|

|

市場調査レポート

商品コード

1401290

ポリエーテルエーテルケトン(PEEK)の世界市場:2023年~2030年Global Polyetheretherketone (PEEK) Market - 2023-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ポリエーテルエーテルケトン(PEEK)の世界市場:2023年~2030年 |

|

出版日: 2023年12月29日

発行: DataM Intelligence

ページ情報: 英文 184 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

概要

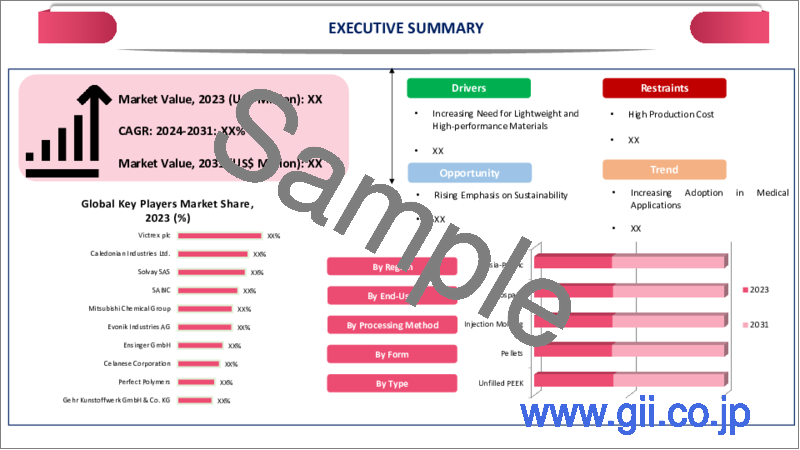

世界のポリエーテルエーテルケトン(PEEK)市場は、2022年に7億米ドルに達し、2023-2030年の予測期間にCAGR 7.8%で成長し、2030年には12億米ドルに達すると予測されています。

PEEKの優れた特性は、その用途の幅を広げ、輸送、半導体、工業、食品産業における製品ラインを拡大しています。PEEKは、金属や他のポリマーと比較した場合、より優れた性能を備えています。ジェット燃料、除氷液、消火剤、油圧作動油、洗浄剤、殺虫剤など、航空機に使用される多くの重要な化学薬品はPEEKに耐性を示します。

PEEKは防錆処理を必要としません。最高260℃の温度にも5,000時間以上耐えることができ、性能を失うことはありません。排出率の点でも、PEEKはどのポリマーよりも有害な汚染物質や煙の発生量が少ないです。これらの特性により、PEEKは理想的な金属代替材料としてイントロダクション採用されました。

北米は、2022年のポリエーテルエーテルケトン(PEEK)の世界市場の25%以上を占める、2番目に支配的で急成長している地域です。この地域には、Chrysler、Tesla、Ford、Cadillacなどの重要な自動車メーカーが存在し、防衛産業や航空製造産業における政府の取り組みもあり、予測期間中の市場の牽引役となることが期待されています。

ダイナミクス

エレクトロニクス分野の技術進歩

Ericsson Mobility Report 2021によると、世界全体で650以上の新しい5Gスマートフォンがリリースされており、全フォームファクターからの5Gの50%を占めています。スマートフォンのハンドヘルド・ワイヤレス・フォームサイズと5Gアクセスのシンプルさは、実質的に他の追随を許さないです。世界の数多くの地域で5Gの展開が始まっているため、これまで未開拓だったいくつかの地域では、将来の5G開始を利用するために、5G対応スマートフォンのリリースを受ける準備が整っています。

予測期間中、技術の向上により家電製品の消費は拡大し、PEEKの世界市場は拡大すると予想されます。予測期間中、デジタル化、ロボット工学、仮想現実、拡張現実、IoT、5G接続などの先端技術に対する需要が高まると予想されます。技術的進歩や超高帯域幅、超低遅延、巨大な接続性に対する需要の高まりにより、市場の拡大が予測されます。

環境に優しいソリューション開発におけるPEEKの出現

PEEKは様々な用途で環境に優しい代替材料として台頭してきています。その使用は、ABS、ポリエステルラミネート、ポリ塩化ビニル、ポリスチレン、ポリサルフォンなどの他のポリマーよりも炭素排出量が少ないです。優れた耐食性により、PEEKは使用される製品の寿命を延ばします。PEEKは、他のポリマーよりも高温に長時間耐えることができ、メーカーに設計の自由を与え、労働力への依存を減らすための最も適応性の高い材料の一つです。

