|

|

市場調査レポート

商品コード

1474049

航空宇宙・防衛材料の世界市場:2024~2031年Global Aerospace And Defense Materials Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空宇宙・防衛材料の世界市場:2024~2031年 |

|

出版日: 2024年05月02日

発行: DataM Intelligence

ページ情報: 英文 197 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

世界の航空宇宙・防衛材料の市場規模は、2023年に438億米ドルに達し、2024~2031年の予測期間中にCAGR 8.0%で成長し、2031年には811億米ドルに達すると予測されています。

世界の近代化イニシアティブと防衛予算は、航空宇宙・防衛製品市場に大きな影響を与えています。各国政府は、最先端の無人航空機(UAV)、ミサイルシステム、軍用機の開発に投資しています。その結果、弾道保護、ステルス性、強度を向上させた材料が求められます。

この産業の成長は、特に新興諸国における航空旅行需要の高まりが主な要因となっています。中産階級が増加し、人々の可処分予算が世界的に増加するにつれて、航空旅行の必要性が高まっています。燃料効率が高く、軽量で環境に優しい航空機へのニーズが高まっているため、民間航空企業はこの動向を受けて航空機の発注を増やしています。

北米は、世界の航空宇宙・防衛材料市場の1/3以上を占める成長地域のひとつです。航空宇宙・防衛材料の研究開発は北米に集中しています。この地域には、革新的な材料や技術を生み出すためにビジネスパートナーと緊密に協力する研究施設、技術拠点、大学の盛んなネットワークがあります。

ダイナミクス

技術革新と材料革新における開発の増加

世界の航空宇宙・防衛材料市場は、材料革新と技術開発の結果として成長しています。材料科学、ナノテクノロジー、積層造形技術が急速に進歩した結果、品質が向上した新材料が絶えず市場に登場しています。例えば、炭素繊維強化ポリマー(CFRP)やその他の高強度軽量複合材料は、強度重量比や耐腐食性が改善され、複合材料の改良によって可能となりました。

例えば、2023年、Hindustan Aeronautics LimitedとSafran Helicopter Enginesは、新たな合弁事業の拠点としてインドのバンガロールを選びました。この試みの主な目標は、13トンのインド製マルチロールヘリコプターと、それに対応する海軍の甲板搭載型マルチロールヘリコプターのために、可能な限り最高の推進システムを開発することです。同社はヘリコプター用エンジンの設計、開発、生産、販売、サポートに全面的に取り組みます。インド初の内燃エンジンの設計・製造はこの合弁企業から行われます。

政府支出の増加と将来の宇宙部門プロジェクト

宇宙産業では、宇宙船の重量を軽減する単殻成形構造のため、航空宇宙・防衛材料が多く使用されています。宇宙技術に対する政府支出は増加しており、航空宇宙・防衛材料市場の拡大をさらに後押ししています。2020年、インドの宇宙部門予算は9,500ルピー(12億8,000万米ドル)でしたが、2021年には46.8%増の1万3,949ルピー(19億米ドル)に増加しました。

将来の宇宙ミッションによって宇宙船の需要が高まることが予想され、航空宇宙・防衛材料事業の拡大がさらに促進されます。例えば、欧州宇宙機関(ESA)は、ExoMars/TGO、Cluster II、Mar Expressなどを今後の宇宙構想の一部として挙げています。

また、米航空宇宙局(NASA)は、同局の今後の宇宙ミッションとして、Moon 2024、Landsat 9、CYGNSSなどを挙げており、衛星や宇宙船の需要を押し上げ、航空宇宙・防衛材料分野の成長を加速させるとしています。その結果、政府投資の増加や今後の宇宙開発構想が航空宇宙・材料産業の拡大に拍車をかけると思われます。

厳しい規制基準とサプライチェーンの混乱

サプライチェーンが中断されやすいことは、防衛・航空宇宙材料の世界市場が直面する大きな障害です。自然災害、貿易紛争、地政学的紛争、世界的流行病などの発生により、完成品や原材料の移動が妨げられる可能性があります。それは生産の遅れやコスト増の原因となります。

さらに、航空宇宙・防衛材料事業を規制する厳格な規制は、これらの材料の世界市場にとって大きな障害となっています。世界各地の航空当局や防衛機関は、航空機や防衛機器が満たさなければならない厳格な安全性、性能、環境に関する規則を強制しています。新材料や新技術の開発・導入は、徹底的な試験・認証・文書化が頻繁に要求されるこれらの基準によって、より困難で高価なものとなっています。

