|

|

市場調査レポート

商品コード

1474057

3Dプリンティング用高機能プラスチックの世界市場:2024~2031年Global 3D Printing High Performance Plastic Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 3Dプリンティング用高機能プラスチックの世界市場:2024~2031年 |

|

出版日: 2024年05月02日

発行: DataM Intelligence

ページ情報: 英文 204 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の3Dプリンティング用高機能プラスチックの市場規模は、2023年に1億2,200万米ドルに達し、2024~2031年の予測期間中にCAGR 23.6%で成長し、2031年には6億6,450万米ドルに達すると予測されています。

3Dプリント可能な高機能ポリマーは、比類のないカスタマイズ性と設計の自由度を提供します。企業は、設計を迅速に繰り返し、プロトタイプを作成し、特定の顧客仕様に合わせて部品をカスタマイズすることで、市場投入までの時間を短縮し、製品の差別化を図ることができます。3Dプリンティングは、従来の製造プロセスよりも金型を不要にし、リードタイムを短縮できるため、企業にとって経済的に有利です。高機能プラスチック部品を、少量生産、オンデマンド、複雑な形状で、金型費用を増やすことなく製造できれば、効率と競争力が高まります。

3Dプリンティングで作られた高機能ポリマーは、ヘルスケア産業で人工関節、インプラント、医療機器、カスタマイズされたヘルスケアソリューションに使用されています。この材料の生体適合性、安定性、カスタマイズ性は医療用途に最適であり、これが市場の成長を後押ししています。従来の製造方法と比較すると、3Dプリンティングによる高機能プラスチックは、材料の廃棄量、エネルギー使用量、二酸化炭素排出量を削減することで、持続可能性の目標を達成するのに役立ちます。アディティブマニュファクチャリングの環境面での魅力は、材料のリサイクルと再利用が可能なことでさらに高まっています。

北米は、高機能プラスチックの3Dプリンティングに対する政府の承認が高まっていることから、同市場において支配的な地域となっており、予測期間中の同地域の市場成長を後押ししています。例えば、2024年4月16日、3D Systems社は、3DプリントPEEK頭蓋インプラントのFDA認可を発表しました。従来の機械加工で作られた同等のインプラントと比較すると、この方法は最大85%少ない材料で患者固有の頭蓋インプラントを作成します。さらに、このプリンターのクリーンルームベースのアーキテクチャと合理化された後処理手順により、コストを抑制しながら、病院現場で患者固有の医療機器をより迅速に製造することができます。

ダイナミクス

3Dプリンティング技術の進歩

3Dプリンティングの技術開発により、印刷効率が向上し、印刷速度が向上しました。このため、生産者は高機能プラスチック部品をより早く作成できるようになり、リードタイムを短縮し、生産レベルを向上させることができるようになりました。最新の3Dプリンティングの解像度が向上し、細部まで造形できるようになったことで、複雑で詳細な高機能プラスチック部品を優れた表面品質と精度で造形できるようになりました。このため、正確な形状と密接な公差を必要とする用途で、3Dプリンティングのメリットが発揮されます。

マルチマテリアルプリンティングを可能にするいくつかの高度な3Dプリンティング技術により、1回のプリント作業で多様な高機能ポリマーや材料の組み合わせを採用することができます。高機能プラスチックを3Dプリントすることで実現する機能や用途の幅は、この適応性によって広がります。大判3Dプリンティングの発展により、高機能ポリマーを使用して、より大きく複雑な部品が製造されるようになりました。これは、建設、自動車、航空宇宙など、大規模な部品を必要とする分野で特に役立ちます。

軽量かつ高機能な部品に対する産業の需要の高まり

航空宇宙産業では、燃費を抑えながら航空機の性能を向上させるため、軽量素材を絶えず探しています。ULTEMやポリエーテルエーテルケトンなどの高機能ポリマーは、ダクトシステムやブラケットなど、耐熱性が高く長持ちする部品に選ばれています。自動車産業が公害削減目標を達成するためには、軽量化が不可欠です。炭素繊維強化ポリマーやアクリロニトリルブタジエンスチレン誘導体は、エンジン部品や構造要素などの軽量部品の3Dプリンティングに使用される高機能プラスチックの一例です。

高機能プラスチックは、手術器具や医療機器などのヘルスケア産業で必要とされています。医療グレードのポリアミド、PEEK、チタン合金、その他の生体適合材料が3Dプリントされ、患者ごとにカスタマイズされ、最高の機械的品質と適合性を持つ手術用ガイド、インプラント、人工関節、歯科用部品が製造されています。家電メーカーは、3Dプリンティングで高機能ポリマーを採用し、ウェアラブルやドローン用の丈夫で軽量な部品を製造しています。ABSやナイロンなどの材料は、電気絶縁性、耐衝撃性、熱安定性に優れているため、推奨されています。