PEEKは、他のポリマーと比較した場合、発火、有害物質の排出、発煙率が最も低いです。PEEK製の電線束クランプは、油圧チューブや配線の航空機システムを管理・制御するために使用されています。約15,000個のPEEKベースのクランプが航空機に使用され、年間80トンの二酸化炭素排出量を削減すると同時に、年間23,000米ドルの燃料を節約しています。強力な累積効果により、PEEKベースのクランプは、この用途でステンレス鋼やアルミニウムに取って代わられています。

高いコストと代替品の存在

PEEKは明確な特徴を持つ高性能ポリマーであるが、その製造には高度な技術と高品質の原材料が必要です。他のポリマーと比較すると、製造コストが比較的高いです。コストが高いため、特定の用途や分野、特にコストに敏感な要求がある分野での使用が制限される可能性があります。厳しい規制、特にヘルスケアや航空宇宙などの業界では、特定の用途でのPEEKの使用を困難にしています。

特殊な要件や認証を満たすには、時間とコストがかかります。PEEKと競合するのは、他の高機能ポリマーやエンジニアリングプラスチックです。代替材料と比較した場合、リサイクル性や環境への影響が懸念されています。用途によっては、性能とコストを両立できる代替材料が見つかり、PEEKの市場シェアが低下する可能性があります。

目次

第1章 調査手法と調査範囲

第2章 定義と概要

第3章 エグゼクティブサマリー

第4章 市場力学

- 影響要因

- 促進要因

- エレクトロニクス分野における技術の進歩

- 環境に優しいソリューション開発におけるPEEKの出現

- 抑制要因

- 高コストと代替品の存在

- 機会

- 影響分析

- 促進要因

第5章 産業分析

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 規制分析

- ロシア・ウクライナ戦争の影響分析

- DMIの見解

第6章 COVID-19分析

第7章 タイプ別

- ガラス充填

- カーボン充填

- その他

第8章 エンドユーザー別

- 自動車

- 航空宇宙

- 石油・ガス

- 電気・電子

- その他

第9章 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- その他欧州

- 南米

- ブラジル

- アルゼンチン

- その他南米

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

第10章 競合情勢

- 競合シナリオ

- 市況/シェア分析

- M&A分析

第11章 企業プロファイル

- Victrex plc

- 会社概要

- 製品ポートフォリオと説明

- 財務概要

- 主な発展

- Caledonian Industries Ltd.

- Solvay SA

- SABIC

- Parkway Products, LLC

- A. Shulman, Inc.

- Mitsubishi Chemical Advanced Materials

- Evonik Industries AG

- Ensinger GmbH

- Celanese Corporation

第12章 付録

Overview

Global Polyetheretherketone (PEEK) Market reached US$ 0.7 billion in 2022 and is expected to reach US$ 1.2 billion by 2030, growing with a CAGR of 7.8% during the forecast period 2023-2030.

PEEK's excellent properties are increasing its application breadth and expanding product lines in transportation, semiconductors, industrial and food industry. PEEK has greater performance features when compared to metals and other polymers. Many essential chemicals used in aircraft, such as jet fuel, de-icing solutions, fire-extinguishing compounds, hydraulic fluids, cleaning agents and pesticides, are resistant to it.

PEEK does not need anti-corrosion treatments. It can even withstand temperatures of up to 260°C for 5,000 hours or more without losing performance. In terms of emission rates, PEEK produces the least amount of hazardous pollutants and smoke of any polymer. All of the characteristics have led to the introduction of PEEK as the ideal metal alternative.

North America is the second-dominant and fastest growing region in the global polyetheretherketone market covering over 25% of the market in 2022. The presence of important vehicle manufacturers in this region, such as Chrysler, Tesla, Ford, Cadillac and others, as well as government initiatives in the defence and aviation manufacturing industries, are expected to drive the market in the forecast period.

Dynamics

Technological Advancements in Electronics Sector

Based on the Ericsson Mobility Report 2021, over 650 new 5G smartphones have been released globally, accounting for 50% of all 5G from all form factors. Smartphones' handheld wireless form size and simplicity of 5G access are practically unrivalled. As numerous parts of the world have started to roll out 5G, several previously untapped regions are prepared to receive 5G-enabled smartphone releases in order to capitalize on the future 5G launch.