最新材料を古い航空機に適応させることの難しさ

航空産業は、最新の材料が古い航空機に適合しないために、多くの障害や制限に直面する可能性があります。この問題の主な原因は、航空宇宙材料と技術の急速な発展であり、その結果、古い航空機と新しい航空機の間に大きな年齢差が生じる可能性があります。最新の材料は、古い航空機の設計や製造に使用された材料や製造技術と互換性がない場合があります。

最先端の金属や複合材、材料を活用するために必要な設計要素や構造補強を備えていない可能性もあります。航空機の重量とバランスの特性は、新しい材料を加えることで変えることができます。古い航空機の設計では、指定された重量配分とバランスポイントが使用されていました。離着陸のたびに起こる急激な温度変化について考えてみる必要があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術革新と材料革新の進展

- 政府支出の増加と将来の宇宙分野プロジェクト

- 抑制要因

- 厳しい規制基準とサプライチェーンの混乱

- 最新の材料を古い航空機に適応させることの難しさ

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 材料別

- アルミニウム合金

- チタン合金

- ニッケル基合金

- スチール合金

- スーパーアロイ

- 複合材料

- 耐熱合金

- プラスチックポリマー

- その他

第8章 航空機タイプ別

- 民間航空機

- 軍用機

- ビジネス・一般航空機

- 宇宙航空機

- ヘリコプター

- その他

第9章 製品形態別

- シート・プレート

- 棒・ロッド

- 管・パイプ

- 箔

- フィルム

- プリプレグ

- その他

第10章 用途別

- 機体

- 内装

- 推進

- 航空エンジン

- 海軍システム

- 兵器

- 航法・センサー

- 人工衛星

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他の欧州

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Toray Industries Inc.

- Solvay S.A.

- Hexcel Corporation

- Teijin Carbon Europe GmbH

- ATI

- Arconic

- Constellium

- Thyssenkrupp Aerospace

- Mitsubishi Chemical Group

- DuPont de Nemours, Inc.

第14章 付録

Overview

Global Aerospace And Defense Materials Market reached US$ 43.8 billion in 2023 and is expected to reach US$ 81.1 billion by 2031, growing with a CAGR of 8.0% during the forecast period 2024-2031.

Global modernization initiatives and defense budgets have a major impact on the market for aerospace and defense products. Governments make investments in the creation of cutting-edge unmanned aerial vehicles (UAVs), missile systems, and military aircraft. As a consequence, they demand materials with improved ballistic protection, stealth, and strength.

Growth in the industry is mostly driven by the rising demand for air travel, particularly in emerging nations. The need for air travel is increasing as the middle class grows and people's disposable budgets increase globally. Due to the growing need for more fuel-efficient, lightweight and environmentally friendly aircraft, commercial airlines are placing more orders for aircraft as a result of this trend.

North America is among the growing regions in the global aerospace and defense materials market covering more than 1/3rd of the market. Aerospace and defense material research and development are concentrated in North America. The area is home to a thriving network of research facilities, technological hubs and universities that work closely with business partners to create innovative materials and technologies.

Dynamics

Increasing Increasing Developments in Technology and Material Innovation

The global aerospace and defense materials market is growing as a result of material innovation and technological developments. New materials with improved qualities are constantly coming to market as a result of the quick advancements in material science, nanotechnology and additive manufacturing. For example, carbon fiber reinforced polymers (CFRP) and other high-strength, lightweight composites with improved strength-to-weight ratios and corrosion resistance have been made possible by improvements in composite materials.

For Instance, in 2023, Hindustan Aeronautics Limited and Safran Helicopter Engines selected Bangalore, India, as the location of their new joint venture business. The primary goal of this endeavor is to create the best possible propulsion system for the 13-ton Indian Multi-Role Helicopter and its naval counterpart, the Deck-Based Multi-Role Helicopter. The company will be fully committed to the design, development, production, sales, and support of helicopter engines. India's first internal engine design and manufacture will occur from this joint venture.

Government Expenditure Increase and Future Space Sector Projects

The space industry uses a lot of aerospace and defense materials because of their single-shell molded construction, which lowers the spacecraft's weight. Government expenditure on space technology is rising, which is propelling the expansion of the aerospace and military materials market even more. In 2020, India's budget for the space department was Rs. 9,500 crores (US$ 1.28 billion); by 2021, however, it had increased to Rs. 13,949 crores (US$ 1.9 billion), a 46.8% increase.

Future space missions are expected to enhance spacecraft demand, which will further drive the expansion of the aerospace and military materials business. The European Space Agency (ESA), for example, lists ExoMars/TGO, Cluster II, Mar Express and other programs as part of its upcoming space initiatives.

