|

|

市場調査レポート

商品コード

1423449

濃縮コーヒーの世界市場 2023年~2030年Global Coffee Concentrate Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 濃縮コーヒーの世界市場 2023年~2030年 |

|

出版日: 2024年02月09日

発行: DataM Intelligence

ページ情報: 英文 246 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

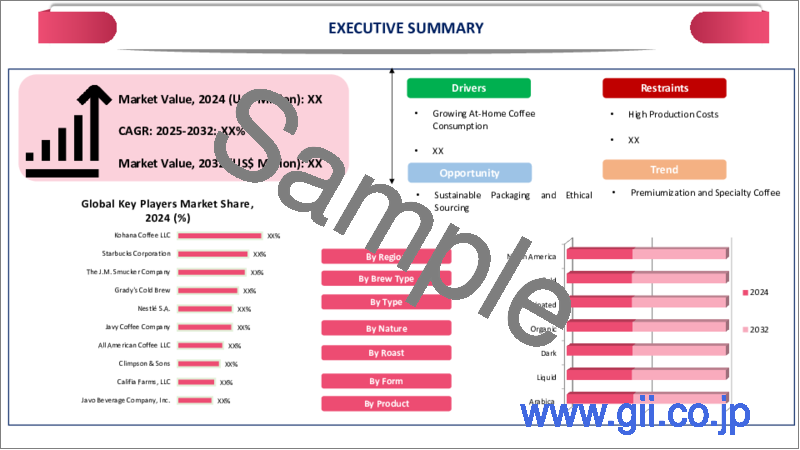

世界の濃縮コーヒー市場は2022年に27億米ドルに達し、2023年~2030年の予測期間中にCAGR 4.7%で成長し、2030年には39億米ドルに達すると予測されています。

濃縮コーヒーはコーヒーを濃縮したもので、事前に抽出し、使用前に希釈する必要があります。濃縮コーヒーは、簡単で継続的な製品の使用を好む人々にとって便利なコーヒーの使用方法です。コーヒー濃縮物は、液体や粉末など複数の形態でさまざまな品種があるため、消費者はさまざまな嗜好やニーズに対応できます。

コーヒー濃縮物は、水やミルクで希釈したり、ホットやコールドで飲んだり、カクテルやスムージーなど複数のレシピで使用するなどの多様な使い方ができるため、世界レベルでの市場拡大を後押ししています。加えて、消費者の所得と購買力の増加に伴い、日常生活でより多くの高級品に注目が集まっています。

北米におけるコーヒー消費嗜好の高まりは、主要企業の新製品発売により、同地域の濃縮コーヒー市場の成長にプラスの影響を与えました。例えば、2020年6月、スターバックスは米国市場でコールドブリューコンセントレートラインを発売し、そのポートフォリオに新製品を追加しました。スターバックスは、自宅でバリスタスタイルのドリンクを作りたいという消費者の嗜好に注目しました。

市場力学

世界のコーヒー消費量の増加

コーヒーは、人体と健康に機能的な利点をもたらすため、世界で広く好まれている飲料です。コーヒーは、そのカフェイン含有量により、疲労に対処し、エネルギーレベルを高めるために消費者に好まれています。また、2型糖尿病やうつ病のリスクを下げ、体重管理に役立つという健康上のメリットもあります。

コーヒーの効能に関する消費者の意識が高まるにつれ、コーヒーの消費量は世界的に急増しています。国際コーヒー機関によると、世界のコーヒー生産量は2021年~2022年に1億6,850万袋に達し、2022年~2023年には1億7,130万袋に達すると予想されています。さらに同機構は、2021年~2022年の世界コーヒー消費量は4.2%増の1億7,560万袋に達したとも報告しています。

濃縮コーヒーは便利で使いやすいため、どこでも快適なコーヒー体験を求める人々に人気があります。濃縮コーヒーが便利に提供する高品質でプレミアムなコーヒー体験は、市場成長を積極的に後押しします。

消費者の便利な製品に対する高い需要

労働人口の増加と消費者の多忙なライフスタイルに伴い、使いやすい製品に対するニーズと需要が急速に高まっています。多忙なライフスタイルを送る消費者は、便利ですぐに入手できる性質を持つ濃縮コーヒーを選びます。伝統的な淹れ方に関係なく、濃縮コーヒーは簡単に準備でき、持ち運びにも適しています。

