|

|

市場調査レポート

商品コード

1401307

AI画像認識の世界市場:2023年~2030年Global AI Image Recognition Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| AI画像認識の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 206 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

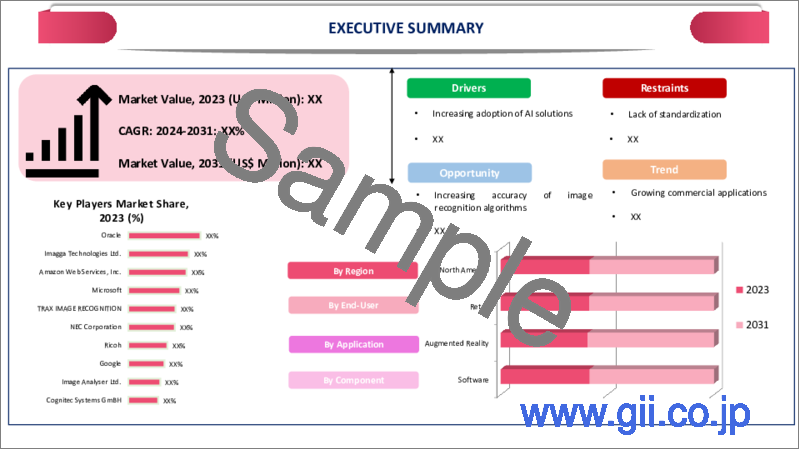

世界のAI画像認識市場は、2022年に19億米ドルに達し、2023年から2030年の予測期間中にCAGR 11.8%で成長し、2030年には46億米ドルに達すると予測されています。

品質管理、検査、モニタリングなどのタスクへのAI画像認識の適用は、AI画像認識市場の市場成長を後押しするあらゆる産業における自動化への世界の動きによって促進されています。自動化は業務効率を高め、反復的な視覚作業における人間の介入を減らします。AI画像認識は、ヘルスケア、小売、自動車、セキュリティ、農業など多様な産業で応用されています。画像認識技術の多用途性は、業界固有の課題解決に広く採用される要因となっています。

eコマースや小売業界では、AI画像認識がビジュアル検索、商品推奨、在庫管理、顧客エンゲージメントの機会を提供しています。ユーザーエクスペリエンスの向上とパーソナライズされたサービスは、小売業界における採用の原動力となっています。スマートシティ構想は、都市計画、交通管理、公共安全、環境モニタリングにおいてAI画像認識の機会を提供します。画像認識技術の統合は、効率的で持続可能な都市の発展に貢献します。

北米のヘルスケア産業におけるAI画像認識の応用拡大が、AI画像認識技術の市場拡大を大きく支援しています。例えば2022年、米国はGDPのほぼ26%をヘルスケア施設に費やしています。北米では、消費者は余剰資金の一部をヘルスケアに費やしています。同地域におけるヘルスケア産業の急成長は、AI画像認識市場の成長を後押ししています。

市場力学

AI採用の拡大

AI技術に対する認識と理解が世界的に高まるにつれ、さまざまな業界の企業が、AI画像認識を自社の業務に組み込むことの潜在的なメリットを認識しています。この理解は、AIソリューションの探求と投資への意欲に寄与しています。AI、特にディープラーニングとニューラルネットワークの継続的な進歩は、より洗練された正確な画像認識モデルをもたらしました。技術的な向上は、AI画像認識システムの全体的な有効性と信頼性を高め、採用を後押ししています。

Harward Business reviewが2021年に発表したデータによると、COVID危機を理由にAI導入計画を加速させた企業は約52%に上った。参加者の86%は、2021年にはAIが自社の「主流技術」になりつつあると回答しています。ハリス・ポールはアペンと共同で、企業の55%がCOVID-19を理由に2020年にAI戦略を加速させたと報告し、67%が2021年にAI戦略をさらに加速させると予想していることを明らかにしました。調査参加者の72%は、AIが将来果たす役割についてポジティブに感じています。

