|

|

市場調査レポート

商品コード

1597144

北米のワックスエマルジョン市場:2031年までの予測 - 地域別分析 - タイプ別、用途別North America Wax Emulsion Market Forecast to 2031 - Regional Analysis - by Type (Polyethylene, Polypropylene, Paraffin, Vegetable-Based, and Others) and Application (Paints & Coatings, Printing Inks, Textile, Personal Care, Packaging, and Others) |

||||||

|

|||||||

| 北米のワックスエマルジョン市場:2031年までの予測 - 地域別分析 - タイプ別、用途別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 99 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のワックスエマルジョン市場は、2023年に4億514万米ドルとなり、2031年までには5億5,309万米ドルに達すると予測され、2023年から2031年までのCAGRは4.0%と推定されます。

塗料・コーティング産業の成長が北米のワックスエマルジョン市場を牽引

塗料・コーティング剤は装飾目的で使用され、耐食性、耐傷性、接着性、外観、耐水性などの表面特性を向上させます。建築、家具、包装、自動車、輸送、その他の産業用途など、最終用途産業での使用が増えています。ワックスエマルジョンは、塗料・コーティング剤に不可欠な成分です。ポリエチレンワックスエマルジョンは、物理的安定性、微粒子、防汚性、防水性、光沢、扱いやすさなどの特性により、水性塗料に使用されています。ワックスエマルジョンは、木材のつや出しや仕上げ、屋外での木材治療にも使用されます。ワックスエマルジョンは、木材に耐摩耗性、防水性、アンチブロッキング性を与えます。また、金属部品や自動車用塗料にも応用されています。電気自動車の世界の販売台数の増加により、高性能塗料や電気絶縁塗料の需要が高まっています。国際エネルギー機関(IEA)によると、電気自動車市場はここ数年で急成長を遂げており、2023年の世界販売台数は1,000万台を超えると報告されています。

米国国勢調査局によると、2023年1月から5月の米国の建設支出総額は7,408億米ドルに達しました。この投資は、オフィス、商業スペース、交通機関、高速道路、道路の開発に費やされました。世界の建設業界の成長は、建築用塗料・コーティングの需要を促進しています。2023年2月に発表された米国塗料協会の報告書によると、2021年、米国塗料業界は140億米ドル以上の建築用塗料、87億米ドルの工業用OEM塗料、40億米ドルの船舶用塗料、軍事用塗料、自動車補修用塗料などの特殊用途塗料を出荷しました。このように、塗料・コーティング産業の成長がワックスエマルジョン市場の原動力となっています。

北米のワックスエマルジョン市場概要

ワックスエマルジョンは、耐摩耗性、耐水性、耐久性など、材料の表面特性を高めるために塗料・コーティング剤に使用されます。自動車産業では、ポリエチレンワックスが研磨用途の非組立洗剤システムに使用されています。国際自動車工業連合会によると、北米の2023年の自動車生産台数は1,479万台でした。米国自動車政策評議会の報告書によると、自動車販売台数は2025年までに年間1,770万台を超えると予想されています。2023年に発表された国際貿易局のデータによると、自動車産業はメキシコの主要部門のひとつであり、同国のGDPの3.5%、製造業の国内総生産の20%を占めています。そのため、自動車生産の増加が塗料・コーティング剤の需要を牽引しています。米国塗料協会によると、建築用塗料は米国塗料業界の最大部門であり、年間生産量の50%以上を占めています。米国運輸省連邦道路局によると、米国政府は2021年に長期的なインフラ投資を包括する「インフラ投資・雇用法」に署名し、道路、橋梁、大量輸送機関、水インフラの建設に2023会計年度から2026会計年度で5,500億米ドルを提供しました。北米のメーカーは、工業用塗料の機能と性能を向上させるための研究開発に注力しています。工業用塗料は、自動車、包装、輸送機器、家電製品、家具、建築製品に使用される仕上げ剤やつや出し剤に含まれます。またこの地域には、International Paper Co、Westrock Co、Berry Global Group、Ball Corp、Crown Holdings Incといった大手包装企業が存在します。したがって、上記の要因は、予測期間中に北米のワックスエマルジョン市場の需要を促進すると予想されます。

北米のワックスエマルジョン市場の収益と2031年までの予測(金額)

