|

|

市場調査レポート

商品コード

1489493

ポストコンシューマーリサイクル(PCR)プラスチックの世界市場-2024-2031Global Post-Consumer Recycled (PCR) Plastic Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポストコンシューマーリサイクル(PCR)プラスチックの世界市場-2024-2031 |

|

出版日: 2024年06月05日

発行: DataM Intelligence

ページ情報: 英文 207 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

ポストコンシューマーリサイクル(PCR)プラスチックの世界市場は、2023年に621億米ドルに達し、2031年には1,232億米ドルに達すると予測され、予測期間2024年~2031年のCAGRは8.9%で成長する見込みです。

セクターや消費者グループ全体で持続可能性と社会的責任への関心が高まっていることが、世界のポストコンシューマーリサイクル(PCR)プラスチック市場の大幅な拡大を促しています。プラスチック廃棄物やその生態系への悪影響に対する人々の意識が高まるにつれ、バージンプラスチックよりも持続可能なプラスチックへのニーズが高まっています。消費者使用後のプラスチック廃棄物を再利用して作られるPCRプラスチックは、プラスチックごみを海や埋立地に持ち込まないことで、希少な資源に代わる選択肢を提供します。

世界のPCRプラスチック市場は、プラスチック廃棄物を減らし、リサイクル努力を奨励することを意図した規則や規制により、さらに急速に拡大しています。リサイクル材料の使用を奨励し、循環型経済を推進するため、世界中の政府が拡大生産者責任(EPR)プログラム、プラスチック禁止、製品中のリサイクル含有量の要件などの規則を設けています。

アジア太平洋は、世界のポストコンシューマーリサイクル(PCR)プラスチック市場の1/3以上を占める成長地域のひとつです。アジア太平洋地域では、プラスチック汚染を減らすための厳しい法律や政策により、PCRプラスチックの使用が増加しています。PCRプラスチックを促進するため、中国、インド、日本、韓国のような国の政府は、プラスチック禁止、拡大生産者責任(EPR)プログラム、リサイクル成分を含む商品の要件を含む政策を実施しています。

ダイナミクス

循環型経済への取り組みと資源効率性

廃棄物削減と資源効率を重視する循環型経済(サーキュラー・エコノミー)により、ポストコンシューマーリサイクル(PCR)プラスチックの人気が高まっています。循環型経済の考え方は、廃棄物を減らし、資源の価値を最大化するために、リサイクル、再利用、再製造を行うことで、できるだけ長く物を使い続けようとするものです。プラスチックのゴミを埋立地や焼却炉から遠ざけ、製造サイクルに戻すことで、PCRプラスチックはこの変革に不可欠です。

PCRプラスチックを含むリサイクル素材の利用を優先する循環型経済の取り組みやクローズドループシステムは、幅広い企業によって受け入れられています。資源効率に集中することで、バリューチェーン全体の創造性とチームワークが促進され、より循環的で持続可能なソリューションが生み出されます。

持続可能性と開発

人工知能(AI)とロボットは、企業部門の持続可能性とリサイクルへの対応を支援しています。この技術に関する追加調査はないが、コロナウイルスの大流行がその原因となっています。今のところ、古いペットボトルの問題に対処する適切なリバース・ロジスティクス・ロボットというものは存在しないです。組立ラインにおいて、リサイクル可能なプラスチックや使用可能なプラスチックとリサイクル不可能なプラスチックの分離を強化するために、ロボット工学や人工知能技術が開発されています。ロボットはまた、荷物の持ち上げ、仕分け、配送業務において、人間の労働者の役割を担っています。

例えば2023年、革新的な潤滑技術の世界的リーダーであるモービルは、環境に優しい包装を推進する取り組みの一環として、ポストコンシューマーリサイクル(PCR)プラスチック缶を50%導入しました。PCRペール缶のようなインセンティブは、再生プラスチックの使用を奨励し、プラスチック廃棄物を減らし、持続可能な開発を促進します。同社は、インド初の潤滑油ペール缶用梱包材である50%PCRペール缶により、顧客の廃棄物削減、廃棄物の価値転換、持続可能な目標達成を支援することを目指しています。

限られたインフラと供給

ポストコンシューマーリサイクルプラスチックゴミが不足していることや、多くの地域でリサイクルインフラが不十分であることも障害となっています。この問題に対する認識が高まり、リサイクルを奨励する取り組みが行われているにもかかわらず、使用済みのプラスチックを分別・処理するためのインフラや回収方法が、特定の場所ではまだ不足しています。