技術の進歩

ディープラーニングアーキテクチャの進歩により、AIの画像認識モデルの精度と性能が大幅に向上しました。強化されたアルゴリズムとモデルアーキテクチャは、より正確な画像認識結果に貢献しています。ディープラーニング、特により深いニューラルネットワークの開発における技術の進歩は、AIシステムが画像内の複雑なパターンや特徴を学習することを可能にします。これにより、物体検出や分類などの画像認識タスクが飛躍的に向上しました。

技術の進歩により、AI画像認識システムは視覚データをリアルタイムで処理・分析できるようになった。これは、監視、自律走行車、ライブビデオ分析など、瞬時の意思決定が不可欠なアプリケーションにとって極めて重要です。例えば、2020年3月8日、オーストリアのフォトニクス研究所の研究者たちは、ニューラル・ネットワークを備えた光センサー・エレクトロニクスを使用することで、小型チップ上に人工眼球を作成しました。ウィーンで発表されたこの新しいデザインは、数ナノ秒以内に物体を識別することができると報告されており、これは技術の重大な進歩です。

AI画像認識における標準化の欠如

標準化された手法がなければ、異なるAI画像認識システム間の相互運用性は課題となります。互換性の欠如は、画像認識ソリューションを既存のワークフローや技術にシームレスに統合する妨げとなります。標準化されたベンチマークや評価指標がないため、異なる画像認識モデル間で性能に一貫性がなくなります。そのため、企業やユーザーは、特定のニーズに最も適したソリューションを比較・選択することが難しくなります。

異なるAI画像認識モデルを公正かつ正確に評価するためには、標準化が不可欠です。標準化された評価基準がないため、開発者やユーザーは様々なモデルの性能を客観的に比較することが困難です。標準化は、AIシステムの透明性と説明可能性を確保する上で重要な役割を果たします。モデルの解釈と説明のための標準化された方法がなければ、ユーザーはAI画像認識システムがどのようにして特定の判断に至るのかを理解することが難しく、信頼の問題につながります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- AI導入の拡大

- 技術の進歩

- 抑制要因

- 標準化の欠如

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 コンポーネント別

- ハードウェア

- ソフトウェア

- サービス

第8章 用途別

- 拡張現実

- スキャン・イメージング

- セキュリティ・監視

- マーケティング・広告

- 画像検索

第9章 エンドユーザー別

- 教育

- ゲーム

- ヘルスケア

- 政府機関

- 航空宇宙・防衛

- メディア・エンターテイメント

- 小売

- 銀行金融サービス・保険

- その他

第10章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第11章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第12章 企業プロファイル

- IBM Corporation

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Imagga Technologies Ltd

- Amazon Web Services, Inc

- Qualcomm

- Google LLC

- Microsoft Corporation

- Trax Technology Solutions Pte Ltd

- NEC Corporation

- Ricoh Company, Ltd

- Catchoom Technologies S.L

第13章 付録

Overview

Global AI Image Recognition Market reached US$ 1.9 Billion in 2022 and is expected to reach US$ 4.6 Billion by 2030, growing with a CAGR of 11.8% during the forecast period 2023-2030.

The application of AI image recognition for tasks like quality control, inspection and monitoring is fueled by the global movement toward automation in all industries which helps to boost the market growth of the AI image recognition market. Automation enhances operational efficiency and reduces human intervention in repetitive visual tasks. AI image recognition finds applications in diverse industries, including healthcare, retail, automotive, security and agriculture. The versatility of image recognition technologies contributes to their widespread adoption in solving industry-specific challenges.

In the e-commerce and retail industry, AI image recognition presents opportunities for visual search, product recommendation, inventory management and customer engagement. Enhanced user experiences and personalized services drive adoption in the retail sector. Smart city initiatives provide opportunities for AI image recognition in urban planning, traffic management, public safety and environmental monitoring. The integration of image recognition technologies contributes to the development of efficient and sustainable cities.

The growing application of AI visual recognition in North America's healthcare industry has greatly assisted the market expansion of AI image recognition technology. For instance, in 2022, U.S. spent almost 26% of its GDP on healthcare facilities. In North America, consumers spend a portion of their extra cash on healthcare. The rapid growth of the healthcare industry in the region helps to boost the market growth of AI image recognition.