Consumer electronics consumption is expected to expand due to technological improvements throughout the forecast period, increasing the global PEEK market. During the forecats period, demand for advanced technologies such as digitalization, robotics, virtual reality, augmented reality, IoT and 5G connectivity is expected to rise. The market is predicted to increase as a result of technical advancements and rising demand for ultra-high bandwidth, ultra-low latency and huge connectivity.

Emergence of PEEK in Developing Environment-friendly Solutions

PEEK is emerging as an eco-friendly alternative in a variety of applications. Its use produces fewer carbon emissions than other polymers such as ABS, polyester laminate, polyvinyl chloride, polystyrene and polysulphone. By offering superior corrosion resistance, PEEK expands the service life of the products in which it is utilised. It can withstand high temperatures for a longer amount of time than other polymers and is one of the most adaptable items for allowing manufacturers design freedom and reducing reliance on labour.

PEEK offers the lowest fire, hazardous emissions and smoke rates when compared to other polymers. Electrical wire bundle clamps made of PEEK are used to manage and control aircraft systems in hydraulic tubing and wiring. Around 15,000 PEEK-based clamps are used in an aeroplane, reducing carbon emissions by 80 Tonss per year while saving US$ 23,000 per year on fuel. Owing to the strong cumulative effect, PEEK-based clamps have largely replaced stainless steel and aluminium in this application.

High Costs and Presence of Alternatives

PEEK is a high-performance polymer with distinct features, but its manufacturing requires sophisticated techniques and high-quality raw materials. When compared to other polymers, it has a comparatively high production cost. The high cost may limit its use in certain applications and sectors, particularly those with cost-sensitive requirements. Stringent regulatory regulations, particularly in industries such as healthcare and aerospace, make the use of PEEK in certain applications difficult.

Meeting specialized requirements and certifications might take time and money. Other high-performance polymers and engineering plastics compete with PEEK. Concerns have been raised about its recyclability and environmental impact when compared to alternative materials. Some applications may discover acceptable substitutes that provide a good combination of performance and cost, reducing PEEK's market share in industries.

Segment Analysis

The global polyetheretherketone (PEEK) market is segmented based type, end-user and region.

Growing Demand for Air Travels Drives Aerospace Segment's Growth

Aerospace is expected to drive the market by holding a share of about 1/3rd of the global market in 2022. Aerospace has emerged as a prominent application area, with increased need for new-generation passenger aircraft likely to drive demand. The carbon filled PEEK used in passenger aeroplanes is expected to be the leading market driver.

According to IBEF and IATA predictions, India's aviation sector would be the world's third-largest by 2024. In 2021, the aviation industry has seen a number of investments and innovations. For example, Tata Sons won the proposal to acquire state-run Air India in October 2021 by giving US$ 2.4 billion for 100% ownership of the airline. Demand for air travel has increased as the number of high-net-worth individuals has risen globally, boosting the demand for PEEK.

Geographical Penetration

Rapid Expansion of Electronics Sector in China Drives Asia-Pacific Growth

During the forecast period, Asia-Pacific is the dominant region in the global Polyetheretherketone market covering more than 1/3rd of the market. Economic expansion in developing economies such as China and India results in the formation of a prosperous urban class. It has increased sales of conventional products such as electronics in these areas. Based on a World Economic Forum article, about 90% of China's electronics are manufactured in the Chinese province of Shenzhen.

The total retail sale of consumer products in China climbed from CNY 39.2 trillion to CNY 44.1 trillion, as per the National Bureau of Statistics of China. As consumer electronics and other electrical products make for a significant portion of the country's export value, the PEEK market is expected to grow rapidly. The country shipped about US$ 3.36 trillion in products in 2021, indicating a 30% increase in export value over 2020, according to China Customs data. Such factors create a favorable market setting for the expansion of China's PEEK market.

Competitive Landscape

The major global players in the market include Victrex plc, Caledonian Industries Ltd., Solvay SA, SABIC, Parkway Products, LLC, A. Shulman, Inc., Mitsubishi Chemical Advanced Materials, Evonik Industries AG, Ensinger GmbH and Celanese Corporation.

