|

|

市場調査レポート

商品コード

1512666

口腔向けプロバイオティクスサプリメントの世界市場:2024年~2031年Global Oral Probiotics Supplements Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 口腔向けプロバイオティクスサプリメントの世界市場:2024年~2031年 |

|

出版日: 2024年07月10日

発行: DataM Intelligence

ページ情報: 英文 235 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

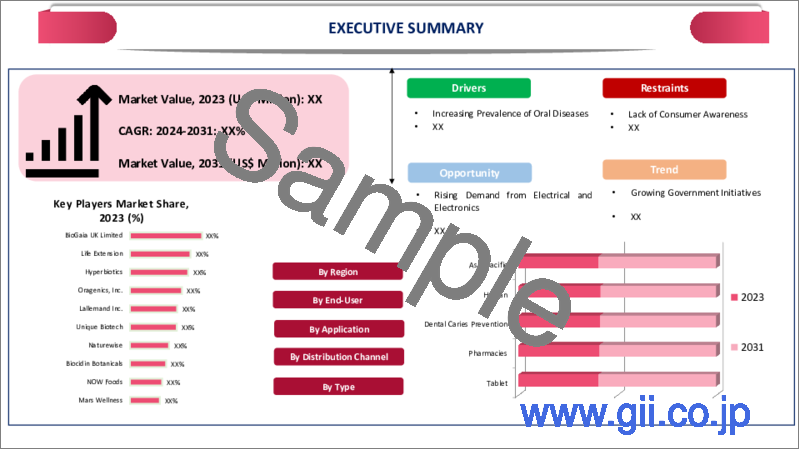

口腔向けプロバイオティクスサプリメントの世界市場は、2023年に2億2,690万米ドルに達し、2031年には3億7,640万米ドルに達すると予測され、予測期間2024-2031年のCAGRは7.5%で成長します。

口腔の健康と全身の健康との関連性に対する消費者の意識の高まりが、口腔向けプロバイオティクスサプリメントの需要を促進しています。自然で予防的なヘルスケアソリューションへの世界のシフトがあり、プロバイオティクスは従来の口腔ケア製品の自然な代替品として認識されています。プロバイオティクスが口腔と歯の健康に役立つという消費者の認識、健康意識の高まり、ライフスタイルの変化が市場にプラスの影響を与えています。

さらに、プロバイオティクスの研究と製剤化技術の進歩により、より効果的で的を絞ったサプリメントの開発が進んでいます。う蝕予防、歯周病管理、口臭対策、歯列矯正など様々な用途向けに、カプセルや洗口液など様々な形態の革新的な新製品が発売されています。

北米が世界市場を独占しています。NIHによると、アメリカでは20歳から64歳の成人の90%が罹患する虫歯と、45歳から64歳の成人のほぼ50%が罹患する歯周病が、依然として最も蔓延している口腔疾患の2つです。口腔衛生問題の増加に伴い、予防医療の文化が強くなり、口腔衛生と健康をサポートするオーラル・プロバイオティクスのような製品に対する需要が高まっています。

市場力学

世界の口腔疾患の有病率の増加

2022年のWHO世界口腔衛生現状報告書によると、世界で約35億人が口腔疾患に罹患しており、その4分の3は中所得国に居住しています。世界全体では、推定20億人が永久歯のう蝕を経験し、5億1,400万人の子供が乳歯のう蝕に苦しんでいます。口唇、口腔、口腔咽頭のがんを含む口腔がんは、世界で13番目に罹患率の高いがんです。

20歳以上の完全な歯牙喪失の世界平均有病率はほぼ7%であり、60歳以上では23%と大幅に上昇します。重度の歯周病は、世界の成人の約19%が罹患しており、その総症例数は10億を超えます。このような疾患の有病率の増加に伴い、プロバイオティクスとともに口腔ケア製品の需要が増加しています。プロバイオティクスは、口腔の健康を維持するための自然で効果的なソリューションとして認識されています。

天然ヘルスケア製品に対する消費者の嗜好の高まり

口腔の健康と予防歯科ケアの重要性に対する消費者の意識の高まりが、口腔ケア製品の需要を押し上げています。従来のヘルスケア製品に含まれる化学物質や合成添加物の潜在的な副作用に対する認識や懸念が高まっており、消費者の関心は自然で予防的なヘルスケアソリューションに移行しています。

プロバイオティクスは、従来の口腔ケア製品に代わる自然な代替品と見なされ、非化学的かつホリスティックなアプローチを求める消費者にアピールしています。口腔ケアにおけるプロバイオティクスは、口腔内の微生物の健康的なバランスを促進する有益な細菌を含みます。虫歯の原因菌を抑制することで虫歯を予防し、炎症を抑えることで歯茎の健康をサポートし、臭いの原因となる菌を抑制することで口臭と闘うことができます。

