|

|

市場調査レポート

商品コード

1423458

エチレングリコールの世界市場-2023年~2030年Global Ethylene Glycol Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| エチレングリコールの世界市場-2023年~2030年 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 208 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界のエチレングリコール市場は、2022年に292億米ドルに達し、2023~2030年の予測期間中にCAGR 4.2%で成長し、2030年には401億米ドルに達すると予測されています。

バイオ燃料から生産されるエチレングリコールも大きな動向です。化石燃料から生産される従来のエチレングリコールの代替品として、バイオテクノロジーに基づくものが研究され、サプライヤーから資金提供を受けています。より環境にやさしく、二酸化炭素排出量も少なくてすむバイオベースのエチレングリコールは、バイオマスや農業廃棄物などの再生可能原料から製造されることが多いです。

エチレングリコールの市場は、主に自動車産業が牽引しています。油圧ブレーキ液、空調システム、自動車エンジンはすべて、冷却剤や不凍液としてエチレングリコールを使用しています。世界の自動車生産台数は、特に新興国で増加しており、これがエチレングリコールの需要を押し上げています。

アジア太平洋は、世界のエチレングリコール市場の1/3以上を占める成長地域のひとつです。市場開拓の原動力となっているのは、アジア太平洋地域におけるエチレングリコール市場の成長であろう。同地域では自動車産業が盛んであることが主な要因のひとつです。中国では、自動車エンジン、エアコン・システム、油圧ブレーキ液の冷却剤や不凍液として広く利用されているエチレングリコールの需要が、自動車生産の増加によって促進されています。

ダイナミクス

繊維・織物産業におけるエチレングリコール使用の拡大

ポリエステル繊維は柔らかく、吸湿性が高く、軽量であるため、衣料品製造への需要が高まっています。ポリエステルは保温性が高く、快適な肌触りとソフトな光沢があるため、薄手の防寒下着やカジュアルな防寒着、スポーツウェアなどによく使われています。柔らかく、耐熱性、耐摩耗性に優れた手袋や靴下もこの素材で作られています。

国際貿易局(ITA)は、米国のファッション衣料市場は2025年までに4,000億米ドル以上の規模に達すると予測しています。インド政府によって制定された「輸出向け衣料品パーク」構想は、集中的な後押しによって、有望な開発拠点に国際標準の衣料品生産ユニットを設立することを目的としています。

エチレングリコールはポリエステル繊維の生産に広く使用されているため、生地・繊維部門の成長に伴って需要が増加すると予想されます。その結果、予測期間を通じて、織物・繊維部門の成長がエチレングリコール市場を押し上げると思われます。

自動車需要の増加

産業動向として、自動車生産分野でのエチレングリコール需要の増加が挙げられます。自動車産業では、エチレングリコールはいくつかの用途に不可欠であり、そのひとつが自動車用不凍液の製造に欠かせない成分です。この多目的化学物質は、極寒時にエンジン冷却水の凍結を防ぎ、炎天下でのオーバーヒートを防ぐのに効果的なため、需要が高いです。

国際貿易局(ITA)の報告によると、中国政府は2025年までに3,500万台の自動車が生産されると予測しています。オランダ統計局(CBS)によると、オランダで毎年1月1日に登録される道路運送車両の総数は、2018年の1,128万7,017台から2019年には1,149万5,837台、2020年には1,170万3,420台になった。

さらに、国際自動車工業会(OICA)の報告によると、ブラジルにおける小型商用車の生産台数は2017年の32万6,647台から2018年には35万8,981台へと10.2%上昇しました。自動車製造台数の増加に伴い、不凍液の製造にエチレングリコールを追加で必要とすることが、予測期間中のエチレングリコール市場を牽引すると思われます。

高い原料コスト

エチレングリコール市場は、原材料の価格変動によって大きな制約を受けています。エチレングリコール製造の主原料はエチレンであり、天然ガスや原油などの石油化学原料に由来します。エチレングリコールの生産に関連する費用は、様々な原材料の価格変動に直接影響を受ける可能性があります。

需給のミスマッチ、地政学的紛争、世界のエネルギー市場の変動など、いくつかの要因に起因する原料コストの変動により、メーカーは不確実性を経験する可能性があります。エチレングリコールの価格設定と収益性にも影響を及ぼす可能性があります。

