|

|

市場調査レポート

商品コード

1401314

ポリベンゾイミダゾール(PBI)の世界市場:2023年~2030年Global Polybenzimidazole (PBI) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリベンゾイミダゾール(PBI)の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 181 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

ポリベンゾイミダゾール(PBI)の世界市場は2022年に7,530万米ドルに達し、2030年には1億3,620万米ドルに達すると予測され、予測期間2023-2030年のCAGRは9.5%で成長する見込みです。

同市場は、軽量素材に対する需要の高まりと安全・安心に対する需要の増加により急速に拡大しています。他の合成繊維と比較して、これらの繊維の魅力的な織物や触感の性能は、市場拡大の原動力となっています。PBIは、空熱可塑性プラスチックの中で最も優れた耐熱性と使用温度を持つ、最高のエンジニアリングポリマーのひとつです。

PBIは極めて熱に安定で、塩素系溶剤、硫酸、弱酸・弱塩基など様々な物質に対して化学的耐性があります。500℃以上で分解します。264気圧の場合、ガラス転移温度は約425℃と非常に高く、融点はなく、熱変位温度は約435℃です。

北米は、2022年の世界PBI市場の約1/4を占める第二の支配的地域になると予想されます。この地域は、北米における国防費の増加により、積極的な成長が見込まれています。米国では、HSE、ANSI、州団体のような様々な産業における労働者の安全とセキュリティ対策に関する厳しい規制が、PBI防護服の需要を牽引しています。

市場力学

技術進歩の増加

技術の進歩は、より効率的で費用対効果の高いPBI製造プロセスをもたらします。合成と生産プロセスの革新は、歩留まりの向上、生産コストの低減、PBI供給全体の増加につながります。ポリマーの分子構造は、先端技術によって精密に制御できるようになった。これにより、PBIを個々の用途に合わせてカスタマイズすることが可能になり、航空宇宙、自動車、工業製造などの業界の明確なニーズや要件に応えることができます。

PBIと他の材料とのブレンドや複合材料は、研究者や生産者によって開発され、より優れた品質のハイブリッド材料を生み出すことができます。それはPBIの用途の多様性を広げ、新たな市場を開拓します。PBI業界では、データ分析、人工知能、スマート製造(インダストリー4.0)などのデジタル技術の採用により、生産工程が最適化され、効率が向上し、全体的な製品品質が改善されます。

PBIの高温耐性

PBIは卓越した熱安定性を持ち、他のほとんどのポリマーが維持できる温度をはるかに超える温度でも構造的完全性と機械的品質を保持します。高温に長時間さらされた後でも、強度、靭性、寸法安定性を維持します。保護手袋、宇宙飛行士の宇宙服、溶接工の服装、消防士の服装などの防護服の製造によるPBI繊維の需要が、市場を牽引する主な要因です。

市場を牽引しているのは、主に航空宇宙・防衛産業における安全装備の需要増と、低融点、引火性、高強度、カビ・摩耗・化学薬品への耐性といった特性を持つPBI繊維ベースの宇宙服の需要です。セラゾールは高温下でも優れた機械的特性を発揮するため、航空エンジンやその他の高温用途に最適です。この驚異的な軽量素材は、200°Fの油圧作動油中で30日経過しても100%の引張強度を保持します。

高いコストと代替品の有無

PBIは、熱安定性や難燃性などの高性能で知られていますが、その製造には複雑で高価な技術が必要です。特にコスト重視の用途では、製造コストの高さが普及の大きな障壁となる可能性があります。PBIは複雑な化学構造を持つため、個々の目的に合わせてカスタマイズすることは難しいです。個々の顧客の要求に合わせてPBIをカスタマイズするためには、かなりの研究開発作業が必要となり、コストが上昇します。

PBIとそのユニークな特質は、特定のビジネスや地域で過小評価されている可能性があります。潜在的なエンドユーザーにPBIの利点を認識させ、教育することが市場拡大にとって重要です。PBIにはユニークな特徴があるが、様々な用途に利用できる他の素材もあります。特にコストが重要な要素である市場では、同一または類似の性能品質を持つ代替品が入手可能性が抑制要因となる可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- 技術の進歩