高機能材料の高コスト

高機能材料はコストが高いため、3Dプリント技術は新興企業や小規模企業には手が出ないです。資金調達に制限のある企業にとって、これらの消耗品、特殊な機械、後処理機器を入手するために必要な初期支出は、手の届かないものかもしれません。コストに敏感なのは、3Dプリンティングで高機能樹脂を大量に消費する自動車、航空宇宙、ヘルスケアなどの産業で一般的です。部品やコンポーネントの製造コスト全体が材料費の高騰によって影響を受け、これらの産業の利益率や競合に影響を与える可能性があります。

高機能ポリマーを大量に3Dプリントしたり、大規模な用途に使用したりする能力は、費用によって制約を受ける。高機能ポリマーを使用した3Dプリンティングの経済性がその支出を正当化できない場合、メーカーは従来の生産技術やより安価な材料を使用することを選択する可能性があります。高機能ポリマーの3Dプリンティングの価格は、丈夫な製品や家電製品のような価格に敏感な消費者カテゴリーにおける顧客の選択に影響を与える可能性があります。市場受容性を達成するには、手頃な価格と性能のバランスを取る必要があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 3Dプリンティング技術の進歩

- 軽量かつ高機能な部品に対する産業の需要の高まり

- 抑制要因

- 高機能材料の高コスト

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ポリアミド(PA)

- ポリエーテルアミド(PEI)

- ポリエーテルエーテルケトン(PEEK)

- ポリエーテルケトン(PEKK)

- 強化HPP

- その他

第8章 形態別

- フィラメント・ペレット

- パウダー

第9章 技術別

- 溶融堆積モデリング(FDM)

- 選択的レーザー焼結(SLS)

第10章 用途別

- プロトタイピング

- 金型・機能部品製造

第11章 エンドユーザー別

- 医療・ヘルスケア

- 航空宇宙・防衛

- 運輸

- 石油・ガス

- 消費財

- その他

第12章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第13章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第14章 企業プロファイル

- Arkema

- DSM

- Stratasys, Ltd

- D Systems, Inc.

- Evonik Industries AG

- Victrex plc.

- Solvay

- Oxford Performance Materials

- SABIC

- ENVISIONTEC INC.

第15章 付録

Overview

Global 3D Printing High Performance Plastic Market reached US$ 122.0 Million in 2023 and is expected to reach US$ 664.5 Million by 2031, growing with a CAGR of 23.6% during the forecast period 2024-2031.

High-performance polymers that can 3D printed provide unmatched customizability and design freedom. Businesses shorten time-to-market and improve product distinctiveness by quickly iterating designs, creating prototypes and customizing parts to particular client specifications. The capacity of 3D printing to eliminate tooling and reduce lead times over traditional manufacturing processes is financially advantageous to businesses. When high-performance plastic components may be produced in small quantities, on-demand or with intricate geometries without increasing tooling costs, efficiency and competitiveness are boosted.

High-performance polymers made by 3D printing are being used by the healthcare industry for prostheses, implants, medical equipment and customized healthcare solutions. The materials' biocompatibility, stabilizability and customizability make them perfect for medical applications, which is driving growth in the market. When compared to conventional production methods, 3D printing high-performance plastics can help accomplish sustainability goals by lowering material waste, energy usage and carbon emissions. The environmental appeal of additive manufacturing is further enhanced by its capacity for material recycling and reuse.

North America is a dominating region in the market due to the growing government approval for the 3D printing of high-performance plastic helps to boost regional market growth over the forecast period. For instance, on April 16, 2024, 3D Systems announced FDA clearance for 3D-printed PEEK cranial implants. When compared to comparable implants made by conventional machining, this method creates patient-specific cranial implants using up to 85% less material, which can result in cost savings for a costly raw material like implantable PEEK. Additionally, the printer's cleanroom-based architecture and streamlined post-processing procedures enable it to produce patient-specific medical equipment at the hospital site more quickly while maintaining cost containment.

Dynamics

Advancements in 3D Printing Technologies

Technological developments in 3D printing have resulted in increased printing efficiency and higher printing rates. Because of this, producers now create high-performance plastic components faster, cutting lead times and raising output levels all around. With the increased resolution and finer detail capabilities of modern 3D printers, it is possible to produce complicated and detailed high-performance plastic components with excellent surface quality and precision. Because of this, applications requiring exact geometries and close tolerances benefit from 3D printing.