エチレングリコールのマイナス効果

エチレングリコールの主な欠点は、人と動物の両方にリスクをもたらすことです。ほとんどの安全データシートはエチレングリコールを「危険」と分類しているが、多くの調査結果は、この物質が微量でも致死量に達する可能性があることを示しています。米国上院は現在も、エチレングリコール中毒の問題を全米で議論しています。通常、エチレングリコールは酸素が入ると分解します。

分解の製品別として、シュウ酸、グリコール酸、ギ酸、酢酸など多くの酸が生成されます。酸素の利用可能性を減らす、酸のpHを緩衝させる、腐食を防止する阻害剤を使用するなど、適切な手順を事前に踏まなければ、これらの酸は炭素鋼やその他の金属部品を急速に侵食する恐れがあります。したがって、予測期間を通じて、これらの問題は市場の成長を制限する重要な要因になると予想されます。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 繊維・ファブリック産業におけるエチレングリコールの使用拡大

- 自動車向け需要の増加

- 抑制要因

- 原料コストの高騰

- エチレングリコールの悪影響

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- モノエチレングリコール(MEG)

- ジエチレングリコール(DEG)

- トリエチレングリコール(TEG)

- その他

第8章 技術別

- ガスベース

- ナフサベース

- 石炭ベース

- バイオベース

- メタノールベース

- その他

第9章 用途別

- 溶剤カプラー

- 安定剤

- 凝固点降下剤

- 熱伝達剤

- 不凍液および冷却剤

- その他

- 化学中間体

- ポリエステル樹脂

- アルキド樹脂

- その他

- 溶剤

- 保湿剤

- 接着剤

- 繊維

- 印刷インキ

- その他

- その他

第10章 エンドユーザー別

- 輸送

- 包装

- 石油・ガス

- 建築・建設

- 飲食品

- スポーツ

- 繊維

- パーソナルケア&化粧品

- 医療・ヘルスケア

- その他

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Saudi Basic Industries Corporation

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Shell plc

- Dow Chemical Company

- BASF SE

- Sinopec Corp

- Reliance Industries Limited

- Mitsubishi Chemical Corporation

- LyondellBasell Industries Holdings B.V.

- Lotte Chemical Corporation

- Huntsman Corporation

第14章 付録

Overview

Global Ethylene Glycol Market reached US$ 29.2 billion in 2022 and is expected to reach US$ 40.1 billion by 2030, growing with a CAGR of 4.2% during the forecast period 2023-2030.

Ethylene glycol produced from biofuels is also a major trend. Alternatives to conventional ethylene glycol produced from fossil fuels that are based on biotechnology are being investigated and funded by suppliers. An alternative that is more environmentally friendly and may have a smaller carbon footprint is bio-based ethylene glycol, which is frequently made from renewable feedstocks like biomass or waste from agriculture.

The market for ethylene glycol is mostly driven by the automobile industry. Hydraulic braking fluids, air conditioning systems and car engines all employ ethylene glycol as a coolant and antifreeze. Global auto manufacturing is rising, particularly in emerging nations, which is driving up demand for ethylene glycol.

Asia-Pacific is among the growing regions in the global ethylene glycol market covering more than 1/3rd of the market. The factors driving the market's development may be linked to the growth of the ethylene glycol market in the Asia-Pacific. The region's flourishing car sector is one of the main contributing factors. In China, the demand for ethylene glycols, which are widely utilized as coolant and antifreeze agents in automotive engines, air conditioning systems and hydraulic braking fluids, is fueled by the growing production of vehicles.

Dynamics

Growing Ethylene Glycol Use in the Textile and Fabric Industries

Polyester fiber is becoming more and more in demand for usage in clothing production because of its qualities of softness, high hygroscopicity and lightweight nature. Because polyester has high warm-keeping, comfortable feeling and soft luster qualities, it is frequently used to make thin thermal underwear, casual warm winter clothing and sportswear. Soft, heat-resistant and wear-resistant gloves and socks are also made using this material.

The International Trade Administration (ITA) projects that the fashion clothing market in U.S. will reach a valuation of over US$400 billion by 2025. The 'Clothing Park for Exports' initiative, instituted by the Indian government, aims to establish internationally-standard clothing production units at promising development locations through a focused push.