COVID-19 Impact Analysis

PEEK is utilized in medical implants and the pandemic raised demand for specific medical devices, particularly those used in respiratory care and diagnostics. To meet the rising demand, the production of medical components, especially those based on PEEK, may have fluctuated. During the pandemic, changes in consumer behavior and market demand may have altered the sectors that use PEEK.

Reduced demand in aerospace and automotive, for example, along with rising demand in medical and healthcare, could have resulted in changes in PEEK uses and production priorities. The epidemic prompted reforms in legislation and standards, particularly in the healthcare industry. PEEK-based medical device manufacturers may have had to adapt to new regulatory standards, compromising production methods and deadlines.

AI Impact

In smart manufacturing processes, AI is used in conjunction with PEEK materials. Intelligent systems optimize production settings, monitor equipment health and assure quality control, resulting in more efficient and dependable PEEK component manufacturing. To estimate when maintenance is required, AI systems analyzes data from sensors implanted in PEEK components.

It is especially useful in industries such as aerospace and automotive, where timely maintenance can extend the life and performance of PEEK-based parts. Artificial intelligence can help with the design and optimization of PEEK-based materials. Machine learning algorithms analyze large datasets to determine the best formulations and processing conditions, resulting in the production of PEEK variants with improved qualities for specific applications.

Russia-Ukraine War Impact

Geopolitical crises interrupted supply chains due to the probable application of sanctions, trade restrictions or transportation concerns. Resin prices, particularly thermoplastic polymers, are expected to climb. Russia is a major petroleum supplier, but due to the invasion of Ukraine, most countries have reduced their imports and sanctioned Russia.

The war in Ukraine caused significant disruptions to global markets for crucial raw resources. Several European countries, including Germany and France, have increased their aerospace defense in the midst of the Russia-Ukraine conflict. The factor raised demand for aerospace components used in military aircraft and planes, as well as use of PEEK.

By Type

- Glass Filled

- Carbon Filled

- Others

By End-User

- Automotive

- Aerospace

- Oil and Gas

- Electrical and Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Rest of Europe

- South America

- Brazil

- Argentina

- Rest of South America

- Asia-Pacific

- China

- India

- Japan

- Australia

- Rest of Asia-Pacific

- Middle East and Africa

Key Developments

- On March 2023, Victrex PLC, a high-performance polymer provider based in UK, has introduced an innovative form of implantable PEEK-OPTIMA polymer which is specifically engineered for use in medical device additive manufacturing methods such as fused deposition modelling (FDM) and fused filament fabrication (FFF).

- On February 2023, Victrex PLC, a British producer of high-performance polymers, has announced intentions to expand its medical subsidiary, Invibio Biomaterial Solutions, including the establishment of a new product development site in Leeds, UK.

- On July 2022, Solvay, a multinational chemical manufacturer headquartered in Belgium, has released KT-850 SCF 30, a new grade of KetaSpire PEEK optimized for precision braking system and e-mobility pump components.

Why Purchase the Report?

- To visualize the global Polyetheretherketone (PEEK) market segmentation based on type, end-user and region, as well as understand key commercial assets and players.

- Identify commercial opportunities by analyzing trends and co-development.

- Excel data sheet with numerous data points of Polyetheretherketone (PEEK) market-level with all segments.

- PDF report consists of a comprehensive analysis after exhaustive qualitative interviews and an in-depth study.

- Product mapping available as excel consisting of key products of all the major players.

The global Polyetheretherketone (PEEK) market report would provide approximately 53 tables, 49 figures and 184 pages.