Dynamics

Growing AI Adoption

As awareness and understanding of AI technologies have grown globally, businesses across various industries recognize the potential benefits of integrating AI image recognition into their operations. The understanding has contributed to a willingness to explore and invest in AI solutions. Ongoing advancements in AI, particularly in deep learning and neural networks, have resulted in more sophisticated and accurate image recognition models. The technological improvements have increased the overall effectiveness and reliability of AI image recognition systems, driving adoption.

According to the data given by Harward Business review in 2021 about 52% of companies accelerated their AI adoption plans because of the COVID crisis. 86%, of participants say that AI is becoming a "mainstream technology" at their company in 2021. Harris Poll, working with Appen, found that 55% of companies reported they accelerated their AI strategy in 2020 due to COVID-19 and 67% expect to further accelerate their AI strategy in 2021. 72% of participants in the survey feel positive about the role that AI play in the future.

Technological Advancements

Advances in deep learning architectures have significantly improved the accuracy and performance of AI image recognition models. Enhanced algorithms and model architectures contribute to more precise image recognition results. Technological advancements in deep learning, especially the development of deeper neural networks, enable AI systems to learn intricate patterns and features within images. The has led to breakthroughs in image recognition tasks, including object detection and classification.

Technological advancements have enabled AI image recognition systems to process and analyze visual data in real time. The is critical for applications such as surveillance, autonomous vehicles and live video analytics where instant decision-making is essential. For instance, on March 08, 2020, researchers from the Institute of Photonics, Austria created an artificial eye on a small chip by using light-sensing electronics with a neural network. The new design, presented in Vienna has been reported to identify an object within a few nanoseconds, which is a serious advancement in the technology.

Lack of Standardization in the AI Image Recognition

Without standardized practices, interoperability between different AI image recognition systems becomes challenging. The lack of compatibility hinders the seamless integration of image recognition solutions into existing workflows and technologies. The absence of standardized benchmarks and evaluation metrics lead to inconsistent performance across different image recognition models. The makes it difficult for businesses and users to compare and choose the most suitable solution for their specific needs.

Standardization is crucial for the fair and accurate evaluation of different AI image recognition models. The lack of standardized evaluation criteria makes it challenging for developers and users to objectively compare the performance of various models. Standardization plays a key role in ensuring transparency and explainability in AI systems. Without standardized methods for model interpretation and explanation, users find it difficult to understand how AI image recognition systems arrive at specific decisions, leading to trust issues.

Segment Analysis

The global AI image recognition market is segmented based on component, application, end-user and region.

Growing Adoption of AI Image Recognition Software in Various Industries

Based on the components, the AI image recognition market is segmented into hardware, software and services. AI image recognition software segment is growing over the forecast period 2023-2030. Artificial intelligence recognizes image software is growing in direct proportion to advances in deep learning and neural networks. Convolutional neural networks (CNNs), in particular, are deep learning models that have shown impressive capabilities in image identification obligations, increasing performance and accuracy.

The availability of large and diverse labeled datasets has played a crucial role in training and fine-tuning sophisticated AI image recognition models. Access to extensive datasets allows software developers to create more accurate and generalized image recognition solutions. The availability of open-source deep learning frameworks such as TensorFlow and PyTorch has democratized AI development.

The has empowered developers to create and customize image recognition models, fostering innovation and accelerating the adoption of AI image recognition software. To fulfill consumer's demand for the AI Image Recognition software major key players in the market launched new products. For instance, on April 07, 2023, Meta launched AI tool that identify, separate items in pictures.

Geographical Penetration

Growing Adoption of AI Image Recognition in Various industries of North America

North America accounted for the largest market share in the global AI image recognition market due to the region's well-established and robust IT infrastructure providing a solid foundation for the deployment and integration of AI image recognition systems across various industries. North America is anticipated to have the greatest market size in the global image recognition market.

North America is home to the headquarters of many of the top technology companies in the world, such as Google, Microsoft and IBM. The companies promote AI innovation and adopt the application of cutting-edge image recognition technologies. Major key players in the region launched new services for AI image recognition that help boost the regional market growth of the global AI image recognition market.