Because ethylene glycol is widely used in the production of polyester fiber, it is thus expected that demand for it would rise in tandem with the growing fabric and textiles sector. Consequently, throughout the projected period, the growing fabric and textile sector will boost the ethylene glycol market.

Growing Demand for Automotive

The industrial trend is the increasing demand for ethylene glycol in the car production sector. In the automobile industry, ethylene glycol is essential for some uses, one of which is a vital component in the creation of car antifreeze. The multipurpose chemical is in high demand because it works well to prevent engine coolant from freezing in very cold temperatures and from overheating in hot weather.

The International Trade Administration (ITA) reports that the Chinese government anticipates that by 2025, 35 million vehicles will be produced. The total number of road vehicles registered in the Netherlands on January 1st of each year went from 1,12,87,017 in 2018 to 1,14,95,837 in 2019 to 1,17,03,420 in 2020, according to Statistics Netherlands (CBS).

Additionally, the International Organization of Automobile Manufacturers (OICA) reports that the production of light commercial vehicles climbed by 10.2% in Brazil, from 326,647 in 2017 to 358,981 in 2018. The need for additional ethylene glycol to produce antifreeze as a result of rising automotive manufacturing will drive the ethylene glycol market during the projected period.

High Cost of Raw Material

The ethylene glycol market is significantly constrained by the price volatility of raw materials. The main ingredient in the production of ethylene glycol is ethylene, which comes from petrochemical feedstocks such as natural gas and crude oil. The expenses associated with producing ethylene glycol can be directly impacted by changes in the pricing of various raw ingredients.

Manufacturers may experience uncertainty due to fluctuating raw material costs, which may be attributed to several factors such as supply-demand mismatches, geopolitical conflicts and volatility in global energy markets. Market players may find it difficult to properly plan and manage their operations as a result of this volatility, which may also have an impact on the pricing and profitability of ethylene glycol.

Negative Effects of Ethylene Glycol

The primary drawback of ethylene glycol is that it poses a risk to both people and animals. Although most Safety Data Sheets classify ethylene glycol as "dangerous," a large body of research indicates that even tiny amounts of the substance may be lethal. The US Senate is still debating the issue of ethylene glycol poisoning across the country. The usual degradation of ethylene glycol occurs when oxygen is introduced.

As byproducts of degradation, many acids are produced, including oxalic, glycolic, formic and acetic acids. If suitable steps aren't followed, such as reducing oxygen availability, buffering the acid's pH and using inhibitors to prevent corrosion in advance, these acids may quickly erode carbon steel and other metal parts. Therefore, throughout the projected period, these issues are expected to become a key factor restricting the market's growth.

Segment Analysis

The global ethylene glycol market is segmented based on type, technology, application, end-user and region.

Rising Demand for Monoethylene Glycol (MEG) in the Applications

The monoethylene glycol (MEG) segment is among the growing regions in the global ethylene glycol market covering more than 1/3rd of the market. The most popular applications for monoethylene glycol (MEG) are as a hydrate inhibition and dewatering agent. In pipelines where hydrate formation is an issue, its modest concentrations are frequently constantly injected.

Due to its higher efficiency at a given mass concentration compared to diethylene glycol (DEG), monoethylene glycol (MEG) is the most widely used glycol. The is because only if the glycol used in the next dehydration process is also DEG may DEG be utilized as an agent in the pipeline.

Geographical Penetration

Rising Demands in the Automotive and Electronics Industries in Asia-Pacific

Asia-Pacific has been a dominant force in the global ethylene glycol market. Industrial paints and coatings are made from ethylene glycol, which comes in many forms such as mono, di and triethylene glycol. The types of ethylene glycol give surface coatings viscous texture and qualities including flexibility and durability.

Additionally, the Indian government recently said that it will begin work on a textile processing project in Maharashtra in 2021, with a budget of INR 905 million (about US$ 12.2 million). Moreover, according to a recent post on fibre2fashion, over 70% of all enterprises in Vietnam are engaged in textile production. Because of this, it is anticipated that the region's soaring textile demand would raise the need for the ethylene glycol needed for textile production. The is anticipated to propel the market's expansion in the Asia-Pacific area throughout the next few years.

