|

|

市場調査レポート

商品コード

1455750

コラーゲンサプリメントの世界市場:2023年~2030年Global Collagen Supplements Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| コラーゲンサプリメントの世界市場:2023年~2030年 |

|

出版日: 2024年03月26日

発行: DataM Intelligence

ページ情報: 英文 209 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

コラーゲンサプリメントの世界市場は、2022年に25億4,000万米ドルに達し、2023年から2030年の予測期間中にCAGR 5.2%で成長し、2030年には38億1,000万米ドルに達すると予測されています。

サプリメントは身体に必要不可欠な栄養素を提供し、全体的な健康を増進するため、世界人口における需要が増加しています。コラーゲンサプリメントは、皮膚や髪の健康増進のために消費者に広く採用されています。酵素加水分解や超音波などの様々な抽出方法の使用は、幅広い抽出や様々な種類のコラーゲン原料の使用に役立ち、市場の成長を積極的に促進しています。

大手企業は、健康維持におけるコラーゲンサプリメントの重要性のプロモーションに着手し、サポートしており、市場成長の幅広い拡大に役立っています。例えば、2021年5月、ネスレヘルスサイエンス中国は、オリジナルコラーゲンペプチドパウダー無香料とマリンコラーゲンパウダー無香料を含むバイタルプロテインの旗艦店をTmallにオープンしました。この取り組みは、中国の消費者にコラーゲンサプリメントの健康効果について啓蒙することを目的としています。

環境に優しいパッケージは最近絶大な人気を得ており、環境に優しい製品を提供するコラーゲンサプリメントメーカーの革新的なアプローチは、市場における製品価値を高めています。例えば、2020年2月、健康・美容サプリメントブランドのRejuvenated Ltdは、コラーゲンショットに堆肥化可能なパッケージであるバイオパウチの使用を導入しました。粉末のスキンケアサプリメント飲料が環境に優しい包装で提供されるようになり、家庭での堆肥化に適しています。

ダイナミクス

消費者の健康意識の高まり

コラーゲンは、肌、心臓、髪の健康を増進し、健康的なライフスタイルの促進に役立ちます。コラーゲンサプリメントがもたらす健康効果に対する消費者の意識が高まったことで、コラーゲンサプリメントの売上は世界的に伸びています。例えば、コラーゲンサプリメントの大手プロバイダーであるNestle S.A.の子会社グループ、Vital Proteinsは、コラーゲンの需要が2020年に50%以上増加していることに注目しています。

同様に、健康とウェルネス製品の大手メーカーであるニュートラワイズは、同社のYoutheoryブランドがサプリメントカテゴリーからの売上を76%増加させ、コラーゲンがその牽引役となっていることに気づいた。コラーゲンサプリメントの様々な健康上の利点が、健康志向の人々が健康的なライフスタイルを促進するためにこれらのサプリメントを使用する原動力となっており、市場成長にプラスの影響を与えています。

コラーゲンサプリメントの機能性向上

コラーゲンサプリメントは、人の健康と幸福を促進する用途の増加により、絶大な人気を博しています。コラーゲンサプリメントは、骨と筋肉の健康をサポートするのに役立ちます。コラーゲンサプリメントは、皮膚や関節の健康のために有名であり、これらの用途での使用が増加しています。例えば、2020年11月、米国のビタミンとサプリメント会社であるライフ・エクステンション社は、関節と皮膚の健康のための新しい加水分解コラーゲンサプリメントペプチドを発表しました。

同様に、2020年5月には、ロンドンの健康・ウェルネス・フィットネス企業であるNutraformis Limitedが、最高品質の海洋性コラーゲンを使用した新しいコラーゲン製品を発売し、同社のポートフォリオに新製品を導入しました。この製品は、皮膚、髪、爪の健康をサポートし、維持すると謳っています。これらのサプリメントの幅広い用途は、市場価値の向上に役立ち、市場の成長を後押ししています。