For instance, on November 03, 2023 oracle announced Oracle Cloud Infrastructure (OCI) AI services that make it easier for developers to apply AI services to their applications without requiring data science expertise. It gives developers the choice of leveraging out-of-the-box models that have been trained on business-oriented data or custom training the services based on their organization's data.

Competitive Landscape

The major global players in the market include IBM Corporation, Imagga Technologies Ltd, Amazon Web Services, Inc, Qualcomm, Google LLC, Microsoft Corporation, Trax Technology Solutions Pte Ltd, NEC Corporation, Ricoh Company, Ltd and Catchoom Technologies S.L.

COVID-19 Impact Analysis

Geopolitical tensions and conflicts lead to disruptions in the global supply chain, affecting the production and availability of hardware components and technologies necessary for AI image recognition systems. Heightened geopolitical tensions contribute to overall market uncertainty. Businesses become more cautious about investments, potentially impacting the demand for AI technologies, including image recognition solutions.

Geopolitical events result in changes to regulations and policies that govern the development, export or use of certain technologies. Regulatory shifts impact the global market landscape for AI image recognition. During geopolitical conflicts, there is often an increased risk of cyber threats and attacks. As AI image recognition systems deal with sensitive visual data, companies invest more in cybersecurity measures to protect these technologies. Geopolitical instability influence research and development activities in the AI field. Collaboration and knowledge exchange between researchers and institutions in different regions were affected.

Russia-Ukraine War Impact Analysis

Geopolitical tensions and conflicts lead to disruptions in the global supply chain, affecting the production and availability of hardware components and technologies necessary for AI image recognition systems. Heightened geopolitical tensions contribute to overall market uncertainty. Businesses become more cautious about investments, potentially impacting the demand for AI technologies, including image recognition solutions. Geopolitical events result in changes to regulations and policies that govern the development, export or use of certain technologies. Regulatory shifts impact the global market landscape for AI image recognition.

During geopolitical conflicts, there is often an increased risk of cyber threats and attacks. As AI image recognition systems deal with sensitive visual data, companies invest more in cybersecurity measures to protect these technologies. Geopolitical instability influences research and development activities in the AI field. Collaboration and knowledge exchange between researchers and institutions in different regions were affected.

By Component

- Hardware

- Software

- Service

By Application

- Augmented Reality

- Scanning & Imaging

- Security & Surveillance

- Marketing & Advertising

- Image Search

By End-User

- Education

- Gaming

- Healthcare

- Government

- Aerospace & Defense

- Media & Entertainment

- Retail

- Banking Financial Services and Insurance

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On October 11, 2023, Klarna, a Swedish fintech company launched AI-powered image Recognition Tool in the market. The tool Shopping Lens uses AI to translate images of products into a search term and directs customers to the best deals on Klarna's app.

- On December 12, 2023, Mastercard, launched Shopping Muse, an AI tool that gives product recommendations. By using this tool shoppers search for products using search terms such as cottage core or beach formal and receive product recommendations based on their demographic profile, intent, purchase history and other traits.

- On October 02, 2023, GoSpotCheck by FORM, the top AI-powered retail execution platform for Beverage Alcohol and CPG launched the latest innovation to its image recognition technology which provides support to the on-premise displays, including beer menu, beer taps, wine menu, cocktail menu and back bar.

Why Purchase the Report?

- To visualize the global AI image recognition market segmentation based on component, application, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of AI image recognition market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