In addition, the Vietnamese government said in 2020 that it intended to grow the paint coating sector with a 2030 target. Between 2021 and 2030, the paint coating industry's output value is predicted to rise at an average pace of up to 14%. Because of the aforementioned qualities of ethylene glycol, it is anticipated that the manufacturing of coatings in the Asia-Pacific would rise, hence increasing the demand for this major raw material. In the next years, this is expected to fuel market expansion in the Asia-Pacific.

The textile industry uses polyethylene terephthalate resin, while polyester fibers are mainly produced using ethylene glycol, such as mono ethylene glycol. For example, the Non-Woven Fabric Manufacturing Expansion Project in Himachal Pradesh, valued at INR 220 million (US$ 2.9 million), was advertised as starting in July 2021 by India.

COVID-19 Impact Analysis

The new coronavirus, known as SARS-CoV-2, has affected every industry, including the packaging and automobile industries. The government-imposed import-export restrictions in different regions have resulted in a decline in the demand for packaging. Additionally, the production of cars has been severely impeded, which has led to a significant decline in the automotive industry as a whole.

For example, the European Automobile Manufacturers Association reports that, in June 2020, the EU's demand for new commercial cars was still sluggish (-20.3%), but at a slower rate than in April and May. Germany (-30.5%), Spain (-24.2%) and Italy (-12.8%) were the three major markets in the area to report double-digit percentage reductions last month, while France saw a slight uptick (+2.2%). The market for ethylene glycol is being greatly impacted by the sharp decline in antifreeze demand brought on by the decline in car manufacturing.

The world shut down and supply chain disruptions caused a large decline in demand for many items. The COVID-19 pandemic has caused the textile industries to stop producing. People are not allowed to go shopping; thus, fabric manufacture has been suspended. The pharmaceutical business continues to function in the market even if many other industries are experiencing difficulties.

The need for personal protective equipment, such as face masks and disinfectants, has surged because of the COVID-19 epidemic. During this scenario, ethylene glycol works great as a disinfectant because of its antibacterial qualities. Ethylene glycol is used in hospitals to sterilize surgical tools. The global market for ethylene glycol is rising significantly as a result of this a pandemic

Russia-Ukraine War Impact Analysis

The Russia-Ukraine conflict has the potential to significantly impact the global ethylene glycol market due to the key role these countries play in the production and transportation of petrochemicals. Both Russia and Ukraine are major players in the production of raw materials like natural gas, a crucial feedstock for ethylene glycol manufacturing.

Disruptions in the supply chain, such as transportation blockades, export restrictions or damage to critical infrastructure, could lead to shortages and increased prices in the global ethylene glycol market. Moreover, the fight may exacerbate geopolitical unrest, which would affect investor confidence and the financial system.

The markets for commodities, such as chemicals like ethylene glycol, are susceptible to fluctuations and speculation brought about by geopolitical events. The cost structure of ethylene glycol manufacturing may be impacted, affecting pricing dynamics in the globally market, by the possibility of higher energy costs brought on by worries about supply interruptions in the area.

By Type

- Monoethylene Glycol (MEG)

- Diethylene Glycol (DEG)

- Triethylene Glycol (TEG)

- Others

By Technology

- Gas-Based

- Naptha-Based

- Coal-Based

- Bio-Based

- Methanol-Based

- Others

By Application

- Solvent Coupler

- Stabilizer

- Freezing Point Depression

- Heat Transfer Agent

- Antifreeze and Coolants

- Others

- Chemical Intermediate

- Polyester Resins

- Alkyd-Resins

- Others

- Solvent

- Humectant

- Adhesives

- Textile Fibers

- Printing Inks

- Others

- Others

By End-User

- Transportation

- Packaging

- Oil & Gas

- Building and Construction

- Food & Beverages

- Sports

- Fabric & Textiles

- Personal Care & Cosmetics

- Medical & healthcare

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On October 16, 2023, BASF SE expanded capacities for both ethylene oxide and its derivatives at the integrated site in Antwerp, Belgium. The investment contributes approximately 400,000 metric tons per year to BASF SE production capacity for these specific products. By establishing these new plants, the company is reinforcing its commitment to supporting the ongoing expansion of its customer base and strengthening its market position in Europe.

- On October 17, 2022, Saudi Basic Industries Corporation (SABIC) is expanded with the establishment of its third Ethylene Glycols Plant under its subsidiary, Jubail United Petrochemicals. SABIC is poised to initiate commercial operations at United Ethylene Glycol Plant. The facility boasts an annual production capacity of 700,000 metric tons of Monoethylene Glycol (MEG).