コーヒー濃縮物は、ゼロからの準備なしで即座に使用されます。濃縮コーヒーは、1回分ずつのパックや携帯用パウチ、ボトルなど、便利な形態で販売されているため、事前の準備なしにどこへでも簡単に持ち運びができ、コーヒーの味や濃さなどの好みに合わせてすぐにコーヒーを楽しむことができます。

淹れたてコーヒーに対する価格感応度と消費者嗜好

濃縮コーヒーは多くの消費者に好まれているが、同時に、レギュラー・コーヒーに比べて価格が高いことや、淹れたてのコーヒー体験に対する需要が高いことから、消費者の認知度が低く、製品に対する嗜好性が低いという課題にも直面しています。コーヒー愛好家の多くは、すぐに手に入るものではなく、淹れたてのコーヒーを好みます。新鮮で熱いコーヒーの消費の必要性は、製品の需要を削減します。

世界的に、消費者は新鮮なコーヒーを感じ、友人や家族との社交性を維持するためにコーヒーショップやカフェを訪れることを好みます。2022年春の全米コーヒーデータ動向では、自宅以外でコーヒーを飲む機会が増えたアメリカ人が8%増加したと報告されています。さらに、全米コーヒーデータ動向報告書によると、米国では消費者のコーヒーショップへの来店とコーヒー消費量が合計で20%増加しています。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 世界のコーヒー消費量の増加

- 消費者の便利な製品への高い需要

- 抑制要因

- 淹れたてのコーヒーに対する価格感応度と消費者の嗜好性

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 豆類別

- ロブスタ

- エクセルサ

- リベリカ

- アラビカ

第8章 ロースト別

- ダーク

- ミディアム

- ライト

第9章 淹れ方別

- コールド

- ドリップ

- フレンチプレス

- エスプレッソ

- ポアオーバー

第10章 形態別

- 液体

- 粉末

第11章 タイプ別

- カフェイン入り

- カフェインレス

第12章 製品別

- 濃縮ドルチェアイスコーヒー

- 濃縮ブラックコーヒー

- コールドブリューコーヒー

- トップローストコーヒー

第13章 流通チャネル別

- スーパーマーケット/ハイパーマーケット

- カフェとフードサービス

- コンビニエンスストア

- 専門店

- その他

第14章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第15章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第16章 企業プロファイル

- Tata Nutrikorner

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Javy Coffee Company

- Grady's Cold Brew

- Kohana Coffee

- The J.M. Smucker Company

- Nestle

- MONIN INCORPORATED.

- Climpson & Sons

- Beangood Private Limited

- Kerry Group plc

第17章 付録

Overview

Global Coffee Concentrate Market reached US$ 2.7 billion in 2022 and is expected to reach US$ 3.9 billion by 2030, growing with a CAGR of 4.7% during the forecast period 2023-2030.

Coffee concentrates are the concentrated form of the coffee that is brewed priorly and needs to be diluted before use. Coffee concentrates are a convenient mode of coffee use for people with a preference for easy and ongoing product usage. The availability of coffee concentrate in multiple forms such as in liquid and powder forms in different varieties helps the consumer to deal with various preferences and needs.

The versatility offered by the coffee concentrates for its use in multiple ways by diluting them with water or milk, consuming them hot or cold and its use in multiple recipes such as cocktails, smoothies and other product preparations boost the market expansion in the global level. In addition, with the increasing income and purchasing power of the consumers, they attract more of the premium range of products in daily life.

The increasing coffee consumption preference in North America positively impacted the coffee concentrate market growth in the region with new product launches from major players. For instance, in June 2020, Starbucks added a new product to its portfolio with the introduction of the Cold Brew Concentrate line in U.S. market that is available in nationwide groceries. The producer focussed on the interest of consumers preference for preparing barista-style drinks at home.

Dynamics

Increasing Global Coffee Consumption

Coffee is a widely preferred beverage in the world due to its functional benefits to the human body and health. Coffee is preferred by consumers to deal with their tiredness and increase their energy levels due to its caffeine content. It also provides health benefits by lowering the risk of type 2 diabetes and depression and helps in weight management.