The National Aeronautics and Space Administration (NASA) also states that the agency's upcoming space missions, which include Moon 2024, Landsat 9, CYGNSS and others, are expected to boost demand for satellites and spacecraft and thus accelerate the growth of the aerospace and defense materials sector. Consequently, rising government investment as well as upcoming space initiatives will fuel the expansion of the aerospace and materials industries.

Strict Regulation Standards and Disruptions to the Supply Chain

The susceptibility of supply chains to interruptions is a major obstacle confronting the globally market for defense and aerospace materials. The movement of components completed goods and raw materials can be disrupted by occurrences like natural catastrophes, trade disputes, geopolitical conflicts and globally pandemics. It can cause production delays and cost growth.

Additionally, the strict regulations regulating the aerospace and defense materials business are a major impediment to the globally market for these materials. globally aviation authorities and defense agencies enforce strict safety, performance and environmental rules that must be met by aircraft and defense equipment. The development and implementation of new materials and technologies are made more difficult and expensive by these standards, which frequently call for thorough testing, certification and documentation.

Difficulties in Adapting Modern Materials to Older Aircraft

The aviation industry may face many obstacles and limitations due to the incompatibility of modern materials with older aircraft. The main cause of this problem is the quick development of aerospace materials and technology, which can result in a large age difference between older and newer aircraft. Modern materials may not be compatible with the materials and manufacturing techniques used in the design and construction of older aircraft.

It might not have the design elements and structural reinforcement demanded to make advantage of cutting-edge metals, composites or materials. The weight and balance characteristics of an aircraft can be changed by adding new materials. There were specified weight distributions and balancing points used in the design of older airplanes. Think about the drastic temperature changes that occur during every takeoff and landing, which can range from 20°C to -40°C.

Segment Analysis

The global aerospace and defense materials market is segmented based on material, aircraft type, product form, application and region.

Rising Demand for Commercial Aircraft in the Commercial Aviation Industry

The commercial aircraft segment is among the growing regions in the global aerospace and defense materials market covering more than 1/3rd of the market. The global market for aerospace and military materials is significantly impacted by the expansion of the commercial aviation industry. Airlines are growing their fleets and modernizing their current aircraft to fulfill capacity demands and boost operational efficiency in response to the growing demand for air travel by passengers.

Additionally, the growth increases demand for modern materials with qualities like durability, lightweighting and fuel economy, which lower operating costs and have a positive environmental impact. The aerospace industry is seeing expansion due to the constant innovation of manufacturers who are creating materials like lightweight metals, titanium alloys and sophisticated composites that can resist the rigors of flight and still fulfill strict safety and performance requirements.

Geographical Penetration

Growing Government Initiations and Expansion of the Aerospace and Defense Industry in North America

North America has been a dominant force in the global aerospace and defense materials market. North American investment in aerospace and defense materials is being driven by government initiatives and defense modernization plans. To finance research and development initiatives targeted at improving military capabilities and technical dominance, United States, in particular, devotes significant financial resources to defense spending.

North America also enjoys the advantages of a developed aerospace and defense industrial sector, complete with well-established supply networks and a trained labor force. The timely supply of systems and components to OEMs and defense contractors is supported by this infrastructure, which facilitates the effective manufacture and distribution of aerospace and defense products.

The demand for satellites and spacecraft will rise as a result of upcoming space projects in the area, spurring the expansion of the aerospace and military materials industry. The National Aeronautics and Space Administration (NASA), for example, states that the region's prospective space programs include the Near-Earth Object Surveyor (2026), Europa Clipper (2024), Sun Radio Interferometer Space Equipment (2023) and others.

Additionally, industry agreements and contracts are driving the production of both commercial and defense aircraft. For example, the Boeing Company was granted a modification (P00215) to contract for licenses, subscriptions and KC-46A Air Force Production Lot 8 aircraft in August 2022. The also includes fifteen more KC-46A aircraft. 100% of US$ 886,242,124 in foreign military sales are attributed to Israel under this contract.

COVID-19 Impact Analysis

The global market for aerospace and defense materials has been significantly influenced by the COVID-19 pandemic, which has created possibilities as well as problems for industry participants. The commercial aviation industry had a major slowdown due to widespread travel restrictions and lower demand for air travel, which resulted in fewer orders for aircraft and a concomitant reduction in the market for aerospace materials.

The producers of metals, composites and other materials required in the production of airplanes were impacted by this slump as it spread across the supply chain. Suppliers of aerospace and defense materials also encountered increased difficulties as a result of manufacturing and logistical bottlenecks brought on by lockdowns and border closures.