さらに、原料の不足がPCRプラスチック製造プロセスの拡張性を制限し、市場の成長を妨げています。供給制限をさらに悪化させているのは、リサイクル原料の輸送と加工に関する物流の問題です。これらの制約を克服するためには、政府、企業、地域社会が協力して回収・リサイクルシステムを強化し、廃棄物管理インフラに大規模な投資を行わなければならないです。

品質と汚染に関する懸念

回収材料の汚染レベルを管理し、均一な品質基準を維持することは、世界的にポストコンシューマーリサイクル(PCR)プラスチック事業が直面している大きな課題です。PCRプラスチックには複数の選別・加工工程が頻繁に使用されるため、材料の品質や属性にばらつきが生じる可能性があります。

PCRプラスチックの使用と性能は、元の商品から残った不純物やリサイクル不可能な成分による汚染によっても影響を受ける可能性があります。このような汚染や品質の課題に対処するためには、最先端の選別・洗浄技術への投資とともに、リサイクル工程全体を通じて厳格な品質管理手順が必要です。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 循環型経済への取り組みと資源効率性

- 持続可能性と発展

- 抑制要因

- インフラと供給の制約

- 品質と汚染に関する懸念

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争影響分析

- DMIの見解

第6章 COVID-19分析

第7章 サービス別

- 収集・輸送

- リサイクル

- 焼却

- 埋立/処分

第8章 供給源別

- ボトル

- ボトル以外

- その他

第9章 ポリマー別

- ポリエチレンテレフタレート(PET)

- 高密度ポリエチレン(HDPE)

- 低密度ポリエチレン(LDPE)

- ポリプロピレン(PP)

- ポリ塩化ビニル(PVC)

- ポリウレタン(PU)

- ポリスチレン(PS)

- その他

第10章 加工別

- 化学的加工

- 機械的加工

- 生物的加工

第11章 エンドユーザー別

- 包装

- 建築・建設

- 自動車

- 家具

- 再生プラスチック

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- BASF SE

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- SABIC

- Arkema

- Celanese Corporation

- Eastman Chemical Company

- Exxon Mobil Corporation

- Covestro AG

- Ultra-Poly Corporation

- Plastipak Holdings, Inc.

- Dow

第15章 付録

Overview

Global Post-Consumer Recycled (PCR) Plastic Market reached US$ 62.1 billion in 2023 and is expected to reach US$ 123.2 billion by 2031, growing with a CAGR of 8.9% during the forecast period 2024-2031.

The growing focus on sustainability and social responsibility across sectors and consumer groups is driving a substantial increase in the globally post-consumer recycled (PCR) plastic market. There is a greater need for sustainable plastics than virgin ones as people become more conscious of plastic waste and its adverse ecological effects. PCR plastics, made from recycled post-consumer plastic waste, provide an alternative to scarce resources by keeping plastic trash out of the seas and landfills.

The global PCR plastic market is expanding faster still because of rules and regulations that are meant to lessen plastic waste and encourage recycling efforts. To encourage the use of recycled materials and advance a circular economy, governments over the world are putting in place rules such as extended producer responsibility (EPR) programs, plastic bans and requirements for recycled content in products.

Asia-Pacific is among the growing regions in the global post-consumer recycled (PCR) plastic market covering more than 1/3rd of the market. The Asia-Pacific has noticed a rise in the use of PCR plastics due to strict laws and policies designed to reduce plastic pollution. To promote PCR plastics, governments in nations like China, India, Japan and South Korea are implementing policies that include plastic bans, extended producer responsibility (EPR) programs and requirements for goods to contain recycled content.

Dynamics

Circular Economy Initiatives and Resource Efficiency

Post-consumer recycled (PCR) plastics are becoming more and more popular due to the circular economy's emphasis on waste reduction and resource efficiency. The circular economy idea seeks to keep things in use for as long as possible by recycling, reusing and remanufacturing to decrease waste and maximize the value of resources. By keeping plastic trash out of landfills and incinerators and restoring it to the manufacturing cycle, PCR plastics are essential to this transformation.

Circular economy efforts and closed-loop systems that prioritize the utilization of recycled materials including PCR plastics are being embraced by a wide range of businesses. The concentration on resource efficiency promotes creativity and teamwork throughout the value chain to create more circular and sustainable solutions, in addition to assisting in the reduction of climate change effects.

Sustainability and Development

Artificial intelligence (AI) and robots are helping the corporate sector deal with sustainability and recycling. No additional research into this technology, but the coronavirus pandemic is to blame for this. As of right now, there isn't a proper reverse logistics robot to address the issue of old plastic bottles. To enhance the separation of recyclable or usable plastics from non-recyclable plastics in assembly lines, robotics and artificial intelligence technologies are being developed. Robots are also taking the role of human laborers in the lifting, sorting and package delivery duties.