高まる動物福祉への責任

コラーゲンサプリメントは豚や牛など様々な動物から摂取されます。Faunanlticsによると、2020年には合計約2億9,320万頭の牛が屠殺され、豚は15億頭以上を占めます。コラーゲンサプリメントの生産にこれらの動物が多用されることで、動物虐待が発生しています。世界の動物愛護の高まりとともに、コラーゲンサプリメントの需要は減少しています。

世界動物衛生機関や国際動物福祉基金などの様々な動物福祉団体が、動物の権利を守り、動物虐待を防ぐために積極的に参加しています。さらに、特定の動物由来製品の消費に対する文化的制限は、特定の地域における市場の成長を妨げる可能性があります。

2023年の世界動物基金の統計によると、世界には8,800万人以上の菜食主義者が存在します。菜食主義者の増加は、動物を原料とするコラーゲンサプリメントの主要な抑制要因のひとつとなり、牛と豚のコラーゲンサプリメント市場を抑制する可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 消費者の健康志向の高まり

- コラーゲンサプリメントの機能性向上

- 抑制要因

- 動物福祉に対する責任の増大

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

第6章 COVID-19分析

第7章 由来別

- 海産

- 牛

- 豚

- その他

第8章 形態別

- カプセル

- 粉末

- 液体

- その他

第9章 流通チャネル別

- ドラッグストア

- 専門店

- eコマース

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- Shiseido Co. Limited

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Nestle SA

- The Clorox Company

- Zenii Limited

- Revive Collagen

- Absolute Collagen

- Needl

- LAPI GELATINE S.p.a.

- Oziva

- Ancient Nutrition

第13章 付録

Overview

Global Collagen Supplements Market reached US$ 2.54 billion in 2022 and is expected to reach US$ 3.81 billion by 2030, growing with a CAGR of 5.2% during the forecast period 2023-2030.

Supplements provide essential nutrients to the body and enhance overall health, increasing their demand in the global population. Collagen supplementation is widely adopted by consumers to enhance skin and hair health. The use of various extraction methods such as enzymatic hydrolysis and ultrasound helps in wide extraction and the use of the various types of collagen source materials, positively driving the market growth.

Major companies' initiation and support in the promotion of collagen-based supplements' importance in health maintenance helps in the wide expansion of the market growth. For instance, in May 2021, Nestle Health Science China opened a flagship store in Tmall for Vital Proteins, including Original Collagen Peptides Powder Unflavored and Marine Collagen Powder Unflavored. This initiative aims to educate Chinese consumers about the health benefits of collagen supplements.

Eco-friendly packaging has gained immense popularity recently and the innovative approach of collagen supplement manufacturers to provide an environmentally friendly product is increasing product value in the market. For instance, in February 2020, Rejuvenated Ltd, a health & beauty supplement brand, introduced the use of a bio-pouch, a compostable packaging for its Collagen Shots. The powdered skin care supplement drink is now available in eco-friendly packaging and is suitable for home composting.

Dynamics

Increased Health Consciousness Among Consumers

Collagen helps in promoting a healthy lifestyle by enhancing skin, heart and hair health. The increased consumer awareness about the health benefits associated with collagen supplements has increased the sales of the products globally. For instance, Nestle S.A's subsidiary group, Vital Proteins, a leading provider of collagen supplements noticed that the collagen demand has increased by more than 50% in 2020.

Similarly, Nutrawise, a leading manufacturer of health and wellness products noticed that the company's Youtheory brand increased its sales from the supplements category by 76 % with collagen leading the path. Various health advantages of collagen supplementation are driving the use of these supplements by health-conscious people to promote a good healthy lifestyle, positively influencing the market growth.

Improved Functionality of Collagen Supplements

Collagen supplements are gaining immense popularity due to their increased applications in promoting the health and well-being of a person. Collagen supplements help in supporting bone and muscle health. Collagen supplements are famous for their skin and joint health, increasing their use in these applications. For instance, in November 2020, Life Extension, a U.S.-based vitamins and supplements company, introduced new hydrolyzed collagen supplement peptides for joints and skin health.

