|

|

市場調査レポート

商品コード

1401321

硝化抑制剤の世界市場:2023年~2030年Global Nitrification Inhibitors Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 硝化抑制剤の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 186 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

世界の硝化抑制剤の市場規模は、2022年に6億276万米ドルに達し、2023年~2030年の予測期間中にCAGR3.4%で成長し、2030年には7億8,760万米ドルに達すると予測されています。

硝化抑制剤は、アンモニア、アンモニウム含有肥料、尿素含有肥料の硝化を抑制するために使用される化学化合物であるため、世界の硝化抑制剤市場は長年にわたって大きな成長を遂げています。

さらに、これらの製品に対する需要が増加しているため、メーカーはこの製品に高い投資を行っています。例えば、2023年12月、Fertiberiaは、硝化抑制剤として作用し、窒素を土壌に保持し、土壌や空気中に溶出するのを防ぐ微生物学的開発品であるNSAFEを発売しました。このように、こういった製品が市場成長の拡大を支えています。

DMPP硝化抑制剤は世界市場で最大のシェアを占めており、アジア太平洋は広大な農地が存在し、政府の支援を受けているため、世界の硝化抑制剤市場で優位性を示しています。

力学

硝酸塩に関連する悪影響に対する懸念の高まり

硝酸塩関連の悪影響に対する懸念が高まっています。例えば、英国心臓財団(British Heart Foundation)によると、硝酸塩の副作用には頭痛、めまいやふらつき、顔面紅潮、顔の温感などがあります。したがって、このような副作用により、硝化抑制剤の採用率が高まっています。

さらに、硝酸塩に関する懸念が顧客の間で高まっているため、アンモニウムから硝酸塩への変換を遅延させ、また硝化抑制剤は地下水への硝酸塩の溶出を減らすのに役立つことから、多くの農家がこれらの硝化抑制剤を多く導入しています。したがって、このような要因が、市場成長の拡大に役立っています。

高い作物生産性への需要増加

より高い作物生産性への需要が増加しており、例えば、2022年の農業・農民福祉省の報告書によると、果物や野菜の生産量が増加しています。果物の生産量は2020年~2021年の1億248万トンに対して1億710万トンと推定され、野菜の生産量は、2020年~2021年の2億45万トンに対して2億461万トンと推定されています。

さらに、農作物生産の需要が増加しているため、農家はこうした硝化抑制剤製品の採用に意欲を示しています。硝化抑制剤製品は土壌の硝化プロセスを減速または抑制するため、作物へのアンモニア態窒素の供給量を増加させ、窒素利用効率を向上させる可能性があります。

政府規制

政府規制は、実際に世界の硝化抑制剤市場に影響を与える可能性があります。規制措置は環境問題に対処し、持続可能な農業を促進し、農業投入物の責任ある使用を確保するために実施されることが多くあり、世界の硝化抑制剤市場の成長に影響を与える可能性があります。

さらに、カナダ政府は、例えば、T-4-127-肥料法・規則に基づく硝化・ウレアーゼ抑制剤の規制など、いくつかの規制を定めています。その結果、肥料とサプリメントのすべての製造業者、輸入業者、流通業者、販売業者を含む規制対象者は、改正された肥料規則を遵守しなければならなくなりました。