For Instance, in 2023, Mobil, a leader in the world of innovative lubricating technologies, has introduced 50% Post-Consumer Recycled (PCR) plastic pails as part of an effort to promote environmentally friendly packaging. Incentives such as the PCR pails encourage the use of recycled plastic, which lowers plastic waste and promotes sustainable development. The company aims to assist clients in reducing waste, converting waste into value and advancing sustainability goals with its 50% PCR pails, which are the first in India for lubricating oil pails packing.

Restricted Infrastructure and Supply

The scarcity of post-consumer plastic trash for recycling and the inadequate recycling infrastructure in many areas are other obstacles. The infrastructure and collection methods for sorting and processing post-consumer plastics are still lacking in certain places, despite increased awareness of the issue and initiatives to encourage recycling.

Additionally, the lack of feedstock restricts the PCR plastic production process's scalability and impedes the market's growth. Further exacerbating supply limits are logistical issues related to the transportation and processing of recycled materials. Governments, businesses and communities must work together to enhance collection and recycling systems and make large investments in waste management infrastructure to overcome these constraints.

Concerns about Quality and Contamination

Managing contamination levels in recovered materials and upholding uniform quality standards are major challenges facing the globally post-consumer recycled (PCR) plastic business. Multiple sorting and processing steps are frequently used for PCR plastics, which may lead to variations in the material's qualities and attributes.

The use and performance of PCR plastics may also be impacted by leftover impurities from the original goods or contamination from non-recyclable components. Strict quality control procedures throughout the recycling process, together with investments in cutting-edge sorting and cleaning technology, are needed to address these contamination and quality challenges.

Segment Analysis

The global post-consumer recycled (PCR) plastic market is segmented based on service, source, polymer, processing, end-user and region.

Rising Demand for Polypropylene in the Packaging Industry

The Polypropylene segment is among the growing regions in the global post-consumer recycled (PCR) plastic market covering more than 1/3rd of the market. Growing demand for sustainable packaging solutions across a variety of sectors is driving a notable expansion in the global post-consumer recycled (PCR) polypropylene (PP) market.

For Instance, in 2023, Repsol S.A. and Signode Industrial Group LLC introduced a pre-made polypropylene (PP) strap, crafted with 30% recycled content, tailored for high-strength applications. The freshly launched Repsol Reciclex RXP33AAA PP compound incorporates 30% mechanically recycled post-consumer domestic plastic (PCR), leading to a 9% reduction in carbon footprint compared to conventional fossil-based materials. The strap boasts equivalent properties to those fashioned from virgin raw materials.

Geographical Penetration

Growing Demand for Non-Residential Building Projects in the Construction Industry in Asia-Pacific

Asia-Pacific has been a dominant force in the global Post-Consumer Recycled (PCR) Plastic Market. The post-consumer recycled (PCR) plastic market in Asia-Pacific is expanding rapidly due to a growing emphasis on environmental conservation and sustainability. The demand for PCR plastics as an environmentally beneficial substitute for virgin plastics has increased as a result of this increased awareness, particularly in sectors like construction, automotive and packaging.

The Asia-Pacific construction industry is expected to have considerable growth in the next years due to a rise in demand for non-residential building projects, such as hospitals, schools and colleges. The demand is expected to persist throughout the projected period. As a result, this will hasten business development and increase demand for personal protective equipment products, such as belts, helmets, safety vests and other items.

For Instance, in 2020, In Asia-Pacific, Dow developed and introduced a brand-new post-consumer recycled (PCR) plastic resin specifically for collation shrink film applications. With a 40 percent PCR concentration, the new resin produces films that function similarly to those created with virgin resins. The product, XUS 60921.01, is manufactured at Dow's external manufacturing facility in Nanjing, China, using recycled plastics that are collected domestically in China through Dow's key recycling partners.

In another instance, in 2021, Dow and Lucro Plastecycle, an Indian recycling company, partnered to develop and launch polyethylene film solutions using post-consumer recycled plastics in India. The collaboration supports Dow's goal of collecting, reusing or recycling 1 MMT of plastics by 2031, contributing to a circular economy in the region.

COVID-19 Impact Analysis

The post-consumer recycled (PCR) plastic business has been impacted by the COVID-19 epidemic in some ways. When several towns and recycling facilities imposed operating limitations and safety precautions to stop the virus's spread, the pandemic first caused disruptions in waste management systems and recycling operations globally.