Competitive Landscape

The major global players in the market include Saudi Basic Industries Corporation, Shell plc, Dow Chemical Company, BASF SE, Sinopec Corp, Reliance Industries Limited, Mitsubishi Chemical Corporation, LyondellBasell Industries Holdings B.V., Lotte Chemical Corporation and Huntsman Corporation.

Why Purchase the Report?

- To visualize the global ethylene glycol market segmentation based on type, technology, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of ethylene glycol market -level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

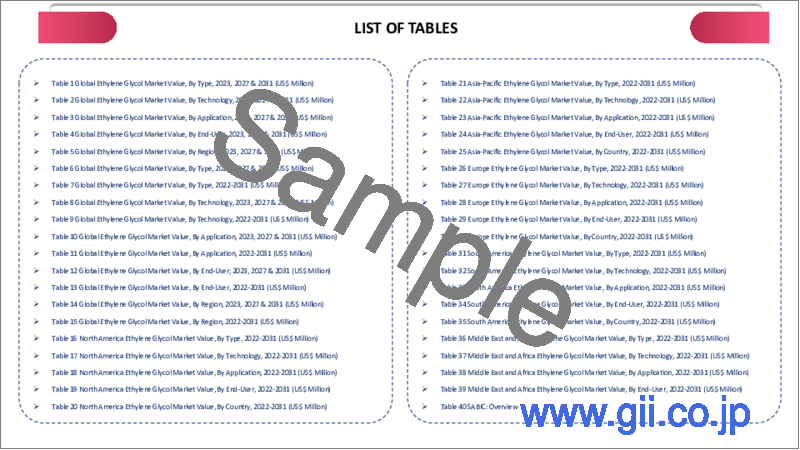

The global ethylene glycol market report would provide approximately 70 tables, 75 figures and 208 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Technology

- 3.3. Snippet by Application

- 3.4. Snippet by End-User

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Ethylene Glycol Use in the Textile and Fabric Industries

- 4.1.1.2. Growing Demand for Automotive

- 4.1.2. Restraints

- 4.1.2.1. High Cost of Raw Material

- 4.1.2.2. Negative Effects of Ethylene Glycol

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Monoethylene Glycol (MEG)*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Diethylene Glycol (DEG)

- 7.4. Triethylene Glycol (TEG)

- 7.5. Others

8. By Technology

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 8.1.2. Market Attractiveness Index, By Technology

- 8.2. Gas-Based*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Naptha-Based

- 8.4. Coal-Based

- 8.5. Bio-Based

- 8.6. Methanol-Based

- 8.7. Others

9. By Application

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.1.2. Market Attractiveness Index, By Application

- 9.2. Solvent Coupler*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.2.3. Stabilizer

- 9.2.4. Freezing Point Depression

- 9.2.5. Heat Transfer Agent

- 9.2.6. Antifreeze and Coolants

- 9.2.7. Others

- 9.3. Chemical Intermediate

- 9.3.1. Polyester Resins

- 9.3.2. Alkyd-Resins

- 9.3.3. Others

- 9.4. Solvent

- 9.5. Humectant

- 9.5.1. Adhesives

- 9.5.2. Textile Fibers

- 9.5.3. Printing Inks

- 9.5.4. Others

- 9.6. Others

10. By End-User

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.1.2. Market Attractiveness Index, By End-User

- 10.2. Transportation*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Packaging

- 10.4. Oil & Gas

- 10.5. Building and Construction

- 10.6. Food & Beverages

- 10.7. Sports

- 10.8. Fabric & Textiles

- 10.9. Personal Care & Cosmetics

- 10.10. Medical & healthcare

- 10.11. Others

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Russia

- 11.3.7.5. Spain

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Technology

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Saudi Basic Industries Corporation*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. Shell plc

- 13.3. Dow Chemical Company

- 13.4. BASF SE

- 13.5. Sinopec Corp

- 13.6. Reliance Industries Limited

- 13.7. Mitsubishi Chemical Corporation

- 13.8. LyondellBasell Industries Holdings B.V.

- 13.9. Lotte Chemical Corporation

- 13.10. Huntsman Corporation

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us