目次

第1章 調査手法と調査範囲

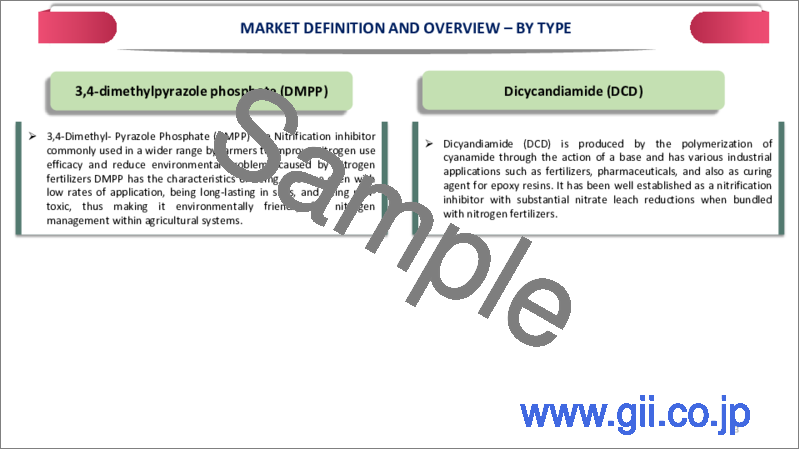

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 硝酸塩関連の悪影響に対する懸念の高まり

- 高い農作物生産性への需要増加

- 抑制要因

- 政府規制

- 機会

- 影響分析

- 促進要因

第5章 産業分析

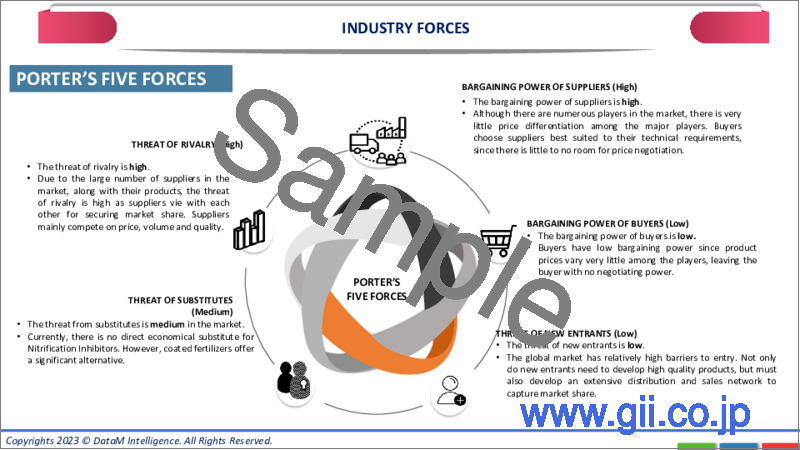

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ニトラピリン

- ジシアンジアミド(DCD)

- DMPP

- その他

第8章 流通チャネル別

- ハイパーマーケット・スーパーマーケット

- 専門店

- その他

第9章 作物タイプ別

- 穀物・ミレット・油糧種子

- 綿花

- 果物・野菜

- プランテーション作物

- 豆類

- その他

第10章 用途別

- 農業

- 園芸

第11章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

第12章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第13章 企業プロファイル

- Koch Industries, Inc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- COMPO EXPERT GmbH

- BASF SE

- EuroChem Group

- Corteva.

- Nico Orgo

- Solvay

- Zhejiang Aofutuo Chemical Co., Ltd.

- Agrichem

- Arclin, Inc.

第14章 付録

Overview

Global Nitrification Inhibitors Market reached US$ 602.76 million in 2022 and is expected to reach US$ 787.60 million by 2030, growing with a CAGR of 3.4% during the forecast period 2023-2030.

The global nitrification inhibitors market has witnessed significant growth over the years, as nitrification inhibitors are chemical compounds that are used to reduce the nitrification of ammonia, ammonium-containing, and urea-containing fertilizers. which can help in improving the crop yield, hence, such factors can help in driving the global nitrification inhibitor market.

Furthermore, as the demand is increasing for these products manufacturers are highly investing in this product. For instance, in December 2023, Fertiberia company launched NSAFE, a microbiological development that acts as a nitrification inhibitor, retaining nitrogen in the soil and preventing it from leaching out in the soil or air. Hence, such products can help in increasing the market growth.

The DMPP nitrification inhibitor accounts the largest share in global market, as well as Asia-Pacific region showa the dominance in global nitrification inhibitor market, as the region have a presence of vast agricultural lands, and government suupport, which can help in increasing the market for global nitrification inhibitors.

Dynamics

Growing Concern About the Negative Affects Associated Nitrate

The growing concerns about the adverse effects associated with nitrates. For instance, according to the British Heart Foundation side effects of nitrates include headaches, dizziness or light-headedness, flushing, or a warm feeling in the face. Hence such adverse effects can help increase the adoption rate of nitrification inhibitors

Furthermore, as the concerns related to nitrates are increasing among customers, many farmers are highly adopting these nitrification inhibitors as they delay the conversion of ammonium to nitrate, also nitrification inhibitors can help reduce the leaching of nitrate into groundwater. Hence, such factors can help in increasing the market growth.

Increase in Demand for High Crop Productivity

The demand for higher crop productivity is increasing, for instance, according to the Ministry of Agriculture & Farmers Welfare report of 2022, an increase in the production of Fruits and vegetables. fruit production is estimated to be 107.10 Million Tonne compared to 102.48 Million Tonne in 2020-21. and Vegetable production is estimated to be 204.61 Million tonnes, compared to. 200.45 Million Tonne in 2020-21.