Decreased post-consumer plastic waste availability for recycling was caused by lower collection rates and processing capacity, which had an impact on the supply of PCR plastic feedstock. Furthermore, the market for PCR plastic items has been impacted by changes in consumer behavior during the pandemic. Personal protective equipment (PPE), medical supplies and food delivery packaging are among the single-use plastic goods that are in high demand due to the increased focus on cleanliness and safety.

The market for recycled plastics has been impacted since manufacturers have been less inclined to invest in and give priority to the usage of PCR plastics as a result of the surge in demand for virgin plastic products. The pandemic has brought attention to the significance of sustainability and circular economy concepts in the plastics sector, though. Business and government pressure to emphasize sustainable practices and encourage the use of recycled materials is growing as environmental issues and plastic pollution become more widely known.

Russia-Ukraine War Impact Analysis

There have been notable effects on the globally post-consumer recycled (PCR) plastic business from the conflict between Russia and Ukraine. In the global petrochemical sector, Russia and Ukraine are both big actors. Russia is a large supplier of natural gas and crude oil, which are necessary feedstocks for the manufacturing of plastic, while Ukraine is a major producer of chemicals.

Due to supply chain disruptions caused by the conflict, there is uncertainty over the availability of raw materials needed to produce PCR plastics. The globally PCR plastic industry is currently experiencing supply shortages and price volatility as a result of this disturbance. The conflict has also affected logistics and transportation lines, making it more difficult to move completed plastic goods and recovered plastics.

Many companies depend on the region's international trade lines and the fighting has resulted in delays, rerouting and higher transportation costs. The supply chain is under stress as a result of manufacturers' inability to deliver completed goods to consumers and get recycled plastic feedstock due to logistical issues.

By Service

- Collection and Transportation

- Recycling

- Incineration

- Landfills/Disposal

By Source

- Bottles

- Non-Bottles Rigid

- Others

By Polymer

- Polyethylene Terephthalate (PET)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyurethane (PU)

- Polystyrene (PS)

- Others

By Processing

- Chemical Process

- Mechanical Process

- Biological Process

By End-User

- Packaging

- Building and Construction

- Automotive

- Furniture

- Recycled Plastics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On May 28, 2020, Dow developed and introduced a brand-new post-consumer recycled (PCR) plastic resin specifically for collation shrink film applications. With a 40 percent PCR concentration, the new resin produces films that function similarly to those created with virgin resins. The product, XUS 60921.01, is manufactured at Dow's external manufacturing facility in Nanjing, China, using recycled plastics that are collected domestically in China through Dow's key recycling partners.

- On February 11, 2021, Dow and Lucro Plastecycle, an Indian recycling company, partnered to develop and launch polyethylene film solutions using post-consumer recycled plastics in India. The collaboration supports Dow's goal of collecting, reusing or recycling 1 MMT of plastics by 2031, contributing to a circular economy in the region.

- On February 03, 2023, Mobil, a leader in the world of innovative lubricating technologies, introduced 50% Post-Consumer Recycled (PCR) plastic pails as part of an effort to promote environmentally friendly packaging. Incentives such as the PCR pails encourage the use of recycled plastic, which lowers plastic waste and promotes sustainable development. The firm aims to assist clients in reducing waste, converting waste into value and advancing sustainability goals with its 50% PCR pails, which are the first in India for lubricating oil pails packing.

Competitive Landscape

The major global players in the market include BASF SE, SABIC, Arkema, Celanese Corporation, Eastman Chemical Company, Exxon Mobil Corporation, Covestro AG, Ultra-Poly Corporation, Plastipak Holdings, Inc. and Dow.

Why Purchase the Report?

- To visualize the global post-consumer recycled (PCR) plastic market segmentation based on service, source, polymer, processing, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of post-consumer recycled (PCR) plastic market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

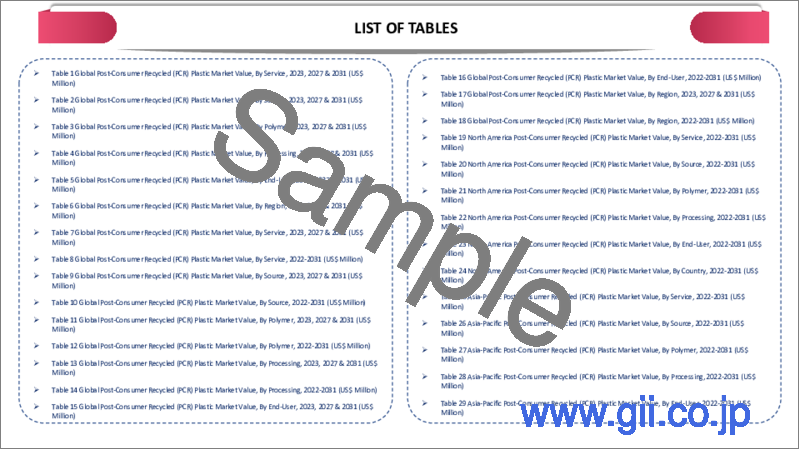

The global post-consumer recycled (PCR) plastic market report would provide approximately 78 tables, 81 figures and 207 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Service