北米のワックスエマルジョン市場のセグメンテーション

北米のワックスエマルジョン市場は、タイプ、用途、国に分類されます。

タイプ別では、北米のワックスエマルジョン市場は、ポリエチレン、ポリプロピレン、パラフィン、植物性、その他に区分されます。2023年には、その他セグメントが最大の市場シェアを占めています。

用途別では、北米のワックスエマルジョン市場は塗料・コーティング、印刷インキ、繊維、パーソナルケア、包装、その他に分類されます。塗料・コーティング分野が2023年に最大の市場シェアを占めました。

国別では、北米のワックスエマルジョン市場は米国、カナダ、メキシコに区分されます。2023年の北米のワックスエマルジョン市場シェアは米国が独占しました。

BASF SE、Hexion Inc、Repsol SA、Sasol Ltd、The Lubrizol Corp、Clariant AG、Michelman Inc、H&R Group、Productos Concentrol SA.は、北米のワックスエマルジョン市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のワックスエマルジョン市場情勢

- エコシステム分析

- 原材料サプライヤー

- ワックスエマルジョンメーカー

- ディストリビューター / サプライヤー

- 最終用途産業

- バリューチェーンのベンダー一覧

- ポーター分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

第5章 北米のワックスエマルジョン市場:主要市場力学

- 市場促進要因

- 塗料・コーティング産業の成長

- ポリエチレンワックスエマルジョンの需要増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- ワックスエマルジョン市場の革新

- 今後の動向

- バイオベースワックスエマルジョンの開発

- 影響分析

第6章 ワックスエマルジョン市場-北米分析

- 北米のワックスエマルジョン市場概要

- ワックスエマルジョン市場数量(キロトン)、2020年~2031年

- 北米のワックスエマルジョン市場数量予測・分析(キロトン)

- ワックスエマルジョン市場の収益、2020年~2031年

- 北米のワックスエマルジョン市場の予測・分析

第7章 北米のワックスエマルジョン市場数量・収益分析:タイプ別

- ポリエチレン

- ポリプロピレン

- パラフィン

- 植物性

- その他

第8章 北米のワックスエマルジョン市場収益分析:用途別

- 塗料・コーティング剤

- 印刷インキ

- テキスタイル

- パーソナルケア

- 包装

- その他

第9章 北米のワックスエマルジョン市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 新製品開発

第12章 企業プロファイル

- BASF SE

- Hexion Inc

- Repsol SA

- Sasol Ltd

- The Lubrizol Corp

- Clariant AG

- Michelman Inc

- H&R Group

- Productos Concentrol SA

第13章 付録

List Of Tables

- Table 1. North America Wax Emulsion Market Segmentation

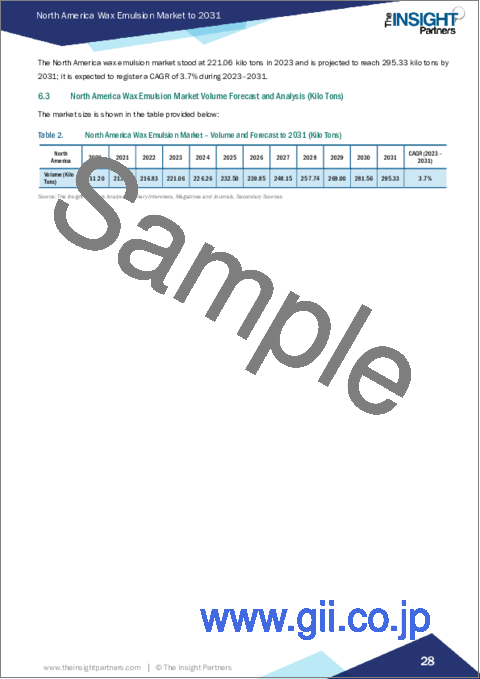

- Table 2. North America Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- Table 3. North America Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 5. Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 6. Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. North America Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons) - by Country

- Table 8. North America Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 9. United States Wax Emulsion Market -Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 10. United States Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 11. United States Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 12. Canada Wax Emulsion Market -Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 13. Canada Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 14. Canada Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 15. Mexico Wax Emulsion Market -Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 16. Mexico Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 17. Mexico Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 18. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. North America Wax Emulsion Market Segmentation, by Country

- Figure 2. Ecosystem: North America Wax Emulsion Market

- Figure 3. North America Wax Emulsion Market-Porter's Analysis

- Figure 4. North America Wax Emulsion Market - Key Market Dynamics

- Figure 5. Global Electric Car Sales (2016-2023)