Diverse high-performance polymers or combinations of materials can be employed in a single print job due to some advanced 3D printing technologies that enable multi-material printing. The range of functions and applications achieved by 3D printing high-performance plastics is increased by this adaptability. Larger and more intricate pieces are produced using high-performance polymers because of developments in large-format 3D printing. The is especially helpful for sectors that need large-scale components, including construction, automotive and aerospace.

Growing Industry Demand for Lightweight and High-Performance Parts

The aerospace industry continually searches for lightweight materials to increase aircraft performance while reducing fuel consumption. High-performance polymers, such as ULTEM and polyetheretherketone are the preferred choice for heat-resistant and long-lasting components, such as ducting systems and brackets. Lightweighting is crucial if the automotive industry is to satisfy pollution reduction objectives. Carbon fiber-reinforced polymers and acrylonitrile butadiene styrene derivatives are examples of high-performance plastics used in the 3D printing of lightweight components, such as engine parts and structural elements.

High-performance plastics are needed by the healthcare industry for surgical equipment and medical devices. Medical-grade polyamides, PEEK, titanium alloys and other biocompatible materials are 3D printed to manufacture surgical guides, implants, prostheses and dental components that are customized for each patient and have the best mechanical qualities and compatibility. Manufacturers of consumer electronics employ high-performance polymers in 3D printing to produce strong and lightweight components for wearables and drones. Materials including ABS and nylon are recommended because of their better electrical insulating properties, impact resistance and thermal stability.

High Cost of High-Performance Materials

The costly nature of high-performance materials makes 3D printing technology unaffordable for startups or smaller companies. For companies with limited financing, the initial outlay necessary to acquire these supplies, specialized machinery and post-processing instruments may be unaffordable. Cost-sensitivity is common in industries including automotive, aerospace and healthcare, which are big consumers of high-performance resins in 3D printing. The whole cost of manufacturing parts and components can be impacted by the high cost of materials, which could affect these industries' profit margins and competitiveness.

The capacity to 3D print high-performance polymers in huge volumes or for large-scale applications is constrained by expenses. If the economics of 3D printing using high-performance polymers do not justify the expenditure, manufacturers may choose to use conventional production techniques or less expensive materials. The price of 3D printing high-performance polymers might affect customer choices in price-sensitive consumer categories like strong products or consumer electronics. Achieving market acceptability requires striking a balance between affordability and performance.

Segment Analysis

The global 3D printing high performance plastic market is segmented based on type, form, technology, application, end-user and region.

Growing Industrial Adoption of Polyamide (PA) 3D Printing High Performance Plastic

Based on the type, the 3D printing high performance plastic market is segmented into Polyamide (PA), Polyetheramide (PEI), Polyetheretherketone (PEEK), Polyetherketoneketone (PEKK), Reinforced HPPs and others.

Due to its flexibility and adaptability, polyamide is used in a variety of 3D printing applications. The process may offer components with different strengths, toughness and flexibilities according to the particular needs of the final application's components. Due to these characteristics, it is used to create functional prototypes, tooling parts and final products which have to be structurally sound and long-lasting. Because polyamide is resistant to a wide range of substances, including oils, solvents and chemicals, it is used in situations where exposure to abrasive conditions is a problem. The components made with polyamide in 3D printing have greater lifetime and durability because of this chemical resistance.

Growing product launches of Polyamide powder in the market help to boost segment growth over the forecast period. For instance, on October 24, 2023, Evonik launched the world's first PA12 powder for 3D printing based on bio-circular raw material. It is 100% of the substitution of fossil feedstock with bio-circular raw material from waste cooking oil. It offers 74% less CO2 emissions compared to its castor oil-based polyamides.

Geographical Penetration

North America is Dominating the 3D Printing High-Performance Plastic Market

North America has an extremely advanced technological infrastructure. The comprises cutting-edge research centers and state-of-the-art 3D printing facilities. The area is a center for 3D printing technology, polymer chemistry and materials science research and innovation. To create creative, high-performance plastic materials specifically suited for 3D printing applications, leading educational institutions, research facilities and business partners work together to boost market share and competitiveness.

3D printing is one of the additive manufacturing technologies in North America. 3D printing has been extensively utilized by industries like consumer products, automotive and healthcare to facilitate the quick fabrication of high-performance plastic components, as well as customized production and prototyping. North America is home to various significant companies in the globally high-performance plastic 3D printing industry. The businesses significantly contribute to the power of the region with their vast resources, experience and market reach. Additionally, North American companies often lead in innovation and product development, driving market trends and standards.