With the increased consumer awareness regarding the benefits of coffee, there is a rapid increase in coffee consumption globally. According to the International Coffee Organization, world coffee production reached 168.5 million bags in the coffee year 2021-22 and is expected to reach 171.3 million bags in 2022-23. Further, the organization also reported that world coffee consumption increased by 4.2 % to 175.6 million bags in 2021-2022.

The convenient and easy-to-use nature of concentrated coffee makes it popular among people in search of a comfortable coffee experience anywhere and everywhere. The high quality and premium coffee experience offered by the coffee concentrate conveniently positively drives the market growth.

High Demand for Convenient Products Among Consumers

With the increasing working population and hectic lifestyle of consumers, the need and demand for products that are easy to use is increasing rapidly. Consumers with busy lifestyles opt for coffee concentrates due to their convenient and readily available nature. Irrespective of the traditional brewing methods, coffee concentrate is easy to prepare and is considered an on-to-go option.

The coffee concentrate is used instantly without any preparation from scratch. The availability of the coffee concentrates in convenient options such as single-serve packets, portable pouches and bottles make it easy to carry it along anywhere without any prior preparations and enjoy the coffee experience instantly according to one preferences over coffee taste and strength.

Price Sensitivity and Consumer Preference Towards Freshly Brewed Coffee

The coffee concentrate is highly preferred by a huge population base, but at the same time, the market also faces challenges with lower consumer awareness and less consumer preference towards the product due to its high price compared to regular coffee and demand for high demand for freshly brewed coffee experience. Most of the coffee lovers prefer coffee that is freshly brewed instead of readily available. The need for fresh and hot coffee consumption reduces the product demand.

Globally, consumers prefer visiting coffee shops and cafes for a fresh coffee feel and to maintain socialization with friends and family. The Spring 2022 National Coffee Data Trends reported that there is an increase of 8% of Americans who have increased their coffee consumption away from home. Further, according to the National Coffee Data Trends report, in U.S. there is a total of 20% increase in consumer visits and coffee consumption in coffee shops.

Segment Analysis

The global coffee concentrate market is segmented based on bean, roast, brew, form, type, product, distribution channel and region.

Superior Taste and Texture of Arabica Beans

The global coffee concentrate market is segmented based on beans into Robusta, Liberia, Arabica and others. The Arabica bean segment of the global coffee concentrate accounted for the largest share due to its superior taste and texture. Arabica beans are highly preferred by consumers due to their delicate and fruity flavors. The low caffeine content in the Arabica bean compared to that of others increases its demand among people wanting to control their caffeine intake considering the taste of the coffee.

The high demand for Arabica beans in the market results in the new and improved product launches of coffee concentrate with the use of Arabica beans. For instance, in May 2023, Estate '98, an American launched Ultra-Concentrated Coffee which is made from made from 100% Arabica beans. The product offers a sustainable and convenient way to make tasty and quality coffee in less time.

Geographical Penetration

Increasing Demand for the Convenient Coffee Products in North America

North America dominated the global coffee concentrate market. The regional market demand is primarily driven by the increasing adoption of coffee culture among regional consumers. In addition, the high demand for convenient and ready-to-use products in this region due to hectic lifestyles helps in expanding the growth of coffee concentrate with its simple and easy-to-use nature.

According to USDA December 2023 statistics, 24,000 60-kg bag beans were imported into U.S. during 2023-2024 as the domestic consumption was reported to be 25,475 60-kg bean bags. According to the National Coffee Association, more than any other beverage, 66% of Americans drink coffee each day as of March 2022. With the increasing coffee consumption, the imports of coffee beans for the region also increasing to meet the demand.

The new product launches in the regional retail market are expanding the market size. For instance, in August 2023, Tim Hortons, North America's largest restaurant chain introduced Tim Hortons Cold Brew Concentrate in the U.S. The new product coffee concentrate is available in four new flavors such as Medium Blend Black, Birthday Cake, Cinnamon Swirl, and Mocha Cereal. The product is available in almost 50 states in U.S. retail market.

Competitive Landscape

The major global players in the market include Tata Nutrikorner, Javy Coffee Company, Grady's Cold Brew, Kohana Coffee, The J.M. Smucker Company, Nestle, MONIN INCORPORATED., Climpson & Sons, Beangood Private Limited and Kerry Group plc.