- Figure 6. Wax Emulsion Market Impact Analysis of Drivers and Restraints

- Figure 7. Wax Emulsion Market Volume (Kilo Tons), 2020-2031

- Figure 8. Wax Emulsion Market Revenue (US$ Million), 2020-2031

- Figure 9. Wax Emulsion Market Share (%) - Type, 2023 and 2031

- Figure 10. Polyethylene: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 11. Polyethylene: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Polypropylene: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 13. Polypropylene: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Paraffin: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 15. Paraffin: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Vegetable-Based: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 17. Vegetable-Based: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Others: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 19. Others: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. North America Wax Emulsion Market Share (%) - Application, 2023 and 2031

- Figure 21. Paints & Coatings: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Printing Inks: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Textile: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Personal Care: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Packaging: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Others: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. North America Wax Emulsion Market, by Key Country - Revenue (2023) (US $ Million)

- Figure 28. North America Wax Emulsion Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 29. United States Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Canada Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Investment in building construction in Canada (2018-2023)

- Figure 32. Mexico Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Company Positioning & Concentration

The North America wax emulsion market was valued at US$ 405.14 million in 2023 and is expected to reach US$ 553.09 million by 2031; it is estimated to register a CAGR of 4.0% from 2023 to 2031.

Growth of Paints & Coatings Industry Fuel North America Wax Emulsion Market

Paints & coatings are used for decorative purposes and enhancing surface properties such as corrosion resistance, scratch-resistance, adhesion, appearance, and water resistance. Paints & coatings are increasingly used in end-use industries such as construction, furniture, packaging, automotive & transportation, and other industrial applications. Wax emulsions are an integral component of paints & coatings. Polyethylene wax emulsions are used in aqueous coatings due to their characteristics such as physical stability, fine particle size, anti-scuff properties, waterproofing, gloss, and ease of handling. Wax emulsions are also used in wood polishes and finishes and outdoor timber treatment. Wax emulsions render wood with abrasion resistance, waterproofing, and anti-blocking properties. It also finds application in metal components and automotive coatings. The growing global sales of electric vehicles drive the demand for high-performance coatings and electrical insulating coatings. According to the International Energy Agency, the electric car market has witnessed exponential growth in the past few years, with reported global sales of more than 10 million electric cars in 2023.

According to the US Census Bureau, the total construction spending in the US accounted for US$ 740.8 billion during the first five months of 2023. The investment was spent on the development of offices, commercial spaces, transportation, highways, and streets. The growth in the global construction industry propels the demand for architectural paints & coatings. According to the American Coatings Association report published in February 2023, in 2021, the US coatings industry shipped architectural coatings worth more than US$ 14 billion; industrial OEM coatings worth US$ 8.7 billion; and special purpose coatings such as marine paints, military-specified coatings, and automotive refinish paints worth US$ 4 billion. Thus, growth in the paints & coatings industry fuels the wax emulsion market.

North America Wax Emulsion Market Overview

Wax emulsions are used in paints & coatings to enhance the surface properties of materials, such as abrasion resistance, water resistance, and durability. In the automotive industry, polyethylene wax is used in non-built detergent systems for polishing applications. According to the International Organization of Motor Vehicle Manufacturers, North America registered a production of 14.79 million vehicles in 2023. As per a report by the American Automotive Policy Council, car sales are expected to exceed 17.7 million vehicles per year by 2025. According to the International Trade Administration data released in 2023, the automotive industry is one of the major sectors of Mexico, accounting for 3.5% of the country's GDP and 20% of the manufacturing gross domestic production. Therefore, the increasing automotive production is driving the demand for paints & coatings. According to the American Coatings Association, architectural coatings are the largest sector and segment of the paint industry in the US, accounting for more than 50% of the total volume of coatings produced annually. According to the US Department of Transportation Federal Highway Administration, the US Government signed the Infrastructure Investment and Jobs Act in 2021, encompassing long-term infrastructure investment, providing US$ 550 billion over fiscal years 2023-2026 for the construction of roads, bridges, and mass transit, and water infrastructure. North American manufacturers are focusing on research and development to improve the functionality and performance of industrial coatings. Industrial coatings are included in finishes and polishes used for automobiles, packaging, transport equipment, appliances, furniture, and building products. The region also marks the presence of major packaging companies, namely International Paper Co, Westrock Co, Berry Global Group, Ball Corp, and Crown Holdings Inc. Thus, the factors mentioned above are expected to drive the demand for the wax emulsion market in North America during the forecast period.