Furthermore, as the demand for crop production is increasing, farmers are showing more willingness to adopt these nitrification inhibitor products, as they slow down or inhibit the nitrification process in soil. and helps in increasing the availability of ammonium nitrogen to crops, potentially improving nitrogen use efficiency. which can help in enhancing crop productivity.

Government Regulations

Government regulations can indeed have an impact on the global nitrification inhibitors market. Regulatory measures are often implemented to address environmental concerns, promote sustainable agriculture, and ensure the responsible use of agricultural inputs. Which could affect the growth of the global nitrification inhibitors market.

Furthermore, the government of Canada has provided some regulations, for instance, T-4-127 - Regulation of nitrification and urease inhibitors under the Fertilizers Act and Regulations. As a result, regulated parties, including all manufacturers, importers, distributors and sellers of fertilizers and supplements must adhere to the amended fertilizers regulations.

Segment Analysis

The global Nitrification Inhibitors market is segmented based on type, distribution channel, crop type, application and region.

Increase in Demand for Effective Crop Nutrition

The DMPP nitrification inhibitors show dominance in the global nitrification inhibitor market, farmers are highly adopting these inhibitors to help improve NUE by inhibiting the conversion of ammonium to nitrate in the soil. This, in turn, allows for a more prolonged availability of ammonium nitrogen for plant uptake, also, they can applied for a wide range of crops which can help in increasing the adoption rate. Hence, such factors can help in increasing the market growth.

Furthermore, manufacturing companies are producing innovative products to attract larger consumer bases. For instance, the ICL company produces Nova Complex Optima. It contains a state-of-the-art nitrification inhibitor (DMPP) to reduce nitrogen loss from leaching and to improve the supply of nitrogen, also designed to let you control the risk of nitrate leaching, which is vital in preventing groundwater contamination. Hence, such products can help in gaining popularity for nitrification inhibitors.

Geographical Penetration

Vast Agricultural Land, Government Initiatives in Asia-Pacific

Asia-Pacific region shows the dominance in global nitrification inhibitors market, due to the presence of vast agricultural lands and government support, farmers in this region are highly adopting these nitrification inhibitors, also they can help slow the process of nitrates and improve the availability of nitrogen to crop which can help in improving the crop yield, hence, such factors can help in driving the market growth in this region.

Furthermore, the presence of vast agricultural lands in this region, for instance, according to the Department of Agriculture, Fisheries and Forestry report, Australia has 427 million hectares of agricultural lands, hence, such presence of vast agricultural lands can help in increasing the adoption rate for nitrification inhibitors.

Additionally, the government in this region also provides some initiatives to help the farmers to adopt the fertilizers. For instance, the government of India has provided the Pradanmantri Kisan Samrudhi Kendra (PMKSK), this scheme provides agri-inputs (fertilizers, seeds, implements) including testing facilities for soil, seeds, and fertilizers. These Kendras will also help create awareness among the farmers. Hence, such schemes can help in increasing the market growth.

Competitive Landscape

The major global players in the market include Koch Industries, Inc., COMPO EXPERT GmbH, BASF SE, EuroChem Group, Corteva., Nico Orgo, Solvay, Zhejiang Aofutuo Chemical Co., Ltd., Agrichem, and Arclin, Inc.

COVID-19 Impact Analysis

The pandemic has brought unprecedented challenges for industries worldwide, including the global nitrification inhibitors market. Also, during a pandemic, many manufacturing companies are shut down which has brought a distribution in the supply chain of the products, which can hamper the availability of products in the market which can affect the global nitrification inhibitors market.

By Type

- Nitrapyrin

- Dicyandiamide (DCD)

- DMPP

- Others

By Distribution Channel

- Hypermarket/Supermarket

- Specialty Stores

- Others

By Crop Type

- Cereals, Millets & Oilseeds

- Cotton

- Fruits & Vegetables

- Plantation Crops

- Pulses

- Others

By Application

- Agriculture

- Horticulture

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In December 2023, Yara acquired the organic-based fertilizer business of Agribios Italiana,. This signifies Yara's commitment to further expand its offering in this sector as a complement to its mineral fertilizers to help promote regenerative agriculture and improve soil health.