Competitive Landscape

The major global players in the market include Arkema, DSM, Stratasys, Ltd, 3D Systems, Inc., Evonik Industries AG, Victrex plc., Solvay, Oxford Performance Materials, SABIC and ENVISIONTEC INC.

COVID-19 Impact Analysis

Disruptions to global supply networks were among the pandemic's initial effects. Travel restrictions and reduced production in key industrial locations have an impact on the availability of raw materials required for high-performance polymer 3D printing. The gave rise to supply shortages and price swings, which impacted market stability. The outbreak altered the dynamics of customer demand for high-performance, 3D-printable polymers. Demand declined in other industries, particularly in the early phases of the pandemic, although increased demand was observed in the aerospace and healthcare sectors because of applications such as medical equipment and prototypes.

The demand for 3D-printed, high-performance polymers in the healthcare sector surged dramatically during the epidemic. The was motivated by a demand for components for diagnostic instruments, personal protective equipment and medical equipment. High-performance polymers, such as polyethylene terephthalate glycol, were extensively used in these applications. The outbreak sparked technological advancements in the business and increased the application of 3D printing in several fields. Businesses and academic institutes focused on developing new materials, improving printing methods and addressing supply chain flaws. The improved the qualities and applications of high-performance polymers and led to advances in 3D printing.

Russia-Ukraine War Impact Analysis

Due to commercial delays, border restrictions and logistical difficulties, the war has affected supply chains. Major suppliers of raw materials for high-performance plastics like polyamide and polyethylene consist of Russia and Ukraine. The globally market is experiencing shortages and price volatility as a result of this change. The price of high-performance polymers for 3D printing has fluctuatedbecause of the unpredictable and volatile nature of the conflict. The cost of producing components and materials for 3D printing has increased due to the rising price of raw materials such as polyethylene.

The geopolitical tensions between Ukraine and Russia have rendered supply chain stability a problem. Businesses could reconsider their procurement strategies and diversify their suppliers to lower geopolitical risk, which might alter market dynamics. Supply chain interruptions and increased raw material costs have affected production capacity and output in the market for 3D-printed high-performance plastics. The has therefore affected end-user cost, lead times and product availability, which have short-term negative effects on demand.

By Type

- Polyamide (PA)

- Polyetheramide (PEI)

- Polyetheretherketone (PEEK)

- Polyetherketoneketone (PEKK)

- Reinforced HPPs

- Others

By Form

- Filament and Pellet

- Powder

By Technology

- Fused Deposition Modelling (FDM)

- Selective Laser Sintering (SLS)

By Application

- Prototyping

- Tooling and Functional Part Manufacturing

By End-User

- Medical and Healthcare

- Aerospace and Defense

- Transportation

- Oil and Gas

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On November 21, 2023, Stratasys launched 3D Printing Materials including Somos WeatherX 100, as well as the development of its Kimya PC-FR and FDM HIPS-validated materials for the F900 for Manufacturing Grade Prototyping in the market. More production applications and an increased expansion of material alternatives accessible in the market are made possible by the advent of these new materials.

- On May 04, 2021, Evonik launched implant-grade PEEK filament for medical applications in 3D printing. The PEEK filament, which is sold under the brand name VESTAKEEP i4 3DF, is an implant-grade material that is derived from Evonik's very viscous, high-performance VESTAKEEP i4 G polymer.

- On November 16, 2022, Hexagon and Stratasys launched 3D-printed PEKK's light-weighting potential for aerospace engineers with simulation. Customers of Stratasys get unique insights from these thoroughly verified simulations, enabling them to launch more sustainable aircraft and spacecraft and lighter components more quickly.

Why Purchase the Report?

- To visualize the global 3D printing high performance plastic market segmentation based on type, form, technology, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of 3D printing high performance plastic market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global 3D printing high performance plastic market report would provide approximately 78 tables, 75 figures and 204 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