Similarly, in May 2020, Nutraformis Limited, a Health, Wellness and Fitness company in London introduced new products in thier portfolio with the launch of the new collagen products with the highest-quality marine collagen. The products are claimed to support and maintain the health of skin, hair, and nails. The wide applications of these supplements help in improving its market value, boosting the market growth.

Increasing Animal Welfare Responsibilities

Collagen supplements are sourced from various animals such as pigs and cows. According to Faunanltics, a total of about 293.2 million cattle were slaughtered in 2020, whereas pigs accounted to be over 1.5 billion. The high use of these animals in collagen supplement production is resulting in animal cruelty. With the increased animal welfare conditions globally, the demand for these collagen supplements is reducing.

Various animal welfare organizations such as the World Organization for Animal Health and the International Fund of Animal Welfare are actively participating to protect animal rights and prevent animal cruelty. Further, the cultural restriction on the consumption of certain animal-sourced products can hinder market growth in certain regions.

According to the World Animal Foundation stats of 2023, there are more than 88 million vegans present in the world. The increasing vegan population can be one of the major restraining factors for collagen supplements that are sourced from animals, restraining the market for bovine and porcine collagen supplements.

Segment Analysis

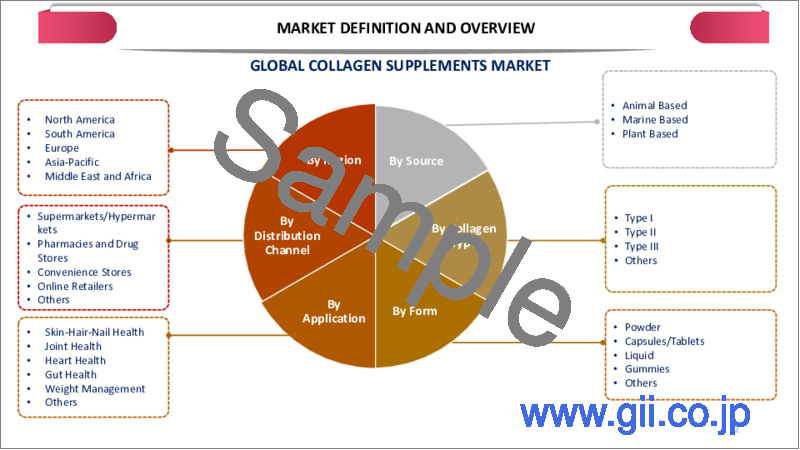

The global collagen supplements market is segmented based on source, form, distribution channel and region.

Increased Marine Collagen Application in Skin and Hair Health

The global collagen supplements market is segmented based on source into marine, bovine and porcine. The marine segment accounted for the largest share of the global collagen supplements market with its increased functionality in skin and hair health. Marine collagen is used as a faster solution to reduce wrinkles and enhance the appearance of skin.

With increased hair and skin health consciousness among consumers, the demand for marine collagen for its application in collagen supplements is driving segment growth. The new product launches sourced from marine collagen boost the segment growth. For instance, in June 2023, Z Natural Foods, a leading provider of premium quality natural foods, introduced a new product offering into the market with the launch of Hydrolyzed Marine Collagen Peptides.

Similarly, in January 2021, Darling Ingredients Inc., a manufacturer and distributor of sustainable ingredients, announced the launch of Peptan, a marine collagen peptide under its brand, Ruosselot. Ruosselot brand, the global leader of collagen-based solutions introduced this product in Beauty & Skincare Formulation Conference 2021.

Geographical Penetration

Increased Demand for Collagen Supplements Among Consumers in North America

North America dominated the collagen supplement market. With the increased consumer awareness about the various health benefits associated with collagen supplementation, there is a greater demand for this product in U.S. and Canada. There is an increased focus on consumers of supplements to improve health conditions. For instance, the Council for Responsible Nutrition's annual Consumer Survey on Dietary Supplements on October 2022, reported that 75 % of U.S. consumers took supplements in 2022.