- In November 2023, A pilot project has been initiated in China by BASF and Yunnan Yuntianhua Co., Ltd., a chemical fertilizer manufacturer based in China, to confirm that using Yuntianhua's stabilized urea fertilizer, which contains BASF's urease inhibitor Limus®, reduces CO2 emissions. It is anticipated that the outcomes will help China's climate smart agricultural activities as well as potential for program development worldwide.

- In September 2023, Nouryon acquired ADOB Fertilizers. This acquisition will enable Nouryon to expand its product portfolio and broaden its offerings for customers in the crop nutrition market.

Why Purchase the Report?

- To visualize the global nitrification inhibitors market segmentation based on type, distribution channel, crop type, application, and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of nitrification inhibitors market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as Excel consisting of key products of all the major players.

The global Nitrification Inhibitors market report would provide approximately 68 tables, 69 figures and 186 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Distribution Channel

- 3.3. Snippet by Crop Type

- 3.4. Snippet by Application

- 3.5. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing Concern About the Negative Effects Associated with Nitrate

- 4.1.1.2. Increase in Demand for High Crop Productivity

- 4.1.2. Restraints

- 4.1.2.1. Government Regulations

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Nitrapyrin*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Dicyandiamide (DCD)

- 7.4. DMPP

- 7.5. Others

8. By Distribution Channel

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 8.1.2. Market Attractiveness Index, By Distribution Channel

- 8.2. Hypermarket/Supermarket*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Specialty Stores

- 8.4. Others

9. By Crop Type

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop Type

- 9.1.2. Market Attractiveness Index, By Crop Type

- 9.2. Cereals, Millets & Oilseeds*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Cotton

- 9.4. Fruits & Vegetables

- 9.5. Plantation Crops

- 9.6. Pulses

- 9.7. Others

10. By Application

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.1.2. Market Attractiveness Index, By Application

- 10.2. Agriculture*

- 10.2.1. Introduction

- 10.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 10.3. Horticulture

11. By Region

- 11.1. Introduction

- 11.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 11.1.2. Market Attractiveness Index, By Region

- 11.2. North America

- 11.2.1. Introduction

- 11.2.2. Key Region-Specific Dynamics

- 11.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop Type

- 11.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.2.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.2.7.1. U.S.

- 11.2.7.2. Canada

- 11.2.7.3. Mexico

- 11.3. Europe

- 11.3.1. Introduction

- 11.3.2. Key Region-Specific Dynamics

- 11.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop Type

- 11.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.3.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.3.7.1. Germany

- 11.3.7.2. UK

- 11.3.7.3. France

- 11.3.7.4. Italy

- 11.3.7.5. Russia

- 11.3.7.6. Rest of Europe

- 11.4. South America

- 11.4.1. Introduction

- 11.4.2. Key Region-Specific Dynamics

- 11.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop Type

- 11.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.4.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.4.7.1. Brazil

- 11.4.7.2. Argentina

- 11.4.7.3. Rest of South America

- 11.5. Asia-Pacific

- 11.5.1. Introduction

- 11.5.2. Key Region-Specific Dynamics

- 11.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop Type

- 11.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 11.5.7. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 11.5.7.1. China

- 11.5.7.2. India

- 11.5.7.3. Japan

- 11.5.7.4. Australia

- 11.5.7.5. Rest of Asia-Pacific

- 11.6. Middle East and Africa

- 11.6.1. Introduction

- 11.6.2. Key Region-Specific Dynamics

- 11.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 11.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Distribution Channel

- 11.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Crop Type

- 11.6.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

12. Competitive Landscape

- 12.1. Competitive Scenario

- 12.2. Market Positioning/Share Analysis

- 12.3. Mergers and Acquisitions Analysis

13. Company Profiles

- 13.1. Koch Industries, Inc*

- 13.1.1. Company Overview

- 13.1.2. Product Portfolio and Description

- 13.1.3. Financial Overview

- 13.1.4. Key Developments

- 13.2. COMPO EXPERT GmbH

- 13.3. BASF SE

- 13.4. EuroChem Group

- 13.5. Corteva.

- 13.6. Nico Orgo

- 13.7. Solvay

- 13.8. Zhejiang Aofutuo Chemical Co., Ltd.

- 13.9. Agrichem

- 13.10. Arclin, Inc.

LIST NOT EXHAUSTIVE

14. Appendix

- 14.1. About Us and Services

- 14.2. Contact Us