COVID-19 Impact Analysis

The COVID-19 pandemic has both positive and negative impacts on the global coffee concentrate market. The market faced challenges during the pandemic situation due to sudden lockdown conditions and interrupted industrial and retail processes. The disrupted supply chain activities reduced the raw material procurement for product production.

The production plants were temporarily shut down causing a greater loss for the manufacturers. The pandemic resulted in the shutdown of cafes and coffee shops due to strict lockdown restrictions by government organisations. The unavailability of fresh rewed products in the lockdown condition created a greater need and demand for readily available and convenient products.

The new products during the pandemic time to meet the increased demand of the product expanded the market size. For instance, in September 2020, in mid-pandemic time, a Singapore-based startup, Wake The Crew was established with a vision to provide high-quality coffee concentrates to customers through an e-commerce platform.

By Bean

- Robusta

- Excelsa

- Liberica

- Arabica

By Roast

- Dark

- Medium

- Light

By Brew

- Cold

- Drip

- French Press

- Espresso

- Pour Over

By Form

- Liquid

- Powder

By Type

- Caffeinated

- Decaffeinated

By Product

- Dolce Iced Coffee Concentrate

- Black Coffee Concentrate

- Cold Brew Coffee Concentrate

- Top Roast Coffee Concentrate

By Distribution Channel

- Supermarket/Hypermarket

- Cafes and Foodservice

- Convenience Stores

- Specialty Stores

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In April 2023, Wake the Crew, a Singapore-based coffee concentrate startup announced its plans to expand into the South East Asia region through supermarkets to incraese their retail sales.

- In June 2023, Monin, a French-based company announced the introduction of its new seasonal coffee concentrate products into the market to keep the growing demand for the products in the market. The new product launches are with various flavours including maple pumpkin cold brew coffee concentrate.

- In May 2021, Finlay, one of the leading manufacturers of powdered and liquid soluble coffee, announced to expansion into the European region by helping European brand owners capitalize on the cold brew coffee opportunity with a major investment in its U.K. facility.

Why Purchase the Report?

- To visualize the global coffee concentrate market segmentation based on the bean, roast, brew, form, type, product, distribution channel and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of coffee concentrate market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

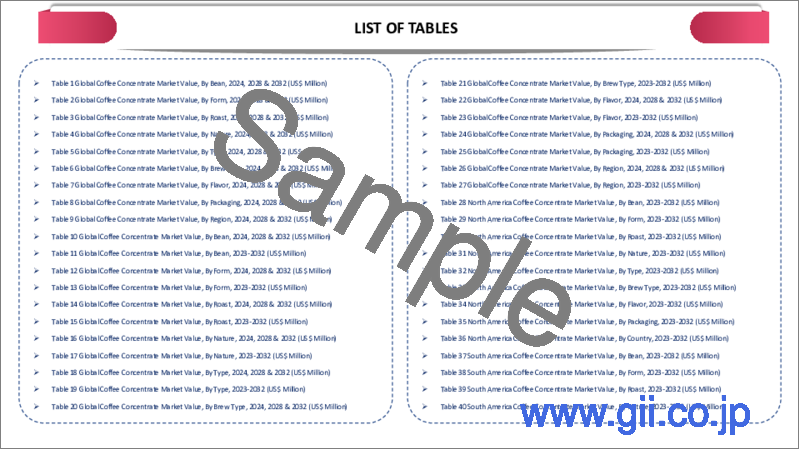

The global coffee concentrate market report would provide approximately 94 tables, 96 figures and 246 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Bean

- 3.2. Snippet by Roast

- 3.3. Snippet by Brew

- 3.4. Snippet by Form

- 3.5. Snippet by Type

- 3.6. Snippet by Product

- 3.7. Snippet by Distribution Channel

- 3.8. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Global Coffee Consumption

- 4.1.1.2. High Demand for Convenient Products Among Consumers

- 4.1.2. Restraints

- 4.1.2.1. Price Sensitivity and Consumer Preference Towards Freshly Brewed Coffee