The region has an increased demand for collagen supplements from the sports industry. The Physical Activity Council's report from 2021 states that 67 % of Americans aged six and above are involved in fitness sports, whereas individual sports accounted for about 43.3 % of Americans. Among Americans, 22. 1 % are reported to be participating in team sports and 52.9 % accounted for outdoor sports.

Sports persons are adopting collagen supplements to increase their performance and support tendon and ligament health, increasing the collagen market demand in the region. The improved personal consciousness among consumers is positively driving this region's market due to its wide applications in improving skin and hair health.

Competitive Landscape

The major global players in the market include Shiseido Co. Limited, Nestle SA, The Clorox Company, Zenii Limited, Revive Collagen, Absolute Collagen, Needl, LAPI GELATINE S.p.a., Oziva and Ancient Nutrition.

COVID-19 Impact Analysis

The outbreak of the COVID-19 pandemic positively impacted the global collagen supplements market. Just like various other industries, the collagen supplements market also received challenges in the early pandemic stages when the collagen processing plants experienced a halt in production activities due to improper labor and other resource availability.

The strict regulations from the government resulted in the shutdown of many manufacturing industries, temporarily negatively impacting the market. The distribution channels were also creating a greater disturbance in product sales through offline stores. The greater adoption of the e-commerce sector for product promotion positively impacted the market, increasing the sales of the products.

The increased health consciousness among consumers during the pandemic increased the dietary supplements market, thereby increasing market demand. Globally, people started adopting dietary supplements to improve their health and immunity systems. According to the U.S. National Health and Nutrition Examination Survey, there was an overall increase of 20% in the consumption of dietary supplements by U.S. consumers.

Russia- Ukraine War Impact

The Russia-Ukraine war had a negative impact on many industrial sectors, including supplements. The war created a disturbance in the sourcing of the raw materials required for product development. The scarcity of raw materials and distribution channel disruption affected the collagen supplement market growth in a negative way.

The war created import and export trade disruptions, resulting in economic disturbances in the market. The political and economic uncertainty created due to the war had a negative impact on the collagen supplements market, increasing the prices of the products and halting the trade functionalities among some nations.

By Source

- Marine

- Bovine

- Porcine

- Others

By Form

- Capsules

- Powder

- Liquid

- Others

By Distribution Channel

- Drug Stores

- Specialty Stores

- E-Commerce

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In June 2023, SOLUGEL premium fish collagen peptides were released by PB Leiner. PB Leiner, a collagen peptides manufacturer announced the joint venture with Hainan Xiangtai Group a leading enterprise of agricultural industrialization in November 2022, to produce this product.

- In April 2023, Darling Ingredients, the world's company that is converting food waste into renewable energy, announced their acquisition completion with Gelnex, a leading global producer of collagen products.

- In June 2020, Nestle Health Science, a leader in the field of nutrition science announced the acquisition of Vital Proteins, a leading collagen brand and a lifestyle and wellness platform. The brand offers collagen-based supplements and food products.

Why Purchase the Report?

- To visualize the global collagen supplements market segmentation based on source, form, distribution channel and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of collagen supplements market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global collagen supplements market report would provide approximately 61 tables, 60 figures and 209 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1.Methodology and Scope