North America Wax Emulsion Market Revenue and Forecast to 2031 (US$ Million)

North America Wax Emulsion Market Segmentation

The North America wax emulsion market is categorized into type, application, and country.

Based on type, the North America wax emulsion market is segmented into polyethylene, polypropylene, paraffin, vegetable-based, and others. The others segment held the largest market share in 2023.

In terms of application, the North America wax emulsion market is categorized into paints & coatings, printing inks, textile, personal care, packaging, and others. The paints & coatings segment held the largest market share in 2023.

By country, the North America wax emulsion market is segmented into the US, Canada, and Mexico. The US dominated the North America wax emulsion market share in 2023.

BASF SE, Hexion Inc, Repsol SA, Sasol Ltd, The Lubrizol Corp, Clariant AG, Michelman Inc, H&R Group, and Productos Concentrol SA., are some of the leading companies operating in the North America wax emulsion market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Wax Emulsion Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 Raw Material Suppliers

- 4.2.2 Wax Emulsion Manufacturers

- 4.2.3 Distributors/Suppliers

- 4.2.4 End-Use Industry

- 4.2.5 List of Vendors in Value Chain

- 4.3 Porters Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.1 Threat of New Entrants

- 4.3.2 Intensity of Competitive Rivalry

- 4.3.3 Threat of Substitutes

5. North America Wax Emulsion Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growth of Paints & Coatings Industry

- 5.1.2 Rising Demand for Polyethylene Wax Emulsions

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Prices

- 5.3 Market Opportunities

- 5.3.1 Innovations in Wax Emulsion Market

- 5.4 Future Trends

- 5.4.1 Development of Bio-Based Wax Emulsions

- 5.5 Impact Analysis

6. Wax Emulsion Market - North America Analysis

- 6.1 North America Wax Emulsion Market Overview

- 6.2 Wax Emulsion Market Volume (Kilo Tons), 2020-2031

- 6.3 North America Wax Emulsion Market Volume Forecast and Analysis (Kilo Tons)

- 6.4 Wax Emulsion Market Revenue (US$ Million), 2020-2031

- 6.5 North America Wax Emulsion Market Forecast and Analysis

7. North America Wax Emulsion Market Volume and Revenue Analysis - by Type

- 7.1 Polyethylene

- 7.1.1 Overview

- 7.1.2 Polyethylene: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.1.3 Polyethylene: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Polypropylene

- 7.2.1 Overview

- 7.2.2 Polypropylene: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.2.3 Polypropylene: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Paraffin

- 7.3.1 Overview

- 7.3.2 Paraffin: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.3.3 Paraffin: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Vegetable-Based

- 7.4.1 Overview

- 7.4.2 Vegetable-Based: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.4.3 Vegetable-Based: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Wax Emulsion Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.5.3 Others: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Wax Emulsion Market Revenue Analysis - by Application

- 8.1 Paints & Coatings

- 8.1.1 Overview

- 8.1.2 Paints & Coatings: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Printing Inks

- 8.2.1 Overview

- 8.2.2 Printing Inks: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Textile

- 8.3.1 Overview

- 8.3.2 Textile: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Personal Care

- 8.4.1 Overview

- 8.4.2 Personal Care: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Packaging

- 8.5.1 Overview

- 8.5.2 Packaging: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Wax Emulsion Market - Country Analysis

- 9.1 North America

- 9.1.1 North America Wax Emulsion Market Breakdown, by Key Country, 2023 and 2031 (%)

- 9.1.1.1 North America Wax Emulsion Market Volume and Forecast and Analysis - by Country

- 9.1.1.2 North America Wax Emulsion Market Revenue and Forecast and Analysis -by Country

- 9.1.1.3 United States Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.3.1 United States Wax Emulsion Market Breakdown by Type

- 9.1.1.4 Canada Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.4.1 Canada Wax Emulsion Market Breakdown by Type

- 9.1.1.5 Mexico Wax Emulsion Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.5.1 Mexico Wax Emulsion Market Breakdown by Type

- 9.1.1 North America Wax Emulsion Market Breakdown, by Key Country, 2023 and 2031 (%)

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

12. Company Profiles

- 12.1 BASF SE

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Hexion Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Repsol SA

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Sasol Ltd

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 The Lubrizol Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Clariant AG

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Michelman Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 H&R Group

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Productos Concentrol SA

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners