

- 4.1.2. Restraints

- 4.1.2.1. High installation costs

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Global Floating Production Storage & Offloading Market - Industry Analysis

- 5.1. Porter's Five Forces Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

6. Global Floating Production Storage & Offloading Market - COVID-19 Analysis

- 6.1. Analysis of COVID-19 on the Market

- 6.1.1. Before COVID-19 Market Scenario

- 6.1.2. Present COVID-19 Market Scenario

- 6.1.3. After COVID-19 or Future Scenario

- 6.2. Pricing Dynamics Amid Covid-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. Global Floating Production Storage & Offloading Market - By Propulsion

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 7.1.2. Market Attractiveness Index, By Propulsion

- 7.2. Self-Propelled*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Towed

8. Global Floating Production Storage & Offloading Market - By Hull Type

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Hull Type

- 8.1.2. Market Attractiveness Index, By Hull Type

- 8.2. Single Hull*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Double Hull

9. Global Floating Production Storage & Offloading Market - By Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.1.2. Market Attractiveness Index, By Type

- 9.2. New Build*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Converted

10. Global Floating Production Storage & Offloading Market - By Usage

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 10.1.2. Market Attractiveness Index, By Usage

- 10.2. Shallow water*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Deep Water

- 10.4. Ultra-deep Water

11. Global Floating Production Storage & Offloading Market - By Region

- 11.1. Introduction

- 11.2. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.3. Market Attractiveness Index, By Region

- 11.4. North America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Hull Type

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. U.S.

- 11.4.7.2. Canada

- 11.4.7.3. Mexico

- 11.5. Europe

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Hull Type

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. Germany

- 11.5.7.2. UK

- 11.5.7.3. France

- 11.5.7.4. Italy

- 11.5.7.5. Spain

- 11.5.7.6. Rest of Europe

- 11.6. South America

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Hull Type

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.6.7.1. Brazil

- 11.6.7.2. Argentina

- 11.6.7.3. Rest of South America

- 11.7. Asia-Pacific

- 11.7.1. Introduction

- 11.7.2. Key Region-Specific Dynamics

- 11.7.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.7.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Hull Type

- 11.7.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.7.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.7.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.7.7.1. China

- 11.7.7.2. India

- 11.7.7.3. Japan

- 11.7.7.4. Australia

- 11.7.7.5. Rest of Asia-Pacific

- 11.8. Middle East and Africa

- 11.8.1. Introduction

- 11.8.2. Key Region-Specific Dynamics

- 11.8.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Propulsion

- 11.8.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Hull Type

- 11.8.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Usage

- 11.8.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

12. Global Floating Production Storage & Offloading Market - Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Global Floating Production Storage & Offloading Market - Company Profiles

- 13.1. Bumi Armada

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Key Highlights

- 13.1.4. Financial Overview

- 13.2. SBM Offshore

- 13.3. Bluewater Energy Services

- 13.4. Teekay

- 13.5. Shell

- 13.6. ExxonMobil

- 13.7. Petrobras

- 13.8. Chevron

- 13.9. BW Offshore

- 13.10. MODEC (*LIST NOT EXHAUSTIVE)

14. Global Floating Production Storage & Offloading Market - Premium Insights

15. Global Floating Production Storage & Offloading Market - DataM

- 15.1. Appendix

- 15.2. About Us and Services

- 15.3. Contact Us