Target Audience 2023

- Manufacturers/ Buyers

- Industry Investors/Investment Bankers

- Research Professionals

- Emerging Companies

Table of Contents

1. Methodology and Scope

- 1.1. Research Methodology

- 1.2. Research Objective and Scope of the Report

2. Definition and Overview

3. Executive Summary

- 3.1. Snippet by Type

- 3.2. Snippet by End-User

- 3.3. Snippet by Region

4. Dynamics

- 4.1. Impacting Factors

- 4.1.1. Drivers

- 4.1.1.1. Technological Advancements in Electronics Sector

- 4.1.1.2. Emergence of PEEK in Developing Environment-friendly Solutions

- 4.1.2. Restraints

- 4.1.2.1. High Costs and Presence of Alternatives

- 4.1.3. Opportunity

- 4.1.4. Impact Analysis

- 4.1.1. Drivers

5. Industry Analysis

- 5.1. Porter's Five Force Analysis

- 5.2. Supply Chain Analysis

- 5.3. Pricing Analysis

- 5.4. Regulatory Analysis

- 5.5. Russia-Ukraine War Impact Analysis

- 5.6. DMI Opinion

6. COVID-19 Analysis

- 6.1. Analysis of COVID-19

- 6.1.1. Scenario Before COVID

- 6.1.2. Scenario During COVID

- 6.1.3. Scenario Post COVID

- 6.2. Pricing Dynamics Amid COVID-19

- 6.3. Demand-Supply Spectrum

- 6.4. Government Initiatives Related to the Market During Pandemic

- 6.5. Manufacturers Strategic Initiatives

- 6.6. Conclusion

7. By Type

- 7.1. Introduction

- 7.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 7.1.2. Market Attractiveness Index, By Type

- 7.2. Glass Filled*

- 7.2.1. Introduction

- 7.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 7.3. Carbon Filled

- 7.4. Others

8. By End-User

- 8.1. Introduction

- 8.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 8.1.2. Market Attractiveness Index, By End-User

- 8.2. Automotive*

- 8.2.1. Introduction

- 8.2.2. Market Size Analysis and Y-o-Y Growth Analysis (%)

- 8.3. Aerospace

- 8.4. Oil and Gas

- 8.5. Electrical and Electronics

- 8.6. Others

9. By Region

- 9.1. Introduction

- 9.1.1. Market Size Analysis and Y-o-Y Growth Analysis (%), By Region

- 9.1.2. Market Attractiveness Index, By Region

- 9.2. North America

- 9.2.1. Introduction

- 9.2.2. Key Region-Specific Dynamics

- 9.2.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.2.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.2.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.2.5.1. U.S.

- 9.2.5.2. Canada

- 9.2.5.3. Mexico

- 9.3. Europe

- 9.3.1. Introduction

- 9.3.2. Key Region-Specific Dynamics

- 9.3.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.3.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.3.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.3.5.1. Germany

- 9.3.5.2. UK

- 9.3.5.3. France

- 9.3.5.4. Italy

- 9.3.5.5. Russia

- 9.3.5.6. Rest of Europe

- 9.4. South America

- 9.4.1. Introduction

- 9.4.2. Key Region-Specific Dynamics

- 9.4.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.4.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.4.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.4.5.1. Brazil

- 9.4.5.2. Argentina

- 9.4.5.3. Rest of South America

- 9.5. Asia-Pacific

- 9.5.1. Introduction

- 9.5.2. Key Region-Specific Dynamics

- 9.5.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.5.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

- 9.5.5. Market Size Analysis and Y-o-Y Growth Analysis (%), By Country

- 9.5.5.1. China

- 9.5.5.2. India

- 9.5.5.3. Japan

- 9.5.5.4. Australia

- 9.5.5.5. Rest of Asia-Pacific

- 9.6. Middle East and Africa

- 9.6.1. Introduction

- 9.6.2. Key Region-Specific Dynamics

- 9.6.3. Market Size Analysis and Y-o-Y Growth Analysis (%), By Type

- 9.6.4. Market Size Analysis and Y-o-Y Growth Analysis (%), By End-User

10. Competitive Landscape

- 10.1. Competitive Scenario

- 10.2. Market Positioning/Share Analysis

- 10.3. Mergers and Acquisitions Analysis

11. Company Profiles

- 11.1. Victrex plc*

- 11.1.1. Company Overview

- 11.1.2. Product Portfolio and Description

- 11.1.3. Financial Overview

- 11.1.4. Key Developments

- 11.2. Caledonian Industries Ltd.

- 11.3. Solvay SA

- 11.4. SABIC

- 11.5. Parkway Products, LLC

- 11.6. A. Shulman, Inc.

- 11.7. Mitsubishi Chemical Advanced Materials

- 11.8. Evonik Industries AG

- 11.9. Ensinger GmbH

- 11.10. Celanese Corporation

LIST NOT EXHAUSTIVE

12. Appendix

- 12.1. About Us and Services

- 12.2. Contact Us