The pandemic also brought to light the significance of military capabilities and crisis resilience, prompting some countries to raise defense budgets to strengthen national security. Some aerospace and defense material producers have benefited from this increase in defense spending, which has partially offset losses in the commercial aircraft industry.

Additionally, the pandemic sped up aircraft design trends toward efficiency and lightweighting, increasing demand for cutting-edge materials that provide improved performance and fuel economy. Due to this, advances in materials science have accelerated, with an emphasis on creating stronger, lighter and more sustainable substances for use in aerospace.

Russia-Ukraine War Impact Analysis

The war between Russia and Ukraine has affected demand dynamics and supply chains in the global aerospace and military materials sector. Due to Ukraine's significant production of high-grade titanium, a crucial component used in the manufacture of aircraft, disturbances in the area have raised worries about possible shortages and price instability. Due to this, aerospace industries all globally are now reevaluating their supply chain plans and looking for alternate sources for titanium and other components.

Furthermore, the strain that geopolitical tensions have placed on budgets for defense across the board has caused swings in the market for defense-related supplies. In response to security concerns, some countries may boost defense capability investments, while others may place a higher priority on diplomatic solutions, which might ultimately result in a short-term decline in the market for defense supplies.

Additionally, production scheduling and inventory management for aerospace and defense firms have been impacted by the increased complexity of planning and procurement procedures brought about by these uncertainties. The war has also highlighted the significance of resilience and diversity in aerospace and defense material supply networks.

By Material

- Aluminum Alloys

- Titanium Alloys

- Nickel-based Alloys

- Steel Alloys

- Super Alloys

- Composites

- Heat-Resistant Alloys

- Plastics And Polymers

- Others

By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- Business and General Aviation

- Spacecrafts

- Helicopters

- Others

By Product Form

- Sheets & Plates

- Bars & Rods

- Tubes & Pipes

- Foils

- Films

- Prepregs

- Others

By Application

- Airframe

- Cabin Interior

- Propulsion

- Aero Engine

- Naval System

- Weapons

- Navigation and Sensors

- Satellites

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On July 14, 2023, Hindustan Aeronautics Limited and Safran Helicopter Engines selected Bangalore, India, as the location of their new joint venture business. The primary goal of this endeavor is to create the best possible propulsion system for the 13-ton Indian Multi-Role Helicopter and its naval counterpart, the Deck-Based Multi-Role Helicopter. The company will be fully committed to the design, development, production, sales, and support of helicopter engines. India's first internal engine design and manufacture will occur from this joint venture.

- On April 14, 2020, Novelis Inc. acquired Aleris Corporation, which had 13 operations in North America, Europe, and Asia. Novelis' product portfolio now includes aircraft, thanks to the purchase of Aleris, a worldwide provider of rolled aluminum products. By diversifying, Novelis was better able to fulfill the rising demand for aluminum from customers and strengthen its strategic position in Asia.

Competitive Landscape

The major global players in the market include Toray Industries Inc., Solvay S.A., Hexcel Corporation, Teijin Carbon Europe GmbH, ATI, Arconic, Constellium, Thyssenkrupp Aerospace, Mitsubishi Chemical Group and DuPont de Nemours, Inc.

Why Purchase the Report?

- To visualize the global aerospace and defense materials market segmentation based on material, aircraft type, product form, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of aerospace and defense materials market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

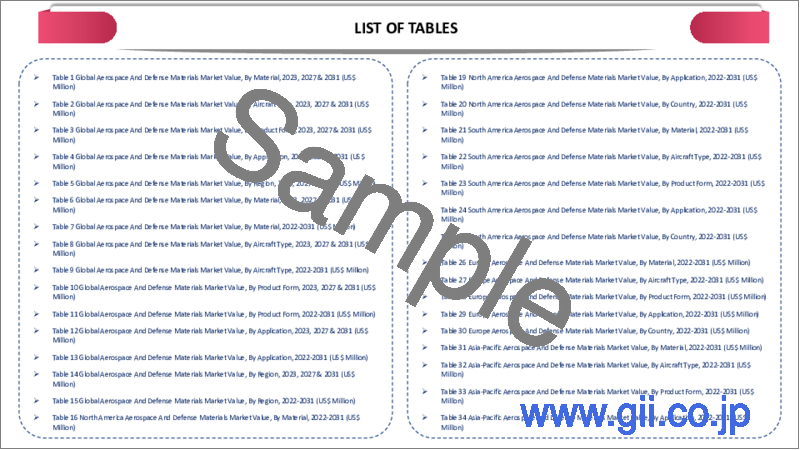

The global aerospace and defense materials market report would provide approximately 70 tables, 81 figures and 197 Pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Material