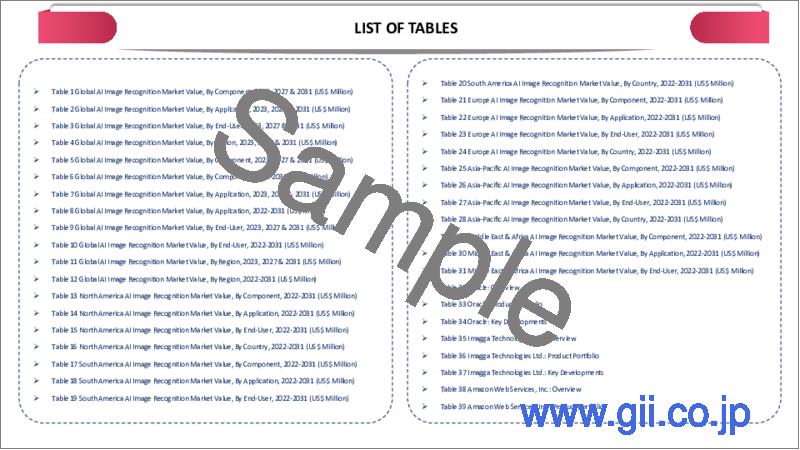

The global AI image recognition market report would provide approximately 61 tables, 65 figures and 206 Pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Component

- 3.2. Snippet by Application

- 3.3. Snippet by End-User

- 3.4. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Growing AI Adoption

- 4.1.1.2. Technological Advancements

- 4.1.2. Restraints

- 4.1.2.1. Lack of Standardization

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Component

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 7.1.2. Market Attractiveness Index, By Component

- 7.2. Hardware*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Software

- 7.4. Service

8. By Application

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 8.1.2. Market Attractiveness Index, By Application

- 8.2. Augmented Reality*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Scanning & Imaging

- 8.4. Security & Surveillance

- 8.5. Marketing & Advertising

- 8.6. Image Search

9. By End-User

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.1.2. Market Attractiveness Index, By End-User

- 9.2. Education*

- 9.2.1. Introduction

- 9.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 9.3. Gaming

- 9.4. Healthcare

- 9.5. Government

- 9.6. Aerospace & Defense

- 9.7. Media & Entertainment

- 9.8. Retail

- 9.9. Banking Financial Services and Insurance

- 9.10. Others

10. By Region

- 10.1. Introduction

- 10.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 10.1.2. Market Attractiveness Index, By Region

- 10.2. North America

- 10.2.1. Introduction

- 10.2.2. Key Region-Specific Dynamics

- 10.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 10.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.2.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.2.6.1. U.S.

- 10.2.6.2. Canada

- 10.2.6.3. Mexico

- 10.3. Europe

- 10.3.1. Introduction

- 10.3.2. Key Region-Specific Dynamics

- 10.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 10.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.3.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.3.6.1. Germany

- 10.3.6.2. UK

- 10.3.6.3. France

- 10.3.6.4. Italy

- 10.3.6.5. Spain

- 10.3.6.6. Rest of Europe

- 10.4. South America

- 10.4.1. Introduction

- 10.4.2. Key Region-Specific Dynamics

- 10.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 10.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.4.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.4.6.1. Brazil

- 10.4.6.2. Argentina

- 10.4.6.3. Rest of South America

- 10.5. Asia-Pacific

- 10.5.1. Introduction

- 10.5.2. Key Region-Specific Dynamics

- 10.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 10.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 10.5.6. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 10.5.6.1. China

- 10.5.6.2. India

- 10.5.6.3. Japan

- 10.5.6.4. Australia

- 10.5.6.5. Rest of Asia-Pacific

- 10.6. Middle East and Africa

- 10.6.1. Introduction

- 10.6.2. Key Region-Specific Dynamics

- 10.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Component

- 10.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By Application

- 10.6.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

11. Competitive Landscape

- 11.1. Competitive Scenario

- 11.2. Market Positioning/Share Analysis

- 11.3. Mergers and Acquisitions Analysis

12. Company Profiles

- 12.1. IBM Corporation*

- 12.1.1. Company Overview

- 12.1.2. Product Portfolio and Description

- 12.1.3. Financial Overview

- 12.1.4. Key Developments

- 12.2. Imagga Technologies Ltd

- 12.3. Amazon Web Services, Inc

- 12.4. Qualcomm

- 12.5. Google LLC

- 12.6. Microsoft Corporation

- 12.7. Trax Technology Solutions Pte Ltd

- 12.8. NEC Corporation

- 12.9. Ricoh Company, Ltd

- 12.10. Catchoom Technologies S.L

LIST NOT EXHAUSTIVE

13. Appendix

- 13.1. About Us and Services

- 13.2. Contact Us