- PBIの高温耐性

- 抑制要因

- 高コストと代替品の利用可能性

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

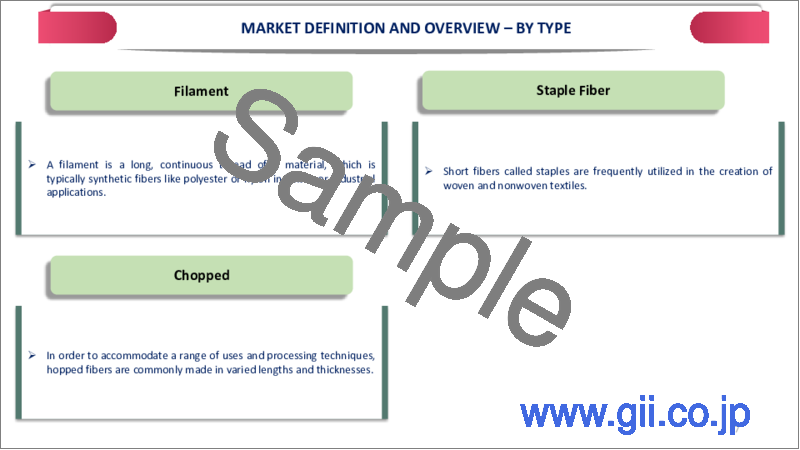

第7章 タイプ別

- フィラメント

- ステープルファイバー

- チョップド

第8章 用途別

- 航空宇宙・防衛

- 自動車

- 石油化学

- 繊維

- 半導体

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- PBI Performance Products Inc.

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Mitsubishi Chemicals

- Goodfellow

- Celanese Corporation

- Solvay SA

- Polymics, Ltd.

- Bally Ribbon Mills

- Koninklijke DSM N.V.

- Sarla Performance Fibers Limited

- SRO Group

第12章 付録

Overview

Global Polybenzimidazole (PBI) Market reached US$ 75.3 million in 2022 and is expected to reach US$ 136.2 million by 2030, growing with a CAGR of 9.5% during the forecast period 2023-2030.

The market is expanding rapidly due to rising demand for lightweight materials and increased demand for safety and security. The appealing textile and tactile performance of these fibres in compared to other synthetic fibres drives market expansion. PBI is one of the best engineering polymers available, with the greatest heat resistance and service temperature for any empty thermoplastic.

PBI is exceptionally heat stable and chemically resistant to a variety of substances, comprising chlorinated solvents, sulfuric acid and mild acids & bases. It decomposes at temperatures more than 500°C. At 264 pressure, it has an extremely high glass transition temperature of around 425°C, no melting point and a heat deflection temperature of approximately 435°C.

North America is expected to be the second-dominant region in the global PBI market covering about 1/4th of the market in 2022. The region is expected to see grow positively due to rising defence expenditure in North America. In U.S. Stringent regulations pertaining to the safety and security measures of workers in various industries like HSE, ANSI and state bodies, have been driving the demand for PBI protective clothing.

Dynamics

Increasing Technological Advancements

Technological advances result in more efficient and cost-effective PBI manufacturing processes. Innovations in synthesis and production processes can lead to improved yields, lower production costs and an increase in overall PBI supply. Polymer molecular structure may now be precisely controlled using advanced technology. It enables PBI to be customised for individual applications, answering the distinct needs and requirements of industries such as aerospace, automotive and industrial manufacturing.

PBI blends and composites with other materials can be developed by researchers and producers to generate hybrid materials with improved qualities. It broadens the variety of PBI applications and opens up new markets. In the PBI industry, the adoption of digital technologies such as data analytics, artificial intelligence and smart manufacturing (Industry 4.0) optimises production processes, improves efficiency and improves overall product quality.

High Temperature Resistance of PBI

PBI has exceptional thermal stability, retaining structural integrity and mechanical qualities at temperatures well exceeding what most other polymers can sustain. Even after extended exposure to high temperatures, it keeps its strength, toughness and dimensional stability. The demand for PBI fibre from the manufacture of protective apparel like protective gloves, astronaut space suits, welders' apparel and fire fighter suits are the major factors driving the market.

The market is being driven a rise in demand for safety gear, mainly in the aerospace & defence industries and the demand for PBI fiber-based space suits, having properties like a low melting point, inflammability, high strength & resistance to mildew, abrasion and chemicals. CELAZOLE has good mechanical properties at high temperatures, making it ideal for usage in aviation engines and other high-temperature applications. The incredible lightweight material holds 100% tensile strength after thirty days in hydraulic fluid at 200°F.

High Costs and Availability of Alternatives

PBI is well-known for its high-performance features, including as thermal stability and flame resistance, but its manufacture entails complicated and expensive techniques. The high cost of manufacture can be a substantial barrier to widespread adoption, particularly in cost-sensitive applications. Because of its complicated chemical structure, customising PBI for individual purposes might be difficult. PBI customisation to match individual customer requirements necessitates substantial R&D work, which raises its costs.

PBI and its unique qualities may be underappreciated in particular businesses or localities. It is critical for market expansion to raise awareness and educate potential end-users about the benefits of PBI. While PBI has unique features, there are other materials available for a variety of uses. The availability of replacements with identical or similar performance qualities can be a constraint, especially in markets where cost is an important element.

Segment Analysis

The global polybenzimidazole (PBI) market is segmented based type, application and region.

