|

|

市場調査レポート

商品コード

1459326

鉄鉱石の世界市場-2024-2031年Global Iron Ore Market - 2024-2031 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 鉄鉱石の世界市場-2024-2031年 |

|

出版日: 2024年04月03日

発行: DataM Intelligence

ページ情報: 英文 202 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の鉄鉱石市場は2023年に3,457億米ドルに達し、2031年には4,245億米ドルに達すると予測され、予測期間2024-2031年のCAGRは2.6%で成長します。

建築と採掘活動の増加は、鉄鋼の世界の需要増加をもたらしました。したがって、採掘活動の増加は、予測期間中に世界の鉄鉱石市場の成長を促進する重要な要素です。世界の鉄鋼会社の台頭は、世界の鉄鉱石産業に有利な需要を生み出しています。

例えば、Arcelormittal Steel Indiaは、Essar Groupからのインフラ資産の買収案から生まれるシナジー効果により、年間2億5,000万~3億米ドルの利益を見込んでいます。さらに、Essar Groupは、世界の鉄鋼メーカーのジョイントベンチャーとの間で、正味24億米ドルに相当する港湾・電力資産を買収することで合意したと発表しました。製造・生産ユニットや採掘活動に関連するすべての拡張事業は、世界の鉄鉱石市場に大きな利益成長の可能性を提供しています。

2023年には、欧州は世界の鉄鉱石市場の1/4以上を保持すると予想されています。英国やドイツのような欧州諸国は、市場のかなりの部分を供給しています。この地域の自動車産業からの鉄鋼需要の増加は、鉄鋼市場の需要を後押しする可能性が高いです。ロシアは、予測期間中に欧州の鉄鉱石市場で最も高い割合を保持すると予測されています。

ダイナミクス

新規プロジェクトへの投資拡大

新規鉄鉱石プロジェクトへの投資は、新規鉱山の創設、既存鉱山の拡張、洗練された採掘方法の採用につながります。これにより生産能力が向上し、より大量の鉄鉱石を採掘して市場に送り出すことが可能になります。その結果、投資の増加は、特に鉄鋼業界における鉄鉱石の需要増に対応するのに役立ちます。

採掘企業は、中国の鉄鋼セクターと世界のインフラの成長に後押しされた鉄鉱石に対する世界の需要増に積極的に対応しようとしています。中国鉄鋼鉱業企業協会の主任技師であるLei Pingxi氏によると、鉄鉱石産業は毎年2%程度発展し、来年にはおよそ4,500万トンの鉄鉱石供給が増加するといいます。

自動車分野での使用量増加

自動車部門は、車体、ローリー、その他の車両に必要な鋼材を製造するため、鉄鉱石への依存度を高めています。中国やインドなどの経済拡大が鉄鉱石需要を押し上げ、燃費が良く環境に優しい自動車へのニーズも高まっています。その結果、鉄鉱石の価格は近年上昇しています。世界の経済成長と自動車需要の増加に伴い、この動向は今後も続くと予測されます。

中国は、年間販売台数、生産台数ともに世界最大の自動車市場であり続け、現地生産台数は2025年までに3,500万台を超えると予測されています。中国汽車工業協会の数字によると、2022年の自動車販売台数は2,690万台を超え、2021年から3.46%増加しました。インドの2022年の年間販売台数は380万台で、2021年の370万台から25%以上増加しました。2022年、インドの乗用車部門はいくつかの記録を更新しました。

環境問題への懸念と需要の変動

炭素排出量の削減と気候変動防止を目的とした厳しい環境法が、鉄鉱石市場に影響を与える可能性があります。鉄鋼メーカーは、よりクリーンな製造技術を採用し、二酸化炭素排出量を削減するよう圧力を受けており、ヘマタイトやマグネタイトなどの伝統的な鉄鉱石原料の需要に影響を与える可能性があります。GDP成長率の変動、貿易摩擦、通貨変動などの経済的不安定性は、鉄鉱石需要を減少させる可能性があります。

不確実な経済情勢は、鉄鉱石を多用するインフラ投資や建設プロジェクトの縮小を引き起こす可能性があります。建設活動、インフラ投資、自動車生産、製造業生産高の変動に起因する鉄鋼需要の変動は、すべて鉄鉱石消費に影響を与える可能性があります。景気後退や消費者の嗜好の調整は、鉄鋼需要の変動を引き起こし、鉄鉱石市場の成長を制限します。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 新規プロジェクトへの投資拡大

- 自動車分野での用途拡大

- 抑制要因

- 環境への懸念と需要の変動

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ヘマタイト

- マグネタイト

- その他

第8章 形態別

- ペレット

- 塊

- 微粒

第9章 用途別

- 鉄鋼生産

- 鉄生産

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Rio Tinto

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Vale

- BHP Billiton

- Fortescue Metal Group

- ArcelorMittal

- Anglo American

- BCI Minerals Ltd.

- Atlas Iron Ltd.

- Cliffs Natural Resources

- Metalloinvest MC LLC

第13章 付録

Overview

Global Iron Ore Market reached US$ 345.7 billion in 2023 and is expected to reach US$ 424.5 billion by 2031, growing with a CAGR of 2.6% during the forecast period 2024-2031.

The rise in building and extraction activities has resulted in increased global demand for iron and steel. The increase in extraction activities is thus the key element driving the growth of the global iron ore market during the anticipated period. The rise of steel companies globally is creating lucrative demand for the global iron ore industry.

For example, Arcelormittal Steel India anticipates a profit of US$ 250-300 million per year from synergies generated by the proposed acquisition of infrastructure assets from Essar Group. Furthermore, the Essar Group announced an agreement with a joint venture of global steelmakers to acquire port and power assets valued at US$ 2.4 billion net. All expansion operations connected to manufacturing and production units, as well as mining activities, are offering major profitable growth potential for the global iron ore market.

In 2023, Europe is expected to be hold over 1/4th of the global iron ore market. European nations like UK and Germany supply a substantial portion of the market. The region's growing demand for steel from the automotive industry is likely to boost demand for the steel market. Russia is predicted to hold the highest proportion of Europe's iron ore market during the forecast period.

Dynamics

Growing Investments in New Projects

Investments in new iron ore projects result in the creation of new mines, the expansion of existing mines and the adoption of sophisticated mining methods. The increases production capacity, allowing for larger volumes of iron ore to be mined and sent to the market. As a result, increased investment helps to meet rising demand for iron ore, particularly in the steel industry.

Mining companies are aggressively attempting to meet the rising global demand for iron ore, which is being fueled by the growth of China's steel sector and global infrastructure. As per Lei Pingxi, chief engineer of the China Association of Steel and Mining Enterprises, the industry will develop by around 2% each year, resulting in an increase in iron ore supply of roughly 45 million tons next year.

Rising Usage in Automotive

The automobile sector is increasingly reliant on iron ore to manufacture the steel required for car bodies, lorries and other vehicles. Economic expansion in nations such as China and India is driving up demand for iron ore, as is the need for more fuel-efficient and environmentally friendly automobiles. As a result, the price of iron ore has increased in recent years. The trend is projected to continue in the future years, as the global economy grows and car demand increases.

China remains the world's largest automobile market in terms of yearly sales and manufacturing output, with local production projected to exceed 35 million vehicles by 2025. According to figures from the China Association of Automobile Manufacturers, more than 26.9 million automobiles were sold in 2022, up 3.46% from 2021. India concluded 2022 with annual sales of 3.8 million units, up more than 25% from 3.7 million in 2021. In 2022, India's passenger vehicle sector broke several records.

Environmental Concerns and Demand Fluctuations

Stringent environmental laws aimed at decreasing carbon emissions and preventing climate change may have an influence on the iron ore market. Steelmakers are under pressure to embrace cleaner manufacturing technologies and decrease their carbon footprint, which might impact demand for traditional iron ore feedstocks such as hematite and magnetite. Economic instability, such as variations in GDP growth, trade conflicts and currency volatility, might reduce demand for iron ore.

Uncertain economic situations may cause a reduction in investment in infrastructure and construction projects, both of which use iron ore extensively. Variations in steel demand, caused by variations in construction activity, infrastructure investment, automotive production and manufacturing output, can all have an impact on iron ore consumption. Economic downturns or adjustments in consumer tastes cause swings in steel demand, limiting iron ore market growth.

Segment Analysis

The global iron ore market is segmented based on type, form, application and region.

Rising Demand for Apparel drives the Segment Growth

Magnetite is expected to be the dominant segment with over 1/3rd of the market during the forecast period 2024-2031. Government-led building and construction activity, particularly in emerging nations, are boosting demand for steel and iron ore. Magnetite's high iron content and compatibility for construction-grade steel products make it an ideal choice for infrastructure projects that require long-lasting, high-strength components.

In 2023, Cyclone Metals, an Australian iron ore firm, announced the acquisition of the Block 103 Magnetite Iron Ore Project in the center of the Labrador Trough iron belt in Quebec, Canada, with the acquisition of Labrador Iron Pty Ltd. According to Cyclone Metals, Block 103 is the world's largest undeveloped magnetite iron ore property, covering 7,275 hectares and having a historical mineral resource estimate of 7,200Mt at 29.2% iron.

Geographical Penetration

Growing Demand From Residential Sector in Asia-Pacific

Asia-Pacific is the dominant region in the global iron ore market covering more than 40% of the market. The market's growth is being driven by the burgeoning construction sector in emerging regional economies, with more residential and commercial buildings, particularly in India and China, as well as higher living standards and per capita disposable incomes. The Indian government has invested more money in infrastructure projects including the Green Corridor, Smart Cities Mission and port expansion, which is increasing demand for iron ore.

Most Chinese steelmakers kept blast furnace working rates high during the Lunar New Year holiday, intending to undertake maintenance on these furnaces after the holidays. In 2024, according to the China Iron and Steel Association, overall crude steel output at major Chinese steel businesses increased 1.5% to 21 million mt between February 11 and February 20, compared to the first ten days of the month.

Competitive Landscape

The major global players in the market include Rio Tinto, Vale, BHP Billiton, Fortescue Metal Group, ArcelorMittal, Anglo American, BCI Minerals Ltd., Atlas Iron Ltd., Cliffs Natural Resources and Metalloinvest MC LLC.

COVID-19 Impact Analysis

The epidemic caused global disruptions in economic activity, industrial output and building, hurting demand for steel and, by extension, iron ore. Lockdowns, limitations and lower consumer spending reduced demand for steel goods, causing variations in iron ore demand and pricing. Metal prices increased 8.4% in June 2020, with a 3.7% increase in May, driven by a demand rebound in China and supply concerns in Latin America.

The World Bank Metals and Minerals Price Index was expected to average 13% lower in 2020 than in 2019, owing to projections of a slow global economic recovery. Unlike base metals, iron ore prices have stayed stable throughout the pandemic. Prices in June had risen than at the beginning of the year. Global supply fears have resurfaced, despite the restart of operations at Vale's iron ore Itabira complex in Brazil. Vale's iron ore production had failed to recover after a tailings dam catastrophe in early 2019.

Russia-Ukraine War Impact

Both Russia and Ukraine are large producers of iron ore, with Ukraine being a major exporter, particularly to Europe. Any disruptions in iron ore production and exports from these nations caused by the conflict, such as infrastructure damage, supply chain disruptions or export restrictions, might tighten global supply and result in market supply shortages. Iron ore is a vital raw ingredient for steel manufacturing and disruptions in iron ore supplies could impact steel production in countries depending on imports from Russia and Ukraine.

Steel makers struggled to secure enough iron ore feedstock, resulting in production slowdowns or shutdowns, which might have an impact on downstream businesses and supply chains. Ukraine's iron ore exports in 2023 declined to 17.75 million tons, a 26% decrease from 22.37 million tons in 2022, as per Ukraine's State Customs Service. The 2023 total was also decreased by 60% from 28.4 million tons in 2021, the year before Russia's invasion.

By Type

- Hematite

- Magnetite

- Others

By Form

- Pellets

- Lumps

- Fines

By Application

- Steel Production

- Iron Production

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In February 2021, Vale S.A. has begun operating six self-driving haul trucks at its Carajas iron ore complex in Para, Brazil. The program is part of a bigger initiative to improve security for workers, make the business more environmentally friendly and increase competitiveness.

- In February 2021, A consortium formed by Midrex Technologies and Primetals Technologies has an agreement with Mikhailovsky GOK (a subsidiary of Metalloinvest) to supply equipment for the development of the HBI facility. The contract includes steel construction, plumbing, ducting, training and advisory services and the engineering and supply of mechanical and electrical equipment.

Why Purchase the Report?