従来のオーラルケア製品との競合

歯磨き粉、マウスウォッシュ、デンタルフロスといった定評のあるオーラルケア製品の中には、消費者のロイヤリティが高く、より従来型の製品で入手しやすいと認識されているものもあり、口腔向けプロバイオティクスサプリメントに強い競合を生み出しています。この競争は、市場における口腔向けプロバイオティクスサプリメントの採用と成長をさらに制限しています。

消費者の多くは、明確なメリットを感じたりヘルスケア専門家から推薦を受けたりしない限り、慣れ親しんだ口腔衛生習慣からの切り替えに消極的です。さらに、経口プロバイオティクスは従来の口腔ケア用品に比べて比較的高価であるため、価格に敏感な消費者が定期的に採用することを躊躇する可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 世界の口腔疾患の有病率の増加

- 天然ヘルスケア製品に対する消費者の嗜好の高まり

- 抑制要因

- 従来のオーラルケア製品との競合

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- 錠剤

- 粉末

- マウスウォッシュ

- その他

第8章 流通チャネル別

- 薬局

- スーパーマーケットおよびハイパーマーケット

- 歯科医院

- eコマース

第9章 用途別

- う蝕予防

- 歯周病管理

- 口臭対策

- 歯列矯正ケア

第10章 エンドユーザー別

- 人間

- ペット

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- BioGaia UK Limited

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Life Extension

- Hyperbiotics

- Oragenics, Inc.

- Lallemand Inc.

- Unique Biotech

- Naturewise

- Biocidin Botanicals

- NOW Foods

- Mars Wellness

第14章 付録

Overview

Global Oral Probiotics Supplements Market reached US$ 226.9 million in 2023 and is expected to reach US$ 376.4 million by 2031, growing with a CAGR of 7.5% during the forecast period 2024-2031.

Greater consumer awareness of the link between oral health and overall well-being is driving demand for oral probiotics supplements. There is a global shift towards natural and preventive healthcare solutions, with probiotics being perceived as natural alternatives to traditional oral care products. Consumer awareness of the oral and dental health benefits associated with probiotics, rising health consciousness and lifestyle changes positively impact the market.

In addition, the advances in probiotics research and formulation technologies are leading to the development of more effective and targeted supplements. The launch of new and innovative products in various forms such as capsules and mouthwashes for various applications such as dental caries prevention, gum disease management, bad breath control and orthodontic care.

North America is dominating the global market. According to NIH, in America tooth decay, affecting 90% of adults aged 20 to 64 years, and gum disease, affecting almost 50% of adults aged 45 to 64 years, remain two of the most prevalent oral diseases. With the increasing oral health problems, there is a strong culture of preventive healthcare, leading to a greater demand for products like oral probiotics that support oral hygiene and health.

Dynamics

Increasing Prevalence of Oral Diseases Globally

According to the WHO Global Oral Health Status Report of 2022, approximately 3.5 billion people worldwide are affected by oral diseases, with three-quarters of those affected residing in middle-income countries. Globally, an estimated 2 billion individuals experience dental caries in their permanent teeth, and 514 million children suffer from caries in their primary teeth. Oral cancer, encompassing cancers of the lip, mouth, and oropharynx, ranks as the 13th most prevalent cancer globally.

The global average prevalence of complete tooth loss among individuals aged 20 and older is nearly 7%, while for those aged 60 and older, it rises significantly to 23%. Severe periodontal diseases affect approximately 19% of adults worldwide, totalling more than 1 billion cases. With the increasing prevalence of such diseases, the demand for oral care products increasing along with probiotics. Probiotics are perceived as natural and effective solutions to maintain oral health.

Rising Consumer Preference For Natural Healthcare Products

Growing awareness among consumers about the importance of oral health and preventive dental care is boosting the demand for oral health care products. There is growing awareness and concern about the potential side effects of chemicals and synthetic additives in traditional healthcare products, shifting the consumer focus to natural and preventive healthcare solutions.

Probiotics are seen as natural alternatives to traditional oral care products, appealing to consumers looking for non-chemical and holistic approaches. Probiotics in oral health care involve beneficial bacteria that promote a healthy balance of microorganisms in the mouth. They can help prevent dental caries by inhibiting cavity-causing bacteria, support gum health by reducing inflammation, and combat bad breath by controlling odor-causing bacteria.

Competition from Traditional Oral Care Products

Some established oral care products such as toothpaste, mouthwash, and dental floss have strong consumer loyalty and are perceived as more conventional and readily available products, creating strong competition for oral probiotic supplements. This competition further limits the adoption and growth of oral probiotics supplements in the market.