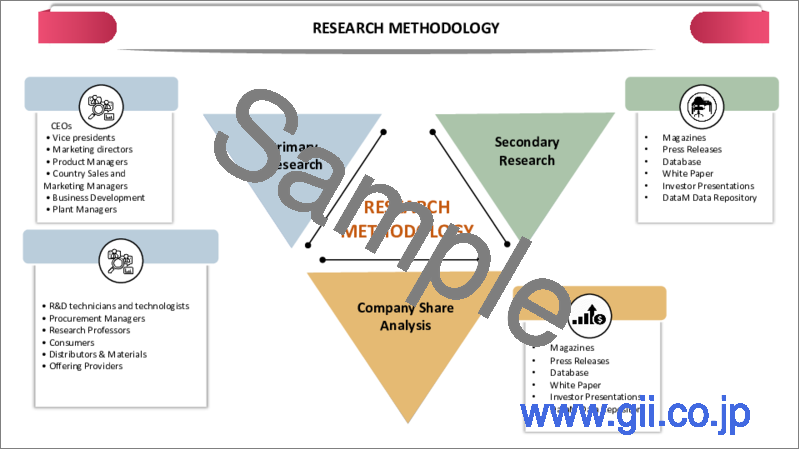

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Type

- 3.2.Snippet by Form

- 3.3.Snippet by Technology

- 3.4.Snippet by Application

- 3.5.Snippet by End-User

- 3.6.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Advancements in 3D Printing Technologies

- 4.1.1.2.Growing Industry Demand for Lightweight and High-Performance Parts

- 4.1.2.Restraints

- 4.1.2.1.High Cost of High-Performance Materials

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID-19

- 6.1.2.Scenario During COVID-19

- 6.1.3.Scenario Post COVID-19

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Type

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2.Market Attractiveness Index, By Type

- 7.2.Polyamide (PA)*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Polyetheramide (PEI)

- 7.4.Polyetheretherketone (PEEK)

- 7.5.Polyetherketoneketone (PEKK)

- 7.6.Reinforced HPPs

- 7.7.Others

8.By Form

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2.Market Attractiveness Index, By Form

- 8.2.Filament and Pellet*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Powder

9.By Technology

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 9.1.2.Market Attractiveness Index, By Technology

- 9.2.Fused Deposition Modelling (FDM)*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Selective Laser Sintering (SLS)

10.By Application

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2.Market Attractiveness Index, By Application

- 10.2.Prototyping*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Tooling and Functional Part Manufacturing

11.By End-User

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.1.2.Market Attractiveness Index, By End-User

- 11.2.Medical and Healthcare*

- 11.2.1.Introduction

- 11.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3.Aerospace and Defense

- 11.4.Transportation

- 11.5.Oil and Gas

- 11.6.Consumer Goods

- 11.7.Others

12.By Region

- 12.1.Introduction

- 12.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 12.1.2.Market Attractiveness Index, By Region

- 12.2.North America

- 12.2.1.Introduction

- 12.2.2.Key Region-Specific Dynamics

- 12.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.2.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.2.8.1.U.S.

- 12.2.8.2.Canada

- 12.2.8.3.Mexico

- 12.3.Europe

- 12.3.1.Introduction

- 12.3.2.Key Region-Specific Dynamics

- 12.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.3.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.3.8.1.Germany

- 12.3.8.2.UK

- 12.3.8.3.France

- 12.3.8.4.Italy

- 12.3.8.5.Spain

- 12.3.8.6.Rest of Europe

- 12.4.South America

- 12.4.1.Introduction

- 12.4.2.Key Region-Specific Dynamics

- 12.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.4.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.4.8.1.Brazil

- 12.4.8.2.Argentina

- 12.4.8.3.Rest of South America

- 12.5.Asia-Pacific

- 12.5.1.Introduction

- 12.5.2.Key Region-Specific Dynamics

- 12.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 12.5.8.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 12.5.8.1.China

- 12.5.8.2.India

- 12.5.8.3.Japan

- 12.5.8.4.Australia

- 12.5.8.5.Rest of Asia-Pacific

- 12.6.Middle East and Africa

- 12.6.1.Introduction

- 12.6.2.Key Region-Specific Dynamics

- 12.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 12.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 12.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 12.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 12.6.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

13.Competitive Landscape

- 13.1.Competitive Scenario

- 13.2.Market Positioning/Share Analysis

- 13.3.Mergers and Acquisitions Analysis

14.Company Profiles

- 14.1.Arkema*

- 14.1.1.Company Overview

- 14.1.2.Product Portfolio and Description

- 14.1.3.Financial Overview

- 14.1.4.Key Developments

- 14.2.DSM

- 14.3.Stratasys, Ltd

- 14.4.3D Systems, Inc.

- 14.5.Evonik Industries AG

- 14.6.Victrex plc.

- 14.7.Solvay

- 14.8.Oxford Performance Materials

- 14.9.SABIC

- 14.10.ENVISIONTEC INC.

LIST NOT EXHAUSTIVE

15.Appendix

- 15.1.About Us and Services

- 15.2.Contact Us