- 1.1.Research Methodology

- 1.2.Research Objective and Scope of the Report

2.Definition and Overview

3.Executive Summary

- 3.1.Snippet by Source

- 3.2.Snippet by Form

- 3.3.Snippet by Distribution Channel

- 3.4.Snippet by Region

4.Dynamics

- 4.1.Impacting Factors

- 4.1.1.Drivers

- 4.1.1.1.Increased Health Consciousness Among Consumers

- 4.1.1.2.Improved Functionality of Collagen Supplements

- 4.1.2.Restraints

- 4.1.2.1.Increasing Animal Welfare Responsibilities

- 4.1.3.Opportunity

- 4.1.4.Impact Analysis

- 4.1.1.Drivers

5.Industry Analysis

- 5.1.Porter's Five Force Analysis

- 5.2.Supply Chain Analysis

- 5.3.Pricing Analysis

- 5.4.Regulatory Analysis

6.COVID-19 Analysis

- 6.1.Analysis of COVID-19

- 6.1.1.Scenario Before COVID

- 6.1.2.Scenario During COVID

- 6.1.3.Scenario Post COVID

- 6.2.Pricing Dynamics Amid COVID-19

- 6.3.Demand-Supply Spectrum

- 6.4.Government Initiatives Related to the Market During Pandemic

- 6.5.Manufacturers Strategic Initiatives

- 6.6.Conclusion

7.By Source

- 7.1.Introduction

- 7.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 7.1.2.Market Attractiveness Index, By Source

- 7.2.Marine

- 7.2.1.Introduction

- 7.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3.Bovine

- 7.4.Porcine

- 7.5.Others

8.By Form

- 8.1.Introduction

- 8.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 8.1.2.Market Attractiveness Index, By Form

- 8.2.Capsules

- 8.2.1.Introduction

- 8.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3.Powder

- 8.4.Liquid

- 8.5.Others

9.By Distribution Channel

- 9.1.Introduction

- 9.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 9.1.2.Market Attractiveness Index, By Distribution Channel

- 9.2.Drug Stores

- 9.2.1.Introduction

- 9.2.2.Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3.Specialty Stores

- 9.4.E-Commerce

- 9.5.Others

10.By Region

- 10.1.Introduction

- 10.1.1.Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2.Market Attractiveness Index, By Region

- 10.2.North America

- 10.2.1.Introduction

- 10.2.2.Key Region-Specific Dynamics

- 10.2.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.2.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.2.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.2.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1.U.S.

- 10.2.6.2.Canada

- 10.2.6.3.Mexico

- 10.3.Europe

- 10.3.1.Introduction

- 10.3.2.Key Region-Specific Dynamics

- 10.3.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.3.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.3.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.3.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1.Germany

- 10.3.6.2.U.K.

- 10.3.6.3.France

- 10.3.6.4.Italy

- 10.3.6.5.Spain

- 10.3.6.6.Rest of Europe

- 10.4.South America

- 10.4.1.Introduction

- 10.4.2.Key Region-Specific Dynamics

- 10.4.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.4.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.4.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.4.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1.Brazil

- 10.4.6.2.Argentina

- 10.4.6.3.Rest of South America

- 10.5.Asia-Pacific

- 10.5.1.Introduction

- 10.5.2.Key Region-Specific Dynamics

- 10.5.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.5.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.5.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 10.5.6.Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1.China

- 10.5.6.2.India

- 10.5.6.3.Japan

- 10.5.6.4.Australia

- 10.5.6.5.Rest of Asia-Pacific

- 10.6.Middle East and Africa

- 10.6.1.Introduction

- 10.6.2.Key Region-Specific Dynamics

- 10.6.3.Market Size Analysis and Y-o-Y Growth Analysis (%), By Source

- 10.6.4.Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.6.5.Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

11.Competitive Landscape

- 11.1.Competitive Scenario

- 11.2.Market Positioning/Share Analysis

- 11.3.Mergers and Acquisitions Analysis

12.Company Profiles

- 12.1.Shiseido Co. Limited

- 12.1.1.Company Overview

- 12.1.2.Product Portfolio and Description

- 12.1.3.Financial Overview

- 12.1.4.Key Developments

- 12.2.Nestle SA

- 12.3.The Clorox Company

- 12.4.Zenii Limited

- 12.5.Revive Collagen

- 12.6.Absolute Collagen

- 12.7.Needl

- 12.8.LAPI GELATINE S.p.a.

- 12.9.Oziva

- 12.10.Ancient Nutrition

LIST NOT EXHAUSTIVE

13.Appendix

- 13.1.About Us and Services

- 13.2.Contact Us