Many consumers are reluctant to switch from their familiar oral hygiene routines unless they perceive clear benefits or receive recommendations from healthcare professionals. Additionally, the relatively high cost of oral probiotics compared to traditional oral care items can deter price-sensitive consumers from adopting them regularly.

Segment Analysis

The global oral probiotics supplements market is segmented based on type, distribution channel, application, end-user and region.

Increasing Health Consciousness Among the Human Population

The global oral probiotics supplements market is segmented based on end-users into humans and pets. The human segment is dominating the global market. The market for human oral probiotics supplements is growing with significant development in terms of product innovation and formulation diversity that is meeting the catering specifically to human health needs.

There is a greater emphasis on preventive healthcare and wellness in human populations, leading to higher demand for products that support oral health, such as probiotics. Consumers are increasingly interested in natural and preventive solutions for maintaining oral hygiene. To meet the demand of growing consumers' willingness to adopt various new products, manufacturers are coming up with various new and innovative oral probiotic supplements driving the market growth.

Geographical Penetration

High Use of Probiotics in North America

North America dominated the global oral probiotics supplements market with the rising health consciousness among consumers. Consumers in North America are generally more aware of the importance of oral health and overall wellness. Consumers are putting more effort into choosing products that show an impact on overall health, including oral and dental health. They are highly incorporating natural products such as probiotics to maximise the positive impact.

In a 2021 survey conducted by the International Food Information Council, findings indicated that 51% of Americans incorporate probiotics into their diets to promote gut health, 33% use them to bolster immune function, 38% integrate probiotics for overall health and wellness purposes, and 13% reported consuming probiotics to support emotional well-being. The higher use of probiotic supplements is parallelly expanding market growth.

The high incorporation of probiotics supplements along with the immense impact of the market players with greater support with the developments boost the market expansion. North America leads in research and development within the probiotics industry, including advancements in probiotic strains, formulation technologies, and clinical studies that validate the efficacy and benefits of oral probiotics, driving regional market growth.

Competitive Landscape

The major global players in the market include BioGaia UK Limited, Life Extension, Hyperbiotics, Oragenics, Inc., Lallemand Inc., Unique Biotech, Naturewise, Biocidin Botanicals, NOW Foods and Mars Wellness.

COVID-19 Impact Analysis

The COVID-19 pandemic has had both positive and negative impacts on the global oral probiotics supplements market. Initially, the market faced challenges due to disruptions in production and supply chains. This led to temporary shortages and delays in product availability, affecting market dynamics. On the other hand, the pandemic heightened global awareness of health and hygiene, leading to increased interest in preventive healthcare solutions, including oral probiotics supplements.

By Type

- Tablet

- Powders

- Mouthwash

- Others

By Distribution Channel

- Pharmacies

- Supermarkets and Hypermarkets

- Dental Clinics

- E-commerce

By Application

- Other Dental Caries Prevention

- Gum Disease Management

- Bad Breath Control

- Orthodontic Care

By End-User

- Human

- Pet

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In May 2023, Roquette introduced PEARLITOL ProTec, a novel excipient aimed at enhancing probiotic supplements in the health and nutrition market. This plant-based blend combines mannitol and maize starch to protect moisture-sensitive active ingredients like probiotics, ensuring longer shelf life, improved consistency, and more consumer-friendly dosage formats.

- IN November 2020, Chr. Hansen launched probiotic lozenges for dental health. These probiotic lozenges can be used by both adults and children from the age of 3, in addition to the regular oral hygiene routine.

Why Purchase the Report?

- To visualize the global oral probiotics supplements market segmentation based on type, distribution channel, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of oral probiotics supplements market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global oral probiotics supplements market report would provide approximately 78 tables, 74 figures and 235 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Distribution Channel

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Prevalence of Oral Diseases Globally

- 4.1.1.2. Rising Consumer Preference For Natural Healthcare Products

- 4.1.2. Restraints

- 4.1.2.1. Competition from Traditional Oral Care Products

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Tablet

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Powders

- 7.4. Mouthwash

- 7.5. Others

8. By Distribution Channel

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 8.1.2. Market Attractiveness Index, By Distribution Channel

- 8.2. Pharmacies

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Supermarkets and Hypermarkets

- 8.4. Dental Clinics

- 8.5. E-commerce

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Dental Caries Prevention

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Gum Disease Management

- 9.4. Bad Breath Control

- 9.5. Orthodontic Care

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Human

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Pet

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. U.K.

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. BioGaia UK Limited

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Life Extension

- 13.3. Hyperbiotics

- 13.4. Oragenics, Inc.

- 13.5. Lallemand Inc.

- 13.6. Unique Biotech

- 13.7. Naturewise

- 13.8. Biocidin Botanicals

- 13.9. NOW Foods

- 13.10. Mars Wellness

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us