High Resistance of PBI Drives its Demand in Textile

Coatings is expected to drive the market by holding a share of about 1/3rd of the global market in 2022. PBI fibre is in high demand in the textile sector because it retains its strength even when exposed to extraordinarily high temperatures. PBI's improved thermal stability increases its demand in high-performance protective garments such as protective gloves, firefighting gear, welders' clothing, astronaut space suits and aircraft wall materials.

As a result, industry firms like Celanese Corporation, in partnership with NASA, have developed PBI textiles for use in space suits and vehicles. Polybenzimidazole fibres are currently being used in the membrane of fuel cells. 100% pure or blended PBI fibres are used in civil engineering for applications like plastic reinforcements.

Geographical Penetration

Rapid Expansion of Aerospace and Defense in Asia-Pacific

During the forecast period, Asia-Pacific is expected to dominate the global polybenzimidazole (PBI) market covering more than 1/3rd of the market. To improve commerce and security, rising nations are focusing on strengthening their aerospace & defence sectors. Along with this, increased government infrastructure modernization activities are paving the way for highly durable thermoplastics with strong heat resistance capabilities, such as PBI.

Boeing estimates that China will demand 7,600 new commercial aircraft worth US$ 1.2 trillion in the next two decades. The Chinese aviation sector has grown significantly throughout the years. With the assistance of the 'Made in China 2025' strategy for improving current low-cost mass production to greater value-added advanced manufacturing, the country's output is expected to rise.

Competitive Landscape

The major global players in the market include PBI Performance Products Inc., Mitsubishi Chemicals, Goodfellow, Celanese Corporation, Solvay SA, Polymics, Ltd., Bally Ribbon Mills, Koninklijke DSM N.V., Sarla Performance Fibers Limited and SRO Group.

COVID-19 Impact Analysis

Lockdowns, limitations and personnel concerns impacted manufacturing operations, particularly those involved in the production of PBI and its raw materials. During the pandemic, demand for some items and chemicals, particularly PBI, fluctuated. The pandemic caused interruptions in global supply chains due to transportation and logistics issues.

Industries where PBI is extensively utilized, such as aerospace, automotive and industrial applications, have experienced interruptions, affecting demand patterns. Different industries were impacted in different ways. For example, the aviation and automobile industries, which rely on PBI for its high-temperature resilience, saw lower demand as a result of travel restrictions, reduced production and economic uncertainty. During the epidemic, economic uncertainty and a shift in priorities could have influenced R&D funds and timeframes.

Russia-Ukraine War Impact

The conflict disrupts supply chains by influencing raw materials and completed commodities transportation. When crucial components or raw materials for PBI production are supplied from conflict-affected locations, supply shortages will result. Price volatility in global markets is caused by uncertainties and disruptions in the geopolitical landscape. Chemical prices, especially PBI, can be influenced by currency fluctuations, changes in demand-supply dynamics and geopolitical risk premiums.

Chemical companies may rethink their supply chain strategies and seek diversification to avoid geopolitical concerns. It could entail locating alternate raw material sources or locating production facilities in less geopolitically dangerous places. Companies are concentrating their efforts on developing solutions that improve supply chain resilience or lessen geopolitical risks.

By Type

- Filament

- Staple Fiber

- Chopped

By Application

- Aerospace and Defense

- Automotive

- Petrochemical

- Textile

- Semiconductors

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- In August 2022, PBI Performance Products Inc., a wholly owned subsidiary of The InterTech Group Inc., has announced numerous organizational changes to its senior management team that will take effect immediately. The modifications are intended to capitalize on the fiber manufacturer's strong global development potential.

- In May 2022, PBI Performance Products Inc., a wholly owned subsidiary of The InterTech Group Inc., has added PBI LP, a proprietary lightweight fiber that improves comfort, breathability and freedom of movement for future structural firefighting gear, to its product range. Even though the unique PBI LPTM is lighter, it nevertheless improves heat and flame resistance and break open resistance without sacrificing performance.

Why Purchase the Report?

- To visualize the global polybenzimidazole (PBI) market segmentation based on type, application and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of polybenzimidazole (PBI) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global polybenzimidazole (PBI) market report would provide approximately 53 tables, 50 figures and 181 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by Application

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Increasing Technological Advancements

- 4.1.1.2. High Temperature Resistance of PBI

- 4.1.2. Restraints

- 4.1.2.1. High Costs and Availability of Alternatives

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Filament*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Staple Fiber

- 7.4. Chopped

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Aerospace and Defense*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Automotive

- 8.4. Petrochemical

- 8.5. Textile

- 8.6. Semiconductors

- 8.7. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. UK

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Russia

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. PBI Performance Products Inc.*

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Mitsubishi Chemicals

- 11.3. Goodfellow

- 11.4. Celanese Corporation

- 11.5. Solvay SA

- 11.6. Polymics, Ltd.

- 11.7. Bally Ribbon Mills

- 11.8. Koninklijke DSM N.V.

- 11.9. Sarla Performance Fibers Limited

- 11.10. SRO Group

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us