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Bean

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bean

- 7.1.2. Market Attractiveness Index, By Bean

- 7.2. Robusta

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Excelsa

- 7.4. Liberica

- 7.5. Arabica

8. By Roast

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Roast

- 8.1.2. Market Attractiveness Index, By Roast

- 8.2. Dark

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Medium

- 8.4. Light

9. By Brew

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Brew

- 9.1.2. Market Attractiveness Index, By Brew

- 9.2. Cold

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Drip

- 9.4. French Press

- 9.5. Espresso

- 9.6. Pour Over

10. By Form

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 10.1.2. Market Attractiveness Index, By Form

- 10.2. Liquid

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Powder

11. By Type

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.1.2. Market Attractiveness Index, By Type

- 11.2. Caffeinated

- 11.2.1. Introduction

- 11.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 11.3. Decaffeinated

12. By Product

- 12.1. Introduction

- 12.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 12.1.2. Market Attractiveness Index, By Product

- 12.2. Dolce Iced Coffee Concentrate

- 12.2.1. Introduction

- 12.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 12.3. Black Coffee Concentrate

- 12.4. Cold Brew Coffee Concentrate

- 12.5. Top Roast Coffee Concentrate

13. By Distribution Channel

- 13.1. Introduction

- 13.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 13.1.2. Market Attractiveness Index, By Distribution Channel

- 13.2. Supermarket/Hypermarket

- 13.2.1. Introduction

- 13.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 13.3. Cafes and Foodservice

- 13.4. Convenience Stores

- 13.5. Specialty Stores

- 13.6. Other

14. By Region

- 14.1. Introduction

- 14.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 14.1.2. Market Attractiveness Index, By Region

- 14.2. North America

- 14.2.1. Introduction

- 14.2.2. Key Region-Specific Dynamics

- 14.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bean

- 14.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Roast

- 14.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Brew

- 14.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 14.2.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.2.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.2.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.2.10.1. U.S.

- 14.2.10.2. Canada

- 14.2.10.3. Mexico

- 14.3. Europe

- 14.3.1. Introduction

- 14.3.2. Key Region-Specific Dynamics

- 14.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bean

- 14.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Roast

- 14.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Brew

- 14.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 14.3.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.3.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.3.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.3.10.1. Germany

- 14.3.10.2. U.K.

- 14.3.10.3. France

- 14.3.10.4. Italy

- 14.3.10.5. Spain

- 14.3.10.6. Rest of Europe

- 14.4. South America

- 14.4.1. Introduction

- 14.4.2. Key Region-Specific Dynamics

- 14.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bean

- 14.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Roast

- 14.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Brew

- 14.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 14.4.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.4.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.4.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.4.10.1. Brazil

- 14.4.10.2. Argentina

- 14.4.10.3. Rest of South America

- 14.5. Asia-Pacific

- 14.5.1. Introduction

- 14.5.2. Key Region-Specific Dynamics

- 14.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bean

- 14.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Roast

- 14.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Brew

- 14.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 14.5.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.5.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 14.5.10. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 14.5.10.1. China

- 14.5.10.2. India

- 14.5.10.3. Japan

- 14.5.10.4. Australia

- 14.5.10.5. Rest of Asia-Pacific

- 14.6. Middle East and Africa

- 14.6.1. Introduction

- 14.6.2. Key Region-Specific Dynamics

- 14.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Bean

- 14.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Roast

- 14.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Brew

- 14.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Form

- 14.6.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 14.6.8. Market Size Analysis and Y-o-Y Growth Analysis (%), By Product

- 14.6.9. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

15. Competitive Landscape

- 15.1. Competitive Scenario

- 15.2. Market Positioning/Share Analysis

- 15.3. Mergers and Acquisitions Analysis

16. Company Profiles

- 16.1. Tata Nutrikorner

- 16.1.1. Company Overview

- 16.1.2. Product Portfolio and Description

- 16.1.3. Financial Overview

- 16.1.4. Key Developments

- 16.2. Javy Coffee Company

- 16.3. Grady's Cold Brew

- 16.4. Kohana Coffee

- 16.5. The J.M. Smucker Company

- 16.6. Nestle

- 16.7. MONIN INCORPORATED.

- 16.8. Climpson & Sons

- 16.9. Beangood Private Limited

- 16.10. Kerry Group plc

LIST NOT EXHAUSTIVE

17. Appendix

- 17.1. About Us and Services

- 17.2. Contact Us