- 3.2.Snippet by Aircraft Type

- 3.3.Snippet by Product Form

- 3.4.Snippet by Application

- 3.5.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Increasing Developments in Technology and Material Innovation

- 4.1.1.2.Government Expenditure Increase and Future Space Sector Projects

- 4.1.2.Restraints

- 4.1.2.1.Strict Regulation Standards and Disruptions to the Supply Chain

- 4.1.2.2.Difficulties in Adapting Modern Materials to Older Aircraft

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Material

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 7.1.2.Market Attractiveness Index, By Material

- 7.2.Aluminum Alloys*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Titanium Alloys

- 7.4.Nickel-based Alloys

- 7.5.Steel Alloys

- 7.6.Super Alloys

- 7.7.Composites

- 7.8.Heat-Resistant Alloys

- 7.9.Plastics And Polymers

- 7.10.Others

8.By Aircraft Type

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Aircraft Type

- 8.1.2.Market Attractiveness Index, By Aircraft Type

- 8.2.Commercial Aircraft*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Military Aircraft

- 8.4.Business and General Aviation

- 8.5.Spacecrafts

- 8.6.Helicopters

- 8.7.Others

9.By Product Form

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Form

- 9.1.2.Market Attractiveness Index, By Product Form

- 9.2.Sheets & Plates*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Bars & Rods

- 9.4.Tubes & Pipes

- 9.5.Foils

- 9.6.Films

- 9.7.Prepregs

- 9.8.Others

10.By Application

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2.Market Attractiveness Index, By Application

- 10.2.Airframe*

- 10.2.1.Introduction

- 10.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3.Cabin Interior

- 10.4.Propulsion

- 10.5.Aero Engine

- 10.6.Naval System

- 10.7.Weapons

- 10.8.Navigation and Sensors

- 10.9.Satellites

- 10.10.Others

11.By Region

- 11.1.Introduction

- 11.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2.Market Attractiveness Index, By Region

- 11.2.North America

- 11.2.1.Introduction

- 11.2.2.Key Region-Specific Dynamics

- 11.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Aircraft Type

- 11.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Form

- 11.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1.U.S.

- 11.2.7.2.Canada

- 11.2.7.3.Mexico

- 11.3.Europe

- 11.3.1.Introduction

- 11.3.2.Key Region-Specific Dynamics

- 11.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Aircraft Type

- 11.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Form

- 11.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1.Germany

- 11.3.7.2.UK

- 11.3.7.3.France

- 11.3.7.4.Russia

- 11.3.7.5.Spain

- 11.3.7.6.Rest of Europe

- 11.4.South America

- 11.4.1.Introduction

- 11.4.2.Key Region-Specific Dynamics

- 11.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Aircraft Type

- 11.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Form

- 11.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1.Brazil

- 11.4.7.2.Argentina

- 11.4.7.3.Rest of South America

- 11.5.Asia-Pacific

- 11.5.1.Introduction

- 11.5.2.Key Region-Specific Dynamics

- 11.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Aircraft Type

- 11.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Form

- 11.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1.China

- 11.5.7.2.India

- 11.5.7.3.Japan

- 11.5.7.4.Australia

- 11.5.7.5.Rest of Asia-Pacific

- 11.6.Middle East and Africa

- 11.6.1.Introduction

- 11.6.2.Key Region-Specific Dynamics

- 11.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Material

- 11.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Aircraft Type

- 11.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Product Form

- 11.6.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12.Competitive Landscape

- 12.1.Competitive Scenario

- 12.2.Market Positioning/Share Analysis

- 12.3.Mergers and Acquisitions Analysis

13.Company Profiles

- 13.1.Toray Industries Inc.*

- 13.1.1.Company Overview

- 13.1.2.Product Portfolio and Description

- 13.1.3.Financial Overview

- 13.1.4.Key Developments

- 13.2.Solvay S.A.

- 13.3.Hexcel Corporation

- 13.4.Teijin Carbon Europe GmbH

- 13.5.ATI

- 13.6.Arconic

- 13.7.Constellium

- 13.8.Thyssenkrupp Aerospace

- 13.9.Mitsubishi Chemical Group

- 13.10.DuPont de Nemours, Inc.

LIST NOT EXHAUSTIVE

14.Appendix

- 14.1.About Us and Services

- 14.2.Contact Us