- 3.2.Snippet by Source

- 3.3.Snippet by Polymer

- 3.4.Snippet by Processing

- 3.5.Snippet by End-User

- 3.6.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Circular Economy Initiatives and Resource Efficiency

- 4.1.1.2.Sustainability and Development

- 4.1.2.Restraints

- 4.1.2.1.Restricted Infrastructure and Supply

- 4.1.2.2.Concerns about Quality and Contamination

- 4.1.3.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID-19

- 6.1.2.Scenario During COVID-19

- 6.1.3.Scenario Post COVID-19

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Service

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 7.1.2.Market Attractiveness Index, By Service

- 7.2.Collection and Transportation*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Recycling

- 7.4.Incineration

- 7.5.Landfills/Disposal

8.By Source

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 8.1.2.Market Attractiveness Index, By Source

- 8.2.Bottles*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Non-Bottles Rigid

- 8.4.Others

9.By Polymer

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Polymer

- 9.1.2.Market Attractiveness Index, By Polymer

- 9.2.Polyethylene Terephthalate (PET)*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.High-Density Polyethylene (HDPE)

- 9.4.Low-Density Polyethylene (LDPE)

- 9.5.Polypropylene (PP)

- 9.6.Polyvinyl Chloride (PVC)

- 9.7.Polyurethane (PU)

- 9.8.Polystyrene (PS)

- 9.9.Others

10.By Processing

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing

- 10.1.2.Market Attractiveness Index, By Processing

- 10.2.Chemical Process*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Mechanical Process

- 10.4.Biological Process

11.By End-User

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2.Market Attractiveness Index, By End-User

- 11.2.Packaging*

- 11.2.1.Introduction

- 11.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3.Building and Construction

- 11.4.Automotive

- 11.5.Furniture

- 11.6.Recycled Plastics

- 11.7.Others

12.By Region

- 12.1.Introduction

- 12.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2.Market Attractiveness Index, By Region

- 12.2.North America

- 12.2.1.Introduction

- 12.2.2.Key Region-Specific Dynamics

- 12.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Polymer

- 12.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing

- 12.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1.U.S.

- 12.2.8.2.Canada

- 12.2.8.3.Mexico

- 12.3.Europe

- 12.3.1.Introduction

- 12.3.2.Key Region-Specific Dynamics

- 12.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Polymer

- 12.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing

- 12.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1.Germany

- 12.3.8.2.UK

- 12.3.8.3.France

- 12.3.8.4.Russia

- 12.3.8.5.Spain

- 12.3.8.6.Rest of Europe

- 12.4.South America

- 12.4.1.Introduction

- 12.4.2.Key Region-Specific Dynamics

- 12.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Polymer

- 12.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing

- 12.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1.Brazil

- 12.4.8.2.Argentina

- 12.4.8.3.Rest of South America

- 12.5.Asia-Pacific

- 12.5.1.Introduction

- 12.5.2.Key Region-Specific Dynamics

- 12.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Polymer

- 12.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing

- 12.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1.China

- 12.5.8.2.India

- 12.5.8.3.Japan

- 12.5.8.4.Australia

- 12.5.8.5.Rest of Asia-Pacific

- 12.6.Middle East and Africa

- 12.6.1.Introduction

- 12.6.2.Key Region-Specific Dynamics

- 12.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Service

- 12.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 12.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Polymer

- 12.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Processing

- 12.6.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13.Competitive Landscape

- 13.1.Competitive Scenario

- 13.2.Market Positioning/Share Analysis

- 13.3.Mergers and Acquisitions Analysis

14.Company Profiles

- 14.1.BASF SE*

- 14.1.1.Company Overview

- 14.1.2.Product Portfolio and Description

- 14.1.3.Financial Overview

- 14.1.4.Key Developments

- 14.2.SABIC

- 14.3.Arkema

- 14.4.Celanese Corporation

- 14.5.Eastman Chemical Company

- 14.6.Exxon Mobil Corporation

- 14.7.Covestro AG

- 14.8.Ultra-Poly Corporation

- 14.9.Plastipak Holdings, Inc.

- 14.10.Dow

LIST NOT EXHAUSTIVE

15.Appendix

- 15.1.About Us and Services

- 15.2.Contact Us