- To visualize the global iron ore market segmentation based on type, form, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of iron ore market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

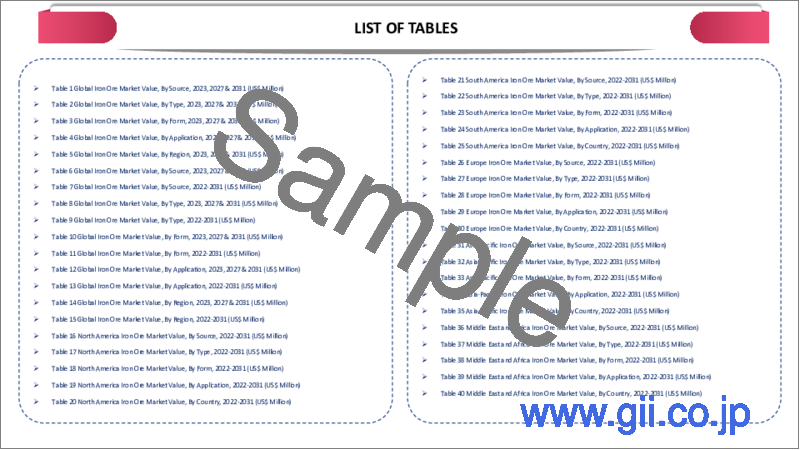

The global iron ore market report would provide approximately 62 tables, 51 figures and 202 pages.

Target Audience 2024

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Type

- 3.2.Snippet by Form

- 3.3.Snippet by Application

- 3.4.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Growing Investments in New Projects

- 4.1.1.2.Rising Usage in Automotive

- 4.1.2.Restraints

- 4.1.2.1.Environmental Concerns and Demand Fluctuations

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

- 5.5.Russia-Ukraine War Impact Analysis

- 5.6.DMI Opinion

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Type

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2.Market Attractiveness Index, By Type

- 7.2.Hematite*

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Magnetite

- 7.4.Others

8.By Form

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2.Market Attractiveness Index, By Form

- 8.2.Pellets*

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Lumps

- 8.4.Fines

9.By Application

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2.Market Attractiveness Index, By Application

- 9.2.Steel Production*

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Iron Production

10.By Region

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2.Market Attractiveness Index, By Region

- 10.2.North America

- 10.2.1.Introduction

- 10.2.2.Key Region-Specific Dynamics

- 10.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1.U.S.

- 10.2.6.2.Canada

- 10.2.6.3.Mexico

- 10.3.Europe

- 10.3.1.Introduction

- 10.3.2.Key Region-Specific Dynamics

- 10.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1.Germany

- 10.3.6.2.UK

- 10.3.6.3.France

- 10.3.6.4.Italy

- 10.3.6.5.Russia

- 10.3.6.6.Rest of Europe

- 10.4.South America

- 10.4.1.Introduction

- 10.4.2.Key Region-Specific Dynamics

- 10.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1.Brazil

- 10.4.6.2.Argentina

- 10.4.6.3.Rest of South America

- 10.5.Asia-Pacific

- 10.5.1.Introduction

- 10.5.2.Key Region-Specific Dynamics

- 10.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1.China

- 10.5.6.2.India

- 10.5.6.3.Japan

- 10.5.6.4.Australia

- 10.5.6.5.Rest of Asia-Pacific

- 10.6.Middle East and Africa

- 10.6.1.Introduction

- 10.6.2.Key Region-Specific Dynamics

- 10.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 10.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

11.Competitive Landscape

- 11.1.Competitive Scenario

- 11.2.Market Positioning/Share Analysis

- 11.3.Mergers and Acquisitions Analysis

12.Company Profiles

- 12.1.Rio Tinto*

- 12.1.1.Company Overview

- 12.1.2.Product Portfolio and Description

- 12.1.3.Financial Overview

- 12.1.4.Key Developments

- 12.2.Vale

- 12.3.BHP Billiton

- 12.4.Fortescue Metal Group

- 12.5.ArcelorMittal

- 12.6.Anglo American

- 12.7.BCI Minerals Ltd.

- 12.8.Atlas Iron Ltd.

- 12.9.Cliffs Natural Resources

- 12.10.Metalloinvest MC LLC

LIST NOT EXHAUSTIVE

13.Appendix

- 13.1.About Us and Services

- 13.2.Contact Us